Best CeFi vs DeFi Yields in 2025

Introduction

What's the difference between CeFi and DeFi yields? CeFi (Centralised Finance) and DeFi (Decentralised Finance) both offer ways to earn passive income But they use How do they differ in custody, transparency, Here's a comprehensive comparison for 2025.

How has the yield landscape evolved? The digital asset yield landscape has undergone a dramatic Both centralised and decentralised finance platforms offer You can generate passive income from digital assets.

What options do you have? The maturation of both ecosystems has created a diverse range of Conservative CeFi platforms offer bank-like security. They Innovative DeFi protocols You get automated market makers, liquidity mining, and yield farming strategies.

How have CeFi platforms improved? Centralised Finance platforms This happened since the market upheavals of 2022-2023. They implemented Regulatory compliance frameworks Institutional-grade risk management practices rival traditional financial institutions.

What yields can you expect from CeFi? These platforms now You can get 3-12% APY They provide user-friendly interfaces. Customer Insurance coverage appeals Newcomers to digital asset investing benefit.

What makes DeFi protocols attractive? Decentralised Finance protocols They're now You can get higher potential yields of 8-20% APY. How do they Through innovative mechanisms like automated yield optimisation, cross-chain farming, and governance token rewards.

How do DeFi protocols work? These protocols operate through They You get complete control However, they require They carry You must carefully evaluate these.

What should you consider when choosing? The choice between CeFi and DeFi yield strategies in 2025 Think about Assess Evaluate yield optimisation goals.

What will this analysis cover? This comprehensive analysis examines the leading platforms and protocols We compare their yield potential, protection protocols, The overall value You'll make informed decisions about where to deploy your Get optimal risk-adjusted returns in today's evolving market.

