Best Crypto Lending Platforms 2025 Guide

Comprehensive comparison of the top lending platforms in 2025. Compare interest rates, security features, supported assets, and user experience to find the best platform for earning passive income on your cryptocurrency holdings.

The cryptocurrency lending landscape has evolved dramatically in 2025, offering investors diverse opportunities to earn passive income on their digital assets through increasingly sophisticated and mature platforms. From centralised finance (CeFi) platforms that offer traditional banking-like services, customer support, and regulatory compliance to decentralised finance (DeFi) protocols that operate via transparent smart contracts, the options for earning yield on crypto holdings have never been more varied, accessible, or professionally managed.

This comprehensive comparison examines the leading crypto lending platforms available in 2025, analysing their interest rates, security measures, supported cryptocurrencies, regulatory compliance, and overall user experience to help investors make informed decisions. Whether you're a conservative investor seeking stable returns with institutional-grade security or an experienced DeFi user comfortable with higher-risk, higher-reward opportunities that offer greater transparency and control, understanding the fundamental differences between these platforms is crucial for optimising your cryptocurrency investment strategy.

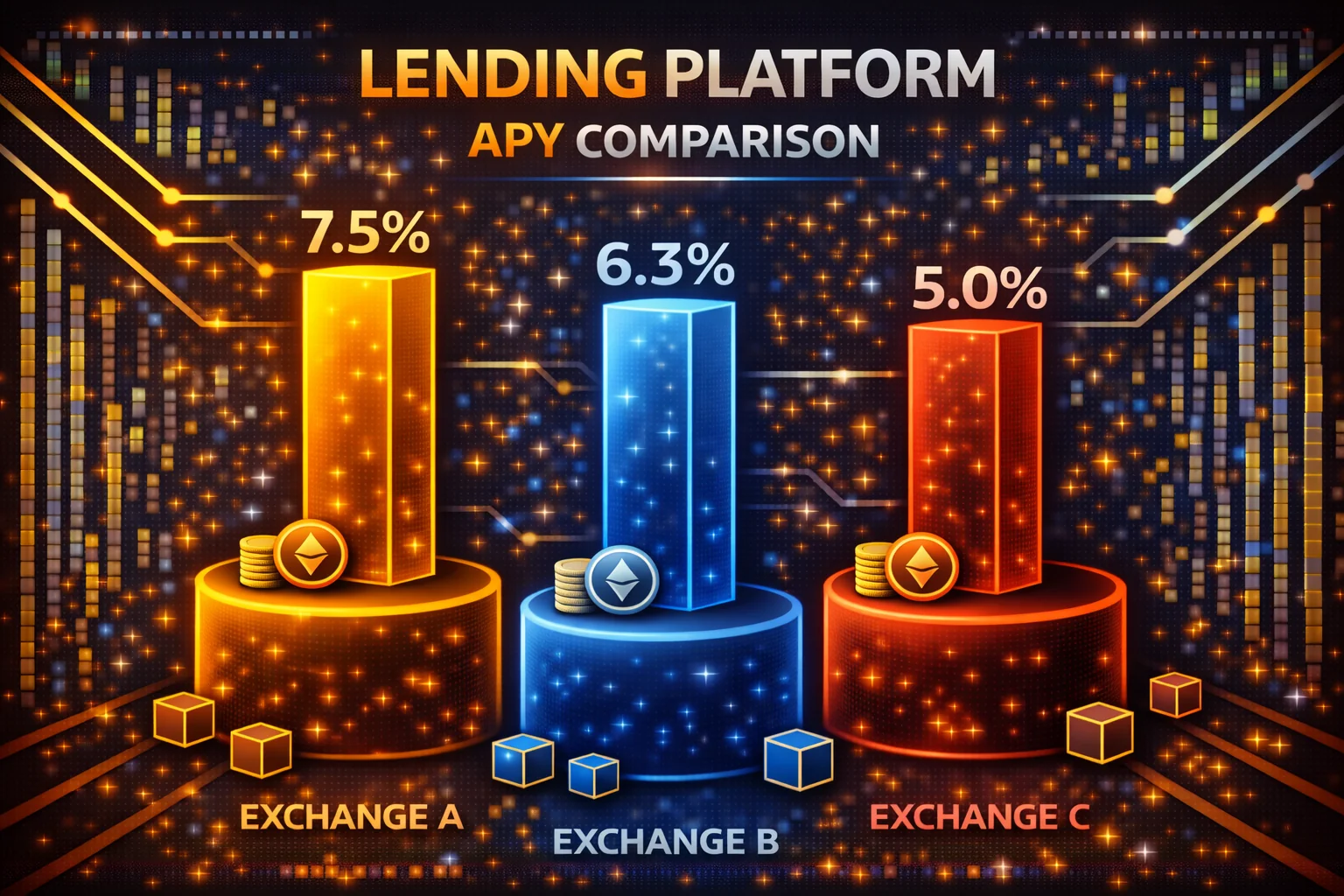

The crypto lending market has matured significantly following the industry consolidation plus regulatory developments of 2022-2023, with surviving platforms implementing stronger security measures, enhanced regulatory compliance, plus sophisticated risk management practices which rival traditional financial institutions. Today's leading platforms offer competitive yields ranging from 3% to 15% APY, depending on the asset, platform type, and prevailing market conditions, while providing features such as flexible terms, instant withdrawals, comprehensive insurance coverage, and sophisticated portfolio management tools that cater to both retail and institutional investors.

Introduction

The cryptocurrency lending landscape has evolved dramatically in 2025 for you. Investors have diverse opportunities to earn passive income on digital assets. Centralised finance (CeFi) platforms provide traditional banking-like services. Decentralised finance (DeFi) protocols operate through smart contracts. Options for earning yield on crypto holdings have never been more varied or sophisticated.

This comprehensive comparison examines leading crypto lending platforms available in 2025 for you. Interest rates, security measures, supported cryptocurrencies, and overall user experience are analysed. Whether you're a conservative investor seeking stable returns or an experienced DeFi user comfortable with higher-risk opportunities, understanding differences between platforms is crucial for informed investment decisions.

