What Is Yield Farming? 2025 Guide

Liquidity provision is one of the most powerful strategies in DeFi for generating income. Learn how it works, understand the risks, and discover the best protocols to maximise your returns in 2025.

Introduction

Yield farming has emerged as one of the most transformative innovations in decentralised finance (DeFi), fundamentally changing how digital currency holders can generate yield generation from their digital assets. In 2025, yield generation has evolved from an experimental concept practiced by a small group of DeFi enthusiasts to a sophisticated financial strategy employed by millions of users worldwide, including institutional investors and traditional finance professionals seeking exposure to DeFi yields.

The concept of liquidity provision, also known as liquidity mining, represents a paradigm shift from traditional yield generation strategies. Instead of simply holding cryptocurrencies and hoping for price appreciation, yield farmers actively deploy their assets across various DeFi protocols to earn rewards in the form of interest, trading fees, and governance tokens. This active approach to digital currency investing has created new opportunities to generate returns that often exceed those of traditional financial products by significant margins.

The explosive growth of liquidity provision has been driven by the composability of DeFi protocols, which allows users to combine different strategies and platforms to optimise their returns. Modern yield generation involves sophisticated techniques such as liquidity provision to automated market makers (AMMs) like Uniswap, lending assets to borrowing protocols, participating in governance token distributions, and leveraging complex multi-protocol strategies that can generate yields ranging from 5% to over 100% annually, depending on market conditions and risk tolerance.

However, the high potential returns of liquidity provision come with corresponding risks that must be carefully understood and managed. Unlike traditional investments, liquidity mining exposes participants to risks such as smart contract vulnerabilities, impermanent loss, token volatility, and protocol governance. The complexity of these risks has led to the development of sophisticated risk oversight tools, insurance protocols, and educational resources that help users navigate the liquidity provision landscape more safely.

The maturation of the yield generation ecosystem in 2025 has brought improved user experiences, stronger security practices, and more transparent risk-assessment tools. Major protocols have undergone extensive audits, implemented robust risk oversight systems, and developed user-friendly interfaces that make liquidity provision accessible to users with varying levels of technical expertise. This evolution has democratized access to sophisticated financial strategies that were previously available only to institutional investors.

Understanding liquidity mining is essential for anyone serious about maximising returns from their digital currency holdings in 2025. The strategy offers unique advantages, including higher potential yields than traditional staking, exposure to innovative DeFi protocols, and the ability to earn governance tokens that provide voting rights in protocol decisions. However, success in liquidity provision requires education, careful risk oversight, and a thorough understanding of the underlying protocols and market dynamics.

This comprehensive guide provides everything you need to know about yield generation in 2025, from basic concepts and mechanics to advanced strategies and risk oversight techniques. Whether you're new to DeFi or looking to optimise your existing liquidity provision strategies, this guide will equip you with the knowledge and tools needed to participate safely and effectively in the exciting world of decentralised finance yield generation.

The regulatory landscape surrounding liquidity mining has also evolved significantly in 2025, with more straightforward guidelines from major jurisdictions providing greater certainty for both individual and institutional participants. This regulatory clarity has contributed to increased mainstream adoption and the development of compliant liquidity provision products that meet traditional finance standards while maintaining the innovation and efficiency that make DeFi attractive.

Modern yield generation strategies in 2025 leverage advanced technologies, including automated yield-optimisation protocols, cross-chain farming opportunities, and AI-powered risk-assessment tools. These innovations have made it possible for users to maximise returns while minimising manual management requirements, creating a more accessible and efficient liquidity provision experience that appeals to both active traders and passive investors seeking enhanced returns on their digital currency holdings.

What Is protocol farming?

Yield farming, also known as yield generation or DeFi farming, is a sophisticated allocation approach that involves providing digital currency assets to DeFi ecosystem (DeFi) protocols in exchange for rewards in the form of interest, trading fees, and governance tokens. This innovative approach to generating yield generation has revolutionized the digital currency landscape by enabling users to earn returns on their digital assets through active participation in the DeFi ecosystem rather than simply holding tokens in static wallets.

At its fundamental level, liquidity provision operates on the principle of capital efficiency and market-making in decentralised financial systems. Unlike traditional banking where institutions use depositor funds to generate profits through lending and investment activities, liquidity mining allows individual users to directly participate in the financial infrastructure by providing the liquidity that powers decentralised exchanges, lending protocols, and other DeFi applications. This direct participation enables users to capture a portion of the value that would traditionally accrue to financial intermediaries.

The mechanics of liquidity provision involve depositing digital currency assets into automated protocols that automatically execute predefined financial functions. These automated protocols, which operate on blockchain networks like Ethereum, Binance Smart Chain, and Polygon, use the deposited assets to facilitate various financial services such as trading, lending, and borrowing. In return for providing this essential liquidity, users receive rewards that can include a percentage of trading fees generated by the protocol, interest payments from borrowers, and newly minted governance tokens that often appreciate in value as the protocol grows.

The concept of yield generation emerged from the broader DeFi movement's goal of creating open, permissionless financial systems that operate without traditional intermediaries. By leveraging distributed ledger technology and automated protocols, liquidity provision protocols can offer higher returns than traditional financial products while maintaining transparency, accessibility, and global availability. This democratization of financial services has enabled millions of users worldwide to access sophisticated investment strategies that were previously available only to institutional investors and high-net-worth individuals.

Modern liquidity mining strategies in 2025 have evolved to encompass a wide range of sophisticated techniques and protocols. Simple liquidity provision to automated market makers (AMMs) like Uniswap or SushiSwap represents just the beginning of the liquidity provision spectrum. Advanced strategies include participating in multi-token liquidity pools, engaging in cross-chain farming opportunities, utilising leverage to amplify returns, and participating in complex yield optimisation protocols that automatically compound rewards and rebalance positions to maximise returns.

