Best DeFi Yield Platforms in 2025

Decentralised Finance (DeFi) offers diverse ways to earn on crypto. Here’s a deep dive into the most trusted yield protocols of 2025.

Introduction

DeFi yield platforms have changed passive income. They offer new ways to earn. You don't need traditional banks. Your digital assets work for you.

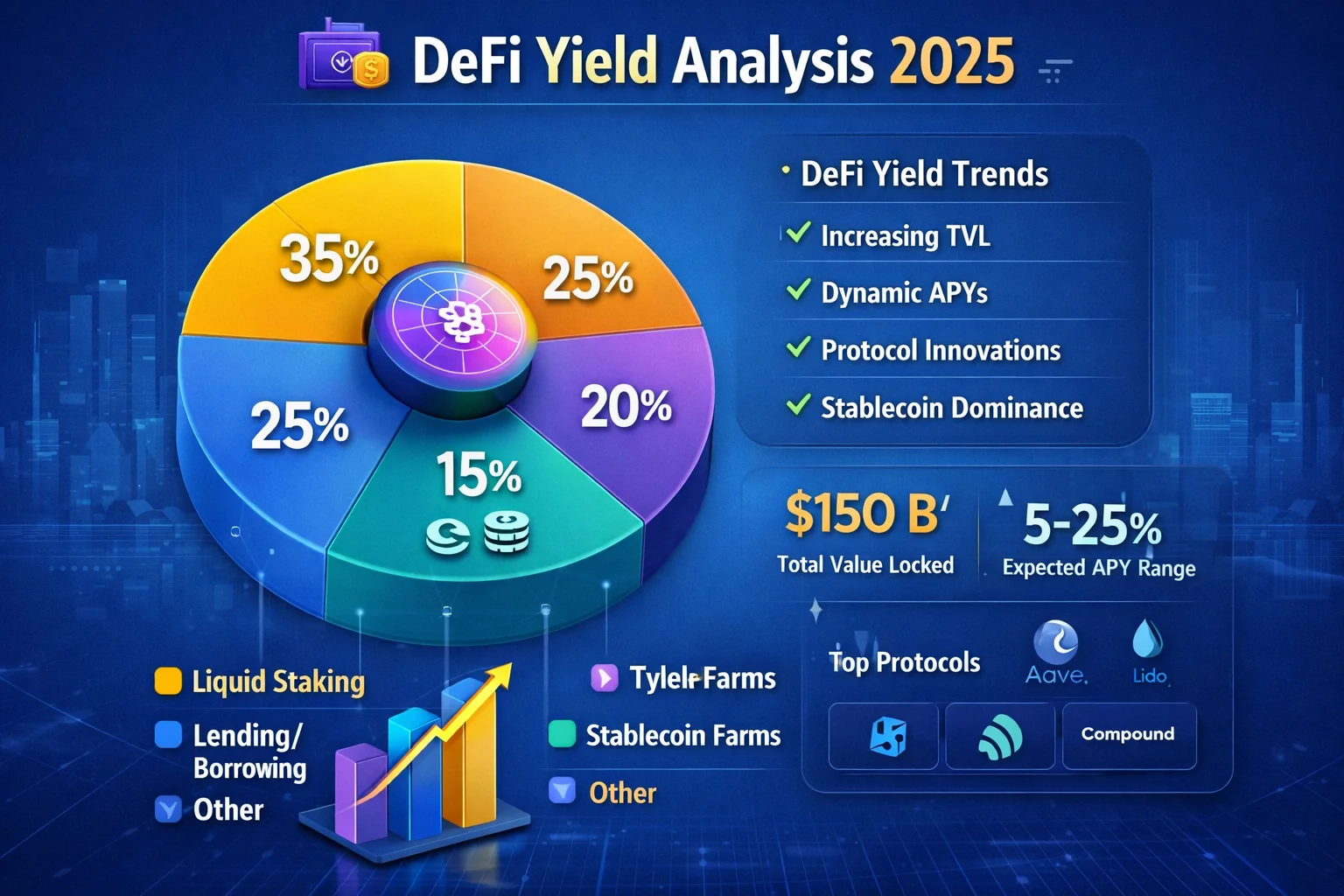

In 2025, DeFi earning has matured. Established protocols provide stable returns. Innovative platforms push boundaries. Strategies include market making. Liquidity mining works well. Algorithmic trading helps too.

