Curve Finance Review 2025: Stablecoin DEX

Low-slippage swaps, deep liquidity for like-assets, boosted yields, and broad DeFi integrations. Here's how Curve stacks up in 2025.

Curve Finance has established itself as the premier decentralised exchange for stablecoin and similar-asset trading, revolutionising how DeFi users swap between pegged assets with minimal slippage. Since its launch in 2020, Curve has grown to become one of the largest DeFi protocols by total value locked, consistently ranking amongst the top 5 DeFi platforms with over $2 billion in TVL

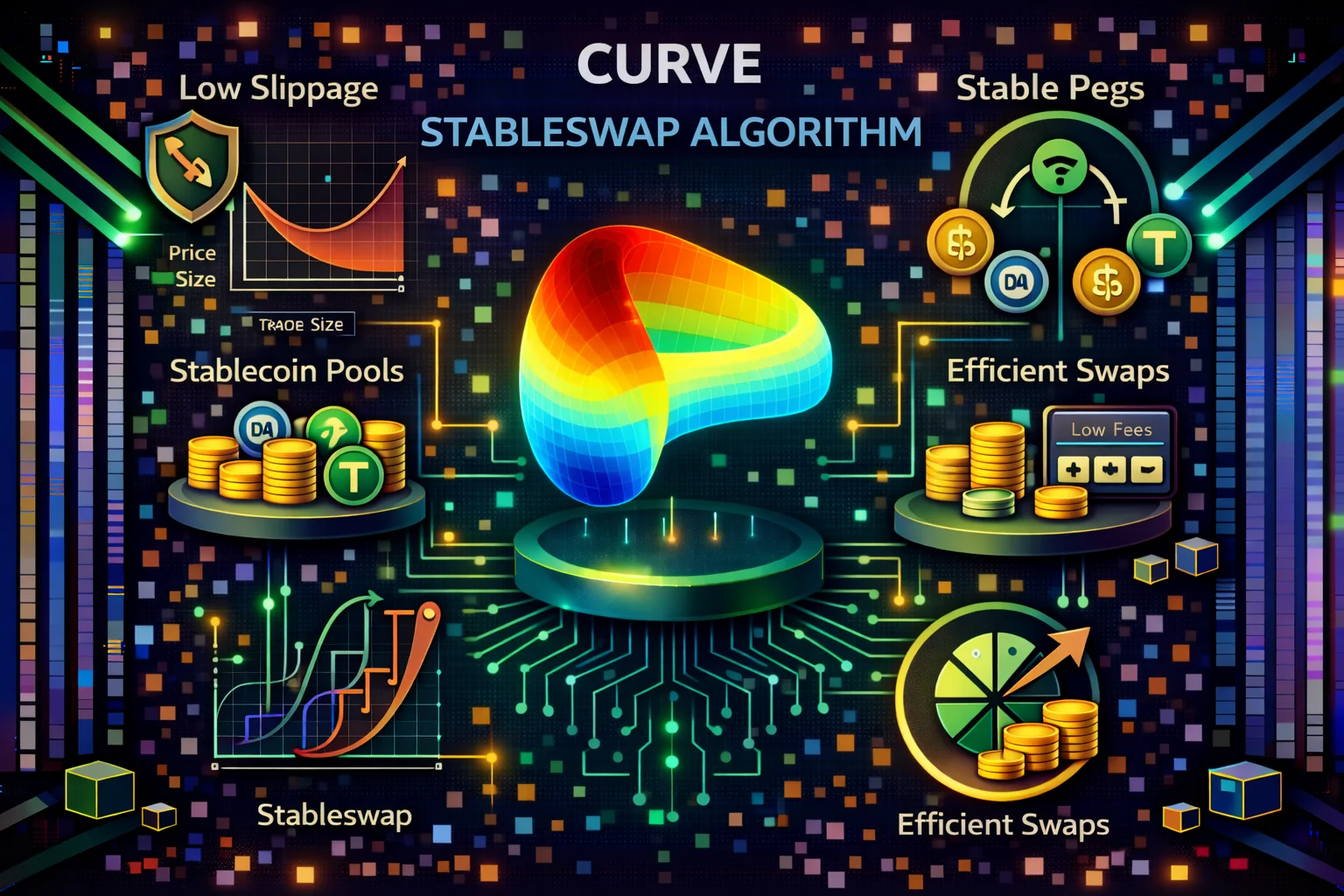

Unlike traditional AMMs that use constant product formulas, Curve employs sophisticated bonding curves specifically optimised for assets that should trade close to 1:1 ratios. This innovation enables users to swap large amounts of stablecoins, wrapped tokens, and liquid staking derivatives with significantly lower slippage than competing platforms.

The platform has become indispensable for institutional traders and yield farmers who require efficient execution for large stablecoin swaps. Major DeFi protocols integrate Curve as their primary liquidity source, while aggregators route trades through Curve pools to achieve optimal pricing for users.

The protocol's governance token, CRV, introduces a unique vote-escrow (veCRV) mechanism that allows long-term token holders to boost their liquidity provision rewards by up to 2.5x while participating in protocol governance. This system has created the famous "Curve Wars", where protocols compete to accumulate veCRV voting power to direct CRV emissions to their preferred pools.

Curve's multichain expansion has brought its efficient AMM technology to Ethereum Layer 2 networks, Polygon, Arbitrum, Optimism, and other major blockchains. This expansion enables users to access Curve's low-slippage trading across multiple ecosystems while benefiting from reduced gas costs and faster transaction finality.

The platform's integration with yield optimisation protocols like Convex Finance and Yearn Finance has created sophisticated strategies for maximising returns on stablecoin holdings. These partnerships allow users to earn multiple layers of rewards while maintaining exposure to stable assets.