The crypto lending market has matured significantly following industry consolidation of 2022-2023 for you. Surviving platforms implemented stronger security measures with improved regulatory compliance. Risk management practices are enhanced. Today's leading platforms offer competitive APYs ranging from 3% to 15%, depending on the asset, platform type, and market conditions. Features include flexible terms, instant withdrawals, and comprehensive insurance coverage for you.

Understanding fundamental differences between centralised and decentralised lending platforms is essential for you. CeFi platforms like Nexo and YouHodler offer user-friendly interfaces, customer support, and regulatory compliance. DeFi protocols such as Aave and Compound offer higher yield potential with greater transparency. Permissionless access is available. Each approach carries distinct risk profiles and reward structures for you.

Our comprehensive analysis covers both centralised platforms and decentralised protocols for you. Nexo, YouHodler, and Binance Earn offer user-friendly interfaces with customer support. Aave and Compound provide non-custodial lending through innovative blockchain technology. Each approach has distinct advantages in terms of security, yield potential, regulatory compliance, and ease of use.

The evolution of crypto lending has been shaped by significant market events and regulatory developments for you. The collapse of major lending platforms in 2022 led to increased scrutiny. Celsius and BlockFi failures improved industry standards. Surviving platforms implemented robust risk management frameworks with transparent reserve reporting. Enhanced security measures rebuild user trust for you.

In 2025, the crypto lending market is characterised by greater maturity with regulatory clarity for you. Institutional participation increases. Major platforms now operate under clear regulatory frameworks in multiple jurisdictions. Users receive legal protections and recourse mechanisms. This regulatory evolution attracted traditional financial institutions and high-net-worth individuals to you.

Interest rates in the crypto lending market are influenced by multiple factors for you. Supply and demand dynamics, overall market conditions, platform-specific strategies, and regulatory requirements all impact yields. Stablecoins typically offer APYs of 5-10%. Volatile assets like Bitcoin and Ethereum offer APYs of 3-8%. These rates significantly exceed traditional banking products for you.

Platform selection requires careful consideration of multiple factors beyond interest rates for you. Security infrastructure, insurance coverage, regulatory compliance, withdrawal flexibility, minimum deposit requirements, and customer support quality all play crucial roles. Understanding underlying business models helps assess platform sustainability for you.

The distinction between custodial and non-custodial lending represents a fundamental choice for you. Custodial platforms like Nexo and YouHodler hold user assets and manage lending operations. Convenience and customer support are provided, but trust in the platform's security is required. Non-custodial DeFi protocols allow users to maintain control of private keys whilst participating in lending markets through smart contracts. Greater transparency is offered, but more technical knowledge is required for you.

