Crypto Lending vs Staking 2025: Guide

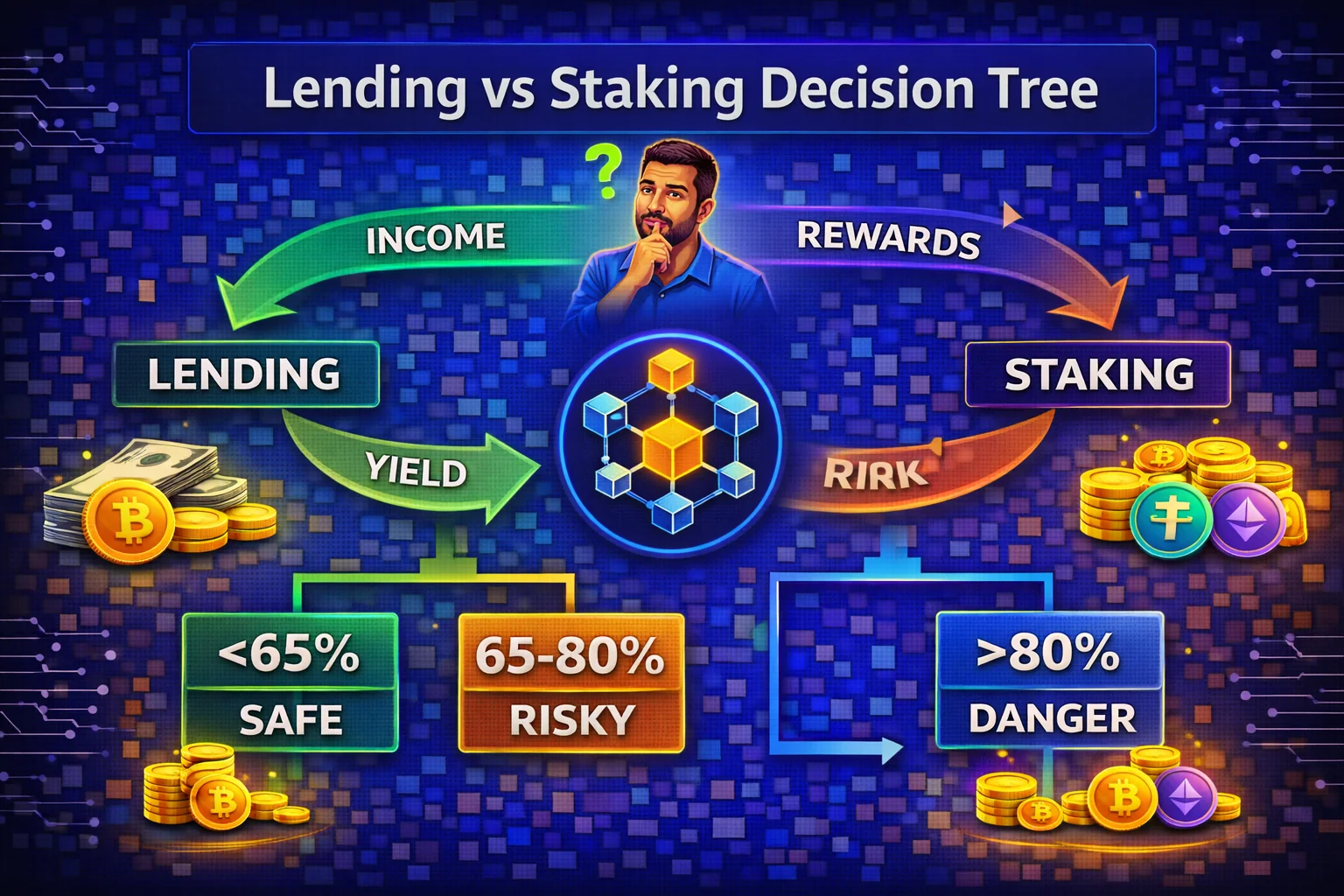

Discover the key differences between digital asset lending and staking, compare yields and risks, and learn which strategy fits your investment goals in 2025.

Introduction

The cryptocurrency ecosystem offers multiple pathways for generating passive income from digital asset holdings, with lending and staking emerging as two of the most popular and accessible strategies for both novice and experienced investors. Understanding the fundamental differences between these approaches is crucial for making informed decisions about where to allocate your crypto assets for optimal risk-adjusted returns.

Whilst both approaches promise attractive yields that often exceed traditional financial products, they operate through fundamentally different mechanisms and present distinct risk profiles that require careful consideration and understanding before committing significant capital to either strategy. The choice between lending and staking often depends on your risk tolerance, investment timeline, technical expertise, and specific financial goals.

Cryptocurrency lending involves providing your digital assets to borrowers through centralised platforms or decentralised protocols in exchange for interest payments, typically ranging from 3% to 15% annually, depending on the asset and market conditions. This approach allows you to earn passive income while maintaining exposure to potential price appreciation of your underlying cryptocurrency holdings.

