Best Passive Income Strategies in 2025

A practical guide to staking, lending, DeFi yields, CeFi earn, liquidity strategies, and crypto cards — with risk, effort and return trade-offs.

Introduction

The cryptocurrency landscape in 2025 has matured into a sophisticated ecosystem offering multiple pathways for generating passive income from digital assets that often exceed conventional investment returns by significant margins. Unlike traditional financial markets where passive income opportunities are limited to dividends, bonds, and savings accounts, cryptocurrency provides diverse yield-generating mechanisms that leverage blockchain technology and decentralised finance protocols to create substantial earning potential for investors at all levels.

Professional cryptocurrency passive income strategies have evolved from simple staking rewards to complex multi-protocol approaches that combine lending, liquidity provision, yield farming, and automated portfolio management to maximise returns while managing risks across different market conditions. The most successful passive income investors understand the importance of diversification, risk assessment, and strategic allocation across multiple yield-generating opportunities within the cryptocurrency ecosystem.

The passive income landscape in cryptocurrency encompasses everything from conservative staking rewards that provide steady 4-8% annual returns to aggressive DeFi strategies that can generate double-digit yields through sophisticated protocol interactions and yield optimisation techniques. This diversity enables investors to construct passive income portfolios that align with their risk tolerance, technical expertise, and capital allocation preferences while participating in the growth of the decentralised finance ecosystem.

This comprehensive guide examines the most effective passive income strategies available in the cryptocurrency market in 2025, providing detailed analysis of returns, risks, and implementation requirements for each approach. Whether you're a beginner looking to earn your first crypto yields or an experienced investor seeking to optimise your passive income portfolio, this guide provides the insights and practical guidance needed to succeed in the dynamic world of cryptocurrency passive income generation.

Passive income in cryptocurrency refers to earning returns on your digital assets without actively trading or managing positions on a daily basis, allowing investors to benefit from the growth and utility of blockchain networks while maintaining their regular activities and commitments. This approach has become increasingly attractive as the cryptocurrency ecosystem has matured and regulatory frameworks have provided greater clarity and security for investors seeking sustainable income streams.

The evolution of decentralised finance (DeFi) has revolutionized passive income opportunities, introducing innovative mechanisms like yield farming, liquidity mining, and automated market making that enable users to earn substantial returns by providing liquidity to decentralised protocols. These opportunities, combined with traditional staking rewards and centralised lending platforms, create a diverse landscape of income-generating strategies that cater to different risk profiles and investment objectives.

Understanding the various passive income strategies available in 2025 is crucial for maximising returns while managing risks appropriately, as each strategy presents unique advantages, risk profiles, and technical requirements that must be carefully evaluated. The complexity of modern cryptocurrency passive income strategies requires comprehensive analysis of platform security, smart contract risks, market volatility impacts, and regulatory considerations that can affect long-term returns and capital preservation.

Market conditions in 2025 have created unprecedented opportunities for crypto passive income, with institutional adoption driving platform improvements and regulatory clarity providing more secure frameworks for yield generation activities. The maturation of DeFi protocols has led to more stable and predictable returns, while traditional financial institutions entering the crypto space have introduced additional yield opportunities through regulated products and services that combine traditional finance stability with cryptocurrency innovation.

Risk management remains paramount in crypto passive income strategies, as the volatile nature of digital assets can significantly impact returns and principal preservation over time. Successful passive income investors implement diversified approaches that balance high-yield opportunities with stable, lower-risk strategies to create sustainable income streams that weather market volatility and provide consistent returns whilstprotecting capital from major losses during market downturns.

The technological infrastructure supporting crypto passive income has evolved dramatically, with automated tools, smart contract auditing, and institutional-grade security measures making yield generation more accessible and secure for retail investors. These improvements have reduced technical barriers while maintaining the high return potential that makes crypto passive income attractive compared to traditional investment alternatives, enabling broader participation in sophisticated yield generation strategies.

Platform diversity offers investors multiple avenues for generating passive income, from centralised exchanges offering staking services to decentralised protocols providing liquidity mining rewards and automated yield optimisation. Understanding the trade-offs between different platforms, including security considerations, yield rates, lock-up periods, and withdrawal flexibility, is essential for building an effective passive income strategy that aligns with your financial goals and risk tolerance.

The integration of artificial intelligence and automated portfolio management tools has further enhanced passive income opportunities, enabling sophisticated strategies that automatically optimise yields, rebalance portfolios, and manage risks without requiring constant manual intervention. These technological advances have made complex yield optimisation strategies accessible to retail investors who previously lacked the technical expertise or time to implement such approaches effectively.

This comprehensive guide examines the most effective passive income strategies available in the cryptocurrency market, providing detailed analysis of returns, risks, and implementation requirements for each approach. Whether you're a beginner looking to earn your first crypto yields or an experienced investor seeking to optimise your passive income portfolio, this guide provides the insights and practical guidance needed to succeed in the dynamic world of cryptocurrency passive income generation.

The evolution of decentralised finance (DeFi) has revolutionized passive income opportunities, introducing innovative mechanisms like yield farming, liquidity mining, and automated market making that enable users to earn substantial returns by providing liquidity to decentralised protocols. These opportunities, combined with traditional staking rewards and centralised lending platforms, create a diverse landscape of income-generating strategies.

