Crypto Taxes 2025: Complete Guide

Cryptocurrency taxation has become increasingly complex as governments worldwide implement new regulations. This comprehensive guide covers everything you need to know about crypto taxes in 2025, from basic concepts to advanced optimisation strategies.

Introduction

Cryptocurrency taxation has evolved from a niche concern to a critical compliance requirement for millions of investors worldwide.

As digital assets have gained mainstream adoption, tax authorities across the globe have developed increasingly sophisticated frameworks to capture revenue from crypto transactions.

This makes proper tax planning essential for anyone involved in the cryptocurrency ecosystem, from casual investors to professional traders and DeFi participants.

The stakes for compliance have never been higher, with substantial penalties and increased enforcement targeting non-compliant taxpayers.

The complexity of crypto taxation stems from the unique nature of digital assets and the diverse ways they can be acquired, traded, and utilised.

Unlike traditional investments, cryptocurrency transactions can involve multiple chains, protocols, and token types. Each has distinct tax implications.

From simple buy-and-hold strategies to complex DeFi yield farming operations, every crypto activity potentially creates taxable events. These must be properly documented and reported. The challenge lies in understanding which activities trigger tax obligations. You must know how to calculate the correct amounts owed.

In 2025, the regulatory landscape has matured significantly. Most major jurisdictions have established clear guidelines for cryptocurrency taxation. However, this clarity comes with increased enforcement and reporting requirements. Many investors are caught unprepared.

Tax authorities now have sophisticated tools to track blockchain transactions. This makes compliance more important than ever for crypto investors and traders. The permanent and transparent nature of blockchain records means all transactions are potentially discoverable by tax authorities.

This comprehensive guide navigates you through the complex world of cryptocurrency taxation. It covers everything from basic concepts to advanced optimisation strategies. Whether you're a casual investor holding Bitcoin in a hardware wallet or an active DeFi participant managing a complex portfolio across multiple protocols, understanding your tax obligations is crucial. For tax-friendly platforms, see our Coinbase tax reporting and exchanges tax comparison.

We explore the fundamental principles of crypto taxation. We examine different types of taxable events. We discuss record-keeping requirements. We provide practical strategies for minimising your tax burden whilst remaining fully compliant. You'll also learn about jurisdiction-specific rules, emerging developments in crypto tax law, and how to prepare for potential audits.

The stakes for proper crypto tax compliance have never been higher. With increased regulatory scrutiny, substantial penalties for non-compliance, and the permanent nature of blockchain records, getting your crypto taxes right is essential. It's about protecting your financial future. It ensures you can continue to participate in the digital asset revolution with confidence and peace of mind.

The evolution of cryptocurrency taxation reflects the broader maturation of the digital asset ecosystem. Regulatory frameworks are becoming more sophisticated. Governments recognise both the revenue potential and the need for clear compliance guidelines. This regulatory clarity creates new obligations. It also provides the certainty that institutional investors and mainstream adoption require for continued growth in the cryptocurrency space.

Modern cryptocurrency tax compliance requires understanding not only the basic principles of capital gains and income recognition. You must also understand the complex interactions between different blockchain protocols. You need to know the tax implications of emerging technologies like NFTs and DeFi. You must consider the international aspects that arise from the global nature of cryptocurrency markets.