DeFi platforms come in categories. AMMs are popular. Lending protocols work differently. Liquid staking derivatives exist. Return aggregators help optimise. Each has unique risks. Each offers different rewards.

Understanding differences matters. Build a diversified portfolio. Balance security with returns. Consider liquidity needs. Lido offers 4-6% APY. Risk is minimal. Pendle yields 15-25%. It needs active management. Risk tolerance must be higher.

Success requires understanding protocols. Assess smart contract risks. Maintain proper diversification. Use different platforms. Apply various strategies. Maximise returns this way. Minimise single point failures.

Security is paramount now. The industry learnt from exploits. Protocol failures taught lessons. Market volatility events matter. Leading platforms implement measures. Security is comprehensive.

Security measures include audits. Multiple smart contract checks happen. Bug bounty programs run. Insurance coverage exists. Formal verification processes work. Successful farmers prioritise security. Track records matter. Transparent operations are essential.

The DeFi yield landscape in 2025 reflects years of protocol evolution and market maturation. Early platforms focused purely on maximising returns, often at the expense of security and sustainability. Modern protocols balance yield optimisation with robust risk management, creating sustainable earning opportunities that can withstand market volatility and regulatory scrutiny. This maturation has attracted institutional capital, bringing professional-grade infrastructure and enhanced security standards to the DeFi ecosystem.

Choosing the right DeFi yield platform requires understanding your investment objectives, risk tolerance, and time commitment. Conservative investors prioritise established protocols with proven track records and lower but stable returns. Aggressive yield farmers seek higher returns through newer protocols and complex strategies, accepting increased risk in exchange for potentially superior performance. Most successful DeFi participants employ a balanced approach, allocating capital across multiple platforms and strategies to optimise risk-adjusted returns whilst maintaining adequate diversification and liquidity for changing market conditions.

This comparison analyses top platforms. We examine historical returns. Security measures are reviewed. User experience matters. Liquidity depth is checked. Long-term sustainability is assessed.

Our analysis covers Aave. Curve is included. Uniswap is reviewed. Emerging platforms appear too. Innovative yield strategies are explored.

At a Glance

| Protocol | Type | Top APY | Assets | Risks |

|---|---|---|---|---|

| Aave | Lending | 4–8% | Stablecoins, ETH, more | Smart contract risk |

| Curve | Stablecoin AMM | 5–10% (with boosts) | Stablecoins | IL, governance risk |

| Lido | Liquid Staking | 3.5–5% | ETH, SOL, others | Validator risk |

| Pendle | Yield Trading | 10–20%+ | stETH, stablecoins | Complexity, depeg risk |

| Compound | Lending | 3–6% | USDC, DAI, ETH | Smart contract risk |

| Yearn Finance | Yield Aggregator | 4–12% | Multi-asset | Strategy complexity |

| Convex Finance | Curve Booster | 6–15% | Curve LP tokens | Protocol dependency |

| Rocket Pool | Decentralised Staking | 3–5% | ETH | Node operator risk |

Key Insights

Platform Comparison Summary

Which platform suits your needs? Let's compare the options:

- Aave: Conservative Lending, Low risk, Beginner complexity

- Curve: Stablecoin Yields, Low-Medium risk, Intermediate complexity

- Lido: ETH Staking, Low risk, Beginner complexity

- Pendle: Advanced Strategies, Medium-High risk, Advanced complexity

Key Platform Insights

What makes each platform unique? Here's what you need to know:

- Aave: Battle-tested DeFi lending. Good for conservative yield.

- Curve: Stablecoin powerhouse. Low slippage, boosted yields with CRV/veCRV

- Lido: Largest liquid staking provider. Simple ETH staking with stETH liquidity.

- Pendle: Advanced strategy protocol for splitting and trading yield. High potential, higher complexity.

Comprehensive Platform Analysis

How do these platforms actually work? Let's dive deep into each one:

Aave - Institutional-Grade Lending

Aave leads the DeFi lending space with institutional-grade features, multi-chain deployment, and innovative products like flash loans and credit delegation.