Understanding the various passive income strategies available in 2025 is crucial for maximising returns while managing risks appropriately. Each strategy presents unique advantages, risk profiles, and technical requirements that must be carefully evaluated based on your investment goals, risk tolerance, and technical expertise level.

Strategic portfolio allocation across multiple passive income streams helps mitigate risks while maximising yield potential in the cryptocurrency ecosystem. By combining staking rewards, DeFi yields, and lending returns, investors can create resilient income portfolios that perform well across different market conditions and regulatory environments, ensuring consistent returns regardless of individual protocol performance or market volatility.

Market conditions in 2025 have created unprecedented opportunities for crypto passive income, with institutional adoption driving platform improvements and regulatory clarity providing more secure frameworks for yield generation activities. The maturation of DeFi protocols has led to more stable and predictable returns, while traditional financial institutions entering the crypto space have introduced additional yield opportunities through regulated products and services.

Risk management remains paramount in crypto passive income strategies, as the volatile nature of digital assets can significantly impact returns and principal preservation. Successful passive income investors implement diversified approaches that balance high-yield opportunities with stable, lower-risk strategies to create sustainable income streams that weather market volatility and provide consistent returns over time.

The technological infrastructure supporting crypto passive income has evolved dramatically, with automated tools, smart contract auditing, and institutional-grade security measures making yield generation more accessible and secure for retail investors. These improvements have reduced technical barriers while maintaining the high return potential that makes crypto passive income attractive compared to traditional investment alternatives.

Platform diversity offers investors multiple avenues for generating passive income, from centralised exchanges offering staking services to decentralised protocols providing liquidity mining rewards. Understanding the trade-offs between different platforms, including security considerations, yield rates, lock-up periods, and withdrawal flexibility, is essential for building an effective passive income strategy that aligns with your financial goals and risk tolerance.

The evolution of decentralised finance (DeFi) and the maturation of centralised finance (CeFi) platforms have created a diverse range of income-generating strategies. From simple staking rewards to complex yield farming protocols, investors can now choose approaches that match their risk tolerance, technical expertise, and investment goals.

However, the promise of high yields comes with important considerations. The cryptocurrency market remains volatile, and many passive income strategies carry risks that don't exist in traditional finance. Smart contract vulnerabilities, platform failures, regulatory changes, and market volatility can all impact returns and principal investments.

The year 2025 has brought increased regulatory clarity in major jurisdictions, leading to better consumer protections and more institutional participation. This regulatory evolution has made crypto passive income strategies more accessible and reliable, while also establishing clearer guidelines for tax reporting and compliance.

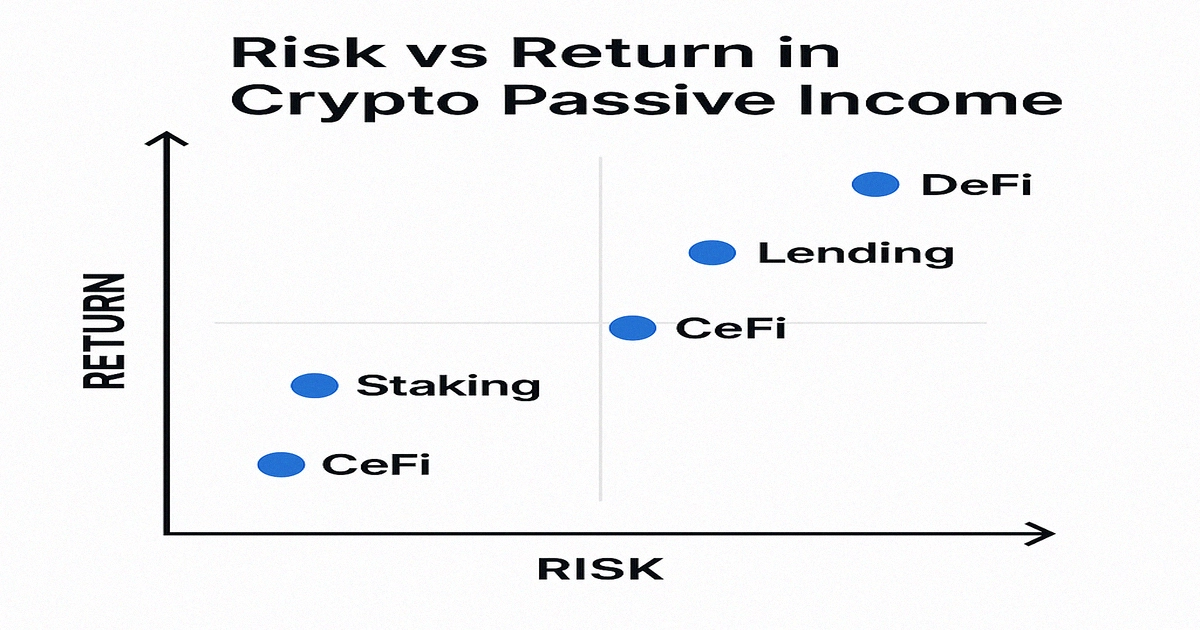

Understanding the risk-return spectrum is crucial for success in crypto passive income generation. Conservative strategies, such as staking established cryptocurrencies, typically offer lower but more predictable returns. In contrast, aggressive approaches, such as yield farming, can yield higher returns but require active monitoring and entail additional risks.

