Staking vs Liquidity Mining Taxation 2025

Navigate the complex world of crypto taxation in 2025: understand how staking rewards and liquidity mining income are taxed, reporting requirements, and strategies to optimise your tax obligations legally.

Introduction

How has crypto taxation evolved? The taxation landscape for cryptocurrency activities has undergone significant evolution. Governments worldwide establish comprehensive frameworks. They regulate digital assets. In 2025, both staking and yield farming activities are subject to taxation. This applies across most major jurisdictions. But the specific treatment varies. Timing differs. Compliance requirements can vary dramatically. It depends on your location, the type of activity, and the scale of your operations.

Why is understanding tax implications crucial? Understanding these tax implications is crucial. This applies to anyone participating in cryptocurrency yield generation activities. The complexity arises from multiple factors. It's not just the technical nature of these activities. Traditional tax frameworks were not designed for this. They can't handle the unique characteristics. Decentralised finance protocols are complex. Automated market makers are new. Proof-of-stake consensus mechanisms are different.

How is staking taxed? Staking taxation generally follows more straightforward principles. It resembles traditional interest income in many respects. However, questions remain. When should taxation occur? At receipt or disposal? How do you value rewards? How do you treat different staking mechanisms? Liquid staking derivatives are complex. Delegated proof-of-stake systems need consideration.

Why is liquidity mining more complex? Liquidity mining taxation presents significantly more complexity. Multiple layers of transactions are involved. Liquidity provision creates events. Reward token distribution happens. Impermanent loss calculations are needed. Constant rebalancing of positions occurs. These create numerous taxable events. You must carefully track and report them. The automated nature of many DeFi protocols can generate hundreds or thousands of microtransactions. Each potentially represents a taxable event.

What's the regulatory environment in 2025? The regulatory environment in 2025 has brought increased clarity in some areas. It introduces new complexities in others. Major jurisdictions have published more detailed guidance. The United States, European Union, and United Kingdom lead. But significant variations remain. Interpretation differs. Enforcement varies. Additionally, the cross-border nature of DeFi protocols raises questions. Jurisdiction matters. Compliance requirements affect international users.