This comprehensive review examines Curve's mechanics, yield opportunities, security considerations, and overall value proposition for DeFi users in 2025. We'll analyse everything from basic swapping functionality to advanced yield farming strategies, helping you understand how to effectively utilise Curve's unique features for optimal returns while managing associated risks.

Introduction

The decentralised finance (DeFi) revolution has fundamentally transformed how we interact with financial services, eliminating traditional intermediaries and enabling direct peer-to-peer financial transactions through smart contracts. Within this rapidly evolving ecosystem, Curve Finance has emerged as one of the most innovative and essential protocols, specifically designed to address the unique challenges of trading between assets that should, in theory, maintain similar values, such as different stablecoins or liquid staking derivatives.

Since its launch in January 2020 by Michael Egorov, Curve Finance has revolutionised the concept of automated market makers (AMMs) by introducing the StableSwap algorithm, a groundbreaking approach that dramatically reduces slippage when trading between like assets. This innovation has made Curve the go-to platform for efficient stablecoin swaps, liquid staking token exchanges, and other similar-asset trades, processing billions of dollars in volume while maintaining some of the lowest slippage rates in the entire DeFi ecosystem.

What distinguishes Curve from traditional AMMs like Uniswap is its specialised focus on capital efficiency for assets that should maintain similar values. Whilst traditional constant-product market makers work well for volatile asset pairs, they are inefficient for stablecoin trades, where users expect minimal price impact. Curve's bonding curve algorithm solves this problem by concentrating liquidity around the expected price range, enabling large trades with minimal slippage while still providing attractive yields for liquidity providers.

Beyond its technical innovations, Curve has become a cornerstone of the broader DeFi ecosystem, serving as critical infrastructure for numerous other protocols. The platform's governance token, CRV, has sparked the phenomenon known as "Curve Wars," where various DeFi protocols compete to accumulate voting power to direct CRV emissions to their preferred liquidity pools. This dynamic has created a complex but lucrative ecosystem where understanding Curve's mechanics can unlock significant yield opportunities for sophisticated users.

In 2025, Curve Finance continues to evolve and expand its influence across the DeFi landscape, with deployments on multiple blockchains, integration with new asset types, and continuous improvements to user experience and capital efficiency. This comprehensive review examines every aspect of Curve Finance, from its technical architecture and yield generation mechanisms to its competitive positioning and future prospects, providing both newcomers and experienced DeFi users with the insights needed to effectively navigate and utilise this powerful protocol.

What's New in Curve 2025

Curve has continued to evolve in 2025, with significant improvements to the user experience, enhanced analytics for tracking fees and impermanent loss, and deeper integrations with partner protocols to boost rewards. The platform has expanded its multichain presence, improving accessibility through DEX aggregators and enhancing cross-chain liquidity management.

New pool types have been introduced to support emerging asset classes, including liquid staking derivatives, real-world assets, and cross-chain bridged tokens. The governance system has been refined to provide more granular control over pool parameters and fee structures, while maintaining the decentralised decision-making process that has made Curve a cornerstone of DeFi.

Technical improvements include gas optimisations for Ethereum mainnet transactions, enhanced security measures for new pool deployments, and better integration with yield-optimisation protocols such as Convex and Yearn Finance. These updates maintain Curve's position as the leading automated market maker for stable and like-asset trading.

Curve Overview: The Stablecoin DEX

Curve, launched in 2020 by Michael Egorov, revolutionised decentralised trading by creating an automated market maker (AMM) optimised explicitly for stablecoins and assets with similar values. Unlike traditional AMMs that use constant-product formulas, Curve employs specialised bonding curves that minimise slippage for trades between like assets.

The protocol has become the backbone of DeFi's stablecoin infrastructure, facilitating billions of dollars in trading volume while providing deep liquidity for USD-pegged assets. Curve's innovation extends beyond simple swapping to include sophisticated yield generation mechanisms through liquidity provision, governance participation, and integration with other DeFi protocols.

What sets Curve apart is its focus on capital efficiency for specific asset types. Whilst other DEXs try to serve all trading pairs, Curve excels at what it does best: providing the deepest liquidity and lowest slippage for stablecoins, liquid staking tokens, and other correlated assets. This specialisation has made it indispensable for DeFi users and protocols alike.

AMM Mechanics & Pool Design

StableSwap Algorithm

Curve's StableSwap algorithm combines the benefits of constant product (x*y=k) and constant sum (x+y=k) formulas to create optimal pricing for assets that should trade near parity. The algorithm behaves like a constant-sum formula when assets are balanced (minimal slippage) and transitions to constant-product behaviour when assets become imbalanced (preventing depletion).

Amplification Parameter

Each Curve pool has an amplification parameter (A) that determines how "flat" the bonding curve is around the balanced point. Higher A values create flatter curves with less slippage for balanced trades but higher slippage when pools become imbalanced. This parameter is carefully calibrated for each asset type and can be adjusted through governance.

Pool Types and Configurations

Curve supports various pool configurations, including basic pools (2-4 assets), metapools (pairing individual tokens with base pools), and factory pools (permissionless deployment). Each configuration serves different use cases, from simple stablecoin swapping to complex multi-asset strategies involving yield-bearing tokens.

Liquidity Provider Mechanics

Liquidity providers deposit assets into pools and receive LP tokens representing their share of the pool. These LP tokens can be staked to earn CRV rewards, used as collateral in other protocols, or held to earn trading fees. The LP token value fluctuates based on trading fees earned and any impermanent loss from asset price divergence.

Yield Generation & Reward Systems

Trading Fee Revenue

Curve pools generate revenue through trading fees, which typically range from 0.04% to 0.4%, depending on the pool type and governance decisions. These fees are distributed proportionally to liquidity providers based on their pool share. High-volume pools with consistent trading activity provide steady fee income for LPs.