Platform selection plays a critical role in passive income success. The collapse of major platforms like Celsius and BlockFi in previous years has highlighted the importance of due diligence, diversification, and understanding counterparty risks when choosing where to deploy capital.

Technical knowledge requirements vary significantly across different strategies. Simple staking through centralised exchanges requires minimal technical expertise, while participating in DeFi protocols may require an understanding of smart contracts, gas fees, and complex tokenomics.

Tax implications represent another crucial consideration for crypto passive income strategies. Most jurisdictions treat staking rewards, lending interest, and yield farming returns as taxable income, requiring careful record-keeping and potentially reducing overall returns due to tax obligations.

The infrastructure supporting crypto passive income has improved dramatically in 2025. Better user interfaces, enhanced security measures, insurance products, and professional custody solutions have made these strategies more accessible to mainstream investors while reducing technical barriers to entry.

Portfolio diversification across multiple strategies and platforms has become a best practice for managing risks while optimising returns. Rather than concentrating on a single high-yield opportunity, successful investors typically spread their capital across various approaches to balance risk and reward.

This comprehensive guide examines the most effective passive income strategies available in 2025, analysing their risk profiles, return potential, and implementation requirements. Whether you're a beginner looking to earn your first crypto yields or an experienced investor seeking to optimise your strategy, this analysis provides the insights needed to make informed decisions in the evolving landscape of cryptocurrency passive income generation.

Passive Income Overview

Earning yields in cryptocurrency has evolved dramatically in 2025, offering investors multiple pathways to generate returns without active trading [2]. From traditional staking and lending to sophisticated DeFi yield strategies, the landscape provides opportunities for every risk profile and investment size.

The key to successful digital asset returns generation lies in understanding the risk-return spectrum and diversifying across multiple strategies. Whilst some methods, such as CeFi earn programs, offer simplicity and predictable returns, others, like yield farming, can provide higher yields but require more active management and carry additional risks.

In 2025, we're seeing increased institutional adoption, better regulatory clarity, and more mature protocols, making passive crypto income more accessible and reliable than ever before. However, the fundamental principle remains: higher returns typically come with higher risks, and proper due diligence is absolutely essential.

Market Context for 2025

The cryptocurrency returns landscape in 2025 is characterised by:

- Regulatory Clarity: Clearer guidelines in major jurisdictions have increased institutional participation

- Protocol Maturity: Battle-tested DeFi protocols with proven track records

- Yield Compression: More competition has led to more sustainable, realistic yield expectations

- Risk Management: Better tools and practices for managing smart contract and counterparty risks

- Accessibility: Improved user interfaces making DeFi accessible to mainstream users

Comprehensive Strategy Breakdown

1. Proof-of-Stake (PoS) Staking

Staking remains one of the most straightforwards yield generation methods in crypto. By locking up tokens in a PoS network, you help secure the blockchain and earn rewards in return.

Native Staking

Direct staking involves running your own validator node or delegating to existing validators [3]. Popular networks include:

- Ethereum (ETH): 3.2-4.1% APY, 32 ETH minimum for solo staking [1]

- Cardano (ADA): 4.5-5.2% APY, no minimum, no lock-up period

- Solana (SOL): 6.8-7.5% APY, flexible delegation options

- Polkadot (DOT): 10-14% APY, 28-day unbonding period

Liquid Staking Solutions

Liquid staking protocols like Lido and Rocket Pool allow you to stake ETH while maintaining liquidity through derivative tokens (stETH, rETH). This innovation has revolutionised staking by eliminating the opportunity cost of locked funds.

Benefits: Maintain liquidity, compound rewards, participate in DeFi

Risks: Smart contract risk, slashing risk, derivative token depeg risk

Restaking (EigenLayer)

The newest evolution in staking, restaking, allows ETH stakers to secure additional protocols and earn extra rewards. EigenLayer leads this space, offering 15-25% additional APY on top of base ETH staking rewards.

2. Crypto Lending (CeFi & DeFi)

Lending your crypto assets to borrowers generates interest income. The approach differs significantly between centralised (CeFi) and decentralised (DeFi) platforms.

CeFi Lending Platforms

Centralised platforms offer simplicity and often insurance, but require trust in the platform's solvency:

- Nexo: Up to 8% APY on stablecoins, EU regulated, insurance coverage

- YouHodler: Up to 7% APY, Swiss regulated, crypto-backed loans

- BlockFi: Competitive rates but limited availability post-bankruptcy

DeFi Lending Protocols

Decentralised lending removes intermediaries but requires more technical knowledge:

- Aave: 2-8% APY depending on asset, flash loans, safety module

- Compound: Algorithmic interest rates, governance token rewards

- MakerDAO: DAI savings rate, currently 3.3% APY

Key Considerations:

- Collateralization ratios and liquidation risks

- Platform security and audit history

- Interest rate volatility

- Regulatory compliance and insurance coverage

3. Yield Farming and Liquidity Mining

Yield farming involves providing liquidity to DeFi protocols in exchange for trading fees plus token incentives. Whilst potentially lucrative, it requires active management and carries significant risks.

Popular Yield Farming Strategies

- Uniswap V3: Concentrated liquidity positions, 0.05-1% fees plus UNI rewards

- Curve Finance: Stablecoin pools, 2-15% APY, CRV token rewards

- Pendle: Yield trading, 8-25% APY on various assets

- Balancer: Multi-asset pools, BAL token incentives

Understanding Impermanent Loss

Impermanent loss occurs when the price ratio of pooled assets changes. For a 50/50 ETH/USDC pool, if ETH doubles in price, you'll have less ETH than if you held it. This loss is "impermanent" because it disappears if prices return to the original ratio.