Staking, conversely, involves participating in blockchain network validation by locking up your tokens to support network security and consensus mechanisms. Staking rewards typically range from 4% to 20% annually and represent your share of newly minted tokens distributed to validators and delegators who help secure the network through proof-of-stake consensus algorithms.

The evolution of both lending and staking markets in 2025 has been shaped by regulatory developments, technological innovations, and market maturation that have created new opportunities while also introducing additional complexities for investors to navigate. Understanding these developments and their implications is crucial for making informed decisions about passive income strategies that align with your investment objectives and risk tolerance.

Institutional adoption of both lending and staking has brought significant improvements in security standards, operational transparency, and risk management practices, with traditional financial institutions introducing established methodologies and regulatory compliance frameworks that benefit all market participants. These developments have made both strategies more accessible and secure for retail investors while also increasing competition and potentially reducing yields.

The technological infrastructure supporting both lending and staking has matured considerably, with advances in smart contract security, user interface design, and automated optimisation tools making these strategies more accessible to mainstream investors. However, the increasing sophistication of these platforms also requires greater technical understanding and due diligence to evaluate risks and opportunities effectively.

Market dynamics in 2025 reflect a fundamental shift towards sustainable yield generation and conservative risk management, moving away from the unsustainable high-yield promises that characterised earlier market cycles. This maturation has resulted in more realistic yield expectations, improved risk assessment processes, and enhanced transparency requirements that help investors make more informed decisions about passive income strategies.

The integration of artificial intelligence and machine learning technologies is transforming both lending and staking markets through automated risk assessment, yield optimisation, and portfolio management capabilities. These technological advances enable more sophisticated strategies and better risk management while also creating new opportunities for passive income generation that were previously unavailable to retail investors.

Regulatory clarity continues improving across major jurisdictions, with governments implementing comprehensive frameworks that balance innovation with consumer protection for both lending and staking activities. These regulatory developments provide greater certainty for both platforms and users, enabling more confident participation in passive income strategies while maintaining appropriate safeguards and compliance requirements.

The diversification benefits of combining lending and staking strategies have become increasingly apparent, with sophisticated investors implementing multi-strategy approaches that optimise risk-adjusted returns through strategic allocation across different passive income opportunities. Understanding how to effectively combine these strategies can significantly enhance overall portfolio performance while managing concentration risks.

This comprehensive comparison examines the key differences between cryptocurrency lending and staking, analysing risk profiles, return potential, operational requirements, and strategic considerations that inform optimal capital allocation decisions. Whether you're new to passive income strategies or looking to optimise your existing approach, understanding these fundamental differences is essential for maximising returns while managing risks in the evolving cryptocurrency ecosystem.

Both strategies have evolved significantly since their inception, with sophisticated platforms now offering enhanced features like compound interest, flexible terms, and insurance coverage that make these passive income strategies more accessible and attractive to mainstream investors seeking alternatives to traditional savings accounts and investment products.

Cryptocurrency lending involves providing digital assets to borrowers through either centralised platforms or decentralised protocols in exchange for interest payments. This approach is similar to traditional banking but offers significantly higher yields and different risk characteristics stemming from the nascent nature of the crypto market and regulatory uncertainty. The lending process can range from simple deposit-and-earn models on centralised platforms to complex DeFi protocols that require active management and a sophisticated understanding of smart contract risks, liquidation mechanisms, and market dynamics.

Staking, on the other hand, involves participating in the consensus mechanism of proof-of-stake blockchain networks by locking up tokens to help secure the network and validate transactions in exchange for staking rewards. This process is more directly tied to the underlying blockchain infrastructure. It typically offers more predictable returns, though liquidity constraints and technical requirements vary depending on whether you choose native staking, liquid staking, or delegated staking.

The decision between crypto lending and staking becomes increasingly complex as both sectors continue to evolve rapidly in 2025. New platforms, protocols, and hybrid approaches regularly emerge, offering innovative ways to earn yield while managing risk. Regulatory developments, technological improvements, and market maturation have significantly impacted both lending and staking opportunities, creating new considerations for investors seeking to optimise their passive income strategies.

This comprehensive comparison examines the key differences between crypto lending and staking across multiple dimensions, including risk profiles, return potential, liquidity considerations, technical requirements, and tax implications. By understanding these factors, you can make more informed decisions about which approach aligns best with your investment objectives and risk management preferences.

Throughout this analysis, we'll explore real-world examples, current market conditions, and practical strategies for implementing either approach safely and effectively. The goal is to provide you with the knowledge needed to navigate these opportunities confidently while avoiding common pitfalls that can lead to significant losses in the volatile cryptocurrency market.

Staking, on the other hand, involves participating in the consensus mechanism of proof-of-stake blockchain networks. You lock up tokens to help secure the network and validate transactions in exchange for staking rewards.

