Binance vs OKX 2025: Exchange Comparison

Want to know which exchange is better? Let's break it down! Both Binance and OKX are great, but they excel in different areas. This comparison will help you choose the right one for your needs.

Are you a beginner? Do you want the safest option? Or are you looking for the lowest fees? Maybe you're interested in DeFi? We'll answer all these questions and more!

By the end of this guide, you'll know exactly which platform suits your trading style. We'll cover everything from basic fees to advanced features. Let's dive in!

The crypto exchange world in 2025 has two big players: Binance and OKX. Both offer great services for different types of traders. Binance is the world's largest crypto exchange. It has over 120 million users. It handles more than $20 billion in daily trades. This makes it very popular with both new and experienced traders.

OKX used to be called OKEx. It focuses on new features and easy DeFi access. The platform serves users in over 180 countries. OKX attracts smart traders who want cutting-edge tools. They also want direct access to DeFi protocols.

This guide compares both platforms in detail. We look at fees, security, trading tools, and earning options. We also check customer support and regulatory compliance. This will help you choose the right platform for your needs.

Quick question: Are you looking for the lowest fees or the best DeFi features? Your answer will help determine which exchange suits you better!

Introduction

The crypto exchange world in 2025 has two major platforms. They keep pushing innovation and user experience. Binance is the world's largest crypto exchange by trading volume. OKX is a fast-growing challenger with great Web3 features. Both platforms serve millions of users worldwide. They compete hard for market share. They do this with new features and competitive prices.

Choosing between Binance and OKX needs careful thought. You should consider trading fees and available cryptos. Also look at security, earning options, and user experience. Both exchanges offer complete crypto trading services. But they have different approaches to innovation. They also have different approaches to user engagement. This creates different advantages for different types of crypto users.

Binance is strong because of its huge liquidity. It also has an extensive crypto selection. It has a mature ecosystem with everything from basic spot trading to smart derivatives. The platform also offers staking services. It provides blockchain infrastructure via BNB Chain. Its global reach makes it popular with institutional investors. High-volume traders also like it because they need liquidity and reliable execution.

OKX stands out with superior Web3 integration. It has innovative DeFi earning products. It has a more streamlined user interface. This appeals to both traditional traders and DeFi enthusiasts. The platform's built-in Web3 wallet attracts users. Its smart trading tools also attract users who want cutting-edge features. It also offers seamless transitions between centralised and decentralised finance.

This complete comparison looks at every important aspect of both platforms. We examine trading fees and security measures. We look at futures trading and staking rewards. We also check DeFi integration and customer support quality. We analyse real-world usage scenarios. We evaluate regulatory compliance in different countries. This will help you choose between these industry leaders. You can base your choice on your specific needs.

Quick Comparison Table

| Feature | Binance | OKX |

|---|---|---|

| Spot Fees (tier 0) | 0.10% | 0.08% |

| Futures Fees | 0.02% / 0.04% | 0.02% / 0.05% |

| Listed Assets | 600+ | 350+ |

| Earn Products | Simple Earn, Launchpad | DeFi Earn, Liquid Staking |

| Web3 Wallet | Trust Wallet (external) | Built-in OKX Wallet |

| KYC | Mandatory | Mandatory |

| SAFU Fund | Yes ($1B) | N/A |

| Mobile App Rating | 4.5/5 | 4.3/5 |

Liquidity & Trading Experience

Binance stays the top choice for liquidity. It has about $65 billion in daily trading volume in 2025. This huge volume means tighter spreads. It also means faster order execution. You get less slippage even for big trades.

OKX is smaller with around $15-20 billion daily volume. But it's catching up fast. Their altcoin order books are deep. This makes them good for trading smaller-cap cryptos. The platform does great in derivatives trading. It often matches or beats Binance's liquidity in popular perpetual contracts.

Pro tip: If you're trading large amounts, Binance's higher liquidity will save you money on slippage!

Trading Interface Comparison

Binance Interface: The classic Binance interface can feel overwhelming for newcomers. It has dozens of trading pairs and advanced charting tools. However, Binance Lite mode offers a simple experience for beginners. The mobile app works well and handles high-frequency trading smoothly.

