Best Crypto Income Strategies 2025

Discover proven strategies to earn income with cryptocurrency in 2025. From staking and lending to advanced DeFi strategies, learn how to maximise yields while managing risks effectively.

Introduction

The cryptocurrency passive income ecosystem has undergone a remarkable transformation in 2025. It has evolved from experimental yield farming protocols to a mature financial infrastructure that rivals traditional investment products in sophistication and reliability.

The convergence of institutional adoption, regulatory clarity, and technological innovation has created unprecedented opportunities. Investors can now generate sustainable returns from their digital asset holdings without active trading or market timing.

Passive income strategies in cryptocurrency have expanded far beyond simple interest-bearing accounts. They now encompass a diverse range of mechanisms, including proof-of-stake staking, liquidity provision, lending protocols, validator operations, and sophisticated DeFi yield optimisation strategies.

Each approach offers distinct risk-return profiles, technical requirements, and time commitments. This enables investors to construct portfolios that align with their individual risk tolerance, technical expertise, and financial objectives.

The maturation of the cryptocurrency market has brought significant improvements in security, transparency, and user experience across passive income platforms. Regulated centralised platforms now offer insurance coverage, professional custody solutions, and compliance with financial regulations.

This provides institutional-grade security for retail investors.

Simultaneously, decentralised finance protocols have implemented rigorous security audits, bug bounty programs, and governance mechanisms that enhance protocol safety. They maintain the permissionless access and transparency that define DeFi.

Yields available in the cryptocurrency passive income market in 2025 range from conservative 4-6% annual returns on regulated platforms to aggressive 15-25% potential yields through advanced DeFi strategies. These returns significantly exceed traditional savings accounts and bonds.

However, they come with correspondingly higher risks, including smart contract vulnerabilities, platform insolvency, regulatory changes, and market volatility. Understanding these risk factors and implementing appropriate mitigation strategies is essential for successful passive income generation in the evolving cryptocurrency landscape.

The regulatory landscape for cryptocurrency passive income has evolved considerably. Major jurisdictions have established clear frameworks that balance innovation with consumer protection.

This regulatory clarity has enabled institutional investors to participate in cryptocurrency passive income strategies, bringing greater liquidity, stability, and legitimacy to the market. However, regulatory requirements vary significantly across jurisdictions.

Investors must ensure compliance with local laws regarding cryptocurrency taxation, reporting, and platform licensing.

This comprehensive guide examines the most effective passive income strategies available in 2025. It analyses their risk profiles, yield potential, technical requirements, and practical implementation considerations.

Whether you're a conservative investor seeking stable returns through regulated platforms or an experienced DeFi user pursuing optimised yields through advanced strategies, this guide provides the knowledge and tools necessary. You can build successful passive-income portfolios that generate sustainable returns while effectively managing risk in the dynamic cryptocurrency market.

The success of cryptocurrency passive income strategies depends heavily on understanding the underlying technologies, market dynamics, and risk factors that influence returns. This guide provides practical, actionable guidance for implementing these strategies safely and effectively.

It includes detailed analysis of platform selection criteria, risk management techniques, and optimisation strategies that have proven successful in real-world applications. By following these principles and maintaining appropriate risk management practices, investors can build sustainable passive income streams.

Why Digital Asset Earnings Matter in 2025

The cryptocurrency landscape has matured significantly, offering numerous opportunities to generate income from digital assets. In 2025, institutional adoption, regulatory clarity, and technological improvements have made digital asset earning methods more accessible and reliable than ever before.

Unlike traditional investments, crypto income strategies can offer higher yields while providing exposure to innovative blockchain technologies. However, these opportunities come with unique risks that require careful consideration and proper risk management.

Market Overview 2025

- Total Staked Value: Over $100 billion across major PoS networks

- DeFi TVL: $80+ billion locked in decentralised finance protocols

- Institutional Participation: Major corporations and funds actively staking

- Regulatory Clarity: Clear frameworks in major jurisdictions

- Technology Maturity: Proven protocols with years of operation

Top Earning Methods for 2025

Each strategy offers a different risk-reward profile, complexity level, and time commitment. Understanding these differences helps you choose the right mix for your portfolio and investment goals.

| Strategy | Expected APY | Risk Level | Complexity | Liquidity |

|---|---|---|---|---|

| PoS Staking | 3-8% | Low-Medium | Low | Variable |

| Crypto Lending | 2-12% | Medium | Low | High |

| Liquid Staking | 3-6% | Medium | Medium | High |

| Yield Farming | 5-50%+ | High | High | Variable |

| Validator Nodes | 4-10% | Medium-High | Very High | Low |

1. Proof-of-Stake (PoS) Staking

Staking involves locking cryptocurrency tokens to help secure Proof-of-Stake networks and earn rewards. It's one of the most straightforward and reliable ways to earn income from crypto holdings.

How PoS Staking Works

When you stake tokens, you're essentially voting for validators who process transactions and create new blocks. In return, you receive a portion of the block rewards and transaction fees proportional to your stake.

