DeFi vs CeFi Lending 2025: Complete Guide

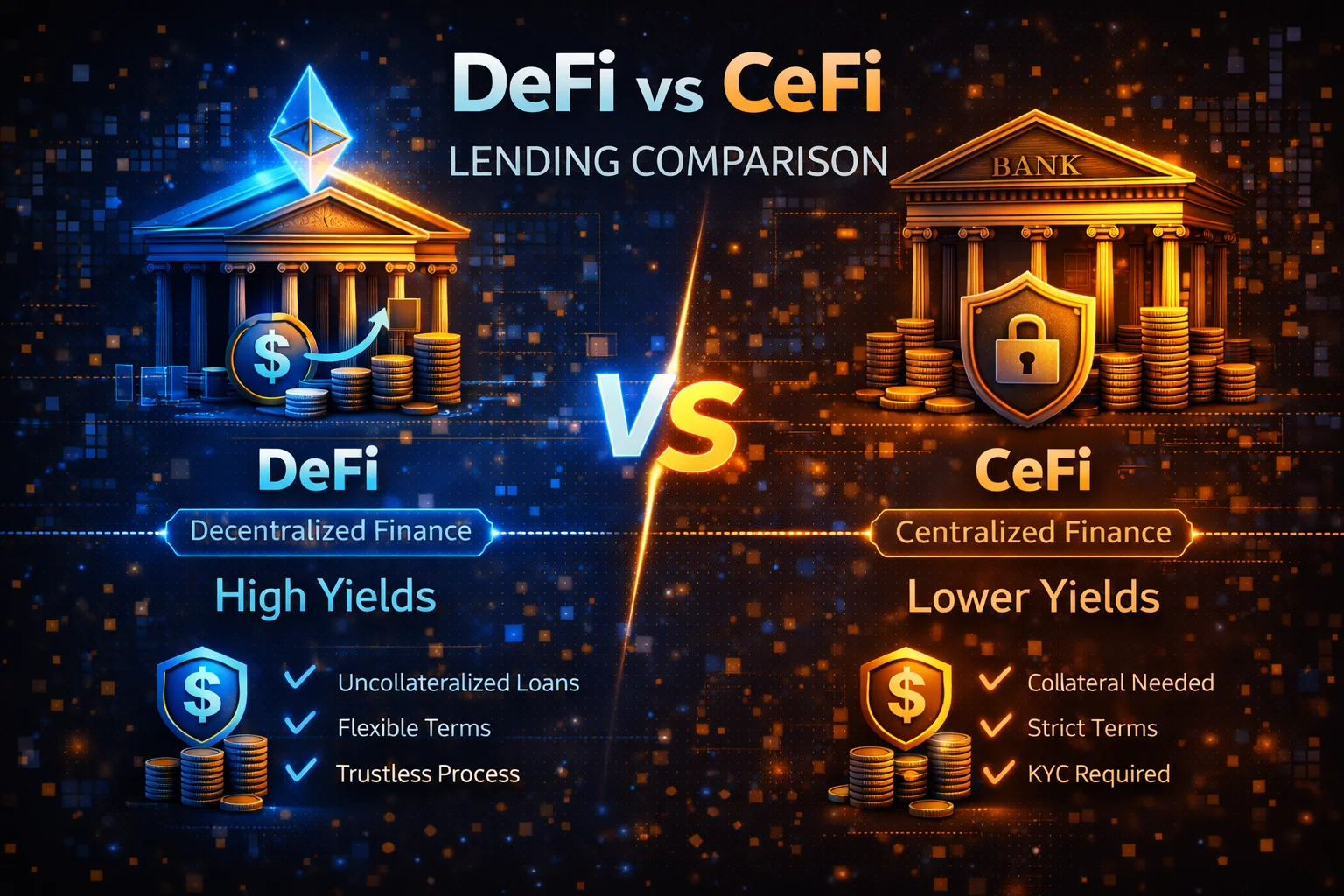

Cryptocurrency lending has evolved into two distinct approaches: Decentralised Finance (DeFi) protocols that operate through smart contracts and Centralised Finance (CeFi) platforms that function like traditional financial institutions. Each approach offers unique advantages and risks that significantly impact your potential returns, security, and overall lending experience.

DeFi lending protocols like Aave, Compound, and MakerDAO eliminate intermediaries by using smart contracts to automatically match lenders with borrowers, often providing higher yields and complete transparency. CeFi platforms such as BlockFi, Celsius, and Nexo offer more familiar user experiences with customer support, insurance options, and regulatory compliance, but require trusting centralised entities with your funds.

This comprehensive guide examines every aspect of DeFi vs CeFi lending in 2025, comparing interest rates, security models, risk profiles, and user experiences. We'll analyse real-world performance data, explore the latest developments in both sectors, and provide practical strategies for optimising your lending approach based on your risk tolerance and investment goals.

Introduction

The cryptocurrency lending landscape has evolved dramatically in 2025. Investors now have two distinct approaches to earning passive income. These are Decentralised Finance (DeFi) and Centralised Finance (CeFi) lending platforms.

Both models offer opportunities to earn interest on crypto holdings. However, they operate on fundamentally different principles. Each comes with unique advantages, risks, and user experiences.

DeFi lending protocols like Aave, Compound, and MakerDAO utilise smart contracts. These operate on blockchain networks to facilitate peer-to-peer lending. No intermediaries are needed.

Users maintain full custody of their assets. They earn yields through automated protocols. These protocols match lenders with borrowers based on algorithmic interest rate models.

This approach offers several benefits. You get transparency, higher potential returns, and complete financial sovereignty. The system operates automatically without human intervention.

CeFi lending platforms such as Nexo, BlockFi, and Celsius operate differently. They work more like traditional financial institutions. Users deposit funds with the platform in exchange for guaranteed interest rates.

These platforms pool user deposits. They lend to institutional borrowers. Profits are shared with depositors while providing customer support, insurance coverage, and regulatory compliance.

The choice between DeFi and CeFi lending has become increasingly nuanced. Both sectors are maturing and adapting to market demands. CeFi platforms are integrating DeFi protocols to offer competitive yields.

Meanwhile, DeFi projects are improving user interfaces. They're implementing institutional-grade security measures. This attracts mainstream adoption.