OKX Interface: OKX offers a cleaner, more modern interface that many traders find easier to use. The unified trading experience smoothly combines spot, futures, and options trading. Their mobile app has an integrated Web3 wallet. This provides a one-stop solution for both CEX and DEX trading.

Order Types and Smart Features

Both platforms support standard order types. These include market, limit, and stop-loss orders. But OKX has more smart options. These include iceberg orders and time-weighted average price (TWAP). It also has smart algorithmic trading tools. Binance fights back with its extensive API ecosystem. It also has third-party trading bot integrations.

Which do you prefer: More order types (OKX) or better bot integration (Binance)?

Comprehensive Fee Analysis

Spot Trading Fees Breakdown

| Trading Volume (30d) | Binance Maker/Taker | OKX Maker/Taker |

|---|---|---|

| $0 - $25,000 | 0.10% / 0.10% | 0.08% / 0.10% |

| $25,000 - $50,000 | 0.09% / 0.10% | 0.07% / 0.09% |

| $50,000 - $100,000 | 0.08% / 0.10% | 0.06% / 0.08% |

| $100,000 - $250,000 | 0.07% / 0.10% | 0.05% / 0.07% |

| $250,000+ | 0.02% / 0.04% | 0.02% / 0.05% |

Token Discount Programs

Binance BNB Discounts: Holding BNB offers up to 25% fee reduction. The discount tiers are based on your BNB balance and 30-day trading volume. For example, holding 25+ BNB reduces fees to 0.075% for most clients.

OKX OKB Benefits: OKB holders receive up to 20% fee discounts plus additional perks like higher lending rates and priority customer support. The loyalty program also takes into account your trading history and platform engagement.

Futures and Derivatives Fees

Both platforms offer competitive futures trading. Maker fees are as low as 0.02%. OKX often offers lower funding rates on popular pairs. For example, BTC/USDT rates are often better. This can significantly impact the cost of holding leveraged positions overnight.

Smart trader tip: Always check funding rates before opening leveraged positions. Small differences add up over time!

Withdrawal Fees Comparison

| Cryptocurrency | Binance Withdrawal Fee | OKX Withdrawal Fee |

|---|---|---|

| Bitcoin (BTC) | 0.0005 BTC | 0.0004 BTC |

| Ethereum (ETH) | 0.005 ETH | 0.005 ETH |

| USDT (ERC-20) | 25 USDT | 20 USDT |

| USDT (TRC-20) | 1 USDT | 0.8 USDT |

| BNB/OKB | 0.005 BNB | 0.01 OKB |

OKX generally offers lower withdrawal fees. This is especially true for stablecoins and popular altcoins. This can save you significant money. This matters if you frequently move funds between platforms. It also matters if you move funds to external wallets.

Money-saving tip: Use TRC-20 USDT for the cheapest withdrawals on both platforms!

Real-World Fee Examples

Let's look at some real examples to see how fees add up:

Example 1: Small Trader ($1,000/month)

- Binance: $10 in trading fees (0.1%)

- OKX: $8 in trading fees (0.08%)

- Monthly savings with OKX: $2

Example 2: Active Trader ($10,000/month)

- Binance: $100 in trading fees

- OKX: $80 in trading fees

- Monthly savings with OKX: $20

These savings add up over time! For active traders, the fee difference can be hundreds of dollars per year.

Earning Opportunities Deep Dive

Binance Earn Ecosystem

Simple Earn: Binance's main earning product offers flexible and locked staking options. Popular assets like ETH offer around 4-5% APY. This comes through liquid staking (BETH). Stablecoins like USDT provide 8-12% in flexible savings.

Launchpad Access: BNB holders get priority access to new token launches. These often provide 10x+ returns on successful projects. Recent launches like Arkham (ARKM) and Cyber (CYBER) have delivered great returns. They delivered these returns to participants.

Dual Investment: This product allows users to earn higher yields. You can get 15-30% APY. But you accept the risk of receiving payments in different cryptos. This depends on market performance.

Insider tip: Launchpad can be incredibly profitable, but you need to hold BNB tokens to participate!

OKX Earn Innovation

DeFi Integration: OKX Earn connects smoothly to major DeFi protocols. These include Aave, Compound, and Curve. Users can access yield farming opportunities directly. They can do this through the exchange interface. This removes the need to manage multiple wallets.