The risk-reward profile of yield generation varies significantly depending on the specific strategy, protocols involved, and market conditions. Whilst some conservative liquidity provision strategies offer relatively stable returns comparable to traditional savings accounts but with higher yields, more aggressive strategies can generate returns exceeding 100% annually during favorable market conditions. However, these higher returns come with correspondingly higher risks, including smart contract vulnerabilities, impermanent loss, token volatility, and protocol governance risks that can result in partial or total loss of invested capital.

The technological infrastructure supporting liquidity mining has become increasingly sophisticated, with the development of yield aggregators, automated strategy protocols, and cross-chain bridges that enable users to optimise their returns across multiple blockchain networks. These innovations have made liquidity provision more accessible to mainstream users while providing advanced tools for experienced farmers to implement complex multi-protocol strategies that can adapt to changing market conditions and optimise returns automatically.

Governance tokens, which are often distributed as rewards to yield farmers, represent a unique aspect of DeFi that distinguishes it from traditional finance. These tokens not only provide potential financial returns through price appreciation but also grant holders voting rights in protocol governance decisions. This creates a symbiotic relationship between protocols and their users, where active participation in yield generation contributes to protocol growth while providing users with both financial returns and influence over the future development of the platforms they support.

The regulatory environment surrounding liquidity provision continues to evolve as governments and financial authorities work to understand and regulate DeFi activities. In 2025, clearer regulatory frameworks have emerged in major jurisdictions, providing greater certainty for both individual and institutional participants while maintaining the innovation and accessibility that make DeFi attractive. This regulatory clarity has contributed to increased mainstream adoption and the development of compliant liquidity mining products that meet traditional finance standards.

Risk management in liquidity provision has become a critical discipline, with the development of sophisticated tools and methodologies for assessing and mitigating the various risks associated with DeFi participation. Professional yield farmers employ diversification strategies, use insurance protocols to protect against smart contract risks, implement position sizing techniques to manage exposure, and utilise automated tools to monitor and respond to changing market conditions. Understanding and implementing proper risk oversight is essential for long-term success in yield generation.

The social and economic impact of liquidity provision extends beyond individual financial returns to include contributions to financial inclusion, innovation in financial services, and the development of more efficient and transparent financial systems. By providing an alternative to traditional banking and investment services, liquidity mining has enabled users in underserved regions to access sophisticated financial tools and generate income from their digital assets, contributing to broader financial inclusion and economic empowerment.

As the DeFi ecosystem continues to mature, liquidity provision is evolving to incorporate new technologies and strategies, including integration with traditional finance through institutional DeFi products, development of more sophisticated risk oversight tools, and expansion to new blockchain networks that offer improved scalability and lower transaction costs. These developments are making yield generation more accessible, efficient, and secure while maintaining the core principles of decentralisation and user empowerment that define the DeFi movement.

Core Components of Yield Farming

Liquidity Pools and Automated Market Makers

Liquidity pools represent the foundation of most liquidity provision strategies, serving as decentralised reserves of digital currency pairs that enable trading on automated market makers (AMMs). These pools operate on mathematical formulas, typically the constant product formula (x * y = k), that automatically determine exchange rates based on the relative quantities of each token in the pool. When users provide liquidity to these pools by depositing equal values of two tokens, they receive liquidity provider (LP) tokens that represent their share of the pool and entitle them to a portion of the trading fees generated by the AMM.

The mechanics of liquidity provision involve several important considerations that affect potential returns and risks. Pool composition, trading volume, fee structures, and token volatility all influence the profitability of liquidity provision. High-volume pools with stable token pairs typically offer lower but more predictable returns, while exotic token pairs may offer higher yields but with increased risk of impermanent loss and lower liquidity. Understanding these dynamics is crucial for selecting appropriate liquidity provision strategies that align with individual risk tolerance and return objectives.

Lending and Borrowing Protocols

decentralised lending protocols like Aave, Compound, and MakerDAO provide another avenue for liquidity mining by enabling users to lend their digital currency assets to borrowers in exchange for interest payments. These protocols use over-collateralization to ensure loan security, requiring borrowers to deposit more value in collateral than they borrow. Lenders earn interest on their deposits, which is typically paid in the same token they lent, while also potentially earning governance tokens distributed by the protocol as additional rewards for participation.

The interest rates in DeFi lending protocols are determined by supply and demand dynamics, with rates fluctuating based on utilisation ratios and market conditions. During periods of high borrowing demand, interest rates increase, providing higher returns for lenders. Conversely, when borrowing demand is low, rates decrease. This dynamic pricing mechanism ensures efficient capital allocation while providing opportunities for yield farmers to optimise their returns by moving assets between different lending protocols based on prevailing rates and reward distributions.

Liquidity provision, also known as LP rewards, is the practice of providing capital to decentralised finance protocols in exchange for rewards. These incentives typically come in the form of exchange fees, interest payments, and governance tokens distributed by the protocols.

The ecosystem has evolved significantly since its inception. Modern automated market makers (AMMs) utilise sophisticated algorithms to optimise capital efficiency, while cross-chain bridges enable multi-network strategies. Layer 2 scaling solutions have dramatically reduced transaction costs, making smaller positions economically viable for retail participants.

Institutional adoption continues accelerating as traditional finance recognizes DeFi's potential. Regulatory frameworks are maturing, providing clearer guidelines for compliance. Advanced risk oversight tools, insurance protocols, and professional-grade analytics platforms have emerged to support institutional-scale operations.

Technological innovations like zero-knowledge proofs, artificial intelligence optimisation, and quantum-resistant cryptography are reshaping the landscape. These developments promise enhanced privacy, automated parameter tuning, and future-proof security architectures.

Unlike traditional staking, where you lock tokens, LP (liquidity provision) involves actively supplying capital to automated market makers (AMMs), lending protocols, or specialised optimisation vaults. The goal is to maximise returns through strategic allocation of assets across different DeFi opportunities.