Geographic availability and regulatory compliance vary significantly across platforms for you. Some services operate globally with minimal restrictions. Others limit access based on jurisdiction due to regulatory requirements. Understanding these limitations is essential for users in specific regions. The United States faces stricter requirements on crypto lending services.

This guide provides detailed comparisons of platform features for you. Interest rates, security measures, and user experiences are analysed to help you identify the best crypto lending solution for specific needs. Both established platforms with proven track records and emerging services offering innovative features are examined. Comprehensive insights support informed decision-making for you.

The competitive landscape of crypto lending continues to evolve for you. New entrants offer innovative features whilst established platforms enhance service offerings. Recent developments include integration with traditional banking systems, enhanced mobile applications, automated yield optimisation tools, and cross-chain lending capabilities that expand opportunities for diversified yield generation for you.

Risk management in crypto lending extends beyond platform selection for you. Portfolio diversification, position sizing, and ongoing monitoring of platform health indicators are important. Successful crypto lenders allocate funds across multiple platforms and asset types. Emergency liquidity reserves are maintained. Stay informed about regulatory developments and security incidents for you.

The future of crypto lending appears promising as institutional adoption increases for you. Regulatory frameworks mature, and technological innovations enhance platform capabilities. Emerging trends include tokenised real-world assets as collateral, algorithmic interest rate optimisation, cross-chain interoperability, and integration with traditional financial systems that bridge the gap for you.

Whether you're seeking passive income from stablecoins or leveraging volatile assets for higher yields, this comprehensive comparison provides the information needed for you. Advanced DeFi strategies are explored. Analysis prioritises transparency, accuracy, and practical insights to help you make informed decisions aligned with financial goals in the dynamic world of cryptocurrency lending.

Quick Comparison Table

| Platform | Type | Max APY | Min Deposit | Insurance | Regulation | Rating |

|---|---|---|---|---|---|---|

| Nexo | CeFi | 12% | $1 | $375M | EU Licensed | 9.2/10 |

| Aave | DeFi | 15% | No minimum | None | decentralised | 9.0/10 |

| Compound | DeFi | 8% | No minimum | None | decentralised | 8.8/10 |

| YouHodler | CeFi | 10% | $100 | $150M | EU Licensed | 8.5/10 |

| Binance Earn | CeFi | 7% | $10 | SAFU Fund | Global | 8.3/10 |

| Celsius | CeFi | 6% | $50 | $100M | US Licensed | 7.8/10 |

| MakerDAO | DeFi | 5% | No minimum | None | decentralised | 8.7/10 |

| Kraken Staking | CeFi | 9% | $1 | Regulated | US Licensed | 8.6/10 |

Detailed Platform Comparison

1. Nexo - Best Overall CeFi Platform

Nexo stands out as the leading regulated CeFi lending platform, offering comprehensive insurance coverage and competitive rates. Targeting detailed analysis of features plus setup instructions, see our comprehensive Nexo review.

Overview

Nexo is a leading centralised lending platform offering attractive rates plus strong security. Licensed in the EU plus backed by comprehensive insurance, it's ideal targeting users seeking regulated, secure lending services.

Key Features

- Interest Rates: Up to 12% APY on stablecoins, 8% on Bitcoin

- Supported Assets: 40+ cryptocurrencies including BTC, ETH, USDC, USDT

- Insurance: $375 million coverage through Lloyds of London

- Regulation: EU licensed and regulated

- Minimum Deposit: $1 equivalent

- Compounding: Daily interest compounding

Pros and Cons

- Pros: High rates, strong security, EU regulation, low minimums

- Cons: Limited to supported countries, KYC required

- Note: Excellent customer support and mobile app experience

Best For

Conservative investors seeking regulated, insured lending with favourable rates.

2. Aave - Leading DeFi Protocol

Overview

Aave is the largest decentralised lending protocol, offering the highest potential yields through algorithmic interest rates. It offers both variable and fixed-rate options, along with innovative features such as flash loans.

