Best DeFi Platforms 2025: Top Rankings

Decentralised Finance (DeFi) has revolutionised traditional financial services, offering unprecedented opportunities for return optimisation, lending, and trading. This comprehensive analysis examines the top platforms of 2025, evaluating their total value locked (TVL), protection protocols, yield opportunities, and long-term sustainability to help you make informed investment decisions.

Introduction

Decentralised Finance (DeFi) has revolutionised the digital asset landscape by creating an open, permissionless financial system that operates without traditional intermediaries. In 2025, the DeFi ecosystem has matured into a sophisticated network of protocols offering lending, borrowing, trading, yield farming, and asset management services that rival traditional financial institutions in both functionality and scale. With over $200 billion in total value locked across various protocols, DeFi represents one of the most significant innovations in financial technology, providing users worldwide with unprecedented access to financial services and investment opportunities.

The rapid evolution of DeFi protocols has created a complex landscape where choosing the right platforms can significantly impact your investment returns and risk exposure. Each protocol offers unique features, risk profiles, and reward mechanisms, making comprehensive comparison essential for informed decision-making. From established giants like Uniswap and Aave that provide stability and proven track records, to innovative newcomers offering cutting-edge features and higher yield potential, the diversity of options requires careful analysis to match protocols with individual investment goals and risk tolerance.

Security considerations have become paramount in selecting DeFi protocols, as the industry has learnt valuable lessons from past exploits and vulnerabilities. Leading protocols now implement multiple security layers including smart contract audits, bug bounty programs, insurance coverage, and formal verification processes. Understanding these protection protocols and their effectiveness is crucial for protecting your investments while maximising returns in the DeFi ecosystem.

This comprehensive comparison examines the top DeFi protocols across multiple categories, including decentralised exchanges, lending platforms, yield farming opportunities, and emerging innovations. We analyse each protocol's features, protection protocols, tokenomics, governance structures, and historical performance to provide you with the insights needed to build a diversified and profitable DeFi portfolio. Whether you're a DeFi newcomer seeking safe entry points or an experienced user looking for advanced strategies, this guide provides the detailed analysis necessary for successful DeFi investing in 2025.

The DeFi Landscape in 2025

The DeFi ecosystem has matured significantly, with total value locked across all platforms exceeding $200 billion. Improved user experience, enhanced protection protocols, and institutional adoption have driven this growth. However, the space remains highly competitive and rapidly evolving, making platform selection crucial for maximising returns while managing risks.

Key trends shaping DeFi in 2025 include cross-chain interoperability, real-world asset tokenisation, and the integration of artificial intelligence for yield optimisation. Understanding these trends is crucial for identifying services that are well-positioned for long-term success.