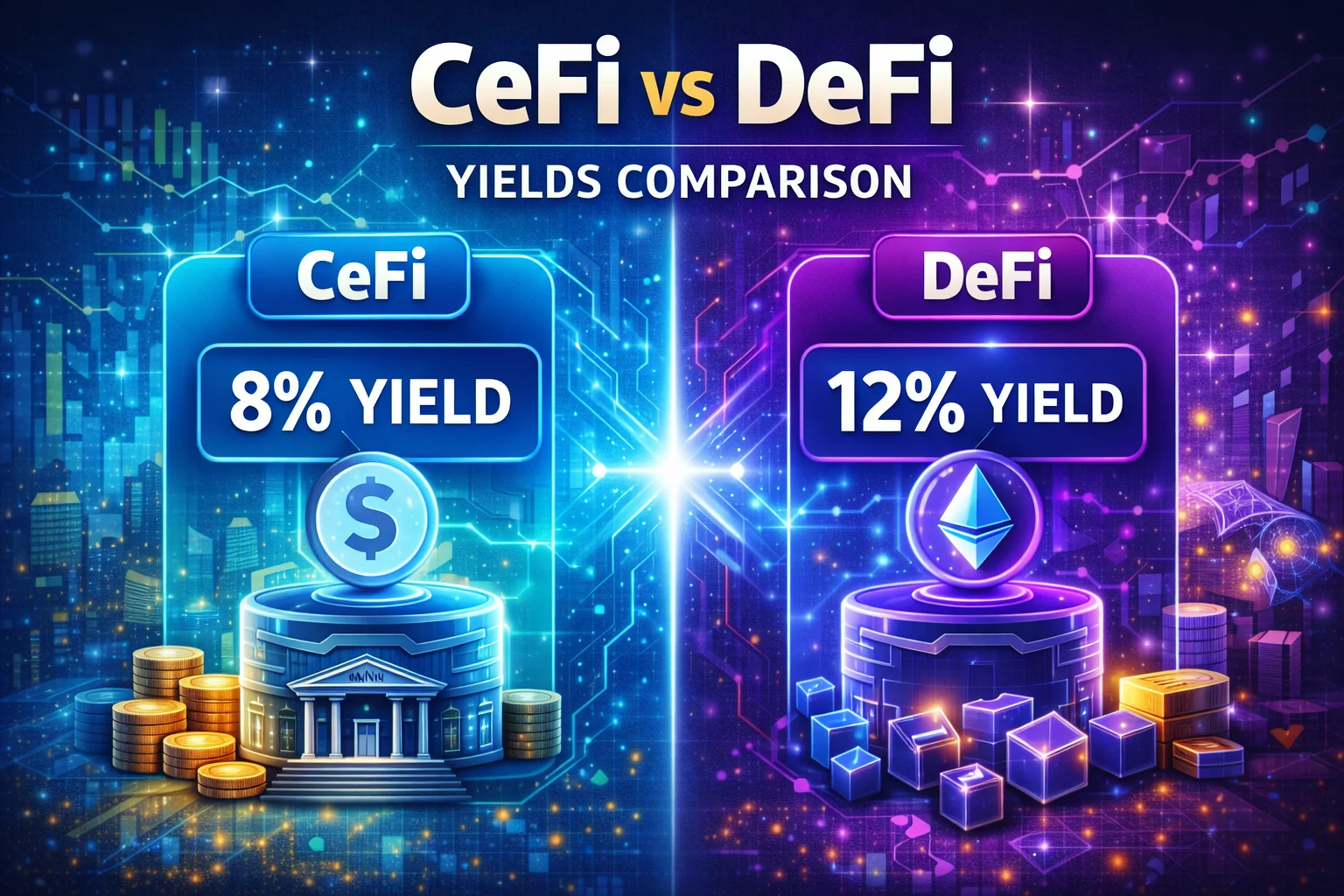

Quick Comparison: CeFi vs DeFi Yields

| Feature | CeFi | DeFi |

|---|---|---|

| Typical APY | 3-12% | 8-20% |

| Custody | Platform holds keys | You hold keys |

| Technical Skill | Beginner-friendly | Intermediate-Advanced |

| Regulation | Regulated | Permissionless |

| Main Risk | Platform failure | Smart contract bugs |

| Best For | Conservative investors | Tech-savvy users |

The Yield Landscape Revolution: 2025 Overview

How has the yield landscape changed? The crypto yield landscape has matured significantly since the DeFi summer of 2020 and In 2025, both CeFi and DeFi platforms offer sophisticated yield-generating products with distinct risk-reward profiles catering to different investor preferences and risk tolerances.

What drove this transformation? The evolution of digital asset yield maximisation has transformed dramatically as experimental protocols matured and unsustainable reward Mature, institutional-grade platforms now provide reliable income streams for digital asset holders, driven by regulatory clarity, technological improvements, and growing sophistication of financial services.

Market Maturation and Regulatory Clarity

How has regulation changed? Regulatory frameworks have evolved significantly as major jurisdictions now provide clear guidelines benefiting both CeFi and DeFi platforms through better protection, improved compliance, and increased market stability.

What does this mean for you? Investors can now participate with more confidence as legal protections become clearer, tax obligations are defined, platforms operate more transparently, and user rights receive better protection.

How do platforms adapt? CeFi platforms obtain licenses and implement KYC procedures whilst DeFi protocols add compliance layers, with both sectors working with regulators to create a safer environment for participants.

How has yield farming matured? The space evolved from experimental protocols to institutional-grade platforms with regulatory DeFi protocols implement robust risk management and strong governance systems, creating more stable yield opportunities with predictable returns available across both sectors.

Yield Ranges by Platform Type

| Platform Type | APY Range | Risk Level |

|---|---|---|

| CeFi Savings | 3-8% | Low-Medium |

| CeFi Staking | 5-12% | Medium |

| DeFi Lending | 4-10% | Medium |

| DeFi Liquidity Mining | 8-20% | Medium-High |

| DeFi Yield Farming | 10-30% | High |

Yield Compression and Normalization

How have yields changed? The extreme yields of 2020-2021 have normalised to more sustainable levels, with CeFi platforms now offering APYs of 3-12% and DeFi protocols providing APYs of 4-15% depending on risk level This normalisation has made yield comparison more meaningful and sustainable for long-term investors.

Why is this better for you? Sustainable yields mean reduced risk with better planning capabilities and more predictable returns as the market has matured, benefiting long-term investors significantly.

Innovation in Yield Generation

What innovations exist? Both sectors have innovated significantly, with CeFi platforms providing structured products and institutional-grade services whilst DeFi has developed liquid staking, real yield protocols, and These innovations provide investors with more options to optimise their risk-adjusted returns.