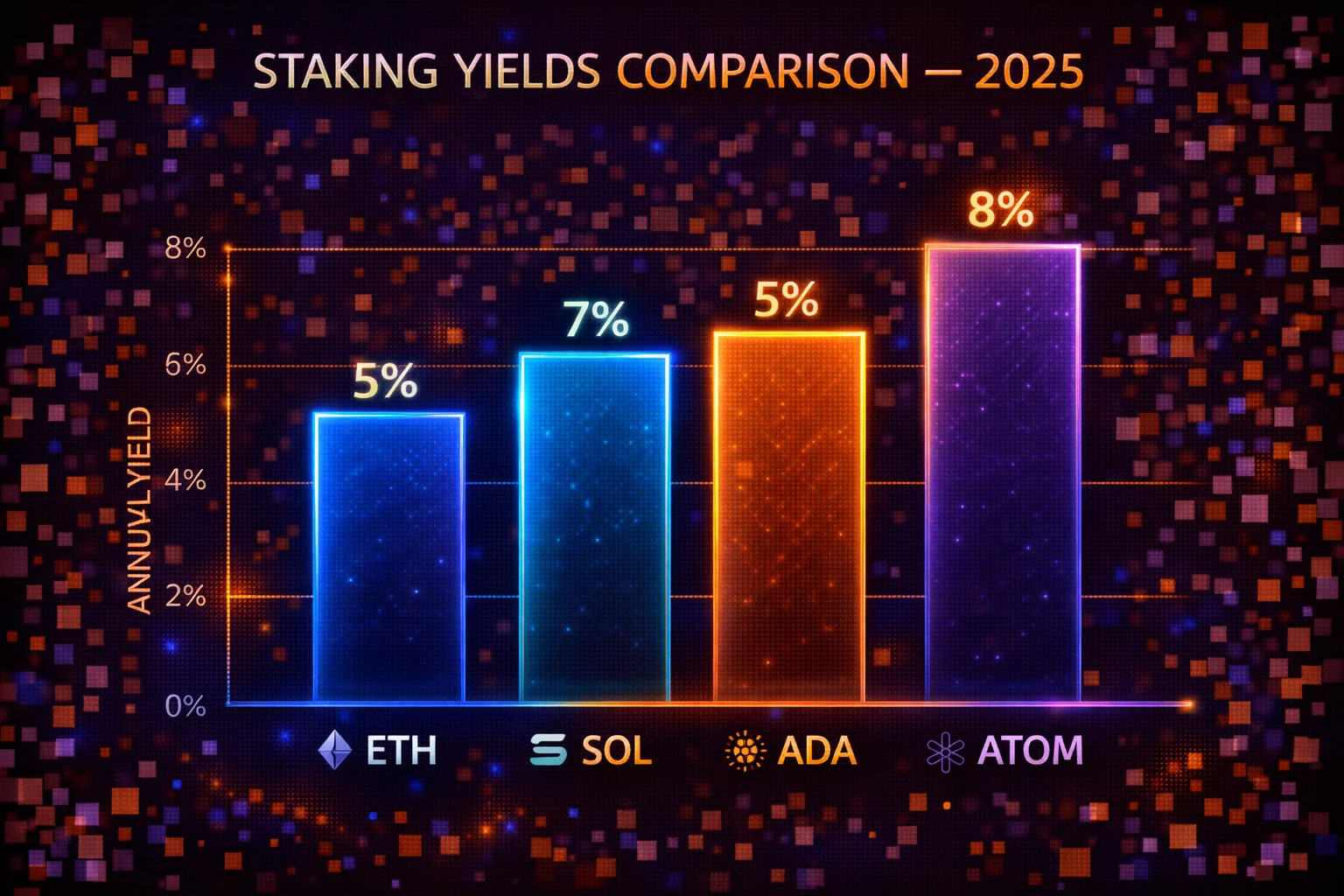

Top Staking Networks in 2025

Ethereum (ETH) - 3.5-5.5% APY

- Minimum: 32 ETH for solo staking, no minimum for pooled staking

- Lock-up: Variable withdrawal queue (hours to days)

- Platforms: Lido, Rocket Pool, Coinbase, Kraken

- Benefits: Largest and most secure PoS network

Solana (SOL) - 6-9% APY

- Minimum: No minimum for delegation

- Lock-up: 2-3 days unbonding period

- Platforms: Phantom Wallet, Solflare, exchanges

- Benefits: High throughput, growing ecosystem

Cardano (ADA) - 4-6% APY

- Minimum: No minimum, ~10 ADA recommended

- Lock-up: No lock-up, liquid delegation

- Platforms: Daedalus, Yoroi, exchanges

- Benefits: No slashing risk, academic approach

Polkadot (DOT) - 10-14% APY

- Minimum: ~120 DOT for direct nomination

- Lock-up: 28 days unbonding period

- Platforms: Polkadot.js, exchanges, LST

- Benefits: High yields, interoperability focus

Staking Strategies

Conservative Approach

- Focus: Established networks with long track records

- Allocation: 70% ETH, 20% ADA, 10% other established PoS

- Platforms: Regulated exchanges or established LST providers

- Expected Return: 3-6% APY with lower risk

Balanced Approach

- Focus: Mix of established and emerging networks

- Allocation: 50% major networks, 30% mid-cap, 20% emerging

- Platforms: Combination of native staking and LST

- Expected Return: 5-8% APY with moderate risk

Aggressive Approach

- Focus: High-yield newer networks and validator operations

- Allocation: Diversified across 5-10 different networks

- Platforms: Native staking, validator nodes, emerging protocols

- Expected Return: 8-15% APY with higher risk

2. Crypto Lending

Crypto lending allows you to earn interest by lending your digital assets to borrowers through centralised or decentralised platforms. It offers flexibility and can provide steady returns across different market conditions.