Advanced Features

- Flash Loans: Uncollateralized loans for arbitrage and liquidations

- Rate Switching: Dynamic choice between stable and variable rates

- Credit Delegation: Lend your credit line to trusted parties

- Multi-Chain: Deployed on Ethereum, Polygon, Avalanche, and more

- Safety Module: AAVE staking provides protocol insurance

Curve Finance - Stablecoin Specialist

Curve specialises in efficient stablecoin trading and provides some of the highest yields in DeFi through its innovative AMM design and reward mechanisms.

Return optimisation

- CRV Rewards: Earn CRV tokens for providing liquidity

- Boost Mechanism: Lock CRV as veCRV for up to 2.5x reward multiplier

- Gauge Voting: Direct CRV emissions to preferred pools

- Low Impermanent Loss: optimised for similar-asset pairs

Lido - Liquid Staking Leader

Lido dominates the liquid staking market, allowing users to earn staking rewards while maintaining liquidity through derivative tokens.

Liquid Staking Benefits

- No Minimum: Stake any amount of ETH without 32 ETH requirement

- Instant Liquidity: Receive stETH tokens immediately

- DeFi Integration: Use stETH across DeFi protocols

- Professional Validators: Distributed across reputable operators

Pendle - Yield Trading Innovation

Pendle introduces sophisticated yield trading mechanisms, allowing users to separate and trade the yield component of yield-bearing assets.

Advanced Strategies

- Yield Tokenization: Split assets into principal and yield tokens

- Fixed Yield: Lock in guaranteed returns through yield trading

- Leveraged Yield: Amplify exposure to yield fluctuations

- Yield Speculation: Trade future yield expectations

Strategic Return optimisation

Risk-Adjusted Yield Strategies

Conservative Approach (3-6% APY)

- Focus: Established protocols with long track records

- Platforms: Aave lending, Lido staking

- Risk Level: Low to moderate smart contract risk

- Liquidity: High liquidity and easy exit strategies

Balanced Approach (6-12% APY)

- Focus: Mix of lending, staking, and LP strategies

- Platforms: Curve LP, Aave + Curve combinations

- Risk Level: Moderate smart contract and impermanent loss risk

- Management: Regular monitoring and rebalancing required

Aggressive Approach (12%+ APY)

- Focus: Complex strategies and newer protocols

- Platforms: Pendle yield trading, leveraged strategies

- Risk Level: High smart contract and market risks

- Expertise: Requires deep DeFi knowledge and active management

Comprehensive Safety Framework

Risk Assessment Matrix

- Aave: Low smart contract risk, Multiple audits, Insurance Yes (Safety Module)

- Curve: Low smart contract risk, Extensive audits, Insurance Limited

- Lido: Low-Medium smart contract risk, Multiple audits, Insurance No

- Pendle: Medium smart contract risk, Audited, Insurance No

Protocol Evaluation Criteria

- Audit History: Multiple audits by reputable firms

- Track Record: Proven performance over multiple market cycles

- TVL Stability: Consistent total value locked indicating user confidence

- Team Reputation: Known and respected development teams

- Governance Quality: Active and engaged community governance

Risk Mitigation Strategies

- Diversification: Spread funds across multiple protocols and strategies

- Position Sizing: Limit exposure to any single protocol

- Gradual Exposure: Start small and increase as comfort grows

- Regular Monitoring: Track protocol health and market conditions

- Exit Planning: Have clear strategies for various scenarios

Technical Best Practices

- Hardware Wallets: Use hardware wallets for large positions

- Multi-Signature: Consider multi-sig setups for institutional amounts

- Gas Management: Monitor and optimise transaction costs

- Slippage Protection: Set appropriate slippage tolerances

- Emergency Procedures: Know how to quickly exit positions if needed

Platform-Specific Strategies

Strategy Comparison by Platform

| Platform | Best Strategy | Time Commitment | Skill Level |

|---|---|---|---|

| Aave | Supply high-demand assets | Low (passive) | Beginner |

| Curve | veCRV locking + gauge voting | Medium (weekly) | Intermediate |

| Lido | stETH in DeFi protocols | Low (passive) | Beginner |

| Pendle | Yield stripping + trading | High (daily) | Advanced |

maximising Aave Returns

- Supply High-Demand Assets: Focus on USDC, USDT, and ETH for consistent demand

- Monitor utilisation Rates: Higher utilisation typically means better supply rates

