Crypto Lending Interest Rates 2025

Understand how lending interest rates work in 2025. Learn about rate drivers, platform comparisons, risk factors, and strategies to maximise your lending returns safely.

Introduction

Cryptocurrency lending has emerged as one of the most popular methods for generating passive income from digital assets. It offers interest rates that often exceed those of traditional banking products. Understanding how these rates are determined, what factors influence them, and how to evaluate different platforms is crucial for maximising returns while managing risk in the evolving crypto lending landscape of 2025.

The cryptocurrency lending market has matured considerably since its early days. It has institutional adoption, regulatory clarity, and advanced risk-management practices, contributing to a more stable and predictable interest-rate environment. But the basic drivers of crypto lending rates remain distinct from those in traditional finance, influenced by factors such as protocol tokenomics, market volatility, and the unique supply-and-demand dynamics of digital assets.

Interest rates in crypto lending vary greatly across platforms, assets, and lending mechanisms, ranging from conservative single-digit returns on stablecoins to double-digit yields on more volatile cryptocurrencies. These variations reflect different risk profiles, platform business models, and market conditions, requiring careful analysis to make informed lending decisions.

The landscape includes both centralised finance (CeFi) platforms that operate similarly to traditional banks and decentralised finance (DeFi) protocols that use smart contracts to automate lending processes. Each approach offers distinct rate structures, risk profiles, and features that appeal to different types of lenders, depending on their risk tolerance and technical expertise.

In 2025, the crypto lending ecosystem will have evolved to include advanced rate improvement tools, insurance mechanisms, and risk management features that help lenders maximise returns while protecting their capital. Understanding these tools and how to use them effectively is key to successful participation in the crypto lending market.

This complete guide examines the current state of crypto lending interest rates, providing a detailed analysis of rate determination mechanisms, platform comparisons, and strategic approaches to improving lending returns. We'll explore both theoretical frameworks and practical use strategies that enable informed decision-making in the dynamic cryptocurrency lending environment, covering everything from basic concepts to advanced improvement techniques for experienced lenders seeking to maximise their passive income potential.

This complete guide examines the factors that drive crypto lending interest rates, compares different platforms and their rate structures, analyses risk factors that affect returns, and provides practical strategies for improving your lending portfolio. Whether you're new to crypto lending or looking to refine your existing strategy, this analysis provides the insights needed to make informed decisions in the dynamic world of cryptocurrency lending.

Market dynamics in 2025 have created unprecedented opportunities for crypto lenders. It has institutional demand driving higher rates for certain assets while regulatory developments provide greater clarity and security for participants. Understanding these macro trends and their impact on interest rates is key to positioning your lending portfolio for optimal returns.

The emergence of yield farming and liquidity mining has added new dimensions to crypto lending. It has protocols that offer additional token rewards on top of base interest rates. These mechanisms can greatly boost overall returns but also introduce more complexity and risk factors that must be carefully evaluated.

Quick Overview

Crypto lending rates in 2025 are mainly variable, responding to market demand, platform liquidity, and regulatory changes. Stablecoins typically offer APRs of 2-10%. Meanwhile, volatile assets can range from 3% to 15% depending on market conditions and platform incentives.

Key factors affecting rates

- Borrowing demand and use rates

- Platform liquidity and reserve levels

- Regulatory environment and compliance costs

- Market volatility and risk premiums

2025 Interest Rate Landscape

Market Overview

The lending market in 2025 has matured greatly. It has clearer regulatory frameworks and more advanced risk management. Interest rates have generally stabilised compared to the volatile periods of 2022-2023, but still offer attractive yields compared to traditional finance.

Total value locked (TVL) in lending protocols has reached new highs. It has over $50 billion across major platforms. This increased liquidity has led to more competitive rates and better user terms. Institutional adoption has also grown. It has pension funds and corporate treasuries allocating portions of their portfolios to lending strategies.

