CeFi vs DeFi Lending 2025: Complete Guide

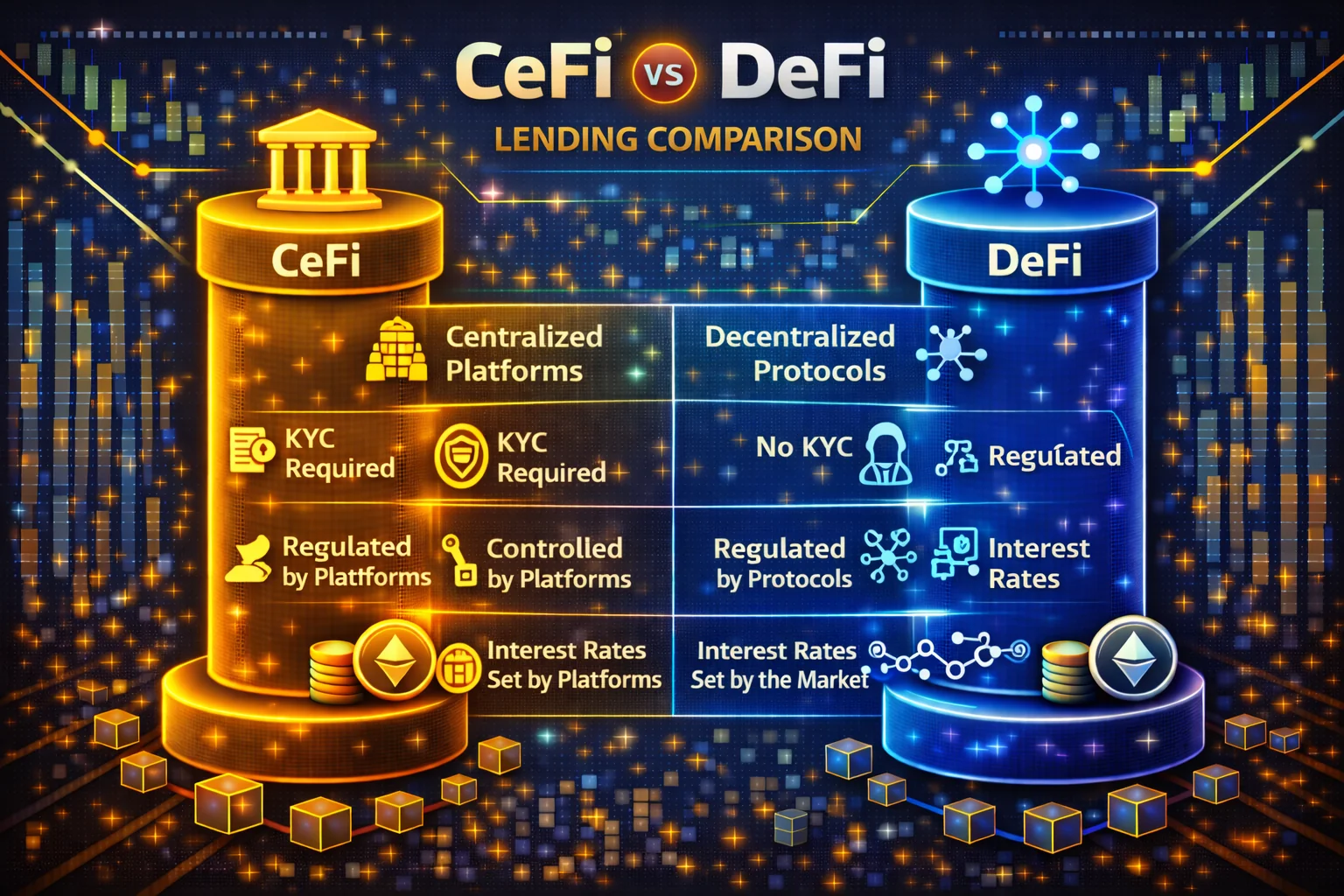

Both CeFi (Centralised Finance) and DeFi (Decentralised Finance) offer lending and borrowing services — but with different trade-offs in custody, yields, and risks. Here’s a side-by-side comparison for 2025.