CRV Token Emissions

The CRV token serves as Curve's governance and incentive token, with emissions distributed to liquidity providers in eligible pools. The emission schedule follows a decreasing curve over time, with governance controlling which pools receive CRV rewards and at what rates. These emissions significantly boost yields for participating LPs.

veCRV Boost Mechanism

Users can lock CRV tokens for up to 4 years to receive vote-escrowed CRV (veCRV), which provides governance voting power and boosts CRV rewards by up to 2.5x. The boost amount depends on the user's veCRV balance relative to their LP position size. This mechanism encourages long-term commitment and active participation in governance.

External Protocol Incentives

Many protocols incentivise liquidity for their tokens by providing additional rewards to Curve LPs. These can include native protocol tokens, stablecoin rewards, or other incentives. Protocols like Convex and Yearn Finance have built entire ecosystems around optimising and compounding Curve yields for users.

Pool Categories & Strategies

Stablecoin Pools

The foundation of Curve's ecosystem consists of stablecoin pools, such as 3Pool (USDC/USDT/DAI) and its related variants. These pools offer relatively low risk with steady yields from trading fees and CRV emissions. They serve as the foundation for many DeFi strategies and provide essential liquidity for stablecoin swaps across the ecosystem.

Liquid Staking Token Pools

Pools containing liquid staking tokens (stETH, rETH, cbETH) have become increasingly popular, allowing users to trade between different staking derivatives while earning yields. These pools carry additional risks from staking, slashing, and liquid staking protocol risks, but offer higher potential returns through staking rewards plus trading fees.

Bitcoin Pools

Curve hosts several Bitcoin-related pools featuring wrapped Bitcoin variants (WBTC, renBTC, sBTC). These pools enable efficient trading between different Bitcoin representations on Ethereum while providing yield opportunities for Bitcoin holders who want to remain exposed to BTC price movements.

Exotic and Experimental Pools

Factory pools enable the permissionless creation of new trading pairs, resulting in experimental pools with diverse risk-reward profiles. These might include algorithmic stablecoins, synthetic assets, or novel DeFi tokens. Whilst potentially offering higher yields, these pools carry significantly higher risks and require careful evaluation.

Governance & Tokenomics

CRV Token Distribution

CRV has a total supply of approximately 3 billion tokens distributed over time through various mechanisms. The majority of the funds go to liquidity providers, with allocations for team members, investors, and community reserves. The emission schedule decreases over time, creating potential scarcity as the protocol matures.

Governance Process

Curve governance operates through a proposal-and-voting system in which veCRV holders can vote on protocol changes, including fee structures, pool parameters, and CRV emission allocations. The governance process includes discussion phases, formal proposals, and implementation periods to ensure community consensus on important decisions.

Gauge Weight Voting

veCRV holders participate in gauge-weight voting to determine how CRV emissions are distributed across pools. This creates a competitive dynamic where protocols lobby for votes to direct more rewards to their pools, often through bribes or incentive programs that benefit veCRV holders.

Revenue Sharing

Curve generates revenue through trading fees, with a portion potentially shared with veCRV holders through governance decisions. The protocol also benefits from the value accrual of CRV tokens and the ecosystem effects of being a critical component of DeFi infrastructure.

Multi-Chain Expansion & Integration

Ethereum Layer 2 Deployments

Curve has expanded to multiple Ethereum Layer 2 networks, including Polygon, Arbitrum, and Optimism, enabling users to pay lower transaction costs while maintaining the same core functionality. Each deployment operates independently but benefits from the shared Curve brand and proven technology.

Alternative Blockchain Networks

Beyond Ethereum and its L2S, Curve operates on networks such as Avalanche, Fantom, and others, each serving local DeFi ecosystems with stablecoin and similar-asset trading needs. These deployments often feature network-specific incentives and partnerships with local protocols.

Cross-Chain Liquidity

Whilst each Curve deployment operates independently, various bridge protocols and cross-chain strategies allow for liquidity arbitrage and yield optimisation across networks. Users can transfer assets between chains to capitalise on different yield opportunities or lower transaction costs.

Integration Ecosystem

Curve's deep integration with other DeFi protocols creates a network effect, making its liquidity increasingly valuable over time. Protocols like Aave, Compound, and Yearn Finance rely on Curve for efficient stablecoin swapping, while yield optimisers build strategies around Curve pools.

Risks & Security Considerations

Impermanent Loss

Whilst Curve pools are designed for assets that should maintain similar values, impermanent loss can still occur when assets depeg or diverge in price. Stablecoin depegging events, liquid staking token discounts, or wrapped asset premiums/discounts can all create impermanent loss for liquidity providers.

Smart Contract Risks

Despite extensive auditing and battle-testing, Curve smart contracts carry inherent risks, including bugs, exploits, or unexpected interactions with other protocols. The complexity of AMM algorithms and governance systems creates multiple potential attack vectors that users should be aware of.

Governance Risks

As a decentralised protocol, Curve is subject to governance decisions that could potentially harm users or change protocol economics. Large veCRV holders or coordinated groups could potentially influence decisions in ways that benefit them at the expense of smaller users.

Liquidity and Market Risks

Pool liquidity can vary significantly, particularly on smaller chains or for newly launched pools. Low liquidity increases slippage and makes large trades more expensive. Additionally, market conditions can affect trading volumes and fee generation, thereby impacting LP returns.

Regulatory Considerations

As DeFi protocols face increasing regulatory scrutiny, Curve could be affected by regulations targeting decentralised exchanges, governance tokens, or yield-generating activities. Users should stay informed about regulatory developments in their jurisdictions.