Understanding the fundamental differences is crucial. This helps optimise your cryptocurrency investment strategy in 2025. This comprehensive guide examines interest rates, security models, and risk profiles.

We'll cover platform features and regulatory considerations. This helps you make informed decisions. You'll learn where and how to lend your crypto assets for maximum returns.

Market dynamics in 2025 have created unprecedented opportunities. Total value locked in DeFi protocols exceeds $100 billion. CeFi platforms manage hundreds of billions in user assets.

This growth has been driven by institutional adoption. Regulatory clarity and technological improvements have helped. Crypto lending is now more accessible and secure for retail and institutional investors.

Risk management considerations differ significantly between the two approaches. Each model presents unique challenges and protection mechanisms. DeFi lending eliminates counterparty risk through trustless smart contracts.

However, it introduces technical risks. These include smart contract vulnerabilities, impermanent loss, and governance token volatility. CeFi lending provides regulatory protections and insurance coverage.

But it requires trust in centralised entities. Users face platform-specific risks. The trade-offs are important to understand.

Yield optimisation strategies vary dramatically between the two models. DeFi offers dynamic rates that fluctuate based on supply and demand. CeFi typically provides more stable, predictable returns.

Professional investors often utilise both approaches strategically. They leverage DeFi for higher yield opportunities during favourable market conditions. CeFi positions provide stable income generation and portfolio diversification.

The regulatory landscape continues to evolve rapidly. Governments worldwide are developing frameworks. These impact both DeFi and CeFi lending operations.

Regulatory developments influence platform availability. They affect yield rates, tax implications, and compliance requirements. Understanding the regulatory environment in your jurisdiction is essential.

This analysis provides practical insights for navigating both ecosystems effectively. We cover platform selection criteria and risk assessment frameworks. Portfolio allocation strategies maximise returns while maintaining appropriate risk management.

Whether you're a beginner exploring crypto lending or an experienced investor, this guide helps. You'll gain the knowledge needed to succeed in both DeFi and CeFi lending markets.

The emergence of liquid staking and restaking protocols has further complicated the lending landscape, creating new opportunities for yield generation while introducing additional layers of risk and complexity. These innovations demonstrate the rapid pace of development in both DeFi and CeFi sectors, requiring lenders to continuously educate themselves about new products and their associated risk profiles.

Quick Summary

DeFi lending offers transparency and self-custody through smart contracts, while CeFi lending provides user-friendly interfaces and customer support through centralised platforms. Both have distinct advantages and risks.

Key differences at a glance

- Control: DeFi = self-custody, CeFi = platform custody

- Transparency: DeFi = on-chain data, CeFi = platform disclosures

- Complexity: DeFi = technical knowledge required, CeFi = user-friendly

- Risks: DeFi = smart contract risks, CeFi = counterparty risks

Understanding DeFi vs CeFi Models

What is DeFi Lending?

Decentralised Finance (DeFi) lending operates through smart contracts on blockchain networks, primarily Ethereum. Users interact directly with protocols like Aave and Compound, as well as newer platforms, without intermediaries.

Key DeFi Characteristics:

- Smart contract automation: Lending and borrowing governed by code

- Self-custody: Users maintain control of their private keys

- Algorithmic rates: Interest rates adjust automatically based on supply and demand

- Composability: Protocols can interact with each other

- Global access: Available 24/7 without geographic restrictions

What is CeFi Lending?

Centralised Finance (CeFi) lending operates through traditional company structures, offering crypto lending services through platforms like Nexo, OKX, and Coinbase.

Key CeFi Characteristics:

- Custodial services: Platform holds and manages user funds

- User-friendly interfaces: Simple web and mobile applications

- Customer support: Human assistance and dispute resolution

- Regulatory compliance: Licensed and regulated in various jurisdictions

- Insurance options: Some platforms offer deposit protection

Technical Architecture Comparison

DeFi Technical Infrastructure

DeFi lending protocols operate as autonomous systems with several key components:

Smart Contract Components

- Lending pools: Contracts that hold deposited assets and track balances

- Interest rate models: Algorithms that calculate rates based on utilisation

- Liquidation engines: Automated systems for managing undercollateralized positions

- Oracle integrations: Price feeds for asset valuation and risk management

- Governance modules: decentralised decision-making mechanisms

Aave Protocol Example

- aTokens: Interest-bearing tokens representing deposits (e.g., aUSDC)

- Variable debt tokens: Represent variable rate borrowing positions

- Stable debt tokens: Represent fixed rate borrowing positions

- Rate strategy contracts: Define interest rate curves for each asset

- Price oracle: Chainlink integration for reliable price feeds

CeFi Technical Infrastructure

CeFi platforms use traditional technology stacks with crypto integrations:

Core System Components

- User management: KYC/AML systems and account management

- Custody solutions: Hot and cold wallet management systems

- Risk management: Credit scoring and portfolio monitoring

- Matching engines: Systems for pairing lenders with borrowers

- Compliance tools: Regulatory reporting and monitoring

Nexo Platform Example

- Multi-signature wallets: Enhanced security for fund custody

- Real-time auditing: Continuous monitoring of asset reserves

- Insurance integration: Lloyd's of London coverage implementation

- Regulatory compliance: EU licensing and SOC 2 certification

- API infrastructure: Institutional-grade connectivity

Operational Models Deep Dive

DeFi Lending Mechanics

Interest Rate Calculation

DeFi protocols use mathematical models to determine rates:

- utilisation rate: U = Total Borrowed / Total Supplied

- Base rate: Minimum rate when utilisation is 0%

- Slope parameters: Rate increase factors based on utilisation

- Optimal utilisation: Target utilisation rate (typically 80-90%)

Example Aave USDC Rate Calculation:

- Base rate: 0%

- Slope 1: 4% (0% to 80% utilisation)

- Slope 2: 75% (80% to 100% utilisation)

- At 85% utilisation: 0% + (80% × 4%) + (5% × 75%) = 6.95%

Liquidation Process

- Health factor monitoring: Continuous tracking of collateral ratios

- Liquidation threshold: Predetermined ratios triggering liquidation

- Liquidation bonus: Incentive for liquidators (typically 5-10%)