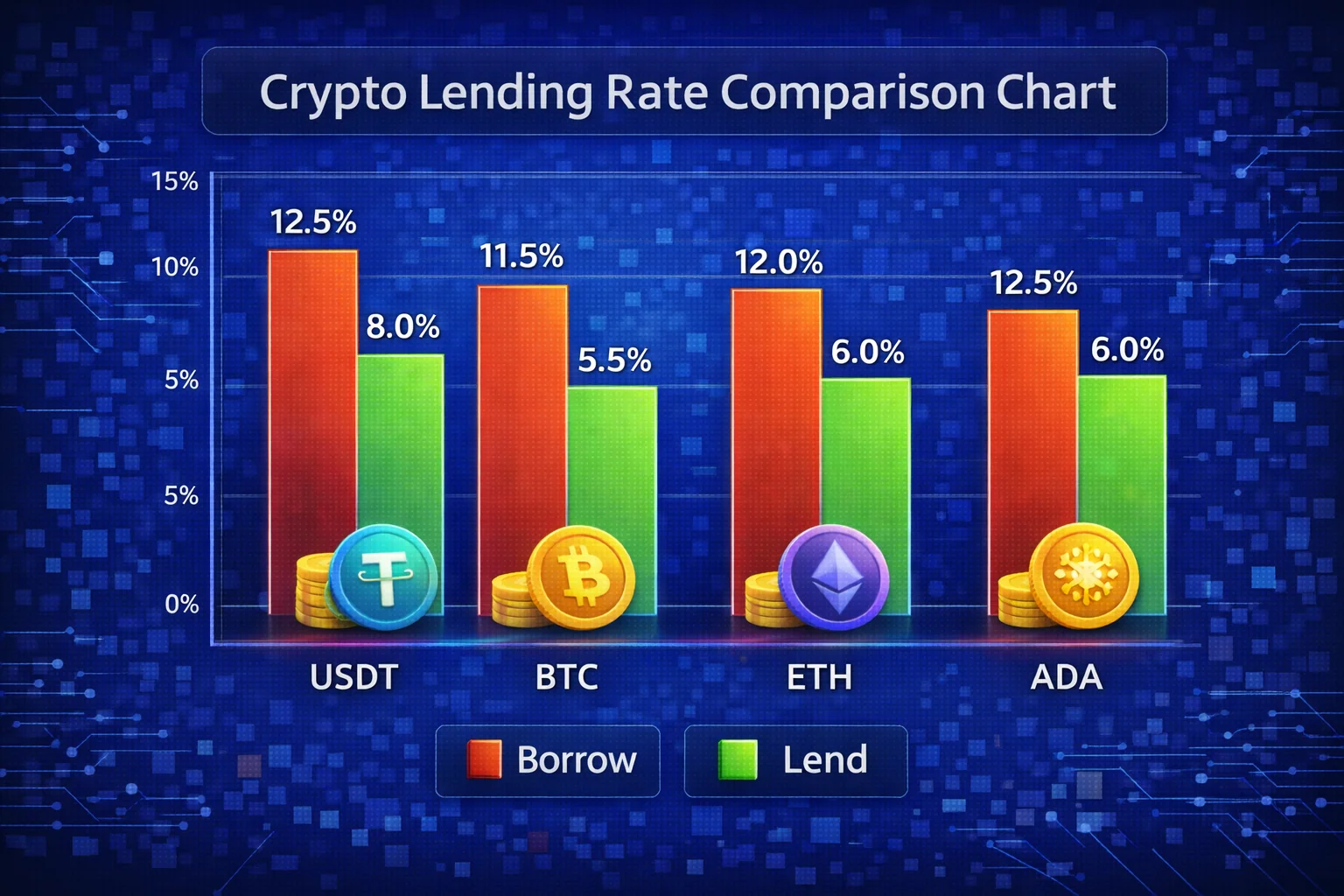

Current Rate Ranges by Asset Type

| Asset Category | Typical APR Range | Platform Type | Risk Level |

|---|---|---|---|

| Stablecoins (USDC, USDT, DAI) | 2-10% | CeFi & DeFi | Low-Medium |

| Bitcoin (BTC) | 1-6% | mainly CeFi | Medium |

| Ethereum (ETH) | 2-8% | CeFi & DeFi | Medium |

| Major Altcoins (SOL, ADA, DOT) | 3-12% | Mixed | Medium-High |

| Smaller Altcoins | 5-25% | mainly DeFi | High |

Platform-Specific Rate Analysis

Top CeFi Platform Rates (September 2025)

| Platform | USDC APR | BTC APR | ETH APR | Special Features |

|---|---|---|---|---|

| Nexo | 8-12% | 4-6% | 5-7% | Loyalty tiers, insurance |

| Binance Earn | 3-8% | 1-3% | 2-5% | Flexible/locked terms |

| Coinbase | 2-5% | 1-2% | 2-4% | FDIC insurance (USD) |

| Kraken | 3-6% | 1-4% | 2-6% | Regulated, transparent |

Leading DeFi Protocol Rates

| Protocol | USDC APR | ETH APR | Token Rewards | use Rate |

|---|---|---|---|---|

| Aave V3 | 4-8% | 2-5% | None | 75-85% |

| Compound V3 | 3-7% | 1-4% | COMP tokens | 70-80% |

| Morpho | 5-9% | 3-6% | MORPHO tokens | 80-90% |

| Euler | 4-8% | 2-5% | EUL tokens | 65-75% |

Regional Rate Variations

Interest rates can vary greatly by geographic region because of regulatory differences, local demand, and platform availability:

- United States: Generally lower rates because of regulatory compliance costs, but higher security

- European Union: Moderate rates with strong consumer protections under MiCA regulation

- Asia-Pacific: Higher rates in some jurisdictions but varying regulatory clarity

- Emerging Markets: Often highest rates but increased regulatory and operational risks

Seasonal Rate Patterns

Crypto lending rates exhibit predictable seasonal patterns:

- Q1 (Jan-Mar): Typically higher rates because of tax-loss harvesting and new year allocations

- Q2 (Apr-Jun): Moderate rates with increased institutional activity

- Q3 (Jul-Sep): Often lower rates because of summer trading lull

- Q4 (Oct-Dec): Variable rates depending on market sentiment and year-end positioning

What Drives Crypto Lending Rates

main Rate Drivers

1. Supply and Demand Dynamics

The basic driver of lending rates is the balance between lenders (supply) and borrowers (demand). High borrowing demand relative to available liquidity tends to push rates up. Meanwhile, excess liquidity tends to drive rates down.

- use rates: Higher use (borrowed/total supplied) increases rates

- Seasonal patterns: Rates often spike during bull markets and DeFi seasons

- use demand: Increased trading activity drives borrowing for margin positions

2. Platform-Specific Factors

- Reserve requirements: Platforms maintain reserves affecting available liquidity

- Risk management: Conservative platforms offer lower but more stable rates

- Operational costs: Compliance, insurance, and operational expenses impact net rates

- Competitive positioning: Platforms adjust rates to attract or retain users

3. Market Conditions

- Volatility: Higher volatility increases risk premiums and borrowing costs

- Liquidation risk: Assets with higher liquidation risk command higher rates

- Correlation: Highly correlated assets may have similar rate movements

- Market sentiment: Bull markets increase use demand and rates

4. Regulatory Environment

- Compliance costs: Regulatory requirements increase operational expenses

- Geographic restrictions: Limited access can affect supply/demand balance

- Insurance requirements: Mandatory insurance reduces net yields to lenders

- Capital requirements: Banking-style regulations may limit lending capacity

CeFi vs DeFi Rate Dynamics

centralised Finance (CeFi) Platforms

CeFi platforms like Nexo, Binance, and Coinbase offer managed lending experiences with several characteristics:

CeFi Rate Characteristics:

- Promotional rates: Often feature limited-time high APR offers

- Tiered systems: Higher balances may earn better rates

- Rate caps: Maximum amounts eligible for advertised rates

- Flexible terms: Usually offer both flexible and fixed-term options

- Insurance coverage: Some platforms provide deposit insurance

Pros and Cons:

| Advantages | Disadvantages |

|---|---|

| User-friendly interfaces | Counterparty risk |

| Customer support | Lower transparency |

| Regulatory compliance | Potential rate changes |

| Insurance options | KYC requirements |

decentralised Finance (DeFi) Protocols

DeFi lending protocols, such as Aave and Compound. Because well as newer platforms, offer algorithmic rate setting with full transparency.