What Makes a DeFi Platform Great

- Security: Robust smart contract audits and proven track record

- Liquidity: Deep capital pools ensuring minimal slippage

- Innovation: Continuous development and feature enhancement

- Governance: Decentralised decision-making and community involvement

- Sustainability: Viable tokenomics and revenue models

- User Experience: Intuitive interfaces and seamless interactions

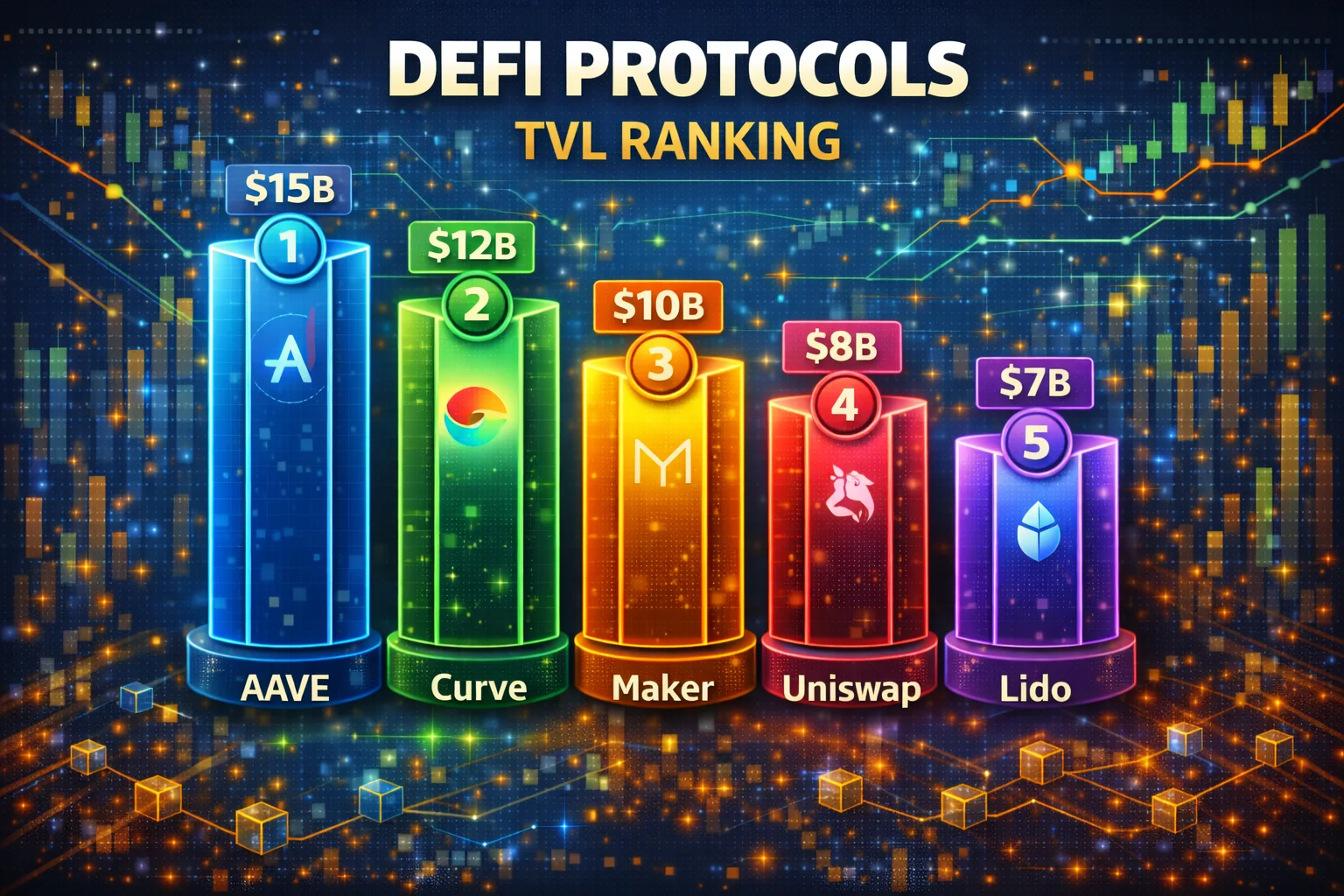

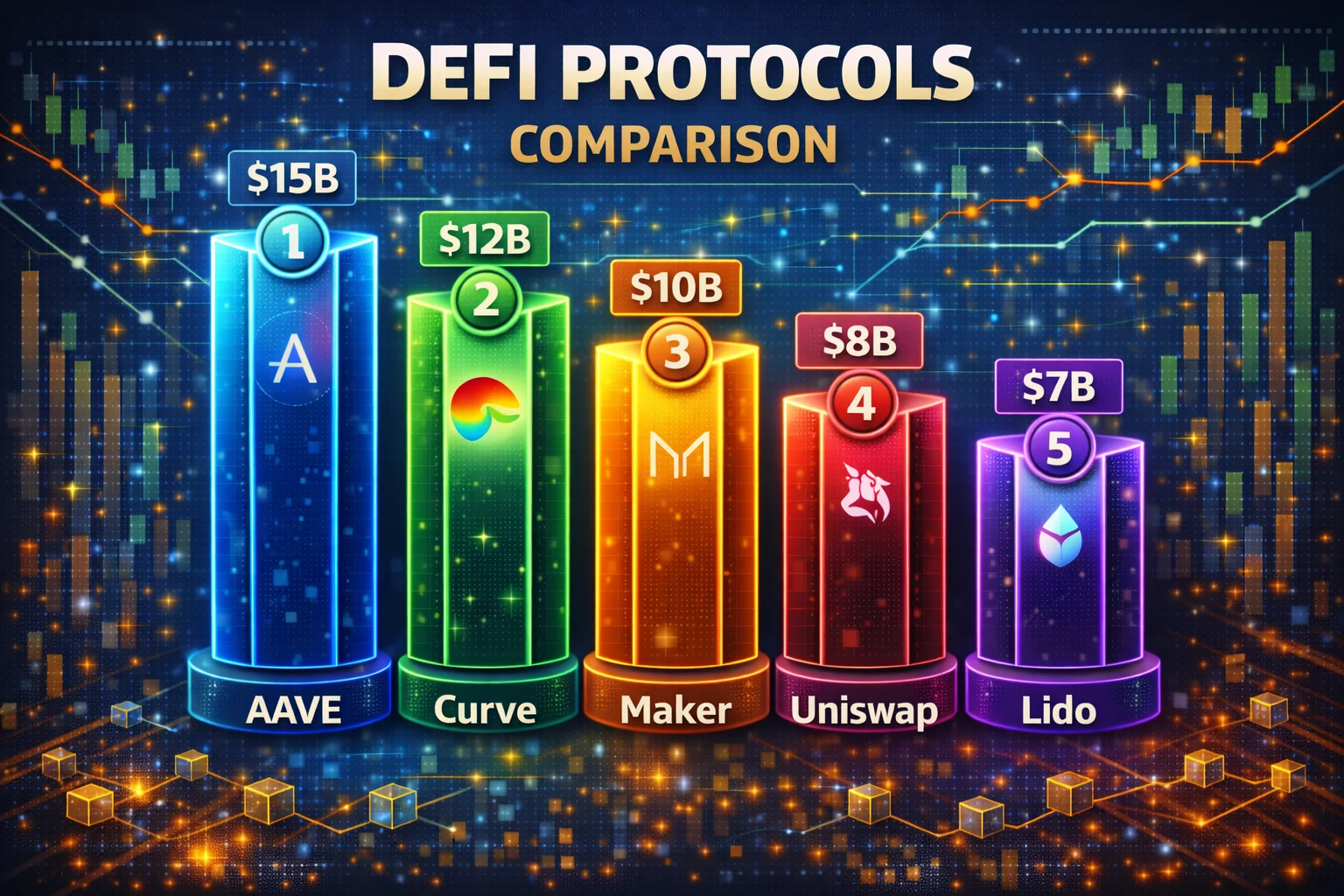

Top DeFi Platforms Ranking 2025

1. Uniswap - The DEX King

TVL: $8.5B | Category: DEX | Chain: Multi-chain | Rating: 9.5/10

Uniswap remains the undisputed leader in decentralised exchanges, processing over $1 trillion in trading volume since inception. The platform's v4 upgrade introduces hooks and custom pools, enabling unprecedented flexibility for liquidity providers and traders.

Key Features:

- Concentrated capital with customizable ranges

- Multiple fee tiers (0.01%, 0.05%, 0.3%, 1%)

- Cross-chain deployment on 10+ networks

- Advanced routing for optimal trade execution

- UNI governance token with voting rights

- Permissionless token listing

Yield Opportunities:

- Capital provision: 5-50% APR depending on pair and range

- UNI staking rewards: 3-8% APR

- Fee sharing from service revenue

- Impermanent loss protection in select pools

Pros:

- Highest capital depth and trading volume

- Battle-tested security with minimal exploits

- Strong brand recognition and adoption

- Continuous innovation and development

- Excellent mobile and web interfaces

Cons:

- High gas fees on Ethereum mainnet

- Complex capital management for beginners

- Impermanent loss risk for LPs

- Competition from newer DEX models

Best For: Active traders and experienced capital providers seeking maximum volume and flexibility.

2. Aave - Lending Protocol Leader

TVL: $12.8B | Category: Lending | Chain: Multi-chain | Rating: 9.3/10

Aave has established itself as the premier DeFi lending platform, offering both variable and stable interest rates across multiple blockchain networks. The service's innovative features, like flash loans and credit delegation, have set industry standards.