User Experience & Interface

Web Interface

Curve's web interface prioritises functionality over aesthetics, providing comprehensive information about pools, yields, and trading options. Whilst the design may seem utilitarian compared to newer DeFi protocols, it offers detailed analytics and transparent information that experienced users appreciate.

Mobile Accessibility

The Curve interface is compatible with mobile devices through web browsers, although it's primarily designed for desktop use. Mobile users can perform basic functions, such as swapping and liquidity provision, but complex operations, such as governance voting, are better suited to desktop interfaces.

Third-Party Integrations

Many users access Curve through third-party interfaces and aggregators, which enhance the user experience. Platforms like 1inch, Paraswap, and Zapper integrate Curve liquidity while offering more polished interfaces and additional features, such as portfolio tracking and yield optimisation.

Educational Resources

Curve provides documentation and educational content to help users understand the mechanics, risks, and strategies of the protocol. However, the protocol's technical nature means that new users often benefit from community-created guides and tutorials that explain concepts in more accessible terms.

Advanced Mathematical Framework and Automated Market Maker Innovation

Curve Finance's revolutionary StableSwap invariant represents a breakthrough in automated market maker (AMM) design, utilising sophisticated mathematical principles that combine the benefits of constant product and constant sum formulas to create optimal trading conditions for similar assets. The StableSwap algorithm employs advanced calculus and numerical optimisation techniques to maintain extremely low slippage for assets that should trade near parity, while gracefully degrading to constant product behaviour when assets deviate significantly from their expected ratios.

The mathematical foundation of Curve's AMM includes complex differential equations that govern price discovery, sophisticated optimisation algorithms that minimise impermanent loss for liquidity providers, and advanced statistical models that predict optimal pool parameters based on historical trading patterns and volatility analysis. Professional traders and institutional users benefit from understanding these mathematical principles to optimise their trading strategies, liquidity provision timing, and risk management approaches within Curve's unique AMM environment.

Institutional Liquidity Management and Professional Trading Infrastructure

Professional asset managers and institutional traders utilise Curve Finance as critical infrastructure for large-scale stablecoin operations, cross-asset arbitrage, and sophisticated treasury management. Institutional approaches to Curve include advanced portfolio optimisation techniques that leverage the platform's deep liquidity pools, low slippage, and comprehensive yield-generation opportunities to execute complex trading strategies while maintaining appropriate risk controls and regulatory compliance standards.

Advanced institutional strategies incorporate quantitative models that analyse pool dynamics, yield-optimisation algorithms that maximise returns across multiple Curve pools simultaneously, and sophisticated risk management frameworks that account for smart contract risks, impermanent loss scenarios, and correlation analysis across different asset classes. Professional users implement comprehensive due diligence processes that evaluate pool security, tokenomics sustainability, and governance risks to construct diversified Curve-based strategies that meet institutional requirements for transparency, security, and performance consistency.

Cross-Chain Integration and Multi-Network optimisation Strategies

Curve Finance's expansion across multiple blockchain networks, including Ethereum, Polygon, Arbitrum, Optimism, and Avalanche, creates sophisticated opportunities for cross-chain arbitrage, multi-network yield optimisation, and comprehensive liquidity management strategies. Professional users implement advanced cross-chain strategies that leverage different network characteristics, gas cost structures, and incentive programs to maximise risk-adjusted returns while managing the complexities of multi-chain DeFi operations and bridge security considerations.

Advanced cross-chain optimisation includes automated rebalancing systems that monitor yield opportunities across networks, sophisticated arbitrage-detection algorithms that identify temporary price discrepancies between chains, and comprehensive risk-management frameworks that account for bridge risks, network congestion, and cross-chain transaction failures. These strategies require a deep understanding of blockchain interoperability, bridge mechanics, and advanced portfolio optimisation techniques that enable systematic capture of cross-chain yield opportunities while maintaining appropriate security and operational controls.

Governance Participation and Protocol Development Influence

Curve Finance's governance system enables sophisticated participants to influence protocol development, fee structures, and emission distributions through the veCRV (vote-escrowed CRV) mechanism. Professional governance participants implement comprehensive voting strategies that consider long-term protocol sustainability, yield optimisation opportunities, and ecosystem development priorities to maximise their influence while supporting beneficial protocol evolution and community growth initiatives.

Advanced governance strategies include sophisticated analysis of proposal impacts, comprehensive evaluation of protocol upgrade implications, and strategic coordination with other governance participants to achieve beneficial outcomes for the broader Curve ecosystem. Professional participants utilise quantitative models to evaluate the long-term value implications of governance decisions, implement systematic approaches to proposal evaluation, and maintain comprehensive monitoring systems that track governance outcomes and their impact on protocol performance and user value creation.

Risk Management and Security Analysis Framework

Professional Curve Finance participation requires comprehensive risk management frameworks that address smart contract risks, impermanent loss scenarios, governance risks, and broader DeFi ecosystem dependencies. Advanced risk management includes sophisticated stress-testing scenarios that evaluate pool performance under extreme market conditions, comprehensive security analysis of smart contract code and upgrade mechanisms, and systematic monitoring of protocol dependencies and external risk factors that could impact user funds and yield-generation capabilities.

Institutional risk management approaches incorporate advanced quantitative models, including value-at-risk calculations, expected shortfall analysis, and comprehensive correlation modelling that evaluates the interdependencies between different Curve pools and broader DeFi ecosystem risks. Professional users implement systematic monitoring systems that track pool health metrics, governance developments, and security incidents across the broader DeFi ecosystem to maintain appropriate risk controls while maximising yield generation opportunities through sophisticated Curve-based strategies.

