CeFi vs DeFi Earn 2025: Comparison Guide

Comprehensive analysis of centralised and decentralised finance for earning crypto income. Compare yields, risks, and custody models to find the best strategy for your goals.

Introduction

The cryptocurrency earning landscape in 2025 presents investors with two fundamentally different approaches: centralised finance (CeFi) and decentralised finance (DeFi) platforms. Each approach offers unique advantages and trade-offs. These significantly impact your earning potential, risk exposure, and overall investment experience. Understanding these differences is crucial for making informed decisions.

CeFi platforms operate similarly to traditional financial institutions. They provide familiar user interfaces, customer support, and regulatory compliance measures. They offer competitive yields on cryptocurrency deposits. These platforms typically require users to deposit funds into company-controlled accounts. This introduces counterparty risk. It provides the security and convenience that many investors prefer. The appeal of CeFi lies in its simplicity and professional management.

DeFi protocols leverage blockchain technology and smart contracts. They enable peer-to-peer earning opportunities without intermediaries. These platforms offer greater transparency, higher potential yields, and complete user control over funds. However, they also introduce technical complexity and smart contract risks. Users must take full responsibility for their security and transaction management. The revolutionary aspect of DeFi is its permissionless nature.

The earning opportunities available through both CeFi and DeFi have evolved significantly. Sophisticated yield generation mechanisms include staking, lending, liquidity provision, and yield farming. The maturation of both ecosystems has created diverse options for generating passive income. The optimal choice depends on individual risk tolerance, technical expertise, and investment objectives. Modern platforms offer yields ranging from conservative 3-5% annual returns to aggressive strategies potentially exceeding 20% annually.

Market conditions in 2025 have created an environment where both CeFi and DeFi platforms compete aggressively for user deposits. This leads to innovative yield products and competitive interest rates. This competition has resulted in improved user experiences, enhanced security measures, and more transparent fee structures. However, the regulatory landscape continues to evolve.

The choice between CeFi and DeFi is not necessarily binary. Many sophisticated investors employ hybrid strategies that leverage the strengths of both approaches. This balanced approach allows investors to benefit from the stability and convenience of CeFi. They can capture the higher yields and innovation available in DeFi. The key is understanding how to allocate capital appropriately across both ecosystems.

This comprehensive comparison examines the key factors that differentiate CeFi and DeFi earning strategies. These include yield potential, risk profiles, user experience, security considerations, and regulatory implications. Understanding these platforms' strengths and limitations will help you construct an optimal earning strategy for your cryptocurrency portfolio.

The regulatory environment has significantly shaped both sectors throughout 2024 and into 2025. CeFi platforms have adapted to stricter compliance requirements, implementing robust know-your-customer procedures and enhanced security measures. Meanwhile, DeFi protocols continue to operate in a more permissionless manner, though increasing regulatory scrutiny has prompted many projects to implement voluntary compliance measures and transparency initiatives.

Security considerations differ substantially between the two approaches. CeFi platforms centralise custody, creating single points of failure but also enabling professional security teams and insurance coverage. DeFi protocols distribute risk across smart contracts and blockchain networks, eliminating counterparty risk but introducing code vulnerabilities and user responsibility for private key management. Recent security improvements in both sectors have reduced but not eliminated these fundamental risk differences.

CeFi vs DeFi: The Fundamental Difference

The choice between CeFi (Centralised Finance) and DeFi (Decentralised Finance) for earning crypto income represents one of the most important decisions in 2025. Each approach offers distinct advantages and trade-offs that can significantly impact your returns and risk exposure.

The Evolution in 2025

The landscape has matured significantly since the early days of DeFi Summer 2020 and the CeFi boom of 2021-2022. **Key developments include:**

- Regulatory Clarity: Clearer guidelines have improved CeFi compliance and user protection

- DeFi Maturation: Battle-tested protocols with improved security and user interfaces

- Yield Normalization: More sustainable, realistic yield expectations across both sectors

- Institutional Adoption: Professional investors using both CeFi and DeFi strategies

- Cross-Chain Integration: Better interoperability between different blockchain networks

Market Context

In 2025, **the total value locked (TVL) in DeFi protocols exceeds $200 billion**, while major CeFi platforms manage over $500 billion in crypto assets. This represents a mature and sophisticated ecosystem where both approaches serve different user needs and risk profiles effectively.

Key Definitions and Models

CeFi (centralised Finance)

CeFi platforms are traditional financial intermediaries that offer crypto services. They maintain custody of user funds and operate like conventional banks or investment firms.

CeFi Characteristics:

- Custodial Model: Platform holds your private keys and assets

- Regulatory Compliance: Subject to financial regulations and licensing

- Customer Support: Traditional customer service and dispute resolution

- Fiat Integration: Easy on/off ramps to traditional banking

- Insurance: Often provides deposit insurance or protection schemes

Popular CeFi Services:

- Earn Programs: Deposit crypto to earn interest

- Staking Services: Simplified staking with automatic rewards

- Lending: Borrow against crypto collateral

- Savings Accounts: High-yield crypto savings products

DeFi (decentralised Finance)

DeFi protocols are smart contract-based applications that provide financial services without traditional intermediaries. Users maintain control of their assets through self-custody wallets.