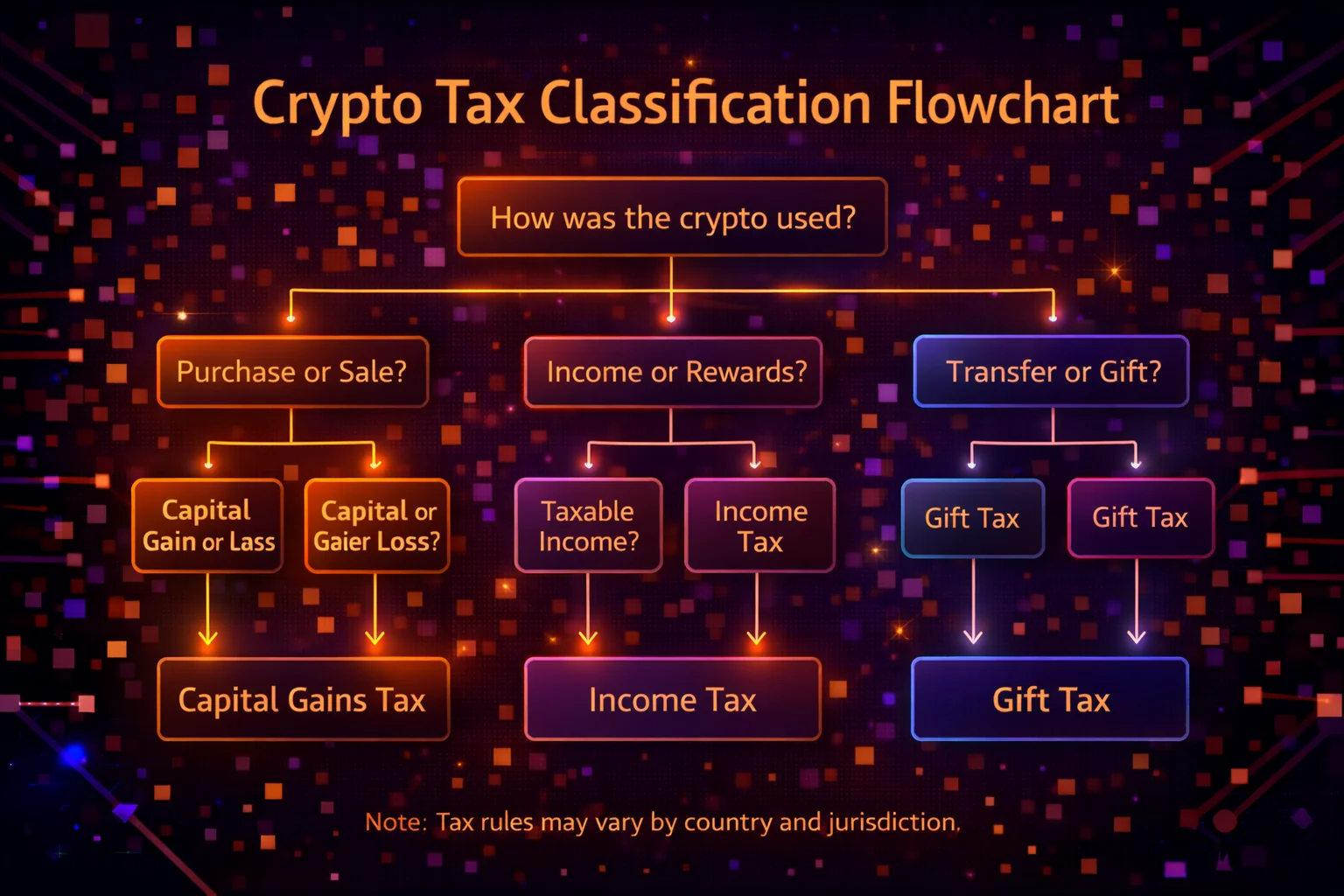

Cryptocurrency Tax Basics

Most tax authorities treat cryptocurrency as property rather than currency. This classification has significant implications for the taxation of cryptocurrency transactions.

Property vs Currency Classification

When crypto is classified as property:

- Investment Profits Apply: Profits from sales are subject to capital gains tax

- Basis Tracking Required: You must track the cost basis of each transaction

- Like-Kind Exchanges Don't Apply: Crypto-to-crypto trades are taxable events

- Fair Market Value: Transactions valued at time of occurrence

Tax Rates Overview

Crypto taxes typically fall into two categories:

- Investment Profits Tax: On profits from selling or trading crypto

- Income Tax: On crypto received as payment or rewards

- Gift and Estate Tax: On crypto transfers and inheritance

Short-term vs Long-term Holdings

The holding period significantly affects tax rates:

- Short-term (≤1 year): Taxed as ordinary income (higher rates)

- Long-term (>1 year): Preferential investment profit rates (lower rates)

- Ultra-long-term (>5 years): Some jurisdictions offer additional tax benefits for extended holding periods

Taxable Events in Cryptocurrency

Understanding what constitutes a taxable event is crucial for proper compliance. Here are the main scenarios that trigger tax obligations:

Selling Crypto for Fiat Currency

Converting cryptocurrency to traditional currency (USD, EUR, etc.) is always a taxable event:

- Calculation: Sale price minus cost basis equals gain/loss

- Timing: Tax liability occurs at time of sale

- Documentation: Keep records of purchase and sale prices

Crypto-to-Crypto Trading

Trading one cryptocurrency for another is taxable, even without fiat involvement:

- Fair Market Value: Use USD value at time of trade

- Both Sides Taxable: Disposing of one crypto and acquiring another

- Complex Tracking: Requires careful record-keeping

Using Crypto for Purchases

Spending cryptocurrency on goods or services triggers investment profits:

- Purchase Price: Fair market value of crypto at time of payment

- Cost Basis: Original purchase price of the crypto used

- Gain/Loss: Difference between current value and cost basis

Receiving Crypto as Income

Cryptocurrency received as payment is taxable as ordinary income:

- Freelance Payments: Full fair market value taxable

- Salary in Crypto: Treated as regular employment income

- Mining Rewards: Income at time of receipt

- Staking Rewards: Income when received

Airdrops and Forks

Free cryptocurrency distributions have tax implications:

- Airdrops: Generally taxable as income at fair market value

- Hard Forks: New coins may be taxable when received

- Promotional Tokens: Usually taxable as income

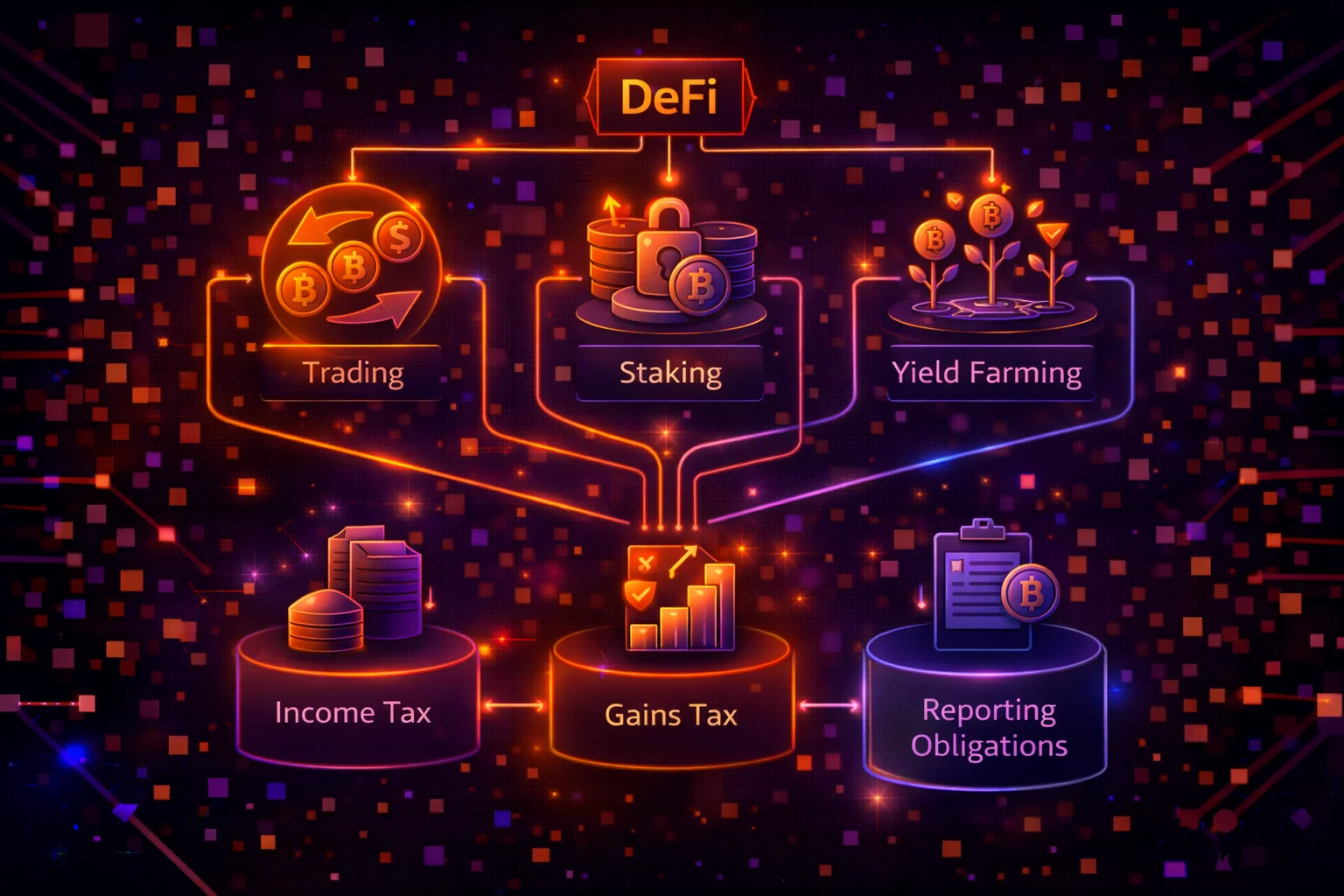

DeFi Activities

Decentralised finance activities create complex tax situations:

- Yield Farming: Rewards taxable as income

- Liquidity Provision: Fees earned are taxable income

- Lending Interest: Taxable as received

- Token Swaps: Each swap is a taxable event

Capital Gains Tax on Cryptocurrency

Capital gains tax applies when you sell, trade, or use cryptocurrency for more than you paid for it.

Calculating Investment Profits

The basic formula for investment profits:

Capital Gain = Sale Price - Cost Basis - Transaction Fees

Cost Basis Methods

When you have multiple purchases of the same cryptocurrency, you need a method to determine which coins you're selling:

First In, First Out (FIFO)

- Method: Sell oldest coins first

- Tax Impact: Often results in higher gains (older coins typically cheaper)

- Simplicity: Easy to track and calculate

- Default Method: Used by most tax software

Last In, First Out (LIFO)

- Method: Sell newest coins first

- Tax Impact: May result in lower gains or losses

- Complexity: More complex tracking required

- Availability: Not accepted in all jurisdictions

Specific Identification

- Method: Choose specific coins to sell

- Tax Impact: Allows optimisation of gains/losses

- Requirements: Detailed records and clear identification

- Flexibility: Most control over tax outcomes

Long-term vs Short-term Capital Gains

The holding period determines your tax rate:

Short-term Capital Gains (≤1 year)

- Tax Rate: Ordinary income tax rates (up to 37% in the US)

- Higher Burden: No preferential treatment

- Timing Matters: Even one day can make a difference

Long-term Capital Gains (>1 year)

- Tax Rate: Preferential rates (0%, 15%, or 20% in US)

- Significant Savings: Can reduce tax burden substantially

- Holding Strategy: Incentivizes longer-term investing

Income Tax on Cryptocurrency

Cryptocurrency received as income is subject to ordinary income tax rates at the time of receipt.

Types of Crypto Income

Employment Income

- Salary in Crypto: Taxed at fair market value when received

- Bonuses: Same treatment as cash bonuses

- Withholding: Employer may need to withhold taxes

Self-Employment Income

- Freelance Payments: Full value taxable as business income

- Self-Employment Tax: May apply in addition to income tax

- Business Expenses: Can deduct related expenses

Mining Income

- Fair Market Value: Taxed at value when mined

- Business Activity: May qualify as business income

- Deductions: Equipment and electricity costs may be deductible

Staking Rewards

- Income Recognition: Taxable when received

- Valuation: Fair market value at time of receipt

- New Cost Basis: Becomes basis for future sales

Interest and Lending

- DeFi Lending: Interest earned is taxable income

- CeFi Platforms: Same treatment as traditional interest

- Compounding: Each interest payment is taxable

DeFi and Tax Implications

Decentralised Finance creates unique tax challenges due to its complexity and rapid innovation.

Yield Farming Taxes

- LP Token Creation: May be taxable event if tokens have different values

- Reward Tokens: Taxable as income when received

- Impermanent Loss: May create deductible losses when realised

- Complex Tracking: Requires detailed record-keeping

Liquidity Pool Participation

- Providing Liquidity: May trigger taxable events

- Fee Collection: Trading fees earned are taxable income

- Withdrawing Liquidity: May realise gains or losses

Governance Token Rewards

- Voting Rewards: Taxable as income when received

- Delegation Rewards: Income to the delegator

- Proposal Rewards: Taxable compensation

Flash Loans and Complex Transactions

- Atomic Transactions: Each step may be taxable

- Arbitrage Profits: Taxable as capital gains

- MEV Extraction: Taxable income

Record Keeping Requirements

Proper documentation is essential for accurate tax reporting and audit protection.

