DeFi vs CeFi Analysis Guide 2025

The cryptocurrency ecosystem has evolved into two distinct paradigms: Decentralised Finance (DeFi) and Centralised Finance (CeFi), each offering unique advantages. Challenges for investors seeking yield and financial services. Understanding the fundamental differences between these approaches is crucial for making informed investment decisions. Optimising your cryptocurrency strategy in 2025.

DeFi protocols operate through smart contracts on blockchain networks. Eliminating intermediaries. Providing permissionless access to financial services including lending, borrowing, trading, and yield farming. Meanwhilst, CeFi platforms function more like traditional financial institutions. Offering cryptocurrency services through centralised entities with customer support, regulatory compliance, and familiar user interfaces.

This complete analysis examines every aspect of the DeFi vs CeFi landscape in 2025, comparing yields, risk profiles, user experience, regulatory considerations, and long-term sustainability. We'll explore real-world performance data, institutional adoption patterns,. Emerging trends that will shape the future of cryptocurrency finance. Helping you determine the optimal balance between DeFi and CeFi for your investment goals.

Introduction

The cryptocurrency ecosystem has evolved into two distinct paradigms: Centralised Finance (CeFi) and Decentralised Finance (DeFi). Both offer opportunities for passive income and financial services, but they operate on fundamentally different principles. Presenting unique advantages. Challenges for investors in 2025.

Centralised Finance (CeFi) platforms like Binance, Nexo, and Celsius operate similarly to traditional banks. Providing cryptocurrency services through regulated entities with customer support, insurance coverage, and familiar user interfaces. These platforms aggregate user funds, manage private keys,. Offer structured products with predictable returns. Making them accessible to mainstream investors who prioritise convenience and regulatory compliance.

Decentralised Finance (DeFi), on the other hand, leverages blockchain technology. Smart contracts to create financial services without intermediaries. Protocols like Aave, Compound, and Uniswap enable users to lend, borrow, trade,. Earn yields directly through automated smart contracts. Maintaining full custody of their assets while accessing possiblely higher returns through liquidity mining and yield farming strategies.

The choice between DeFi and CeFi has become increasingly complex as both ecosystems mature. Converge in certain areas. CeFi platforms are integrating DeFi protocols to offer higher yields, while DeFi projects are useing user-friendly interfaces and institutional-grade security measures. This convergence creates hybrid opportunities but also new risks that investors must carefully evaluate.

Risk profiles differ largely between the two approaches, with CeFi offering counterparty risk through centralised entities but providing regulatory protections and insurance coverage. DeFi eliminates counterparty risk through trustless smart contracts but introduces technical risks including smart contract vulnerabilities, impermanent loss,. Protocol governance risks that need advanced understanding to navigate effectively.

Market dynamics in 2025 have shifted considerably from previous years, with institutional adoption driving demand for compliant CeFi solutions while retail investors increasingly embrace DeFi protocols for their transparency and possible returns. Regulatory frameworks are evolving rapidly, with jurisdictions like the European Union useing complete crypto regulations that favor compliant CeFi platforms while creating uncertainty for DeFi protocols.