How do these innovations help you? Investors benefit from more choices, improved risk management, more stable returns, easier earning through technology, and advantages from competition between platforms.

Comprehensive Platform Comparison

How do you choose between CeFi and DeFi? The choice depends on your priorities regarding security, simplicity, control, CeFi platforms might be better if you value security and simplicity with customer support DeFi protocols could suit you better if you want maximum control and transparency through direct smart contract Consider your technical skills, risk tolerance, and yield expectations when making this decision.

What are the key differences? CeFi platforms hold your assets in custody whilst providing customer support and insurance coverage DeFi protocols give you full control through direct smart contract interactions without any intermediaries involved Each approach has distinct trade-offs between convenience and control that investors should carefully evaluate.

Can you use both? Many investors successfully use both CeFi and DeFi platforms to diversify their risk and gain benefits Conservative funds typically go to CeFi platforms for safety, whilst experimental strategies utilise DeFi protocols for This balanced approach works well for managing overall portfolio risk.

Which platforms offer the best yields? Compare the top platforms below to see how APY ranges vary significantly across different custody models, asset support options, Understanding which platform matches your specific needs requires careful evaluation of these factors.

| Platform | Type | APY Range | Custody | Top Assets | Key Features |

|---|---|---|---|---|---|

| Nexo | CeFi | 3-12% | Custodial | BTC, ETH, USDT, NEXO | Daily payouts, insurance |

| Binance Earn | CeFi | 1-10% | Custodial | 200+ assets | Flexible/locked options |

| OKX Earn | CeFi | 2-15% | Custodial | ETH, BTC, stablecoins | DeFi integration |

| Aave | DeFi | 2-8% | Non-custodial | ETH, USDC, WBTC | Flash loans, rate switching |

| Lido | DeFi | 3-5% | Non-custodial | ETH, SOL, MATIC | Liquid staking tokens |

| Curve Finance | DeFi | 3-12% | Non-custodial | Stablecoins, ETH | Low slippage swaps |

| Compound | DeFi | 2-6% | Non-custodial | ETH, USDC, DAI | Algorithmic rates |

| Kraken Staking | CeFi | 2-10% | Custodial | 20+ assets | Regulated US exchange |

CeFi Platforms: Detailed Analysis

Nexo - The Regulated Leader

Why choose Nexo? Nexo has established itself as the premier regulated crypto yield platform offering institutional-grade security Licensed in multiple jurisdictions and backed by comprehensive insurance, Nexo provides the most traditional banking-like experience for crypto yields with bank-like security.

Yield Products

- Earn Interest: Up to 12% APY available on crypto and stablecoins

- Fixed Terms: Higher rates available for 1-12 month lockups

- Flexible Savings: Daily payouts with instant access for liquidity needs

- Loyalty Bonuses: Enhanced rates for NEXO token holders providing additional value

- Fiat Yields: Earn on USD, EUR, and GBP deposits

Risk Management

- Insurance: $375 million coverage for digital assets

- Regulatory Compliance: Licensed in EU, UK, and US states

- Proof of Reserves: Regular third-party audits for verification

- Segregated Custody: User funds held separately for safety

Binance Earn - The Ecosystem Giant

Why choose Binance Earn? Binance Earn leverages the world's largest crypto exchange ecosystem providing With over 200 supported assets and multiple product types, it offers the most comprehensive CeFi yield platform available.

Product Portfolio

- Flexible Savings: Instant access with competitive rates

- Locked Staking: Higher yields for committed terms

- DeFi Staking: Access to DeFi protocols through Binance

- Launchpool: Earn new tokens by staking existing assets

- Dual Investment: Structured products with enhanced yields

Advantages

- Asset Variety: Widest selection of yield-bearing assets

- Integrated Ecosystem: Seamless integration between trading and earning features

- Low Minimums: Start earning with $1 equivalent

- Auto-Subscribe: Automatic reinvestment options for compound growth

OKX Earn - The DeFi Bridge

OKX Earn uniquely bridges CeFi and DeFi by offering both centralised yield products and direct access to DeFi protocols through a user-friendly interface. This hybrid approach provides the best

Hybrid Features

What makes OKX unique? It bridges Simple Earn, DeFi Earn Structured Liquid. Which feature suits you?