Essential Records to Keep

- Transaction Dates: Exact timestamps for all activities

- Transaction Amounts: Quantities of crypto involved

- Fair Market Values: USD values at time of transaction

- Transaction Fees: Gas fees and exchange fees

- Wallet Addresses: Source and destination addresses

- Transaction Hashes: Blockchain confirmation records

Documentation Best Practices

- Real-time Tracking: Record transactions as they occur

- Multiple Backups: Store records in multiple locations

- organised System: Use consistent naming and filing

- Regular Reviews: Verify accuracy periodically

Retention Requirements

- Minimum Period: Keep records for at least 7 years

- Audit Protection: Longer retention provides better protection

- Digital Copies: Acceptable in most jurisdictions

Tax optimisation Strategies

Legal strategies to minimise your cryptocurrency tax burden while maintaining compliance.

Long-term Holding Strategy

- Hold Over One Year: Qualify for lower long-term capital gains rates

- Significant Savings: Can reduce tax rate from 37% to 20% or less

- Planning Required: Track holding periods carefully

Tax-Loss Harvesting

- realise Losses: Sell losing positions to offset gains

- Wash Sale Rules: May not apply to crypto (jurisdiction dependent)

- Timing Strategy: Harvest losses before year-end

- Repurchase Options: May be able to rebuy immediately

Strategic Asset Location

- Tax-Advantaged Accounts: Use IRAs or 401(k)s where permitted

- Geographic Arbitrage: Consider tax-friendly jurisdictions

- Entity Structures: Corporate structures for active trading

Timing Strategies

- Year-End Planning: Time transactions for optimal tax years

- Income Smoothing: Spread gains across multiple years

- Rate Arbitrage: Time sales for favorable rate years

Charitable Giving

- Donate Appreciated Crypto: Avoid capital gains while getting deduction

- Donor-Advised Funds: Flexible charitable giving strategies

- Charitable Remainder Trusts: Advanced planning techniques

Reporting Requirements

Understanding what forms and disclosures are required in your jurisdiction.

United States Requirements

- Form 8949: Capital gains and losses reporting

- Schedule D: Summary of capital gains

- Form 1040: Include crypto income and gains

- FBAR: Foreign crypto accounts over $10,000

- Form 8938: Foreign financial assets reporting

International Reporting

- Country-Specific Forms: Each jurisdiction has different requirements

- Double Taxation Treaties: May provide relief for international investors

- Professional Advice: Essential for complex international situations

Disclosure Requirements

- Virtual Currency Question: Many tax forms now ask about crypto

- Honest Disclosure: Answer all questions accurately

- Voluntary Disclosure: Programs available for past non-compliance

International Tax Considerations

The global nature of cryptocurrency creates complex international tax issues.

Tax Residency

- Determining Factors: Physical presence, tax home, ties to country

- Multiple Residencies: May owe taxes in multiple countries

- Treaty Benefits: Tax treaties may provide relief

Source of Income Rules

- Trading Income: Often sourced where trader is located

- Mining Income: May be sourced where mining occurs

- Staking Rewards: Complex sourcing rules apply

Reporting Foreign Accounts

- FBAR Requirements: US persons must report foreign crypto accounts

- CRS Reporting: Automatic exchange of information between countries

- Penalties: Severe penalties for non-compliance

Tax Tools and Software

Specialised software can help manage the complexity of cryptocurrency tax calculations.

Popular Crypto Tax Software

- CoinTracker: Comprehensive tracking and reporting

- Koinly: Multi-exchange integration and tax optimisation

- TaxBit: Enterprise-grade solutions

- CryptoTrader.Tax: Affordable option for individual traders

- Accointing: Portfolio tracking with tax features

Key Features to Look For

- Exchange Integration: Automatic import from major exchanges

- DeFi Support: Tracking of complex DeFi transactions

- Multiple Methods: Support for different cost basis methods

- Tax Forms: Generation of required tax forms

- Audit Support: Detailed records for audit defence

Manual Tracking Options

- Spreadsheets: Custom solutions for simple portfolios

- Accounting Software: Traditional software adapted for crypto

- Blockchain Explorers: Direct transaction verification

Jurisdiction-Specific Tax Rules

Cryptocurrency tax rules vary significantly across different countries and jurisdictions. Understanding your local requirements is crucial for compliance.

United States

- Property Classification: Crypto treated as property, not currency

- Capital Gains Rates: 0%, 15%, or 20% for long-term; ordinary rates for short-term

- Like-Kind Exchanges: Not applicable to crypto since 2018

- Wash Sale Rules: Currently don't apply to crypto (may change)

- Reporting Threshold: Must report all transactions regardless of amount

- FBAR Requirements: Foreign crypto accounts over $10,000

United Kingdom

- Capital Gains Tax: 10% or 20% depending on income level

- Annual Exemption: £6,000 capital gains allowance (2024-25)

- Income Tax: Mining and staking rewards taxed as income

- Same Day Rule: Special rules for same-day purchases and sales

- 30-Day Rule: Prevents wash sale strategies

Canada

- 50% Inclusion Rate: Only half of capital gains are taxable

- Business vs Investment: Distinction affects tax treatment

- Superficial Loss Rules: Prevent wash sales

- Foreign Reporting: T1135 for foreign crypto holdings over CAD $100,000

Australia

- CGT Discount: 50% discount for assets held over 12 months

- Personal Use Asset: Transactions under AUD $10,000 may be exempt

- Trading vs Investing: Different tax treatment based on activity

- Record Keeping: Must keep records for 5 years

Germany

- One-Year Rule: Tax-free after holding for one year

- Speculation Tax: Up to 45% for short-term gains

- €600 Exemption: Annual exemption for private sales

- Staking Complications: May extend holding period requirement

Singapore

- No Capital Gains Tax: Generally no tax on crypto gains

- Income Tax: Trading as business may be taxable

- GST Exempt: Crypto transactions exempt from goods and services tax

Portugal

- Tax-Free for Individuals: No tax on crypto gains for non-professional activity

- Professional Activity: Business taxation applies to professional trading

- Holding Period: Must hold for investment purposes

Practical Tax Calculation Examples

Real-world examples to illustrate how crypto tax calculations work in practice.