Liquid Staking Solutions: Beyond basic ETH staking, OKX offers exposure to new protocols. These include EigenLayer restaking. This provides 6-8% base yields. You also get additional rewards from actively validated services (AVS).

Cross-Chain Yield Farming: The integrated Web3 wallet allows users to farm yields. You can do this across multiple blockchains. These include Ethereum, Polygon, Arbitrum, and Optimism. You don't need to leave the OKX ecosystem.

DeFi secret: OKX's integrated approach makes complex DeFi strategies as easy as regular trading!

Risk-Adjusted Returns Comparison

- Stablecoin Savings: Binance 8-12% APY, OKX 10-15% APY, low risk profile.

- ETH Staking: Binance 4-5% APY, OKX 5-6% APY, low risk profile.

- DeFi Yield Farming: Not available in Binance Earn core flows, OKX typically 15-40% APY with high risk.

- Structured Products: Binance 15-30% APY, OKX 12-25% APY, medium risk with payoff conditions.

- Launchpad / Jumpstart: Returns are event-driven on both platforms with high risk and high variance.

Web3 Integration & DeFi Access

OKX Web3 Wallet Advantages

The integrated OKX Web3 wallet represents a significant competitive advantage. It supports over 80 blockchains. These include Bitcoin, Ethereum, Solana, and Polygon. It also supports emerging networks like Base and Arbitrum. Key capabilities include:

- Multi-Chain Asset Management: View and manage assets across all supported networks. You can do this in a single interface.

- Built-in DEX Aggregator: Access to 200+ decentralised exchanges. It has automatic route optimisation for best prices.

- NFT Support: Full NFT marketplace integration. It supports minting, trading, and portfolio tracking.

- Bitcoin Ordinals: Native support for Bitcoin NFTs and BRC-20 tokens.

- Cross-Chain Bridges: Seamless asset transfers between different blockchains. It has competitive fees.

Binance Web3 Approach

Binance takes a different approach with Trust Wallet. This is their recommended Web3 solution. Whilst this requires a separate app installation, it offers some advantages:

Web3 strategy question: Do you prefer everything in one app (OKX) or separate specialised apps (Binance)?

- Enhanced Security: Separate app reduces attack surface. This helps with Web3 interactions.

- Broader DApp Support: Trust Wallet supports over 100 blockchains. It supports thousands of DApps.

- Open Source: Trust Wallet's open-source nature allows for community audits. It also allows for contributions.

- Hardware Wallet Integration: Seamless connection with Ledger and other hardware wallets.

DeFi Yield Comparison

OKX's integrated approach makes DeFi participation significantly easier. It's also more accessible for mainstream clients. Users can:

- Stake ETH directly to Lido or Rocket Pool. You can do this from the exchange interface. It has one-click functionality.

- Provide liquidity to Uniswap V3 pools. It has automated position management. It also has impermanent loss protection.

- Participate in governance voting for major DeFi protocols. You don't need to leave the platform.

- Access yield farming opportunities on Layer 2 networks. These have lower gas fees. They also have optimised strategies.

- utilise cross-chain yield farming. It has automatic asset bridging. It also has position optimisation.

- Access exclusive DeFi partnerships. Get higher APY rates via OKX's institutional relationships.

Advanced DeFi Features Comparison

OKX offers smart DeFi tools. These rival dedicated DeFi platforms:

- Portfolio Analytics: Real-time tracking of DeFi positions. This works across multiple protocols and chains.

- Risk Management: Automated alerts for impermanent loss and liquidation risks. Also alerts for yield changes.

- Strategy optimisation: AI-powered recommendations for maximising yield. This also minimises risk.

- Gas optimisation: Intelligent transaction batching and timing. This reduces network fees.

- Institutional DeFi: Access to institutional-grade DeFi products. These have enhanced security and compliance.

Binance DeFi Integration Challenges

Whilst Binance offers extensive DeFi access via Trust Wallet, the separation creates several challenges:

- Fragmented Experience: Users must manage assets across multiple applications. They also need to manage multiple interfaces.

- Manual Bridging: Complex process for moving funds. This applies to moving between centralised and decentralised platforms.

- Higher Complexity: Requires deeper technical knowledge. This is needed to navigate DeFi protocols effectively.

- Gas Fee Management: Users must manually optimise transaction timing. They also need to optimise batching.