Key Features:

- Variable and stable interest rate options

- Flash loans for arbitrage and liquidations

- Credit delegation for institutional use

- Isolation mode for new asset listings

- Multi-chain deployment (Ethereum, Polygon, Avalanche)

- Governance through AAVE token holders

Yield Opportunities:

- Supply APY: 1-15% depending on asset and utilisation

- AAVE staking: 4-7% APR plus safety module rewards

- Capital mining incentives on new chains

- Flash loan fee sharing for AAVE holders

Pros:

- Proven security with extensive audits

- Wide range of supported assets

- Innovative features driving adoption

- Strong institutional partnerships

- Active development and governance

Cons:

- Lower returns compared to newer services

- Complex risk parameters

- Liquidation risks for borrowers

- Gas costs for small transactions

Best For: Conservative DeFi users seeking reliable lending and borrowing with institutional-grade security.

3. Lido - Liquid Staking Pioneer

TVL: $35.2B | Category: Liquid Staking | Chain: Multi-chain | Rating: 9.1/10

Lido dominates the liquid staking sector, allowing users to stake ETH and other PoS assets while maintaining liquidity through derivative tokens. The service has become essential infrastructure for Ethereum staking.

Key Features:

- Capital staking for ETH, SOL, MATIC, and more

- stETH tokens maintaining DeFi composability

- Professional node operator network

- No minimum staking requirements

- Automatic reward compounding

- Insurance coverage through Lido DAO

Yield Opportunities:

- ETH staking: 3.5-5% APR through stETH

- LDO governance rewards: 5-12% APR

- Curve stETH/ETH LP: 4-8% APR

- Cross-chain staking opportunities

Pros:

- Largest liquid staking service by TVL

- High capital availability for stETH across DeFi

- Professional validator management

- Strong security and insurance

- Multi-chain expansion

Cons:

- centralisation concerns with large market share

- Slashing risks from validator performance

- Regulatory uncertainty around staking

- Competition from native staking solutions

Best For: ETH holders wanting staking rewards while maintaining DeFi flexibility.

4. Curve Finance - Stablecoin DEX Specialist

TVL: $4.2B | Category: DEX/Stablecoins | Chain: Multi-chain | Rating: 8.9/10

Curve Finance specialises in efficient stablecoin and similar-asset trading with minimal slippage. The platform's unique AMM design and vote-escrowed tokenomics have created a sustainable ecosystem for trading stable assets.

Key Features:

- Low-slippage stablecoin trading

- optimised AMM for similar assets

- Vote-escrowed CRV (veCRV) governance

- Gauge system for reward distribution

- Cross-chain deployment

- Integration with major services

Yield Opportunities:

- LP rewards: 2-25% APR depending on pool

- CRV emissions through gauges

- veCRV voting rewards and bribes

- Trading fee sharing

Pros:

- Minimal slippage for stable assets

- Sustainable tokenomics model

- Strong institutional adoption

- Deep integration with DeFi ecosystem

- Proven long-term viability

Cons:

- Complex tokenomics for newcomers

- Limited to similar asset pairs

- Declining returns in mature pools

- Competition from newer stablecoin DEXs

Best For: Stablecoin traders and return farmers seeking consistent earnings with lower volatility.

5. MakerDAO - Decentralised Stablecoin

TVL: $8.1B | Category: Stablecoin/Lending | Chain: Ethereum | Rating: 8.7/10

MakerDAO pioneered decentralised stablecoins with DAI, backed by over-collateralised positions. The service has evolved to include real-world assets and remains a cornerstone of DeFi infrastructure.

Key Features:

- DAI stablecoin minting through CDPs

- Multi-collateral support (ETH, WBTC, USDC, RWAs)

- decentralised governance through MKR

- Stability fee adjustments

- Emergency shutdown mechanism

- Real-world asset integration

Yield Opportunities:

- DAI Savings Rate (DSR): 1-8% APR

- MKR governance rewards

- Vault management strategies

- RWA return opportunities

Pros:

- Most decentralised major stablecoin

- Proven stability mechanism

- Strong governance framework

- Real-world asset diversification

- Deep DeFi integration

Cons:

- Complex system with multiple components

- Liquidation risks for vault owners

- Governance complexity

- Competition from centralised stablecoins

Best For: Users seeking decentralised stablecoin exposure and governance participation.