Introduction

The cryptocurrency lending landscape has evolved dramatically in recent years. You now face two distinct paradigms for earning yield. CeFi platforms operate like traditional banks. DeFi protocols use blockchain smart contracts. Your choice depends on your needs and technical expertise.

Crypto lending offers two main options today. CeFi platforms use traditional company structures. They provide centralised custody and customer support. DeFi protocols employ blockchain-based smart contracts. They eliminate intermediaries entirely. Each approach has distinct benefits and trade-offs.

This choice represents a critical decision for crypto investors. It directly impacts your passive income generation. Security levels vary dramatically between the two options. User experience differs substantially as well. You should evaluate your needs carefully before selecting an approach.

CeFi lending platforms operate like traditional banks. You deposit cryptocurrency with a centralised entity. These companies manage the lending process for you. They handle customer support when needed. They maintain regulatory compliance for protection. Companies hold your crypto assets in custody.

These platforms offer user-friendly interfaces. They provide dedicated customer support teams. Many offer insurance coverage for depositors. This makes them attractive to newcomers. You can start earning yield quickly. Support teams answer questions and resolve issues.

DeFi lending operates via smart contracts. These run on blockchain networks. This eliminates intermediaries completely. You lend or borrow through automated protocols. No centralised company is required. Blockchain technology handles all transactions securely.

DeFi offers greater transparency. All operations are visible on the blockchain. It provides potentially higher yields. You maintain complete control over funds. However, DeFi requires more technical knowledge. It exposes you to smart contract risks. You must understand gas fees and wallet management.

Your choice reflects your risk tolerance. It shows your technical expertise level. Technology is just one factor to consider. Your risk tolerance determines acceptable platform risks. Your technical skills affect DeFi success likelihood. Your philosophy guides the centralisation preference.

CeFi platforms have faced significant challenges recently. Several high-profile failures occurred. These highlighted counterparty risks clearly. DeFi protocols showed greater resilience. However, they require complex interface navigation. You take full responsibility for security. Celsius and BlockFi collapses made risks real.

This guide examines CeFi versus DeFi lending comprehensively. We cover yield opportunities for each approach. We explain detailed risk profiles clearly. We describe user experience considerations. This helps you make confident decisions.

Understanding these differences is crucial for success. This applies to newcomers and experienced users alike. The knowledge helps you deploy funds wisely. Beginners learn essential basics safely. Experienced users optimise advanced strategies. This improves decision-making at all levels.

Both approaches have evolved significantly. CeFi platforms implemented stronger security measures. They added insurance policies and compliance frameworks. DeFi protocols became more user-friendly. They improved interfaces and documentation. Both ecosystems continue improving rapidly.

Comparison Table

| Aspect | CeFi Lending | DeFi Lending |

|---|---|---|

| Custody | Assets held by the platform (Nexo, YouHodler) | Assets remain in your wallet; managed by smart contracts (Aave, MakerDAO/Sky) |

| Yields | Advertised ~6–12% APY, may include promos | Variable ~2–8% APY, based on supply/demand and collateral |

| Access | KYC required, regional restrictions | Open globally, no KYC |

| Risks | Custodial risk, solvency issues | Smart contract exploits, liquidation cascades, oracle failures |

| User Experience | Mobile apps, fiat ramps, credit cards | Dapps, wallets, gas fees (cheaper on L2) |

| Transparency | Limited visibility into operations | Full transparency via blockchain and open-source code |

| Liquidity | Platform-dependent withdrawal limits | Instant withdrawal (subject to available liquidity) |

| Insurance | Some platforms offer insurance coverage | No traditional insurance, but protocol-specific safety modules |

When to Use CeFi Lending

Use CeFi lending platforms if you prefer simplicity, mobile-first user experience, and convenient fiat on/off ramps that make it easy to move between traditional currency and cryptocurrency. Platforms like Nexo and YouHodler offer user-friendly interfaces with professional customer support, though they introduce custodial risk since the platform controls your private keys.