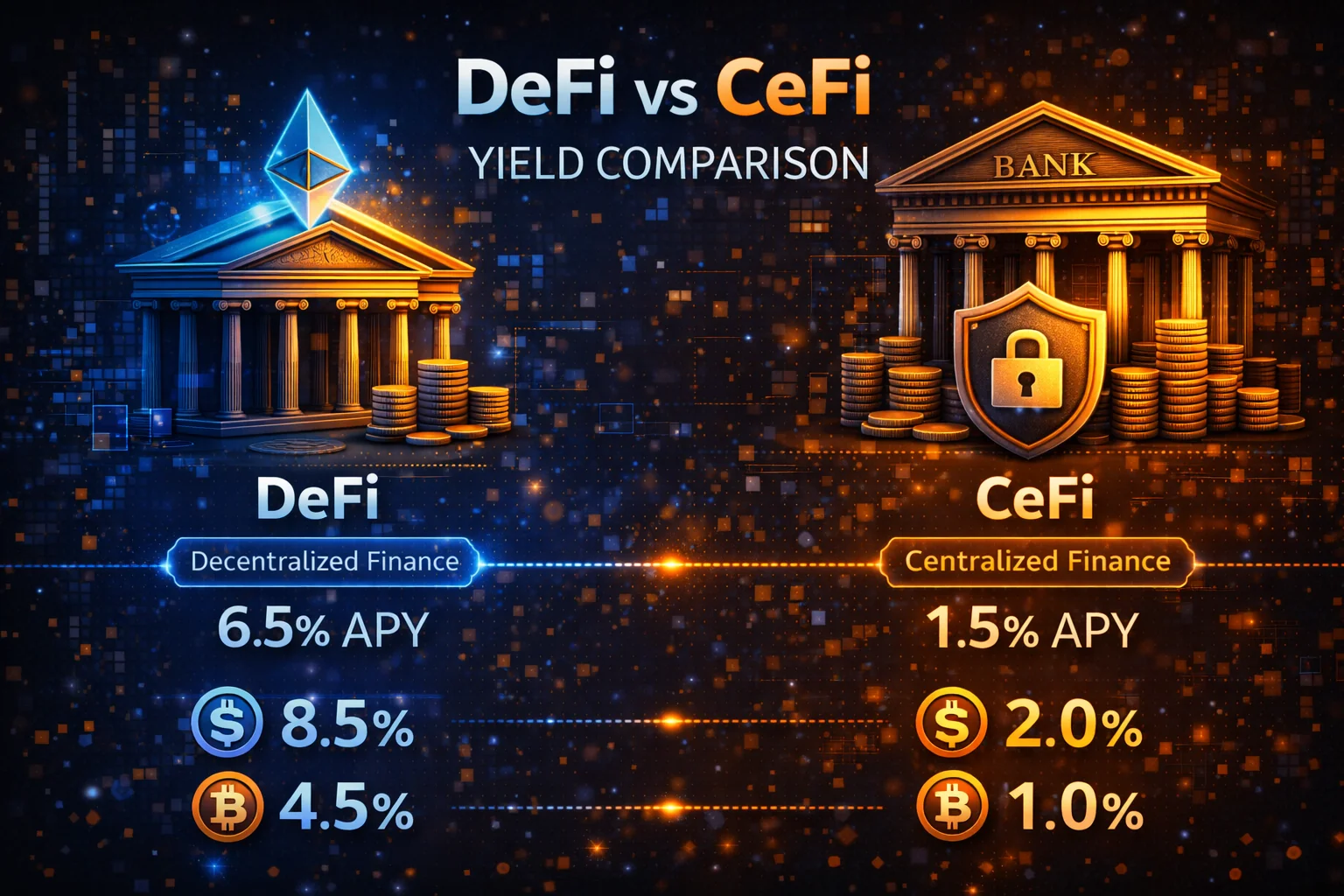

Yield opportunities vary dramatically between the two ecosystems, with CeFi platforms typically offering 3-8% annual percentage yields (APY) on stablecoins and major cryptocurrencies, while DeFi protocols can provide 10-50% APY through liquidity provision, yield farming, and governance token rewards. However, these higher DeFi yields often come with more complexity, gas fees,. Impermanent loss risks that can largely impact net returns.

User experience is another critical differentiator, as CeFi platforms offer familiar banking-style interfaces, customer support, account recovery options, and simplified tax reporting. DeFi protocols need users to manage private keys, understand smart contract interactions,. Navigate complex yield strategies independently. Creating barriers for less technical users but offering complete financial sovereignty for those willing to invest the time to learn.

This complete analysis examines both ecosystems across multiple dimensions. Including security, yields, user experience, regulatory compliance, and long-term sustainability. We'll explore real-world case studies, analyse current market conditions,. Provide actionable insights to help investors make informed decisions about allocating capital between CeFi and DeFi opportunities in the current market environment.

Yield opportunities vary dramatically across both sectors, with CeFi typically offering stable, predictable returns ranging from 3-12% annually. In comparison, DeFi can provide explosive yields exceeding 100% during favorable market conditions but with corresponding volatility and complexity. Understanding these risk-return profiles becomes key for strategic asset allocation and portfolio optimisation.

Market conditions in 2025 have created unique opportunities in both ecosystems, with institutional adoption driving growth in CeFi platforms while DeFi innovation continues to push the boundaries of financial services. This dynamic environment needs investors to stay informed about emerging trends, new protocols,. Evolving risk factors to make optimal allocation decisions between DeFi and CeFi strategies.

The regulatory landscape continues to evolve, with governments worldwide developing frameworks that impact both DeFi and CeFi operations. These regulatory developments create both opportunities and challenges. Influencing everything from yield rates. Platform availability to tax implications and compliance needments. Understanding these regulatory trends is key for long-term investment planning in the cryptocurrency space.

This complete analysis examines real-world performance data, security considerations, regulatory implications,. Practical useation strategies for both CeFi and DeFi platforms. We'll explore how professional investors use both approaches strategically. Leveraging the stability of CeFi for core holdings while accessing DeFi for enhanced yield opportunities. Innovative financial products that traditional finance cannot provide.

Understanding the fundamental differences between these approaches is crucial for making informed investment decisions in 2025. Whether you're a beginner exploring crypto passive income or an experienced investor optimising your strategy, this guide provides the insights needed to navigate both ecosystems effectively.

In 2025, the choice between DeFi and CeFi is no longer binary. Many investors use both approaches strategically. Leveraging the strengths of each to build diversified crypto portfolios. Understanding the nuances of both systems is crucial for making informed investment decisions.

The convergence of traditional finance. Decentralised protocols has created hybrid solutions that combine the best aspects of both worlds. These innovations include institutional DeFi platforms with enhanced compliance features and CeFi services that integrate DeFi protocols to offer competitive yields while maintaining regulatory oversight and customer protection measures.

Key Definitions and Concepts

centralised Finance (CeFi)

CeFi refers to cryptocurrency financial services provided by centralised entities such as exchanges. Lending platforms, and custodial services. These platforms operate similarly to traditional financial institutions, with centralised control over user funds and decision-making processes.

Key CeFi Characteristics:

- centralised custody of user funds

- Traditional corporate governance structures

- Regulatory compliance and licensing

- Customer support and user-friendly interfaces

- Insurance coverage (varies by platform)

decentralised Finance (DeFi)

DeFi encompasses financial services built on blockchain networks using smart contracts. Eliminating the need for traditional intermediaries. Users maintain control of their funds while accessing lending, borrowing, trading, and yield generation services.

Key DeFi Characteristics:

- Noncustodial, user-controlled funds

- Governance through decentralised autonomous organisations (DAOs)

- Open-source, transparent code

- Permissionless access and composability

- Smart contract automation

Hybrid Models

Emerging hybrid models combine elements of both CeFi and DeFi. Offering a centralised user experience with a decentralised underlying infrastructure. Examples include centralised exchanges offering DeFi staking services and DeFi protocols with centralised customer support layers.