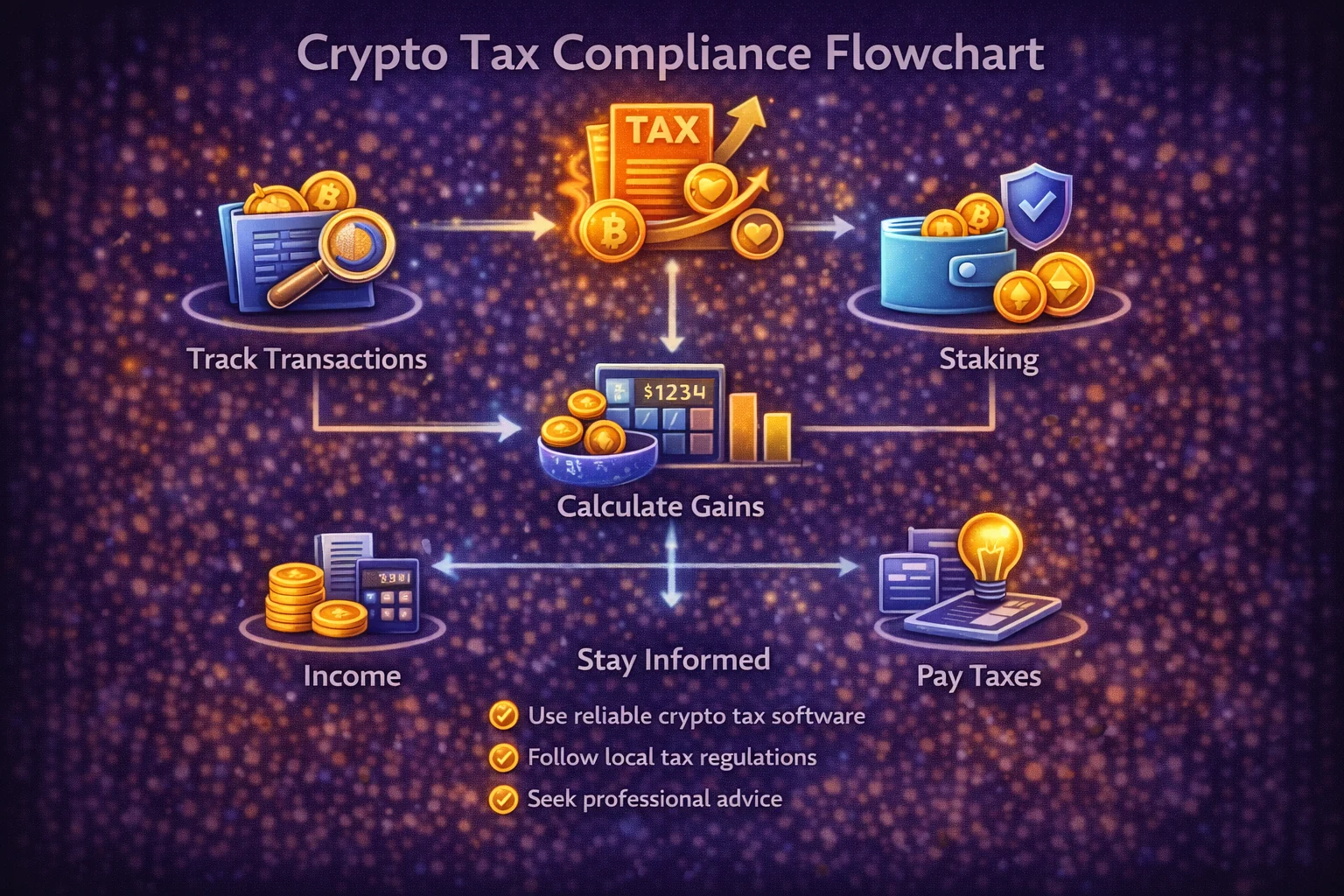

What about compliance costs? Compliance costs and complexity have become major considerations. This affects cryptocurrency investors. You need detailed transaction tracking. Accurate valuation records are essential. Sophisticated tax reporting software helps. This has created an entire industry. Specialised service providers exist. Understanding these requirements upfront helps you. You can make informed decisions. Choose yield-generation strategies that align with your tax-planning objectives.

How has institutional adoption influenced policy? The emergence of institutional cryptocurrency adoption has influenced tax policy development. Regulators increasingly focus on creating frameworks. These accommodate both retail and institutional participation. This evolution has led to more nuanced approaches. Taxation considers different risk profiles. Operational complexities matter. Economic realities of various cryptocurrency activities are important.

What record-keeping is required? Record-keeping requirements have become increasingly sophisticated. Tax authorities expect detailed documentation. You need all cryptocurrency transactions documented. Include timestamps, valuations, and counterparties. Document the business purpose of each activity. The decentralised nature of many protocols means users must compile this information. You gather from multiple sources. Use blockchain explorers, protocol interfaces, and third-party analytics tools.

What about international considerations? International tax considerations add another layer of complexity. This affects users participating in global DeFi protocols. Questions arise about permanent establishment. Source of income matters. Treaty benefits can significantly impact tax obligations. This applies to users operating across multiple jurisdictions. The pseudonymous nature of many cryptocurrency transactions raises questions. Information reporting is important. Compliance verification matters.

What will this guide cover? This comprehensive guide examines the current state of cryptocurrency taxation. We focus on staking and yield farming activities. You'll get practical insights for compliance planning. Risk management strategies are included. Strategic decision-making guidance helps. We'll explore jurisdiction-specific requirements. Common compliance challenges are covered. Emerging best practices for managing tax obligations are shared. Understanding these considerations is essential. This applies to anyone seeking to build sustainable, compliant cryptocurrency investment strategies in 2025 and beyond.