DeFi Rate Characteristics:

- Algorithmic rates: Rates adjust automatically based on use curves

- Real-time updates: Rates can change with every block

- Token incentives: more rewards through governance tokens

- Composability: Ability to use receipt tokens in other protocols

- No minimums: Usually no minimum deposit requirements

Rate Calculation Examples

DeFi protocols typically use use-based models. Here's how rates are calculated:

Aave Interest Rate Model

Aave uses a kinked interest rate model with the following formula:

- Base rate: 0% (minimum rate when use is 0%)

- Slope 1: 4% increase up to 80% use

- Slope 2: 75% increase from 80% to 100% use

- Optimal use: 80% for most stablecoins

Example calculation for USDC at 85% use:

- Base rate: 0%

- Rate from 0-80%: 80% × 4% = 3.2%

- Rate from 80-85%: 5% × 75% = 3.75%

- Total supply APR: 0% + 3.2% + 3.75% = 6.95%

Compound Interest Rate Model

Compound uses a different approach with continuous rate adjustments:

- Base rate per year: 2%

- Multiplier per year: 5%

- Jump multiplier per year: 109%

- Kink: 80%

Formula:

- If use ≤ kink: borrowRate = baseRate + (use × multiplier)

- If use > kink: borrowRate = baseRate + (kink × multiplier) + ((use. kink) × jumpMultiplier)

- supplyRate = borrowRate × use × (1. reserveFactor)

Token Reward Calculations

Many protocols offer more rewards in governance tokens:

- Emission rate: Tokens distributed per block/second

- Pool allocation: Percentage of emissions for each asset

- User share: Your deposit / total pool deposits

- Token price: Current market value of reward tokens

Example COMP reward calculation:

- Daily COMP emissions to USDC pool: 100 COMP

- Your USDC deposit: $10,000

- Total USDC pool: $100,000,000

- Your share: 0.01%

- Daily COMP earned: 100 × 0.0001 = 0.01 COMP

- If COMP = $50: Daily reward = $0.50

- Annual reward APR: ($0.50 × 365) / $10,000 = 1.83%

Fixed vs Variable Rate Strategies

Variable Rate Lending

Most lending platforms use variable rates that adjust based on market conditions.

Advantages:

- Capture rate increases during high-demand periods

- No lockup periods. maintain liquidity

- Benefit from platform incentive programs

- Easier to rebalance across platforms

Disadvantages:

- Rate uncertainty and potential decreases

- Need for active monitoring and management

- Exposure to platform policy changes

- Potential for sudden rate drops

Fixed Rate Lending

Some platforms offer fixed-rate products. But these are less common in the crypto space.

Advantages:

- Predictable returns for planning purposes

- Protection against rate decreases

- Reduced need for active management

- Better for conservative strategies

Disadvantages:

- Miss out on rate increases

- Usually require lockup periods

- Limited availability and selection

- Often lower rates than variable peaks

Hybrid Strategies

Many experienced lenders use a combination approach:

- Core allocation: 60-70% in stable, variable rate platforms

- Opportunistic allocation: 20-30% chasing higher rates

- Fixed allocation: 10-20% in fixed rates for stability

Risk Factors Affecting Rates

Platform-Specific Risks

- Counterparty risk: Platform insolvency or mismanagement

- Regulatory risk: Changes in legal status or compliance requirements

- Operational risk: Technical failures or security breaches

- Liquidity risk: Inability to withdraw funds when needed

Market Risks

- Interest rate risk: Rates may decrease after commitment

- Currency risk: Exposure to volatile crypto asset prices

- Correlation risk: many positions affected by same events

- Systemic risk: Broader crypto market or DeFi protocol failures

Smart Contract Risks (DeFi)

- Code vulnerabilities: Bugs leading to fund loss

- Oracle failures: Price feed manipulation or failures

- Governance attacks: Malicious protocol changes

- Composability risks: Failures in connected protocols

Monitoring and improvement Strategies

key Monitoring Practices

Regular Rate Checks

- Weekly reviews: Check rates across your active platforms

- Rate alerts: Set up notifications for large changes

- use tracking: Monitor DeFi protocol use rates

- Incentive updates: Track changes in token reward programs

Performance Metrics

- Net APR: Account for fees, taxes, and token reward volatility

- Risk-adjusted returns: Consider platform and asset risks

- Opportunity cost: Compare with staking and other alternatives

- Liquidity premium: Value the ability to withdraw quickly

Advanced Monitoring Tools

Automated Tracking Solutions

- DeFiSaver: Automated position management and rebalancing

- Instadapp: DeFi portfolio improvement and automation

- Yearn Finance: Automated yield farming strategies

- Harvest Finance: Yield improvement with auto-compounding

Rate Comparison Platforms

- DeFi Rate: Real-time comparison of lending rates across protocols

- Loanscan: complete lending rate aggregator

- DeFi Prime: Curated list of DeFi lending platforms

- Staking Rewards: Comparison of staking vs lending yields

Analytics and Research Tools

- Dune Analytics: Custom dashboards for protocol analysis

- DefiLlama: TVL tracking and protocol comparisons

- Token Terminal: Financial metrics for DeFi protocols

- Messari: basic analysis and protocol research

improvement Strategies

Platform Diversification Framework

| Allocation | Platform Type | Risk Level | Purpose |

|---|---|---|---|

| 40-50% | Tier 1 CeFi (Nexo, Binance) | Low-Medium | Stable base yield |

| 30-40% | Blue-chip DeFi (Aave, Compound) | Medium | Higher yields with transparency |

| 10-20% | Emerging protocols | High | Capture new opportunities |

| 5-10% | Liquid reserves | Low | Emergency access |

Dynamic Rebalancing Strategies

Threshold-Based Rebalancing

- Rate differential threshold: Move funds when rate difference exceeds 1-2%

- Minimum position size: Only rebalance amounts above $1,000 to justify gas costs