Curve vs DeFi Competitors

Curve vs Uniswap

Uniswap offers broader token coverage and concentrated liquidity features, but lacks Curve's specialisation in stablecoin trading. Uniswap V3's concentrated liquidity can provide higher capital efficiency for volatile pairs but requires active management. Curve excels for stablecoin swaps while Uniswap dominates general token trading.

Curve vs Balancer

Balancer offers more flexible pool configurations with multiple assets and custom weightings, whereas Curve focuses specifically on trading like assets. Balancer's composable pools and protocol-owned liquidity features provide different use cases, but Curve maintains advantages in stablecoin trading efficiency and established liquidity.

Curve vs centralised Exchanges

Centralised exchanges like Binance or Coinbase offer better user experience and customer support, but require custody of funds and KYC compliance. Curve provides self-custody and permissionless access but requires technical knowledge and carries smart contract risks.

Curve vs Yield Platforms

Compared to centralised yield platforms like Nexo, Curve offers transparency and self-custody but requires active management and technical understanding. Centralised platforms may offer higher advertised yields but carry counterparty risk and regulatory restrictions.

Advantages & Disadvantages

Advantages:

- specialised Efficiency: Optimal AMM design for stablecoins and like-assets

- Deep Liquidity: Established pools with billions in total value locked

- Yield Opportunities: Multiple revenue streams from fees, emissions, and boosts

- Battle-Tested Security: Years of operation without major exploits

- Governance Participation: veCRV system provides meaningful protocol control

- Multi-Chain Presence: Available across multiple blockchain networks

- DeFi Integration: Core infrastructure used by many other protocols

- Transparent Operations: All parameters and mechanics are publicly visible

- No KYC Required: Permissionless access for global users

- Continuous Innovation: Regular improvements and new pool types

Disadvantages:

- Complex Mechanics: veCRV boosting and governance require deep understanding

- Impermanent Loss Risk: Asset depegging can cause losses even in stable pools

- Gas Costs: Ethereum mainnet transactions can be expensive

- Utilitarian Interface: Less polished UX compared to newer protocols

- Limited Asset Scope: Focused on stablecoins and like-assets only

- Governance Concentration: Large veCRV holders have disproportionate influence

- Technical Barriers: Requires DeFi knowledge for optimal usage

- Smart Contract Risk: Potential for bugs or exploits despite auditing

Getting Started with Curve

Wallet Setup

To use Curve, you'll need a Web3 wallet like MetaMask, WalletConnect, or a hardware wallet like Ledger. Ensure your wallet is connected to the correct network and has sufficient native tokens to cover transaction fees. Start with small amounts to familiarise yourself with the interface and mechanics.

Choosing Your First Pool

Begin with established stablecoin pools, such as 3Pool (USDC/USDT/DAI), which offer lower risk and steady yields. These pools provide good learning opportunities while generating modest returns from trading fees and CRV emissions. Avoid exotic or new pools until you understand the risks and mechanics.

Understanding Yields and Boosts

Study the different yield components, including base APY from trading fees, CRV emissions, and potential boosts from veCRV holdings. Utilise Curve's analytics tools to gain insight into historical performance and projected returns. Please note that yields fluctuate based on market conditions and protocol updates.

Risk Management Strategies

Diversify across multiple pools and chains to reduce concentration risk, monitor your positions regularly for impermanent loss, set aside funds for transaction fees, and never invest more than you can afford to lose. Consider starting with smaller positions and scaling up as you gain experience.

User Reviews & Community Feedback

Positive User Experiences

"My go-to for stablecoin swaps; fees add up nicely for LPs in the right pools. The 3Pool has been consistently profitable for me over the past year, and the CRV rewards are a nice bonus." — Elena, Italy

"Boosts are powerful but not plug-and-play — read the docs first. Once you understand the mechanics of veCRV, the yield enhancement is significant. I've been able to achieve 2x boost on most of my positions." — Kenji, Japan

"Curve is essential DeFi infrastructure. I use it for large stablecoin swaps with minimal slippage, and the liquidity is always there when I need it. The governance participation through veCRV is also rewarding." — Marcus, Germany

Common User Concerns

"The interface feels dated compared to newer DeFi protocols, and understanding all the mechanics takes time. I wish there were better onboarding materials for beginners." — Sarah, UK

"Gas fees on Ethereum make small positions uneconomical. I mostly use Curve on Polygon now, but the yields aren't as attractive as mainnet." — Carlos, Mexico

Community Sentiment

The Curve community is highly engaged and technical, with a strong appreciation for the protocol's role in DeFi infrastructure. Users value transparency, participation in governance, and consistent yields, though many acknowledge the learning curve required to use them optimally. The protocol maintains high levels of trust and is often recommended as essential DeFi infrastructure.

Curve vs Competitors

| Feature | Curve | Uniswap | Balancer |

|---|---|---|---|

| Focus | Stablecoins | All pairs | Multi-asset |

| Slippage | Very low | Moderate | Moderate |

| Governance Token | CRV (veCRV) | UNI | BAL |

| LP Boost | Up to 2.5x | No | Yes (veBAL) |

| Complexity | High | Medium | High |

| Best For | Stable swaps | General trading | Custom pools |

Advanced Curve Implementation and Professional DeFi Strategies

Institutional Stablecoin Management and Yield optimisation

Professional Curve Finance implementations enable sophisticated institutional stablecoin management strategies that leverage the protocol's specialised architecture for corporate treasury optimisation, systematic yield generation, and comprehensive liquidity management frameworks. Enterprise applications include systematic treasury optimisation for corporate stablecoin holdings, sophisticated yield enhancement strategies through veCRV governance participation, and comprehensive risk management procedures that maximise returns while managing smart contract risks, impermanent loss exposure, and operational complexity for institutional DeFi participation and professional cryptocurrency treasury management.