Yield and Return Analysis

CeFi Yield Characteristics

CeFi platforms typically offer more predictable, stable yields with clear terms and conditions. Rates are often fixed or have defined ranges. Making them suitable for conservative investors seeking steady returns.

Typical CeFi Yields (2025):

- Stablecoin Lending: 3-8% APY on USDC, USDT, DAI

- Bitcoin Lending: 1-4% APY with lower volatility risk

- Ethereum Lending: 2-6% APY plus possible staking rewards

- Altcoin Lending: 5-15% APY with higher risk premiums

- Flexible Savings: 1-3% APY with instant liquidity

DeFi Yield Opportunities

DeFi protocols often provide higher yields through many mechanisms. Including liquidity mining, governance token rewards, and protocol revenue sharing. However, yields are more volatile. Dependent on market conditions.

Typical DeFi Yields (2025):

- Stablecoin Pools: 5-15% APY from trading fees and rewards

- Liquidity Mining: 10-50%+ APY with token incentives

- Yield Farming: 15-100%+ APY in high-risk strategies

- Lending Protocols: 3-12% APY on supplied assets

- Staking Derivatives: 4-8% APY plus liquid staking benefits

Yield Sustainability Analysis

CeFi yields are generally more sustainable as they're based on actual lending demand and platform revenue. DeFi yields can be inflated by token emissions. May not be sustainable in the long term. Requiring careful evaluation of the underlying economics.

Factors Affecting Yield Sustainability:

- Protocol revenue and fee generation

- Token emission schedules and inflation

- Market demand for borrowing and lending

- Competition between platforms and protocols

- Regulatory changes affecting operations

Risk Profiles Comparison

CeFi Risk Factors

CeFi platforms concentrate risk in centralised entities. Creating single points of failure but also enabling traditional risk management approaches.

Primary CeFi Risks:

- Counterparty Risk: Platform insolvency or mismanagement (Celsius, FTX examples)

- Regulatory Risk: Government restrictions or compliance needments

- Operational Risk: Technical failures, security breaches, or internal fraud

- Liquidity Risk: Withdrawal restrictions during market stress

- Custody Risk: Loss of funds due to poor security practices

DeFi Risk Factors

DeFi distributes risks across smart contracts and governance systems. Eliminating counterparty risk but introducing new technical and governance risks.

Primary DeFi Risks:

- Smart Contract Risk: Code bugs, exploits, or unintended behavior

- Governance Risk: Malicious proposals or centralised control

- Oracle Risk: Price feed manipulation or failures

- Impermanent Loss: Value reduction in liquidity provision

- Composability Risk: Failures cascading across integrated protocols

Risk Mitigation Strategies

Effective risk management needs understanding. Addressing the specific risks of each ecosystem:

CeFi Risk Mitigation:

- Diversify across multiple regulated platforms

- Research platform financials and audit reports

- Monitor regulatory developments and compliance

- Use platforms with insurance coverage

- Maintain emergency funds outside platforms

DeFi Risk Mitigation:

- Use audited protocols with long track records

- Understand smart contract mechanics and governance

- Diversify across multiple protocols and strategies

- Monitor protocol health and governance proposals

- Consider insurance protocols like Nexus Mutual

User Experience Analysis

CeFi User Experience

CeFi platforms prioritise user-friendly interfaces. Traditional financial service experiences. Making them accessible to mainstream users without technical cryptocurrency knowledge.

CeFi UX Advantages:

- Intuitive mobile and web applications

- 24/7 customer support and help resources

- Fiat on-ramps and off-ramps

- Account recovery and password reset options

- Integrated tax reporting and transaction history

- Educational resources and guided onboarding

CeFi UX Limitations:

- Account verification and KYC needments

- Geographic restrictions and compliance limitations

- Withdrawal limits and processing delays

- Limited customisation and advanced features

- Dependence on platform availability and policies

DeFi User Experience

DeFi offers powerful functionality. Complete user control but needs technical knowledge. Comfort with blockchain interactions.

DeFi UX Advantages:

- Complete control over funds and private keys

- Permissionless access without geographic restrictions

- Composability and integration between protocols

- Transparent operations and real-time data

- Advanced features and customisation options

- No account creation or identity verification

DeFi UX Challenges:

- Steep learning curve for beginners

- Gas fees and transaction complexity

- No customer support or account recovery

- Risk of permanent fund loss from user errors

- Interface complexity and technical jargon

- Need for multiple tools and wallet management

UX Evolution and Improvements

Both ecosystems are rapidly improving the user experience. CeFi platforms are incorporating DeFi features, while DeFi protocols are enhancing their user-friendly interfaces and abstraction layers.

Adoption and Growth Trends

CeFi Adoption Metrics (2025)

CeFi continues to dominate in terms of total users and mainstream adoption, very amongst retail investors. Institutions seeking familiar financial service models.

Key CeFi Growth Indicators:

- Over 100 million users across major exchanges

- Institutional adoption through custody and prime services

- Integration with traditional financial systems

- Regulatory approval and licensing expansion

- Corporate treasury adoption (MicroStrategy, Tesla models)

DeFi Adoption Metrics (2025)

DeFi shows rapid innovation and total value locked (TVL) growth, though user numbers remain smaller due to technical barriers.

Key DeFi Growth Indicators:

- $200+ billion total value locked across protocols

- Thousands of active protocols and applications

- Cross-chain expansion and interoperability

- Institutional DeFi adoption through specialised services

- Integration with CeFi platforms and traditional finance

Geographic and Demographic Trends

Adoption patterns vary largely by region, with DeFi seeing higher adoption in crypto-native communities. Regions with limited traditional financial access. At the same time, CeFi dominates in regulated markets with established financial systems.