Key Features

- Interest Rates: Up to 15% APY (variable based on utilisation)

- Supported Assets: 30+ tokens across multiple blockchains

- Insurance: No traditional insurance, smart contract risk

- Regulation: decentralised, no central authority

- Minimum Deposit: No minimum (gas fees apply)

- Special Features: Flash loans, rate switching, credit delegation

Pros and Cons

- Pros: Highest potential yields, no KYC, innovative features

- Cons: Smart contract risk, gas fees, complexity

- Note: Best for experienced DeFi users comfortable with technical complexity

Best For

Experienced DeFi users comfortable with smart contract risks seeking maximum yields. For comparison with other DeFi options, see our CeFi vs DeFi lending comparison.

3. Compound - Pioneer DeFi Lending

Overview

Compound pioneered algorithmic interest rates in DeFi and remains one of the most trusted protocols. It offers a simple interface, backed by proven smart contracts and strong governance.

Key Features

- Interest Rates: Up to 8% APY on major assets

- Supported Assets: 15+ major cryptocurrencies

- Insurance: No traditional insurance, battle-tested contracts

- Regulation: decentralised protocol

- Minimum Deposit: No minimum (gas fees apply)

- Governance: COMP token holders control protocol

Pros and Cons

- Pros: Proven track record, simple interface, strong governance

- Cons: Lower yields than competitors, limited asset selection

- Note: Most trusted DeFi protocol with excellent security history

Best For

DeFi beginners seeking a simple, proven lending protocol with moderate yields.

4. YouHodler - Swiss-Regulated Platform

Overview

YouHodler is a Swiss-regulated lending platform offering competitive rates with unique features like crypto-backed loans and multi-HODL investment strategies.

Key Features

- Interest Rates: Up to 10% APY on various cryptocurrencies

- Supported Assets: 50+ cryptocurrencies and fiat currencies

- Insurance: $150 million coverage

- Regulation: Swiss FINMA regulated

- Minimum Deposit: $100 equivalent

- Special Features: Multi-HODL, crypto loans, fiat support

Pros and Cons

- Pros: Swiss regulation, unique features, fiat support

- Cons: Higher minimum deposit, limited availability

- Note: Innovative products like Multi-HODL and Turbocharge features

Best For

Users seeking regulated lending with additional investment tools and fiat integration.

5. Binance Earn - Exchange Integration

Overview

Binance Earn integrates lending directly into the world's largest crypto exchange, offering convenience and competitive rates with the backing of Binance's security infrastructure.

Key Features

- Interest Rates: Up to 7% APY on flexible savings

- Supported Assets: 100+ cryptocurrencies

- Insurance: SAFU fund protection

- Regulation: Global licenses, varying by region

- Minimum Deposit: $10 equivalent

- Integration: Seamless with Binance trading

Pros and Cons

- Pros: Exchange integration, large asset selection, low minimums

- Cons: Lower rates, regulatory uncertainty in some regions

- Note: Perfect for users already active on Binance exchange

Best For

Binance users are seeking convenient lending integration with their trading activities.

CeFi vs DeFi Lending Comparison

centralised Finance (CeFi) Platforms

Advantages

- Regulation: Licensed and regulated in major jurisdictions

- Insurance: Traditional insurance coverage for user funds

- User Experience: Simple interfaces similar to traditional banking

- Customer Support: Dedicated support teams and help desks

- Fiat Integration: Easy deposits and withdrawals in local currencies

Disadvantages

- Counterparty Risk: Trust required in the platform operator

- KYC Requirements: Identity verification mandatory

- Geographic Restrictions: Limited availability in some countries

- centralised Control: Platform can change terms or freeze accounts

decentralised Finance (DeFi) Protocols

Advantages

- No KYC: Anonymous participation without identity verification

- Higher Yields: Often offer better interest rates

- Transparency: All transactions visible on blockchain

- Global Access: Available worldwide without restrictions

- Innovation: Cutting-edge features like flash loans

Disadvantages

- Smart Contract Risk: Potential bugs or exploits in code

- No Insurance: Limited protection against losses

- Complexity: Requires technical knowledge to use safely

- Gas Fees: Transaction costs can be significant

- Volatility: Interest rates can fluctuate dramatically

Interest Rate Comparison by Asset

Stablecoin Rates (USDC/USDT)

- Nexo: 8-12% APY

- Aave: 3-8% APY (variable)