Types of Crypto Lending

centralised Lending (CeFi)

Centralised platforms handle all aspects of lending, from borrower verification to risk management. They offer user-friendly interfaces and customer support, but require you to trust the platform with your assets.

Top CeFi Lending Platforms

For detailed platform comparisons, see our crypto lending platforms comparison:

- Nexo: EU-regulated, up to 12% APY, insurance coverage, flexible terms

- Binance Review: Multiple products, 1-15% APY, largest user base, global access

- Coinbase: US-regulated, FDIC insurance on USD, limited but safe options

- YouHodler: Swiss-regulated, up to 12% APY, crypto-backed loans available

decentralised Lending (DeFi)

DeFi lending protocols use smart contracts to automate lending without intermediaries. You maintain custody of your assets, but you face risks associated with smart contracts and protocols.

Top DeFi Lending Protocols

- Aave: Leading DeFi protocol, 2-15% APY, multiple markets, flash loans

- Compound: Established protocol, algorithmic rates, and governance token rewards

- Maker: DAI stablecoin protocol, DSR savings rate, conservative approach

Lending Strategies by Asset Type

Stablecoin Lending (USDC, USDT, DAI)

- Expected APY: 2-8% (can spike to 15%+ during high demand)

- Risk Level: Low-Medium (no price volatility risk)

- Best For: Conservative investors, dollar-cost averaging

- Platforms: All major lending platforms support stablecoins

Bitcoin Lending

- Expected APY: 1-6% (lower but more stable)

- Risk Level: Medium (BTC price volatility)

- Best For: Long-term BTC holders seeking extra yield

- Considerations: Lower yields but potentially safer collateral

Altcoin Lending

- Expected APY: 3-12% (highly variable)

- Risk Level: High (price volatility + platform risk)

- Best For: Experienced users with diversified portfolios

- Strategy: Focus on established altcoins with strong fundamentals

3. Liquid Staking

Liquid staking combines the benefits of traditional staking with the flexibility of DeFi. You stake your assets and receive derivative tokens that can be traded, used as collateral, or deployed in other yield strategies.

How Liquid Staking Works

- Deposit: Send your tokens to a LST protocol

- Receive Derivatives: Get LST tokens (e.g., stETH, rETH)

- Earn Rewards: Derivative tokens accrue staking rewards over time

- Use in DeFi: Trade, lend, or use as collateral while earning staking rewards

- Redeem: Exchange derivative tokens back for original assets

Top Liquid Staking Protocols

Lido (stETH, stSOL, stMATIC)

- Assets: Ethereum, Solana, Polygon, Terra

- TVL: $15+ billion (largest LST provider)

- APY: 3-5% for stETH, 6-8% for stSOL

- Benefits: High liquidity, wide DeFi integration

- Risks: centralisation concerns, smart contract risk

Rocket Pool (rETH)

- Assets: Ethereum only

- Approach: decentralised validator network

- APY: 3-5% (similar to Lido but more decentralised)

- Benefits: True decentralisation, community-run

- Considerations: Lower liquidity than Lido

Frax Ether (sfrxETH)

- Innovation: Algorithmic LST with dual tokens

- APY: Often higher than competitors due to MEV optimisation

- Benefits: Innovative tokenomics, competitive yields

- Risks: Newer protocol, complex mechanics

Liquid Staking Strategies

Simple Hold Strategy

- Approach: Hold LST tokens and earn rewards

- Benefits: Simple, maintains liquidity

- Expected Return: Base staking rate (3-8% APY)

- Risk: Depeg risk, smart contract risk

DeFi Integration Strategy

- Approach: Use LST tokens in DeFi protocols

- Examples: Lend stETH on Aave, provide stETH/ETH liquidity

- Benefits: Compound yields, capital efficiency

- Expected Return: 5-15% APY (staking + DeFi yields)

- Risk: Multiple protocol risks, complexity

Arbitrage Strategy

- Approach: Trade price differences between LST tokens and underlying assets

- Example: Buy discounted stETH, hold until peg restoration

- Benefits: Potential for enhanced returns during market stress

- Risk: Timing risk, potential for further depeg

4. Yield Farming

Yield farming involves providing liquidity to decentralised exchanges and protocols to earn trading fees plus incentive tokens. Whilst potentially lucrative, it requires active management and carries significant risks.

Yield Farming Mechanics

Yield farmers provide liquidity to automated market makers (AMMs) by depositing token pairs into liquidity pools. In return, they earn a share of trading fees plus additional rewards in the form of governance or incentive tokens.