- Consider Borrowing Strategies: Use stable rate borrowing for predictable costs

- Multi-Chain Opportunities: Compare rates across Ethereum, Polygon, and Avalanche

Curve optimisation Techniques

- veCRV Strategy: Lock CRV for maximum periods to achieve 2.5x boost

- Pool Selection: Focus on high-volume pools with consistent trading fees

- Gauge Voting: Participate in governance to direct rewards to your pools

- Convex Integration: Consider Convex for simplified CRV optimisation

Lido Staking Strategies

- stETH utilisation: Use stETH in other DeFi protocols for additional yield

- Curve stETH Pool: Provide liquidity to stETH/ETH pool for extra rewards

- Multi-Asset Staking: Diversify across ETH, SOL, and other supported assets

- Withdrawal Planning: Understand withdrawal queues and timing

Advanced Pendle Strategies

- Yield Stripping: Separate principal and yield for targeted exposure

- Fixed Yield Locking: Secure guaranteed returns in volatile markets

- Yield Amplification: Use leverage to increase yield exposure

- Market Timing: Trade yield tokens based on rate expectations

Market Conditions and Timing

Bull Market Strategies

- Higher Risk Tolerance: Explore newer protocols and higher-yield opportunities

- Leverage Considerations: Carefully managed leverage can amplify returns

- Growth Token Exposure: Consider protocols with strong token appreciation potential

- Active Management: More frequent rebalancing to capture opportunities

Bear Market Approaches

- Safety First: Focus on established protocols with proven track records

- Stablecoin Strategies: Emphasize stablecoin yields for capital preservation

- Reduced Complexity: Avoid complex strategies that may be harder to exit

- Liquidity Priority: Maintain higher liquidity for potential opportunities

Regulatory Considerations

- Jurisdiction Awareness: Understand local regulations affecting DeFi participation

- Tax Implications: Track transactions for proper tax reporting

- Compliance Tools: Use portfolio tracking tools for regulatory compliance

- Future-Proofing: Consider how regulations might affect chosen strategies

Getting Started Guide

Recommended Learning Path

| Level | Platform | Starting Amount | Time to Learn |

|---|---|---|---|

| Beginner | Lido | $500+ | 1 week |

| Beginner | Aave | $1,000+ | 2 weeks |

| Intermediate | Curve | $2,000+ | 1 month |

| Advanced | Pendle | $5,000+ | 2-3 months |

Beginner Approach

- Start with Lido: Simple ETH staking with immediate liquidity

- Learn Aave Basics: Supply stablecoins for conservative yield

- Understand Risks: Study smart contract and market risks thoroughly

- Small Positions: Begin with amounts you can afford to lose

Intermediate Progression

- Curve Liquidity: Provide liquidity to stablecoin pools

- Multi-Protocol: Diversify across 2-3 established protocols

- Return Enhancement: Learn about compounding and reinvestment

- Risk Assessment: Implement position sizing and diversification

Advanced Strategies

- Pendle Integration: Explore yield trading and fixed-rate strategies

- Cross-Chain: utilise opportunities across multiple blockchains

- Leverage Usage: Carefully implement leveraged yield strategies

- Active Management: Develop systematic rebalancing approaches

2025 DeFi Trends and Future Outlook

2025 DeFi Trends Overview

| Trend | Impact | Timeline |

|---|---|---|

| Layer 2 Expansion | Lower fees, faster transactions | Now |

| Real-World Assets | New yield sources | 2025-2026 |

| AI Integration | Automated optimisation | 2025 |

| Institutional Adoption | Increased liquidity | 2025-2027 |

Emerging Technologies

- Layer 2 Expansion: Arbitrum, Optimism, and Polygon driving lower costs and higher throughput

- Cross-Chain Protocols: Seamless yield opportunities across multiple blockchains

- Real-World Assets: Tokenized bonds, real estate, and commodities entering DeFi

- AI Integration: Automated return enhancement and risk mitigation tools

- Institutional Infrastructure: Professional-grade custody and compliance solutions