The Evolution of Liquidity Provision

DeFi yields exploded in popularity during the 2020 "DeFi Summer" when protocols like Compound began distributing governance tokens to liquidity providers. This created a new paradigm where users could earn multiple layers of rewards:

- Base returns: trading costs or lending interest

- Token incentives: Governance assets distributed to bootstrap capital

- Compounding opportunities: Reinvesting earnings for exponential growth

Capital Provision vs Traditional Finance

Traditional finance offers limited yield opportunities options with low earnings:

- Savings accounts: 0.1-2% APY

- CDs: 2-4% APY

- Stock dividends: 1-3% average earnings

Capital provision can offer significantly higher earnings, but with correspondingly higher risks:

- Stablecoin cultivation: 5-15% APY

- Volatile pair cultivation: 10-50% APY

- High-risk strategies: 50-200%+ APY (often unsustainable)

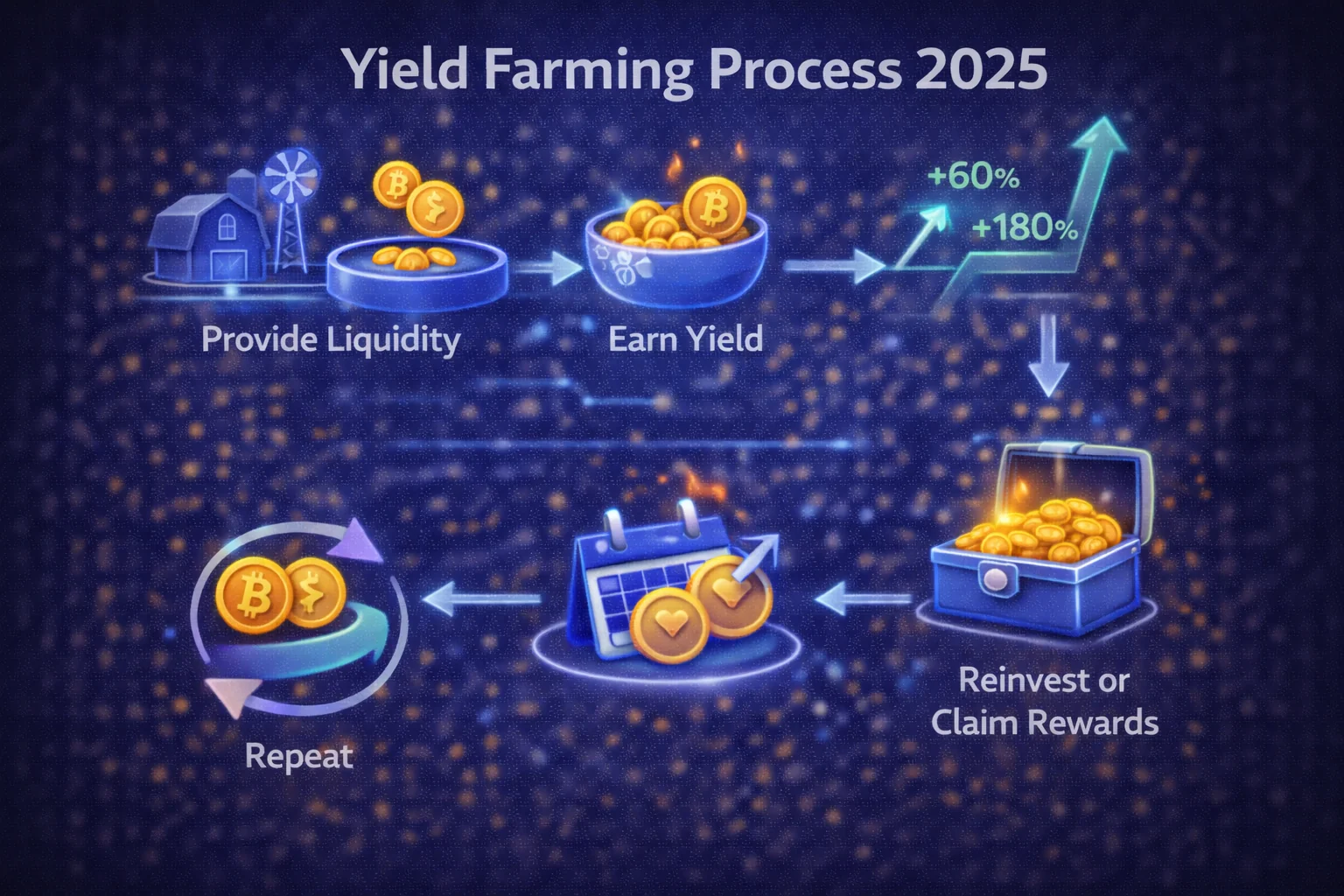

How Capital Cultivation Works: Step-by-Step Process

Basic Capital Provision Mechanics

- Choose a Protocol: Select a DeFi platform offering cultivation opportunities

- Provide Capital: Deposit assets into pools or lending markets

- Receive LP Assets: Get provider certificates representing your share

- Stake LP Assets: Often stake these certificates in additional incentive contracts

- Earn Multiple Incentives: Collect platform fees, interest, and governance distributions

- Compound or Harvest: Reinvest earnings or claim them for other opportunities

Automated Market Makers (AMMs)

AMMs are the foundation of most capital provision strategies. They work by:

Pool Mechanics

- Constant Product Formula: x * y = k maintains pool balance

- Price Discovery: Asset ratios determine exchange rates

- Fee Collection: Traders pay 0.05-1% charges to capital providers

- Slippage: Large trades move prices, creating arbitrage opportunities

Popular AMM Models

Uniswap V2 Style (50/50 pools):

- Equal value deposits of two assets

- Automatic rebalancing as prices change

- Simple but subject to IL (temporary loss)

Uniswap V3 (Concentrated Capital):