CeFi platforms suit beginners particularly well because their mobile applications work similarly to traditional banking apps, making fiat deposits straightforward whilst customer support teams remain available to help whenever you encounter issues. However, this simplicity comes with important trade-offs, primarily the custodial risk inherent in trusting a centralised entity with your cryptocurrency holdings. Before selecting a CeFi platform, you should carefully consider several critical factors:

- Platform reputation and track record

- Insurance coverage details

- Withdrawal limits and fees

- Supported cryptocurrencies

- Interest rates offered

When to Use DeFi Lending

Use DeFi if you value transparency, sovereignty, and global access. Aave and MakerDAO’s Sky let you lend/borrow directly via smart contracts with no intermediaries.

Detailed Analysis and Strategic Framework

CeFi Lending Deep Dive

Centralised Finance platforms operate like traditional banks. They hold user funds in custody. Internal systems manage all lending operations. This approach offers significant simplicity. However, it introduces counterparty risk. You must trust the platform completely.

CeFi platforms function similarly to banks. Companies hold your cryptocurrency funds. Internal systems manage operations automatically. The primary benefit is simplicity. However, counterparty risk remains genuine. Platform failures can cause complete fund loss.

CeFi Advantages

- User Experience: Mobile apps, customer support, fiat integration

- Simplicity: No need to manage private keys or understand smart contracts

- Regulatory Compliance: Licensed platforms with consumer protections

- Insurance: Some platforms offer deposit insurance or protection funds

- Stable Rates: More predictable yields with less volatility

CeFi Risks

- Counterparty Risk: Platform insolvency can result in total loss

- Custody Risk: Users don't control their private keys

- Geographic Restrictions: KYC requirements and regional limitations

- Transparency: Limited visibility into platform operations

DeFi Lending Deep Dive

Decentralised Finance operates via smart contracts. These run on blockchain networks. This allows peer-to-peer lending without intermediaries. Users maintain custody of their assets. This eliminates the need to trust centralised entities. However, it requires more technical knowledge.

DeFi protocols automate all lending operations. They run directly on the blockchain. This eliminates intermediaries entirely. Users maintain complete custody always. Peer-to-peer lending works directly between participants. Control stays with you throughout the process.

DeFi Advantages

- Self-Custody: Users maintain control of their private keys

- Transparency: Open-source code and on-chain operations

- Global Access: No KYC or geographic restrictions

- Composability: Integrate with other DeFi protocols

- Innovation: Rapid development of new capabilities

DeFi Risks

- Smart Contract Risk: Bugs or exploits can result in fund loss

- Technical Complexity: Requires understanding of wallets and protocols

- Gas Fees: Transaction costs can be significant

- User Error Risk: Mistakes can be irreversible

Platform Comparison and Selection Guide

Decision Framework

Choose CeFi If You:

- Prefer simplicity and ease of use over technical control

- Want customer support and assistance when needed

- Need fiat integration and traditional banking capabilities

- prioritise regulatory compliance and consumer protection

- Are new to cryptocurrency and prefer guided experiences

Choose DeFi If You:

- Value self-custody and complete control over your assets

- Want transparency and verifiable on-chain operations

- Need global access without KYC or geographic restrictions

- Enjoy technical complexity and protocol innovation

- Want to integrate lending with other DeFi strategies

risk mitigation and Best Practices

CeFi Risk Mitigation

- Research platform financial health and regulatory status

- Diversify throughout multiple CeFi platforms

- Understand insurance coverage and limitations

- Monitor platform news and user sentiment

- Never invest more than you can afford to lose

DeFi Risk Mitigation

- Use only audited protocols with proven track records

- Understand smart contract mechanics and risks

- Start with small amounts to learn the systems

- Keep emergency funds for gas fees and liquidations

- Use hardware wallets for large positions

Yield optimisation Strategies

CeFi Yield maximisation

- Loyalty Programs: Higher tiers often provide better rates and benefits

- Platform Tokens: Holding native tokens can unlock premium rates

- Promotional Rates: Take advantage of limited-time offers for new clients

- Flexible vs Fixed: Choose terms based on market outlook and liquidity needs

DeFi Yield optimisation

- Multi-Protocol Strategy: Diversify throughout Aave, Compound, and others

- Layer 2 utilisation: Use Polygon or Arbitrum for lower gas costs

- Governance Participation: Earn additional rewards via protocol governance

- Automated Strategies: Use Yearn Finance or similar for optimised yields

Hybrid Approaches

- Portfolio Allocation: Split funds between CeFi and DeFi based on risk tolerance

- Market Timing: Adjust allocation based on market conditions and opportunities

- Risk Laddering: Use CeFi for stable base yield, DeFi for higher-risk opportunities

- Liquidity Management: Maintain emergency funds in easily accessible CeFi platforms

2025 Market Analysis and Practical Case Studies

Real User Scenarios

Conservative Investor Profile

Sarah, 35, Traditional Finance Background: Prefers regulated centralised platforms for their familiar interface and customer support. Allocates 70% to CeFi for stable 8-10% yields, with 30% reserved in traditional savings as a backup.

Tech-Savvy DeFi User Profile

Alex, 28, Software Developer: Uses decentralised lending protocols for self-custody. Leverages Layer 2 solutions to minimise gas costs and participates in governance for additional rewards.

Hybrid Strategy Profile

Michael, 42, Business Owner: Splits portfolio 50/50 between CeFi and DeFi. Uses centralised services for stable income and decentralised protocols for higher-yield opportunities, adjusting allocation based on market conditions.

2025 Regulatory Landscape

CeFi Regulatory Developments

- MiCA Compliance: European platforms implementing complete regulatory frameworks

- US Clarity: Clearer guidelines for crypto lending products and consumer protection

- Insurance Requirements: Mandatory coverage for user deposits in regulated jurisdictions

- Transparency Standards: Required disclosure of lending practices and risk assessment

DeFi Regulatory Challenges

- Protocol Governance: Increased scrutiny of DAO decision-making processes

- Front-End Restrictions: Geographic blocking of DeFi interfaces in some regions

- Tax Reporting: Enhanced requirements for DeFi transaction reporting

- Stablecoin Regulations: Impact on DeFi lending markets and collateral options

Technical Infrastructure Comparison

CeFi Technical Stack

- centralised Databases: Traditional SQL databases for user accounts and transactions

- API Integration: Third-party services for KYC, payments, and compliance

- Security Measures: Multi-signature wallets, cold storage, and insurance policies

- Scalability: Can handle high transaction volumes without blockchain limitations

DeFi Technical Architecture

- Smart Contracts: Ethereum-based protocols with automated execution

- Oracles: Chainlink and other price feeds for accurate collateral valuation

- Governance Tokens: decentralised decision-making via token holder voting

- Interoperability: Cross-chain bridges and multi-protocol integration

Advanced Risk Analysis and Mitigation

CeFi Risk Deep Dive

Operational Risks

- Liquidity Crises: Platform inability to meet withdrawal demands during market stress

- Regulatory Changes: Sudden policy shifts affecting platform operations

- Management Risk: Poor decision-making by platform executives

- Technology Failures: System outages during critical market periods

Financial Risks

- Credit Risk: Borrower defaults affecting platform solvency

- Market Risk: Crypto price volatility impacting collateral values

- Interest Rate Risk: Mismatched lending and borrowing rates

- Concentration Risk: Over-exposure to specific assets or borrowers

DeFi Risk Assessment

Protocol-Specific Risks

- Smart Contract Bugs: Code vulnerabilities leading to fund drainage

- Oracle Manipulation: Price feed attacks causing incorrect liquidations

- Governance Attacks: Malicious proposals affecting protocol parameters

- Composability Risk: Failures in integrated protocols affecting the entire stack