Regulatory Developments

- Clearer Guidelines: More defined regulatory frameworks for DeFi protocols

- Compliance Tools: Better tax reporting and regulatory compliance solutions

- Institutional Adoption: Traditional finance integrating DeFi strategies

- Geographic Considerations: Varying regulations across different jurisdictions

Innovation Areas

- Yield Derivatives: More sophisticated instruments for yield trading and hedging

- Insurance Products: Better coverage for smart contract and protocol risks

- Automated Strategies: Set-and-forget return enhancement protocols

- Social Trading: Copy successful DeFi strategies from experienced users

Practical Implementation Checklist

Pre-Investment Preparation

- Wallet Security: Set up hardware wallet and secure seed phrase storage

- Gas Fund: Maintain ETH for transaction fees across all activities

- Research Tools: Bookmark DeFiPulse, DeFiLlama, and protocol documentation

- Risk Assessment: Define maximum acceptable loss per protocol

- Tax Planning: Understand local tax implications and tracking requirements

Portfolio Construction

- Core Allocation (60%): Established protocols like Aave and Lido

- Growth Allocation (30%): Higher-yield opportunities like Curve and Pendle

- Experimental (10%): New protocols and innovative strategies

- Emergency Fund: Keep 3-6 months expenses in stable, liquid assets

Ongoing Management

- Weekly Reviews: Monitor protocol health, yields, and market conditions

- Monthly Rebalancing: Adjust allocations based on performance and opportunities

- Quarterly Deep Dive: Comprehensive review of strategy effectiveness

- Annual Strategy Update: Major portfolio restructuring based on market evolution

Red Flags to Watch

- Sudden TVL Drops: Large outflows may indicate protocol issues

- Governance Attacks: Malicious proposals or voting irregularities

- Audit Findings: New vulnerabilities discovered in smart contracts

- Team Changes: Key developer departures or leadership changes

- Regulatory Actions: Government enforcement or policy changes

Advanced optimisation Techniques

Compounding Methods Comparison

- Automated (Yearn): Low cost, High efficiency

- Manual Daily: High gas cost, Medium efficiency

- Manual Weekly: Medium cost, Good efficiency

- Layer 2 Auto: Very Low cost, Excellent efficiency

Gas optimisation Strategies

- Batch Transactions: Combine multiple operations to reduce gas costs

- Layer 2 Usage: utilise Polygon, Arbitrum, or Optimism for cheaper transactions

- Timing optimisation: Execute transactions during low-congestion periods

- Gas Token Strategies: Use gas tokens during high-fee periods

Yield Compounding Methods

- Automated Compounding: Use protocols like Yearn Finance for automatic reinvestment

- Manual optimisation: Regular harvesting and reinvestment of rewards

- Cross-Protocol Strategies: Move rewards between protocols for optimal yields

- Tax-Efficient Compounding: Consider tax implications of frequent transactions

Risk-Adjusted Return optimisation

- Sharpe Ratio Analysis: Evaluate risk-adjusted returns across protocols

- Correlation Management: Diversify across uncorrelated yield sources

- Volatility Targeting: Adjust position sizes based on volatility metrics

- Drawdown Management: Implement stop-loss mechanisms for large positions

DeFi Earning Platforms Comparison

- Lido: Liquid Staking, 3-5% APY, $20B+ TVL, Low risk

- Aave: Lending, 3-8% APY, $10B+ TVL, Low risk

- Curve: DEX, 4-10% APY, $5B+ TVL, Low-Medium risk

- Pendle: Yield Trading, 8-15% APY, $500M+ TVL, Medium risk

- Compound: Lending, 2-6% APY, $2B+ TVL, Low-Medium risk

- Yearn Finance: Yield Aggregator, 5-12% APY, $1B+ TVL, Medium risk

- Convex: Curve optimiser, 6-15% APY, $3B+ TVL, Medium risk

- Frax Finance: Stablecoin + Staking, 4-9% APY, $800M+ TVL, Low-Medium risk

Get Started with DeFi Yield

Ready to start earning DeFi yields? Choose your preferred platform:

- Start with Aave - Leading DeFi lending protocol

- Start with Lido - Liquid staking leader

- Start with Curve - Stablecoin return enhancement

Advanced Return Enhancement and Professional DeFi Strategies

Automated Yield Farming and Portfolio Rebalancing Systems

Professional DeFi return enhancement requires sophisticated automated systems that continuously monitor earning opportunities across multiple protocols while implementing dynamic rebalancing strategies that maximise returns while maintaining appropriate risk profiles. Automated earning systems utilise advanced algorithms to identify optimal return opportunities, execute complex multi-protocol strategies, and manage liquidity positions across different DeFi platforms to optimise overall portfolio performance.