- Provide capital within specific price ranges

- Higher capital efficiency and charges

- Requires active management

Curve (Stablecoins/Similar Assets):

- optimised for assets with similar values

- Lower slippage and IL

- Ideal for stablecoin and liquid delegation derivative pairs

Lending Protocol Cultivation

Lending protocols offer another avenue for capital cultivation:

Supply-Side Cultivation

- Deposit assets: Lend cryptocurrencies to earn interest

- Receive aAssets: Interest-bearing certificates that appreciate

- Earn incentives: Additional governance distributions for participation

- Maintain access: Most lending certificates can be withdrawn anytime

Borrow-Side Cultivation

- Collateralize assets: Deposit cryptocurrencies as collateral

- Borrow other assets: Take loans against collateral

- Earn borrowing incentives: Some protocols pay borrowers

- Leverage strategies: Use borrowed funds for additional cultivation

Types of DeFi Cultivation Strategies

1. Capital Provider (LP) Cultivation

The most common form of capital mining involves providing assets to AMM pools.

Stablecoin Pairs (Low Risk)

- USDC/USDT: Minimal IL, steady charges

- DAI/FRAX: decentralised stablecoin exposure

- Expected APY: 3-8% from charges + incentives

Crypto/Stablecoin Pairs (Medium Risk)

- ETH/USDC: Balanced exposure to ETH price movements

- BTC/USDT: Bitcoin exposure with stablecoin hedge

- Expected APY: 5-15% but subject to IL

Volatile Crypto Pairs (High Risk)

- ETH/BTC: Two major cryptocurrencies

- Altcoin pairs: Higher volatility and potential earnings

- Expected APY: 10-50%+ but high IL risk

2. Lending and Borrowing

Earn interest by lending assets or receive incentives for borrowing.

Single-Asset Lending

- Aave: Deposit USDC, earn interest + AAVE distributions

- Compound: Supply ETH, receive cETH + COMP incentives

- Advantages: No IL, simple strategy

- Disadvantages: Lower earnings than LP cultivation

Leveraged Lending

- Recursive lending: Borrow against deposits to increase exposure

- Earnings multiplication: Amplify profits through leverage

- Liquidation risk: Positions can be liquidated if collateral falls

3. Earnings Aggregators and Vaults

Automated strategies that optimise earnings optimisation across multiple protocols.

Auto-Compounding Vaults

- Yearn Finance: Automated earnings optimisation

- Beefy Finance: Cross-chain DeFi cultivation

- Harvest Finance: Automated compounding strategies

Strategy Vaults

- Delta-neutral strategies: Hedge price exposure while cultivating

- Arbitrage vaults: Exploit price differences across platforms

- Leveraged cultivation: Amplified exposure to cultivation incentives

4. Liquid Delegation Derivative (LSD) Cultivation

Cultivate with delegated assets while maintaining delegation earnings.

Popular LSD Pairs

- stETH/ETH: Lido staked ETH with minimal IL

- rETH/ETH: Rocket Pool staked ETH farming

- Benefits: Earn validation rewards + farming rewards

- Risks: Smart contract risk, potential depeg events

Returns & Comprehensive Risk Analysis

Returns Sources and Sustainability

Sustainable Returns Sources

- transaction costs: Generated by real trading volume

- Lending Interest: Paid by borrowers for capital use

- Protocol Revenue: Share of platform profits

- MEV Capture: Maximal Extractable Value sharing

Unsustainable Returns Sources

- Token Emissions: New token creation (inflationary)

- Ponzi Mechanics: New user deposits funding old user rewards

- Vampire Attacks: Temporary incentives to steal liquidity

- Liquidity Incentives: Bootstrap liquidity programs

Risk Categories and Mitigation

1. Smart Contract Risk

Description: Bugs, exploits, or vulnerabilities in protocol code

Examples:

- Flash loan attacks draining pools

- Oracle manipulation affecting prices

- Governance attacks changing protocol parameters

- Upgrade bugs introducing vulnerabilities

Mitigation Strategies:

- Use protocols with multiple security audits

- Check audit reports and bug bounty programs

- Start with battle-tested protocols (6+ months live)