Market Structure Risks

- Liquidation Cascades: Mass liquidations during market downturns

- MEV Exploitation: Maximal Extractable Value attacks on user transactions

- Network Congestion: High gas fees preventing timely position management

- Bridge Risks: Cross-chain protocol vulnerabilities and exploits

Market Trends and Future Outlook

CeFi Evolution

- Regulatory Compliance: Increased focus on licensing and consumer protection

- Insurance Products: Better coverage and security measures tools

- Traditional Integration: Banks and fintechs entering crypto lending

- Institutional Services: Professional-grade products for large investors

DeFi Innovation

- Cross-Chain Protocols: Seamless lending throughout multiple blockchains

- Real-World Assets: Tokenized traditional assets as collateral

- Improved UX: Better interfaces and simplified user experiences

- Institutional Adoption: Professional tools and compliance capabilities

Implementation Checklist and Action Steps

Getting Started with CeFi Lending

- Research and Compare: Evaluate platforms for rates, security, and capabilities

- Start Small: Begin with a small amount to test the platform and understand the process

- Complete KYC: Prepare identification documents and complete verification requirements

- Enable Security: Set up 2FA, withdrawal whitelisting, and other security measures

- Monitor Performance: Track yields, fees, and platform communications regularly

DeFi Lending Preparation Steps

- Wallet Setup: Install and secure a non-custodial wallet like MetaMask or a hardware wallet

- Gas Fund Preparation: Maintain ETH for transaction fees or use Layer 2 solutions

- Protocol Research: Study protocol documentation and smart contract audits

- Test Transactions: Start with small amounts to understand the interface and mechanics

- protection strategies: Set up monitoring tools and understand liquidation parameters

Portfolio Allocation Guidelines

Conservative Approach (Low Risk Tolerance)

- 80% CeFi: Stable platforms with insurance and regulatory compliance

- 20% DeFi: Blue-chip protocols like Aave with proven track records

- Emergency Fund: Keep 3-6 months expenses in traditional savings

Balanced Approach (Moderate Risk Tolerance)

- 60% CeFi: Mix of established platforms for stable base yield

- 40% DeFi: Diversified throughout multiple protocols and strategies

- Rebalancing: Quarterly review and adjustment based on performance

Aggressive Approach (High Risk Tolerance)

- 30% CeFi: Minimum allocation for stability and liquidity

- 70% DeFi: Active strategies featuring yield farming and governance participation

- Innovation Focus: Early adoption of new protocols with proper due diligence

Final Recommendations and Verdict

CeFi lending is best for newcomers and conservative investors who prioritise ease of use, customer support, and regulatory protection. DeFi lending gives advanced clients more control, transparency, and innovation at the cost of increased complexity and responsibility.

CeFi platforms suit beginners particularly well because customer support teams help whenever needed, whilst regulations provide some level of protection against fraud and mismanagement. DeFi protocols offer substantially more control over your assets with complete transparency of all operations, though this increased autonomy requires significant technical skills to use safely and effectively. Choose your approach based on several key factors including your experience level with cryptocurrency, desired level of control over your assets, risk tolerance and personal preferences, technical knowledge currently available to you, and your intended investment time horizon.

- Experience level with crypto

- Desired level of control

- Risk tolerance and preferences

- Technical knowledge available

- Investment time horizon

A balanced portfolio approach using both CeFi and DeFi can provide optimal diversification, allowing clients to benefit from the stability and simplicity of centralised platforms while accessing the innovation and transparency of decentralised protocols. The key is matching your choice to your technical expertise, risk tolerance, and investment goals.

Using both CeFi and DeFi platforms together often produces the best results by combining their complementary strengths. CeFi provides stability and predictable yields with professional management, whilst DeFi enables innovation and higher potential returns through algorithmic efficiency. Diversification throughout both approaches reduces overall portfolio risks by avoiding over-concentration in either model. Match your platform choices to your existing technical skills and comfort level, carefully consider your personal risk tolerance when allocating funds, and implement a strategic approach that balances both ecosystems:

- Start with 70% CeFi, 30% DeFi

- Gradually increase DeFi as you learn

- Never put all funds in one platform

- Rebalance quarterly based on performance

- Keep emergency funds in CeFi

In 2025, both sectors continue to mature with improved security measures, better user experiences, and clearer regulatory frameworks that make cryptocurrency lending more accessible and safer than ever before. Consider starting with CeFi platforms to learn the fundamental basics of cryptocurrency lending, then gradually exploring DeFi protocols as your knowledge and confidence grow through hands-on experience.