This process directly supports blockchain infrastructure while generating passive income. However, it requires an understanding of network-specific risks, validator selection, and the technical aspects of different staking implementations across various blockchain ecosystems.

The choice between lending and staking involves evaluating multiple factors, including yield potential, risk tolerance, liquidity requirements, technical complexity, and long-term investment goals. Market conditions, regulatory developments, and technological innovations continue to reshape both sectors.

This makes it essential for investors to stay informed about evolving opportunities and risks in each approach to passive income generation.

Recent market events, including the collapse of major lending platforms and staking infrastructure providers, have highlighted the importance of thorough due diligence and risk management in both strategies. The failures of Celsius, BlockFi, and other major platforms have fundamentally changed how investors approach cryptocurrency lending.

Similarly, slashing events and validator failures in various staking networks have demonstrated the importance of proper validator selection and diversification strategies.

The regulatory landscape for both lending and staking has evolved significantly in 2025, with clearer guidelines in major jurisdictions providing better consumer protection while also imposing compliance requirements that affect platform operations and user access.

Understanding the fundamental differences between lending and staking, along with their respective advantages and disadvantages, enables investors to make more informed decisions about portfolio allocation and risk management strategies.

This comprehensive comparison examines the key differences between cryptocurrency lending and staking. It analyses yield potential, risk factors, platform options, and strategic considerations to help investors determine which approach best aligns with their financial goals and risk tolerance in the current market environment.

Overview: Two Paths to Crypto Passive Income

Both digital asset lending and staking offer ways to earn passive income from your cryptocurrency holdings, but they work through fundamentally different mechanisms. Understanding these differences is crucial for making informed decisions about where to allocate your crypto assets for maximum risk-adjusted returns.

In 2025, the landscape for both strategies has matured significantly, with clearer regulations, better security practices, and more sophisticated platforms. However, each approach still carries distinct risks and rewards that every investor should understand before committing capital.

Understanding the Fundamentals

What is Digital Asset Lending?

Digital asset lending involves depositing your cryptocurrency assets into platforms where borrowers can access them for various purposes , such as trading, arbitrage, or leveraged positions. In return, you earn interest payments funded by the borrowers' fees.

Types of Digital Asset Lending

- centralised Lending (CeFi): Platforms like Nexo, BlockFi, or exchange lending programs

- decentralised Lending (DeFi): Protocols like Aave, Compound, or Maker

- Peer-to-Peer Lending: Direct lending between individuals with platform facilitation

- Institutional Lending: Lending to hedge funds, market makers, and trading firms

How Lending Generates Returns

Lending returns come from interest payments borrowers make. Rates fluctuate based on supply and demand dynamics:

- High Demand Periods: Bull markets, high volatility, arbitrage opportunities drive up rates

- Low Demand Periods: Bear markets, low volatility, reduced trading activity, lower rates

- Asset-Specific Factors: Some tokens have higher borrowing demand due to shorting or DeFi usage

What is Crypto Staking?

Crypto staking involves participating in the consensus mechanism of Proof-of-Stake (PoS) blockchains by locking up tokens to help validate transactions and secure the network. In return, you earn staking rewards distributed by the protocol.

Types of Staking

- Native Staking: Direct staking through blockchain wallets and validators

- Exchange Staking: Simplified staking through centralised exchanges

- LST Protocols: Staking while maintaining liquidity through derivative tokens

- Delegated Staking: Delegating stake to validators while retaining ownership

How Staking Generates Returns

Staking rewards come from protocol-level mechanisms designed to incentivise network security:

- Block Rewards: New tokens created and distributed to validators and delegators

- Transaction Fees: Fees collected from network transactions

- MEV (Maximal Extractable Value): Additional value from transaction ordering

- Protocol Incentives: Additional rewards from ecosystem development funds

Detailed Comparison: Lending vs Staking

| Factor | Digital Asset Lending | Crypto Staking |

|---|---|---|

| Yield Generation | Interest from borrowers; market-driven rates | Protocol rewards; algorithmically determined |

| Typical Returns (2025) | 2-15% APY (highly variable) | 3-12% APY (more predictable) |

| Volatility of Returns | High rates fluctuate with market conditions | Low-Medium - protocol adjustments are gradual |

| Liquidity | Often flexible, but may have withdrawal queues | Varies: instant (liquid) to 21+ days (native) |

| Minimum Requirements | Usually low or no minimums | Varies: 32 ETH (solo) to no minimum (pools) |

| Technical Complexity | Simple (CeFi) to moderate (DeFi) | Simple (exchange) to high (solo validation) |

| Custody Model | Custodial (CeFi) or self-custody (DeFi) | Self-custody (native) or custodial (exchange) |

| Primary Risks | Counterparty, rehypothecation, liquidity | Slashing, validator performance, protocol changes |

Yield Analysis: What to Expect in 2025

Digital Asset Lending Yields

Lending yields in 2025 vary significantly based on market conditions, asset type, and platform choice. Understanding the factors that drive these yields helps inform allocation decisions.