Example 1: Simple Buy and Sell

Scenario: Bought 1 BTC for $30,000 in September, sold for $45,000 in December

Calculation:

- Purchase Price: $30,000

- Sale Price: $45,000

- Transaction Fees: $100 (buy) + $150 (sell) = $250

- Capital Gain: $45,000 - $30,000 - $250 = $14,750

- Tax (Long-term 15%): $14,750 × 15% = $2,212.50

Example 2: Crypto-to-Crypto Trade

Scenario: Traded 2 ETH (bought at $2,000 each) for 0.5 BTC when BTC was $16,000

Calculation:

- ETH Cost Basis: 2 × $2,000 = $4,000

- Fair Market Value: 0.5 × $16,000 = $8,000

- Capital Gain: $8,000 - $4,000 = $4,000

- New BTC Basis: $8,000 (for future calculations)

Example 3: Staking Rewards

Scenario: Received 10 ADA as staking rewards when ADA was $0.50

Tax Treatment:

- Income: 10 × $0.50 = $5.00 (taxable as ordinary income)

- New Cost Basis: $5.00 for the 10 ADA received

- Future Sale: Any gain/loss calculated from $0.50 basis

Example 4: DeFi Yield Farming

Scenario: Provided $10,000 USDC + $10,000 worth of ETH to liquidity pool, earned $500 in fees

Tax Implications:

- LP Token Creation: Potentially taxable if token values differ

- Fee Income: $500 taxable as ordinary income

- Impermanent Loss: May create deductible loss when realised

- Withdrawal: Calculate gains/losses on underlying assets

Example 5: Tax-Loss Harvesting

Scenario: Portfolio has $10,000 gain on BTC and $8,000 loss on altcoins

Strategy:

- realise Loss: Sell altcoins to realise $8,000 loss

- Offset Gains: $10,000 gain - $8,000 loss = $2,000 net gain

- Tax Savings: Pay tax on $2,000 instead of $10,000

- Repurchase: May be able to rebuy altcoins immediately (no wash sale rule)

Audit Preparation and defence

Being prepared for a potential tax audit can save significant time, money, and stress.

Audit Triggers

- Large Gains: Significant capital gains may attract attention

- Inconsistent Reporting: Discrepancies between years

- Exchange Data: Tax authorities have access to exchange information

- Random Selection: Some audits are purely random

- Related Investigations: Connection to other audited parties

Documentation Requirements

- Complete Transaction History: All buys, sells, trades, and transfers

- Exchange Statements: Official records from all platforms used

- Wallet Records: Private wallet transaction histories

- Fair Market Value Evidence: Price data for all transaction dates

- Fee Documentation: Records of all transaction costs

- Method Consistency: Evidence of consistent cost basis method

Professional Representation

- Tax Attorney: For complex legal issues

- CPA: For technical tax calculations

- Enrolled Agent: IRS representation specialists

- Crypto Specialists: Professionals with crypto expertise

Audit defence Strategies

- organised Records: Present information clearly and completely

- Reasonable Positions: Ensure all positions are defensible

- Cooperative Approach: Work constructively with auditors

- Professional Representation: Let experts handle communications

- Appeal Rights: Understand options if disagreeing with results

Future Tax Developments

The cryptocurrency tax landscape continues evolving as governments adapt to new technologies and market developments.

Regulatory Trends

- Increased Enforcement: More resources dedicated to crypto tax compliance

- Clearer Guidance: More specific rules for complex transactions

- International Coordination: Greater cooperation between tax authorities

- Simplified Reporting: standardised forms and procedures

- Safe Harbors: Clear rules for specific activities

Technology Integration

- Automated Reporting: Direct reporting from exchanges to tax authorities

- Blockchain Analysis: Advanced tools for transaction tracking

- AI Compliance: Automated compliance checking

- Real-time Calculations: Instant tax calculations for transactions

Potential Changes

- Wash Sale Rules: May be extended to cryptocurrency

- Mark-to-Market: Possible for active traders

- Simplified Methods: Safe harbor calculations for small investors

- DeFi Guidance: Specific rules for complex DeFi transactions

- NFT Rules: Clarification of non-fungible token taxation

Preparing for Changes

- Stay Informed: Follow regulatory developments

- Flexible Systems: Use adaptable record-keeping methods

- Professional Advice: Regular consultations with tax professionals

- Conservative Approach: Take defensible positions

- Documentation: Maintain detailed records for all activities

Professional Tax Implementation and Advanced Compliance Strategies

Comprehensive Tax Planning and Strategic Implementation

Professional cryptocurrency tax management requires sophisticated planning strategies that integrate tax optimisation with investment objectives while maintaining full regulatory compliance across multiple jurisdictions and transaction types. Strategic tax planning includes systematic evaluation of tax implications for different investment strategies, comprehensive optimisation procedures that minimise tax liability, and advanced compliance frameworks that ensure regulatory adherence whilstmaximising after-tax returns through professional tax management and strategic implementation excellence.