- Cooling period: Wait 7-14 days between moves to avoid overtrading

- Platform health check: Verify platform stability before moving funds

Calendar-Based Rebalancing

- Monthly review: complete portfolio assessment

- Quarterly rebalancing: Major allocation adjustments

- Annual strategy review: Update risk tolerance and goals

- Tax-loss harvesting: Year-end improvement for tax efficiency

Risk-Adjusted improvement

Sharpe Ratio Calculation

Calculate risk-adjusted returns using the Sharpe ratio:

- Formula: (Portfolio Return. Risk-Free Rate) / Portfolio Volatility

- Risk-free rate: Use US Treasury or stablecoin base rate

- Portfolio volatility: Standard deviation of monthly returns

- Target Sharpe ratio: Aim for >1.0 for good risk-adjusted performance

Maximum Drawdown Management

- Set limits: Maximum 20% allocation to any single platform

- Correlation analysis: Avoid overexposure to correlated risks

- Stress testing: Model performance during market downturns

- Recovery planning: Strategies for rebuilding after losses

Tools and Resources

Portfolio Management Tools

- Zapper: Portfolio tracking across many protocols

- DeBank: complete DeFi portfolio management

- Zerion: Mobile-first DeFi portfolio tracker

- Rotki: Open-source portfolio tracking and tax reporting

API Integration

- Platform APIs: Direct integration for automated monitoring

- Price feeds: CoinGecko, CoinMarketCap for token valuations

- DeFi APIs: The Graph Protocol for on-chain data

- Notification services: Discord, Telegram bots for alerts

Spreadsheet Templates

Create complete tracking spreadsheets with:

- Platform allocation and current rates

- Historical performance tracking

- Risk metrics and correlation analysis

- Tax reporting and cost basis tracking

- Rebalancing triggers and decision logs

2025 Rate Outlook and Trends

Regulatory Impact

Increasing regulatory clarity in major jurisdictions is expected to:

- Stabilise rates as compliance costs become predictable

- Reduce extreme rate volatility through better risk management

- Increase institutional participation, adding liquidity

- Create clearer distinctions between compliant and non-compliant platforms

Technology Developments

- Layer 2 scaling: Reduced transaction costs enabling smaller position management

- Cross-chain protocols: Better rate arbitrage opportunities

- Automated strategies: Yield farming and rate improvement tools

- Insurance products: Better risk management and potentially lower rates

Market Maturation

- More advanced risk pricing models

- Increased competition leading to better user terms

- Greater integration with traditional finance

- More stable, sustainable rate structures

Tax and Regulatory Considerations

Tax Implications of Crypto Lending

Income Tax Treatment

In most jurisdictions, crypto lending interest is treated as ordinary income:

- Accrual basis: Income recognised when earned, not when withdrawn

- Fair market value: Interest valued at time of receipt

- Token rewards: more income at token's FMV when received

- Compounding: Reinvested interest creates more taxable events

Record Keeping Requirements

- Transaction logs: All deposits, withdrawals, and interest payments

- Platform statements: Monthly or annual statements from each platform

- Token valuations: USD value of all token rewards at receipt time

- Cost basis tracking: Original purchase price and dates for all assets

Tax improvement Strategies

- Tax-loss harvesting: realise losses to offset lending income

- Timing withdrawals: Manage income recognition across tax years

- Retirement accounts: Use tax-advantaged accounts where possible

- Geographic arbitrage: Consider tax-friendly jurisdictions

Regulatory Compliance

Know Your Customer (KYC) Requirements

Most regulated platforms require identity verification:

- Identity documents: Government-issued ID and proof of address

- Source of funds: Documentation of crypto acquisition

- Ongoing monitoring: Periodic re-verification and updates

- Reporting thresholds: Automatic reporting for large transactions

Anti-Money Laundering (AML) Compliance

- Transaction monitoring: Platforms monitor for suspicious activity

- Reporting requirements: Suspicious activity reports to authorities

- Sanctions screening: Compliance with international sanctions lists

- Enhanced due diligence: more checks for high-risk customers

Jurisdiction-Specific Regulations

United States

- SEC oversight: Some lending products may be considered securities

- State regulations: Varying state-level licensing requirements

- CFTC jurisdiction: Derivatives and futures-related lending

- Banking regulations: FDIC insurance for USD deposits on some platforms

European Union

- MiCA regulation: complete crypto asset regulation framework

- GDPR compliance: Data protection requirements for user information

- National implementations: Country-specific licensing and oversight

- Passporting rights: EU-wide service provision for licensed entities

Best Practices for Rate improvement

Getting Started Framework

Phase 1: Foundation (Months 1-2)

- Education: Complete crypto lending courses and read platform documentation

- Small start: Begin with $100-500 on 1-2 reputable platforms

- Risk assessment: Understand and document your risk tolerance

- Setup tracking: Create spreadsheets or use portfolio tools

Phase 2: Expansion (Months 3-6)

- Platform diversification: Add 2-3 more platforms

- Asset diversification: Experiment with different cryptocurrencies

- Strategy testing: Try both CeFi and DeFi options

- Performance analysis: Compare actual vs expected returns

Phase 3: improvement (Months 6+)

- Advanced strategies: use yield farming and token rewards

- Automated tools: Use APIs and bots for monitoring

- Tax improvement: use tax-efficient strategies

- Continuous improvement: Regular strategy reviews and updates

Advanced Strategies

Yield Farming Integration

- Liquidity provision: Combine lending with DEX liquidity provision

- Leveraged farming: Borrow to increase farming positions (high risk)