6. Compound - Autonomous Interest Rate Protocol

TVL: $3.8B | Category: Lending | Chain: Ethereum | Rating: 8.5/10

Compound established the foundation for DeFi lending with its algorithmic interest rate model. Whilst facing increased competition, the service remains a reliable choice for straightforward lending and borrowing.

Key Features:

- Algorithmic interest rate determination

- cToken representation of deposits

- COMP governance token distribution

- Liquidation mechanism for bad debt

- Integration with major services

- Simple user interface

Yield Opportunities:

- Supply APY: 0.5-12% depending on asset

- COMP rewards for suppliers and borrowers

- Governance participation rewards

- cToken strategies in other services

Pros:

- Simple and reliable lending model

- Strong security track record

- Wide DeFi integration

- Transparent governance

- User-friendly interface

Cons:

- Lower returns than newer services

- Limited innovation compared to competitors

- Ethereum-only deployment

- Declining market share

Best For: Conservative users seeking simple, reliable lending with proven security.

Emerging DeFi Services to Watch

Pendle - Yield Trading Innovation

TVL: $2.1B | Category: Yield Trading | Rating: 8.3/10

Pendle enables users to trade future earnings, separating principal and return components of yield-bearing assets. This innovation allows for sophisticated return strategies and fixed-rate products in DeFi.

GMX - decentralised Perpetuals

TVL: $1.8B | Category: Derivatives | Rating: 8.1/10

GMX offers decentralised perpetual trading with zero price impact through its unique multi-asset pool design. The service has gained significant traction on Arbitrum and Avalanche.

Rocket Pool - decentralised ETH Staking

TVL: $3.2B | Category: Liquid Staking | Rating: 8.4/10

Rocket Pool provides a more decentralised alternative to Lido for Ethereum staking, with a permissionless network of node operators and innovative tokenomics.

DeFi Platform Comparison Matrix

Security & Audits

| Platform | Audit Firms | Bug Bounty | Exploit History | Security Score |

|---|---|---|---|---|

| Uniswap | Trail of Bits, Consensys | $2.25M | Minimal | 9.5/10 |

| Aave | OpenZeppelin, Consensys | $1M | None major | 9.3/10 |

| Lido | MixBytes, Sigma Prime | $2M | None | 9.1/10 |

| Curve | Trail of Bits, MixBytes | $1.5M | Minor incidents | 8.9/10 |

| MakerDAO | Trail of Bits, PeckShield | $1M | Black Thursday | 8.7/10 |

| Compound | OpenZeppelin, Trail of Bits | $500K | Minor incidents | 8.5/10 |

| Synthetix | Sigma Prime, Iosiro | $750K | Oracle issues | 8.3/10 |

| Yearn Finance | MixBytes, Consensys | $300K | Multiple exploits | 7.8/10 |

Yield Comparison

| Platform | Base APY | Token Rewards | Total APR Range | Risk Level |

|---|---|---|---|---|

| Uniswap | 0.1-5% | UNI incentives | 5-50% | Medium-High |

| Aave | 1-15% | AAVE rewards | 3-20% | Low-Medium |

| Lido | 3.5-5% | LDO rewards | 4-12% | Low |

| Curve | 2-8% | CRV emissions | 5-25% | Low-Medium |

| MakerDAO | 1-8% | MKR governance | 2-10% | Low |

Investment Strategies by Risk Profile

Conservative Strategy (Low Risk)

Allocation: 40% Lido, 30% Aave, 20% MakerDAO, 10% Curve

Focus on established services with proven track records and lower volatility. Prioritise stablecoin strategies and liquid staking for steady returns with minimal risk.

Balanced Strategy (Medium Risk)

Allocation: 25% Uniswap, 25% Aave, 20% Lido, 15% Curve, 15% Emerging platforms

Diversify across multiple service types while maintaining exposure to blue-chip platforms. Include some emerging services for higher yield potential.

Aggressive Strategy (High Risk)

Allocation: 30% Uniswap, 20% Emerging platforms, 20% Pendle, 15% GMX, 15% Blue-chip services

Maximise yield potential through active liquidity provision and exposure to newer, higher-yielding services. Requires active management and higher risk tolerance.