- Diversify across multiple protocols

- Consider insurance protocols like Nexus Mutual

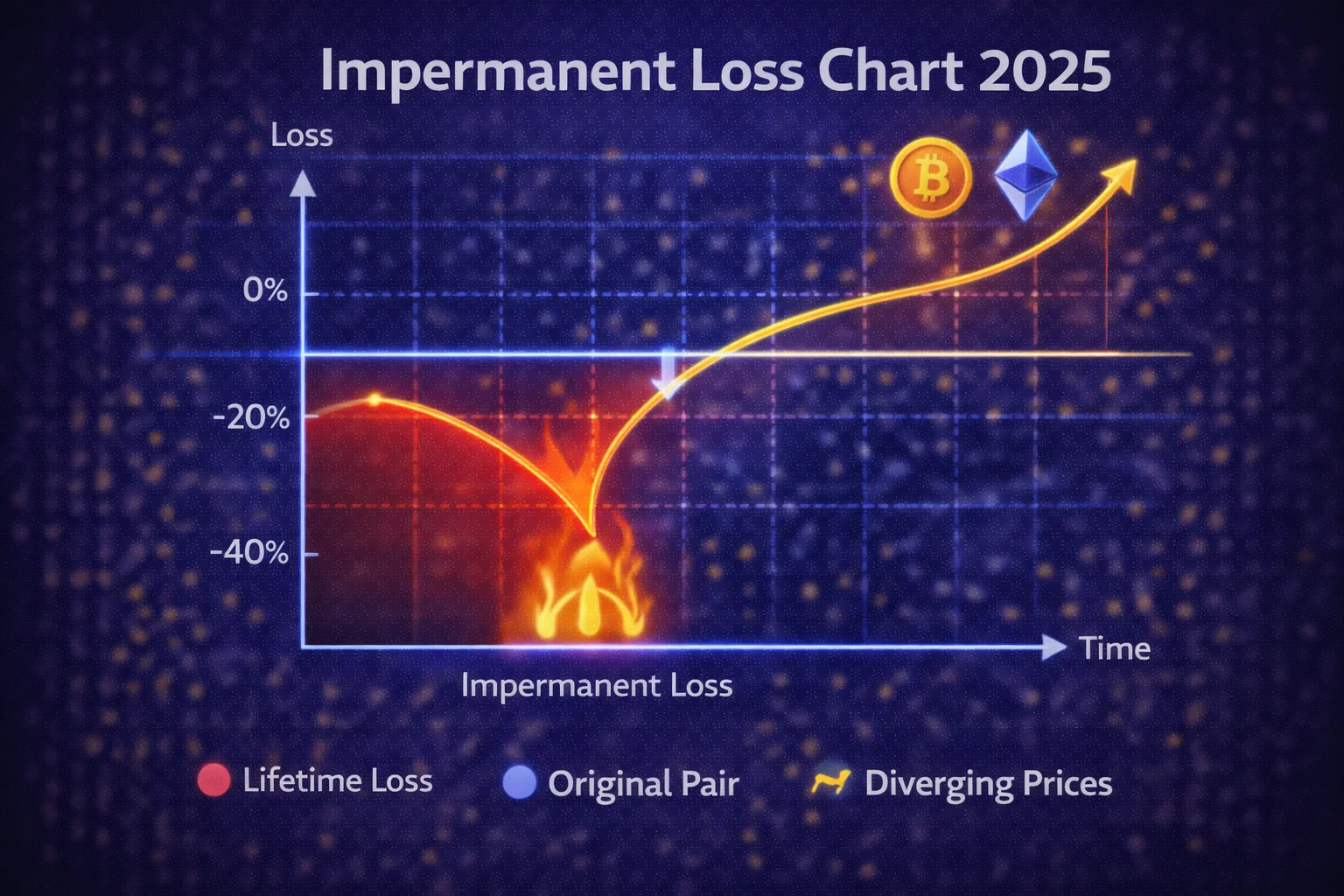

2. IL risk Risk

Description: Loss compared to holding assets when prices diverge

IL Risk by Price Shift:

- 25% price change: 0.6% IL

- 50% price movement: 2.0% IL

- 100% price shift: 5.7% IL

- 500% price divergence: 25.5% IL

Mitigation Strategies:

- Choose correlated asset pairs (stETH/ETH)

- Use stablecoin pairs for minimal IL

- Ensure transaction costs exceed potential IL

- Monitor positions and exit during high volatility

3. Liquidity and Market Risk

Description: Inability to exit positions or adverse market conditions

Risk Factors:

- Low liquidity pools: High slippage when exiting

- Market crashes: Correlated asset price declines

- Stablecoin depegs: USDC, USDT, DAI losing $1 peg

- Network congestion: High gas fees preventing exits

4. Regulatory and Compliance Risk

Description: Government actions affecting DeFi protocols

Potential Impacts:

- Protocol shutdowns or restrictions

- Token delisting from exchanges

- Tax implications for farming rewards

- KYC requirements for DeFi access

Expected Returns by Strategy (2025)

| Strategy Type | Risk Level | Expected APY | Key Risks |

|---|---|---|---|

| Stablecoin LP | Low | 3-8% | Smart contract, depeg |

| Single Asset Lending | Low-Medium | 2-6% | Protocol risk, rate changes |

| ETH/Stablecoin LP | Medium | 5-15% | liquidity risk, volatility |

| LSD Farming | Medium | 4-12% | Slashing, smart contract |

| Leveraged Strategies | High | 10-30% | Liquidation, amplified losses |

| New Protocol Farming | Very High | 20-200%+ | Rug pulls, unsustainable returns |

Understanding IL Risk: Complete Guide

What Is IL Risk?

Impermanent loss occurs when the price ratio of tokens in a liquidity pool changes compared to when you deposited them. The loss is "impermanent" because it only becomes permanent when you withdraw your liquidity.

How IL Risk Works

Example Scenario:

- Initial Deposit: 1 ETH + 2,000 USDC (ETH = $2,000)

- Price Shift: ETH rises to $4,000

- Pool Rebalancing: AMM automatically rebalances to maintain equal value

- New Position: 0.707 ETH + 2,828 USDC

- Value Comparison:

- LP Position: $5,656 (0.707 × $4,000 + $2,828)

- HODL Strategy: $6,000 (1 × $4,000 + $2,000)

- Impermanent Loss: $344 (5.7%)

Factors Affecting Impermanent Loss

Price Volatility

- Higher volatility = Higher IL: Dramatic price changes increase losses

- Correlation matters: Correlated assets (stETH/ETH) have minimal IL

- Direction irrelevant: IL occurs whether prices go up or down

Time Factor

- Short-term: Price may revert, making loss truly impermanent

- Long-term: Sustained price changes make losses more permanent

- Fee accumulation: exchange fees can offset IL over time

Strategies to minimise IL Risk

1. Choose Correlated Assets

- Stablecoin pairs: USDC/USDT, DAI/FRAX

- Liquid staking derivatives: stETH/ETH, rETH/ETH

- Wrapped tokens: WBTC/BTC, WETH/ETH

2. Focus on High-Fee Pools

- Volume matters: High trading volume generates more fees

- Fee tiers: Higher fee pools (0.3-1%) for volatile pairs

- Break-even analysis: Calculate if fees can offset potential IL

3. Use Concentrated Liquidity (Uniswap V3)

- Narrow ranges: Higher capital efficiency and fees

- Active management: Adjust ranges as prices move

- Risk trade-off: Higher fees but requires more attention

4. IL Protection

Some protocols offer IL protection mechanisms:

- Bancor: 100% IL protection after 100 days

- Thorchain: Asymmetric LP

- Insurance protocols: Cover IL through insurance products

Calculating IL Risk

Formula:

IL = (2 × √(price_ratio) / (1 + price_ratio)) - 1

Tools for IL Tracking:

- DeFiPulse: IL calculator and tracking

- APY.vision: Real-time IL monitoring

- Zapper: Portfolio tracking with IL analysis

- DeBank: DeFi portfolio dashboard

Best farming incentives Platforms in 2025

Tier 1: Battle-Tested Protocols

Uniswap - Leading AMM

Overview: The largest decentralised exchange with the most liquidity

Key Features:

- V2: Simple 50/50 pools with 0.3% fees

- V3: Concentrated liquidity with multiple fee tiers

- V4: Hooks and custom pool logic (2024 launch)

- Governance: UNI token holders vote on protocol changes

Best For: High-volume pairs, established tokens, concentrated liquidity strategies

Curve Finance - Stablecoin Specialist

Overview: optimised for stablecoins and similar-value assets

Key Features:

- StableSwap: Low slippage for similar assets

- Gauge System: CRV token incentives for liquidity

- Vote Locking: veCRV for boosted rewards and governance

- Metapools: Efficient routing through base pools

Best For: Stablecoin farming, liquid staking derivatives, low IL strategies

Aave - Premier Lending Protocol

Overview: Leading money market with innovative features

Key Features:

- Variable/Stable Rates: Choose your interest rate type

- Flash Loans: Uncollateralized loans within single transaction

- Isolation Mode: Risk management for new assets

- GHO Stablecoin: Native stablecoin with unique mechanics

Best For: Single-asset yield, leveraged strategies, flash loan arbitrage

Tier 2: specialised Protocols

Pendle - Yield Trading

Overview: Trade and speculate on future returns

Key Features:

- Returns Tokenization: Split assets into principal and returns tokens

- Fixed Returns: Lock in guaranteed profits

- Returns Speculation: Bet on future profit rates

- Boosted Pools: Enhanced rewards for PENDLE stakers

Best For: Returns optimisation, fixed-rate strategies, advanced users

Convex Finance - Curve optimiser

Overview: Simplified Curve farming with boosted rewards

Key Features:

- Automated veCRV: No need to lock CRV tokens

- Boosted Rewards: Higher returns than direct Curve farming

- CVX Tokens: Additional governance and reward token

- Simple Interface: One-click Curve farming

Balancer - Multi-Asset Pools

Overview: Flexible AMM with customizable pool weights

Key Features:

- Weighted Pools: Custom asset ratios (80/20, 60/40, etc.)

- Stable Pools: Curve-like pools for similar assets

- Boosted Pools: Yield-bearing token integration

- BAL Incentives: Governance token rewards

Cross-Chain Opportunities

Arbitrum

- Lower fees: Reduced gas costs for farming

- ARB incentives: Native token rewards

- Major protocols: Uniswap, Curve, Aave available

Polygon

- Minimal fees: Nearly free transactions

- QuickSwap: Native AMM with QUICK rewards

- Aave Polygon: High returns on lending

Avalanche

- Trader Joe: Native DEX with JOE tokens

- Benqi: Lending protocol with QI rewards

- Fast finality: Quick transaction confirmation

Platform Selection Criteria

Security Assessment

- Audit history: Multiple audits by reputable firms

- Bug bounties: Active security researcher programs

- Time in market: Protocols live for 6+ months

- TVL stability: Consistent or growing total value locked

Returns Sustainability

- Revenue sources: Real fees vs token emissions

- Token economics: Sustainable reward mechanisms

- Volume trends: Growing or stable trading activity

- Competition: Moat against other protocols

Advanced DeFi Strategies

1. Delta-Neutral Farming

Earn farming rewards while hedging price exposure through derivatives.

Basic Delta-Neutral Setup

- Provide liquidity: Deposit ETH/USDC to earn fees and rewards

- Short ETH: Open short position equal to ETH exposure

- Net exposure: Zero price sensitivity, pure yield capture

- Manage positions: Rebalance as pool composition changes

Platforms for Delta-Neutral

- GMX: Perpetual trading with GLP LP

- dYdX: Perpetual futures for hedging

- Gains Network: Synthetic trading pairs

2. Leveraged protocol farming

Amplify returns by borrowing additional capital for farming.

Recursive Lending Strategy

- Deposit collateral: Supply ETH to Aave

- Borrow stablecoin: Take USDC loan against ETH

- Farm with proceeds: Use USDC for yield generation

- Repeat process: Use farming rewards as additional collateral

Leveraged Farming Platforms

- Alpha Homora: Leveraged liquidity provision up to 3x

- Gearbox: Composable leverage for DeFi strategies

- Instadapp: Automated leverage management

3. Cross-Chain Arbitrage

Exploit returns differences across different blockchain networks.

Returns Arbitrage Process

- Identify spreads: Find returns differences between chains

- Bridge assets: Move capital to higher-returns chain

- Farm profits: Capture higher earnings

- Monitor costs: Account for bridge fees and gas costs

Cross-Chain Tools

- Hop Protocol: Fast Ethereum L2 bridges

- Multichain: Cross-chain asset bridges

- LayerZero: Omnichain protocol infrastructure

4. Automated Returns optimisation

Use returns aggregators to optimise profits automatically.