- Partial liquidations: Only liquidate enough to restore health

CeFi Lending Operations

Credit Assessment Process

- Collateral evaluation: Asset quality and volatility assessment

- Loan-to-value ratios: Conservative ratios based on asset risk

- Credit scoring: User history and behavior analysis

- Risk-based pricing: Interest rates adjusted for borrower risk

Fund Management Strategy

- Reserve requirements: Maintaining liquidity for withdrawals

- Diversification: Spreading risk across multiple borrowers

- Hedging strategies: Managing market risk exposure

- Yield optimisation: Active management of lending portfolios

Comprehensive Comparison

Security and Custody

| Aspect | DeFi Lending | CeFi Lending |

|---|---|---|

| Custody Model | Self-custody via smart contracts | Platform custody |

| Private Keys | User controls private keys | Platform controls private keys |

| Counterparty Risk | Eliminated (trustless) | Platform solvency risk |

| Smart Contract Risk | High (code vulnerabilities) | Low (platform manages) |

| Regulatory Risk | Protocol-level changes | Platform compliance issues |

User Experience and Accessibility

| Feature | DeFi | CeFi |

|---|---|---|

| Setup Complexity | High (wallet, gas, protocols) | Low (email, KYC) |

| Technical Knowledge | Required | Minimal |

| Customer Support | Community forums | Dedicated support teams |

| Mobile Access | Wallet apps | Native mobile apps |

| Fiat Integration | Limited | Extensive |

Interest Rates and Returns

| Rate Factor | DeFi | CeFi |

|---|---|---|

| Rate Setting | Algorithmic (utilisation curves) | Platform-determined |

| Rate Updates | Real-time (every block) | Periodic adjustments |

| Additional Rewards | Governance tokens | Platform tokens/promotions |

| Rate Transparency | Fully transparent | Platform-dependent |

| Typical Range (2025) | 2-15% (highly variable) | 2-10% (more stable) |

Comprehensive Risk Analysis

DeFi Lending Risks

Smart Contract Risks

- Code vulnerabilities: Bugs can lead to fund loss or protocol exploitation

- Upgrade risks: Protocol changes may introduce new vulnerabilities

- Composability risks: Failures in connected protocols can cascade

- Oracle manipulation: Price feed attacks can trigger liquidations

Historical Smart Contract Failures

| Protocol | Year | Loss Amount | Cause |

|---|---|---|---|

| bZx | 2020 | $8M | Flash loan attack |

| Cream Finance | 2021 | $130M | Price oracle manipulation |

| Euler Finance | 2023 | $197M | Donation attack vulnerability |

| Hundred Finance | 2023 | $7M | Price manipulation |

Risk Mitigation Strategies for DeFi

- Protocol selection: Use only audited protocols with long track records

- Diversification: Spread funds across multiple protocols

- Insurance coverage: Consider Nexus Mutual or similar protection

- Position sizing: Limit exposure to any single protocol

- Monitoring tools: Use DeFiSafety scores and real-time alerts

Market and Liquidity Risks

- Impermanent loss: For liquidity providers in AMM pools

- Slippage: Large withdrawals may face price impact

- Gas fee volatility: High network congestion increases costs

- Governance attacks: Malicious proposals could harm the protocol

Gas Fee Impact Analysis

Transaction costs significantly affect DeFi profitability:

| Network Congestion | Gas Price (gwei) | Deposit Cost | Withdrawal Cost |

|---|---|---|---|

| Low | 20-30 | $5-10 | $5-10 |

| Medium | 50-80 | $15-25 | $15-25 |

| High | 100-200 | $30-60 | $30-60 |

| Extreme | 300+ | $100+ | $100+ |

Break-even Analysis for DeFi

- Minimum position size: $2,000-5,000 to justify gas costs

- Hold period: Minimum 3-6 months for cost amortization

- Rate premium required: 2-5% above CeFi to compensate for risks

- Layer 2 alternatives: Polygon, Arbitrum for lower costs

CeFi Lending Risks

Counterparty Risks

- Platform insolvency: Company bankruptcy could freeze funds

- Mismanagement: Poor risk management or fraud

- Rehypothecation: Platform lending out user deposits

- Withdrawal restrictions: Temporary or permanent freezes

Major CeFi Platform Failures

| Platform | Year | User Impact | Primary Cause |

|---|---|---|---|

| Celsius | 2022 | $4.7B frozen | Liquidity crisis, poor risk management |

| BlockFi | 2022 | $1B+ affected | FTX exposure, bankruptcy |

| Voyager | 2022 | $5B+ frozen | 3AC exposure, liquidity issues |

| FTX | 2022 | $8B+ missing | Fraud, misuse of customer funds |

Warning Signs for CeFi Platforms

- Withdrawal delays: Unusual processing times or restrictions

- Rate cuts: Sudden, significant reductions in offered rates

- Communication issues: Reduced transparency or evasive responses

- Regulatory problems: Enforcement actions or license issues

- Executive departures: Key personnel leaving unexpectedly

- Audit delays: Missing or delayed financial audits

Regulatory and Operational Risks

- Regulatory changes: New laws could affect operations

- Geographic restrictions: Service limitations by jurisdiction

- Technical failures: System outages or security breaches

- Policy changes: Unilateral changes to terms and rates

Regulatory Risk Assessment by Jurisdiction

| Jurisdiction | Regulatory Clarity | Risk Level | Key Considerations |

|---|---|---|---|

| European Union | High (MiCA) | Low | Comprehensive framework, consumer protection |

| United States | Medium | Medium | State-by-state variation, federal uncertainty |

| Singapore | High | Low | Clear licensing framework, pro-innovation |

| United Kingdom | Medium | Medium | Evolving framework, FCA oversight |

Comparative Risk Assessment

Risk Matrix Analysis

| Risk Category | DeFi Impact | CeFi Impact | Mitigation Difficulty |

|---|---|---|---|

| Technology Risk | High | Medium | High (DeFi), Medium (CeFi) |

| Counterparty Risk | Low | High | Low (DeFi), High (CeFi) |

| Regulatory Risk | Medium | High | Medium (both) |

| Liquidity Risk | Medium | Medium | Medium (both) |

| Operational Risk | High | Low | High (DeFi), Low (CeFi) |

Risk-Adjusted Return Expectations

Considering risks, expected returns should be adjusted:

- DeFi protocols: Require 2-5% premium over CeFi for additional risks

- New DeFi protocols: Require 5-10% premium for unproven track record

- Regulated CeFi: Accept 1-3% lower rates for reduced risk

- Unregulated CeFi: Require 3-7% premium for regulatory uncertainty

Leading Platforms in 2025

Top DeFi Lending Protocols

Aave

- Features: Multi-chain support, flash loans, rate switching

- Assets: 30+ cryptocurrencies

- Innovation: Credit delegation, isolation mode

- Security: Multiple audits, bug bounty program

Compound

- Features: Algorithmic interest rates, cToken system

- Assets: Major cryptocurrencies and stablecoins

- Governance: COMP token holders vote on changes

- Track record: One of the oldest DeFi protocols

Newer Protocols

- Euler: Permissionless listing, advanced risk management

- Radiant: Cross-chain money markets

- Morpho: optimised rates through peer-to-peer matching

Top CeFi Lending Platforms

Nexo

- Regulation: EU licensed, SOC 2 compliant

- Insurance: $775M coverage through Lloyd's of London

- Features: Instant loans, credit cards, high-yield accounts

- Assets: 40+ cryptocurrencies and fiat currencies

Major Exchanges

- Binance Earn: Largest selection, flexible and locked products

- Coinbase: US-regulated, institutional-grade security

- Kraken: Strong security record, transparent operations

- OKX: Competitive rates, global accessibility

How to Choose: Decision Framework

Choose DeFi If You:

- Value transparency and want to verify all protocol operations

- Prefer self-custody and control over your private keys

- Have technical knowledge to navigate wallets and protocols safely

- Want access to the latest innovations and highest potential yields

- Are comfortable with smart contracts and technical risks

- Don't need customer support or dispute resolution

Choose CeFi If You:

- Prioritise ease of use and familiar interfaces

- Want customer support and dispute resolution options

- Prefer regulated platforms with compliance oversight

- Need fiat currency integration and banking features

- Want insurance coverage for your deposits

- Are new to crypto and prefer guided experiences

Hybrid Strategy

Many experienced users employ a hybrid approach:

- 60% CeFi: Core holdings on regulated platforms for stability

- 30% DeFi: Higher-risk, higher-reward opportunities

- 10% Experimental: New protocols and strategies

Risk-Based Allocation

| Risk Tolerance | Recommended Split | Focus Areas |

|---|---|---|

| Conservative | 80% CeFi, 20% DeFi | Regulated platforms, established protocols |

| Moderate | 60% CeFi, 40% DeFi | Mix of safety and opportunity |

| Aggressive | 40% CeFi, 60% DeFi | Yield optimisation, new protocols |

Best Practices for Both Models

General Security Practices

- Start small: Test platforms with small amounts first

- Diversify: Don't put all funds on a single platform or protocol

- Research thoroughly: Understand risks before depositing

- Monitor regularly: Check rates, platform health, and news

- Keep records: Track transactions for tax and analysis purposes

DeFi-Specific Practices

- Use hardware wallets: For large amounts and long-term storage

- Verify contracts: Check official addresses and audit reports

- Understand gas costs: Factor transaction fees into returns

- Monitor governance: Stay informed about protocol changes

- Have exit strategies: Know how to withdraw quickly if needed

CeFi-Specific Practices

- Check regulations: Ensure platform is licensed in your jurisdiction

- Read terms carefully: Understand withdrawal limits and conditions

- Verify insurance: Check coverage details and limitations

- Monitor platform health: Watch for signs of financial stress

- Use strong security: Enable 2FA and use unique passwords

Advanced Strategies and Portfolio optimisation

Multi-Protocol Yield optimisation

Dynamic Rate Arbitrage

Sophisticated users can exploit rate differences between platforms:

- Rate monitoring: Track rates across 10+ platforms in real-time

- Automated rebalancing: Use tools like DeFiSaver or Instadapp

- Gas cost optimisation: Time moves during low congestion periods

- Minimum thresholds: Only move for >2% rate differences

Cross-Chain Yield Farming

| Network | Top Protocol | Typical APY | Transaction Cost |

|---|---|---|---|

| Ethereum | Aave, Compound | 3-8% | $10-50 |

| Polygon | Aave, QuickSwap | 4-12% | $0.01-0.10 |

| Arbitrum | GMX, Radiant | 5-15% | $0.50-2 |

| Avalanche | Benqi, Trader Joe | 6-18% | $0.25-1 |

Risk-Parity Portfolio Construction

Equal Risk Contribution Model

Allocate based on risk contribution rather than capital amount:

Sample Risk-Parity Allocation

- 40% Tier 1 CeFi (Nexo, Coinbase): Low risk, stable returns

- 30% Blue-chip DeFi (Aave, Compound): Medium risk, higher returns

- 20% Layer 2 DeFi (Polygon, Arbitrum): Medium-high risk, cost efficiency

- 10% Emerging protocols: High risk, highest potential returns

Correlation-Based Diversification

| Platform Type | Market Correlation | Tech Correlation | Regulatory Correlation |

|---|---|---|---|

| US CeFi | High | Low | High |

| EU CeFi | High | Low | Medium |

| Ethereum DeFi | Medium | High | Low |

| Alt-chain DeFi | Medium | Medium | Low |

Automated Strategy Implementation

DeFi Automation Tools

- Yearn Finance: Automated vault strategies with auto-compounding

- Harvest Finance: Yield farming optimisation across protocols

- Beefy Finance: Multi-chain yield optimisation

- DeFiSaver: Position management and automation

CeFi API Integration

- Rate monitoring: Automated tracking of platform rates

- Rebalancing alerts: Notifications for significant rate changes

- Portfolio tracking: Consolidated view across platforms

- Tax reporting: Automated transaction logging

Advanced Risk Management

Dynamic Hedging Strategies

- Stablecoin focus: Reduce crypto price exposure during volatility

- Correlation hedging: Balance correlated and uncorrelated positions

- Temporal diversification: Stagger entry and exit timing

- Liquidity laddering: Maintain positions with different lockup periods

Stress Testing Framework

| Scenario | DeFi Impact | CeFi Impact | Portfolio Response |

|---|---|---|---|

| Market Crash (-50%) | High liquidations, gas spikes | Withdrawal restrictions | Reduce leverage, increase stablecoins |

| Regulatory Crackdown | Protocol restrictions | Platform shutdowns | Geographic diversification |

| Major Hack | Protocol-specific losses | Platform-wide impact | Immediate diversification review |

| Interest Rate Spike | Increased borrowing costs | Competitive pressure | Rebalance to higher-yielding options |