DeFi Characteristics:

- Non-Custodial: You control your private keys and assets

- Permissionless: Open access without KYC or geographic restrictions

- Transparent: All transactions and code are publicly verifiable

- Composable: Protocols can be combined for complex strategies

- Programmable: Automated execution through smart contracts

Popular DeFi Services:

- Liquidity Mining: Provide liquidity to earn fees and tokens

- Yield Farming: optimise returns across multiple protocols

- Liquid Staking: Stake assets while maintaining liquidity

- Lending Markets: decentralised borrowing and lending

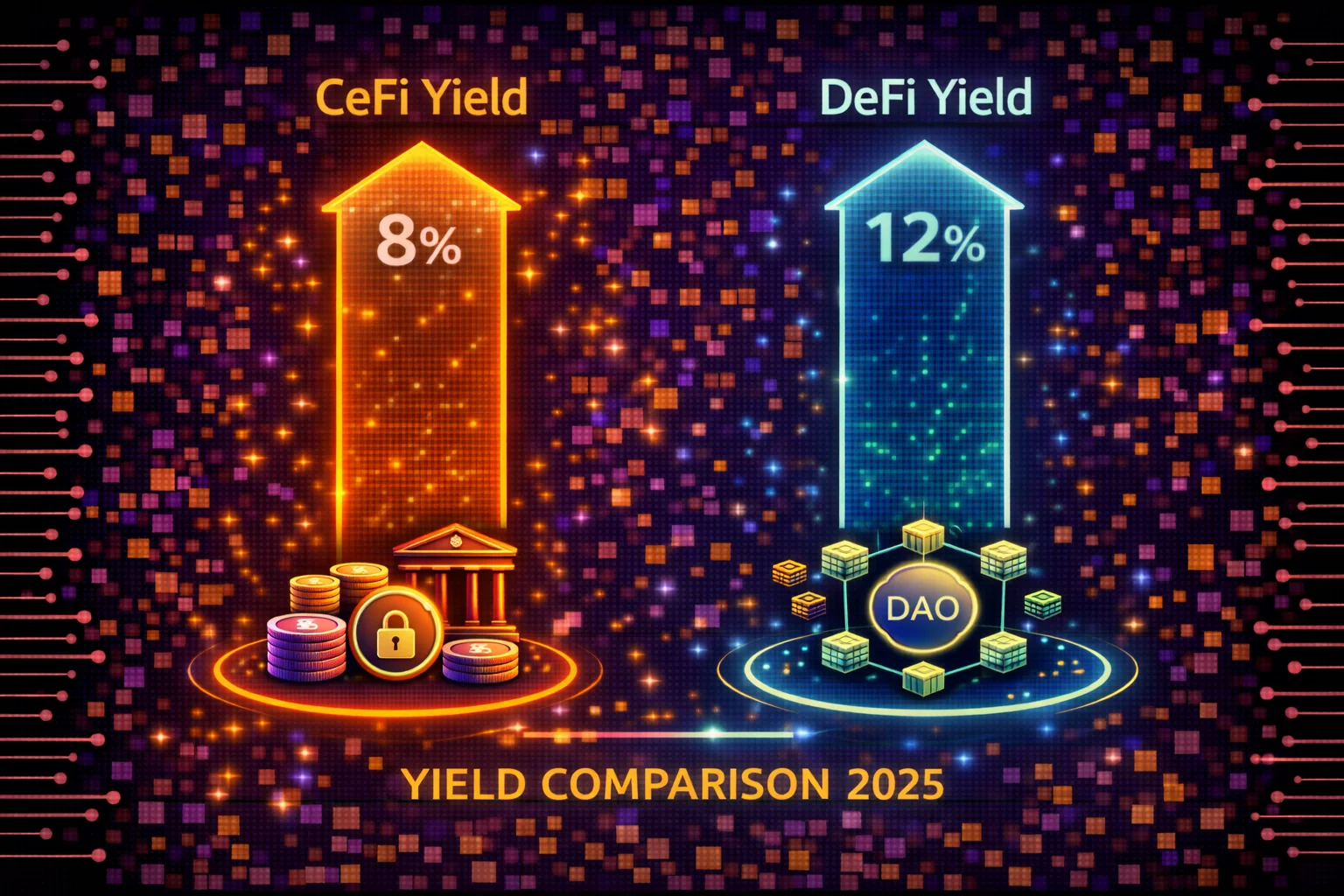

Yield Comparison: Returns and Sustainability

CeFi Yield Characteristics

Yield Sources in CeFi

- Lending Operations: Platform lends your assets to institutional borrowers

- Market Making: Profits from trading spreads and arbitrage

- Staking Operations: Platform runs validators and shares rewards

- Investment Products: Structured products and yield strategies

CeFi Yield Ranges (2025)

| Asset Type | Typical APY | Platform Examples |

|---|---|---|

| Stablecoins (USDC, USDT) | 3-8% | Nexo, Binance Earn |

| Bitcoin (BTC) | 1-4% | Coinbase, Kraken |

| Ethereum (ETH) | 2-5% | Binance, OKX |

| Altcoins | 5-15% | Various platforms |

CeFi Yield Features

- Predictable Rates: More stable APYs with less volatility

- Tiered Systems: Higher rates for larger deposits or premium tiers

- Promotional Rates: Limited-time offers for new users or assets

- Caps and Limits: Maximum amounts eligible for highest rates

DeFi Yield Characteristics

Yield Sources in DeFi

- Trading Fees: Share of AMM trading fees from liquidity provision

- Token Incentives: Governance tokens distributed to liquidity providers

- Lending Interest: Interest paid by borrowers in money markets

- Staking Rewards: Network rewards from proof-of-stake validation

DeFi Yield Ranges (2025)

| Strategy Type | Typical APY | Protocol Examples |

|---|---|---|

| Stablecoin LP | 2-12% | Curve, Uniswap |

| ETH Liquid Staking | 3-6% | Lido, Rocket Pool |

| Lending Markets | 1-8% | Aave, Compound |

| Yield optimisation | 5-25% | Pendle, Yearn |

DeFi Yield Features

- Variable Rates: APYs fluctuate based on market conditions

- Compounding: Ability to automatically reinvest rewards

- Multiple Rewards: Earn fees plus governance tokens

- No Caps: Generally no limits on deposit amounts

Yield Sustainability Analysis

Sustainable vs Unsustainable Yields

Sustainable Yield Sources:

- **Real trading volume generating fees**

- **Genuine borrowing demand paying interest**

- **Network security rewards from staking**

- **Value-added services (MEV, arbitrage)**

Unsustainable Yield Sources:

- **Pure token emissions without utility**

- **Ponzi-like structures requiring new deposits**

- **Temporary liquidity mining incentives**

- **Artificially inflated promotional rates**

Red Flags for Unsustainable Yields

- Extremely High APYs: **>50% without clear value creation**

- New Protocols: **Unproven tokenomics and mechanics**

- Declining TVL: **Users withdrawing despite high advertised yields**

- Lack of Transparency: **Unclear how yields are generated**

Comprehensive Risk Analysis

CeFi Risk Profile

1. Counterparty Risk

Description: **Risk that the platform becomes insolvent or acts against user interests**

Historical Examples:

- FTX Collapse (2022): **$8 billion user fund shortfall**

- Celsius Bankruptcy (2022): **Frozen withdrawals, user funds locked**

- BlockFi Bankruptcy (2022): **Regulatory issues and insolvency**

Mitigation Strategies:

- **Choose regulated platforms with proper licensing**

- **Verify insurance coverage and protection schemes**

- **Monitor platform financial health and transparency**

- **Diversify across multiple platforms**

- **Keep only earning amounts on platforms, not entire holdings**

2. Regulatory Risk

Description: **Changes in regulations affecting platform operations**

Potential Impacts:

- **Forced platform shutdowns or service restrictions**

- **Reduced yields due to compliance costs**

- **Geographic restrictions on services**

- **Enhanced KYC/AML requirements**

3. Operational Risk

Description: **Platform technical issues, hacks, or operational failures**

Examples:

- **Exchange hacks and security breaches**

- **System outages during market volatility**

- **Withdrawal delays or restrictions**

- **Account freezes due to compliance issues**

DeFi Risk Profile

1. Smart Contract Risk

Description: **Security flaws, coding errors, or exploitable weaknesses in smart contract implementations**

Historical Examples:

- Poly Network Hack (2021): **$600 million exploit**

- Wormhole Bridge Hack (2022): **$320 million stolen**

- Euler Finance Hack (2023): **$200 million flash loan attack**

Mitigation Strategies:

- **Use protocols with multiple security audits**

- **Check audit reports and bug bounty programs**

- **Prefer battle-tested protocols (6+ months live)**

- **Consider insurance protocols like Nexus Mutual**

- **Start with small amounts on new protocols**

2. Impermanent Loss Risk

Description: **Loss from providing liquidity when asset prices diverge**

Impact by Price Change:

- 25% price change: **0.6% impermanent loss**

- 50% price change: **2.0% impermanent loss**

- 100% price change: **5.7% impermanent loss**

Mitigation Strategies:

- **Use correlated asset pairs (stETH/ETH)**

- **Focus on stablecoin pairs for minimal IL**

- **Ensure trading fees exceed potential IL**

- **Monitor positions during high volatility**

For detailed platform security analysis and risk comparisons, explore our CeFi vs DeFi comparison and Lido staking guide.

3. Governance and Protocol Risk

Description: **Risks from protocol governance decisions and upgrades**

Examples:

- **Malicious governance proposals**

- **Protocol parameter changes affecting yields**

- **Failed upgrades introducing bugs**

- **Governance token concentration**

Risk Comparison Matrix

| Risk Type | CeFi Impact | DeFi Impact | Mitigation |

|---|---|---|---|

| Custody | **High (platform holds keys)** | **Low (self-custody)** | Diversify platforms / Use hardware wallets |

| Technical | **Medium (platform systems)** | **High (smart contracts)** | Choose audited platforms/protocols |

| Regulatory | **High (compliance required)** | **Medium (evolving landscape)** | Stay informed, use compliant services |

| Liquidity | **Medium (withdrawal limits)** | **Low (instant access)** | Maintain emergency reserves |

| Operational | **Medium (human error)** | **High (user error)** | Education and careful execution |

User Experience Comparison

CeFi User Experience

Onboarding Process

- Account Creation: Email signup with KYC verification

- Identity Verification: Upload documents, wait for approval

- Deposit Funds: Bank transfer, card payment, or crypto deposit

- Start Earning: One-click activation of earn programs

Daily Operations

- Mobile Apps: User-friendly interfaces with push notifications

- Customer Support: Live chat, email, phone support

- Automatic Compounding: Rewards automatically reinvested

- Tax Reporting: Built-in tools for tax calculation and reporting

CeFi Advantages

- Simplicity: No technical knowledge required

- Fiat Integration: Easy conversion between crypto and traditional currency

- Customer Protection: Dispute resolution and account recovery

- Regulatory Compliance: Licensed operations with consumer protections

CeFi Disadvantages

- KYC Requirements: Identity verification and privacy concerns

- Geographic Restrictions: Limited availability in some regions

- Withdrawal Limits: Daily/monthly limits on fund access

- Platform Dependency: Subject to platform policies and changes

DeFi User Experience

Onboarding Process

- Wallet Setup: Install MetaMask or hardware wallet

- Secure Seed Phrase: Safely store recovery phrase

- Fund Wallet: Transfer crypto from exchange or buy directly

- Connect to Protocols: Interact with DeFi applications

Daily Operations

- Transaction Signing: Approve each transaction manually

- Gas Fee Management: Monitor and optimise network fees

- Portfolio Tracking: Use third-party tools like Zapper or DeBank

- Manual Compounding: Manually claim and reinvest rewards

DeFi Advantages

- Full Control: Complete ownership of assets and private keys

- Permissionless Access: No KYC or geographic restrictions

- Transparency: All transactions and code publicly verifiable

- Composability: Combine multiple protocols for complex strategies

- Innovation: Access to cutting-edge financial products

DeFi Disadvantages

- Technical Complexity: Requires understanding of wallets, gas, etc.