Stablecoin Lending (USDC, USDT, DAI)

- Typical Range: 2-8% APY

- Peak Periods: Can spike to 15%+ during high demand

- Low Periods: May drop below 2% in bear markets

- Best Platforms: Aave, Compound, Nexo, exchange lending

Bitcoin Lending

- Typical Range: 1-6% APY

- Demand Drivers: Institutional borrowing, derivatives trading

- Considerations: Lower yields but potentially safer collateral

Ethereum and Altcoin Lending

- Typical Range: 3-12% APY

- Volatility: Higher yields but more variable rates

- Use Cases: DeFi protocols, shorting, arbitrage

Crypto Staking Yields

Staking yields are generally more predictable than lending yields, as they're determined by protocol economics rather than market demand. However, they can still vary based on network participation and validator performance.

Major PoS Networks (2025 Estimates)

- Ethereum (ETH): 3-6% APY

- Solana (SOL): 6-9% APY

- Cardano (ADA): 4-6% APY

- Polkadot (DOT): 10-14% APY

- Cosmos (ATOM): 8-12% APY

- Avalanche (AVAX): 8-11% APY

Factors Affecting Staking Yields

- Network Participation: Higher participation generally lowers yields

- Validator Performance: Uptime and efficiency affect rewards

- Protocol Changes: Network upgrades can modify reward structures

- Inflation Rate: Some networks adjust inflation based on staking participation

Risk Analysis: Understanding What Can Go Wrong

Digital Asset Lending Risks

Counterparty Risk

The primary risk in digital asset lending is that the borrower or lending platform fails to return your assets. This risk varies significantly between centralised and decentralised platforms.

- CeFi Platforms: Company insolvency, regulatory action, management fraud

- DeFi Protocols: Smart contract bugs, governance attacks, oracle failures

- Mitigation: Diversify across platforms, check audits, monitor platform health

Rehypothecation Risk

Some platforms lend out your deposited assets to generate returns, creating additional layers of counterparty risk. Your assets may be used as collateral for other loans, increasing exposure to market volatility.

Liquidity Risk

During market stress, lending platforms may implement withdrawal restrictions, queues, or temporary suspensions. This can prevent you from accessing your funds when you need them most.

Regulatory Risk

Changing regulations can compel platforms to modify their terms, restrict services, or even cease operations entirely. This risk is particularly high for unregulated platforms or those operating in jurisdictions with uncertain regulatory frameworks.

Crypto Staking Risks

Slashing Risk

Validators can lose a portion of their staked tokens for malicious behaviour or extended downtime. Whilst rare with reputable validators, slashing can result in permanent loss of principal.

- Common Causes: Double signing, extended offline periods, malicious behavior

- Typical Penalties: 0.5-5% of staked amount, depending on severity

- Mitigation: Choose reputable validators, diversify across multiple validators

Validator Performance Risk

Poor validator performance can reduce your staking rewards through missed block proposals, attestation failures, or high commission rates.

Protocol Risk

Changes to the underlying blockchain protocol can affect staking mechanics, reward rates, or validator requirements. Major upgrades may introduce bugs or unintended consequences.

LST Protocol Risks

LST derivatives add additional risks, including smart contract vulnerabilities, depeg events, and centralisation concerns around major LST providers.

- Depeg Risk: stETH/ETH ratio deviating from 1:1 during market stress

- Smart Contract Risk: Bugs in LST protocols

- centralisation Risk: Dominance of large LST providers

Platform Comparison: Where to Lend and Stake

Top Digital Asset Lending Platforms

centralised Platforms (CeFi)

- Nexo: EU-regulated, insurance coverage, flexible terms, 4-12% APY on various assets

- YouHodler: Swiss-regulated, multiple products, competitive rates, 1-15% APY depending on product

- Coinbase: US-regulated, FDIC insurance on USD, limited digital asset lending options

- Kraken: Strong security record, transparent operations, staking and lending options

decentralised Platforms (DeFi)

- Aave: Leading DeFi lending protocol, multiple markets, 2-15% APY, instant loans

- Compound: Established money market, algorithmic interest rates, governance token rewards

- Maker: DAI stablecoin protocol, DSR (DAI Savings Rate), conservative yields

Top Crypto Staking Platforms

LST Providers

- Lido: Largest LST provider, stETH for Ethereum, 3-5% APY

- Rocket Pool: Decentralised Ethereum staking, rETH token, community-run validators

- Frax Ether: Algorithmic LST, sfrxETH token, competitive yields

Exchange Staking

- Coinbase: Simple staking for multiple assets, a regulated platform, and competitive rates

- OKX: Extensive staking options, flexible and locked products, and global access

- Kraken: On-chain staking, transparent fees, and multiple PoS networks are supported

Native Staking Solutions

- Solo Staking: Run your own validator, maximum decentralisation, technical complexity

- Staking Pools: Pool resources with others, lower minimums, shared rewards

- Staking-as-a-Service: Professional validator services, white-glove setup

Decision Framework: Choosing Your Strategy

Asset Allocation Considerations

Long-term Holdings (1+ years)

For assets you plan to hold long-term, staking often makes more sense as it aligns with your investment timeline and provides steady, predictable returns without counterparty risk.