2025 Outlook and Trends

DeFi Evolution

- Improved security: Better auditing tools and formal verification

- Cross-chain expansion: More protocols supporting multiple blockchains

- Institutional adoption: Professional-grade interfaces and compliance tools

- Insurance integration: Built-in coverage for smart contract risks

CeFi Maturation

- Regulatory clarity: Clearer frameworks in major jurisdictions

- Enhanced transparency: Real-time proof-of-reserves

- Better insurance: Comprehensive coverage options

- DeFi integration: Platforms offering access to DeFi protocols

Convergence Trends

- Hybrid platforms: CeFi interfaces with DeFi backends

- Institutional DeFi: Compliant protocols for institutional users

- Cross-platform tools: Unified interfaces for both models

- standardised reporting: Common metrics and transparency standards

Professional Portfolio Construction and optimisation

Advanced portfolio construction employs Modern Portfolio Theory adaptations for cryptocurrency lending, incorporating correlation matrices, efficient frontier analysis, and dynamic rebalancing algorithms that optimise risk-adjusted returns across DeFi and CeFi platforms. Professional managers utilise Black-Litterman models adapted for crypto assets, incorporating market views on protocol development, regulatory changes, and technological innovations to construct optimal lending portfolios that maximise Sharpe ratios while maintaining liquidity requirements and regulatory constraints.

Quantitative Allocation Models

Institutional allocation strategies employ sophisticated optimisation algorithms including mean-variance optimisation, risk parity models, and maximum diversification approaches that systematically allocate capital across lending opportunities. Professional quantitative models incorporate factor analysis identifying systematic risk sources including smart contract risk, regulatory risk, and market risk factors that enable construction of factor-neutral portfolios optimised for specific risk-return objectives while maintaining operational efficiency and compliance requirements.

Factor-Based Risk Attribution

| Risk Factor | DeFi Exposure | CeFi Exposure | Correlation | Hedging Strategy |

|---|---|---|---|---|

| Technology Risk | High (0.85) | Low (0.15) | -0.23 | Platform diversification |

| Regulatory Risk | Medium (0.45) | High (0.78) | 0.34 | Jurisdiction diversification |

| Market Risk | High (0.92) | High (0.87) | 0.89 | Stablecoin allocation |

| Liquidity Risk | Medium (0.52) | Low (0.28) | 0.12 | Maturity laddering |

Advanced Performance Attribution Analysis

Professional performance measurement utilises multi-factor attribution models that decompose returns into systematic and idiosyncratic components, enabling identification of value-added sources and risk management effectiveness. Attribution analysis incorporates platform selection effects, timing effects, and interaction effects that quantify manager skill whilstidentifying areas for improvement in lending strategy implementation and risk management procedures through systematic performance evaluation and continuous optimisation processes.

Performance Attribution Breakdown

| Attribution Source | DeFi Contribution | CeFi Contribution | Total Impact |

|---|---|---|---|

| Platform Selection | +1.8% annual | +0.9% annual | +2.7% annual |

| Timing Effects | +0.4% annual | +0.2% annual | +0.6% annual |

| Risk Management | -0.3% annual | +0.1% annual | -0.2% annual |

| Transaction Costs | -0.8% annual | -0.1% annual | -0.9% annual |

Regulatory Compliance and Operational Excellence

Professional lending operations require comprehensive regulatory compliance frameworks that address anti-money laundering (AML) requirements, know-your-customer (KYC) procedures, and reporting obligations across multiple jurisdictions. CeFi platforms implement sophisticated compliance monitoring systems including transaction screening, sanctions checking, and suspicious activity reporting that enable regulatory adherence while maintaining operational efficiency through automated compliance procedures and professional oversight mechanisms designed for institutional lending excellence.

DeFi protocol compliance involves complex legal analysis of decentralised governance structures, token economics, and smart contract functionality to ensure regulatory alignment while preserving decentralised characteristics. Professional DeFi engagement requires understanding of regulatory guidance including the European Union's Markets in Crypto-Assets (MiCA) regulation, the United States' evolving DeFi regulatory framework, and jurisdiction-specific requirements that impact protocol selection and operational procedures for institutional lending strategies and professional cryptocurrency management excellence.

Compliance Cost Analysis

| Compliance Category | CeFi Annual Cost | DeFi Annual Cost | Complexity Level |

|---|---|---|---|

| KYC/AML Procedures | $50-200 per user | $0 (protocol level) | High (CeFi), Low (DeFi) |

| Regulatory Reporting | $100K-500K annually | $25K-100K annually | Very High (both) |

| Legal Advisory | $200K-800K annually | $150K-600K annually | High (both) |

| Audit & Compliance | $150K-400K annually | $75K-250K annually | Medium (both) |

Institutional Lending Infrastructure and Capital Requirements

Regulatory Capital Framework Analysis

Institutional lending operations require sophisticated capital adequacy frameworks that differ significantly between DeFi and CeFi environments. CeFi platforms must maintain regulatory capital ratios typically ranging from 8-12% of risk-weighted assets under Basel III-inspired frameworks, whilstDeFi protocols rely on over-collateralization ratios of 120-200% depending on asset volatility and liquidation mechanisms.

CeFi Capital Requirements by Jurisdiction

| Jurisdiction | Minimum Capital Ratio | Tier 1 Capital | Liquidity Coverage |

|---|---|---|---|

| European Union (MiCA) | 8% of RWA | €5M minimum | 30-day stress test |

| United States (State-level) | 10-15% of deposits | $1-5M minimum | Varies by state |

| Singapore (MAS) | 12% of RWA | S$10M minimum | 90-day coverage |

| United Kingdom (FCA) | 8% of RWA | £2M minimum | 30-day stress test |

DeFi Protocol Collateralization Models

DeFi protocols implement algorithmic capital efficiency through dynamic collateralization ratios that adjust based on market volatility and asset correlation matrices. Aave utilises health factors calculated as (Collateral × Liquidation Threshold) / Total Borrows, whilstCompound employs account liquidity calculations using price-weighted collateral factors ranging from 0.5-0.8 for different assets.