Both the CeFi and DeFi sectors keep improving continuously as security infrastructure gets stronger, user interfaces become progressively simpler and more intuitive, and regulatory frameworks clarify gradually to provide better guidance for participants. Starting with CeFi platforms first allows you to build foundational knowledge before moving to DeFi protocols later as your technical skills and confidence develop through practical experience.

Remember: Never invest more than you can afford to lose, diversify throughout multiple platforms and strategies to reduce concentration risk, and stay informed about regulatory developments that may affect your chosen approach. The crypto lending landscape evolves rapidly with new opportunities and risks emerging constantly, so continuous learning and adaptation are essential for achieving long-term success in this dynamic market.

Only invest amounts you can afford to lose completely without affecting your financial stability, diversify your holdings across multiple platforms to reduce single-point-of-failure risks, and stay informed about regulatory changes that could impact your lending activities. Markets change rapidly with new developments emerging constantly, learning never stops in this fast-evolving space, and adaptation ensures continued success as conditions shift. Follow these essential rules to protect your capital and maximise your chances of sustainable success:

- Never invest more than you can lose

- Use at least 3 different platforms

- Read regulatory updates monthly

- Track market trends weekly

- Review strategy quarterly

Conclusion

The choice between CeFi and DeFi lending represents a fundamental decision that reflects your risk tolerance, technical expertise, and investment philosophy. Both approaches offer compelling advantages and face distinct challenges that must be carefully considered when developing your cryptocurrency yield strategy.

This choice matters greatly because your risk tolerance guides all investment decisions, your technical skills largely determine your likelihood of success with different platforms, and your investment philosophy fundamentally shapes which approach aligns better with your values. Both CeFi and DeFi have clear advantages that make them suitable for different investor profiles, whilst challenges exist on both sides that require careful consideration and mitigation. Evaluate these critical factors before committing your funds to either approach:

- Your comfort with technology

- Amount of capital to deploy

- Time available for management

- Regulatory environment in your country

- Long-term investment goals

CeFi lending platforms provide the familiar comfort of traditional financial services with professional customer support, regulatory compliance, and user-friendly interfaces that make cryptocurrency lending accessible to mainstream investors. However, the recent failures of several prominent CeFi platforms have highlighted the inherent counterparty risks and the critical importance of conducting thorough due diligence when selecting centralised providers for your cryptocurrency lending activities.

CeFi platforms feel familiar to users because they operate similarly to traditional banks, support teams help constantly by answering questions and resolving issues, and regulations provide some comfort through consumer protection frameworks. Mainstream adoption becomes easier with these familiar interfaces and professional support, though platform failures have occurred in recent years that demonstrate real risks. Due diligence is absolutely essential before depositing funds, so check these critical factors thoroughly before committing your capital:

- Platform operational history

- Insurance coverage amounts

- Regulatory licenses held

- User reviews and ratings

- Withdrawal processing times

DeFi lending protocols offer unprecedented transparency with all operations visible on the blockchain, higher potential yields due to algorithmic efficiency and reduced operational costs, and complete control over your assets via intelligent contract automation that eliminates intermediaries. Whilst this decentralised approach eliminates counterparty risk by removing the need to trust centralised entities, it introduces substantial technical complexity and requires users to take full responsibility for their own security and transaction management without professional support.