- Limited Integration: Reduced synergy between centralised trading and DeFi strategies.

However, Binance clients benefit from greater control. They can also get potentially higher yields. This works for experienced clients who can navigate DeFi protocols independently. The separation also offers enhanced security. It does this by isolating DeFi risks from centralised exchange holdings.

Experience check: Are you comfortable managing multiple wallets and apps, or do you prefer everything in one place?

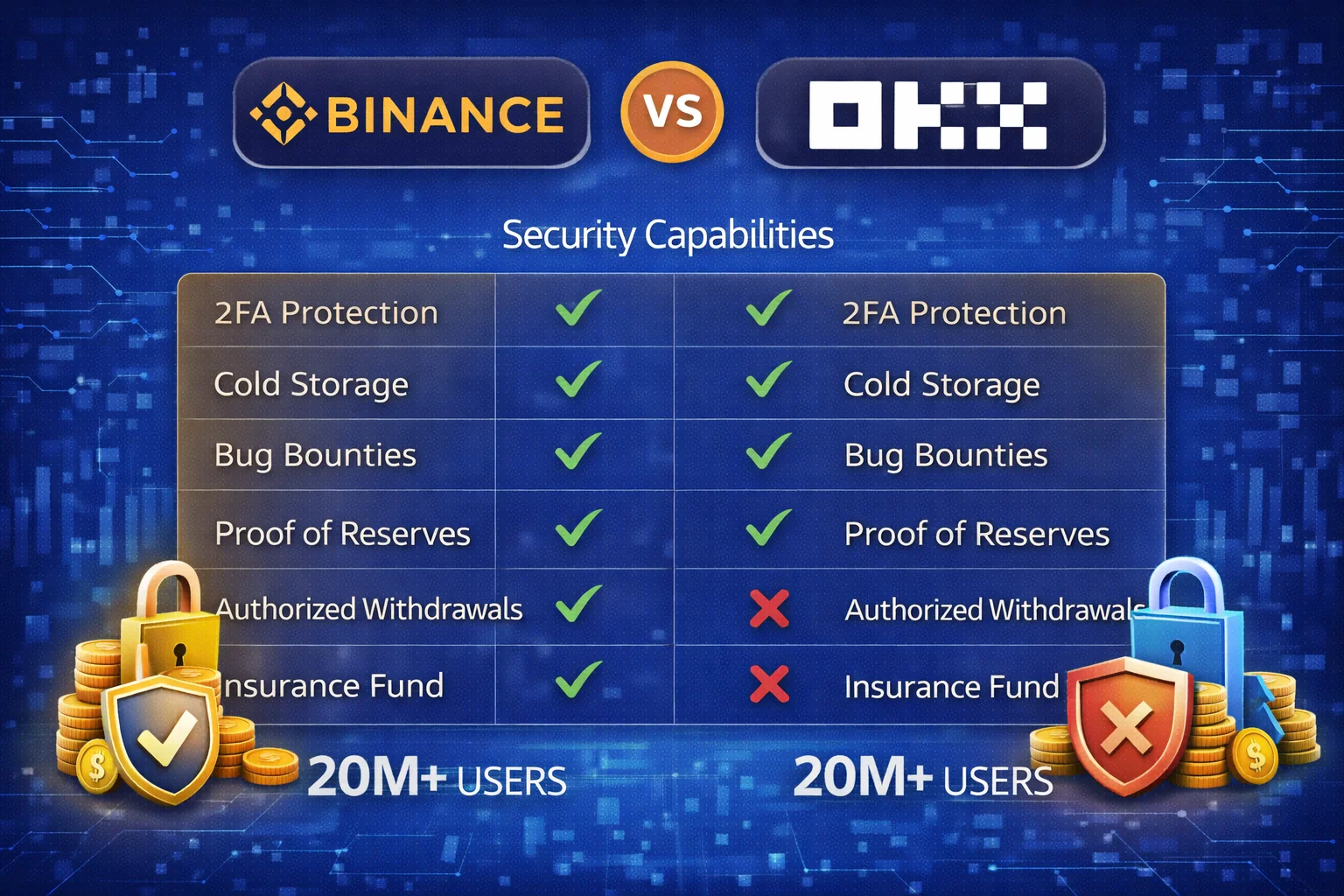

Security Infrastructure & Compliance

Binance Security Measures

SAFU Fund: Binance maintains a $1 billion Secure Asset Fund for Users. This is funded by 10% of trading fees. This fund has successfully compensated clients during security incidents. This includes the 2019 hack. During this hack, 7,000 BTC was stolen but was fully reimbursed.