Yearn Finance Strategies

- Auto-compounding: Automatic reward reinvestment

- Strategy rotation: Move between best opportunities

- Gas optimisation: Batch transactions for efficiency

- Risk management: Professional strategy development

Other Returns Aggregators

- Beefy Finance: Multi-chain returns optimisation

- Harvest Finance: Automated farming strategies

- Badger DAO: Bitcoin-focused returns strategies

Real-World DeFi yields Examples

Example 1: Conservative Stablecoin Strategy

Profile: Risk-averse investor seeking steady returns

Strategy:

- Platform: Curve Finance USDC/USDT pool

- Capital: $10,000 (5,000 USDC + 5,000 USDT)

- Expected APY: 5-8% (trading costs + CRV rewards)

- Risk Level: Low (minimal IL)

Monthly Returns:

- Trading fees: ~$25-35

- CRV rewards: ~$15-25

- Total monthly: ~$40-60 ($480-720 annually)

Key Considerations: Gas costs on Ethereum mainnet can be $50-100 for entry/exit, making this strategy more suitable for larger amounts or Layer 2 networks.

Example 2: Moderate Risk ETH/USDC Strategy

Profile: Moderate risk tolerance, bullish on ETH

Strategy:

- Platform: Uniswap V3 ETH/USDC (0.3% fee tier)

- Capital: $5,000 (1.25 ETH + 2,500 USDC at $2,000/ETH)

- Price Range: $1,800-$2,400 (concentrated liquidity)

- Expected APY: 10-20% (higher fees from concentration)

Scenario Analysis:

- ETH stays $1,800-$2,400: Earn full fees, minimal IL

- ETH rises to $3,000: Position exits range, stop earning fees

- ETH falls to $1,500: Position exits range, accumulate more ETH

Active Management: Requires monitoring and rebalancing every 1-2 weeks to maintain optimal fee generation.

Example 3: Advanced Leveraged Strategy

Profile: Experienced DeFi user, high risk tolerance

Strategy:

- Step 1: Deposit 10 ETH to Aave as collateral

- Step 2: Borrow 12,000 USDC (60% LTV)

- Step 3: Provide liquidity to Curve stETH/ETH pool

- Step 4: Stake LP tokens for additional CRV rewards

Return Breakdown:

- Curve trading fees: 3-5% APY

- CRV rewards: 4-8% APY

- Borrowing cost: -2% APY (USDC borrow rate)

- Net leveraged APY: 8-15% on total position

Risk Management: Monitor health factor daily, maintain >1.5 to avoid liquidation. Set price alerts for ETH at key levels.

Example 4: Yield Aggregator Approach

Profile: Passive investor, minimal time commitment

Strategy:

- Platform: Yearn Finance USDC vault

- Capital: $20,000 USDC

- Management: Fully automated by Yearn strategies

- Expected APY: 4-10% (varies with market conditions)

Benefits:

- Automatic compounding (no manual claiming)

- Professional strategy management

- Gas cost optimisation through batching

- Dynamic reallocation to best opportunities

Trade-offs: Lower maximum returns compared to active strategies, but significantly less time investment and complexity.

Lessons from Real Farmers

Success Story: Stablecoin Farmer

A conservative investor started with $50,000 in Curve's 3pool (DAI/USDC/USDT) in early 2024. By consistently compounding rewards and maintaining the position through market volatility, they achieved:

- 7.2% average APY over 12 months

- $3,600 in total returns

- Zero IL (stablecoin pool)

- Minimal active management (monthly check-ins)

Cautionary Tale: High-Risk Chaser

An aggressive farmer chased 200%+ APY on a new protocol with unaudited contracts. Initial $10,000 investment grew to $15,000 in two weeks, but:

- Protocol suffered smart contract exploit

- Lost 80% of position value ($12,000 loss)

- Reward tokens became worthless

- Lesson: Sustainable returns over unsustainable promises

Getting Started with liquidity mining: Complete Guide

Prerequisites and Setup

1. Wallet Setup

- Hardware wallet: Ledger or Trezor for large amounts

- MetaMask: Browser extension for DeFi interactions

- WalletConnect: Mobile wallet connections

- Backup security: Secure seed phrase storage

2. Network Selection

- Ethereum: Highest liquidity, highest fees

- Arbitrum: Lower fees, good protocol selection

- Polygon: Minimal fees, many opportunities

- Avalanche: Fast transactions, native protocols

3. Initial Capital Planning

- Start small: 1-5% of crypto portfolio

- Gas budget: Reserve ETH for transaction fees

- Emergency fund: Keep liquid reserves

- Risk tolerance: Match strategies to risk appetite

Step-by-Step Beginner Strategy

Week 1: Education and Setup

- Learn basics: Understand AMMs, IL risk, gas fees

- Set up wallet: Install MetaMask, secure seed phrase

- Get testnet experience: Practice on Goerli or Mumbai testnets

- Join communities: Discord, Telegram, Reddit for learning

Week 2: First Position

- Choose conservative strategy: Stablecoin LP on Curve

- Start with $100-500: Small amount to learn mechanics

- Provide liquidity: Deposit USDC/USDT to Curve pool

- Monitor position: Track fees, rewards, and pool health

Week 3-4: optimisation

- analyse performance: Calculate actual APY vs expectations

- Explore alternatives: Compare other stablecoin opportunities

- Compound rewards: Reinvest earned tokens

- Risk assessment: Evaluate comfort with current strategy

Risk Management Framework

Position Sizing

- Conservative: 5-10% of crypto portfolio in farming

- Moderate: 10-25% across multiple strategies

- Aggressive: 25-50% with active management

- Never exceed: 50% of total crypto holdings

Diversification Rules

- Protocol diversification: No more than 30% in single protocol

- Strategy diversification: Mix LP farming, lending, vaults

- Asset diversification: Different token exposures

- Chain diversification: Spread across multiple networks

Monitoring and Alerts

- Daily checks: Pool health, reward rates, news

- Price alerts: Set alerts for major price movements

- APY tracking: Monitor yield decay and competition

- Security alerts: Follow protocol announcements

Tools and Resources

Portfolio Tracking

- DeBank: Comprehensive DeFi portfolio dashboard

- Zapper: Position tracking and management

- APY.vision: IL risk and yield tracking

- Zerion: Mobile-friendly portfolio tracker

Analytics and Research

- DeFiPulse: Protocol rankings and TVL data

- DeFiLlama: Cross-chain yield and TVL tracking

- Token Terminal: Protocol revenue and metrics

- Dune Analytics: Custom dashboards and queries

Security Tools

- Revoke.cash: Manage token approvals

- Etherscan: Transaction verification

- MyCrypto: Wallet security tools

- Forta: Real-time security monitoring

Conclusion

Yield farming represents one of the most dynamic and potentially rewarding aspects of decentralised finance, offering sophisticated investors the opportunity to earn substantial returns through strategic liquidity provision and protocol participation. The evolution of DeFi in 2025 has created a mature ecosystem where yield farmers can access diverse strategies ranging from conservative stablecoin pools to advanced multi-protocol compositions that maximise capital efficiency while managing risk exposure.