- Best for Staking: ETH, SOL, ADA, DOT, ATOM

- Strategy: Native or liquid staking depending on liquidity needs

- Considerations: Unbonding periods, validator selection, protocol roadmaps

Tactical Positions (weeks to months)

For shorter-term positions or assets you may need to access quickly, lending provides more flexibility while still generating yield during holding periods.

- Best for Lending: Stablecoins, BTC, liquid altcoins

- Strategy: Flexible lending terms, monitor rate changes

- Considerations: Withdrawal terms, platform reliability, rate volatility

Risk Tolerance Assessment

Conservative Approach

- Staking: Established PoS networks with long track records

- Lending: Regulated platforms with insurance coverage

- Allocation: 70% staking, 30% lending

- Focus: Capital preservation with modest yield enhancement

Moderate Approach

- Staking: Mix of native and liquid staking across multiple networks

- Lending: Diversified across CeFi and DeFi platforms

- Allocation: 50% staking, 50% lending

- Focus: Balanced risk-return optimisation

Aggressive Approach

- Staking: Newer PoS networks with higher yields

- Lending: DeFi protocols with variable rate optimisation

- Allocation: 30% staking, 70% lending

- Focus: Maximum yield with active management

Operational Considerations

Time Commitment

- Low Maintenance: Exchange staking, CeFi lending

- Medium Maintenance: Liquid staking, DeFi lending

- High Maintenance: Solo staking, active DeFi strategies

Technical Expertise

- Beginner: Start with exchange-based solutions

- Intermediate: Explore liquid staking and established DeFi protocols

- Advanced: Consider solo staking and complex DeFi strategies

Tax Implications: What You Need to Know

General Tax Principles

Tax treatment of digital asset lending and staking varies by jurisdiction, but most developed countries have established frameworks that treat both activities as taxable events. Understanding these implications is crucial for compliance and optimisation.

Lending Tax Treatment

Income Recognition

- Timing: Interest typically taxed when received or accrued

- Rate: Usually taxed as ordinary income at marginal rates

- Currency: Must be valued in local currency at time of receipt

- Frequency: Daily accrual may require frequent valuations

Capital Gains Considerations

- Lending Activity: Generally not considered a disposal for capital gains

- Platform Tokens: Rewards in platform tokens may trigger immediate income recognition

- Withdrawal: Converting earned interest to other assets triggers capital gains

Staking Tax Treatment

Income Recognition

- Timing: Rewards typically taxed when received and accessible

- Valuation: Fair market value at time of receipt

- Frequency: May be daily, weekly, or per epoch, depending on the network

- Cost Basis: Received tokens have cost basis equal to income recognised

Special Considerations

- Slashing Events: May be deductible as capital losses

- Liquid Staking: Token swaps may trigger capital gains events

- Validator Rewards: May be treated differently than delegator rewards

Record Keeping Requirements

- Transaction Logs: Detailed records of all staking and lending activities

- Valuation Data: Historical price data for all reward receipts

- Platform Statements: Official records from all platforms used

- Cost Basis Tracking: Maintain accurate cost basis for all positions

Tax optimisation Strategies

- Jurisdiction Shopping: Consider tax-friendly jurisdictions for operations

- Timing Strategies: Harvest losses to offset staking/lending income

- Entity Structures: Corporate structures may offer tax advantages

- Professional Advice: Consult qualified tax professionals for complex situations