Advanced portfolio rebalancing systems implement sophisticated risk mitigation frameworks that automatically adjust positions based on changing market conditions, protocol risks, and earning opportunities while maintaining diversification and risk control objectives. Professional return enhancement includes automated compounding strategies, cross-protocol arbitrage opportunities, and dynamic allocation systems that maximise returns while minimising exposure to protocol-specific risks and market volatility.

Institutional DeFi Yield Management and Compliance Integration

Institutional DeFi earning management requires comprehensive compliance frameworks that address regulatory requirements, fiduciary obligations, and risk assessment standards while enabling participation in high-return DeFi opportunities. Professional DeFi earning management includes sophisticated custody solutions, comprehensive audit trails, and regulatory reporting capabilities that meet institutional requirements while maintaining operational efficiency and return enhancement.

Institutional yield management systems provide comprehensive risk assessment, automated compliance monitoring, and detailed performance reporting that enable professional investment managers to optimise DeFi allocations while maintaining appropriate oversight and regulatory compliance. Advanced institutional systems include multi-signature governance, emergency response procedures, and comprehensive insurance coverage that protect institutional assets while enabling participation in sophisticated DeFi yield strategies.

Cross-Chain Yield optimisation and Multi-Protocol Integration

Advanced DeFi yield optimisation requires sophisticated cross-chain capabilities that enable seamless yield farming across multiple blockchain networks while maintaining security and operational efficiency. Cross-chain yield optimisation includes automated bridge management, multi-chain portfolio tracking, and comprehensive analytics that provide unified views of yield opportunities across Ethereum, Polygon, Arbitrum, and other major DeFi ecosystems.

Multi-protocol integration helps develop sophisticated yield strategies by combining lending protocols, automated market makers, and yield aggregators to build complex yield-generation systems. Professional cross-chain yield optimisation includes automated gas optimisation, bridge security management, and comprehensive risk assessment for efficient multi-chain yield farming with appropriate security and risk management practices.

Advanced Yield optimisation and Professional DeFi Strategies

Institutional DeFi Implementation and Risk Assessment

Professional DeFi return generation requires sophisticated risk mitigation frameworks. You need a comprehensive protocol evaluation. Advanced portfolio optimisation strategies maximise returns. They maintain appropriate capital preservation. Operational security meets institutional requirements.

Institutional DeFi implementation includes comprehensive due diligence processes. Advanced smart contract auditing is essential. Sophisticated monitoring systems enable professional participation. They maintain fiduciary obligations. Regulatory compliance is achieved through institutional-grade DeFi investment. Professional return enhancement strategies support large-scale cryptocurrency investment.

Advanced yield optimisation includes systematic protocol evaluation. Comprehensive risk assessment frameworks are crucial. Sophisticated portfolio management techniques balance yield generation with capital preservation. Professional investors and institutional participants benefit most.

Professional DeFi strategies utilise automated rebalancing systems. Comprehensive performance monitoring is standard. Advanced risk management protocols optimise returns. They maintain operational efficiency. Security standards support institutional DeFi implementation. Professional yield optimisation serves sophisticated cryptocurrency investment.

Final Verdict

In 2025, DeFi protocols offer flexibility and higher potential than CeFi. Aave, Curve, Lido, and Pendle represent the most reputable options. Match your choice to your risk tolerance and technical comfort. Start conservatively with established protocols, such as Lido and Aave, and then gradually explore more complex strategies as your knowledge and confidence grow.

Success in DeFi requires continuous learning, careful risk assessment, and disciplined execution. The landscape evolves rapidly, so staying informed about protocol updates, market conditions, and regulatory changes is essential for long-term success.

The future of DeFi yield farming looks promising with increasing institutional adoption and improved user interfaces making these protocols more accessible to mainstream users. Cross-chain yield opportunities are expanding, allowing users to optimise returns across multiple blockchain networks.