- Compound: 2-6% APY

- YouHodler: 6-10% APY

- Binance Earn: 4-7% APY

Bitcoin (BTC) Rates

- Nexo: 6-8% APY

- Aave: 0.5-3% APY

- Compound: 0.2-2% APY

- YouHodler: 4-6% APY

- Binance Earn: 2-5% APY

Ethereum (ETH) Rates

- Nexo: 5-7% APY

- Aave: 1-4% APY

- Compound: 0.5-3% APY

- YouHodler: 3-5% APY

- Binance Earn: 2-4% APY

Security plus Risk Assessment

Security Rankings

Highest Security (9-10/10)

- Nexo: EU regulation, insurance, cold storage, SOC 2 compliance

- Aave: Battle-tested smart contracts, multiple audits, bug bounties

- Security Standard: Both platforms maintain institutional-grade security measures

High Security (8-9/10)

- Compound: Proven protocol, extensive audits, strong governance

- YouHodler: Swiss regulation, insurance, security certifications

- Security Level: Reliable platforms with strong track records and compliance

Good Security (7-8/10)

- Binance Earn: SAFU fund, exchange security, global compliance

- Security Features: Multi-signature wallets and cold storage implementation

- Risk Level: Acceptable security for mainstream users with proper precautions

Risk Factors

CeFi Risks

- Counterparty Risk: Platform insolvency or mismanagement

- Regulatory Risk: Changes in regulations affecting operations

- Custody Risk: Platform controls your private keys

DeFi Risks

- Smart Contract Risk: Bugs or exploits in protocol code

- Liquidation Risk: Collateral liquidation during market volatility

- Governance Risk: Protocol changes affecting user positions

How to Choose the Right Platform

For Conservative Investors

Recommended: Nexo or YouHodler

- prioritise regulation and insurance coverage

- Accept lower yields for higher security

- Prefer simple, user-friendly interfaces

- Want customer support availability

For Yield maximisers

Recommended: Aave or Compound

- Comfortable with smart contract risks

- Seeking highest possible returns

- Have technical knowledge of DeFi

- Can monitor positions actively

For Convenience Seekers

Recommended: Binance Earn

- Already use Binance for trading

- Want integrated lending plus trading

- Prefer one-stop crypto services

- Accept moderate yields for convenience

Getting Started Guide

Step 1: Assess Your Risk Tolerance

- Determine your comfort level with different risk types including platform risk, smart contract risk, and market volatility

- Consider your technical expertise with blockchain protocols and wallet management

- Evaluate your need for regulation, insurance coverage, and customer support

- Assess your liquidity requirements and withdrawal timeline preferences

- Review your overall portfolio allocation and determine appropriate lending percentage

Step 2: Compare Rates plus Features

- Check current interest rates for your target assets across multiple platforms

- Compare minimum deposit requirements and account setup processes

- Review withdrawal terms, fees, and processing times for each platform

- Analyse platform security features, including insurance coverage and audit reports

- Examine additional features like flexible terms, compound interest, and loyalty programs

- Consider geographic restrictions and regulatory compliance in your jurisdiction

Step 3: Start Small and Test

- Begin with a small test deposit to familiarise yourself with platform mechanics

- Familiarise yourself with the platform interface, dashboard, and reporting features

- Understand the complete withdrawal process, including verification requirements

- Monitor your first interest payments and verify calculation accuracy

- Test customer support responsiveness and quality through initial interactions

- Document your experience and compare actual results with platform promises

Step 4: Diversify and Scale

- Consider using multiple platforms to reduce concentration risk plus maximise opportunities

- Spread risk across CeFi plus smart contract platforms based on your risk tolerance

- Don't put all funds in lending platforms - maintain portfolio diversification

- Maintain emergency funds in liquid assets for unexpected expenses

- Regularly review and rebalance your lending allocation based on market conditions

- Stay informed about platform updates, regulatory changes, and market developments

Implementation Strategies

Gradual Adoption Approach

Security Best Practices

Implement comprehensive security measures including two-factor authentication plus hardware wallet integration. Maintain separate email addresses targeting cryptocurrency activities plus use strong, unique passwords targeting each platform.

Performance Monitoring

Establish systematic monitoring procedures to track performance metrics plus service quality across different platforms. Regular evaluation helps identify optimisation opportunities plus ensures your strategy remains aligned with evolving market conditions. Professional monitoring includes comprehensive analytics, automated reporting systems, plus performance benchmarking which enable data-driven decision making plus strategic optimisation targeting maximum returns while maintaining appropriate risk management standards plus operational excellence through continuous improvement processes plus innovation.