Advanced institutional strategies require a comprehensive understanding of Curve's governance mechanisms, vote-escrowed token economics, and gauge weight optimisation that enables sophisticated yield enhancement through strategic governance participation and systematic reward optimisation. Professional users implement comprehensive veCRV accumulation strategies, systematic bribe optimisation techniques, and advanced gauge voting procedures that enable institutional users to benefit from Curve Wars dynamics while maintaining appropriate risk management and regulatory compliance for professional DeFi operations and institutional cryptocurrency management.

Cross-Protocol Integration and Multi-Chain optimisation

Professional Curve strategies increasingly leverage cross-protocol integration and multichain optimisation techniques that maximise yield generation across different blockchain networks while managing operational complexity and cross-chain risks. Advanced users implement systematic cross-chain arbitrage strategies, comprehensive multiprotocol yield farming, and sophisticated bridge utilisation techniques that optimise returns while managing the increased complexity associated with multi-chain DeFi operations and cross-protocol yield optimisation strategies for professional cryptocurrency management.

Multiprotocol integration requires a comprehensive understanding of DeFi ecosystem dynamics, systematic analysis of yield opportunities across different protocols, and advanced risk assessment procedures that enable optimal protocol selection and allocation strategies. Professional users implement automated monitoring systems, comprehensive performance tracking, and systematic rebalancing protocols that ensure optimal multi-protocol yield generation while maintaining appropriate risk management and operational efficiency across complex DeFi strategies and evolving protocol landscapes for institutional cryptocurrency operations.

Comprehensive Curve Ecosystem Analysis and Strategic Implementation

Advanced Liquidity Provision Strategies and Yield Optimisation

Professional Curve Finance liquidity provision requires a sophisticated understanding of pool mechanics, yield optimisation techniques, and comprehensive risk management strategies that enable systematic profit generation while managing impermanent loss exposure and operational complexity. Advanced liquidity providers implement systematic pool-selection methodologies, comprehensive yield-analysis frameworks, and sophisticated rebalancing strategies that maximise returns across different market conditions while maintaining appropriate risk levels and operational efficiency for long-term DeFi participation and professional yield-generation strategies.

Yield optimisation strategies include systematic veCRV accumulation for boost maximisation, comprehensive gauge weight analysis for optimal pool selection, and advanced bribe optimisation techniques that enable professional users to maximise returns through strategic governance participation. Professional liquidity providers utilise automated monitoring systems, comprehensive performance tracking, and systematic rebalancing protocols that ensure optimal yield generation while adapting to changing market conditions, protocol developments, and competitive dynamics within the evolving DeFi ecosystem and the Curve Finance protocol landscape.

Governance Participation and Vote-Escrowed CRV Strategies

Strategic veCRV accumulation and governance participation enable sophisticated yield enhancement strategies that leverage Curve's governance mechanisms for systematic profit optimisation and ecosystem influence. Professional governance participants implement comprehensive veCRV accumulation strategies, systematic gauge voting optimisation, and advanced bribe collection techniques that maximise returns while contributing to protocol development and ecosystem growth through informed governance participation and strategic voting coordination across different governance proposals and ecosystem initiatives.

Advanced governance strategies require a comprehensive understanding of Curve Wars dynamics, systematic analysis of gauge weight optimisation opportunities, and sophisticated coordination mechanisms that enable professional users to maximise governance rewards while supporting ecosystem development. Professional participants utilise automated governance tools, comprehensive proposal analysis frameworks, and systematic voting coordination systems that ensure optimal governance participation while maintaining appropriate risk management and strategic alignment with long-term protocol development and ecosystem growth objectives.

Risk Management and Security Considerations for Professional Users

Professional Curve Finance participation requires comprehensive risk management frameworks that address smart contract risks, impermanent loss exposure, and operational complexity while maintaining optimal yield generation and strategic positioning within the DeFi ecosystem. Advanced risk management includes systematic smart contract auditing procedures, comprehensive impermanent-loss modelling, and sophisticated operational risk assessment, enabling informed decision-making while maintaining appropriate risk levels for professional DeFi participation and institutional cryptocurrency management strategies.

Security considerations include comprehensive protocol analysis, systematic vulnerability assessment, and advanced monitoring systems that protect against smart contract risks, governance attacks, and operational failures. Professional users implement multi-layered security frameworks, comprehensive backup procedures, and sophisticated incident response protocols that ensure asset protection while maintaining operational efficiency and strategic positioning within the evolving DeFi landscape and the Curve Finance ecosystem.

Integration with Broader DeFi Ecosystem and Yield Farming Strategies

Curve Finance serves as a foundational component within broader DeFi yield farming strategies that leverage cross-protocol integration, systematic yield optimisation, and comprehensive portfolio management techniques for professional cryptocurrency operations. Advanced users implement systematic cross-protocol arbitrage strategies, comprehensive yield farming optimisation, and sophisticated portfolio rebalancing techniques that maximise returns while managing operational complexity and cross-protocol risks associated with multi-protocol DeFi strategies and evolving ecosystem dynamics.

Ecosystem integration includes systematic analysis of yield farming opportunities across different protocols, comprehensive risk assessment for cross-protocol strategies, and advanced automation systems that enable optimal protocol selection and allocation strategies. Professional users utilise comprehensive monitoring systems, automated rebalancing protocols, and systematic performance tracking to ensure optimal multi-protocol yield generation while maintaining appropriate risk management and operational efficiency across complex DeFi strategies and evolving protocol landscapes for institutional cryptocurrency operations and professional yield optimisation.