- User Responsibility: No customer support or account recovery

- Gas Costs: Network fees can be significant on Ethereum

- Interface Complexity: Less polished user interfaces

- Security Responsibility: Users responsible for wallet security

Learning Curve Comparison

CeFi Learning Requirements

- Basic: Understanding of crypto assets and market basics

- Platform-Specific: Learning specific platform features and terms

- Risk Awareness: Understanding counterparty and regulatory risks

- Time Investment: 1-2 hours to get started

DeFi Learning Requirements

- Wallet Management: Private keys, seed phrases, security practices

- Network Understanding: Gas fees, transaction confirmation, MEV

- Protocol Mechanics: AMMs, lending markets, yield farming

- Risk Assessment: Smart contract audits, impermanent loss, governance

- Time Investment: 10-20 hours to become proficient

Top Platforms for 2025

Leading CeFi Platforms

Binance Earn - Global Leader

Overview: World's largest crypto exchange with comprehensive earn products

Key Features:

- Flexible Savings: 1-8% APY, withdraw anytime

- Locked Staking: 5-20% APY, fixed terms

- Launchpool: Earn new tokens by staking BNB/BUSD

- Auto-Invest: Dollar-cost averaging with earning

Pros: Highest liquidity, wide asset selection, competitive rates

Cons: Regulatory scrutiny in some regions, complex fee structure

Nexo - EU Regulated

Overview: European-regulated platform focusing on institutional-grade security

Key Features:

- Earn Program: Up to 8% APY on stablecoins

- Insurance: $375 million insurance coverage

- NEXO Token Benefits: Higher yields for token holders

- Credit Line: Borrow against crypto without selling

Pros: Strong regulation, insurance, transparent operations

Cons: Limited asset selection, geographic restrictions

Coinbase Earn - US Regulated

Overview: Publicly traded US company with strong regulatory compliance

Key Features:

- Staking Rewards: 2-5% APY on major PoS assets

- FDIC Insurance: USD balances protected up to $250k

- Educational Rewards: Earn crypto by learning

- Institutional Services: Prime and custody solutions

Pros: Regulatory compliance, insurance, beginner-friendly

Cons: Lower yields, limited advanced features

Leading DeFi Protocols

Lido Finance - Liquid Staking Leader

Overview: Largest liquid staking protocol with $25+ billion TVL

Key Features:

- stETH: Liquid Ethereum staking with 3.8% APY

- Multi-Chain: Supports ETH, SOL, MATIC, DOT

- DeFi Integration: Use stETH across DeFi protocols

- Professional Validators: Curated validator set

Pros: Highest liquidity, battle-tested, wide integration

Cons: centralisation concerns, smart contract risk

Aave - Premier Money Market

Overview: Leading decentralised lending protocol with innovative features

Key Features:

- Supply & Earn: 1-8% APY on various assets

- Flash Loans: Uncollateralized loans for arbitrage

- Isolation Mode: Risk management for new assets

- GHO Stablecoin: Native overcollateralized stablecoin

Pros: Innovation leader, strong security, multiple chains

Cons: Complex interface, gas costs on Ethereum

Curve Finance - Stablecoin Specialist

Overview: optimised AMM for stablecoins and similar-value assets

Key Features:

- Low Slippage: Efficient trading for similar assets

- CRV Rewards: Governance token incentives

- Vote Locking: veCRV for boosted rewards

- Gauge System: Community-directed liquidity incentives

Pros: Low impermanent loss, high efficiency, strong tokenomics

Cons: Complex mechanics, governance dependency

Pendle - Yield Trading

Overview: Advanced protocol for trading and optimising future yields

Key Features:

- Yield Tokenization: Split assets into principal and yield

- Fixed Yields: Lock in guaranteed returns

- Boosted Pools: Enhanced rewards for PENDLE stakers

- Yield Trading: Speculate on future yield rates

Pros: Innovative mechanics, high yields, professional team

Cons: Complex strategies, newer protocol, learning curve

Hybrid Strategies: Best of Both Worlds

Portfolio Allocation Approaches

Conservative Hybrid (70% CeFi / 30% DeFi)

Profile: Risk-averse investors seeking steady returns with some DeFi exposure

Allocation:

- 50% CeFi Stablecoins: Nexo/Binance USDC earn (6-8% APY)

- 20% CeFi Staking: Coinbase ETH staking (3-4% APY)

- 20% DeFi Liquid Staking: Lido stETH (3.8% APY)

- 10% DeFi Stablecoin LP: Curve USDC/USDT (4-6% APY)

Expected Return: 5-7% APY

Risk Level: Low to Medium

Time Commitment: 2-3 hours/month

Balanced Hybrid (50% CeFi / 50% DeFi)

Profile: Balanced risk approach with DeFi familiarity

Allocation:

- 30% CeFi Earn: Mixed stablecoins and major cryptos

- 20% CeFi Staking: ETH, ADA, SOL staking services

- 25% DeFi Liquid Staking: Lido, Rocket Pool

- 15% DeFi Yield Farming: Curve, Uniswap LPs

- 10% DeFi Lending: Aave supply positions

Expected Return: 6-10% APY

Risk Level: Medium

Time Commitment: 5-8 hours/month

Aggressive Hybrid (30% CeFi / 70% DeFi)

Profile: Experienced DeFi user with high risk tolerance

Allocation:

- 20% CeFi Stablecoins: Emergency liquidity and stability

- 10% CeFi Staking: Set-and-forget major assets

- 30% DeFi Liquid Staking: Multiple protocols and chains

- 25% DeFi Yield Farming: Active LP management

- 15% DeFi Advanced: Pendle, leveraged strategies

Expected Return: 8-15% APY

Risk Level: High

Time Commitment: 10-15 hours/month

Cross-Platform Arbitrage

Yield Arbitrage Opportunities

- Rate Differences: Same asset earning different rates across platforms

- Promotional Rates: Temporary high rates on CeFi platforms

- Token Incentives: DeFi protocols offering bonus rewards

- Chain Differences: Same protocols offering different rates on different chains

Arbitrage Execution Strategy

- Monitor Rates: Track yields across platforms daily

- Calculate Costs: Include withdrawal fees, gas costs, time

- Execute Moves: Transfer funds to higher-yielding opportunities

- Set Alerts: Automate monitoring where possible

Risk Management in Hybrid Strategies

Diversification Rules

- Platform Limit: Maximum 25% of portfolio on any single platform

- Protocol Limit: Maximum 20% in any single DeFi protocol

- Asset Diversification: Spread across stablecoins, ETH, BTC, alts

- Geographic Diversification: Use platforms in different jurisdictions

Monitoring Framework

- Daily: Check for major news, protocol issues, rate changes

- Weekly: Review performance, rebalance if needed

- Monthly: Comprehensive portfolio review and optimisation

- Quarterly: Strategy assessment and major adjustments

Real-World Case Studies

Case Study 1: Conservative Beginner ($5,000)

Profile: New to crypto, prioritises safety and simplicity

Strategy:

- 60% Nexo USDC: $3,000 at 7% APY = $210/year

- 25% Coinbase ETH Staking: $1,250 at 3.5% APY = $44/year

- 15% Binance Flexible Savings: $750 at 4% APY = $30/year

Results After 1 Year:

- Total Earnings: $284 (5.68% APY)

- Risk Events: None, all platforms remained stable

- Time Spent: 1 hour/month monitoring

- Lessons learnt: Gained confidence to explore DeFi

Case Study 2: Balanced Intermediate ($25,000)

Profile: Some DeFi experience, moderate risk tolerance

Strategy:

- 30% Binance Earn Mix: $7,500 at 6% APY = $450/year

- 25% Lido stETH: $6,250 at 3.8% APY = $238/year

- 20% Curve USDC/USDT: $5,000 at 8% APY = $400/year

- 15% Aave USDC Supply: $3,750 at 4% APY = $150/year

- 10% Emergency Cash: $2,500 at 0% APY = $0/year

Results After 1 Year:

- Total Earnings: $1,238 (4.95% APY)

- Risk Events: Minor IL on Curve position during USDC depeg

- Time Spent: 4 hours/month managing positions

- Lessons learnt: Importance of diversification and monitoring

Case Study 3: Advanced DeFi User ($100,000)

Profile: Experienced DeFi user, high risk tolerance

Strategy:

- 20% Nexo Stablecoins: $20,000 at 7% APY = $1,400/year

- 25% Multi-Chain Liquid Staking: $25,000 at 5% APY = $1,250/year

- 30% Active Yield Farming: $30,000 at 12% APY = $3,600/year

- 15% Pendle Strategies: $15,000 at 18% APY = $2,700/year

- 10% Arbitrage Opportunities: $10,000 at 15% APY = $1,500/year

Results After 1 Year:

- Total Earnings: $10,450 (10.45% APY)

- Risk Events: One protocol exploit (2% portfolio loss)

- Time Spent: 15 hours/month active management

- Lessons learnt: High returns require active management and risk acceptance

Key Takeaways from Case Studies

- Risk-Return Correlation: Higher returns require higher risk tolerance and time investment

- Diversification Benefits: Spreading across CeFi and DeFi reduces single points of failure

- Learning Curve: Start conservative and gradually increase complexity

- Time Investment: Active strategies require significant time commitment

- Risk Management: Even experienced users face losses; position sizing is crucial

Decision Framework: Choosing Your Path

Assessment Questions

Risk Tolerance Assessment

- Can you afford to lose 10-20% of your investment? (DeFi consideration)

- Are you comfortable with platform custody of your funds? (CeFi consideration)

- How important is guaranteed access to your funds? (Liquidity preference)

- Do you prefer predictable or potentially higher variable returns? (Yield preference)

Technical Capability Assessment

- Are you comfortable managing private keys and seed phrases?

- Can you research and evaluate smart contract risks?

- Do you understand impermanent loss and how to calculate it?

- Are you willing to learn about gas optimisation and transaction timing?

Time Commitment Assessment

- How much time can you dedicate to monitoring positions?

- Do you want set-and-forget or active management strategies?

- Are you interested in learning about new protocols and opportunities?

- Can you respond quickly to market changes or protocol issues?