As the DeFi ecosystem matures, we expect to see more sophisticated risk mitigation tools, insurance products, and regulatory compliance features that will make yield farming safer and more attractive to conservative investors seeking passive income opportunities.

Institutional Yield Strategies and Professional Implementation

Enterprise DeFi Integration and Compliance Frameworks

Institutional DeFi participation requires comprehensive compliance frameworks. They address regulatory requirements. Fiduciary responsibilities are essential. Operational risk management is crucial. Professional implementation includes establishing governance procedures. Comprehensive audit trails are implemented. Risk management protocols meet institutional standards. They access innovative DeFi yield opportunities.

Enterprise integration strategies include API-based portfolio management. Automated compliance reporting is standard. Institutional custody solutions enable traditional financial institutions to participate. They maintain regulatory compliance. Operational excellence standards support institutional asset management.

Advanced Risk Management and Portfolio optimisation

Professional yield optimisation employs sophisticated risk models. They evaluate protocol security. Market risks are assessed. Operational complexities across multiple DeFi platforms are considered. Advanced portfolio construction includes correlation analysis. Volatility modelling is essential. Scenario planning optimises risk-adjusted returns. Appropriate diversification is maintained. Capital preservation requirements are met.

Institutional risk management includes implementing stop-loss mechanisms, maintaining emergency liquidity reserves, and developing comprehensive contingency plans that address various market scenarios and protocol risks. Professional monitoring systems track protocol health, governance changes, and market conditions that affect portfolio performance and risk exposure.

Future Trends and Technology Development

DeFi yield platform evolution includes integration with traditional finance infrastructure, development of institutional-grade features, and implementation of advanced automation technologies that enhance user experience while maintaining security standards. Emerging trends include cross-chain yield optimisation, artificial intelligence-powered strategy automation, and integration with regulatory compliance frameworks that expand institutional adoption.

Technology development focuses on improving capital efficiency, reducing transaction costs, and enhancing user experience through sophisticated interface design and automated portfolio management tools. Future innovations include advanced risk assessment algorithms, predictive analytics for yield optimisation, and comprehensive integration with traditional financial systems that bridge DeFi innovation with established financial infrastructure.

Market Analysis and Competitive Landscape

DeFi yield platform competition drives continuous innovation in user experience, yield optimisation, and security features that benefit users through improved services and competitive rates. Market analysis reveals consolidation trends, protocol partnerships, and technological developments that shape the competitive landscape and influence platform selection criteria for professional users.

Competitive advantages include protocol innovation, user experience design, security track records, and community governance that differentiate platforms in an increasingly crowded market. Professional evaluation criteria include total value locked, audit history, governance quality, and long-term sustainability factors that indicate platform viability and user protection standards.

User Education and Support Infrastructure

Successful DeFi yield platforms provide comprehensive educational resources, community support systems, and professional guidance that help users navigate complex protocols and optimise their yield strategies. Educational initiatives include detailed documentation, video tutorials, and community forums that enable users to understand protocol mechanics and implement effective strategies.

Professional support includes dedicated customer service, technical assistance, and educational webinars that help users maximise platform benefits whilstavoiding common mistakes. Advanced platforms offer personalised guidance, strategy consultation, and ongoing support that enables users to achieve their financial objectives through effective DeFi participation and yield optimisation strategies that maximise returns while maintaining appropriate risk management standards.

Advanced Yield optimisation Strategies

Professional DeFi yield optimisation requires a sophisticated understanding of protocol mechanics, market dynamics, and risk management principles. Advanced strategies include yield farming across multiple protocols, liquidity mining optimisation, and strategic asset allocation that maximises returns while maintaining appropriate risk exposure through diversified approaches and systematic portfolio management techniques that ensure sustainable long-term growth.

Conclusion

The DeFi earning platform landscape in 2025 offers sophisticated opportunities to generate passive income from cryptocurrency holdings, with established protocols providing stable returns and innovative platforms pushing the boundaries of return enhancement.

Success in DeFi earning requires balancing the pursuit of higher returns with prudent risk mitigation, thorough platform research, and continuous learning about evolving protocols and market conditions.

Conservative investors should prioritise battle-tested platforms like Lido, Aave, and Curve that offer moderate yet sustainable yields, strong security track records, and comprehensive risk controls.