Regional Adoption Patterns:

- North America/Europe: CeFi dominance with growing DeFi interest

- Asia-Pacific: Mixed adoption with strong DeFi innovation

- Latin America/Africa: Higher DeFi adoption for financial inclusion

- Emerging Markets: DeFi as alternative to limited banking infrastructure

Transparency and Governance

CeFi Transparency

CeFi platforms operate with varying levels of transparency, typically providing limited visibility into fund management. Lending practices, and risk management procedures.

CeFi Transparency Levels:

- Financial reporting varies by jurisdiction and regulation

- Limited visibility into lending and investment strategies

- Proof-of-reserves initiatives by some platforms

- Regulatory filings and compliance reports

- Third-party audits and security assessments

DeFi Transparency

DeFi protocols offer unprecedented transparency through open-source code, on-chain transactions, and public governance processes.

DeFi Transparency Features:

- Open-source smart contract code

- Real-time on-chain transaction visibility

- Public governance proposals and voting

- Transparent protocol metrics and analytics

- Community-driven development and auditing

Governance Models

Governance structures differ fundamentally between CeFi and DeFi. Affecting decision-making, risk management, and user protection.

CeFi Governance:

- Traditional corporate governance structures

- centralised decision-making by management teams

- Regulatory oversight and compliance needments

- Limited user input on platform policies

- Professional risk management and controls

DeFi Governance:

- Decentralised autonomous organisation (DAO) structures

- Token-based voting and proposal systems

- Community-driven development and upgrades

- Transparent governance processes and discussions

- Potential for governance attacks and manipulation

Regulatory Landscape

CeFi Regulatory Environment

CeFi platforms operate within established regulatory frameworks. Providing clarity but also imposing compliance costs and operational restrictions.

CeFi Regulatory Advantages:

- Clear regulatory guidelines and compliance paths

- Legal protections for users and platforms

- Insurance coverage and consumer protections

- Institutional acceptance and integration

- Established dispute resolution mechanisms

CeFi Regulatory Challenges:

- High compliance costs and operational complexity

- Geographic restrictions and service limitations

- Regulatory uncertainty in emerging markets

- Potential for sudden policy changes

- KYC/AML needments affecting privacy

DeFi Regulatory Environment

DeFi operates in a regulatory grey area. Offering innovation freedom but facing increasing scrutiny and possible future restrictions.

DeFi Regulatory Considerations:

- Regulatory uncertainty and evolving frameworks

- Potential for retroactive compliance needments

- Challenges in applying traditional regulations to decentralised systems

- Varying approaches by different jurisdictions

- Risk of protocol restrictions or bans

Future Regulatory Trends

Regulatory frameworks are evolving to address both CeFi and DeFi, with trends towards clearer guidelines, consumer protection, and innovation-friendly approaches in leading jurisdictions.

Technology and Infrastructure

CeFi Technology Stack

CeFi platforms use traditional cloud infrastructure, databases, and security systems. Enabling high performance. Reliability but creating centralised points of failure.

CeFi Infrastructure Characteristics:

- centralised servers and databases

- Traditional cybersecurity measures

- High-performance trading engines

- Integrated payment processing systems

- Professional IT support and maintenance

DeFi Technology Stack

DeFi relies on blockchain networks, smart contracts, and decentralised infrastructure. Providing censorship resistance. Transparency but facing scalability and cost challenges.

DeFi Infrastructure Characteristics:

- Blockchain-based smart contracts

- decentralised storage and computing

- Peer-to-peer network architecture

- Cryptographic security mechanisms

- Community-maintained infrastructure

Scalability and Performance

CeFi platforms can achieve higher transaction throughput and lower latency, while DeFi faces blockchain scalability limitations but benefits from Layer 2 solutions and alternative networks.

Performance Comparison:

- CeFi: Thousands of transactions per second, millisecond latency

- DeFi: Limited by blockchain capacity, higher latency and costs

- Layer 2 DeFi: Improved performance with reduced costs

- Alternative Chains: Higher throughput DeFi on faster blockchains

Cost Structure Analysis

CeFi Cost Structure

CeFi platforms typically charge fees through spreads, commissions, and service fees, with costs often hidden in exchange rates or yield reductions.

Typical CeFi Costs:

- Trading Fees: 0.1-1% per transaction

- Withdrawal Fees: Fixed fees or percentages

- Spread Costs: Hidden in buy/sell prices

- Inactivity Fees: Monthly charges for dormant accounts

- Premium Services: Subscription fees for advanced features

DeFi Cost Structure

DeFi costs are mainly driven by blockchain transaction fees (gas), with more costs from slippage and MEV (Maximal Extractable Value).

Typical DeFi Costs:

- Gas Fees: $5-100+ per transaction on Ethereum

- Slippage: 0.1-5% depending on liquidity and size

- Protocol Fees: 0.05-0.3% for most DeFi services

- MEV Costs: Hidden costs from front-running and arbitrage

- Bridge Fees: Cross-chain transaction costs

Cost optimisation Strategies

Both ecosystems offer ways to minimise costs through strategic timing, platform selection, and optimisation techniques.

CeFi Cost optimisation:

- Choose platforms with competitive fee structures

- use volume-based fee discounts

- Time withdrawals to minimise network fees

- Use native tokens for fee discounts

DeFi Cost optimisation:

- Use Layer 2 solutions for lower gas fees

- Batch transactions to reduce per-operation costs

- Time transactions during low network congestion

- use gas optimisation tools and strategies

Security Comparison

CeFi Security Model

CeFi platforms employ traditional cybersecurity measures and professional security teams, but concentrate risk in centralised systems.