Advanced Strategies: maximising Risk-Adjusted Returns

Hybrid Approaches

Core-Satellite Strategy

- Core (70%): Stable staking positions in major PoS networks

- Satellite (30%): Tactical lending and high-yield staking opportunities

- Benefits: Stability with upside potential, risk diversification

Yield Curve Strategies

- Short-term: Flexible lending for rate volatility capture

- Medium-term: Liquid staking for steady returns with liquidity

- Long-term: Native staking for maximum yields and network participation

Risk Management Techniques

Diversification Strategies

- Platform Diversification: Spread across multiple platforms and protocols

- Asset Diversification: Different cryptocurrencies with varying risk profiles

- Strategy Diversification: Combine lending, staking, and other yield strategies

- Geographic Diversification: Use platforms in different jurisdictions

Hedging Approaches

- Delta Hedging: Use derivatives to hedge price exposure while earning yield

- Basis Trading: Arbitrage between spot and futures while staking/lending

- Cross-Asset Hedging: Use correlated assets to reduce overall portfolio risk

Automation and optimisation

Yield Aggregators

- Yearn Finance: Automated yield optimisation across DeFi protocols

- Beefy Finance: Auto-compounding strategies for various networks

- Harvest Finance: Yield farming automation with gas optimisation

Rebalancing Strategies

- Rate-Based Rebalancing: Move funds based on yield differentials

- Risk-Based Rebalancing: Adjust allocation based on risk metrics

- Calendar Rebalancing: Regular rebalancing regardless of market conditions

Market Dynamics and Economic Factors

Interest Rate Environment Impact

The broader macroeconomic interest rate environment significantly influences both cryptocurrency lending and staking yields through complex mechanisms that affect capital flows, risk appetite, and opportunity costs for investors. When traditional financial markets offer higher risk-free rates, cryptocurrency yields must compensate investors for additional risks including volatility, regulatory uncertainty, and technological complexity that characterize digital asset investments.

Rising traditional interest rates typically compress cryptocurrency lending spreads as institutional borrowers reduce leverage and speculative activity decreases across digital asset markets. Conversely, low traditional rates often drive capital towards higher-yielding cryptocurrency opportunities, increasing demand for lending services and potentially reducing available yields through increased supply of lendable assets. Understanding these relationships enables more informed timing decisions for entering and exiting lending positions.

Market Volatility and Yield Correlation

Cryptocurrency market volatility creates complex relationships between asset prices and yield opportunities that experienced investors learn to navigate effectively. High volatility periods typically increase borrowing demand for trading and arbitrage activities, driving up lending rates while simultaneously increasing liquidation risks and platform stress that can threaten principal preservation. Staking yields remain more stable during volatile periods but may face increased slashing risks if network congestion or validator errors increase during market stress.

Professional yield farmers develop sophisticated strategies for managing volatility exposure while maintaining yield generation objectives. These approaches include dynamic hedging strategies, correlation analysis between different yield sources, and systematic risk management protocols that protect capital during adverse market conditions while positioning for opportunities during favorable periods. Understanding volatility patterns enables better timing for strategy implementation and risk management decisions.

Liquidity Cycles and Capital Efficiency

Cryptocurrency markets experience distinct liquidity cycles that significantly impact both lending and staking opportunities through changing supply and demand dynamics for different digital assets. Bull market periods typically feature increased borrowing demand for leveraged positions and arbitrage opportunities, driving up lending rates while also increasing competition amongst lenders and potentially compressing margins over time. Bear markets often see reduced borrowing demand but may create opportunities for patient capital providers willing to accept longer-term commitments.

Capital efficiency optimisation requires understanding these cycles and positioning appropriately for different market phases. Experienced investors develop systematic approaches for adjusting their lending and staking allocations based on market cycle indicators, liquidity conditions, and relative value opportunities across different platforms and protocols. This includes maintaining flexibility to capitalise on temporary dislocations while avoiding overexposure during periods of elevated risk.

Regulatory Evolution and Market Structure

Regulatory developments continue reshaping cryptocurrency lending and staking markets through new compliance requirements, consumer protection measures, and institutional frameworks that affect platform operations and yield opportunities. Clear regulatory frameworks generally improve market stability and institutional participation while potentially reducing yields through increased compliance costs and operational requirements that platforms must absorb or pass through to users.

Market structure evolution includes the emergence of regulated institutional platforms, improved custody solutions, and sophisticated risk management tools that enhance safety while potentially commoditizing yield opportunities. Understanding regulatory trends enables better platform selection and strategy positioning for long-term success in evolving market conditions. Professional investors monitor regulatory developments across multiple jurisdictions to identify opportunities and risks that may affect their yield generation strategies.

Technology Innovation and Competitive Dynamics

Technological innovations in blockchain infrastructure, smart contract capabilities, and yield optimisation tools continuously create new opportunities while disrupting existing market dynamics. Layer 2 scaling solutions reduce transaction costs and enable new yield strategies, while improved interoperability protocols facilitate more efficient capital allocation across different networks and platforms. These developments often create temporary arbitrage opportunities for early adopters while eventually leading to more efficient and competitive markets.

Competitive dynamics amongst platforms drive innovation in yield products, risk management tools, and user experience improvements that benefit investors through better opportunities and enhanced safety features. However, intense competition can also lead to unsustainable yield offerings and increased platform risks as providers attempt to attract capital through aggressive marketing and potentially inadequate risk management. Evaluating platform sustainability and competitive positioning becomes crucial for long-term success.

Cross-Asset Correlation and Portfolio Effects

Cryptocurrency lending and staking yields exhibit complex correlations with traditional financial markets, commodity prices, and macroeconomic indicators that affect portfolio construction and risk management decisions. During periods of financial stress, correlations between different asset classes often increase, reducing diversification benefits and potentially creating concentrated risks across seemingly different investment strategies. Understanding these correlation patterns enables better portfolio construction and risk management.