Decision Matrix

| Your Profile | Recommended Approach | Allocation | Expected APY |

|---|---|---|---|

| Complete Beginner | CeFi Only | 100% CeFi | 3-6% |

| Conservative Investor | CeFi Heavy | 80% CeFi / 20% DeFi | 4-7% |

| Balanced Approach | Hybrid Strategy | 50% CeFi / 50% DeFi | 6-10% |

| DeFi Enthusiast | DeFi Heavy | 20% CeFi / 80% DeFi | 8-15% |

| Advanced User | DeFi Native | 10% CeFi / 90% DeFi | 10-20%+ |

Implementation Roadmap

Phase 1: Foundation (Month 1-2)

- Education: Learn basics of chosen approach

- Setup: Create accounts or wallets

- Start Small: Begin with 10-20% of intended allocation

- Monitor: Track performance and learn platform mechanics

Phase 2: Expansion (Month 3-6)

- Increase Allocation: Gradually add more funds

- Diversify: Add second platform or protocol

- optimise: Compare rates and move funds if beneficial

- Learn Advanced: Explore more complex strategies

Phase 3: optimisation (Month 6+)

- Full Allocation: Deploy complete intended amount

- Active Management: Regular rebalancing and optimisation

- Risk Management: Implement comprehensive risk controls

- Strategy Evolution: Adapt to market changes and new opportunities

Market Dynamics and Economic Factors

Quantitative Performance Analysis and Metrics

Professional cryptocurrency earning requires sophisticated quantitative analysis that evaluates risk-adjusted returns, volatility metrics, and correlation coefficients across CeFi and DeFi platforms. Advanced performance measurement includes calculation of Sharpe ratios, maximum drawdown analysis, and Value-at-Risk assessments that enable objective comparison of earning strategies. CeFi platforms typically demonstrate Sharpe ratios between 0.8-1.2 with maximum drawdowns of 5-15%, whilstDeFi protocols show higher volatility with Sharpe ratios of 0.6-2.5 and potential drawdowns exceeding 30% during market stress periods.

Quantitative comparison reveals that CeFi platforms provide more consistent returns with lower standard deviation, typically ranging from 8-15% annualized volatility, compared to DeFi protocols which exhibit 25-60% volatility depending on strategy complexity. Professional users implement systematic backtesting procedures, Monte Carlo simulations, and stress testing scenarios that evaluate performance across different market conditions whilstaccounting for platform-specific risks, operational costs, and tax implications that affect net returns.

Regulatory Environment Evolution

Earning strategies in centralised and decentralised finance require careful evaluation of risk-reward profiles. Successful investors diversify across multiple platforms while maintaining appropriate security measures for fund protection.

Institutional Adoption Impact

Financial institutions offering structured cryptocurrency earning products create new opportunities for conservative investors while maintaining regulatory compliance. This institutional involvement provides additional security layers and professional management options for earning strategies.

Technology Innovation Cycles

Earning platform technology emphasises automated portfolio management, risk-adjusted returns, and transparent fee structures. Innovation focuses on creating sustainable earning mechanisms that balance user returns with platform stability and regulatory requirements.

Technical Implementation and Advanced Strategies

Optimising cryptocurrency earning strategies requires understanding platform mechanics, yield sustainability, and risk management principles. Experienced users can leverage both centralised and decentralised earning opportunities to create balanced portfolios that maximise returns while maintaining appropriate risk levels.

Protocol-Level Considerations

Earning platforms utilise different technical approaches to generate yields, with CeFi services typically employing traditional lending and market-making strategies, whilstDeFi protocols leverage automated market makers, liquidity mining, and algorithmic trading strategies that operate transparently through smart contracts.

Advanced Yield optimisation Methodologies

Professional yield optimisation employs sophisticated mathematical models that maximise returns through dynamic allocation algorithms, automated rebalancing protocols, and systematic arbitrage strategies across multiple platforms. Advanced optimisation includes implementation of Kelly Criterion position sizing, Black-Litterman portfolio optimisation, and mean reversion strategies that capitalise on yield differentials while managing correlation risks and operational complexity through systematic execution frameworks.

Institutional yield optimisation requires comprehensive understanding of market microstructure, liquidity dynamics, and execution costs that affect net returns across different platforms and strategies. Professional users implement sophisticated monitoring systems that track real-time opportunities, automated execution protocols that optimise timing and minimise slippage, and comprehensive risk management frameworks that ensure appropriate diversification whilstmaximising yield generation through systematic application of quantitative finance principles and advanced portfolio theory.

Smart Contract Integration

Yield optimisation Techniques

Professional Earning Strategies and Advanced Implementation

Institutional Yield Generation and Portfolio Integration

Professional cryptocurrency earning strategies require sophisticated approaches that integrate both CeFi and DeFi opportunities within comprehensive portfolio management frameworks while addressing regulatory compliance, risk management, and operational efficiency requirements. Institutional applications include treasury management strategies that optimise yield generation on corporate cryptocurrency holdings, endowment and pension fund allocation strategies that incorporate cryptocurrency earning opportunities, and sophisticated hedge fund strategies that leverage both CeFi and DeFi platforms for alpha generation and portfolio diversification.

Advanced portfolio integration techniques include systematic allocation strategies that optimise risk-adjusted returns across different earning opportunities, dynamic rebalancing protocols that maintain optimal allocation while minimising transaction costs, and comprehensive performance measurement frameworks that enable objective evaluation of different earning strategies and continuous optimisation of portfolio performance. Professional users implement sophisticated monitoring systems, automated alerting capabilities, and comprehensive reporting frameworks that enable efficient management of complex multi-platform earning strategies.