Types of Yield Farming

Stablecoin Farming (Low Risk)

- Pairs: USDC/DAI, USDT/USDC, FRAX/USDC

- Platforms: Curve, Balancer, Uniswap V3

- Expected APY: 2-8% (low impermanent loss risk)

- Best For: Conservative farmers, stable returns

Correlated Asset Farming (Medium Risk)

- Pairs: stETH/ETH, wBTC/BTC, MATIC/stMATIC

- Benefits: Reduced impermanent loss, decent yields

- Expected APY: 4-12%

- Considerations: Monitor correlation strength

Volatile Pair Farming (High Risk)

- Pairs: ETH/LINK, BTC/ETH, various altcoin pairs

- Potential: High yields during favorable conditions

- Expected APY: 10-50%+ (highly variable)

- Risks: Significant impermanent loss potential

Advanced Yield Farming Strategies

Concentrated Liquidity (Uniswap V3)

- Concept: Provide liquidity within specific price ranges

- Benefits: Higher capital efficiency, increased fees

- Requirements: Active management, price monitoring

- Tools: Gamma, Arrakis, Charm Finance for automation

Cross-Chain Farming

- Opportunities: Higher yields on newer chains

- Networks: Arbitrum, Optimism, Polygon, Avalanche

- Benefits: Lower gas costs, less competition

- Risks: Bridge risks, newer protocol risks

Yield Aggregation

- Platforms: Yearn Finance, Beefy Finance, Harvest

- Benefits: Automated optimisation, gas savings

- Trade-offs: Additional fees, less control

5. Running Validator Nodes

Operating your own validator node provides maximum control and potentially higher rewards, but requires significant technical expertise, capital commitment, and ongoing maintenance.

Validator Requirements by Network

Ethereum Validator

- Minimum Stake: 32 ETH (~$75,000 at current prices)

- Hardware: Dedicated server with 16GB RAM, 2TB SSD

- Technical Skills: Linux administration, networking, security

- Expected APY: 4-6% (higher than delegated staking)

- Risks: Slashing (up to 32 ETH), downtime penalties

Solana Validator

- Minimum Stake: No fixed minimum, but ~50,000 SOL recommended for competitiveness

- Hardware: High-performance server with 256GB RAM

- Ongoing Costs: $500-1000/month in server and bandwidth costs

- Expected APY: 6-9% minus operational costs

Cardano Stake Pool

- Minimum Stake: 500 ADA pledge (more competitive with higher pledge)

- Hardware: Modest requirements, can run on VPS

- Complexity: Moderate technical requirements

- Expected APY: 4-6% for pool operators

Validator Operation Strategies

Solo Validation

- Benefits: Maximum rewards, full control, network decentralisation

- Requirements: High capital, technical expertise, 24/7 monitoring

- Best For: Technical experts with significant capital

Validator-as-a-Service

- Providers: Figment, Staked, P2P Validator

- Benefits: Professional management, reduced technical burden

- Costs: 5-15% commission on rewards

- Best For: Large holders wanting validator-level returns

Validator Pools

- Concept: Pool resources with others to meet minimum requirements

- Benefits: Lower individual capital requirements

- Considerations: Shared control, trust requirements

Risk Management and Best Practices

Common Risks Across All Strategies

Market Risk

- Price Volatility: Crypto prices can fluctuate dramatically

- Correlation Risk: Most crypto assets are correlated during market stress

- Mitigation: Diversify across assets, use stablecoins for portion of portfolio

Platform Risk

- centralised Platforms: Custody risk, regulatory risk, operational risk

- DeFi Protocols: Smart contract bugs, governance attacks, oracle failures

- Mitigation: Use multiple platforms, check audits, start with small amounts

Liquidity Risk

- Lock-up Periods: Some strategies require locking funds for extended periods

- Withdrawal Queues: High demand can create delays in accessing funds

- Mitigation: Maintain emergency funds, use liquid alternatives when possible

Risk Management Framework

Portfolio Allocation

- Conservative (60% of crypto portfolio): Established staking, regulated lending

- Moderate (30% of crypto portfolio): Liquid staking, DeFi lending

- Aggressive (10% of crypto portfolio): Yield farming, new protocols

Platform Diversification

- No Single Point of Failure: Never put more than 25% with one platform

- Mix CeFi and DeFi: Balance convenience with decentralisation

- Geographic Diversification: Use platforms in different jurisdictions

Monitoring and Adjustment

- Regular Reviews: Monthly assessment of platform health and yields

- Risk Metrics: Track TVL, audit status, team reputation

- Exit Strategies: Have clear criteria for when to exit positions

Tax Considerations for Income

Crypto income strategies create various taxable events that require careful tracking and reporting. Understanding tax implications helps optimise strategies and ensure compliance.