CeFi Security Measures:

- Multi-signature wallets and cold storage

- Professional security teams and audits

- Insurance coverage for platform failures

- Regulatory compliance and oversight

- 24/7 monitoring and incident response

DeFi Security Model

DeFi security relies on cryptographic guarantees, code audits, and decentralised validation, but faces smart contract and governance risks.

DeFi Security Features:

- Cryptographic security and immutable code

- decentralised validation and consensus

- Open-source code review and auditing

- Non-custodial fund control

- Transparent operations and real-time monitoring

Security Best Practices

Users must adopt different security practices for CeFi and DeFi to protect their investments effectively.

CeFi Security Best Practices:

- Enable two-factor authentication

- Use strong, unique passwords

- Verify platform security certifications

- Monitor account activity regularly

- Diversify across multiple platforms

DeFi Security Best Practices:

- Secure private key storage and backup

- Use hardware wallets for large amounts

- Verify smart contract addresses

- Understand protocol risks before investing

- Keep software and wallets updated

Investment Strategy Recommendations

Beginner Strategy: CeFi-First Approach

New investors should typically start with CeFi platforms to learn cryptocurrency basics before exploring DeFi opportunities.

Beginner Allocation (CeFi-Heavy):

- 80% CeFi: Regulated exchanges and lending platforms

- 15% Conservative DeFi: Established protocols like Aave or Compound

- 5% Learning: Small amounts for DeFi experimentation

Intermediate Strategy: Balanced Approach

Experienced users can balance CeFi convenience with DeFi opportunities for optimised risk-adjusted returns.

Intermediate Allocation (Balanced):

- 50% CeFi: Stable yields and liquidity

- 35% Established DeFi: Proven protocols and strategies

- 15% Experimental DeFi: Higher-risk, higher-reward opportunities

Advanced Strategy: DeFi-optimised Portfolio

Sophisticated investors can maximise returns through advanced DeFi strategies while maintaining some CeFi exposure for stability.

Advanced Allocation (DeFi-Heavy):

- 25% CeFi: Stable base and emergency liquidity

- 50% Core DeFi: Diversified protocol exposure

- 25% Advanced DeFi: Yield farming, governance, and new protocols

Risk Management Across Strategies

Regardless of allocation, effective risk management needs diversification, regular monitoring, and clear exit strategies.

Universal Risk Management Principles:

- Never invest more than you can afford to lose

- Diversify across platforms, protocols, and strategies

- Maintain emergency funds in liquid, low-risk assets

- Regularly review and rebalance allocations

- Stay informed about platform and protocol developments

Future Outlook and Trends

Convergence Trends

The future likely involves convergence between CeFi and DeFi, with hybrid models combining the best aspects of both approaches.

Emerging Hybrid Models:

- CeFi platforms offering DeFi access and integration

- DeFi protocols with centralised user experience layers

- Institutional DeFi services with compliance features

- Cross-chain bridges connecting CeFi and DeFi ecosystems

Technology Evolution

Technological advances will address current limitations in both ecosystems. Improving scalability, security, and user experience.

Key Technology Developments:

- Layer 2 scaling solutions reducing DeFi costs

- Improved smart contract security and formal verification

- Better user interfaces and wallet abstractions

- Cross-chain interoperability and unified experiences

- AI-powered risk management and optimisation

Regulatory Evolution

Clearer regulatory frameworks will provide certainty for both CeFi and DeFi. Enabling broader adoption and institutional participation.

Expected Regulatory Developments:

- Comprehensive DeFi regulatory frameworks

- standardised CeFi compliance needments

- Cross-border regulatory cooperation

- Consumer protection enhancements

- Innovation-friendly regulatory sandboxes

Market Maturation

Both ecosystems will mature, with improved infrastructure, better risk management,. More advanced financial products.

Detailed Comparison Table

Comprehensive side-by-side comparison of DeFi and CeFi across all major dimensions:

| Aspect | CeFi | DeFi | Winner |

|---|---|---|---|

| Yield Potential | 3-12% APY (stable) | 5-50%+ APY (variable) | DeFi |

| Risk Level | Medium (counterparty) | Medium-High (smart contract) | CeFi |

| User Experience | Excellent (beginner-friendly) | Complex (technical knowledge needd) | CeFi |

| Transparency | Limited (corporate disclosure) | High (open-source, on-chain) | DeFi |

| Custody | centralised (platform controlled) | Self-custody (user controlled) | DeFi |

| Regulatory Clarity | High (established frameworks) | Low (evolving regulations) | CeFi |

| Innovation Speed | Moderate (corporate processes) | High (permissionless development) | DeFi |

| Accessibility | High (mainstream adoption) | Medium (technical barriers) | CeFi |

| Cost Structure | Hidden fees, spreads | Transparent gas fees | Tie |

| Liquidity | High (instant withdrawals) | Variable (depends on protocol) | CeFi |

| Composability | Limited (siloed platforms) | High (protocol integration) | DeFi |

| Insurance Coverage | Available (varies by platform) | Limited (emerging protocols) | CeFi |

Real-World DeFi vs CeFi Comparisons

Case 1: Yield Comparison - Stablecoin Lending

User: Conservative investor with $50,000 USDC

Goal: maximise yield with minimal risk

Comparison:

- CeFi (Binance Earn): 3.5% APY, instant withdrawal, insured

- DeFi (Aave): 4.2% APY, instant withdrawal, no insurance

- Risk Assessment: CeFi offers security, DeFi offers higher yield

Results After 12 Months:

- CeFi earnings: $1,750 (3.5% on $50k)

- DeFi earnings: $2,100 (4.2% on $50k)

- Difference: $350 more with DeFi (20% higher yield)

Decision: User split 70% CeFi (security) / 30% DeFi (higher yield) for balanced approach.