Institutional yield generation requires comprehensive understanding of regulatory requirements, fiduciary responsibilities, and operational constraints that affect platform selection and strategy implementation. Professional users implement sophisticated due diligence frameworks, comprehensive risk assessment procedures, and professional-grade operational controls that ensure appropriate risk management whilstmaximising yield generation and maintaining regulatory compliance across multiple jurisdictions and evolving regulatory frameworks.

Cross-Platform optimisation and Arbitrage Strategies

Sophisticated earning strategies leverage yield differentials and market inefficiencies between CeFi and DeFi platforms to implement advanced optimisation techniques that maximise returns while managing operational complexity and transaction costs. These strategies include systematic yield farming across multiple DeFi protocols, cross-platform rate arbitrage between CeFi and DeFi offerings, and dynamic allocation strategies that capitalise on temporary yield premiums while maintaining appropriate risk management and liquidity requirements for optimal performance.

Professional optimisation requires comprehensive understanding of platform mechanics, fee structures, market dynamics, and technical requirements that affect returns and operational efficiency across different environments. Advanced users implement automated monitoring systems that track opportunities in real-time, systematic execution protocols that optimise timing and minimise costs, and comprehensive analytics platforms that enable consistent performance optimisation while managing the increased complexity associated with multi-platform strategies and cross-platform arbitrage opportunities.

Cross-platform strategies require sophisticated risk management frameworks that address platform risks, smart contract vulnerabilities, regulatory changes, and market volatility while maintaining optimal yield generation and operational efficiency. Professional users implement comprehensive diversification strategies, systematic stress testing procedures, and sophisticated contingency planning that ensures appropriate protection against various risk scenarios while maintaining optimal earning potential and operational flexibility across changing market conditions.

Technology Integration and Automation Frameworks

Modern cryptocurrency earning strategies increasingly rely on sophisticated technology integration that automates monitoring, execution, and risk management across multiple platforms while maintaining appropriate security and operational efficiency. Advanced users implement comprehensive API integration, automated portfolio rebalancing, systematic performance tracking, and professional-grade security measures that enable efficient management of complex earning strategies while maintaining appropriate risk management and regulatory compliance across multiple platforms and jurisdictions.

Automation frameworks include sophisticated monitoring systems that provide real-time visibility into earning opportunities and risk factors, automated execution capabilities that optimise timing and minimise transaction costs, and comprehensive reporting systems that enable professional-grade performance measurement and regulatory compliance. These systems integrate with multiple platforms simultaneously, provide unified dashboards for monitoring complex strategies, and implement automated alerting capabilities that ensure timely response to market opportunities and risk events.

Technology integration requires comprehensive security frameworks that protect against cyber threats, implement appropriate access controls, and maintain detailed audit trails that meet professional standards and regulatory requirements. Professional users implement multi-factor authentication, hardware security modules, comprehensive backup systems, and systematic security monitoring that ensures appropriate protection of assets and sensitive information while maintaining operational efficiency and regulatory compliance across multiple platforms and evolving security threat landscapes.

Advanced Earning Strategies and Professional Portfolio Management

Hybrid CeFi-DeFi Allocation Strategies

Professional cryptocurrency earning requires sophisticated allocation strategies that optimise the balance between CeFi stability and DeFi yield opportunities through systematic risk assessment, performance monitoring, and strategic rebalancing procedures. Advanced practitioners implement dynamic allocation frameworks that adjust CeFi-DeFi ratios based on market conditions, yield differentials, and risk tolerance parameters while maintaining optimal diversification across platforms and protocols. These comprehensive approaches enable sustainable income generation through strategic platform selection, systematic risk management, and continuous optimisation of earning opportunities across the evolving cryptocurrency ecosystem with enhanced performance monitoring and strategic implementation excellence for professional cryptocurrency portfolio management and advanced earning optimisation strategies.

Professional cryptocurrency earning requires sophisticated allocation strategies that combine CeFi stability with DeFi innovation through systematic diversification and dynamic rebalancing approaches. Advanced hybrid strategies include allocation frameworks that optimise risk-adjusted returns across both centralised and decentralised platforms while managing correlation risks and operational complexity through strategic portfolio construction and systematic risk management procedures.

Hybrid allocation optimisation includes implementation of dynamic rebalancing systems that adjust CeFi-DeFi ratios based on market conditions, yield opportunities, and risk assessment metrics. Professional hybrid strategies include systematic evaluation of platform performance, comprehensive risk assessment procedures, and strategic timing of allocation adjustments that maximise returns while maintaining appropriate risk controls and operational efficiency for sophisticated earning portfolio management.

Institutional Earning Infrastructure and Enterprise Solutions

Institutional cryptocurrency earning requires enterprise-grade infrastructure that combines regulatory compliance, operational efficiency, and sophisticated risk management across both CeFi and DeFi platforms. Professional institutional solutions include comprehensive custody frameworks, automated compliance monitoring, and sophisticated reporting systems that meet fiduciary standards while enabling access to diverse earning opportunities across centralised and decentralised platforms.

Enterprise earning strategies include implementation of systematic due diligence procedures, comprehensive risk management frameworks, and sophisticated operational controls that ensure appropriate oversight whilstmaximising earning potential. Institutional approaches include development of governance frameworks, implementation of performance measurement systems, and creation of comprehensive audit procedures that meet regulatory requirements while enabling professional participation in cryptocurrency earning opportunities.