General Tax Principles

- Income Recognition: Most rewards are taxed as income when received

- Fair Market Value: Income valued at market price when received

- Cost Basis: Received tokens have cost basis equal to income amount

- Capital Gains: Selling or exchanging tokens triggers capital gains/losses

Strategy-Specific Tax Implications

Staking Rewards

- Timing: Taxed when rewards are received and accessible

- Frequency: May be daily, weekly, or per epoch

- Valuation: Use fair market value at time of receipt

Lending Interest

- Accrual: May be taxed as accrued or when withdrawn

- Platform Tokens: Bonus tokens typically taxed at receipt

- Compounding: Reinvested interest may create additional taxable events

Yield Farming

- LP Tokens: Providing liquidity may be taxable swap

- Farming Rewards: Governance tokens taxed when claimed

- Impermanent Loss: May be deductible when realised

Tax optimisation Strategies

- Loss Harvesting: realise losses to offset income

- Timing: Consider timing of reward claims and withdrawals

- Entity Structures: Corporate entities may offer advantages

- Professional Help: Consult qualified tax professionals

Getting Started: Your First Steps

Beginner's Roadmap

Step 1: Education and Preparation

- Learn the Basics: Understand blockchain, wallets, and basic DeFi concepts

- Risk Assessment: Determine your risk tolerance and investment timeline

- Capital Allocation: Decide how much to allocate to earning methods

Step 2: Start Conservative

- First Strategy: Begin with staking on a regulated exchange

- Amount: Start with 5-10% of your crypto portfolio

- Platform: Choose established platforms with good reputations

Step 3: Diversify Gradually

- Add Strategies: Gradually add lending and LST

- Platform Diversification: Spread across multiple platforms

- Monitor Performance: Track returns and adjust allocation

Step 4: Advanced Strategies

- DeFi Exploration: Try yield farming with small amounts

- Automation: Use yield aggregators for optimisation

- Validator Consideration: Evaluate running your own validator

Recommended Starting Allocation

- 40% - Exchange Staking: ETH, ADA, SOL on Coinbase/Kraken

- 30% - Stablecoin Lending: USDC on Nexo or Aave

- 20% - Liquid Staking: stETH through Lido

- 10% - Experimental: Small yield farming positions

Advanced Passive Income Strategies for 2025

Institutional-Grade Staking Operations and Validator Services

Professional staking operations have evolved into sophisticated institutional services that provide enhanced yields through optimised validator performance, MEV (Maximum Extractable Value) capture, and advanced risk management techniques. Institutional staking providers utilise enterprise-grade infrastructure, redundant systems, and professional monitoring to maximise uptime and rewards whilstminimising slashing risks and operational failures that can impact individual validators.

Advanced staking strategies include liquid staking derivatives that enable users to maintain liquidity whilstearning staking rewards, validator diversification across multiple networks and operators to reduce concentration risk, and sophisticated MEV strategies that capture additional value from transaction ordering and arbitrage opportunities. These institutional approaches typically generate 2-4% higher yields than basic staking while providing enhanced security and professional management.

Professional validator operations require substantial technical expertise, significant capital commitments, and comprehensive risk management frameworks that address slashing risks, infrastructure failures, and regulatory compliance requirements. However, the enhanced yields and institutional-grade security make these strategies attractive for sophisticated investors and institutional participants seeking optimised staking returns with professional risk management.

Cross-Chain Yield Optimisation and Multi-Protocol Strategies

Cross-chain yield optimisation strategies leverage opportunities across multiple blockchain networks to maximise returns while managing risks through diversification and sophisticated arbitrage techniques. These strategies utilise bridge technologies, cross-chain protocols, and multi-network deployment to capture yield opportunities across Ethereum, Polygon, Arbitrum, Optimism, Avalanche, and other major networks while managing bridge risks and cross-chain complexities.

Advanced cross-chain strategies include automated yield farming that dynamically allocates capital across different networks based on risk-adjusted returns, cross-chain arbitrage that exploits price differences between networks, and sophisticated liquidity provision strategies that optimise returns across multiple decentralised exchanges and automated market makers. These approaches require deep understanding of cross-chain technologies, bridge risks, and network-specific characteristics.

Multi-protocol strategies combine different DeFi primitives including lending, borrowing, liquidity provision, and derivatives to create complex yield generation mechanisms that can achieve higher returns than single-protocol approaches. However, these strategies involve increased complexity, smart contract risks, and operational requirements that demand sophisticated risk management and continuous monitoring to maintain optimal performance and security.

Algorithmic Trading and Systematic Yield Generation

Algorithmic trading strategies for passive income generation utilise systematic approaches including grid trading, dollar-cost averaging, momentum strategies, and mean reversion techniques that generate consistent returns through automated execution and disciplined risk management. These strategies leverage market inefficiencies, volatility patterns, and systematic opportunities to generate income while maintaining appropriate risk controls and capital preservation.

Advanced algorithmic strategies include statistical arbitrage between different exchanges and trading pairs, automated market making on decentralised exchanges, and sophisticated derivatives strategies that generate income through options selling, futures contango capture, and volatility trading. These approaches require substantial technical expertise, comprehensive backtesting, and robust risk management systems to ensure consistent performance across different market conditions.

Systematic yield generation strategies combine multiple algorithmic approaches with passive income mechanisms to create comprehensive investment systems that generate returns through both active trading and passive yield capture. These hybrid approaches can achieve higher risk-adjusted returns than pure passive strategies while maintaining systematic, disciplined approaches that reduce emotional decision-making and improve consistency.