Security fact: Binance's SAFU fund is one of the largest insurance funds in crypto - that's real protection for your money!

Multi-Tier Security:

- Cold storage for 95% of user funds

- Multi-signature wallet architecture

- Real-time risk monitoring and AI-powered fraud detection

- Mandatory 2FA for all accounts

- Whitelist withdrawal addresses with 24-hour delay

- Device management and login notifications

OKX Security Framework

Proof-of-Reserves: OKX offers monthly Merkle tree proofs. These allow clients to verify that their funds are backed 1:1 independently. This transparency initiative was launched in the wake of the FTX collapse. It fosters trust via verifiable cryptographic evidence.

Transparency win: You can actually verify your funds exist on OKX - no more trusting blindly!

Advanced Protection:

- Semi-offline signature technology for enhanced cold storage

- Multi-party computation (MPC) for institutional clients

- Real-time blockchain monitoring for suspicious activities

- Insurance coverage via third-party providers

- Regular security audits by leading cybersecurity firms

KYC and Regulatory Compliance

Binance KYC Process: Requires government-issued ID, proof of address, and facial verification. The process typically takes 15-30 minutes for most clients. Binance has strengthened compliance following regulatory challenges, implementing region-specific restrictions and enhanced monitoring.

OKX Verification: Similar requirements with additional emphasis on source of funds documentation for high-volume traders. OKX has proactively obtained licenses in multiple jurisdictions, featuring Malta, Dubai, and several other regions with favourable regulatory environments.

Regulatory Standing in 2025

Both exchanges have significantly improved their regulatory compliance. Binance has resolved most regulatory issues. It operates legally in major markets. OKX has maintained a cleaner regulatory record. It has fewer enforcement actions.

Regulation update: Both exchanges are now much more compliant than they were in 2022-2023!

Detailed Pros & Cons Analysis

Binance Advantages

- Unmatched Liquidity: $65B+ daily volume guarantees minimal slippage and tight spreads for professional trading

- Launchpad Exclusivity: Early access to promising new projects with potential for significant returns and portfolio growth

- Comprehensive Fiat Support: 60+ fiat currencies with credit card, bank transfer, and P2P options for global accessibility

- Educational Resources: Binance Academy offers extensive crypto education for beginners and advanced professional traders

- Global Reach: Available in 180+ countries with comprehensive localised support

- Institutional Services: Dedicated institutional platform with advanced trading tools

- Mobile App Excellence: Highly rated mobile app with full feature parity

Binance Disadvantages

- Interface Complexity: Can be overwhelming for newcomers with hundreds of capabilities

- Regulatory Uncertainty: Ongoing regulatory challenges in some jurisdictions

- Customer Support: Response times can be slow during high-volume periods

- Limited DeFi Integration: Requires external wallets for complete DeFi access

- Withdrawal Limits: Lower limits for unverified accounts compared to competitors

OKX Advantages

- Integrated Web3 Ecosystem: Seamless CEX-to-DeFi experience in one platform

- Superior DeFi Yields: Direct access to high-yield farming opportunities

- Modern Interface: Clean, intuitive design preferred by many traders

- Lower Fees: Generally more competitive fee structure throughout most trading pairs

- Cross-Chain Support: Native support for 80+ blockchains

- Regulatory Compliance: Proactive licensing and cleaner regulatory record

- Innovation Focus: Quick to adopt new technologies and trading capabilities

OKX Disadvantages

- Lower Liquidity: Smaller trading volumes can result in higher slippage

- Limited Fiat Options: Fewer fiat on-ramps compared to Binance

- Smaller Altcoin Selection: Fewer micro-cap and new token listings

- Regional Restrictions: Not available in some major markets like the United States

- Learning Curve: Web3 capabilities may be complex for traditional traders

Choosing the Right Platform for Your Needs

Choose Binance If You:

- prioritise Liquidity: Trade large volumes or need minimal slippage

- Want Launchpad Access: Interested in early-stage token investments

- Need Fiat Flexibility: Require multiple fiat on-ramp options

- Prefer Established Platforms: Value the security of the world's largest exchange