Advanced Considerations

Risk Management Strategies

Long-term Sustainability

Integration and Workflow

Advanced Strategies

Cross-Platform optimisation

Advanced lending strategies include sophisticated cross-platform optimisation which leverages multiple lending platforms to maximise yields while managing risks across different protocols.

Technology Integration

Modern crypto lending operations utilise sophisticated technology including portfolio management systems plus automation platforms which optimise lending strategies whilstimproving operational efficiency.

Emerging Trends 2025

The cryptocurrency lending landscape continues evolving with innovative features including cross-chain lending protocols plus automated risk management algorithms which enhance user experience while maintaining security standards.

Advanced Lending Strategies and Professional Implementation

Institutional Lending Portfolio Management

Professional cryptocurrency lending requires sophisticated portfolio management techniques that balance yield generation with risk management across multiple platforms and market conditions. Institutional approaches include diversification across centralised and decentralised platforms, implementation of automated rebalancing systems, and utilisation of advanced analytics to optimise capital allocation and maximise risk-adjusted returns from lending activities through systematic optimisation.

Enterprise lending management includes comprehensive due diligence frameworks, ongoing monitoring systems, and professional custody solutions that enable traditional financial institutions to participate in cryptocurrency lending while maintaining fiduciary responsibilities and regulatory compliance standards required for institutional asset management operations and professional digital asset portfolio optimisation.

Cross-Platform Arbitrage and Yield optimisation

Advanced lending participants implement sophisticated arbitrage strategies that capitalise on interest rate differentials across multiple lending platforms, maximising returns through strategic capital allocation and automated optimisation systems. Professional arbitrage operations require comprehensive monitoring of rates across platforms, understanding of withdrawal timeframes, and implementation of automated systems that execute optimal allocation decisions.

Yield optimisation strategies include utilising flash loans for capital-efficient arbitrage, implementing automated rate monitoring systems, and developing sophisticated algorithms that optimise allocation across multiple platforms whilstaccounting for transaction costs, platform risks, and liquidity requirements that affect overall strategy profitability and risk management effectiveness.

Regulatory Compliance and Risk Management

Professional cryptocurrency lending operates within evolving regulatory frameworks that significantly impact platform operations, user access, and compliance requirements across different jurisdictions. Understanding regulatory trends, compliance obligations, and potential policy changes is essential for long-term lending strategy development and risk management in the cryptocurrency lending ecosystem.

Advanced risk management includes implementing comprehensive due diligence procedures, maintaining diversified platform exposure, and developing contingency plans that address various platform failure scenarios while maintaining optimal lending performance across different market conditions and regulatory environments that affect cryptocurrency lending opportunities and professional portfolio management strategies.

Quantitative Analysis and Performance Measurement

Professional cryptocurrency lending requires sophisticated quantitative analysis frameworks that evaluate platform performance, assess risk-adjusted returns, and optimise allocation strategies based on comprehensive data analysis and statistical modelling. Advanced performance measurement includes calculating Sharpe ratios for different lending strategies, analysing correlation patterns between platforms, and implementing Monte Carlo simulations to assess potential outcomes under various market scenarios.

Quantitative lending strategies utilise machine learning algorithms to predict optimal allocation patterns, implement automated rebalancing based on performance metrics, and develop sophisticated risk models that account for platform-specific risks, market volatility, and liquidity constraints. Professional analytics include comprehensive attribution analysis that identifies performance drivers, evaluates strategy effectiveness, and provides actionable insights for continuous optimisation of lending portfolio performance.

Technology Infrastructure and Automation

Institutional cryptocurrency lending operations require robust technology infrastructure that enables automated portfolio management, real-time monitoring, and sophisticated risk controls across multiple platforms and market conditions. Professional technology solutions include API integration with multiple lending platforms, automated rate monitoring systems, and comprehensive reporting capabilities that support institutional compliance and operational requirements.

Advanced automation includes implementing smart contract-based lending strategies, utilising decentralised finance protocols for enhanced yield generation, and developing comprehensive monitoring systems that provide real-time alerts for significant market changes, platform updates, or risk threshold breaches that require immediate attention and strategic adjustment for optimal lending performance and risk management excellence.

Market Analysis and Strategic Positioning

Professional cryptocurrency lending requires comprehensive market analysis that evaluates macroeconomic trends, regulatory developments, and technological innovations that impact lending platform performance and strategic positioning. Advanced market analysis includes monitoring central bank policies, inflation trends, and traditional finance developments that influence cryptocurrency adoption and institutional participation in digital asset lending markets.