Professional portfolio managers develop sophisticated models for analysing cross-asset correlations and their impact on combined lending and staking strategies. These models incorporate traditional financial metrics, cryptocurrency-specific indicators, and behavioral factors that influence market dynamics during different economic conditions. Effective correlation analysis enables better diversification decisions and more robust risk management frameworks that protect capital while maintaining yield generation objectives through various market environments.

Advanced Strategy Implementation and Professional Portfolio Management

Institutional Lending and Staking Portfolio optimisation

Professional cryptocurrency portfolio management requires sophisticated strategies that combine lending and staking opportunities to optimise risk-adjusted returns while maintaining appropriate diversification and risk management objectives. Institutional portfolio optimisation includes comprehensive analysis of lending yields, staking rewards, and risk characteristics that enable informed allocation decisions across different yield generation strategies and platform providers through advanced portfolio management and optimisation techniques.

Advanced portfolio management includes dynamic allocation systems, automated rebalancing mechanisms, and comprehensive performance analytics that optimise lending and staking allocations while maintaining appropriate risk management and diversification objectives. Professional portfolio optimisation utilises sophisticated algorithms, predictive modelling, and comprehensive risk assessment that enable optimal allocation across lending and staking opportunities while maintaining appropriate oversight and control mechanisms that support institutional investment objectives and fiduciary obligations.

Cross-Platform Strategy Integration and Yield maximisation

Modern cryptocurrency yield strategies require sophisticated cross-platform integration that leverages multiple lending platforms and staking providers to maximise returns while managing risks across different protocols and platforms. Cross-platform optimisation includes comprehensive market analysis, automated arbitrage opportunities, and sophisticated risk management that optimise overall portfolio performance while maintaining appropriate diversification and risk management objectives through professional yield optimisation and platform integration strategies.

Yield maximisation strategies include dynamic allocation systems, automated compound optimisation, and comprehensive performance tracking that enable professional investors to optimise their cryptocurrency yields while maintaining appropriate risk management and operational efficiency. Advanced cross-platform strategies utilise sophisticated analytics, predictive modelling, and automated execution systems that optimise yield generation while maintaining operational efficiency and risk management standards required for professional cryptocurrency yield optimisation and portfolio management.

Risk Management and Hedging Strategies for Combined Approaches

Professional cryptocurrency yield strategies require comprehensive risk management frameworks that address the unique risks associated with both lending and staking while enabling optimal yield generation and capital preservation. Risk management for combined strategies includes comprehensive assessment of platform risks, market volatility, and operational considerations that enable informed risk management decisions while maintaining yield optimisation objectives through sophisticated risk assessment and mitigation strategies.

Hedging strategies for combined lending and staking portfolios include sophisticated risk mitigation techniques, comprehensive insurance coverage, and advanced portfolio protection mechanisms that safeguard investments while maintaining yield generation objectives. Professional risk management utilises advanced analytics, predictive modelling, and comprehensive risk assessment that enable optimal risk management while maintaining appropriate exposure to cryptocurrency yield opportunities through sophisticated hedging and risk mitigation strategies.

Regulatory Compliance and Tax optimisation for Hybrid Strategies

Combined lending and staking strategies involve complex regulatory and tax considerations that require comprehensive understanding of applicable regulations, tax implications, and compliance obligations across different jurisdictions and yield generation activities. Regulatory compliance for hybrid strategies includes comprehensive compliance monitoring, automated reporting systems, and sophisticated legal analysis that ensures activities maintain regulatory compliance while optimising tax efficiency and operational effectiveness.

Tax optimisation for combined strategies includes comprehensive tax planning, sophisticated reporting systems, and advanced tax management techniques that minimise tax obligations while maintaining compliance with applicable tax regulations and reporting requirements. Professional tax management requires understanding of cryptocurrency taxation, yield generation tax implications, and comprehensive compliance frameworks that enable optimal tax efficiency while maintaining appropriate regulatory compliance and operational effectiveness through professional tax planning and compliance management.

Technology Infrastructure and Operational Excellence

Professional implementation of combined lending and staking strategies requires sophisticated technology infrastructure that addresses security requirements, operational efficiency, and scalability considerations while maintaining reliability and performance standards that support institutional yield generation operations. Technology infrastructure includes comprehensive security frameworks, automated monitoring systems, and sophisticated operational management that ensure reliable performance while maintaining appropriate security and risk management practices.

Operational excellence for combined strategies includes comprehensive workflow management, automated compliance monitoring, and sophisticated performance optimisation that enable efficient operations while maintaining appropriate oversight and control mechanisms. Professional operational frameworks utilise advanced analytics, predictive maintenance, and automated optimisation systems that ensure reliable performance while maintaining cost efficiency and operational effectiveness that support institutional yield generation objectives through sophisticated technology infrastructure and operational management.