- Trade Futures Actively: Need the deepest derivatives markets

- Are Location-Restricted: Live in regions where OKX isn't available

Choose OKX If You:

- Embrace DeFi: Want seamless access to decentralised finance

- Value Lower Fees: prioritise cost-effective trading

- Prefer Modern UX: Want a cleaner, more intuitive interface

- Trade Cross-Chain: Need multi-blockchain asset management

- Seek Higher Yields: Want access to advanced earning strategies

- Are Tech-Savvy: Comfortable with Web3 and DeFi concepts

Multi-Platform Strategy

Many advanced crypto clients employ a multi-platform approach:

The "Best of Both" Strategy:

- Use Binance for high-liquidity trading and Launchpad participation

- Use OKX for DeFi yield farming and cross-chain activities

- Leverage arbitrage opportunities between both platforms

- Keep the majority of funds in cold storage (hardware wallets)

- Maintain small trading balances on both platforms

Risk Management Considerations:

- Never keep all funds on a single exchange

- Use hardware wallets like Tangem for long-term storage

- Regularly withdraw profits to reduce exchange exposure

- Monitor both platforms' regulatory developments

Migration and Setup Guide

Setting Up Both Platforms:

- Complete KYC verification on both exchanges

- Enable maximum security capabilities (2FA, withdrawal whitelist)

- Start with small amounts to test functionality

- Set up API keys for portfolio tracking tools

- Configure withdrawal addresses and test with small amounts

Fund Allocation Strategy:

- 70% in cold storage (hardware wallets)

- 15% on Binance for trading and Launchpad

- 10% on OKX for DeFi and yield farming

- 5% in hot wallets for immediate access

Binance vs OKX Quick Comparison

- Trading Pairs: Binance 600+, OKX 500+

- Spot Trading Fee: Binance 0.1%, OKX 0.08%

- DeFi Integration: Binance Basic, OKX Advanced

- Best For: Binance Liquidity & Variety, OKX DeFi & Lower Fees

Professional Trading Features

API Integration and Trading Support

Both Binance and OKX provide complete API systems for professional trading. These APIs support high-frequency trading and advanced order management. Professional traders can implement complex strategies while maintaining security and reliability.

The APIs include authentication systems, rate limiting, and error handling. This ensures reliable trading for institutional clients. Both platforms offer dedicated support and complete documentation for enterprise users.

Regulatory Compliance and Custody

Institutional clients need complete regulatory compliance and advanced custody solutions. Both platforms provide institutional-grade compliance systems and complete audit trails. They also offer advanced reporting that meets regulatory requirements.

Professional custody solutions include multi-signature security and complete insurance coverage. They also have advanced risk management systems that protect institutional assets while enabling efficient trading.

Execution Framework: How to Decide with Real Data

The most reliable way to choose between Binance and OKX is to run a controlled two-platform test with your own execution profile, because headline fee tables do not capture spread differences, withdrawal friction, or support quality under load. If you trade only once or twice per month, the practical winner can differ from the platform that looks cheapest in a static comparison chart.

Run a seven-day validation cycle with identical conditions: same funding amount, same trading pairs, same order types, and one test withdrawal per platform. For example, if you trade $2,000 in BTC and ETH pairs, record fill quality, effective fees, plus end-to-end withdrawal time, then compare net execution cost instead of relying on nominal maker or taker rates.

Add one risk-control check before scaling volume: confirm that account recovery, withdrawal whitelisting, and anti-phishing controls are configured and tested on both exchanges. This step is operationally critical, because better fills are irrelevant if your security posture is weaker than your capital exposure.

If you plan to combine spot trading with passive yield, pair this comparison with the staking platforms comparison and validate exchange-specific product details in the Binance Staking review before committing larger allocations.

Final Verdict: Binance vs OKX in 2025

After complete analysis, both Binance and OKX excel in different areas, making the choice dependent on your specific needs and trading style. The cryptocurrency exchange landscape has evolved to a point where both platforms offer exceptional services, but with distinct advantages that cater to different user preferences and investment strategies.