Tax optimisation and Regulatory Compliance

Cryptocurrency earning across CeFi and DeFi platforms creates complex tax implications that require sophisticated understanding of regulatory frameworks, reporting requirements, and optimisation strategies across different jurisdictions. Professional tax optimisation includes systematic record-keeping procedures, strategic timing of transactions, and comprehensive understanding of tax treatment differences between centralised and decentralised earning methods.

Regulatory compliance includes implementation of appropriate reporting procedures, systematic documentation of earning activities, and comprehensive understanding of evolving regulatory frameworks that impact cryptocurrency earning across different platforms and jurisdictions. Advanced compliance includes consultation with qualified professionals, implementation of tax-efficient structures, and systematic monitoring of regulatory developments that may impact earning strategies and operational requirements.

Performance Measurement and optimisation

Professional cryptocurrency earning requires sophisticated performance measurement systems that track returns, risk metrics, and operational efficiency across both CeFi and DeFi platforms. Advanced performance measurement includes development of risk-adjusted return metrics, implementation of benchmark comparison procedures, and systematic evaluation of earning strategies that enable continuous optimisation and improvement of portfolio performance and risk management effectiveness.

optimisation strategies include systematic analysis of platform performance data, implementation of improvement procedures based on performance insights, and development of adaptive frameworks that enhance earning effectiveness while maintaining risk controls. Professional optimisation includes continuous evaluation of new opportunities, systematic assessment of emerging platforms and strategies, and implementation of innovation procedures that maintain competitive advantages while ensuring appropriate risk management and operational excellence for long-term earning success and sustainable growth with professional excellence.

Conclusion

The choice between CeFi and DeFi earning strategies in 2025 represents a fundamental decision about how you want to balance risk, reward, and control in your cryptocurrency investment approach. Both ecosystems have matured significantly, offering sophisticated earning opportunities that can generate substantial returns when properly understood and implemented with appropriate risk management strategies.

CeFi platforms excel in providing user-friendly experiences, regulatory compliance, and predictable yields that appeal to investors seeking familiar financial services adapted for cryptocurrency. The convenience, customer support, and insurance coverage offered by leading CeFi platforms make them ideal for beginners and conservative investors who prioritise security and simplicity over maximum yield potential.

DeFi protocols offer unparalleled transparency, innovation, and yield potential through direct participation in decentralised financial markets. The composability and programmability of DeFi enable sophisticated earning strategies that aren't possible in traditional finance. Still, they require technical knowledge, active management, and acceptance of the risks of smart contracts and the market.

The most successful cryptocurrency earners in 2025 often employ hybrid strategies that leverage the strengths of both ecosystems. This approach allows investors to benefit from the stability and convenience of CeFi while capturing the higher yields and innovation available in DeFi, creating diversified earning portfolios that can adapt to changing market conditions and opportunities.

Risk management remains paramount regardless of which approach you choose, as both CeFi and DeFi carry significant risks that can result in substantial losses if not properly managed. Understanding these risks, implementing appropriate mitigation strategies, and maintaining diversification across platforms and strategies is essential for long-term success in cryptocurrency earning.

Looking forwards, the convergence of CeFi and DeFi will likely accelerate, with traditional financial institutions adopting DeFi technologies while DeFi protocols implement more user-friendly interfaces and risk management features. This evolution will create new opportunities for earning cryptocurrency while potentially reducing some of the current barriers and risks associated with each approach.

Sources

Frequently Asked Questions

- Which earns more in 2025: CeFi or DeFi?

- DeFi typically offers higher variable yields but with higher technical and protocol risk. CeFi offers simpler access with steadier rates but introduces counterparty risk and often includes yield caps. The best approach depends on your risk tolerance, technical skills, and time commitment.

- Is CeFi safer than DeFi?

- Neither is universally safer. CeFi concentrates risk in the custodian and regulatory changes. DeFi exposes you to smart-contract and governance risks. Diversification across both approaches helps manage different types of risk.

- Can I use both CeFi and DeFi?

- Yes, many investors combine CeFi for simplicity and DeFi for higher-yield opportunities, balancing risk, time commitment, and returns across both approaches. This hybrid strategy is often optimal for intermediate users.

- What's the minimum amount to start with each approach?

- CeFi: Most platforms have low minimums ($10–100), making them accessible for small investors.

DeFi: Ethereum gas costs make ~$500+ more practical, though Layer 2 networks allow smaller amounts ($50–100). - How do taxes work for CeFi vs DeFi earnings?

- Both are generally taxed as income when earned:

- CeFi: Many platforms provide tax documents and basic reporting tools.

- DeFi: You are responsible for tracking all transactions and calculating gains.

- Tools: Use services like Koinly or CoinTracker to aggregate and calculate tax data.

- What happens if a CeFi platform fails?

- Risks include:

- Total loss: If the platform becomes insolvent (as with FTX).

- Frozen funds: Temporary or permanent withdrawal restrictions.

- Partial recovery: Bankruptcy proceedings may recover some funds.

- Insurance: Some platforms offer limited insurance coverage, but it rarely covers all users fully.

- What happens if a DeFi protocol is exploited?

- Potential outcomes:

- Partial loss: Exploits may drain only part of protocol funds.

- Total loss: Complete protocol failure in worst cases.

- Insurance claims: Some setups use insurance solutions such as Nexus Mutual.

- Community recovery: Some protocols attempt to compensate users after exploits.

- Should beginners start with CeFi or DeFi?

- Most beginners should start with CeFi because:

- Lower complexity: Familiar interface and customer support.

- Reduced risk of user error: Menus and flows are simpler.

- Learning opportunity: Easier to understand markets before facing DeFi complexity.

- Gradual transition: You can move to DeFi after gaining experience and confidence.