- Cross-protocol strategies: Use lending receipts in other protocols

- Impermanent loss hedging: Balance farming with stable lending

Rate Arbitrage Techniques

- Cross-platform arbitrage: Exploit rate differences between platforms

- Temporal arbitrage: Time entries and exits based on rate cycles

- Geographic arbitrage: Access region-specific rates and platforms

- Asset arbitrage: Convert between assets to capture rate premiums

Token Farming improvement

- Emission schedules: Time entries to maximise token rewards

- Vesting strategies: improve token claim timing for tax efficiency

- Governance participation: Use tokens for voting and more rewards

- Token diversification: Manage exposure to governance token volatility

Risk Management Framework

Position Sizing Rules

- Maximum platform exposure: No more than 20% on any single platform

- Asset concentration limits: Maximum 40% in any single cryptocurrency

- Geographic diversification: Spread across many jurisdictions

- Liquidity requirements: Maintain 10-20% in highly liquid positions

Emergency Procedures

- Platform failure protocol: Steps to take if a platform becomes insolvent

- Market crash response: Predetermined actions during severe downturns

- Regulatory changes: Adaptation strategies for new regulations

- Personal emergencies: Quick liquidation procedures for urgent needs

Insurance and Protection

- Platform insurance: prioritise platforms with deposit insurance

- DeFi insurance: Consider protocols like Nexus Mutual for smart contract coverage

- Self-insurance: Maintain emergency funds in traditional accounts

- Legal protection: Understand legal recourse in different jurisdictions

Regulatory Impact on Interest Rates in 2025

The European Union's MiCA regulation affects cryptocurrency lending platforms operating in EU markets, requiring enhanced capital reserves and compliance procedures that may influence interest rate structures. Platforms must maintain operational reserves equivalent to 2% of managed assets, potentially reducing yields by 0.2-0.5% annually to cover regulatory compliance costs and capital requirements.

United States regulatory developments, including potential stablecoin legislation and SEC guidance on cryptocurrency lending products, create uncertainty that affects platform risk premiums and interest rate offerings. Regulatory clarity could reduce risk premiums by 1-2% annually, while continued uncertainty may keep rates elevated as platforms price in compliance and legal risks throughout 2025.

Singapore's progressive regulatory framework enables competitive interest rates through operational efficiency and regulatory certainty. It has licensed platforms offering rates 0.5-1% higher than jurisdictions with unclear regulatory environments. The Monetary Authority of Singapore's clear guidelines reduce operational risks and enable more aggressive rate competition amongst licensed providers while maintaining complete consumer protection measures.

Advanced Interest Rate Analysis and Professional improvement

Institutional Interest Rate Modelling and Quantitative Analysis

Professional cryptocurrency lending platforms use advanced interest rate models. This includes dynamic pricing algorithms, complete risk-adjusted return calculations, and advanced market microstructure analysis that improve lending rates while maintaining competitive positioning and operational profitability. Institutional rate modelling incorporates advanced statistical techniques, complete correlation analysis, and advanced volatility forecasting that enable systematic interest rate improvement through mathematical excellence and quantitative analysis designed for professional cryptocurrency lending operations and institutional rate management.

Quantitative interest rate analysis includes the use of advanced econometric models. It also includes advanced yield curve construction and complete term structure analysis. These provide deep insights into cryptocurrency lending market dynamics. They enable strategic rate positioning and competitive advantage. Professional practitioners use advanced mathematical frameworks. They use complete backtesting systems and advanced performance attribution. These enable continuous rate improvement through quantitative analysis and institutional-grade interest rate management techniques.

Market Dynamics and Competitive Interest Rate Strategies

Cryptocurrency lending interest rates reflect complex market dynamics. This includes supply and demand imbalances. It also includes regulatory developments and institutional adoption trends. Macroeconomic factors influence lending market conditions. This creates opportunities for strategic rate positioning and competitive advantage. Market analysis includes complete competitor monitoring. It includes advanced demand forecasting and advanced supply analysis. These enable strategic interest rate positioning. They maintain appropriate risk management and operational efficiency.

Competitive rate strategies include dynamic pricing mechanisms, advanced market timing techniques, and comprehensive competitive positioning that maximise lending returns while maintaining market share and operational sustainability. Professional rate management requires complete market analysis, advanced competitive intelligence, and advanced strategic planning that enable optimal interest rate positioning while managing competitive pressures and market volatility through professional rate strategy development and market leadership techniques designed for cryptocurrency lending excellence.

Risk-Adjusted Return improvement and Professional Rate Management

Advanced cryptocurrency lending requires a comprehensive risk-adjusted return analysis that incorporates credit risk assessment, liquidity risk evaluation, and operational risk management, while optimising interest rate positioning for maximum risk-adjusted profitability. Professional risk-adjusted analysis includes advanced stress testing, complete scenario modelling, and advanced portfolio improvement that enable strategic rate positioning while maintaining appropriate risk management standards and operational excellence through professional risk management and return improvement techniques.

Professional rate management includes the use of advanced risk-monitoring systems, performance measurement frameworks, and optimisation algorithms that maximise risk-adjusted returns while maintaining operational efficiency and competitive positioning. Institutional practitioners use advanced analytical tools, complete risk assessment systems, and advanced improvement techniques that enable continuous improvement in risk-adjusted return performance through professional rate management excellence and institutional-grade improvement strategies designed for cryptocurrency lending leadership.

Technology Integration and Automated Rate improvement

Modern cryptocurrency lending platforms use advanced technology, including artificial intelligence, machine learning algorithms, and fully automated systems, that improve interest rate management whilst enhancing operational efficiency and competitive positioning through technological excellence and innovation. Technology-enhanced rate management includes automated pricing systems, advanced market monitoring tools, and complete analytics platforms that enable real-time rate improvement while maintaining appropriate risk controls and operational oversight through technological innovation and professional automation.

Automated rate improvement includes the use of advanced algorithms for dynamic pricing, advanced market response systems, and comprehensive performance monitoring, enabling systematic rate management while maintaining competitive advantage and operational efficiency. Professional technology integration requires advanced system architecture, comprehensive data management capabilities, and analytical frameworks that enable continuous rate improvement through technological excellence while maintaining security and regulatory compliance standards, key to professional cryptocurrency lending operations and technological leadership.