Institutional DeFi and Professional Yield Farming

Professional yield farming strategies utilise institutional-grade approaches including comprehensive due diligence, systematic risk assessment, and sophisticated portfolio construction techniques that optimise returns while managing the complex risks associated with DeFi protocols. These strategies leverage professional research, quantitative analysis, and systematic monitoring to identify and capture yield opportunities whilstavoiding common pitfalls that affect retail participants.

Institutional DeFi strategies include systematic liquidity provision across multiple protocols and networks, professional governance token farming with strategic voting and value capture, and sophisticated derivatives strategies that enhance yields through options selling, covered call strategies, and volatility capture techniques. These approaches require substantial capital, professional expertise, and comprehensive risk management frameworks.

Advanced yield farming techniques include automated compounding strategies that optimise gas costs and timing, systematic rebalancing that maintains optimal portfolio allocation across different protocols and risk levels, and professional tax optimisation that maximises after-tax returns through strategic harvesting and jurisdiction optimisation. These institutional approaches typically achieve superior risk-adjusted returns compared to basic yield farming strategies.

Regulatory Arbitrage and Jurisdiction Optimisation

Regulatory arbitrage strategies leverage differences in cryptocurrency regulations, taxation, and compliance requirements across different jurisdictions to optimise after-tax returns and regulatory compliance while maintaining appropriate legal and operational frameworks. These strategies require comprehensive understanding of international cryptocurrency regulations, tax treaties, and compliance requirements across multiple jurisdictions.

Advanced regulatory strategies include jurisdiction shopping for optimal tax treatment of staking rewards, lending income, and capital gains, strategic entity structuring that optimises tax efficiency while maintaining compliance with relevant regulations, and sophisticated reporting and compliance frameworks that ensure full regulatory compliance whilstmaximising after-tax returns. These approaches require professional legal and tax advice to implement effectively.

International diversification strategies utilise regulatory differences to access different yield opportunities, reduce regulatory risks through geographic diversification, and optimise overall portfolio returns through strategic allocation across different regulatory environments. However, these strategies involve increased complexity, compliance requirements, and operational challenges that require professional management and ongoing monitoring.

Risk Management and Portfolio Construction for Advanced Strategies

Professional risk management for advanced passive income strategies requires comprehensive frameworks that address smart contract risks, counterparty risks, liquidity risks, and systematic risks while maintaining optimal capital allocation and yield generation. These frameworks utilise quantitative risk models, stress testing, and scenario analysis to ensure appropriate risk-adjusted returns across different market conditions and risk environments.

Advanced portfolio construction techniques include correlation analysis across different yield sources, systematic diversification that reduces concentration risks while maintaining yield optimisation, and dynamic allocation strategies that adjust portfolio composition based on changing market conditions and risk factors. These approaches require sophisticated analytical tools and continuous monitoring to maintain optimal performance.

Professional risk management also includes comprehensive insurance strategies, systematic monitoring and alerting systems, and detailed contingency planning that addresses various failure scenarios including protocol hacks, market crashes, and regulatory changes. These risk management frameworks are essential for maintaining sustainable passive income generation whilstprotecting capital and ensuring long-term success in the dynamic cryptocurrency market.

Advanced Yield Generation Strategies and Professional Implementation

Multi-Protocol Yield optimisation and Cross-Chain Strategies

Professional cryptocurrency yield generation requires sophisticated multi-protocol strategies that optimise returns across different blockchain networks while managing operational complexity and cross-chain risks. Advanced yield optimisation includes systematic analysis of yield opportunities across Ethereum, Polygon, Arbitrum, and other networks, comprehensive fee optimisation techniques that minimise transaction costs, and sophisticated timing strategies that capitalise on yield fluctuations and protocol incentives for professional cryptocurrency management and institutional yield generation operations.

Cross-chain yield strategies include systematic analysis of bridge technologies, comprehensive risk assessment for cross-chain operations, and advanced portfolio construction techniques that maximise yields while managing bridge risks and operational complexity. Professional users implement automated monitoring systems, comprehensive performance tracking, and sophisticated decision-making frameworks that enable optimal cross-chain yield generation while maintaining appropriate risk management and operational efficiency for sustainable long-term success and professional cryptocurrency management strategies.

Institutional Yield Generation and Enterprise Implementation

Enterprise cryptocurrency yield generation requires comprehensive frameworks that address regulatory compliance, operational security, and professional asset management whilstleveraging yield opportunities for corporate treasury optimisation and institutional investment strategies. Institutional implementations include systematic due diligence procedures for protocol selection, comprehensive compliance frameworks, and advanced operational controls that enable businesses to utilise yield generation strategies while maintaining appropriate risk management and regulatory adherence for corporate financial operations.

Professional enterprise strategies include comprehensive legal consultation frameworks, systematic regulatory compliance procedures, and advanced reporting systems that ensure appropriate institutional adoption whilstmaximising operational efficiency and yield optimisation benefits. Enterprise users implement comprehensive governance procedures, systematic risk management protocols, and sophisticated monitoring systems that ensure professional yield operations while maintaining corporate standards and regulatory compliance requirements for institutional cryptocurrency management and corporate treasury optimisation strategies.