Case 2: Trading Fees - Active Trader

User: Day trader with $100,000 capital

Monthly Volume: $500,000

Comparison:

- CeFi (Binance): 0.1% maker/taker = $500/month

- DeFi (Uniswap V3): 0.3% swap fee = $1,500/month

- Volume Impact: Higher volumes favor CeFi's lower fee structure

Annual Cost:

- CeFi: $6,000 in trading fees

- DeFi: $18,000 in swap fees

- Savings with CeFi: $12,000/year (67% lower)

Decision: Active traders benefit from CeFi's lower fees and better liquidity.

Case 3: Custody Control - Self-Custody Advocate

User: Privacy-focused holder with 10 BTC

Priority: Full control, no KYC

Experience:

- CeFi Attempt: Required KYC, 2-week verification, withdrawal limits

- DeFi Solution: Wrapped BTC on Ethereum, used in DeFi protocols

- Access Speed: DeFi provided immediate access vs CeFi delays

Results:

- DeFi: Instant access, no KYC, full control of keys

- Earned 5% APY on wBTC in Aave

- Maintained privacy and sovereignty

- Trade-off: Smart contract risk, bridge risk

Decision: DeFi provided desired privacy and control, user accepted technical risks.

Case 4: Beginner Experience - First-Time User

User: Crypto beginner with $5,000

Goal: Start earning yield safely

Comparison:

- CeFi (Coinbase): 1-click staking, customer support, insurance

- DeFi (Aave): Wallet setup, gas fees, no support

- Learning Curve: CeFi needs minimal knowledge vs DeFi complexity

Experience:

- CeFi: 10 minutes to start earning, simple interface

- DeFi: 2 hours learning curve, $50 in gas fees, confusion

- CeFi yield: 3% APY

- DeFi yield: 4.5% APY (but $50 gas = 1% of capital)

Decision: Beginner chose CeFi for simplicity, plans to explore DeFi after gaining experience.

Case 5: Institutional Allocation - Fund Manager

User: Crypto fund managing $10M

Strategy: Diversified across DeFi and CeFi

Allocation:

- CeFi (60% - $6M): Coinbase Custody, Kraken, Binance

- DeFi (40% - $4M): Aave, Compound, Curve

- Risk Management: Majority in regulated CeFi for institutional compliance

Results After 12 Months:

- CeFi returns: $240,000 (4% average)

- DeFi returns: $280,000 (7% average)

- Total: $520,000 (5.2% blended)

- CeFi: Zero security incidents, full insurance

- DeFi: One protocol exploit (0.5% loss), higher yields compensated

Decision: Hybrid approach balanced security (CeFi) with yield optimisation (DeFi).

Institutional Adoption Patterns and Professional Trading Infrastructure

Corporate Treasury Adoption Trends

Institutional adoption of DeFi and CeFi platforms follows distinct patterns based on regulatory needments, risk tolerance, and operational complexity. Fortune 500 companies increasingly allocate treasury funds to CeFi platforms like Coinbase Custody and Kraken Institutional. Seeking regulatory compliance and insurance coverage. These institutions typically start with 1-5% cryptocurrency allocations, mainly through regulated custodians that provide institutional-grade security, compliance reporting,. Fiduciary protections needd for corporate governance standards.

Hedge funds. Family offices show more aggressive DeFi adoption, with advanced investors allocating 10-30% of cryptocurrency holdings to protocols like Aave, Compound, and Curve Finance. These institutions employ dedicated blockchain analysts, use multi-signature treasury management systems, and use institutional DeFi platforms like Fireblocks and Anchorage Digital that provide enterprise-grade access to decentralised protocols while maintaining custody standards and compliance frameworks.

Professional Trading Infrastructure Differences

CeFi trading infrastructure offers institutional-grade features including dedicated account managers, API access with high rate limits, advanced order types,. Direct market access that enables advanced trading strategies. Platforms like Binance Institutional and OKX Prime provide co-location services, algorithmic trading support,. Institutional liquidity pools that help large-volume transactions without large market impact. These services include dedicated support teams, custom fee structures,. Regulatory compliance assistance tailored to institutional needments.

DeFi trading infrastructure operates through automated market makers. Decentralised exchanges that provide different advantages including composability, permissionless access, and transparent pricing mechanisms. Institutional DeFi access typically needs specialised infrastructure including MEV protection services, transaction simulation tools, and gas optimisation systems. Professional DeFi traders use platforms like 1inch Pro, Matcha,. Institutional aggregators that provide advanced routing, slippage protection,. Batch transaction capabilities designed for advanced trading operations.

Regulatory Framework Comparison Analysis

CeFi regulatory frameworks provide clear compliance pathways through established financial services regulations. Enabling institutions to integrate cryptocurrency operations within existing risk management and compliance systems. Regulated CeFi platforms must comply with anti-money laundering needments, know-your-customer procedures,. Capital adequacy standards that provide institutional investors with familiar regulatory protections and legal recourse mechanisms.

DeFi regulatory frameworks remain evolving, with institutions navigating uncertain compliance needments while accessing innovative financial products unavailable in traditional markets. forwards-thinking institutions use complete DeFi compliance programs including transaction monitoring, counterparty risk assessment,. Regulatory reporting systems that anticipate future regulatory needments while capitalising on current opportunities in decentralised finance protocols.