Mitigation Strategies:

- Choose correlated asset pairs (ETH/stETH)

- Use stablecoin pairs to minimise IL

- Ensure trading fees + rewards exceed potential IL

- Monitor positions regularly and rebalance when needed

→ Complete yield farming guide

4. CeFi Earn Programs

Centralised exchange earn programs offer the simplest entry point for digital asset income generation. Major exchanges provide competitive rates with user-friendly interfaces.

Top CeFi Earn Platforms 2025

- Binance Earn: Flexible savings (1-8% APY), locked staking (up to 20% APY)

- Coinbase: 2-5% APY on various assets, FDIC insurance on USD

- Kraken: On-chain staking, 4-20% APY depending on asset

- OKX: Earn products, DeFi integration, competitive rates

Advantages: Simple UX, customer support, often insured

Disadvantages: Counterparty risk, withdrawal limits, KYC requirements

5. Advanced Liquidity Strategies

Sophisticated investors can employ advanced strategies combining multiple DeFi protocols for enhanced yields.

Leveraged Staking

Borrow stablecoins against staked ETH to buy more ETH and stake it, amplifying returns. Platforms like Lido + Aave make this possible:

- Stake ETH on Lido, receive stETH

- Deposit stETH as collateral on Aave

- Borrow USDC against stETH

- Buy more ETH with USDC and repeat

Risk Warning: Leveraged positions can be liquidated if the stETH/ETH ratio drops or if the ETH price falls significantly.

Delta-Neutral Strategies

Earn yield while hedging price exposure by taking equal long and short positions. Popular on Pendle and GMX.

Cross-Chain Yield optimisation

Bridge assets to different chains for higher yields, considering gas costs and bridge risks. Popular chains include Arbitrum, Polygon, and Avalanche.

6. Crypto Cashback and Rewards Cards

Crypto cards offer yield generation through everyday spending, providing cashback in cryptocurrency.

Top Crypto Cards 2025

- Wirex: Up to 8% cashback, multiple cryptocurrencies

- Crypto.com Card: Up to 5% cashback, CRO staking requirements

- Coinbase Card: 4% cashback in select cryptos, no annual fee

Considerations: Geographic availability, staking requirements, spending categories

Real-World Case Studies

These case studies demonstrate practical passive income strategies across different risk levels and portfolio sizes. For an in-depth analysis of a real investor's journey and detailed results, see our comprehensive passive income case study.

Case Study 1: Conservative Approach ($10,000 Portfolio)

Profile: Conservative investor prioritising stable yields

Strategy:

- 40% USDC on Nexo (8% APY) = $4,000 → $320/year

- 30% ETH liquid staking via Lido (3.8% APY) = $3,000 → $114/year

- 20% BTC on Binance Earn (2% APY) = $2,000 → $40/year

- 10% emergency cash = $1,000 → $0/year

Total Annual Return: $474 (4.74% APY)

Risk Level: Low to Medium

Time Commitment: 1-2 hours/month

Case Study 2: Balanced Approach ($25,000 Portfolio)

Profile: Moderate risk tolerance, some DeFi experience

Strategy:

- 25% stETH/ETH Curve pool (5% APY) = $6,250 → $312/year

- 25% USDC lending on Aave (4% APY) = $6,250 → $250/year

- 20% SOL staking (7% APY) = $5,000 → $350/year

- 15% Pendle PT-stETH (12% APY) = $3,750 → $450/year

- 15% stable reserves = $3,750 → $0/year

Total Annual Return: $1,362 (5.45% APY)

Risk Level: Medium

Time Commitment: 3-5 hours/month

Case Study 3: Aggressive Approach ($50,000 Portfolio)

Profile: High risk tolerance, active DeFi participant

Strategy:

- 30% Leveraged stETH strategy (15% APY) = $15,000 → $2,250/year

- 25% High-yield farming rotations (20% APY) = $12,500 → $2,500/year

- 20% Restaking on EigenLayer (18% APY) = $10,000 → $1,800/year

- 15% Arbitrage opportunities (25% APY) = $7,500 → $1,875/year

- 10% Stable reserves = $5,000 → $0/year

Total Annual Return: $8,425 (16.85% APY)

Risk Level: High

Time Commitment: 10-15 hours/month

Key Lessons from Case Studies

- Diversification is crucial: No single strategy should dominate your portfolio

- Risk scales with returns: Higher yields require more active management and carry more risk

- Time commitment matters: Passive strategies require less monitoring but offer lower returns

- Reserve funds are essential: Always maintain liquidity for opportunities and emergencies

Comprehensive Risk Analysis

Smart Contract and Protocol Risks

DeFi protocols are governed by smart contracts that can contain bugs or vulnerabilities. Even audited protocols can have issues:

- Code vulnerabilities: Bugs that can be exploited by attackers

- Governance attacks: Malicious proposals that change protocol parameters

- Oracle manipulation: Price feed attacks affecting lending protocols

- Upgrade risks: Protocol changes that affect user funds

Mitigation: Use battle-tested protocols, check audit reports, diversify across platforms, and start with small amounts.