Advanced tax implementation encompasses comprehensive transaction structuring, systematic timing optimisation, and sophisticated compliance procedures that maximise tax efficiency while maintaining regulatory compliance. Professional tax management includes implementation of comprehensive record-keeping systems, systematic evaluation of tax optimisation opportunities, and advanced compliance monitoring that ensures ongoing regulatory adherence while optimising tax outcomes through systematic tax excellence and professional implementation procedures designed for institutional cryptocurrency operations.

Multi-Jurisdictional Compliance and International Tax Management

International cryptocurrency operations require comprehensive understanding of multi-jurisdictional tax requirements, cross-border compliance obligations, and sophisticated tax planning strategies that optimise global tax efficiency while maintaining compliance across different regulatory environments. International tax management includes systematic evaluation of tax treaties, comprehensive understanding of foreign reporting requirements, and advanced structuring strategies that minimise global tax liability while ensuring compliance with all applicable regulations.

Cross-border compliance encompasses comprehensive reporting procedures, systematic evaluation of tax obligations across multiple jurisdictions, and advanced optimisation strategies that maximise tax efficiency while maintaining regulatory compliance. Professional international tax management includes consultation with qualified professionals across different jurisdictions, implementation of comprehensive compliance monitoring systems, and development of sophisticated tax optimisation strategies that ensure optimal outcomes while maintaining full regulatory compliance through systematic international tax excellence and professional compliance management designed for global cryptocurrency operations.

Common Tax Mistakes to Avoid

Learn from others' mistakes to ensure proper compliance and avoid costly penalties.

Record-Keeping Mistakes

- Incomplete Records: Missing transaction details, dates, or amounts

- Lost Access: Not backing up wallet and exchange data before losing access

- Delayed Tracking: Trying to reconstruct old transactions without proper records

- Inconsistent Methods: Switching between cost basis methods without justification

- Missing Fees: Not tracking transaction fees and gas costs

Calculation Errors

- Wrong Cost Basis: Using incorrect purchase prices or methods

- Ignoring Fees: Not including transaction costs in basis calculations

- Currency Conversion: Using wrong exchange rates or conversion dates

- Timing Issues: Recording transactions in wrong tax years

- Double Counting: Reporting same transaction multiple times

Reporting Mistakes

- Unreported Income: Missing staking rewards, airdrops, or mining income

- Wrong Forms: Using incorrect tax forms or schedules

- Timing Errors: Reporting transactions in wrong tax year

- Incomplete Disclosure: Not answering crypto questions on tax forms

- Foreign Account Failures: Not reporting foreign crypto accounts

Strategic Mistakes

- No Tax Planning: Not considering tax implications before trading

- Ignoring Holding Periods: Missing long-term capital gains benefits

- No Professional Help: Trying to handle complex situations without expert guidance

- Panic Decisions: Making hasty tax decisions during market volatility

- Inadequate Documentation: Not maintaining sufficient records for audit defence

How to Avoid These Mistakes

- Start Early: Begin tracking from your first crypto transaction

- Use Software: Employ specialised crypto tax software

- Regular Reviews: Periodically review and reconcile your records

- Professional Consultation: Work with crypto-experienced tax professionals

- Conservative Approach: When in doubt, take the more conservative tax position

- Stay Updated: Keep current with changing tax laws and regulations

Practical Implementation Guidelines

Cryptocurrency tax compliance demands a comprehensive understanding of reporting obligations, calculation methodologies, and regulatory frameworks that govern digital asset transactions. Effective tax management integrates accurate record-keeping with strategic planning to minimise liabilities while ensuring full compliance with evolving tax regulations across multiple jurisdictions.

Step-by-Step Execution Framework

Strategic tax compliance implementation begins with comprehensive planning that includes transaction tracking, tax calculation, and reporting preparation procedures. Professional taxpayers establish clear protocols for record maintenance, tax software utilisation, and filing schedules that maintain consistency while allowing flexibility for tax optimisation and changing regulatory conditions.

Security and Operational Procedures

Performance Tracking and optimisation

Tax reporting for cryptocurrency activities requires specialised software and methodologies. These account for complex transaction types. These include staking rewards, DeFi yield farming, and cross-chain transfers. Regular tax planning enables compliance optimisation and strategic timing. It maintains alignment with regulatory requirements. It minimises tax liabilities.

Advanced Tax Strategies and Professional Compliance Management

Institutional Tax Planning and Corporate Cryptocurrency Taxation

Professional cryptocurrency taxation for institutional investors requires sophisticated compliance frameworks, comprehensive record-keeping systems, and advanced tax optimisation strategies that ensure regulatory adherence whilstmaximising after-tax returns for corporate entities and professional trading operations. Institutional tax planning includes systematic transaction analysis, comprehensive reporting procedures, and advanced tax structuring that minimises tax liability while maintaining operational transparency and regulatory compliance through professional tax management and institutional cryptocurrency operations designed for sophisticated tax optimisation and compliance excellence.

Corporate cryptocurrency taxation includes comprehensive entity structuring, sophisticated tax planning strategies, and advanced compliance procedures that optimise tax efficiency while maintaining regulatory adherence and operational transparency. Professional corporate tax management utilises advanced analytics, systematic monitoring procedures, and comprehensive regulatory frameworks that enable optimal tax efficiency while maintaining regulatory compliance and operational excellence through professional tax planning and institutional compliance management designed for sophisticated cryptocurrency operations and professional asset management excellence.