Quantitative Risk-Return Profile Analysis

Statistical Performance Metrics

Quantitative analysis of DeFi versus CeFi performance reveals large differences in risk-adjusted returns, volatility patterns, and correlation structures. CeFi platforms show lower volatility with Sharpe ratios typically ranging from 0.8 to 1.5, reflecting more stable but lower absolute returns. Historical analysis shows CeFi yields maintain 60-80% consistency month-over-month, with standard deviations of 15-25% annually. Making them suitable for conservative institutional mandates requiring predictable income streams.

DeFi protocols exhibit higher volatility with Sharpe ratios ranging from 0.5 to 2.5, depending on strategy complexity and market conditions. Yield farming strategies show 200-400% annual volatility with possible for both exceptional returns and large losses. Advanced quantitative models incorporating impermanent loss calculations, smart contract risk premiums,. Governance token volatility suggest optimal DeFi allocations of 15-35% for risk-tolerant institutional portfolios seeking alpha generation.

Correlation Analysis and Portfolio optimisation

Correlation analysis between DeFi and CeFi returns shows low to moderate correlation coefficients of 0.3-0.6, indicating diversification benefits from combined exposure. DeFi returns show higher correlation with broader cryptocurrency markets, while CeFi returns show more stability during market downturns due to platform risk management and yield smoothing mechanisms. Modern portfolio theory applications suggest optimal allocations of 60-70% CeFi and 30-40% DeFi for maximum risk-adjusted returns in institutional portfolios.

Advanced optimisation models incorporating transaction costs, liquidity constraints,. Regulatory needments indicate that advanced investors can achieve 15-25% higher risk-adjusted returns through strategic DeFi-CeFi allocation compared to single-ecosystem approaches. These models account for rebalancing costs, tax implications,. Operational complexity to provide practical guidance for institutional useation of hybrid cryptocurrency strategies.

Stress Testing and Scenario Analysis

Comprehensive stress testing reveals different failure modes between DeFi and CeFi systems during market crises. CeFi platforms face liquidity crises, regulatory shutdowns, and counterparty failures, as showd during the 2022 market downturn when platforms like Celsius and FTX collapsed. Monte Carlo simulations suggest 5-15% annual probability of large CeFi platform failures affecting user funds, with recovery rates varying from 0-90% depending on platform structure and regulatory jurisdiction.

DeFi protocols face smart contract exploits, governance attacks,. Liquidity crises that create different risk profiles requiring specialised analysis. Historical data indicates 2-8% annual probability of major protocol exploits, with average loss rates of 10-50% of affected funds. However, DeFi's non-custodial nature means users retain control during most crisis scenarios. Enabling faster recovery. Risk mitigation compared to centralised platform failures where user funds may be frozen indefinitely.

Professional Trading Infrastructure and Operational Excellence

Enterprise-Grade Security Architecture

Professional CeFi platforms use multi-layered security architectures including hardware security modules, cold storage systems,. Institutional custody solutions that meet bank-grade security standards. Leading platforms like Coinbase Custody and BitGo use geographically distributed storage, multi-signature authorisation systems,. Complete insurance coverage exceeding $1 billion in aggregate protection. These systems undergo regular SOC 2 Type II audits, penetration testing,. Compliance assessments that ensure institutional-grade security standards.

DeFi security architecture relies on cryptographic guarantees, smart contract audits,. Decentralised validation mechanisms that provide different security properties compared to traditional systems. Professional DeFi operations use complete security frameworks including multi-signature treasury management, time-locked governance systems,. Formal verification processes that ensure protocol integrity. Advanced DeFi security includes bug bounty programs, continuous monitoring systems,. Emergency response procedures that enable rapid incident response and fund protection.

Liquidity Management and Market Making

CeFi liquidity management uses professional market-making services, institutional order books,. Advanced matching engines that provide deep liquidity. Tight spreads for large-volume transactions. Institutional CeFi platforms offer dedicated liquidity pools, over-the-counter trading desks,. Algorithmic execution services that minimise market impact for large trades. These services include real-time risk management, position monitoring,. Automated hedging systems that ensure optimal execution quality.

DeFi liquidity management operates through automated market makers, liquidity mining incentives,. Composable protocol integration that creates unique opportunities for yield generation and capital efficiency. Professional DeFi liquidity strategies include concentrated liquidity provision, cross-protocol arbitrage,. Yield optimisation techniques that maximise returns while managing impermanent loss and smart contract risks. Advanced DeFi operations use advanced analytics, automated rebalancing systems, and multi-protocol strategies that optimise capital allocation across the decentralised finance ecosystem.

Regulatory Compliance and Reporting Systems

CeFi regulatory compliance uses established frameworks. Including anti-money laundering procedures, know-your-customer verification,. Complete transaction monitoring that ensure regulatory adherence across multiple jurisdictions. Professional CeFi platforms provide institutional reporting services, tax optimisation strategies,. Regulatory consultation that simplify compliance needments for institutional investors. These systems include automated reporting, audit trail maintenance,. Regulatory change management that ensure ongoing compliance with evolving needments.

DeFi regulatory compliance needs innovative approaches. Including transaction analysis, protocol risk assessment,. Proactive compliance monitoring that address the unique challenges of decentralised systems. forwards-thinking institutions use complete DeFi compliance frameworks including smart contract analysis, governance participation monitoring,. Regulatory scenario planning that prepare for future regulatory developments while maximising current opportunities in decentralised finance protocols.