- Simple Earn: Traditional CeFi savings products

- DeFi Earn: Direct access to Aave, Compound, and others

- Structured Products: Options and dual currency investments

- Liquid Staking: ETH staking with immediate liquidity

DeFi Protocols: Comprehensive Overview

Aave - The Lending Pioneer

What makes Aave revolutionary? Aave revolutionised decentralised lending with innovations like flash loans, rate switching, As the leading DeFi lending protocol, Aave offers transparency and composability that centralised platforms cannot match.

Yield Mechanisms

- Supply Yields: Earn interest in supplying assets to lending pools

- aTokens: Interest-bearing tokens that appreciate over time

- Safety Module: Stake AAVE tokens for protocol security rewards

- Liquidity Mining: Additional token rewards for participation

Risk Management

- Isolation Mode: Risk containment for new assets requiring careful management

- E-Mode: Higher efficiency for correlated assets

- Liquidation Protection: Automated risk management requiring careful management

- Insurance: Community-driven coverage options

Lido - The Liquid Staking Leader

Why is Lido dominant? Lido has become the dominant liquid staking protocol allowing users to stake ETH and other Proof-of-Stake assets whilst maintaining liquidity This innovation has unlocked trillions in previously illiquid staked assets.

Staking Solutions

- Ethereum Staking: Stake ETH and receive stETH tokens for liquidity

- Solana Staking: Liquid SOL staking with stSOL derivative tokens

- Polygon Staking: MATIC staking with stMATIC derivative tokens

- Multi-Chain: Expanding to additional networks

Yield optimisation

- Validator Selection: Professional validator management

- MEV Rewards: Capture maximum extractable value

- Compound Strategies: Use Use stTokens in other DeFi protocols

- Governance Participation: Can Vote with staked assets

Curve Finance - The Stablecoin Specialist

What makes Curve special? Curve Finance specialises in It handles similar-asset trading. You get low-slippage swaps Its innovative AMM design makes it essential DeFi infrastructure.

Yield Sources

- Trading Fees: How do Earn from swap volume

- CRV Rewards: Native token incentives for liquidity providers

- Gauge Voting: Can Direct rewards to preferred pools

- Convex Integration: Want Boosted yields through Convex

Risk Analysis: CeFi vs DeFi

What are the main risks? Both CeFi and Understanding Which risks Let's compare them.

Risk Comparison Matrix

How do risks compare? This matrix CeFi has DeFi has Which risk profile suits you?

| Risk Type | CeFi | DeFi |

|---|---|---|

| Platform Failure | High | Low |

| Smart Contract | None | Medium-High |

| Regulatory | Medium | Low |

| Custody | Platform holds | Self-custody |

| Transparency | Limited | Full |

CeFi Risk Factors

What risks does CeFi carry? Counterparty Platform Regulatory How do you protect yourself?

Counterparty Risks

What counterparty risks exist? Platform Regulatory Operational How significant are these risks?

- Platform Insolvency: Risk of platform failure or bankruptcy requiring careful management

- Rehypothecation: Platforms lending user funds to third parties

- Regulatory Risk: Changes in regulations affecting operations

- Operational Risk: Internal fraud, mismanagement, or security breaches

Mitigation Strategies

How do you reduce CeFi risks? Due Proof What steps should you take?

- Due Diligence: Research platform licenses and audits

- Diversification: Spread funds across multiple platforms

- Insurance: Choose platforms with comprehensive coverage

- Proof of Reserves: Verify platform solvency regularly

DeFi Risk Factors

What risks does DeFi have? Smart Market How do you mitigate these?

Technical Risks

What technical risks threaten DeFi? Smart contract bugs Oracle Governance Composability How do you assess these?

- Smart Contract Bugs: Code vulnerabilities leading to fund loss

- Oracle Failures: Price feed manipulation or failures

- Governance Attacks: Malicious protocol changes through governance

- Composability Risk: Failures in integrated protocols

Market Risks

What market risks exist in DeFi? Impermanent loss Liquidation Token Slippage How do you manage these?

- Impermanent Loss: Value loss from providing liquidity

- Liquidation Risk: Automated position closures during market volatility

- Token Risk: Reward token price volatility affecting returns

- Slippage: Price impact on large transactions

Risk Mitigation

How do you protect DeFi investments? Position What's your risk management plan?