Counterparty and Custodial Risks

CeFi platforms introduce counterparty risk - the possibility that the platform becomes insolvent or acts maliciously:

- Platform insolvency: FTX, Celsius, and BlockFi collapse in 2022-2023

- Regulatory action: Government intervention affecting operations

- Operational failures: Technical issues, hacks, or mismanagement

- Withdrawal restrictions: Limits during market stress

Mitigation: Choose regulated platforms, check insurance coverage, don't keep all funds on one platform, verify platform solvency regularly.

Market and Liquidity Risks

Crypto markets are volatile, and this affects yield generation strategies:

- Price volatility: Asset values can fluctuate dramatically

- Impermanent loss: Affects liquidity providers in AMMs

- Liquidation risk: Leveraged positions can be forcibly closed

- Correlation risk: Crypto assets often move together during market stress

Mitigation: Diversify across asset classes, use stablecoins for yield, avoid excessive leverage, maintain emergency reserves.

Operational and Security Risks

User errors and security breaches are common causes of fund loss:

- Private key loss: Losing access to wallets

- Phishing attacks: Fake websites stealing credentials

- Transaction errors: Sending to wrong addresses

- Device compromise: Malware or hardware failures

Mitigation: Use hardware wallets, verify URLs carefully, double-check transactions, maintain backups, and use multi-signature wallets for large amounts.

Regulatory and Tax Risks

The regulatory landscape for crypto is evolving rapidly:

- Changing regulations: New rules affecting platform operations

- Tax implications: Yield earnings are typically taxable

- Geographic restrictions: Some platforms may become unavailable

- Reporting requirements: KYC/AML compliance obligations

Mitigation: Stay informed about regulations, maintain detailed records, consult tax professionals, use compliant platforms.

Risk vs Return Chart

Tools & Providers

- CeFi: Binance Earn, Nexo, Coinbase

- DeFi: Lido, Rocket Pool, Aave, Pendle (see best staking platforms compare)

- Analytics: CoinGlass, TradingView for tracking yields

Comparison Table

| Method | Effort | Risk | Return potential | Where to start |

|---|---|---|---|---|

| Staking | Low | Medium | Medium | Lido Review |

| Lending | Low | Medium | Medium | Nexo |

| Yield Farming | Medium | High | High | Yield Farming guide |

| CeFi Earn | Low | Medium | Low–Medium | Binance Earn |

| Liquidity | High | High | High | DeFi vs CeFi analysis |

Practical Implementation Tips

Getting Started Checklist

- Education first: Understand each strategy before investing

- Start small: Begin with 5-10% of your crypto portfolio

- Choose your risk level: Conservative, moderate, or aggressive approach

- Set up proper security: Hardware wallet, 2FA, secure passwords

- Track everything: Use spreadsheets or portfolio trackers

- Plan for taxes: Understand your jurisdiction's requirements

Platform Selection Criteria

When choosing platforms for yield generation, evaluate:

- Security track record: No major hacks or fund losses

- Regulatory compliance: Licensed and compliant operations

- Insurance coverage: Protection for user funds

- Transparency: Clear terms, regular audits, proof of reserves

- User experience: Intuitive interface, good customer support

- Yield sustainability: Realistic, not too-good-to-be-true rates

Portfolio Allocation Guidelines

Recommended allocation by risk tolerance:

Conservative Portfolio (Low Risk)

- 50% Stablecoins on regulated CeFi platforms

- 30% Large-cap staking (ETH, ADA, SOL)

- 15% Liquid staking derivatives

- 5% Cash reserves

Moderate Portfolio (Medium Risk)

- 30% CeFi earn programs

- 25% DeFi lending (Aave, Compound)

- 20% Liquid staking

- 15% Conservative yield farming

- 10% Cash reserves

Aggressive Portfolio (High Risk)

- 20% Leveraged staking strategies

- 25% High-yield farming

- 20% Restaking protocols

- 15% Arbitrage opportunities

- 10% Experimental protocols

- 10% Cash reserves

Monitoring and Rebalancing

Successful yield generation requires periodic review:

- Weekly: Check for any protocol issues or news

- Monthly: Review yields and compare alternatives

- Quarterly: Rebalance portfolio based on performance

- Annually: Comprehensive strategy review and tax planning

Red Flags to Avoid

Warning signs of potentially risky opportunities:

- Unsustainable yields: >50% APY without clear value creation

- Anonymous teams: No known developers or advisors

- No audits: Unaudited smart contracts

- Ponzi mechanics: Returns paid from new investor funds

- Pressure tactics: Limited-time offers, FOMO marketing

- Lack of transparency: Unclear how yields are generated

Future of Crypto Yield Generation: 2025 and Beyond

Emerging Technologies

The digital asset returns landscape continues evolving with new technologies:

Restaking Protocols

Restaking allows validators to secure multiple networks simultaneously, potentially increasing rewards. EigenLayer and similar protocols enable ETH stakers to earn additional yields by validating other services. This innovation could significantly boost yield opportunities while maintaining security.

Real World Asset (RWA) Tokenization

Traditional assets like real estate, bonds, and commodities are being tokenised on blockchain. This creates new yield streams through:

- Tokenized real estate dividends

- Government bond yields on-chain

- Commodity-backed staking rewards

- Traditional finance integration

Cross-Chain Yield optimisation

Advanced protocols automatically move funds between chains to capture the highest yields. These "yield aggregators" use sophisticated algorithms to maximise returns while managing gas costs and bridge risks.