What practical guidance will you find? This comprehensive analysis examines the current tax treatment. Both staking and yield farming activities are covered. You'll get practical guidance for compliance. optimisation strategies remain within legal boundaries. We'll explore real-world scenarios. Common pitfalls are highlighted. Emerging trends may affect your tax obligations in the coming years.

Important Disclaimer: This guide provides general information and educational content only. Tax laws vary significantly by jurisdiction. They are subject to frequent changes and reinterpretation. The information presented here should not be considered professional tax advice. Always consult with a qualified tax professional. Choose someone who specialises in cryptocurrency taxation. Get advice specific to your situation, jurisdiction, and individual circumstances. The authors and publishers of this guide assume no responsibility. This applies to any tax-related decisions made based on this information.

How Staking Is Taxed in 2025

General Delegation Tax Principles

Consensus participation taxation follows relatively straightforward principles in most jurisdictions:

- Income Recognition: Validation rewards are typically taxed as ordinary income at fair market value when received

- Timing: Tax liability occurs when rewards are credited to your account, not when you sell them

- Valuation: Fair market value is determined at the time of receipt using reputable exchange rates

- Cost Basis: The fair market value at receipt becomes your cost basis for future capital gains calculations

Common Delegation Tax Scenarios

Scenario 1: Direct Protocol Validation

Example: You delegate 32 ETH directly with Ethereum 2.0 and receive rewards

Tax Treatment:

- Each reward payment is taxable income at fair market value

- If you receive 0.1 ETH when ETH = $3,000, you have $300 of taxable income

- Your cost basis in the 0.1 ETH becomes $300

- Future sale triggers capital gains/losses based on this cost basis

Scenario 2: Liquid Staking Tokens

Example: You stake ETH through Lido and receive stETH

Tax Treatment:

- Initial staking may be a non-taxable exchange in some jurisdictions

- Rebasing rewards (automatic stETH increases) are taxable income

- Converting back to ETH may trigger capital gains/losses

- Some jurisdictions treat the initial exchange as taxable

Scenario 3: centralised Exchange Staking

Example: You stake through Binance, Coinbase, or Kraken

Tax Treatment:

- Rewards are clearly taxable income when credited

- Exchange provides clear records for tax reporting

- May be subject to additional reporting requirements

- Platform fees may be deductible business expenses

Scenario 4: Multi-Asset Staking Portfolios

Example: You stake multiple cryptocurrencies across different protocols

Tax Treatment:

- Each asset's rewards are taxed separately based on individual fair market values

- Different assets may have different tax implications based on classification

- Portfolio rebalancing between staked assets triggers taxable events

- Compound staking strategies require careful tracking of each reward cycle

- Cross-chain staking may involve additional complexity for bridge transactions

Scenario 5: Validator Node Operations

Example: You operate your own validator node for Ethereum or other networks

Tax Treatment:

- Validation rewards are business income subject to self-employment tax

- Hardware costs, electricity, and maintenance are deductible business expenses

- Slashing penalties may be deductible as business losses

- MEV (Maximum Extractable Value) rewards are additional taxable income

- Node setup costs may be depreciated over time rather than immediately deducted

Jurisdictional Variations in Staking Taxation

United States Approach

The IRS treats staking rewards as ordinary income at fair market value upon receipt. Key considerations include:

- Form 1099-MISC reporting requirements for platforms paying over $600

- Self-employment tax may apply to professional validators

- Like-kind exchange treatment is not available for cryptocurrency transactions

- Wash sale rules do not currently apply to cryptocurrencies

- State tax implications vary significantly by jurisdiction

European Union Framework

EU member states have varying approaches, but common themes include:

- Income tax on rewards at receipt, with rates varying by country

- Capital gains tax on disposal of staked assets

- Professional trading classification may apply to large-scale operations

- VAT implications for certain staking services

- Cross-border reporting requirements under DAC8 regulations

Asia-Pacific Considerations

Diverse regulatory approaches across the region:

- Singapore: Generally tax-free for personal investment, taxable for business

- Australia: CGT events for staking, with potential income tax on rewards

- Japan: Miscellaneous income classification for staking rewards

- South Korea: Comprehensive taxation framework under development

- Hong Kong: Generally tax-free for personal investment activities

Advanced Staking Tax Planning Strategies

Timing optimisation Techniques

Strategic timing of staking activities can optimise tax outcomes:

- Year-end unstaking to realise losses for tax harvesting

- Staking initiation timing to align with favorable tax years

- Reward claiming strategies to manage annual income levels

- Multi-year planning for large staking positions

- Coordination with other investment activities for overall tax efficiency

Entity Structure Considerations

Different entity structures offer varying tax advantages:

- Individual ownership: Simplest structure with direct tax implications

- LLC structures: Potential for business expense deductions and loss utilisation

- Corporate entities: Different tax rates and planning opportunities

- Trust structures: Estate planning and tax deferral possibilities

- International structures: Complex but potentially beneficial for large operations

Jurisdiction-Specific Staking Rules

United States

- Validation rewards are ordinary income under IRS guidance

- Taxed at receipt, not when sold

- Must report on Form 1040 and potentially Schedule C for business activity

- Self-employment tax may apply for large-scale operations

United Kingdom

- Delegation rewards are income subject to Income Tax

- May be subject to National Insurance contributions

- Annual exempt amount applies (£1,000 for 2024-25)

- Capital gains tax on disposal of staked tokens

European Union (General)

- Varies by member state but generally treated as income

- MiCA regulation provides some harmonization

- Some countries have specific crypto tax regimes

- Withholding tax may apply in certain circumstances

Canada

- Validation rewards are business income or investment income

- 50% of capital gains are taxable

- CRA provides specific guidance on crypto taxation

- GST/HST may apply to mining/validation operations

How Yield Farming Is Taxed in 2025

Why Yield Farming Taxation Is More Complex

Yield farming presents significantly more complex tax scenarios than simple staking:

- Multiple Token Types: LP tokens, governance tokens, reward tokens

- Frequent Transactions: Adding/removing liquidity, claiming rewards, compounding

- IL (Impermanent Loss): Unclear tax treatment in many jurisdictions

- Protocol Interactions: Multiple DeFi protocols with different mechanisms

- Valuation Challenges: Fair market value determination for new/illiquid tokens

Taxable Events in Yield Farming

1. Providing Liquidity

Tax Implication: May be treated as a disposal of original tokens

- Swapping tokens to create LP pairs often triggers capital gains/losses

- Receiving LP tokens may be non-taxable in some jurisdictions

- Cost basis tracking becomes complex with multiple tokens

2. Earning Trading Fees

Tax Implication: Generally taxable income when earned

- Fees earned from providing liquidity are taxable income

- Auto-compounding may create continuous taxable events

- Valuation based on fair market value at time of earning

3. Receiving Governance/Reward Tokens

Tax Implication: Taxable income at fair market value

- Airdropped governance tokens are taxable income

- Liquidity mining rewards are ordinary income

- Valuation challenges for new or illiquid tokens

4. Removing Liquidity

Tax Implication: Capital gains/losses on LP token disposal

- Burning LP tokens to receive underlying assets

- IL may or may not be deductible

- Complex calculations for cost basis and gains/losses

Advanced Yield Farming Tax Scenarios

Multi-Protocol Yield Strategies

Complex strategies involving multiple DeFi protocols create intricate tax implications:

- Yield Aggregators: Platforms like Yearn Finance automatically compound rewards across protocols

- Cross-Chain Farming: Bridge transactions and multi-chain rewards complicate tracking

- Leveraged Yield Farming: Borrowing to increase farming positions creates additional taxable events