Success in liquidity provision requires a comprehensive understanding of the underlying protocols, careful risk assessment, and disciplined portfolio management. The most profitable strategies often involve balancing high-yield opportunities with sustainable protocols that generate revenue through real economic activity rather than unsustainable token emissions. Innovative yield farmers diversify across multiple protocols, actively manage impermanent loss exposure, and maintain sufficient liquidity reserves to navigate market volatility without being forced into unfavorable positions.

The maturation of the DeFi ecosystem has brought both opportunities and challenges for yield farmers. Whilst the infrastructure has become more robust and user-friendly, the increased competition has compressed yields in many traditional farming strategies. This evolution has pushed successful farmers towards more sophisticated approaches, including cross-chain strategies, automated yield optimisation, and participation in governance processes that can provide additional value beyond simple yield generation.

Risk management remains the cornerstone of successful yield generation in 2025. The most effective farmers employ multiple layers of protection: diversification across protocols and strategies, careful position sizing, regular monitoring of protocol health and governance decisions, and maintaining emergency exit strategies for adverse market conditions. Understanding and quantifying risks such as impermanent loss, smart contract vulnerabilities, and regulatory changes is essential for long-term success.

The key to long-term success lies in continuous education, staying informed about protocol developments, and adapting strategies as market conditions evolve. Whilst liquidity provision can generate attractive returns that significantly exceed traditional financial products, it requires active management and carries significant risks, including smart contract vulnerabilities, impermanent loss, and regulatory uncertainty. Conservative approaches that focus on established protocols with proven track records and sustainable tokenomics often outperform aggressive strategies that chase unsustainable yields.

As DeFi continues to mature and potentially face increased regulation, liquidity mining will likely become more institutionalised and standardised, but the fundamental opportunities for earning yield through liquidity provision will remain. The farmers who succeed in this evolving landscape will be those who combine deep technical knowledge with prudent risk oversight, treating liquidity provision as a sophisticated allocation approach rather than a speculative gamble.

For those beginning their yield generation journey, the path to success involves starting with small positions, thoroughly understanding each protocol before committing significant capital, and building expertise gradually through hands-on experience. Focus on learning the fundamentals, understanding the risks, and developing a systematic approach to strategy selection and risk oversight. With proper preparation and disciplined execution, liquidity provision can become a valuable component of a diversified digital currency allocation approach in 2025 and beyond.

Sources & References

Frequently Asked Questions

- What is liquidity mining?

- Liquidity mining is providing capital to DeFi protocols (AMMs, lending platforms, vaults) to earn trading fees, interest, and token incentives. Returns are variable and depend on pool dynamics, trading volume, and token emissions programs.

- What is IL (impermanent loss)?

- IL occurs in AMM pools when asset prices diverge from the initial deposit ratio, potentially reducing your position value compared to simply holding the assets. The loss is "impermanent" because it only becomes permanent when you withdraw liquidity.

- Is protocol farming safe in 2025?

- DeFi farming carries risks including smart contract exploits, IL risk, and token volatility. However, using audited protocols, diversifying positions, starting with small amounts, and understanding the risks can help manage these dangers effectively.

- How much money do I need to start DeFi farming?

- You can start liquidity provision with as little as $50-100, but consider gas fees on Ethereum. For the Ethereum mainnet, $500+ is more practical due to gas costs. Layer 2 networks, such as Arbitrum or Polygon, allow for smaller starting amounts due to lower fees.

- What's the difference between DeFi farming and staking?

- Staking involves locking tokens in a proof-of-stake network to earn rewards, while yield generation provides capital to DeFi protocols. Staking is generally simpler and lower risk, while LP offers higher potential returns but with increased complexity and risks, such as IL risk.

- How often should I compound my DeFi rewards?

Compounding frequency depends on gas costs and reward amounts:

- Ethereum mainnet: Weekly or bi-weekly due to high gas fees

- Layer 2 networks: Daily or every few days with low fees

- Auto-compounding vaults: Handle this automatically

- Rule of thumb: Compound when rewards exceed 2-3x the gas cost

- Can I lose all my money in DeFi farming?

Whilst total loss is possible, it's rare with established protocols. Main risks include:

- Smart contract exploits: Protocol hacks or bugs

- IL risk: Typically 5-25% in extreme scenarios

- Token crashes: Reward tokens losing value

- Stablecoin depegs: Stablecoins losing $1 parity

Mitigation: Use audited protocols, diversify positions, and never invest more than you can afford to lose.

- What are the tax implications of DeFi farming?

Tax treatment varies by jurisdiction, but generally:

- Farming rewards: Taxed as income when received

- LP tokens: May trigger taxable events when minting/burning

- IL risk: May be deductible as capital loss

- Record keeping: Track all transactions and token values

- Professional advice: Consult tax professionals for large amounts

- Should I use leverage in DeFi farming?

Leverage amplifies both gains and losses. Only consider leverage if you:

- Fully understand liquidation mechanics

- Have experience with basic DeFi farming

- Can monitor positions actively

- Have risk oversight strategies in place

Start with unleveraged positions and gradually increase complexity as you gain experience.

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.