Regulatory Developments

Regulatory clarity in 2025 is creating more institutional participation:

Institutional Adoption

- Corporate treasuries: More companies allocating to crypto staking

- Pension funds: Exploring regulated staking products

- Insurance coverage: Better protection for institutional stakers

- Tax clarity: Clearer guidelines for staking rewards taxation

Compliance-First Platforms

New platforms prioritising regulatory compliance offer:

- Automated tax reporting

- KYC/AML compliance

- Institutional-grade custody

- Regulatory insurance coverage

Market Maturation Trends

Yield Normalization

As markets mature, expect yields to normalise around sustainable levels:

- Staking yields: 4-8% for major cryptocurrencies

- DeFi lending: 6-12% for established protocols

- Liquidity provision: 8-15% depending on risk

- High-risk strategies: 15-30% with appropriate warnings

Infrastructure Improvements

Better infrastructure reduces barriers to entry:

- Lower gas fees: Layer 2 solutions making DeFi accessible

- Better UX: Simplified interfaces for complex strategies

- Mobile optimisation: Managing yields from smartphones

- Automated strategies: Set-and-forget yield optimisation

Advanced Yield Generation Strategies

Delta-Neutral Strategies

Advanced users can earn yields while minimising price exposure:

Perpetual Funding Arbitrage

Capture funding rates on perpetual contracts while hedging spot positions. This strategy can generate 10-30% APY during volatile markets with minimal directional risk.

Basis Trading

Exploit price differences between spot and futures markets. Buy spot assets while shorting futures, capturing the basis as profit when contracts expire.

Cross-Chain Arbitrage

Profit from price differences across different blockchains:

- Bridge arbitrage: Exploit temporary price differences

- Yield arbitrage: Move funds to highest-yielding chains

- Governance arbitrage: Participate in multiple governance tokens

Leveraged Staking Strategies

Use borrowed funds to amplify staking returns (high risk):

Recursive Staking

Stake assets, borrow against staked tokens, stake borrowed funds. This amplifies both returns and risks significantly.

Liquid Staking Leverage

Use liquid staking tokens as collateral for additional borrowing, creating leveraged exposure to staking rewards.

MEV (Maximal Extractable Value) Strategies

Advanced users can participate in MEV extraction:

- MEV staking pools: Share MEV rewards with validators

- Flashloan arbitrage: Capture arbitrage opportunities

- Sandwich protection: Earn from protecting other users

Quantitative Analysis and Performance Metrics

Professional yield optimisation requires sophisticated quantitative analysis frameworks that evaluate risk-adjusted returns, volatility patterns, and correlation matrices across different passive income strategies. Advanced practitioners utilise Sharpe ratios, maximum drawdown analysis, and Value-at-Risk calculations to optimise portfolio allocation while maintaining appropriate risk controls through systematic performance measurement and optimisation methodologies.

Performance measurement encompasses tracking annualized percentage yields, compound annual growth rates, and risk-adjusted returns across different time horizons and market conditions. Professional investors monitor daily, weekly, and monthly performance metrics whilstimplementing systematic rebalancing strategies based on quantitative signals and market volatility indicators that optimise long-term returns through data-driven decision making processes.

Institutional Yield Management Approaches

Institutional passive income strategies encompass sophisticated treasury management, regulatory compliance frameworks, and professional custody solutions that enable large-scale yield generation while maintaining fiduciary responsibilities and operational excellence. Professional institutions implement multi-signature wallets, comprehensive audit trails, and systematic risk management protocols that ensure secure and compliant yield generation operations across various cryptocurrency platforms and strategies.

Corporate treasury optimisation includes implementing automated yield strategies, maintaining appropriate liquidity reserves, and utilising professional-grade analytics platforms that monitor performance across multiple yield-generating protocols simultaneously. Institutional approaches prioritise regulatory compliance, comprehensive reporting, and systematic risk management while optimising returns through sophisticated allocation strategies and professional operational frameworks that ensure sustainable passive income generation.

Advanced Risk-Return optimisation Models

Professional yield optimisation utilises modern portfolio theory, Monte Carlo simulations, and sophisticated risk modelling techniques that optimise allocation across different passive income strategies based on historical performance data, volatility patterns, and correlation analysis. Advanced practitioners implement systematic rebalancing algorithms, dynamic hedging strategies, and comprehensive stress testing methodologies that ensure optimal risk-adjusted returns through quantitative optimisation and systematic portfolio management approaches.

Technical Implementation and Advanced Strategies

Maximising cryptocurrency passive income requires understanding yield sources, risk factors, and market dynamics. Advanced investors can leverage diversified strategies across multiple platforms and protocols to create sustainable income streams while managing volatility and regulatory considerations.

Protocol-Level Considerations

Passive income opportunities vary significantly across blockchain networks, with each offering different yield mechanisms from native staking rewards to DeFi protocol incentives. Ethereum provides extensive DeFi options but higher transaction costs, whilstnewer networks like Solana and Avalanche offer competitive staking yields with lower barriers to entry.

Smart Contract Integration

Yield optimisation Techniques

Advanced Considerations and Professional Implementation

Building sustainable passive income streams requires diversification across multiple platforms, understanding compound interest mechanics, and regular portfolio rebalancing. Successful investors allocate capital across staking, lending, and yield farming opportunities while maintaining appropriate risk levels and liquidity reserves for market volatility.