Market Analysis and Strategic Positioning for Long-Term Success

Long-term success in Curve Finance requires comprehensive market analysis, systematic strategic positioning, and an advanced understanding of DeFi ecosystem evolution that enables informed decision-making and optimal protocol utilisation. Professional users implement systematic market analysis frameworks, comprehensive competitive assessment procedures, and advanced strategic planning methodologies that ensure optimal positioning within the evolving DeFi landscape while maintaining appropriate risk management and operational efficiency for sustainable long-term participation and professional yield-generation strategies.

Strategic positioning includes comprehensive analysis of protocol development roadmaps, systematic assessment of competitive dynamics, and advanced understanding of regulatory developments that impact DeFi operations and protocol sustainability. Professional participants utilise comprehensive research frameworks, systematic trend analysis, and advanced forecasting methodologies to optimise strategic positioning while adapting to changing market conditions, regulatory developments, and technological innovations within the rapidly evolving DeFi ecosystem and cryptocurrency markets, enabling long-term success and sustainable yield generation.

Professional Tools and Analytics for Curve Finance Optimisation

Professional Curve Finance participation requires sophisticated analytics tools, comprehensive monitoring systems, and advanced automation frameworks that enable optimal protocol utilisation and systematic yield optimisation. Advanced users implement comprehensive analytics platforms, automated monitoring systems, and sophisticated performance tracking tools that provide real-time insights into pool performance, yield optimisation opportunities, and risk management requirements for professional DeFi operations and institutional cryptocurrency management strategies.

Analytics tools include comprehensive yield analysis frameworks, systematic risk assessment platforms, and advanced performance attribution systems that enable informed decision-making and optimal strategy implementation. Professional users utilise automated alert systems, comprehensive reporting frameworks, and sophisticated dashboard solutions that provide comprehensive oversight of Curve Finance operations while maintaining operational efficiency and strategic positioning within the evolving DeFi ecosystem and competitive landscape for sustainable long-term success and professional yield optimisation.

Future Developments and Protocol Evolution Considerations

Curve Finance continues to evolve with significant protocol upgrades, ecosystem expansions, and technological innovations that create new opportunities while requiring adaptive strategies and continuous learning for professional users. Future developments include enhanced cross-chain functionality, improved user experience features, and advanced yield optimisation mechanisms that expand protocol capabilities while maintaining security standards and operational efficiency for professional DeFi participation and institutional cryptocurrency management strategies.

Protocol evolution requires systematic monitoring of development roadmaps, comprehensive analysis of upgrade implications, and advanced strategic planning that enables optimal adaptation to changing protocol features and ecosystem dynamics. Professional users implement systematic upgrade monitoring systems, comprehensive impact assessment procedures, and advanced strategic adaptation frameworks that ensure optimal positioning within the evolving protocol landscape while maintaining appropriate risk management and operational efficiency for long-term success and sustainable yield generation within the dynamic DeFi ecosystem.

Advanced Curve Finance Features and optimisation

Sophisticated Pool Mechanics and Arbitrage Opportunities

Curve Finance's innovative StableSwap algorithm creates unique arbitrage opportunities for sophisticated traders and liquidity providers. The protocol's specialised bonding curves are mathematically optimised for stablecoin trading, maintaining minimal slippage even for large transactions while generating consistent fee revenue for liquidity providers.

Advanced users can leverage Curve's multi-pool architecture to implement complex trading strategies involving cross-pool arbitrage, where price discrepancies between different Curve pools or external exchanges create profitable opportunities. The protocol's deep liquidity and low fees make it an ideal venue for institutional-scale stablecoin operations and treasury management activities.

Gauge System and Governance Token optimisation

Curve's gauge voting system enables CRV token holders to direct liquidity mining rewards towards specific pools, creating a sophisticated governance mechanism that balances protocol incentives with market demands. Strategic gauge voting can significantly impact pool APYs and attract additional liquidity to preferred trading pairs.

The veCRV (vote-escrowed CRV) mechanism rewards long-term token holders with enhanced voting power and fee sharing, creating powerful incentives for protocol alignment. Advanced users can optimise their veCRV positions through strategic lock periods, maximising both governance influence and fee collection while participating in protocol decision-making processes.

Cross-Chain Integration and Multi-Asset Strategies

Curve's expansion across multiple blockchain networks creates opportunities for sophisticated cross-chain yield strategies and liquidity provision. Users can optimise their positions across Ethereum, Polygon, Arbitrum, and other supported networks based on gas costs, yield opportunities, and market conditions.

The protocol's integration with major DeFi ecosystems enables complex strategies involving lending protocols, yield aggregators, and derivatives platforms. Advanced users can implement leveraged liquidity-provisioning strategies, using borrowed assets to increase their Curve positions while managing risk through careful position sizing and hedging.

Institutional Features and Enterprise Integration

Curve Finance provides institutional-grade features including high-capacity pools, minimal slippage for large transactions, and integration with professional trading infrastructure. The protocol's reliability and deep liquidity make it suitable for treasury operations, institutional arbitrage, and large-scale stablecoin management activities.

Enterprise users benefit from Curve's transparent fee structure, predictable execution costs, and integration with major DeFi protocols and centralised exchanges. The protocol's governance model ensures long-term stability and community-driven development, making it a reliable foundation for institutional DeFi strategies and treasury management operations.

Risk Management and Protocol Security

Curve Finance implements comprehensive risk management frameworks that protect liquidity providers and traders from various market and technical risks. The protocol's battle-tested smart contracts have undergone extensive security audits and formal verification processes, establishing a strong track record of reliability and security in the DeFi ecosystem.

Advanced risk management features include automated slippage protection, emergency pause mechanisms, and decentralised governance oversight that ensures protocol security and user protection. These features make Curve suitable for institutional users who require robust risk controls and regulatory compliance capabilities for their DeFi operations.