- Protocol Selection: Use audited, battle-tested protocols

- Position Sizing: Never risk more than you can afford to lose

- Diversification: Spread risk across multiple protocols requiring careful management

- Insurance: Consider DeFi insurance products

Yield optimisation Strategies

Portfolio Allocation Strategies

How should you allocate your portfolio? Your allocation depends What are Conservative, balanced, or Each has different CeFi/DeFi ratios. Which suits your goals?

Conservative Approach (60% CeFi, 40% DeFi)

- CeFi Allocation: Regulated platforms like Nexo and Coinbase

- DeFi Allocation: Blue-chip protocols like Aave and Lido

- Target Yield: 4-7% with lower risk for optimal returns

- Suitable For: Risk-averse investors and beginners requiring careful management

Allocation Strategy Comparison

Which strategy matches your risk profile? Compare ?

- Conservative: 70% CeFi, 30% DeFi, Target 4-7%, Low risk

- Balanced: 40% CeFi, 60% DeFi, Target 6-10%, Medium risk

- Aggressive: 20% CeFi, 80% DeFi, Target 10-20%, High risk

Balanced Approach (40% CeFi, 60% DeFi)

- CeFi Allocation: Mix of established and emerging platforms

- DeFi Allocation: Diversified across lending, staking, and LP

- Target Yield: 6-10% with moderate risk for optimal returns

- Suitable For: Experienced crypto investors

Aggressive Approach (20% CeFi, 80% DeFi)

- CeFi Allocation: High-yield platforms and structured products

- DeFi Allocation: Yield farming, new protocols, leveraged strategies

- Target Yield: 10-20% with high risk for optimal returns

- Suitable For: DeFi experts and high-risk tolerance investors

Advanced optimisation Techniques

How can you maximise yields? Advanced techniques exist What Yield stacking Tax Which techniques suit you?

Yield Stacking

- Liquid Staking + DeFi: Stake ETH on Lido, use stETH in Curve

- Lending + Borrowing: Supply on Aave, borrow stablecoins for farming

- Cross-Platform: Move funds based on rate differentials

Tax optimisation

- Jurisdiction Shopping: Use platforms in favorable tax jurisdictions

- Timing Strategies: Harvest losses and time income recognition

- Structure Selection: Choose tax-efficient yield structures

Platform Selection Framework

How do you choose the right platform? Your choice What matters most Simplicity Security Let's examine the decision factors.

Decision Matrix

Choose CeFi If You:

Is CeFi right for you? Do you Need CeFi might suit you.

- prioritise Simplicity: Want easy onboarding and management

- Need Customer Support: Value human assistance and problem resolution

- Prefer Predictability: Want stable, advertised rates

- Require Fiat Integration: Need to earn on traditional currencies

- Want Insurance: Prefer platforms with comprehensive coverage

Choose DeFi If You:

Is DeFi better for you? Do you Prefer self-custody? Seek DeFi could be ideal.

- Value Transparency: Want to see exactly how protocols work

- Prefer Self-Custody: Don't want to trust centralised entities

- Seek Higher Yields: Willing to take more risk for better returns

- Want Composability: Plan to use multiple protocols together

- Need Global Access: Require unrestricted, permissionless access

Hybrid Strategies

Can you use both CeFi and DeFi? Many Why You optimise risk-adjusted returns. How does it work?

Many sophisticated investors use both CeFi and DeFi platforms to optimise their risk-adjusted returns:

- Stable Base: Use CeFi for core holdings and predictable income

- Growth Layer: Use DeFi for higher-risk, higher-reward strategies

- Diversification: Spread risk across both centralised and decentralised platforms

- Opportunity Capture: Move funds to capture temporary yield opportunities

Future Trends and Developments

What's next for yield platforms? The CeFi and What trends should you watch?

Convergence Trends

How are CeFi and DeFi converging? Platforms now What does this mean for you?

- CeFi-DeFi Integration: Platforms offering both centralised and decentralised options

- Institutional DeFi: Professional-grade interfaces for DeFi protocols

- Regulated DeFi: Compliance-focused decentralised protocols

- Cross-Chain Yields: Multi-blockchain yield optimisation

Technology Innovations

What innovations are coming? AI Zero-knowledge Layer Real-world How will these affect yields?