Advanced Passive Income Strategies and Professional Implementation

Multi-Protocol Yield Farming and optimisation

Advanced yield farming strategies require sophisticated understanding of DeFi protocols, liquidity provision mechanics, and automated optimisation techniques that maximise returns while managing impermanent loss and smart contract risks. Professional yield farmers utilise multiple protocols simultaneously, implementing automated rebalancing strategies that capture optimal yields across different market conditions while maintaining appropriate risk diversification through systematic portfolio management approaches.

Sophisticated yield optimisation includes utilising yield aggregators, implementing cross-protocol arbitrage strategies, and leveraging automated compounding mechanisms that enhance returns through systematic reinvestment and optimisation. Advanced practitioners monitor gas costs, opportunity costs, and market timing to optimise their yield farming strategies while maintaining appropriate risk controls through comprehensive analysis and systematic decision-making processes.

Institutional Staking and Validator Operations

Professional staking operations encompass running validator nodes, participating in governance mechanisms, and implementing sophisticated delegation strategies that optimise staking returns whilstcontributing to network security and decentralisation. Institutional staking requires comprehensive technical infrastructure, sophisticated monitoring systems, and professional risk management that enables large-scale staking operations while maintaining operational efficiency and security standards.

Advanced validator operations include multi-client setups, comprehensive monitoring systems, and sophisticated slashing protection mechanisms that ensure reliable validator performance whilstmaximising staking rewards. Professional staking services provide institutional-grade infrastructure, comprehensive reporting, and sophisticated risk management that enable large-scale staking operations while maintaining the security and reliability required for institutional cryptocurrency management.

Cryptocurrency Lending and Credit Strategies

Professional cryptocurrency lending encompasses both centralised and decentralised lending platforms, implementing sophisticated credit strategies that optimise interest income while managing counterparty risks and platform risks through diversification and systematic risk assessment. Advanced lending strategies include utilising multiple platforms, implementing automated rebalancing, and leveraging credit derivatives to enhance returns while maintaining appropriate risk controls.

Sophisticated credit strategies encompass utilising lending protocols as collateral for additional borrowing, implementing yield curve strategies, and leveraging interest rate differentials across different platforms and time periods. Professional lenders monitor credit risks, platform risks, and market conditions to optimise their lending strategies while maintaining appropriate liquidity and risk management through comprehensive analysis and systematic optimisation processes.

Liquidity Provision and Market Making Strategies

Advanced liquidity provision requires sophisticated understanding of automated market makers, impermanent loss mechanics, and fee optimisation strategies that maximise returns from providing liquidity to decentralised exchanges while managing associated risks through systematic analysis and optimisation. Professional liquidity providers utilise multiple DEX platforms, implement automated rebalancing strategies, and leverage concentrated liquidity positions to optimise their returns.

Sophisticated market making strategies include utilising algorithmic trading systems, implementing cross-platform arbitrage, and leveraging advanced order types to optimise liquidity provision returns while managing inventory risks and market volatility. Professional market makers monitor trading volumes, volatility patterns, and fee structures to optimise their liquidity provision strategies while maintaining appropriate risk controls through comprehensive market analysis and systematic optimisation methodologies.

Cross-Chain Yield optimisation and Interoperability

Cross-chain yield strategies enable diversification across multiple blockchain ecosystems while maintaining operational efficiency through unified management interfaces and automated optimisation systems. Advanced cross-chain strategies utilise bridge protocols, wrapped tokens, and multi-chain wallets to maintain optimal allocation across different networks while minimising transaction costs and operational complexity through sophisticated automation and monitoring systems.

Professional cross-chain optimisation includes monitoring yield opportunities across different blockchain networks, implementing automated arbitrage strategies, and leveraging interoperability protocols to maximise returns while managing bridge risks and cross-chain operational complexity. Advanced practitioners utilise sophisticated analytics to identify optimal allocation strategies across different blockchain ecosystems while maintaining appropriate risk diversification and operational efficiency.

Automated Portfolio Management and Rebalancing

Professional passive income generation requires sophisticated portfolio management systems that automatically optimise allocation across different yield-generating strategies based on changing market conditions, risk assessments, and performance metrics. Advanced portfolio management includes automated rebalancing, systematic risk monitoring, and comprehensive performance tracking that enables optimal passive income generation while maintaining appropriate risk controls through systematic optimisation processes.

Sophisticated automation systems encompass yield optimisation algorithms, risk management protocols, and comprehensive monitoring systems that enable hands-off passive income generation while maintaining security and performance standards. Professional automated systems utilise machine learning algorithms, predictive analytics, and systematic optimisation techniques to enhance passive income generation while minimising manual intervention and operational complexity through advanced technological implementation.

Risk Management and Insurance Strategies

Professional passive income generation requires comprehensive risk management frameworks that protect against smart contract risks, platform risks, and market volatility while maintaining yield optimisation objectives. Advanced risk management includes diversification strategies, insurance coverage, and sophisticated monitoring systems that ensure portfolio resilience under various market scenarios and operational conditions while maintaining passive income generation capabilities.