Our Verdict on Curve 2025

Curve remains a core DeFi primitive in 2025, continuing to provide essential infrastructure for stablecoin trading and yield generation. The protocol's specialised focus on like-asset trading has proven its value over multiple market cycles, maintaining deep liquidity and consistent functionality even during periods of high volatility.

The combination of efficient AMM mechanics, robust governance systems, and extensive DeFi integrations makes Curve indispensable for serious DeFi participants. Whilst the learning curve is steep and the interface may seem utilitarian, the protocol's transparency and battle-tested security provide confidence for users managing significant positions.

For stablecoin swaps and liquidity provision of like assets, Curve is simply unmatched in terms of efficiency and depth. The yield opportunities through LP provision, CRV emissions, and veCRV boosts create compelling reasons for long-term engagement, though users must understand the risks and mechanics involved.

Whether you're looking to swap stablecoins with minimal slippage, earn yield on stable assets, or participate in DeFi governance, Curve provides the tools and liquidity needed for sophisticated DeFi strategies. LPs should size positions prudently, understand the mechanics of boosts, and diversify across pools and chains to achieve optimal risk-adjusted returns.

Conclusion

Curve Finance stands as the undisputed leader in stablecoin and similar-asset trading, offering unmatched efficiency for swapping pegged assets with minimal slippage. The protocol's sophisticated AMM design, combined with deep liquidity pools and innovative tokenomics, creates a compelling platform for both casual users and institutional traders seeking optimal execution for large stablecoin transactions.

The veCRV governance system and yield boosting mechanism add significant value for long-term participants, enabling enhanced returns through strategic CRV locking and active participation in protocol governance. For DeFi users focused on stablecoin strategies, yield farming, or building diversified liquidity provision portfolios, Curve provides essential infrastructure with proven security and reliability.

However, users should carefully consider the complexity of Curve's mechanics, potential impermanent loss in volatile pools, and smart contract risks inherent in DeFi protocols. The platform's specialisation in similar assets means it complements rather than replaces general-purpose DEXs like Uniswap, making it most valuable as part of a broader DeFi strategy.

Overall, Curve Finance represents an excellent choice for users seeking efficient stablecoin trading, competitive yields on stable assets, and participation in one of DeFi's most established and battle-tested protocols. Its continued innovation and strong community governance position it well for sustained relevance in the evolving DeFi landscape of 2025.

Advanced Trading Strategies and Professional Implementation

Professional traders leverage Curve's sophisticated AMM mechanics through advanced strategies including cross-pool arbitrage, yield optimisation across multiple gauges, and strategic CRV accumulation for maximum voting power. These strategies require a deep understanding of Curve's tokenomics, gauge weights, and liquidity dynamics, but can generate substantial returns for experienced DeFi participants who actively manage their positions and participate in governance.

Institutional users benefit from Curve's deep liquidity and minimal slippage for large stablecoin transactions, making it essential infrastructure for treasury management, yield generation, and sophisticated DeFi strategies. The protocol's integration with major DeFi platforms creates opportunities for complex yield-farming strategies that combine Curve's efficient swaps with lending protocols, derivatives platforms, and other yield-generating mechanisms.

Risk Management and Security Considerations for Professional Users

Professional risk management on Curve requires a comprehensive understanding of impermanent loss dynamics, smart contract risks, and governance token volatility that can significantly impact overall returns. Advanced users implement sophisticated hedging strategies, diversify across multiple pools, and carefully monitor gauge weights and CRV emissions to optimise risk-adjusted returns while maintaining exposure to Curve's yield opportunities.

Security best practices include thorough smart contract auditing, careful evaluation of new pool launches, and implementation of position sizing strategies that account for potential smart contract vulnerabilities and market volatility. Professional users also monitor governance proposals, participate in community discussions, and stay informed about protocol developments that could affect their investment strategies and risk profiles.

Future Development and Protocol Evolution Outlook

Curve's roadmap includes continued expansion into new asset classes, enhanced cross-chain functionality, and improved user experience through simplified interfaces and automated strategy implementation. These developments position Curve for sustained growth and relevance in the evolving DeFi ecosystem, while maintaining its core focus on efficient similar-asset trading and competitive yield generation for liquidity providers.

The protocol's commitment to decentralisation, community governance, and continuous innovation ensures its position as essential DeFi infrastructure for stablecoin trading and yield generation. As the DeFi space matures, Curve's specialised focus and proven track record make it a cornerstone protocol for both individual users and institutional participants seeking reliable, efficient, and profitable DeFi strategies in the competitive landscape of decentralised finance.

Sources

Frequently Asked Questions

- What is Curve Finance?

- Curve is a DEX focused on stablecoins and assets with similar pegs, enabling low-slippage swaps and yield from liquidity provision and incentives.

- How do yields work on Curve?

- LPs earn trading fees and, where applicable, additional incentives (e.g., CRV/partner tokens). veCRV boosting and external protocols can further enhance yields.

- What are the main risks?

- Impermanent loss (especially in non-stable pools), smart-contract vulnerabilities, and market/liquidity risks. Always diversify and monitor positions.

- How does Curve compare to Uniswap?

- Curve specialises in stablecoin swaps with lower slippage, while Uniswap handles all token pairs. Curve is better for stable assets, Uniswap for diverse trading pairs.

- Do I need CRV tokens to use Curve?

- No, you can swap and provide liquidity without CRV. However, locking CRV as veCRV boosts your LP rewards up to 2.5x and gives governance voting power.

Affiliate Disclosure

This page contains affiliate links. When you sign up through our referral links, we may earn a commission at no additional cost to you. This helps support our platform and allows us to continue providing valuable content and recommendations.