Risk Management in DeFi

Smart Contract Risks

- Always verify platform audits and protection protocols

- Start with small amounts to test services

- Diversify across multiple platforms to reduce single-point failures

- Monitor platform governance and upgrade proposals

- Consider insurance options like Nexus Mutual

Market Risks

- Understand impermanent loss for liquidity provision

- Monitor correlation between assets in LP pairs

- Set stop-losses for leveraged positions

- Keep emergency funds in stablecoins

- Regularly rebalance portfolio allocations

Operational Risks

- Use hardware wallets for large amounts

- Double-check transaction details before signing

- Keep private keys secure and backed up

- Be aware of phishing attempts and fake websites

- Understand gas optimisation strategies

Future of DeFi Platforms

The DeFi landscape continues evolving with several key trends shaping the future. Cross-chain interoperability is becoming crucial as users demand seamless experiences across multiple blockchains. Real-world asset tokenisation is bringing traditional finance into DeFi, while AI-powered yield optimisation is making sophisticated strategies accessible to retail users.

Key Trends to Watch

- Cross-Chain Integration: Services expanding to multiple chains for better user experience

- Real-World Assets: Tokenisation of traditional assets like real estate and bonds

- AI-Powered Strategies: Automated yield optimisation and risk management

- Regulatory Compliance: Services adapting to evolving regulatory frameworks

- Institutional Adoption: Traditional finance integrating DeFi services

- Sustainability Focus: Energy-efficient services and carbon-neutral operations

Getting Started with DeFi

Step 1: Education and Research

Before investing in any DeFi service, thoroughly understand how it works, its risks, and potential returns. Read white papers, audit reports, and community discussions to make informed decisions. Focus on understanding smart contract mechanics, tokenomics, and governance structures.

Step 2: Start Small

Begin with small amounts to familiarise yourself with platform interfaces and mechanics. This approach minimises risk while you learn and gain confidence. Test different features like lending, borrowing, and liquidity provision with minimal capital exposure.

Step 3: Diversify Gradually

As you gain experience, gradually diversify across multiple services and strategies. This reduces concentration risk and provides exposure to a range of yield opportunities. Consider spreading investments across different blockchain networks and protocol types.

Step 4: Monitor and Adjust

Regularly monitor your positions and platform developments. Be prepared to adjust your strategy in response to changing market conditions and service updates. Stay informed about governance proposals, security incidents, and regulatory developments that might affect your investments.

Essential Tools for DeFi Success

- Portfolio Trackers: Monitor positions across multiple chains

- Gas optimisers: Reduce transaction costs

- Yield Aggregators: Automate strategy optimisation

- Risk Assessment: Evaluate protocol safety scores

- News Sources: Stay updated on developments

DeFi Platform Comparison Table

| Platform | Category | TVL | APY Range | Risk Level |

|---|---|---|---|---|

| Aave | Lending | $10B+ | 3-8% | Low |

| Uniswap | DEX | $5B+ | 5-15% | Low-Medium |

| Lido | Staking | $20B+ | 3-5% | Low |

| Curve | DEX | $5B+ | 4-10% | Low-Medium |

| GMX | Derivatives | $500M+ | 15-30% | Medium-High |

Institutional DeFi Adoption and Professional Integration

Enterprise DeFi Infrastructure and Compliance Frameworks

Professional DeFi adoption requires sophisticated infrastructure solutions that address institutional security requirements, regulatory compliance obligations, and operational risk management while maintaining the efficiency and innovation benefits of decentralised finance protocols. Enterprise DeFi infrastructure includes dedicated custody solutions, comprehensive audit frameworks, and regulatory reporting capabilities that enable institutional participation in decentralised finance markets.

Institutional DeFi integration requires advanced risk management systems that monitor protocol risks, smart contract vulnerabilities, and market conditions while providing automated risk mitigation and portfolio rebalancing capabilities. Professional DeFi infrastructure includes multi-signature governance systems, emergency response procedures, and comprehensive insurance coverage that protect institutional assets while enabling participation in high-yield DeFi opportunities.

Advanced DeFi Strategy Implementation and Portfolio optimisation

Professional DeFi asset management requires sophisticated strategy implementation that combines multiple protocols, automated rebalancing systems, and comprehensive risk management to optimise returns while maintaining appropriate risk profiles for institutional investors. Advanced DeFi strategies include yield farming optimisation, liquidity provision management, and cross-protocol arbitrage opportunities that maximise returns while minimising exposure to protocol-specific risks.