Insurance strategies encompass utilising DeFi insurance protocols, maintaining emergency reserves, and implementing systematic risk assessment procedures that protect passive income portfolios against various risk factors while maintaining operational efficiency. Professional risk management includes comprehensive stress testing, scenario analysis, and systematic optimisation that ensures sustainable passive income generation through various market conditions and operational challenges while maintaining appropriate security and performance standards.

Conclusion: Building Sustainable Crypto Passive Income in 2025

The cryptocurrency passive income landscape in 2025 offers unprecedented opportunities for investors willing to navigate the complexities of digital asset yield generation. From conservative staking strategies offering 4-8% annual returns to aggressive DeFi farming yielding 15-30%, the spectrum of available options caters to every risk tolerance and investment objective. Success in this space requires careful platform selection, thorough risk assessment, and strategic diversification across multiple income streams.

The maturation of both centralised and decentralised platforms has created more reliable and accessible passive income opportunities than ever before. Regulatory clarity in major jurisdictions has enhanced consumer protections, while institutional adoption has brought professional-grade tools and deeper liquidity to retail investors. However, the fundamental principle remains unchanged: higher yields typically correlate with higher risks, making education and due diligence essential for long-term success.

Building a sustainable passive income portfolio requires balancing conservative strategies like Bitcoin and Ethereum staking with more aggressive approaches such as liquidity provision and yield farming. Diversification across multiple platforms, protocols, and asset types helps mitigate risks while capturing opportunities across the entire cryptocurrency ecosystem. Regular monitoring, rebalancing, and staying informed about protocol changes and market developments are crucial for maintaining optimal returns.

The future of cryptocurrency passive income looks increasingly promising as blockchain technology continues evolving and traditional finance integrates with digital assets. New opportunities will emerge through technological innovation, regulatory development, and market maturation. By starting with established strategies, gradually building expertise, and maintaining disciplined risk management, investors can build substantial passive income streams that complement traditional investment portfolios and provide financial independence in the digital economy.

Regulatory Environment Evolution

Cryptocurrency passive income opportunities expand through innovative staking mechanisms and yield optimisation strategies. Modern platforms offer automated compounding and risk management tools for maximising long-term returns.

Institutional Adoption Impact

Corporate treasury management increasingly includes cryptocurrency passive income strategies, validating these approaches for individual investors. Institutional participation creates deeper liquidity pools and more stable yield opportunities across various passive income platforms.

Technology Innovation Cycles

Passive income platform development focuses on user experience improvements, automated rebalancing, and comprehensive risk assessment tools. These technological advances make sophisticated yield strategies accessible to users without requiring extensive technical knowledge or constant monitoring.

Sources & References

- CoinGecko. (2025). "Cryptocurrency Prices, Charts, and Market Data". Real-time staking yields and APY data for major cryptocurrencies.

- Messari. (2025). "Crypto Research and Data". In-depth analysis of DeFi protocols and passive income strategies.

- Ethereum.org. (2025). "Ethereum Staking". Official documentation on Ethereum staking mechanisms and rewards.

Frequently Asked Questions

- What is the safest yield generation method in crypto?

- There is no zero-risk method in crypto. However, for many users, staking large-cap assets like ETH or ADA via reputable providers offers a good balance of risk and return. CeFi platforms, such as Nexo or Binance, provide additional simplicity but introduce counterparty risk. The key is diversification and never investing more than you can afford to lose.

- Is DeFi yield better than CeFi earnings in 2025?

- It depends on your risk tolerance and technical expertise. DeFi typically offers higher yields (8–25% APY) but requires more active management and carries risks associated with smart contracts. CeFi is simpler (2–8% APY) but introduces counterparty risk and often caps earnings. Many investors use both approaches for diversification.

- How much can I realistically earn with $1,000?

With $1,000, you can expect:

- Conservative approach: $30–50/year (3–5% APY) via CeFi staking

- Moderate approach: $50–80/year (5–8% APY) mixing CeFi and simple DeFi

- Aggressive approach: $80–200/year (8–20% APY) with active DeFi strategies

Remember that higher returns come with higher risks and time commitments.

- Do I need a lot of money to start?

No, you can start with as little as $50 to $100. Many platforms have low minimums:

- Binance Earn: $1 minimum

- Lido staking: No minimum

- Aave lending: ~$10 minimum (due to gas costs)

- Most CeFi platforms: $10–50 minimum

- How often should I check my positions?

It depends on your strategy:

- CeFi earn/Simple staking: Monthly check is sufficient

- DeFi lending: Weekly monitoring recommended

- Yield farming: Daily to weekly, depending on volatility

- Leveraged strategies: Daily monitoring essential

- What about taxes on passive crypto income?

Cryptocurrency earnings are generally taxable as ordinary income in most jurisdictions. Key considerations:

- Track all rewards and their USD value when received

- Staking rewards are taxed when received, not when sold

- DeFi yields may have complex tax implications

- Consider using crypto tax software like Koinly or CoinTracker

- Consult a tax professional for large amounts

- Should I use a hardware wallet for yield generation?

- For significant amounts (>$1,000), yes. Hardware wallets like Ledger or Tangem provide better security than software wallets. However, some strategies require keeping funds on platforms or in hot wallets for functionality.

- What's the biggest mistake beginners make?

The most common mistakes include:

- Chasing high yields without understanding risks

- Not diversifying across strategies and platforms

- Ignoring gas costs on Ethereum-based strategies

- Poor security practices leading to fund loss

- Not tracking for tax purposes

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.