Future Interest Rate Trends and Strategic Positioning

Cryptocurrency lending interest rate evolution includes anticipated developments in regulatory frameworks, institutional adoption patterns, and technological innovations that will influence future rate environments whilst creating strategic opportunities for professional positioning and competitive advantage. Future rate trends include potential regulatory standardisation, enhanced institutional participation, and full technology integration, which will reshape cryptocurrency lending markets whilst creating opportunities for strategic positioning and professional excellence through market leadership and innovation.

Strategic rate positioning requires comprehensive trend analysis, advanced forecasting, and strategic planning to position rates optimally for future market conditions while maintaining current operational excellence and competitive advantage. Professional strategic planning includes comprehensive scenario analysis, advanced risk assessment, and advanced opportunity identification, enabling strategic rate positioning while managing uncertainty and market volatility through professional strategic excellence and market leadership techniques designed for long-term cryptocurrency lending success and competitive advantage.

Advanced Lending Economics and Market Analysis

Interest Rate modelling and Predictive Analytics

Professional cryptocurrency lending requires an advanced understanding of interest rate dynamics, market cycles, and economic factors that influence lending rates across different platforms and market conditions. Advanced rate modelling includes analysing supply and demand patterns, understanding the relationship between traditional finance rates and cryptocurrency lending yields, and using predictive models that anticipate rate changes based on market indicators.

Quantitative analysis of lending rates includes correlation studies with traditional financial markets, volatility modelling that accounts for cryptocurrency-specific factors, and scenario analysis that evaluates potential rate movements under different market conditions. Professional lenders use these analytical frameworks to improve the timing of lending activities and maximise risk-adjusted returns across many market cycles.

Machine learning algorithms increasingly power interest rate prediction models, analysing vast datasets including on-chain metrics, trading volumes, social sentiment indicators, and macroeconomic variables to forecast rate movements with greater accuracy. These predictive systems process real-time market data, historical lending patterns, and external economic indicators to generate actionable insights for optimal loan timing and platform selection.

Statistical arbitrage opportunities emerge from temporary rate dislocations between platforms. This creates profit potential for advanced lenders who can quickly identify and exploit these inefficiencies. Advanced practitioners use automated monitoring systems that track rate spreads across dozens of platforms simultaneously, reallocating capital rapidly when profitable opportunities exceed transaction costs and risk thresholds.

Institutional Lending Strategies and Portfolio Management

Enterprise cryptocurrency lending involves using advanced portfolio management techniques that balance yield generation with capital preservation requirements for institutional investors. Professional strategies include diversification across multiple lending platforms, automated rebalancing systems, and advanced risk management protocols that protect against platform failures and market volatility.

Institutional lending infrastructure includes complete due diligence frameworks, ongoing monitoring systems, and professional custody solutions that enable traditional financial institutions to participate in cryptocurrency lending while maintaining fiduciary responsibilities and regulatory compliance standards required for institutional asset management operations.

Treasury management for institutional cryptocurrency lending involves advanced cash flow modelling, liquidity planning, and capital allocation strategies that improve returns while maintaining operational flexibility. Professional treasury operations include automated rebalancing systems, strategic reserves for opportunistic investments, and advanced hedging strategies to manage currency and interest rate risks inherent in cryptocurrency lending activities.

Risk budgeting frameworks enable institutional lenders to systematically allocate risk capital across different lending strategies, platforms, and asset classes while maintaining overall portfolio risk within acceptable parameters. These frameworks incorporate value-at-risk calculations, stress testing scenarios, and correlation analysis to ensure diversified exposure and appropriate risk-adjusted return expectations across the entire lending portfolio.

Cross-Platform Arbitrage and Yield improvement

Advanced lending participants use advanced arbitrage strategies that capitalise on interest rate differentials across many lending platforms, maximising returns through strategic capital allocation and automated rebalancing systems. Professional arbitrage operations require complete monitoring of rates across platforms, understanding of withdrawal timeframes, and use of automated systems that execute optimal allocation decisions.

Yield improvement strategies include using flash loans for capital-efficient arbitrage, using automated rate monitoring systems, and developing advanced algorithms that improve allocation across many platforms whilstaccounting for transaction costs, platform risks, and liquidity requirements that affect overall strategy profitability and risk management.

Cross-chain arbitrage opportunities arise from rate differences between lending protocols on different blockchains, requiring advanced bridge protocols and multi-chain wallet management to execute efficiently. Professional arbitrageurs maintain positions across Ethereum, Binance Smart Chain, Polygon, Avalanche, and other networks to capture rate premiums while managing bridge risks and transaction costs associated with cross-chain operations.

Automated arbitrage systems use smart contracts and algorithmic trading strategies to execute rapid capital movements between platforms when rate differentials exceed predetermined thresholds. These systems incorporate real-time rate monitoring, automated execution logic, and complete risk controls that prevent excessive exposure to any single platform whilstmaximising capture of arbitrage opportunities across the lending ecosystem.

Regulatory Impact and Compliance Considerations

Cryptocurrency lending operates within evolving regulatory frameworks that greatly impact interest rates, platform operations, and user access across different jurisdictions. Understanding regulatory trends, compliance requirements, and potential policy changes is key for long-term lending strategy development and risk management in the cryptocurrency lending ecosystem.

Professional compliance strategies include monitoring regulatory developments, using appropriate reporting procedures, and maintaining complete documentation that supports regulatory compliance while improving lending activities within applicable legal frameworks. International lending operations require more consideration of cross-border regulations and tax implications that affect overall strategy use and returns improvement.

Regulatory arbitrage opportunities exist between jurisdictions with different cryptocurrency lending regulations. This enables advanced lenders to improve their operations across many regulatory environments. Professional practitioners maintain legal entities in favorable jurisdictions while ensuring compliance with applicable regulations in their home countries, maximising operational flexibility while maintaining legal compliance and tax efficiency.