Choose Binance If:

You prioritise maximum liquidity, want access to the largest selection of trading pairs, and value the security of the world's largest cryptocurrency exchange. Binance is ideal for active traders, those interested in new token launches via Launchpad, and clients who need extensive fiat on-ramp options.

Choose OKX If:

You want seamless DeFi integration, prefer lower fees, and value a modern, intuitive interface. OKX is perfect for clients interested in yield farming, cross-chain activities, and exploring Web3 without managing multiple wallets.

The Multi-Platform Approach

For maximum flexibility and opportunity, consider using both platforms strategically. Many successful crypto investors maintain accounts on both exchanges, using Binance for high-liquidity trading and Launchpad access whilstleveraging OKX for DeFi yields and cross-chain activities.

Remember that regardless of which platform you choose, never store all your cryptocurrency on exchanges. Use hardware wallets for long-term storage and only keep active trading amounts on centralised platforms.

2025 Market Outlook

Both exchanges continue to innovate and improve their offerings. Binance is focusing on regulatory compliance and institutional services, whilstOKX is pushing the boundaries of Web3 integration. The competition between these platforms ultimately benefits clients via better capabilities, lower fees, and improved security. As the cryptocurrency market matures, both platforms are positioning themselves as complete financial ecosystems rather than simple trading venues, offering everything from basic spot trading to advanced DeFi integration and institutional-grade services.

Start with the platform that best matches your current needs, but remain open to exploring both as your crypto journey evolves. The future of cryptocurrency trading lies in leveraging the unique strengths of different platforms to maximise opportunities while managing risk effectively.

Exchange comparison requires thorough analysis of trading features, security measures, and regulatory compliance across different jurisdictions. Binance and OKX represent different approaches to cryptocurrency trading, with each platform offering unique advantages for specific user types and trading strategies that align with individual investment goals and risk tolerance levels throughout various market conditions and economic environments.

Which Platform Should You Choose?

Still not sure which exchange to pick? Here's a quick guide:

Choose Binance if you:

- Are new to crypto trading

- Want the most trading pairs

- Need maximum liquidity

- Want access to new token launches

- Prefer the most established platform

Choose OKX if you:

- Want lower trading fees

- Are interested in DeFi

- Like modern, clean interfaces

- Want built-in Web3 features

- Trade across multiple blockchains

Remember: You can use both! Many smart traders do exactly that.

Getting Started: Step-by-Step Guide

Ready to start trading? Here's how to get started on either platform:

Step 1: Sign Up

- Visit the official website

- Create your account with email

- Verify your email address

- Set up a strong password

Step 2: Complete KYC

- Upload your ID document

- Take a selfie for verification

- Wait for approval (usually 15-30 minutes)

- Some features require additional verification

Step 3: Secure Your Account

- Enable 2FA (two-factor authentication)

- Set up withdrawal whitelist

- Use Google Authenticator or SMS

- Never share your login details

Step 4: Make Your First Deposit

- Choose your deposit method

- Start with a small amount

- Bank transfer is usually cheapest

- Credit cards are faster but more expensive

Step 5: Start Trading

- Begin with spot trading

- Use limit orders to control prices

- Start small and learn gradually

- Never invest more than you can afford to lose

Common Mistakes to Avoid

New traders often make these mistakes. Here's how to avoid them:

Mistake 1: Not Using 2FA

Always enable two-factor authentication. This simple step protects your account from hackers. Use Google Authenticator instead of SMS when possible.

Mistake 2: Keeping All Funds on Exchange

Exchanges can be hacked. Only keep trading amounts on exchanges. Store long-term holdings in hardware wallets like Ledger or Tangem.

Mistake 3: FOMO Trading

Don't chase pumping coins. Stick to your strategy. Set stop-losses and take profits. Emotional trading leads to losses.

Mistake 4: Ignoring Fees

Small fees add up quickly. Compare fee structures. Use native tokens for discounts. Consider withdrawal costs in your strategy.

Mistake 5: Not Doing Research

Never buy coins without research. Understand the project. Check the team and roadmap. Read whitepapers and community discussions.

Advanced Trading Tips

Ready to take your trading to the next level? Here are some advanced strategies:

Dollar-Cost Averaging (DCA)

Instead of buying all at once, spread your purchases over time. This reduces the impact of price volatility. Both exchanges support recurring buys for popular coins.