- AI-Powered optimisation: Machine learning for yield strategy optimisation

- Zero-Knowledge Proofs: Privacy-preserving yield farming

- Layer 2 Integration: Lower costs and higher efficiency

- Real-World Assets: Tokenized traditional assets in yield protocols

Advanced Yield optimisation and Portfolio Management

Multi-Platform Yield Aggregation Strategies

How do professionals optimise yields? They use multi-platform approaches. Returns are Risk Liquidity What strategies work best?

Professional digital asset yield strategies require sophisticated multi-platform approaches. They optimise returns across centralised Counterparty Liquidity Operational Advanced practitioners implement Capital is distributed across This is based on risk-adjusted Platform reliability Correlation analysis between different return mechanisms is performed.

Yield aggregation strategies Rate differentials across Automated rebalancing systems respond to Comprehensive risk evaluation frameworks assess platform-specific risks. Broader market risks Professional yield optimisation includes Yield Appropriate position sizing is implemented based on risk tolerance.

Cross-Chain Yield Farming and Liquidity Mining

How do cross-chain strategies work? Advanced DeFi Each Returns are maximised Bridge How do you optimise across chains?

Advanced DeFi yield strategies leverage cross-chain opportunities. Returns are maximised Multiple blockchain Each offers unique Liquidity mining Governance token Cross-chain yield optimisation requires Transaction Timing is important for moving Optimal capital efficiency is maintained.

Liquidity mining strategies involve providing liquidity Automated market Trading Governance token Advanced practitioners implement hedging strategies to Yield farming aggregators Diversified exposure across different protocols reduces Reward potential from emerging DeFi innovations is maximised.

Institutional-Grade Risk Management and Compliance

Professional yield enhancement requires comprehensive Platform Smart contract Regulatory Market risk is mitigated Position sizing Continuous monitoring Institutional-grade risk management includes Detailed audit Professional custody solutions are utilised for large-scale operations.

Compliance considerations include Different jurisdictions Appropriate record-keeping Regulatory Anti-money laundering Know-your-customer Advanced practitioners work Legal and tax Return optimisation activities comply After-tax returns are optimised through strategic planning.

Technology Integration and Automation Systems

Advanced yield optimisation leverages Automated asset management Real-time monitoring Algorithmic rebalancing Manual Operational Professional technology integration Multiple Automated yield tracking Comprehensive analytics platforms provide detailed performance metrics.

Automation systems enable Systematic execution of rebalancing Automated compound interest Real-time alert Significant market Platform Advanced practitioners implement Yields across multiple Risk-adjusted Comprehensive reporting capabilities support professional decision-making.

Market Analysis and Strategic Planning

How do you analyse yield markets? Professional strategies Macroeconomic Market Platform What factors should you monitor?

Professional yield strategies require a Macroeconomic Digital asset market Platform-specific They Risk Advanced market evaluation Traditional financial markets affect the yields Regulatory developments High-yield opportunity sustainability is assessed based on economic fundamentals.

Strategic planning involves developing long-term They adapt to Consistent risk management Capital preservation Advanced strategic planning Different market Portfolio allocation stress Adverse Systematic review processes Performance Changing market opportunities are captured.

Advanced Yield optimisation and Strategic Implementation

Portfolio Diversification and Risk-Adjusted Returns

How do you build a diversified yield portfolio? Professional maximisation Balance CeFi Systematic Risk How do you optimise your allocation?

Professional yield maximisation requires sophisticated portfolio construction that balances CeFi and DeFi opportunities through systematic diversification, risk evaluation, and return optimisation strategies that maximise yield while managing exposure to various risk categories, including counterparty risk, smart contract risk, Advanced practitioners implement comprehensive allocation frameworks that optimise risk-adjusted returns by strategically distributing capital across platforms, protocols, and return-optimisation mechanisms.

Diversification strategies include geographic distribution across different regulatory jurisdictions, platform diversification to reduce counterparty concentration, and strategy diversification across different yield mechanisms, including staking, lending, liquidity provision, Professional users implement systematic rebalancing protocols that maintain optimal allocation while adapting to changing market conditions, yield opportunities, and risk profiles across the evolving CeFi and DeFi landscape.