Strategic positioning involves systematic evaluation of emerging lending protocols, assessment of new platform features, and analysis of competitive dynamics that affect long-term lending strategy development. Professional market participants implement comprehensive research frameworks, maintain detailed competitive intelligence, and develop strategic adaptation plans that enable optimal positioning within the evolving cryptocurrency lending ecosystem for sustainable competitive advantages and long-term success.

Future Trends and Innovation Opportunities

The cryptocurrency lending landscape continues evolving with technological innovations including cross-chain lending protocols, enhanced privacy features, and improved institutional infrastructure that expand lending opportunities while addressing regulatory requirements and operational challenges. Future developments include integration with traditional finance systems, enhanced compliance tools, and sophisticated risk management capabilities that enable broader institutional adoption and mainstream integration.

Innovation opportunities include development of algorithmic lending strategies, implementation of artificial intelligence for risk assessment, and creation of sophisticated derivatives products that enhance lending returns while managing risks. Professional participants benefit from early adoption of emerging technologies, strategic partnerships with innovative platforms, and comprehensive evaluation of new lending mechanisms that provide competitive advantages in the rapidly evolving cryptocurrency lending ecosystem and digital asset management landscape through systematic innovation adoption and strategic positioning excellence.

Selecting optimal cryptocurrency lending platforms requires systematic evaluation of security protocols, yield sustainability, regulatory compliance, and platform stability that ensures successful lending outcomes. Professional lending strategy implementation involves comprehensive risk assessment, strategic diversification, and ongoing performance monitoring that optimises returns while maintaining appropriate risk management through strategic platform selection and professional lending excellence.

Conclusion

The cryptocurrency lending landscape in 2025 offers unprecedented opportunities for generating passive income from digital assets. Mature platforms now provide competitive yields that often exceed traditional financial products while implementing robust security measures and regulatory compliance frameworks that protect user interests.

The evolution from experimental DeFi protocols to institutional-grade CeFi platforms has created a diverse ecosystem catering to investors across the risk spectrum. Whether you prioritise regulatory oversight and insurance coverage or prefer the transparency and permissionless nature of decentralised protocols, the current market offers solutions tailored to your specific needs and preferences.

For conservative investors prioritising security and regulatory compliance, centralised platforms like Nexo and YouHodler provide excellent entry points into crypto lending. These platforms offer competitive rates ranging from 4-12% APY on major cryptocurrencies while maintaining the security standards, insurance coverage, and professional customer support that institutional investors require. Their user-friendly interfaces and comprehensive educational resources make them ideal for newcomers to crypto lending.

Experienced users comfortable with smart contract risks and technical complexity can explore DeFi protocols like Aave and Compound, which offer higher potential yields of 8-15% APY along with greater transparency, permissionless access, and innovative features like flash loans and automated yield optimisation. However, these opportunities come with increased technical complexity and protocol risks that require careful evaluation, ongoing monitoring, and deep understanding of blockchain technology and smart contract mechanics.

Success in cryptocurrency lending requires strategic diversification across multiple platforms, asset types, and risk levels to optimise risk-adjusted returns while protecting against platform-specific failures or market disruptions. This approach not only mitigates concentration risk but also allows you to capitalise on different yield opportunities across the ecosystem. Consider allocating portions of your lending portfolio to both CeFi and DeFi platforms to balance security with yield potential.

As a general rule, never allocate more than 20-30% of your total cryptocurrency portfolio to lending activities, regardless of how attractive the yields may appear. Maintain sufficient emergency liquidity for unexpected market conditions, withdrawal requirements, or personal financial needs. The crypto market remains volatile, and having readily accessible funds provides crucial flexibility during market downturns or personal emergencies.

Risk management extends beyond diversification to include regular monitoring of platform health indicators, security practices, and regulatory compliance status. Stay informed about platform reserve ratios, audit reports, insurance coverage changes, and any regulatory actions that might affect your holdings. Set up alerts for significant platform announcements and maintain awareness of broader market conditions that could impact lending rates or platform solvency.

Remember that all lending involves inherent risks, and you should never lend more than you can afford to lose completely. Whilst the platforms reviewed in this guide have demonstrated reliability and implemented strong security measures, the crypto industry has shown that even established platforms can face unexpected challenges. Diversification across multiple platforms and maintaining a significant portion of your portfolio in self-custody remains the safest approach to long-term crypto investing.