Compliance technology solutions include automated reporting systems, transaction monitoring tools, and complete audit trails that support regulatory requirements while minimising operational overhead. These systems integrate with lending platforms to provide real-time compliance monitoring, automated tax reporting, and complete documentation that supports regulatory examinations and audit requirements for professional lending operations.

Technology Innovation and Platform Evolution

Cryptocurrency lending platforms continue evolving through technological innovation, enhanced security measures, and improved user experiences that expand access to lending opportunities while maintaining safety and reliability standards. Innovation trends include automated lending improvement, artificial intelligence-powered risk assessment, and integration with traditional finance infrastructure that bridges conventional banking with decentralised lending protocols.

Platform evolution includes development of institutional-grade features, use of advanced compliance tools, and creation of advanced portfolio management interfaces that serve both retail and professional users. These technological advances democratize access to advanced lending strategies while maintaining the security and transparency benefits that make cryptocurrency lending attractive for portfolio improvement and yield generation strategies.

Artificial intelligence integration transforms lending platform operations through automated risk assessment, dynamic rate improvement, and predictive analytics that enhance user experience whilstimproving platform profitability. AI-powered systems analyse borrower behavior patterns, market conditions, and platform use metrics to improve lending rates in real-time while maintaining appropriate risk management standards and competitive positioning.

Blockchain interoperability solutions enable seamless lending across many networks, expanding opportunities for yield improvement whilstreducing technical barriers for users. Cross-chain lending protocols use bridge technologies, wrapped tokens, and multi-signature systems to enable lending activities across different blockchain ecosystems while maintaining security and transparency standards key for professional lending operations.

Market Microstructure and Advanced Rate Dynamics

Liquidity Pool Mechanics and Rate Formation

Understanding the underlying mechanics of how interest rates form in cryptocurrency lending markets requires deep analysis of liquidity pool dynamics, use curves, and the mathematical models that govern rate adjustments. Different platforms employ varying approaches to rate calculation, from simple supply-demand ratios to advanced algorithmic models that incorporate many market variables and risk factors.

Automated market makers in DeFi lending protocols use mathematical formulas that create predictable rate curves based on use ratios. These curves typically feature exponential increases in borrowing costs as use approaches maximum capacity. This creates natural equilibrium points that balance lender supply with borrower demand while maintaining platform stability and liquidity.

Rate volatility analysis reveals patterns in how quickly lending rates respond to market changes. It has some platforms featuring near-instantaneous adjustments whilstothers use smoothing mechanisms to reduce rate volatility. Understanding these response patterns enables advanced lenders to anticipate rate movements and position their capital accordingly for optimal returns.

Liquidity depth analysis examines the relationship between available lending capital and rate stability, revealing how large deposits or withdrawals can impact rates across different platforms. Platforms with deeper liquidity pools typically offer more stable rates, whilstsmaller platforms may experience large rate volatility from large capital movements.

Behavioral Economics in Cryptocurrency Lending

Lender behavior patterns greatly influence interest rate dynamics. It has psychological factors affecting capital allocation decisions and market efficiency. Research into cryptocurrency lending behavior reveals distinct patterns in how retail versus institutional lenders respond to rate changes, market volatility, and platform incentives.

Herding behavior in cryptocurrency lending creates temporary rate distortions as lenders collectively move capital towards platforms offering promotional rates or enhanced rewards. These movements can create arbitrage opportunities for contrarian lenders who maintain positions in temporarily underutilized platforms whilstothers chase higher advertised yields.

Risk perception varies greatly amongst different lender categories. It has retail lenders often prioritising advertised rates over complete risk assessment, whilstinstitutional lenders focus on risk-adjusted returns and platform stability. These different risk preferences create market segmentation that affects rate structures across different platform types and user categories.

Seasonal lending patterns emerge from tax considerations, bonus distributions, and market cycles that influence when lenders deploy or withdraw capital. Understanding these patterns enables strategic timing of lending activities to capture favorable rates during periods of reduced competition or increased demand.

Advanced Yield Farming Integration Strategies

advanced cryptocurrency lending strategies integrate traditional lending with yield farming opportunities to maximise overall returns through compound strategies that use many DeFi protocols simultaneously. These strategies require careful analysis of protocol interactions, token emission schedules, and the sustainability of reward mechanisms across different platforms.

Leveraged yield farming strategies use borrowed capital to amplify returns from liquidity mining programs. This creates complex risk-return profiles that require advanced risk management and continuous monitoring. These strategies can greatly enhance returns during favorable market conditions but also amplify losses during adverse scenarios.

Protocol token accumulation strategies focus on earning governance tokens through lending activities. It has the potential for large more returns if these tokens appreciate in value. but, these strategies also introduce more volatility and require careful evaluation of token utility, governance participation benefits, and long-term protocol sustainability.

Cross-protocol composability enables advanced strategies that use lending receipts as collateral in other DeFi protocols. This creates layered yield generation opportunities. These strategies require deep understanding of protocol interactions, liquidation risks, and the potential for cascading failures across interconnected DeFi systems.

Institutional Infrastructure and Professional Services

Professional cryptocurrency lending infrastructure includes specialised custody solutions, institutional-grade reporting systems, and complete compliance frameworks that enable traditional financial institutions to participate in cryptocurrency lending markets while maintaining regulatory compliance and fiduciary standards.

Prime brokerage services for cryptocurrency lending provide institutional clients with access to many lending platforms through single interfaces, complete risk management tools, and professional execution services that improve returns while maintaining appropriate oversight and control mechanisms.

Institutional lending analytics platforms provide advanced performance measurement, risk assessment, and portfolio improvement tools specifically designed for professional cryptocurrency lending operations. These platforms integrate with many lending protocols to provide complete portfolio views and automated rebalancing capabilities.

Professional custody integration enables institutional lenders to maintain control over their private keys whilstparticipating in lending activities through qualified custodians that provide insurance coverage and regulatory compliance for institutional cryptocurrency holdings.