Technology Integration and Automation Excellence

How does technology enhance yields? Advanced Monitoring Analytics API What tools should you use?

Advanced yield optimisation leverages sophisticated technology solutions, including automated asset management, systematic monitoring systems, and comprehensive analytics platforms that optimise returns while minimising operational complexity and Technology integration includes application programming interface utilisation, automated execution systems, and real-time monitoring capabilities that enable a systematic approach to yield optimisation across multiple platforms and protocols.

Automation capabilities include intelligent allocation algorithms, automated compound optimisation, and comprehensive performance tracking systems that enable continuous optimisation of yield strategies while adapting to changing market conditions Professional users implement custom technology solutions that integrate with both CeFi platforms and DeFi protocols while providing unified monitoring and optimisation capabilities for sophisticated return optimisation and asset management operations.

Market Analysis and Strategic Intelligence

What intelligence do you need? Professional enhancement Macroeconomic Platform Regulatory How do you stay informed?

Professional yield enhancement requires comprehensive market evaluation capabilities that incorporate macroeconomic factors, digital asset market dynamics, and platform-specific developments that affect yield opportunities and risk profiles across both centralised and Market analysis includes systematic monitoring of interest rate trends, competitive dynamics, and regulatory developments that create opportunities and risks in return-optimisation markets.

Strategic intelligence includes comprehensive tracking of platform developments, protocol upgrades, and competitive positioning that affect yield opportunities and optimal strategy selection for different market conditions Professional users utilise advanced analytics platforms, comprehensive data sources, and systematic research methodologies that enable informed decision-making while maintaining competitive advantages through superior market intelligence and strategic positioning in the evolving yield landscape.

Regulatory Compliance and Tax optimisation

How do regulations affect yields? Compliance matters. Reporting What do you need to know?

Professional yield management involves a comprehensive understanding of regulatory frameworks, tax implications, and compliance requirements that affect strategy selection and implementation across different jurisdictions Regulatory considerations include understanding securities law implications, tax treatment differences between various return optimisation mechanisms, and reporting requirements that vary across different platforms and protocols.

Tax optimisation strategies include understanding the different tax treatment of staking rewards, lending interest, and DeFi yield farming returns whilstimplementing appropriate structures and timing strategies that maximise after-tax returns. Professional practitioners work with specialised legal and tax professionals to implement comprehensive compliance frameworks that ensure regulatory compliance while optimising returns and maintaining appropriate risk management for different investment mandates and jurisdictional requirements.

Advanced Yield optimisation and Portfolio Management

Dynamic Yield Farming and Strategy Automation

How do you automate yield strategies? Dynamic Market Risk What tools help?

Advanced yield optimisation requires implementing dynamic strategies that automatically adjust to changing market conditions, protocol incentives, Professional yield farmers utilise sophisticated monitoring systems that track yield opportunities across multiple protocols, automatically rebalance positions, and execute complex strategies that maximise risk-adjusted returns while minimising transaction costs and operational complexity.

Automated yield strategies include liquidity mining optimisation, cross-protocol arbitrage, and sophisticated hedging mechanisms that protect against impermanent loss These advanced techniques require deep understanding of DeFi mechanics, smart contract interactions, and market dynamics that affect yield generation across different protocols and market conditions.

Risk-Adjusted Return Analysis and Portfolio Construction

How do you measure real returns? Risk-adjusted Absolute Market How do you optimise your portfolio?

Professional yield optimisation focuses on risk-adjusted returns rather than absolute yield percentages, implementing comprehensive risk assessment frameworks that evaluate protocol security, market risks, Advanced portfolio construction includes correlation analysis, volatility modelling, and scenario planning that optimise overall portfolio performance while maintaining appropriate risk levels.

Sophisticated risk management includes diversification across multiple yield sources, implementation of stop-loss mechanisms, and continuous monitoring of protocol health Professional yield investors employ quantitative models that assess risk-return profiles, optimise capital allocation, and implement dynamic hedging strategies that protect against adverse market movements.

Tax optimisation and Regulatory Compliance

How do you optimise taxes? Different returns Staking rewards differ DeFi What strategies maximise after-tax returns?