Cross-Jurisdictional Tax optimisation and International Compliance

Cross-jurisdictional cryptocurrency taxation involves complex regulatory considerations, international tax treaties, and sophisticated compliance requirements that impact global cryptocurrency operations and investment strategies. International tax optimisation includes comprehensive jurisdictional analysis, sophisticated tax structuring, and advanced compliance procedures that minimise global tax liability while maintaining regulatory adherence across multiple jurisdictions through professional international tax management and comprehensive global compliance frameworks designed for institutional cryptocurrency operations and professional international asset management.

Global compliance strategies include systematic regulatory monitoring. They include comprehensive treaty utilisation. They include advanced tax planning. These optimise international cryptocurrency operations whilst maintaining regulatory compliance and operational transparency. Professional international tax management utilises sophisticated analytics. It uses comprehensive regulatory frameworks. It uses advanced compliance procedures. These enable optimal global tax efficiency whilst maintaining regulatory adherence and operational excellence.

DeFi Tax Implications and Advanced Reporting Strategies

Decentralised finance taxation presents unique challenges. These include complex transaction tracking, sophisticated yield calculation, and advanced reporting requirements. These impact DeFi participation and tax compliance for professional investors and institutional participants. DeFi tax management includes comprehensive transaction analysis. It includes sophisticated yield tracking. It includes advanced reporting procedures. These ensure regulatory compliance whilst maintaining operational efficiency and tax optimisation.

Advanced DeFi reporting strategies include systematic transaction categorization. They include comprehensive yield analysis. They include sophisticated compliance procedures. These enable optimal DeFi participation whilst maintaining regulatory adherence and tax efficiency. Professional DeFi tax management utilises advanced analytics. It uses comprehensive tracking systems. It uses sophisticated reporting frameworks. These ensure optimal tax compliance whilst maintaining operational excellence and regulatory adherence.

Liquidity Mining and Yield Farming Tax Treatment

Liquidity mining and yield farming activities create complex tax implications including income recognition timing, fair market value determination, and comprehensive reporting requirements that require sophisticated tax planning and professional compliance management. Tax treatment includes systematic income calculation, comprehensive basis tracking, and advanced reporting procedures that ensure accurate tax compliance while optimising tax efficiency through professional yield farming tax management and institutional DeFi compliance designed for sophisticated decentralised finance taxation and professional asset management excellence.

Tax-Loss Harvesting and Strategic Portfolio Management

Tax-loss harvesting for cryptocurrency portfolios requires sophisticated timing strategies, comprehensive wash sale rule compliance, and advanced optimisation techniques that maximise tax benefits while maintaining investment objectives and portfolio performance. Tax-loss harvesting includes systematic loss realisation, comprehensive gain offsetting, and advanced timing strategies that optimise after-tax returns while maintaining appropriate risk management and investment discipline through professional tax-loss management and institutional portfolio operations designed for sophisticated tax optimisation and professional investment excellence.

Strategic portfolio management for tax efficiency includes comprehensive tax planning, sophisticated rebalancing procedures, and advanced optimisation strategies that enhance after-tax returns while maintaining investment objectives and regulatory compliance. Professional tax-efficient portfolio management utilises advanced analytics, systematic tax planning, and comprehensive optimisation frameworks that enable optimal after-tax performance while maintaining operational excellence and regulatory adherence through professional tax-efficient management and institutional asset allocation designed for sophisticated cryptocurrency operations and professional investment management excellence.

Cryptocurrency Estate Planning and Succession Strategies

Cryptocurrency estate planning requires sophisticated succession strategies, comprehensive valuation procedures, and advanced legal frameworks that ensure proper wealth transfer while minimising estate tax liability and maintaining family wealth preservation objectives. Estate planning includes systematic asset valuation, comprehensive succession planning, and advanced legal structuring that optimise wealth transfer while maintaining regulatory compliance and family objectives through professional estate planning and institutional wealth management designed for sophisticated cryptocurrency succession and professional family office operations.

Succession strategies include comprehensive trust structures, sophisticated gifting strategies, and advanced operational procedures that optimise intergenerational wealth transfer while maintaining appropriate tax efficiency and regulatory compliance. Professional succession planning utilises advanced legal frameworks, systematic wealth transfer strategies, and comprehensive compliance procedures that enable optimal estate planning while maintaining operational excellence and regulatory adherence through professional succession management and institutional estate planning designed for sophisticated cryptocurrency wealth transfer and professional family wealth management excellence.

Technology Integration and Automated Tax Compliance

Technology integration for cryptocurrency tax compliance includes advanced automation systems, sophisticated tracking platforms, and comprehensive reporting tools that enhance tax efficiency while maintaining compliance standards and operational excellence. Technology implementation includes real-time transaction tracking, comprehensive tax calculation systems, and advanced reporting automation that optimise tax compliance whilstreducing operational overhead through professional technology integration and institutional tax operations designed for sophisticated compliance automation and professional operational excellence.

Automated tax compliance includes sophisticated algorithms, comprehensive data integration systems, and advanced reporting procedures that maintain optimal tax compliance while managing regulatory requirements and operational complexities. Professional automation utilises advanced technology platforms, systematic compliance monitoring, and comprehensive reporting frameworks that enable optimal tax efficiency while maintaining regulatory adherence and operational excellence through professional automation systems and institutional tax operations designed for sophisticated cryptocurrency compliance and professional asset management excellence.

Advanced Tax Strategies and Professional Implementation

Professional Tax Planning Frameworks

Professional cryptocurrency tax planning requires sophisticated frameworks that address regulatory requirements, compliance obligations, and operational efficiency while maintaining strategic advantages and competitive positioning. Advanced tax strategies include comprehensive record-keeping procedures, systematic tax optimisation, and professional compliance frameworks that enable institutional-grade tax management while maintaining appropriate oversight and control mechanisms through professional excellence and systematic implementation designed for enterprise tax operations and sustainable compliance success.