Institutional DeFi strategy implementation includes automated portfolio rebalancing, dynamic risk evaluation, and comprehensive performance analytics that enable professional investment managers to optimise DeFi allocations while maintaining fiduciary obligations and regulatory compliance requirements. Advanced strategy implementation utilises machine learning algorithms, predictive analytics, and automated execution systems that optimise DeFi investments while maintaining appropriate oversight and control mechanisms.

DeFi Integration with Traditional Finance and Regulatory Evolution

The evolution of decentralised finance includes increasing integration with traditional financial systems through regulated custody solutions, institutional exchange services, and comprehensive compliance frameworks that enable mainstream adoption while maintaining the innovation and efficiency benefits of decentralised protocols. DeFi integration with traditional finance includes regulated on-ramps, institutional custody solutions, and comprehensive reporting capabilities that meet traditional finance requirements.

Regulatory evolution in decentralised finance includes developing comprehensive frameworks for protocol governance, institutional participation, and consumer protection while maintaining the decentralised and permissionless characteristics that drive DeFi innovation. Professional DeFi adoption requires understanding evolving regulatory requirements, implementing appropriate compliance procedures, and maintaining operational flexibility to adapt to changing regulatory environments whilstmaximising the benefits of decentralised finance participation.

Protocol Governance and Community Participation

decentralised Governance Mechanisms

DeFi protocol governance enables token holders to participate in decision-making processes that affect protocol development, risk parameters, and treasury management. Understanding governance mechanisms is essential for long-term protocol participation, as governance decisions directly impact protocol functionality, security, and economic incentives that affect user returns and risk exposure.

Active governance participation includes proposal evaluation, community discussion engagement, and informed voting on protocol changes. Professional governance participants conduct thorough analysis of proposed changes, understand their implications for protocol economics, and consider long-term effects on protocol sustainability and user interests.

Token Economics and Incentive Alignment

DeFi protocol tokenomics determine long-term sustainability, user incentives, and value accrual mechanisms that affect protocol success and token holder returns. Understanding token distribution, emission schedules, and utility mechanisms is crucial for evaluating protocol investment potential and participation strategies that align with individual risk tolerance and return objectives.

Advanced tokenomics analysis includes evaluating inflation rates, fee distribution mechanisms, and governance power concentration that affect protocol decentralisation and long-term viability. Professional analysis considers market dynamics, competitive positioning, and regulatory implications that influence token value and protocol adoption rates.

Cross-Protocol Integration and Composability

DeFi protocol composability enables complex financial strategies that combine multiple protocols for enhanced functionality and return optimisation. Understanding protocol interactions, integration risks, and composability benefits is essential for advanced DeFi participation that maximises opportunities while managing complexity and potential failure points across multiple systems.

Professional composability strategies include risk assessment of protocol dependencies, evaluation of integration security, and monitoring of cross-protocol relationships that affect overall strategy performance. Advanced users implement sophisticated monitoring systems that track protocol health, governance changes, and market conditions that influence multi-protocol strategies.

Advanced Protocol Selection and Portfolio optimisation

Strategic protocol selection requires comprehensive analysis of tokenomics, governance structures, development activity, and long-term sustainability factors that influence protocol success and user returns. Professional investors implement systematic evaluation frameworks that assess protocol fundamentals, competitive positioning, and growth potential through detailed research and ongoing monitoring of protocol developments, market adoption, and ecosystem expansion that affects long-term investment outcomes.

Portfolio optimisation across multiple DeFi protocols involves sophisticated risk management, yield optimisation, and strategic asset allocation that maximises returns while maintaining appropriate diversification and risk exposure. Advanced strategies encompass automated rebalancing, yield farming optimisation, and systematic protocol evaluation that ensures optimal capital allocation and sustainable long-term growth through professional-grade portfolio management techniques and comprehensive market analysis.

Conclusion

The DeFi platform landscape in 2025 offers unprecedented opportunities for return optimisation and financial innovation across multiple blockchain ecosystems and decentralised applications. Whilst established services like Uniswap, Aave, and Lido provide stability and proven returns, emerging platforms offer higher yield potential but carry greater risk profiles.