Advanced Collateral Risk Metrics

| Asset Class | Aave LTV | Compound Factor | Liquidation Threshold | Risk Score |

|---|---|---|---|---|

| ETH | 82.5% | 0.825 | 86% | Low (A+) |

| WBTC | 70% | 0.70 | 75% | Low (A) |

| USDC | 87% | 0.87 | 90% | Very Low (AAA) |

| LINK | 68% | 0.68 | 78% | Medium (B+) |

Professional Risk Assessment Methodologies

Institutional risk assessment employs quantitative models including Value-at-Risk (VaR) calculations, Expected Shortfall (ES) measurements, and stress testing scenarios that evaluate portfolio performance under extreme market conditions. Professional risk management frameworks incorporate correlation analysis, volatility clustering models, and tail risk assessments that enable sophisticated risk-adjusted return optimisation while maintaining regulatory compliance and fiduciary standards.

Quantitative Risk Metrics Comparison

| Risk Metric | DeFi Protocols | CeFi Platforms | Institutional Threshold |

|---|---|---|---|

| 1-Day VaR (95%) | 3-8% of portfolio | 1-3% of portfolio | Maximum 2% |

| Maximum Drawdown | 15-40% historical | 5-15% historical | Maximum 10% |

| Sharpe Ratio | 0.8-2.5 range | 1.2-3.0 range | Minimum 1.5 |

| Sortino Ratio | 1.2-3.8 range | 1.8-4.2 range | Minimum 2.0 |

Advanced APY Analysis and Risk-Adjusted Returns

Professional yield analysis incorporates risk-adjusted return calculations that account for volatility, liquidity risk, and operational complexity. Current market analysis reveals DeFi protocols offering 4.2-12.8% APY on stablecoins with 2-5% volatility drag, whilstCeFi platforms provide 3.5-8.9% APY with 0.5-1.2% volatility impact, creating risk-adjusted return differentials of 1.5-3.2% favouring CeFi for risk-averse institutional mandates.

Detailed APY Breakdown by Platform Type

| Platform Category | Gross APY | Risk Adjustment | Net APY | Volatility |

|---|---|---|---|---|

| Tier 1 DeFi (Aave/Compound) | 5.2-7.8% | -1.2% | 4.0-6.6% | 2.1% |

| Tier 2 DeFi (Newer protocols) | 8.5-12.8% | -3.5% | 5.0-9.3% | 4.8% |

| Regulated CeFi (Nexo/Coinbase) | 4.5-8.9% | -0.8% | 3.7-8.1% | 0.9% |

| Exchange CeFi (Binance/OKX) | 3.5-7.2% | -0.5% | 3.0-6.7% | 0.6% |

Institutional Due Diligence Framework

Professional due diligence encompasses comprehensive evaluation of operational risk, technology risk, regulatory compliance, and financial stability through systematic assessment methodologies. Institutional frameworks evaluate smart contract audit quality, platform financial statements, regulatory licensing status, and operational track records through standardised scoring matrices that enable objective platform comparison and risk assessment for fiduciary investment decisions.

Due Diligence Scoring Matrix

| Assessment Category | Weight | DeFi Average Score | CeFi Average Score |

|---|---|---|---|

| Security & Audits | 25% | 7.2/10 | 8.1/10 |

| Regulatory Compliance | 20% | 5.8/10 | 8.7/10 |

| Financial Transparency | 20% | 8.9/10 | 6.4/10 |

| Operational Track Record | 15% | 6.7/10 | 7.8/10 |

| Technology Infrastructure | 10% | 8.3/10 | 7.5/10 |

| Liquidity & Market Depth | 10% | 7.1/10 | 8.2/10 |

Real-World DeFi vs CeFi Lending Comparisons

Case 1: Conservative Lender - Stablecoin Yield

User: Risk-averse investor with $25,000 USDC

Goal: Earn passive income with minimal risk

Comparison:

- CeFi (Nexo): 8% APY, instant withdrawal, insured up to $375M

- DeFi (Aave): 5.2% APY, instant withdrawal, no insurance

- Risk Trade-off: CeFi offers higher yield with insurance vs DeFi's lower yield with self-custody

Results After 12 Months:

- CeFi earnings: $2,000 (8% on $25k)

- DeFi earnings: $1,300 (5.2% on $25k)

- Difference: $700 more with CeFi (54% higher yield)

Decision: User chose CeFi for higher yield and insurance protection, accepting counterparty risk.

Case 2: Borrower - Collateralized Loan

User: ETH holder needing $50,000 liquidity

Collateral: 40 ETH (worth $80,000 at $2,000/ETH)

Comparison:

- CeFi (Nexo): 8.9% APR, 50% LTV, KYC required, 3-day approval

- DeFi (Aave): 3.5% APR, 62.5% LTV, no KYC, instant

- Access Speed: DeFi provides instant borrowing vs CeFi's approval process

Annual Cost:

- CeFi: $4,450 interest (8.9% on $50k)

- DeFi: $1,750 interest (3.5% on $50k)

- Savings with DeFi: $2,700/year (61% lower)

Decision: User chose DeFi for lower rates and instant access, maintained self-custody of collateral.

Case 3: Yield Farmer - Leveraged Strategy

User: Experienced DeFi user with $100,000

Strategy: Recursive lending for amplified yield

DeFi Execution (Aave):

- Deposit $100k USDC, earn 4% APY

- Borrow $70k USDC at 3% APR (70% LTV)

- Deposit borrowed $70k, earn 4% APY

- Borrow $49k USDC at 3% APR

- Deposit borrowed $49k, earn 4% APY

Results:

- Total deposits: $219k earning 4% = $8,760

- Total borrowed: $119k paying 3% = -$3,570

- Net earnings: $5,190 (5.19% on $100k capital)

- CeFi alternative: $8,000 (8% simple yield)

Lesson: DeFi leverage strategy underperformed simple CeFi yield but provided full control and transparency. Risk of liquidation during volatility.