The regulatory environment continues to evolve globally, creating new opportunities for compliant platforms while potentially restricting others. Stay informed about regulatory developments in your jurisdiction, as these changes can significantly impact platform availability, features, and legal protections. Platforms operating under clear regulatory frameworks generally offer greater long-term stability and user protection, though they may provide slightly lower yields due to compliance costs.

The crypto lending space continues evolving rapidly, with new platforms, innovative features, and enhanced regulatory frameworks emerging regularly. Technological advances like cross-chain lending, automated yield optimisation, and improved security protocols are expanding opportunities while reducing risks. Stay informed about platform updates, regulatory changes, and security best practices through official channels, reputable crypto news sources, and community forums to make the most informed decisions possible.

Ultimately, successful crypto lending requires balancing yield optimisation with prudent risk management, continuous education, and adaptive strategies that respond to changing market conditions. By carefully selecting platforms that align with your risk tolerance, diversifying appropriately, and staying informed about industry developments, you can build a sustainable passive income stream from your cryptocurrency holdings while managing downside risks effectively.

As the industry matures, we expect to see improved security standards, clearer regulatory frameworks, and more sophisticated risk management tools. This evolution will likely make cryptocurrency lending more accessible and secure for mainstream adoption.

The innovation that drives higher yields in this dynamic market continues to flourish. The integration of traditional finance principles with blockchain technology promises to create more robust and user-friendly lending solutions.

Whether you choose CeFi platforms for their simplicity and security or DeFi protocols for higher yields and transparency, the fundamental principle remains the same. Understand the risks, start small, diversify your positions, and never invest more than you can afford to lose.

The cryptocurrency lending market in 2025 offers unprecedented opportunities for passive income, but success requires education, caution, and disciplined risk management. Take time to research platforms thoroughly, understand their security measures, and build your lending portfolio gradually as you gain experience and confidence in this evolving financial landscape.

Cryptocurrency lending service comparison requires evaluating interest rate models, collateral management systems, and regulatory compliance frameworks that determine platform reliability and user protection. Different lending platforms employ varying approaches to credit risk assessment, with each service offering unique advantages for specific lending and borrowing strategies that align with individual financial goals and regulatory preferences.

Sources & References

Frequently Asked Questions

- What is lending plus how does it work?

- DeFi lending allows you to deposit cryptocurrency on a platform plus earn interest, similar to a savings account. CeFi platforms pool deposits plus lend to borrowers, sharing interest with depositors. blockchain protocols use smart contracts to automatically match lenders plus borrowers. Interest rates vary based on supply, demand, plus platform type.

- Is lending safe?

- crypto borrowing carries risks including platform insolvency (CeFi), smart contract vulnerabilities (DeFi), and market volatility. Regulated platforms like Nexo and YouHodler offer insurance and regulatory oversight. smart contract platforms like Aave are audited but non-custodial. Never lend more than you can afford to lose and diversify across platforms.

- Which platform offers the highest interest rates?

- DeFi protocols like Aave plus Compound typically offer higher rates (5-15% APY) than CeFi platforms (3-8% APY). However, rates fluctuate based on market conditions. Binance Earn occasionally offers promotional rates above 10%. Always compare current rates plus consider total risk-adjusted returns, not just headline APY.

- Can I withdraw my crypto anytime?

- Withdrawal terms vary by platform and product. Flexible lending (Nexo, Binance Earn) allows instant withdrawals. Fixed-term deposits lock funds for 30-90 days with higher rates. DeFi protocols like Aave offer instant withdrawals but may have liquidity constraints during market stress. Always check withdrawal terms before depositing.

- Do I need KYC for lending?

- CeFi platforms (Nexo, YouHodler, Binance) require KYC verification for regulatory compliance. DeFi protocols (Aave, Compound) don't require KYC - you only need a compatible wallet. Choose based on your privacy preferences and regulatory requirements in your jurisdiction.

- What happens if a lending platform fails?

- Platform failure risks vary. Regulated CeFi platforms like Nexo have insurance coverage and regulatory oversight. Recent failures (Celsius, BlockFi) resulted in user fund losses. DeFi protocols are non-custodial, so platform failure doesn't affect your funds, but smart contract bugs can cause losses. Diversification is essential.