Success in DeFi requires careful research, risk management, and continuous learning about emerging protocols and market dynamics. Start with established services, understand the risks thoroughly, and gradually explore more advanced strategies as your knowledge and confidence grow. The key is finding the right balance between risk and reward that aligns with your investment goals and risk tolerance.

Remember that DeFi is still an evolving space with regulatory uncertainty and technical risks across different jurisdictions. Never invest more than you can afford to lose, and always prioritise security and due diligence in your investment decisions. Consider using insurance products, diversifying across multiple chains, and keeping emergency funds readily available.

The future of decentralised finance looks promising, with institutional adoption increasing and infrastructure improving across multiple blockchain ecosystems. However, success requires patience, education, and disciplined risk management. Focus on building knowledge, starting conservatively, and scaling your involvement as you become more experienced with the ecosystem.

Conservative investors should prioritise battle-tested platforms with extensive security audits, insurance coverage, and proven track records across multiple market cycles worldwide today. These services have weathered multiple market cycles and demonstrated resilience during challenging periods, making them suitable foundations for long-term wealth-building strategies.

More aggressive investors might explore emerging opportunities in yield trading through innovative tokenomics, derivatives trading, or cross-chain arbitrage mechanisms. However, these higher-yield options require a thorough understanding of associated risks, active asset management, and a willingness to accept potential losses during market volatility.

Professional DeFi portfolio management in 2025 involves sophisticated risk assessment frameworks that evaluate smart contract security, tokenomics sustainability, and governance decentralisation across multiple protocols. Advanced practitioners implement automated rebalancing strategies, utilise yield aggregators for optimisation, and maintain comprehensive insurance coverage through decentralised insurance protocols. These methodologies enable consistent returns while managing downside risks through systematic diversification and continuous monitoring of protocol health indicators, market conditions, and regulatory developments that could impact platform operations and user returns across different blockchain ecosystems.

Diversification remains crucial regardless of risk tolerance levels. Spreading investments across multiple platforms, blockchain networks, and service types helps mitigate potential losses while capturing a range of yield opportunities. Consider geographic diversification through different regulatory jurisdictions and technological diversification across various consensus mechanisms and blockchain architectures.

Regular reassessment of your DeFi portfolio ensures alignment with changing market dynamics, technological developments, and personal financial goals. Consider consulting with financial advisors familiar with digital asset investments for personalised guidance tailored to your specific circumstances, objectives, and regulatory environment.

DeFi protocol comparison involves analysing smart contract architecture, governance mechanisms, and tokenomics models that determine protocol sustainability and user value proposition. Decentralised finance protocols offer different approaches to financial services automation, with each protocol providing unique advantages for specific DeFi strategies and yield optimisation techniques that align with individual risk tolerance and investment objectives.

Sources & References

Frequently Asked Questions

- What is the safest DeFi platform?

- Aave is considered the safest DeFi service with extensive security audits, bug bounties, insurance coverage, and years of proven operation. MakerDAO and Curve also have excellent security track records. Always diversify across multiple services and never invest more than you can afford to lose.

- Which DeFi platform has the highest yield?

- Yields vary constantly, but Pendle and GMX typically offer higher returns (10-30% APY) due to their innovative tokenomics. However, higher yields come with higher risks. Established services like Aave and Curve offer lower but more stable yields (3-8% APY) with better security.

- Are DeFi platforms safe?

- Established services with multiple audits and long track records are relatively safe, but risks remain, including smart contract bugs, economic exploits, and market volatility. Use services with insurance options, start with small amounts, and diversify across multiple platforms to manage risk.

- How do I choose a DeFi platform?

- Evaluate services based on security audits, TVL (Total Value Locked), time in operation, insurance availability, and community reputation. Start with established services like Aave or Curve, check for multiple security audits, and verify the service has been operating successfully for at least 12 months.

- Can I lose money in DeFi platforms?

- Yes, you can lose money through smart contract exploits, impermanent loss in liquidity pools, market volatility, or service failures. Mitigate risks by using audited services, diversifying across platforms, starting with small amounts, and never investing more than you can afford to lose. Consider using services with insurance coverage.