Future Evolution and Innovation in Yield Generation

The future of cryptocurrency yield generation includes significant innovations in lending and staking technologies that will expand opportunities while addressing current limitations and challenges. Innovation priorities include advanced automated strategies, enhanced risk management capabilities, and sophisticated integration solutions that maintain competitive advantages whilstexpanding accessibility and utility for professional investors and institutional participants through continuous technological advancement and innovation.

Development roadmaps for yield generation focus on ecosystem expansion, enhanced functionality, and improved integration capabilities that ensure lending and staking strategies remain competitive while providing unique advantages and opportunities for professional investors. Future innovations include advanced analytics, enhanced security features, and comprehensive integration capabilities that support the evolution of cryptocurrency yield generation while maintaining the security and performance standards that define successful professional yield generation implementations and strategies.

Conclusion

Both digital asset lending and staking offer viable paths to generating passive income from cryptocurrency holdings, but they serve different purposes in a well-rounded portfolio and require distinct approaches to risk management and strategy implementation. Staking works best for long-term holdings in proof-of-stake networks you believe in fundamentally, while lending provides flexibility for tactical positions and stablecoin yields that can adapt to changing market conditions.

Key Takeaways

- Diversify: Use both strategies to optimise risk-adjusted returns and reduce single-point-of-failure risks

- Start Small: Begin with small allocations to learn the mechanics and understand platform-specific risks

- Stay Informed: Monitor platform health, rate changes, and regulatory developments that could impact your positions

- Manage Risk: Never put all funds in a single platform or strategy, regardless of attractive yields

- Plan for Taxes: Maintain detailed records and consult tax professionals to understand reporting obligations

- Understand Liquidity: Consider your access to funds and potential lock-up periods before committing capital

- Evaluate Platforms: Research platform security, insurance coverage, and track record before depositing funds

The cryptocurrency passive income landscape continues to evolve rapidly, with new opportunities and risks emerging regularly as the market matures and regulatory frameworks develop. Successful investors maintain a balanced approach, combining the stability of established staking protocols with the flexibility of lending platforms while staying adaptable to changing market conditions and technological innovations.

As institutional adoption increases and regulatory frameworks mature, both lending and staking are becoming more accessible and secure for mainstream investors, though this evolution also brings new considerations around compliance and tax reporting. The key to long-term success lies in understanding the fundamental differences between these strategies, staying informed about market developments, and maintaining a disciplined approach to risk management that prioritises capital preservation alongside yield generation.

Whether you choose lending, staking, or a combination of both, remember that patience and continuous learning are your most valuable assets in building sustainable crypto passive income streams. The most successful practitioners treat these strategies as active investments requiring ongoing attention rather than truly passive income sources, adapting their approaches based on market conditions, platform performance, and evolving opportunities in the dynamic cryptocurrency ecosystem.

Sources & References

- Ethereum.org. (2025). Ethereum Staking Guide. Official documentation on Ethereum staking mechanisms.

- Aave Protocol. (2025). Aave Documentation. Technical documentation for DeFi lending protocol.

- CoinDesk. (2025). Crypto Staking Explained. Educational resource on staking vs lending.

Frequently Asked Questions

- Is digital asset lending safer than staking?

- Neither is inherently safer - both have different risk profiles. Lending risks include platform default and smart contract vulnerabilities, while staking risks include slashing penalties and validator failures. CeFi lending offers insurance but centralisation risk, while staking is more decentralised but requires technical knowledge.

- Can I do both lending and staking at the same time?

- Yes, you can diversify by allocating different portions of your portfolio to both strategies. Many investors allocate 50-70% to staking (lower risk, stable returns) and 30-50% to lending (higher potential returns). This approach balances risk and maximises overall yield.

- Which generates higher returns: lending or staking?

- Lending typically offers higher APYs (8-15%) compared to staking (4-8%), but with increased risk. Returns vary by platform, asset, and market conditions. Staking provides more predictable returns, while lending rates fluctuate based on supply and demand.

- Do I need technical knowledge for staking vs lending?

- Lending is generally more beginner-friendly - deposit assets on a platform and earn interest. Staking can be more complex, especially for solo staking, which requires running a validator node. However, liquid staking services like Lido make staking as easy as lending.

- What are the tax implications of lending vs staking?

- Both generate taxable income in most jurisdictions. Interest from loans is typically taxed as ordinary income when received. Staking rewards may be taxed upon receipt or when sold, depending on your country's regulations. Consult a crypto tax professional for specific guidance.

- Can I lose my principal in lending or staking?

- Yes, both carry principal risk. In lending, platform bankruptcy or smart contract exploits can result in total loss. In staking, slashing penalties can reduce your stake by 1-100% depending on the violation. Always research platforms thoroughly and never invest more than you can afford to lose.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.