Risk Management and Portfolio Construction for Yield Generation

Professional yield generation requires sophisticated risk management frameworks that optimise risk-adjusted returns while managing protocol risks, market volatility, and operational complexity across diverse yield strategies. Advanced risk management includes systematic diversification across different yield types, comprehensive correlation analysis between various protocols, and sophisticated rebalancing techniques that maintain optimal risk-return profiles while adapting to changing market conditions and yield opportunities for professional cryptocurrency management and institutional yield generation strategies.

Portfolio construction optimisation includes systematic analysis of yield sustainability, comprehensive stress testing procedures, and advanced monitoring systems that provide real-time visibility into portfolio health and yield performance metrics. Professional users implement automated risk monitoring systems, comprehensive backup procedures, and sophisticated emergency response protocols that ensure appropriate protection while enabling efficient yield operations for complex cryptocurrency management requirements and institutional yield generation strategies.

Strategic Implementation Framework

Portfolio Construction Methodologies

Cryptocurrency passive income strategies encompass staking rewards, lending protocols, liquidity provision, and yield farming opportunities. Each approach carries distinct risk profiles, requiring careful evaluation of platform security, smart contract audits, and sustainable tokenomics to ensure long-term profitability and capital preservation.

Risk Assessment and Mitigation

Passive income cryptocurrency strategies require balancing yield potential against smart contract risks, platform security, and regulatory compliance. Diversifying across multiple protocols, understanding tokenomics, and monitoring platform health indicators helps optimise returns while minimising exposure to protocol failures or market manipulation.

Performance Monitoring and optimisation

Comprehensive Market Analysis

Passive income generation through cryptocurrency requires strategic selection of platforms, protocols, and investment vehicles that align with individual risk tolerance and financial objectives. Successful strategies combine multiple income streams while maintaining appropriate diversification across different blockchain ecosystems.

Institutional Adoption Trends

Institutional adoption of cryptocurrency passive income strategies validates the sector while introducing professional risk management standards. Traditional finance principles of diversification, due diligence, and regulatory compliance now apply to cryptocurrency investments, creating more mature market conditions.

Regulatory Landscape Evolution

Technology Infrastructure Development

Automated yield optimisation protocols continuously monitor market conditions, adjust position allocations, and compound rewards to maximise passive income generation. These sophisticated systems enable users to benefit from professional-grade strategies without requiring constant manual intervention or deep technical knowledge.

Professional Investment Methodologies and Advanced Strategies

Comprehensive passive income strategies require systematic evaluation of yield sustainability, platform security, and risk-adjusted returns across different cryptocurrency earning mechanisms. Successful investors develop structured approaches that balance yield generation with capital preservation while maintaining diversified exposure across multiple protocols and risk categories.

Quantitative Analysis and Mathematical modelling

Analytical frameworks for passive income evaluation include yield sustainability analysis, risk-adjusted return calculations, and platform security assessments. These systematic approaches help investors compare different earning opportunities while accounting for protocol-specific risks, market conditions, and long-term sustainability factors that affect passive income generation.

On-Chain Analytics and Fundamental Analysis

Protocol analysis for passive income strategies includes examining smart contract security, governance mechanisms, and revenue distribution models that determine yield sustainability. Investors should evaluate audit reports, tokenomics structures, and historical performance data while understanding the underlying economic models that generate passive income rewards.

Multi-Asset Portfolio Construction

Portfolio allocation for passive income strategies involves balancing different earning mechanisms across risk categories, platforms, and cryptocurrency types. Effective diversification includes spreading capital across staking, lending, and liquidity provision while maintaining appropriate exposure to different blockchain ecosystems and protocol types.

Risk Management and Hedging Strategies

Risk management for passive income strategies includes platform diversification, yield sustainability analysis, and systematic monitoring of protocol health indicators. Effective approaches combine multiple risk mitigation techniques including position sizing, platform selection criteria, and continuous assessment of changing market conditions and protocol developments.

Liquidity Management and Market Microstructure

Market dynamics for passive income strategies include understanding liquidity requirements, entry and exit timing, and market conditions that affect yield sustainability. Effective passive income management requires awareness of market cycles, protocol adoption patterns, and competitive dynamics that influence earning opportunities and risk exposure.

Tax optimisation and Regulatory Compliance

Tax considerations for passive income strategies include understanding how staking rewards, lending interest, and DeFi yields are treated for tax purposes. Investors should maintain detailed records of all earning activities, understand income recognition timing, and consider the tax efficiency of different passive income strategies when making allocation decisions.

Technology Due Diligence and Security Assessment

Technology assessment for passive income protocols includes evaluating smart contract security, audit reports, and development team credentials. Effective protocol selection requires understanding technical risk factors including code quality, security measures, and governance structures that affect the safety and sustainability of passive income opportunities.

Cutting-Edge Industry Developments and Future Outlook

Passive income opportunities continue expanding with new protocols, innovative earning mechanisms, and evolving yield strategies that require ongoing evaluation and adaptation. Successful passive income generation requires staying informed about emerging opportunities while maintaining systematic approaches to risk assessment and portfolio management across changing market conditions.