Emerging Trends and Future Market Evolution

Central Bank Digital Currency Impact

The development and deployment of central bank digital currencies will greatly impact cryptocurrency lending markets by providing new base rate benchmarks and potentially competing with existing stablecoin lending opportunities. CBDC use may create new regulatory frameworks that affect how cryptocurrency lending platforms operate and the rates they can offer to users.

Integration between CBDC systems and cryptocurrency lending platforms could create new opportunities for yield generation while providing greater regulatory clarity and potentially enhanced security for lenders. but, CBDC adoption may also reduce demand for existing stablecoin lending products if central bank alternatives offer competitive rates with government backing.

Cross-border CBDC systems may enable more efficient international lending markets with reduced settlement times and lower transaction costs. These developments could greatly impact current cryptocurrency lending dynamics by providing alternative channels for international capital flows and yield generation opportunities.

Artificial Intelligence and Machine Learning Integration

Advanced AI systems increasingly power cryptocurrency lending platforms through automated risk assessment, dynamic rate improvement, and predictive analytics that enhance both platform profitability and user returns. Machine learning algorithms analyse vast datasets to identify optimal lending strategies and predict market movements with increasing accuracy.

Personalised lending recommendations use AI to analyse individual user behaviour, risk preferences, and market conditions to suggest optimal lending strategies tailored to specific user profiles and objectives. These systems continuously learn from user interactions and market outcomes to improve recommendation accuracy over time.

Automated portfolio management systems use AI to continuously improve lending allocations across many platforms and assets, responding to rate changes and market conditions faster than human managers while maintaining appropriate risk controls and diversification standards.

Environmental and Social Governance Considerations

Environmental sustainability concerns increasingly influence cryptocurrency lending decisions as institutional investors prioritise ESG-compliant investment strategies. Lending platforms that use proof-of-stake networks or carbon-neutral operations may attract premium rates from ESG-focused institutional capital.

Social impact lending initiatives enable cryptocurrency holders to support specific causes or projects whilstearning returns. This creates new categories of purpose-driven lending that align financial returns with social objectives. These initiatives may command premium rates from impact-focused investors willing to accept lower returns for social benefits.

Governance token voting rights associated with lending activities enable lenders to participate in protocol governance decisions that affect long-term platform sustainability and user benefits. Active governance participation may become increasingly important for maximising long-term returns from cryptocurrency lending activities.

Conclusion

The cryptocurrency lending interest rate landscape in 2025 presents both large opportunities and complex challenges that require advanced understanding and careful risk management. Interest rates in crypto lending continue to offer attractive yields compared to traditional finance, but success depends on understanding the underlying factors that drive these rates and using appropriate strategies for improvement and risk mitigation.

The maturation of both CeFi and DeFi lending platforms has created a more stable and predictable interest rate environment. It has improved risk management practices, regulatory compliance, and institutional adoption contributing to greater market stability. but, the basic volatility and unique characteristics of cryptocurrency markets ensure that lending rates remain dynamic and require continuous monitoring and adjustment.

Successful crypto lending in 2025 requires a diversified approach that combines many platforms, asset types, and lending strategies to improve risk-adjusted returns. The emergence of advanced rate improvement tools, insurance mechanisms, and automated portfolio management solutions has made it easier for lenders to maximise returns while managing risk effectively.

The regulatory landscape continues to evolve. It has clearer frameworks providing greater certainty for both platforms and lenders while potentially impacting rate structures and available opportunities. Understanding these regulatory implications and their impact on interest rates is crucial for long-term success in crypto lending.

Looking forwards, the integration of artificial intelligence, improved risk assessment models, and cross-chain lending protocols will likely continue to enhance the efficiency and attractiveness of crypto lending markets. but, the basic principles of diversification, risk management, and continuous education remain key for navigating this dynamic and evolving landscape successfully while maximising returns and protecting capital.

The key to successful crypto lending lies in maintaining a balanced approach that considers both potential returns and associated risks. By staying informed about market developments, regularly reviewing and adjusting lending strategies, and maintaining appropriate diversification across platforms and assets, lenders can position themselves to benefit from the attractive yields available in the crypto lending market while protecting their capital from potential losses.

As the crypto lending ecosystem continues to mature and evolve, new opportunities and challenges will emerge that require ongoing adaptation and learning. The most successful crypto lenders will be those who remain flexible, informed, and committed to using sound risk management practices while taking advantage of the unique opportunities that cryptocurrency lending provides in the broader context of portfolio diversification and yield generation strategies.

Sources & References

Frequently Asked Questions

- What drives crypto lending interest rates?

- Crypto lending rates are influenced by factors such as borrowing demand, platform liquidity, collateral requirements, market volatility, the regulatory environment, and platform-specific incentive programs.

- Are stablecoin lending rates more predictable?

- Stablecoin rates are generally more stable than volatile crypto assets, but they still fluctuate based on use rates, platform policies, and market demand for use.

- Should I choose fixed or variable rates?

- Variable rates offer flexibility and can capture rate increases. Meanwhile, fixed rates provide predictability. Choose based on your risk tolerance and market outlook.

- How often should I monitor lending rates?

- Check rates weekly for DeFi protocols and monthly for CeFi platforms. Set up alerts for large rate changes and regularly monitor platform announcements.

- What's a good diversification strategy?

- Spread funds across 3-5 reputable platforms, mix CeFi and DeFi options, diversify across different asset types, and maintain some highly liquid positions for flexibility.

- How do I calculate net returns?

- Calculate net APR by subtracting platform fees, transaction costs, and tax implications from gross rates. Also consider the volatility and liquidity of any token rewards.

- What are the biggest risks to watch?

- Key risks include platform insolvency, regulatory changes, smart contract vulnerabilities, market volatility, and liquidity constraints during stress periods.

- Are promotional rates sustainable?

- Promotional rates are typically temporary marketing tools. Always check the terms, duration, and the rates that revert after the promotional period ends.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.