Advanced Yield optimisation and Capital Allocation Strategies

Dynamic Yield Farming and Protocol Selection

Professional yield optimisation needs advanced analysis of protocol fundamentals, tokenomics structures,. Market dynamics that enable systematic identification of sustainable yield opportunities. Advanced DeFi strategies include multi-protocol yield farming, governance token optimisation,. Liquidity mining strategies that maximise returns while managing protocol-specific risks. These approaches use complete due diligence frameworks, real-time monitoring systems,. Automated rebalancing mechanisms that ensure optimal capital allocation across evolving DeFi opportunities.

CeFi yield optimisation focuses on platform diversification, rate comparison analysis, and risk-adjusted return maximisation that provides stable income generation with institutional-grade security. Professional CeFi strategies include structured product utilisation, term optimisation,. Platform arbitrage that enhance returns while maintaining appropriate risk profiles. These approaches incorporate complete platform analysis, regulatory compliance monitoring,. Liquidity management that ensure optimal yield generation within institutional risk parameters.

Cross-Platform Arbitrage and Market Inefficiency Exploitation

Sophisticated arbitrage strategies exploit price differences between CeFi and DeFi platforms. Enabling risk-free profit generation through systematic market inefficiency identification. Professional arbitrage operations use automated trading systems, real-time price monitoring,. Advanced execution algorithms that capitalise on temporary price discrepancies across platforms. These strategies need large capital, advanced technology infrastructure,. Complete risk management systems that ensure profitable execution while managing operational and market risks.

Advanced market-making strategies provide liquidity across both CeFi and DeFi platforms while generating consistent returns through bid-ask spread capture and volume-based fee optimisation. Professional market makers use advanced pricing models, inventory management systems,. Risk hedging strategies that ensure profitable operations across varying market conditions. These operations need advanced technology, large capital commitments,. Complete risk management frameworks that enable sustainable profitability in competitive market making environments through systematic optimisation. Professional execution excellence with institutional-grade operational standards. Complete performance monitoring systems for optimal trading efficiency. Strategic market positioning excellence through systematic useation and operational reliability.

Conclusion

The choice between DeFi and CeFi in 2025 is not binary but rather about finding the optimal balance that aligns with your risk tolerance, technical expertise, and investment goals. Both ecosystems have evolved largely, with CeFi platforms integrating DeFi protocols to offer competitive yields while maintaining regulatory compliance, and DeFi projects improving user experience. Security measures to attract mainstream adoption.

For most investors, a hybrid approach proves most effective: utilising CeFi platforms for stability, regulatory protection, and ease of use, while allocating a portion to DeFi protocols for higher yield possible and financial sovereignty. The key is understanding that these are complementary rather than competing systems, each serving different aspects of a complete cryptocurrency investment strategy.

As the cryptocurrency ecosystem continues to mature, the lines between DeFi and CeFi will likely blur further. Creating new opportunities for investors who understand both paradigms. Success in 2025. Beyond will come from staying informed about developments in both sectors. Maintaining proper risk management across platforms,. Adapting your strategy as the landscape evolves.

The emergence of institutional-grade DeFi protocols and regulatory-compliant CeFi platforms has created a more advanced investment environment that rewards educated participants. Investors who take the time to understand the nuances of both ecosystems, use proper security measures,. Maintain diversified exposure across multiple platforms. Protocols will be best positioned to capitalise on the opportunities that emerge in this rapidly evolving space.

Whether you choose CeFi's security and simplicity or DeFi's innovation and yields, the most important factor is making informed decisions based on thorough research. Understanding of the risks involved.

The regulatory environment in 2025 continues to evolve, with clearer guidelines emerging for both DeFi and CeFi operations. This regulatory clarity is reducing uncertainty. Enabling more institutional participation in both sectors. Smart investors will monitor these developments closely, as regulatory changes can largely impact the risk-reward profiles of different platforms and strategies. Making adaptability a key component of successful long-term cryptocurrency investment approaches.

Sources & References

- DeFiLlama - DeFi TVL Analytics - Real-time decentralised finance protocol data. Total value locked metrics

- CoinDesk - What is DeFi? - Comprehensive educational resource on decentralised finance fundamentals

- Ethereum.org - DeFi Overview - Official Ethereum documentation on decentralised finance ecosystem

- Binance Earn - CeFi Yield Products - centralised finance yield offerings and staking options

- Bybit CeFi Platform Guide

- Aave DeFi Protocol Guide

Frequently Asked Questions

- Which is growing faster in 2025: DeFi or CeFi?

- DeFi is expanding faster in terms of innovation and total value locked (TVL), while CeFi maintains broader retail adoption due to its simpler onboarding and regulatory compliance. Both are growing, but in different dimensions.

- Which offers higher yields: DeFi or CeFi?

- DeFi typically offers higher yields (10–50%+) due to liquidity mining and protocol incentives, while CeFi provides more stable yields (3–12%) with lower volatility. DeFi yields often come with higher risks and complexity.

- Which is safer: DeFi or CeFi?

- Neither is inherently safer. CeFi has counterparty and regulatory risks, while DeFi has smart contract and governance risks. Diversification across both reduces overall risk exposure.

- Should beginners start with DeFi or CeFi?

- Beginners should typically start with CeFi platforms due to simpler interfaces, customer support, and lower technical barriers, then gradually explore DeFi as they gain experience and knowledge.

- What's the future outlook for DeFi vs CeFi?

- Both will likely coexist and converge. CeFi will adopt DeFi innovations, while DeFi will enhance the user experience. Hybrid models combining both approaches are emerging as the future of crypto finance.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.