Yield optimisation strategies must consider tax implications and regulatory compliance requirements that vary Professional tax planning includes understanding the treatment of different yield types, implementing tax-efficient harvesting strategies, and maintaining comprehensive records that support accurate tax reporting and regulatory compliance.

Advanced tax strategies include timing of yield realisation, utilisation of tax-advantaged accounts where available, and sophisticated structuring that minimises tax burden while maintaining compliance Professional advice is essential for significant yield farming activities, particularly for institutional participants or those operating across multiple jurisdictions.

Advanced CeFi vs DeFi Yield optimisation Strategies

Professional yield optimisation requires a sophisticated understanding of both centralised and decentralised finance mechanisms, risk profiles, and market dynamics that influence yield generation across different Advanced users implement comprehensive approaches that leverage both CeFi and DeFi opportunities through strategic asset allocation, systematic risk management, and ongoing optimisation of yield-generating positions that maximise returns while maintaining appropriate diversification and risk exposure through professional-grade portfolio management techniques and systematic monitoring of market conditions and platform developments that affect overall performance.

Conclusion and Recommendations

Which approach is right for you? The choice depends on Technical What's your priority?

The choice between CeFi and DeFi ultimately depends on your comprehensive risk tolerance, technical expertise, and specific investment CeFi platforms like Nexo and Binance Earn offer simplicity and regulatory compliance, making them ideal for beginners

What's the future of yields? Convergence CeFi Hybrid Innovation continues. How should you prepare?

DeFi protocols like Aave and Lido offer transparency and potentially higher yields, but they require more technical knowledge and The most sophisticated investors often use both, creating diversified yield portfolios that balance risk and return across the

As the space continues to evolve, we anticipate further convergence between CeFi and DeFi, with platforms offering hybrid solutions that combine the best aspects Stay informed, start small, and always prioritise understanding the risks before chasing

The yield enhancement landscape in 2025 offers unprecedented opportunities for digital asset holders to earn passive income, but success requires careful platform selection, risk management, Whether you choose the simplicity and security of centralised platforms or the innovation and transparency of decentralised protocols, remember that sustainable yields come from understanding the underlying mechanisms and maintaining realistic

What's the best strategy? Most investors benefit from Combine CeFi This provides optimal risk-adjusted returns. You maintain Gain experience. Always keep some holdings in secure offline storage.

For most investors, a balanced approach combining CeFi and DeFi strategies provides optimal risk-adjusted returns while maintaining exposure to innovation across the entire Start with smaller amounts to gain experience, gradually increase your exposure as you become more comfortable with the platforms and protocols, and always maintain a portion of your holdings in secure, offline storage regardless of

Yield comparison between centralised and decentralised finance requires understanding risk-reward dynamics, liquidity considerations, and regulatory implications that affect long-term returns. CeFi and DeFi platforms offer different approaches to yield generation, with each model presenting unique advantages for specific investment strategies and risk tolerance levels that align with individual financial objectives.

Sources & References

Frequently Asked Questions

- Which offers higher APYs — CeFi or DeFi?

- DeFi often advertises higher APYs due to token incentives and variable liquidity conditions, but these come CeFi rates tend to be more stable and predictable, though generally lower

- What are the main risks of DeFi yields?

- Smart contract bugs, governance attacks, oracle failures, and impermanent loss are. Using audited protocols, diversified positions, and conservative strategies can help

- Are CeFi yield products safer?

- CeFi removes smart contract risk but introduces custodial Platform solvency, rehypothecation, and regulatory changes. Always review transparency reports and

- How should I compare APYs across platforms?

- Check net yield after fees, compounding frequency, lockup terms, early withdrawal penalties, token incentive sustainability, and whether APYs are. Also consider the total cost of ownership, including gas

- Can I use both CeFi and DeFi simultaneously?

- Absolutely. Many investors use a hybrid approach, allocating stable funds to CeFi for predictable returns and using DeFi for higher-risk, higher-reward strategies. This diversification can optimise risk-adjusted returns.

- What's the minimum investment for CeFi vs DeFi?

- CeFi platforms typically have low or no minimums, starting from $10-100. DeFi requires considering gas fees on Ethereum, making $1,000+ Layer 2 solutions reduce