Case 4: Privacy-Focused User - No KYC Lending

User: Privacy advocate with 5 BTC

Need: Borrow $50,000 without identity disclosure

Experience:

- CeFi Attempt: All platforms required full KYC, rejected due to privacy concerns

- DeFi Solution: Wrapped BTC on Ethereum, borrowed from Aave

- Privacy Benefit: DeFi enabled borrowing without identity verification

Results:

- Borrowed $50k USDC against 2.5 wBTC (50% LTV)

- Interest rate: 4.2% APR

- No KYC, no identity verification

- Full control of collateral keys

- Trade-off: Bridge risk, smart contract risk

Decision: DeFi was the only option for privacy-preserving lending, the user accepted technical risks.

Case 5: Institutional Borrower - Large-Scale Lending

User: Crypto fund needing $5M credit line

Collateral: $10M in BTC and ETH

Comparison:

- CeFi (Genesis/BlockFi): Personalized rates, OTC desk, relationship manager

- DeFi (Aave/Compound): Algorithmic rates, no negotiation, self-service

- Service Level: CeFi provides institutional support vs DeFi's automated approach

Decision Factors:

- CeFi: Negotiated 6.5% APR (vs 8% standard)

- DeFi: Market rate 4.8% APR (non-negotiable)

- CeFi: Dedicated support, flexible terms

- DeFi: No support, rigid liquidation rules

Decision: Fund split: 60% DeFi (lower rates) + 40% CeFi (relationship, flexibility). Diversified counterparty risk.

Advanced Lending Ecosystem Analysis and Professional Implementation

Institutional DeFi vs CeFi Lending Strategies and Enterprise Integration

Professional lending ecosystem evaluation requires sophisticated analysis of institutional requirements, regulatory compliance frameworks, and operational efficiency considerations that enable enterprise-grade lending strategies while maintaining fiduciary responsibilities and stakeholder protection. Institutional lending strategies incorporate comprehensive due diligence procedures, advanced risk assessment methodologies, and sophisticated portfolio optimisation techniques that maximise returns while maintaining appropriate risk profiles for professional investment management and corporate treasury operations through lending excellence and institutional financial optimisation designed for enterprise cryptocurrency lending and professional asset management requirements.

Enterprise lending integration includes a comprehensive evaluation of DeFi protocol governance, CeFi platform regulatory compliance, and sophisticated operational procedures that enable systematic lending adoption while maintaining security standards and regulatory oversight. Professional enterprise operations utilise advanced analytics, comprehensive reporting systems, and sophisticated optimisation techniques that enable strategic lending integration while managing technical risks and operational complexity through institutional lending excellence and professional financial management designed for corporate lending optimisation and enterprise cryptocurrency strategies.

Quantitative Lending Analysis and Mathematical Risk Assessment

Advanced lending ecosystem analysis utilises sophisticated quantitative models, including comprehensive yield analysis, systematic risk assessment, and mathematical optimisation, that enable informed lending decisions while managing portfolio risks and operational requirements. Quantitative lending analysis incorporates advanced statistical techniques, sophisticated correlation modelling, and comprehensive backtesting frameworks that enable systematic lending evaluation while maintaining appropriate risk management and strategic positioning through mathematical excellence and professional quantitative analysis designed for institutional lending operations and yield optimisation.

Mathematical risk assessment includes implementation of advanced algorithms for optimal lending allocation, sophisticated risk measurement, and comprehensive performance attribution that maximise lending efficiency while maintaining security standards and operational reliability. Professional practitioners utilise advanced econometric models, comprehensive scenario analysis, and sophisticated optimisation techniques that enable continuous improvement in lending strategies while managing market volatility through quantitative excellence and professional optimisation designed for institutional lending operations and cryptocurrency yield generation excellence.

Technology Integration and Automated Lending Management

Modern lending operations utilise advanced technology, including sophisticated portfolio management systems, comprehensive automation platforms, and advanced analytics tools that optimise lending strategies whilstimproving operational efficiency and risk management through technological excellence and innovation. Technology-enhanced lending management includes automated yield optimisation, sophisticated rebalancing systems, and comprehensive performance tracking that enable real-time lending oversight while maintaining strategic positioning and risk control through technological innovation and professional automation designed for advanced lending operations and institutional cryptocurrency management excellence.

Automated lending management includes the implementation of advanced algorithms for optimal platform selection, sophisticated risk monitoring systems, and comprehensive performance optimisation that maximise lending returns whilstminimising operational overhead and risk exposure through technological excellence. Professional technology integration requires advanced system architecture, comprehensive data management capabilities, and sophisticated analytical frameworks that enable continuous lending optimisation while maintaining security and operational excellence through technological innovation and professional automation designed for institutional lending management and cryptocurrency yield generation leadership in the evolving digital asset lending ecosystem.

Future Trends and Market Evolution

Future developments in DeFi and CeFi lending include the evolution of hybrid platforms, the implementation of advanced interoperability solutions, and the development of sophisticated regulatory frameworks that enable seamless lending operations while maintaining security and compliance standards. These emerging trends encompass development of institutional-grade infrastructure, implementation of advanced custody solutions, and creation of comprehensive risk management frameworks that support lending ecosystem growth while addressing regulatory requirements and operational challenges through innovation and professional excellence.

Market evolution includes the development of sophisticated yield optimisation strategies, the implementation of advanced automated lending protocols, and the creation of comprehensive cross-platform integration solutions that maximise lending efficiency while maintaining security and operational requirements. Professional lending management requires understanding of emerging market dynamics, implementation of adaptive strategies, and development of comprehensive risk assessment frameworks that capitalise on evolving opportunities while managing regulatory changes and technological developments through professional excellence and institutional-grade lending operations.

Strategic positioning for future lending developments requires continuous monitoring of technological innovations, systematic evaluation of regulatory changes, and implementation of adaptive strategies that capitalise on emerging opportunities while managing evolving risks and compliance requirements. Professional lending ecosystem management includes development of comprehensive scenario planning, implementation of flexible operational frameworks, and creation of sophisticated adaptation mechanisms that ensure long-term lending success while maintaining competitive advantages and operational excellence in the rapidly evolving cryptocurrency lending landscape and digital asset yield generation ecosystem.