Enterprise cryptocurrency tax management utilises advanced methodologies, comprehensive regulatory analysis, and systematic optimisation approaches that minimise tax liabilities while managing complexity and compliance requirements. Professional implementation includes sophisticated tracking systems, comprehensive reporting procedures, and systematic audit preparation that ensure optimal tax compliance while adapting to changing regulatory requirements and tax legislation through professional excellence and systematic optimisation designed for sustainable competitive advantages and long-term tax compliance success in the evolving cryptocurrency regulatory landscape.

Technology Integration and Compliance Excellence

Professional cryptocurrency tax operations require sophisticated technology infrastructure that enables automated transaction tracking, real-time compliance monitoring, and comprehensive reporting capabilities across multiple platforms and jurisdictions. Technology integration includes advanced tax software systems, automated record-keeping capabilities, and comprehensive audit trail tools that support regulatory compliance and operational requirements while maintaining security standards and operational efficiency through technological excellence and systematic automation designed for professional cryptocurrency tax operations and compliance advantages.

Regulatory Compliance and Professional Standards

Professional cryptocurrency tax compliance requires comprehensive understanding of regulatory frameworks, reporting obligations, and professional standards that govern cryptocurrency taxation across multiple jurisdictions and regulatory environments. Compliance considerations include systematic documentation procedures, comprehensive audit preparation, and professional reporting standards that ensure appropriate regulatory compliance while maintaining operational efficiency and strategic advantages through regulatory excellence and systematic compliance designed for professional cryptocurrency tax operations and sustainable compliance success in the dynamic regulatory environment.

Advanced Tax Planning

Strategic tax optimisation requires understanding evolving regulations and planning techniques for cryptocurrency investments through comprehensive analysis and professional guidance that ensures compliance while maximising efficiency. Professional tax planning incorporates sophisticated strategies including loss harvesting, strategic timing of transactions, and comprehensive record-keeping systems that enable optimal tax outcomes for cryptocurrency investors and traders seeking enhanced financial performance through disciplined tax management approaches and comprehensive compliance frameworks for sustainable investment success and long-term wealth preservation strategies through professional guidance excellence.

Conclusion

Cryptocurrency taxation in 2025 represents both a challenge and an opportunity for digital asset investors. Whilst the regulatory landscape has become more complex and enforcement more stringent, the increased clarity around tax rules provides a framework for compliant participation in the crypto ecosystem. Understanding and properly managing your crypto tax obligations is no longer optional – it's an essential skill for any serious cryptocurrency investor.

The key to successful crypto tax management lies in proactive planning, meticulous record-keeping, and staying informed about evolving regulations. As we've explored throughout this guide, the complexity of crypto taxation stems not just from the technology itself, but from the diverse ways digital assets can be acquired, traded, and utilised across different protocols and jurisdictions.

Essential Action Steps

Start implementing proper tax practices immediately: maintain detailed records of all transactions from day one, use professional tax software designed for cryptocurrency, understand the tax implications before engaging in complex DeFi activities, consult with qualified tax professionals for significant portfolios, and stay informed about regulatory changes in your jurisdiction.

The investment in proper tax compliance – whether through software, professional services, or education – is minimal compared to the potential costs of non-compliance. With tax authorities increasingly sophisticated in tracking blockchain transactions and substantial penalties for tax evasion, the risks of inadequate tax planning far outweigh the costs of proper compliance.

Looking Ahead

The future of crypto taxation will likely bring further standardisation across jurisdictions, more sophisticated reporting requirements, and continued evolution of rules around emerging technologies like NFTs, DeFi, and layer-2 solutions. However, the fundamental principles of accurate record-keeping, understanding taxable events, and proactive tax planning will remain constant.

By following the strategies and best practices outlined in this guide, you'll be well-positioned to navigate the complex world of crypto taxation while maximising your after-tax returns. Remember that tax compliance is not just about following rules – it's about building a sustainable foundation for long-term wealth creation in the digital asset space.

Need help with crypto tax tools and platforms? Explore our crypto tools comparison for comprehensive tax management solutions.

Sources & References

Frequently Asked Questions

- Do I need to pay taxes on cryptocurrency in 2025?

- Yes, most countries treat cryptocurrency as taxable property. You must pay capital gains tax on profits from selling, trading, or using crypto. The specific rules vary by jurisdiction, so check your local tax laws and consult a tax professional for guidance.

- What crypto activities are taxable events?

- Taxable events include selling cryptocurrency for fiat currency, trading one cryptocurrency for another, using cryptocurrency for purchases, receiving cryptocurrency as income (including staking rewards and airdrops), and most DeFi activities, such as yield farming and liquidity provision.

- How can I reduce my crypto tax liability legally?

- Legal strategies include holding cryptocurrencies for over one year to qualify for long-term capital gains rates, tax-loss harvesting to offset gains with losses, utilising tax-advantaged accounts where permitted, and strategically timing transactions across tax years.

- Do I need to report every crypto transaction?

- Generally, yes, especially transactions that result in gains or losses. Requirements vary by country, but detailed record-keeping of all transactions is essential for accurate tax reporting and compliance. Utilise crypto tax software to help track all transactions.

- What happens if I don't report crypto taxes?

- Failing to report crypto taxes can result in penalties, interest charges, and potential criminal prosecution for tax evasion. Many tax authorities are increasing enforcement and have access to exchange data, making detection more likely.

- Are staking rewards taxable?

- Yes, staking rewards are generally taxable as income at their fair market value when received. This creates a new cost basis for future sales. The tax treatment may vary by jurisdiction, so consult local tax guidance.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.