- Auto-Compounding Vaults: Continuous reinvestment may trigger frequent taxable events

- Strategy Migration: Moving between different yield opportunities creates disposal events

Impermanent Loss Tax Treatment

The tax treatment of impermanent loss varies significantly by jurisdiction:

- realised Loss Approach: Some jurisdictions allow deduction when liquidity is removed

- Unrealised Loss Treatment: Others don't recognise IL until actual disposal occurs

- Mark-to-Market Considerations: Professional traders may need to account for IL continuously

- Hedging Strategies: Using derivatives to hedge IL may create additional complexity

- Documentation Requirements: Detailed records needed to support IL calculations

Governance Token Complications

Governance tokens received through yield farming present unique challenges:

- Valuation Difficulties: New tokens may lack established market prices

- Vesting Schedules: Locked tokens may have different tax timing implications

- Voting Rights Value: Some jurisdictions may value governance rights separately

- Token Utility: Multi-purpose tokens complicate fair value determination

- Airdrop vs Earned Distinction: Different tax treatment for different acquisition methods

Essential Record Keeping for Yield Farming

Transaction-Level Documentation

Comprehensive record keeping is crucial for yield farming tax compliance:

- Liquidity Provision Records: Timestamps, token amounts, exchange rates, gas fees

- Reward Tracking: All token rewards with fair market values at receipt

- Fee Documentation: Trading fees earned from liquidity provision

- Impermanent Loss Calculations: Detailed IL tracking for each position

- Protocol Interaction Logs: All smart contract interactions and their purposes

Automated Tracking Solutions

Given the complexity, automated tools become essential:

- DeFi Tax Platforms: specialised tools for yield farming tax calculations

- Portfolio Trackers: Real-time monitoring of positions and rewards

- API Integrations: Direct connections to DeFi protocols for accurate data

- Custom Spreadsheets: Detailed tracking for complex strategies

- Professional Services: Tax professionals specialising in DeFi taxation

Tax optimisation Strategies for Yield Farming

Strategic Position Management

optimising yield farming positions for tax efficiency:

- Loss Harvesting: realising impermanent losses to offset other gains

- Timing Strategies: Managing reward claims across tax years

- Entity Structures: Using business entities for professional farming operations

- Geographic Arbitrage: Considering jurisdiction-specific tax advantages

- Long-Term Holding: Structuring strategies to qualify for capital gains treatment

Risk Management Considerations

Balancing tax optimisation with investment risk:

- Diversification Impact: Tax implications of portfolio rebalancing

- Liquidity Management: Maintaining flexibility while optimising taxes

- Protocol Risk Assessment: Considering tax implications of protocol failures

- Regulatory Changes: Adapting strategies to evolving tax regulations

- Professional Guidance: Working with tax professionals for complex strategies

IL (Impermanent Loss) Tax Treatment

IL taxation remains one of the most unclear areas in DeFi taxation:

Current Approaches by Jurisdiction

Conservative Approach (US, UK)

- IL not recognised until liquidity withdrawal

- Treated as capital loss when LP position is closed

- May be limited by capital loss deduction rules

- No offset against ordinary income from fees in some cases

Progressive Approach (Some EU Countries)

- Mark-to-market accounting for some professional traders

- IL may be deductible against other crypto gains

- Requires detailed record-keeping and professional status

- Not available for casual investors

Unclear/Developing (Many Jurisdictions)

- No specific guidance on IL treatment

- Taxpayers must make reasonable interpretations

- Risk of future rule changes affecting past positions

- Professional advice essential for large positions

Staking vs Yield Farming: Tax Complexity Comparison

| Aspect | Delegation | Yield Farming |

|---|---|---|

| Income Recognition | Simple - rewards when received | Complex - multiple income streams |

| Transaction Frequency | Low - periodic rewards | High - frequent interactions |

| Record Keeping | Moderate - track rewards | Extensive - track all interactions |

| Valuation Complexity | Low - established tokens | High - new/illiquid tokens |

| Capital Gains Events | Minimal - mainly on disposal | Frequent - swaps and LP operations |

| Loss Recognition | Clear - standard capital loss rules | Unclear - IL treatment |

| Professional Help Needed | Optional for simple cases | Recommended for complex strategies |

| Audit Risk | Lower - straightforward reporting | Higher - complex calculations |