Institutional Lending and Professional Management

Institutional lending strategies encompass sophisticated portfolio management techniques, comprehensive risk assessment frameworks, and advanced compliance procedures that enable professional-grade lending operations while maintaining fiduciary responsibilities and regulatory adherence. Professional institutional lending includes implementation of comprehensive due diligence procedures, sophisticated performance monitoring systems, and advanced reporting frameworks that ensure optimal lending outcomes while maintaining transparency and accountability through institutional-grade lending management excellence.

Advanced institutional approaches include the development of comprehensive lending policies, the implementation of sophisticated risk management systems, and the creation of advanced performance attribution frameworks that optimise institutional lending strategies while maintaining prudent risk management and operational excellence. Professional institutional lending requires understanding of complex regulatory requirements, implementation of comprehensive compliance monitoring systems, and development of sophisticated reporting procedures that ensure regulatory adherence whilstmaximising lending performance through institutional excellence and professional lending management designed for fiduciary success.

Institutional lending optimisation includes systematic evaluation of lending opportunities, implementation of advanced portfolio construction techniques, and development of comprehensive performance measurement systems that ensure optimal institutional lending outcomes while maintaining risk management and compliance requirements. Professional institutional management encompasses continuous monitoring of lending markets, systematic assessment of emerging opportunities, and implementation of adaptive strategies that capitalise on market developments while maintaining institutional standards and fiduciary excellence through professional lending management and institutional-grade operational procedures designed for long-term institutional lending success.

Advanced Lending Technology and Automation

Advanced lending technology encompasses sophisticated automated lending protocols, comprehensive smart contract implementations, and innovative yield optimisation algorithms that maximise lending efficiency while maintaining security and operational reliability. Professional lending technology includes development of comprehensive automated rebalancing systems, sophisticated risk monitoring frameworks, and advanced performance tracking solutions that enable optimal lending management whilstreducing operational overhead and human error through technological excellence and professional automation designed for institutional lending operations.

Automated lending management systems include the implementation of advanced machine learning algorithms, sophisticated predictive analytics frameworks, and comprehensive market analysis tools that optimise lending strategies while maintaining risk management and performance objectives. Professional lending automation requires understanding of complex market dynamics, implementation of sophisticated algorithmic trading strategies, and development of comprehensive monitoring systems that ensure optimal lending performance while maintaining security and operational excellence through technological innovation and professional automation designed for advanced lending management and cryptocurrency yield optimisation success in the evolving digital asset lending ecosystem.

Lending Performance optimisation and Analytics

Advanced lending performance optimisation encompasses sophisticated analytics frameworks, comprehensive performance measurement systems, and innovative optimisation algorithms that maximise lending returns while maintaining risk management and operational efficiency. Professional performance optimisation includes implementation of advanced data analysis techniques, sophisticated benchmarking procedures, and comprehensive reporting systems that enable continuous improvement in lending strategies while maintaining transparency and accountability through analytical excellence and professional performance management designed for institutional lending success and cryptocurrency yield generation leadership in the competitive digital asset lending marketplace.

Conclusion

The choice between DeFi and CeFi lending in 2025 ultimately depends on your risk tolerance, technical expertise, and investment objectives. Both approaches offer compelling advantages: CeFi provides user-friendly interfaces, customer support, and regulatory protection, while DeFi offers higher yields, complete transparency, and financial sovereignty through self-custody.

For most investors, a diversified approach proves most effective, utilising both DeFi and CeFi platforms to balance risk and reward. Start with CeFi platforms if you prioritise simplicity and security, then gradually explore DeFi protocols as you gain experience and confidence in managing smart contract risks and wallet security.

The regulatory landscape will continue to shape both sectors, with CeFi platforms likely benefiting from clearer compliance frameworks while DeFi protocols adapt to evolving regulatory requirements. This evolution creates opportunities for investors who understand the implications of regulatory changes and can position their lending strategies accordingly.

Risk management remains paramount in cryptocurrency lending, regardless of whether you choose DeFi or CeFi platforms. Diversification across multiple platforms, understanding the underlying risks of each approach, and never lending more than you can afford to lose are fundamental principles that apply to both ecosystems.

The future of cryptocurrency lending will likely see continued convergence between DeFi and CeFi approaches, with regulatory frameworks evolving to accommodate both models while protecting investors. Staying informed about these developments and adapting your lending strategy accordingly will be crucial for long-term success in this rapidly evolving space.

As the cryptocurrency lending landscape continues to evolve, the distinction between DeFi and CeFi is becoming increasingly blurred, with hybrid solutions emerging that combine the best of both worlds. Success in crypto lending requires staying informed about platform developments, understanding the risks involved, and maintaining proper diversification across multiple platforms and strategies. Whether you choose DeFi's innovation or CeFi's stability, the key is making informed decisions based on thorough research and your personal financial situation.

Sources & References

Frequently Asked Questions

- Is DeFi lending safer than CeFi lending?

- Neither is universally safer. DeFi eliminates counterparty risk but introduces risks from smart contracts and oracles. CeFi offers a simpler user experience but depends on platform solvency and governance.

- Which offers higher interest rates?

- Rates vary by market conditions. DeFi can offer higher rates during high-utilisation periods, while CeFi may offer competitive promotional rates with caps or lockup requirements.

- Which is more transparent?

- DeFi is generally more transparent with on-chain data and auditable smart contracts. CeFi transparency depends on platform disclosures and the quality of proof-of-reserves.

- Can I use both DeFi and CeFi lending?

- Yes, many users diversify across both models to balance convenience, transparency, and risk. This approach can reduce single-point-of-failure risks.

- What's the minimum amount to start?

- DeFi protocols typically have no minimums but require gas fees for transactions. CeFi platforms often have no minimums but may have caps on promotional rates.

- How do I track performance across both models?

- Use portfolio tracking tools like Zapper or DeBank for DeFi, and maintain spreadsheets or use platform APIs for CeFi. Consider net returns after fees and taxes.

- What happens during market crashes?

- Both models face stress during crashes. DeFi may see liquidation cascades and high gas fees, while CeFi platforms might impose withdrawal limits or freeze operations.

- Should beginners start with DeFi or CeFi?

- Beginners should typically start with CeFi for its user-friendly interface and support, then gradually explore DeFi as they gain experience and technical knowledge.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.