DeFi protocols offer complete transparency since all operations are verifiable on the blockchain, yields often exceed CeFi rates due to algorithmic efficiency, and you control everything at all times without surrendering custody to third parties. Counterparty risk disappears entirely in this model since no centralised entity holds your funds, though technical complexity remains significantly high and requires substantial learning. Responsibility stays entirely with you for security and proper protocol usage, so research these critical aspects thoroughly before participating:

- Smart contract audit reports

- Protocol TVL and history

- Community size and activity

- Developer team reputation

- Bug bounty programs available

The optimal strategy for most investors involves a balanced approach that leverages the strengths of both ecosystems whilstmitigating their respective weaknesses. Starting with CeFi platforms to understand the fundamentals of cryptocurrency lending, then gradually exploring DeFi protocols as your knowledge and confidence grow, offers a prudent path for maximising yield while managing risk.

A balanced approach works best for most investors because it allows you to use the strengths of both ecosystems whilst strategically mitigating their respective weaknesses. Start by learning CeFi basics to build foundational knowledge, then progress to DeFi gradually as your technical skills develop, recognising that knowledge builds progressively over time through hands-on experience. Follow this structured learning path to develop expertise safely:

- Month 1-3: Learn CeFi basics

- Month 4-6: Try small DeFi amounts

- Month 7-9: Increase DeFi allocation

- Month 10-12: Optimise both strategies

- Year 2+: Advanced multi-protocol strategies

As the cryptocurrency lending landscape continues to evolve in 2025, both CeFi and DeFi sectors are maturing with improved security measures, better user experiences, and clearer regulatory frameworks. Success in this space requires continuous learning, careful risk prevention, and the flexibility to adapt your strategy as market conditions and available opportunities change. The integration of artificial intelligence and machine learning is enhancing risk assessment and user experiences throughout both sectors, creating more advanced and accessible lending opportunities for all investor types.

Both sectors mature rapidly with continuous improvements in infrastructure and user experience, security measures improve continuously through better protocols and protective mechanisms, and user experience gets progressively better as interfaces become more intuitive. Regulations become clearer over time as governments develop comprehensive frameworks, learning never stops in this fast-evolving space where new developments emerge constantly, and adaptation ensures long-term success as you adjust to changing conditions. Markets evolve constantly with new protocols and opportunities, new opportunities emerge regularly that require evaluation and potential integration, so stay flexible and adaptable to capitalise on the best opportunities as they arise.

Sources & References

Frequently Asked Questions

- What is the main difference between CeFi and DeFi lending?

- CeFi lending involves depositing crypto with a centralised company that manages your funds and offers customer support. DeFi lending uses smart contracts, allowing you to maintain control of your assets via a non-custodial wallet. CeFi requires KYC and offers insurance, whilstDeFi is permissionless but requires technical knowledge.

- Which offers better interest rates: CeFi or DeFi?

- DeFi typically offers higher rates (5-15% APY) due to lower operational costs and direct peer-to-peer lending. CeFi rates are generally lower (3-8% APY) but more stable and predictable. Rates fluctuate based on market conditions, so it's important to compare current offerings on both platforms.

- Is CeFi or DeFi lending safer?

- Both have different risk profiles. CeFi has counterparty risk (platform bankruptcy) but offers insurance and regulatory oversight. DeFi has smart contract risk (code vulnerabilities), but is non-custodial. Diversifying throughout both reduces overall risk exposure.

- Do I need technical knowledge for DeFi lending?

- Yes, DeFi requires understanding of wallets, gas fees, smart contracts, and blockchain transactions. You need to manage your own security and understand the risks of liquidation. Start with small amounts and use established protocols like Aave or Compound to learn safely.

- Can I use both CeFi and DeFi lending?

- Absolutely! Many experienced clients diversify throughout both to balance risk and maximise returns. Use CeFi for stable, passive income with customer support, and DeFi for higher yields and innovative strategies. A 60/40 or 50/50 split is common for balanced portfolios.

- What happens if a CeFi platform fails?

- If a CeFi platform becomes insolvent, you may lose your funds despite insurance claims. Recent examples include the bankruptcies of Celsius and BlockFi. Always check platform insurance coverage, regulatory compliance, and never deposit more than you can afford to lose.