These platforms have weathered multiple market cycles and demonstrated resilience during challenging periods, making them suitable foundations for long-term wealth-building strategies.

More aggressive yield seekers can explore platforms like Pendle and GMX, as well as emerging protocols that offer higher potential returns through innovative mechanisms, but these opportunities require deeper technical understanding and a higher risk tolerance.

The key to successful yield farming lies in diversification across multiple platforms, risk categories, and time horizons while maintaining strict security practices and never investing more than you can afford to lose.

As the DeFi ecosystem continues evolving with cross-chain integration, real-world asset tokenisation, and AI-powered optimisation, staying informed about protocol developments and maintaining adaptable strategies becomes increasingly important. The platforms that prioritise security, sustainability, and user experience while delivering consistent value to their communities are most likely to thrive in the competitive DeFi landscape of 2025 and beyond.

Sources & References

- Lido Finance - Liquid Staking Protocol

- Aave - DeFi Lending Platform

- Curve Finance - Stablecoin DEX

- DeFi Llama - TVL Rankings

Professional DeFi Yield optimisation Strategies

Advanced DeFi yield optimisation requires a systematic approach to protocol selection, risk assessment, and portfolio management that maximises returns while maintaining appropriate security and diversification standards. Professional strategies include automated yield farming through smart contract integration, cross-protocol arbitrage opportunities, and systematic liquidity provision across multiple platforms that optimise capital efficiency while minimising exposure to individual protocol risks and market volatility.

Institutional DeFi yield management encompasses analytics frameworks, automated rebalancing systems, and sophisticated monitoring tools that optimise protocol participation with institutional-grade risk management standards. Professional portfolio construction techniques include systematic performance measurement and comprehensive reporting capabilities that support informed decision-making and regulatory compliance requirements for institutional cryptocurrency investment operations.

DeFi Yield Platform Security and Risk Assessment

Professional DeFi yield platform evaluation requires a comprehensive security analysis that examines smart contract audits, protocol governance structures, and operational risk factors that affect long-term sustainability and user protection. Security assessment frameworks include technical due diligence, audit report analysis, and ongoing monitoring systems that identify potential vulnerabilities while maintaining access to innovative yield generation opportunities across the decentralised finance ecosystem.

Risk management strategies encompass diversification across multiple protocols, systematic position sizing based on risk-adjusted returns, and comprehensive insurance coverage through decentralised insurance platforms. Automated monitoring systems, emergency exit procedures, and systematic risk assessment protocols enable confident DeFi participation while maintaining appropriate capital preservation and operational security standards that support professional cryptocurrency portfolio management and yield optimisation.

Frequently Asked Questions

- Which DeFi yield platform is safest?

- Lido and Aave are considered the safest DeFi protocols with extensive security audits, large TVL, and proven track records. Both have operated successfully for years without major security incidents and offer insurance options for additional protection.

- What are the risks of DeFi yield farming?

- Main risks include smart contract vulnerabilities, impermanent loss in liquidity pools, market volatility, and protocol failures. Mitigate risks by using audited protocols, diversifying across platforms, starting small, and never investing more than you can afford to lose.

- How much can I earn from DeFi earning platforms?

- Returns vary from 3-5% APY on conservative platforms like Lido to 8-15% on higher-risk platforms like Pendle. Actual yields fluctuate based on market conditions, protocol incentives, and network activity. Always consider gas fees and potential impermanent loss.

- Do I need technical knowledge for DeFi yield farming?

- Basic platforms like Lido require minimal technical knowledge - connect a wallet and stake. Advanced strategies like farming on Curve or Pendle require an understanding of liquidity pools, impermanent loss, and smart contract interactions. Start simple and learn gradually.

- Are DeFi yields sustainable long-term?

- Established protocols like Aave and Lido offer sustainable returns from real economic activity (lending fees, staking rewards). High APYs from token incentives may not be sustainable. Focus on protocols with proven business models and real revenue generation for long-term sustainability.

- How do I withdraw from DeFi yield platforms?

- Most protocols allow instant withdrawals, though some, like Lido staking, may have unbonding periods. Always check withdrawal terms, potential fees, and liquidity conditions before depositing. Keep some funds liquid for emergencies and gas fees.