Blockchain Technology Evolution and Impact

Regulatory Landscape Transformation

Passive income strategies in cryptocurrency require careful consideration of regulatory developments and tax implications. Investors should maintain detailed records of all earning activities and consult with tax professionals to ensure compliance with local regulations whilstmaximising their passive income potential through legitimate and sustainable methods.

Institutional Adoption Acceleration

Passive income generation in cryptocurrency markets requires strategic diversification across multiple yield sources, platforms, and risk profiles. Successful investors balance high-yield opportunities with stable, conservative options while maintaining appropriate position sizing and regular portfolio rebalancing to optimise returns while managing downside risk exposure.

decentralised Finance Innovation Cycles

Modern DeFi ecosystems introduce advanced financial products, improved automated trading systems, and diversified income streams that broaden passive earning potential. Mastering protocol fundamentals, risk assessment techniques, and market dynamics allows strategic participation in decentralised finance while preserving capital through sound investment principles.

Central Bank Digital Currency Integration

Cryptocurrency passive income strategies have evolved beyond simple staking to include sophisticated DeFi protocols, yield farming, and liquidity provision. Understanding risk-reward profiles, smart contract security, and market dynamics enables investors to build diversified income streams while managing exposure to protocol risks and market volatility.

Environmental Sustainability and ESG Considerations

Sustainable passive income strategies focus on protocol fundamentals, revenue generation models, and long-term viability rather than unsustainable yield farming schemes. Understanding tokenomics, governance structures, and economic incentives helps identify opportunities with lasting value creation potential.

Artificial Intelligence and Machine Learning Integration

Quantum Computing Implications and Cryptographic Security

Conclusion

Crypto yield strategies offer compelling opportunities to generate returns from digital assets, but success requires careful planning, risk management, and ongoing education. The key is to start conservatively, diversify across strategies and platforms, and gradually increase complexity as you gain experience.

The cryptocurrency yield landscape in 2025 represents a mature, sophisticated financial ecosystem offering viable alternatives to traditional investment products. The evolution from experimental DeFi protocols to regulated, institutional-grade platforms has created opportunities for investors across all risk tolerance levels to participate in the digital asset economy while generating sustainable returns.

Success in cryptocurrency yield generation requires a balanced approach that combines thorough research, appropriate risk management, and continuous learning. The most successful investors start with conservative strategies on regulated platforms, gradually expanding their knowledge and risk exposure as they gain experience and confidence. Diversification across multiple platforms, strategies, and asset types remains the most effective method for optimising risk-adjusted returns while protecting against platform-specific risks.

The regulatory environment continues to evolve, bringing greater clarity and consumer protection to the cryptocurrency yield market. This regulatory maturation, combined with technological improvements and institutional adoption, suggests that yield opportunities in cryptocurrency will become increasingly accessible, secure, and integrated with traditional financial services. However, the fundamental principles of risk management, diversification, and continuous education will remain essential for long-term success.

Ready to start earning passive income from your crypto? Explore our comprehensive Binance review for centralised staking options, or dive into our crypto lending platforms guide for detailed platform comparisons. For advanced strategies, check out our yield farming guide to maximise your returns.

Key Takeaways

- Start Simple: Begin with staking and lending on established platforms

- Diversify: Spread risk across multiple strategies and platforms

- Manage Risk: Never invest more than you can afford to lose

- Stay Informed: Monitor platform health and market conditions

- Plan for Taxes: Keep detailed records and understand tax implications

Ready to Start Earning?

Explore these trusted platforms to begin your income journey:

Sources & References

Frequently Asked Questions

- What are the safest ways to earn income with crypto in 2025?

- The safest strategies include staking on established PoS networks like Ethereum, lending on regulated platforms like Nexo or Coinbase, and using LST protocols like Lido. Always diversify across platforms and start with small amounts to test strategies.

- How much income can you earn with crypto in 2025?

- Typical yields range from 3–6% APY for conservative staking strategies to 8–20% for more aggressive DeFi approaches. Returns vary based on market conditions, platform choice, and risk level. Higher yields generally indicate higher risks.

- Is yield farming still profitable in 2025?

- Yield farming can be profitable but carries significant risks, including impermanent loss, smart contract vulnerabilities, and reward token volatility. Success requires careful platform selection, risk management, and active monitoring of positions.

- What is LST and how does it work?

- Liquid staking allows you to stake cryptocurrencies while maintaining liquidity via derivative tokens (such as stETH). You earn staking rewards while being able to trade, lend, or use these tokens in DeFi protocols, maximising capital efficiency.

- Do I need to pay taxes on crypto income?

- In most jurisdictions, crypto income is taxable when received. This includes staking rewards, lending interest, and yield farming tokens. Keep detailed records and consult tax professionals for compliance guidance.

- How do I choose between different income strategies?

- Consider your risk tolerance, technical expertise, capital requirements, and liquidity needs. Start with conservative strategies like staking and lending, then gradually explore more advanced options as you gain experience.

← Back to Crypto Investing Blog

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.