Using Stop-Loss Orders

Protect your investments with stop-loss orders. Set them at 5-10% below your buy price. This limits your losses if prices drop suddenly.

Taking Profits Systematically

Don't get greedy. Take profits at predetermined levels. Consider selling 25% at 2x, 25% at 3x, and so on. This locks in gains while keeping upside potential.

Portfolio Diversification

Don't put all eggs in one basket. Spread investments across different coins and sectors. Consider Bitcoin, Ethereum, DeFi tokens, and Layer 1 blockchains.

Market Analysis Tools

Both platforms offer tools to help you make better trading decisions:

Technical Analysis

Learn to read charts and indicators. RSI shows if coins are overbought or oversold. Moving averages help identify trends. Support and resistance levels guide entry and exit points.

Fundamental Analysis

Research the underlying technology and team. Check partnerships and adoption metrics. Monitor development activity on GitHub. Strong fundamentals support long-term growth.

Market Sentiment

Pay attention to market mood. Fear and greed drive short-term prices. Use sentiment indicators to time your trades better. Contrarian approaches often work well.

Security Best Practices

Protecting your crypto is crucial. Follow these security guidelines:

Strong Passwords

Use unique, complex passwords for each exchange. Include uppercase, lowercase, numbers, and symbols. Consider using a password manager like 1Password or Bitwarden.

Two-Factor Authentication

Always enable 2FA on your accounts. Google Authenticator is more secure than SMS. Backup your 2FA codes in case you lose your phone.

Email Security

Secure your email account with 2FA too. Hackers often target email to reset exchange passwords. Use a dedicated email for crypto activities.

Hardware Wallets

For long-term storage, use hardware wallets. Ledger and Trezor are popular options. They keep your private keys offline and secure from hackers.

Regular Security Checkups

Review your account activity regularly. Check for unauthorised logins or trades. Update your passwords every few months. Stay vigilant against phishing attempts.

Tax Considerations

Don't forget about taxes! Crypto trading has tax implications:

Record Keeping

Keep detailed records of all trades. Note dates, amounts, and prices. Both exchanges provide transaction history downloads. Use tools like CoinTracker or Koinly for tax reporting.

Tax Events

Trading crypto to crypto is taxable. Taking profits triggers capital gains tax. Staking rewards are taxable income. Consult a tax professional for guidance.

Both Binance and OKX provide detailed transaction histories to help with tax reporting. Download your data regularly and keep good records for tax season. This makes filing taxes much easier and more accurate for your crypto investments and trading activities throughout the year. Stay organised and compliant with all applicable tax regulations worldwide always.

Sources & References

Frequently Asked Questions

- Which is better for beginners: Binance or OKX?

- Binance is generally better for beginners due to its extensive educational resources, larger user base, and more fiat on-ramp options. OKX offers a more intuitive interface that some beginners find easier to navigate. Start with Binance if you want complete support and learning tools.

- Are Binance and OKX safe?

- Both exchanges have strong security practices, featuring cold storage, 2FA, and comprehensive insurance funds. Binance maintains a larger insurance fund ($1B+) and has a more extended operational history. OKX has never been hacked and upholds high security standards. Always enable 2FA and avoid storing large holdings on any exchange.

- Which exchange has lower fees?

- OKX offers slightly lower base spot trading fees (0.08% vs 0.1% on Binance). Both exchanges provide discounts via native tokens (BNB, OKB) and VIP tiers. For high-volume traders, fee differences become minimal after VIP and token discounts.

- Can I use both Binance and OKX?

- Yes. Many traders use both exchanges strategically. Binance offers deeper liquidity and strong support for new token launches. OKX offers lower fees and superior DeFi/Web3 integration. Using both maximises opportunities and diversifies platform risk. For detailed setup guides, see our Binance setup guide and OKX registration guide.

- Which exchange is better for DeFi?

- OKX offers significantly better DeFi functionality thanks to its integrated Web3 wallet, cross-chain swaps, and native access to DeFi protocols. Binance offers only basic DeFi capabilities and requires more manual steps. If DeFi is a priority, OKX is the stronger choice.

- Do Binance and OKX work in the US?

- Neither Binance.com nor OKX.com serve US customers due to regulatory restrictions. US clients must use Binance.US (limited capabilities) or regulated alternatives like Coinbase or Kraken.