Essential Record Keeping for Tax Compliance

Critical Records to Maintain

Transaction Records

- Date and Time: Exact timestamp of each transaction

- Transaction Hash: Blockchain confirmation for verification

- Amounts: Precise quantities of all tokens involved

- Fair Market Value: USD/local currency value at transaction time

- Gas Fees: Transaction costs (may be deductible)

- Purpose: Clear description of transaction purpose

Validation-Specific Records

- Initial delegation transaction details

- All reward payments with timestamps and values

- Validator performance and commission rates

- Slashing events (if any) with loss amounts

- Undelegation transactions and waiting periods

Yield Farming Records

- LP token creation and destruction transactions

- All reward token claims with fair market values

- IL calculations at withdrawal

- Protocol interaction history

- Auto-compounding events and frequencies

Recommended Tax Software and Tools

Comprehensive Crypto Tax Platforms

- CoinTracker: Supports major DeFi protocols, automatic transaction import

- Koinly: Extensive DeFi support, multiple jurisdiction tax reports

- TaxBit: Professional-grade platform with audit support

- Accointing: Real-time portfolio tracking with tax optimisation

specialised DeFi Tracking

- DeBank: DeFi portfolio tracking and history

- Zapper: DeFi position management and tracking

- Zerion: Multi-protocol DeFi portfolio management

- APY.vision: Liquidity pool performance and IL tracking

Manual Tracking Tools

- Spreadsheet templates for transaction logging

- Blockchain explorers for transaction verification

- Price APIs for historical fair market value data

- Wallet export tools for transaction history

Legal Tax optimisation Strategies

Timing Strategies

Harvest Tax Losses

Strategically realise capital losses to offset gains:

- Sell underperforming positions before year-end

- Use losses to offset validation and yield farming income

- Be aware of wash sale rules in your jurisdiction

- Consider the impact on your overall portfolio strategy

Long-Term Capital Gains Planning

Hold assets for preferential tax treatment:

- Hold delegation rewards for long-term capital gains rates

- Plan disposal timing around tax year boundaries

- Consider the holding period requirements in your jurisdiction

- Balance tax benefits with investment risk

Income Smoothing

Manage the timing of taxable events:

- Spread large reward claims across tax years

- Time liquidity withdrawals strategically

- Consider the impact on tax brackets

- Plan for estimated tax payments

Jurisdiction-Specific optimisation

Tax-Advantaged Accounts (Where Available)

- Self-Directed IRAs (US): Hold crypto in retirement accounts

- ISAs (UK): Limited crypto investment options

- Pension Schemes: Some allow crypto investments

- Corporate Structures: May provide tax advantages for large operations

Residency and Domicile Planning

- Consider tax implications of residency changes

- Understand exit tax rules when relocating

- Plan for double taxation treaty benefits

- Seek professional advice for international structures

Compliance Best Practices

- Conservative Approach: When rules are unclear, take the more conservative tax position

- Professional Consultation: Engage qualified tax professionals for complex situations

- Regular Reviews: Update tax strategies as regulations evolve

- Documentation: Maintain detailed records supporting all tax positions

- Estimated Payments: Make quarterly payments to avoid penalties

Common Tax Mistakes to Avoid

Record Keeping Mistakes

- Incomplete Records: Missing transaction details or fair market values

- Late Documentation: Trying to reconstruct records at tax time

- Ignoring Small Transactions: Not tracking minor rewards or airdrops

- Wrong Valuation Sources: Using inconsistent or unreliable price data

Timing Mistakes

- Delayed Recognition: Not reporting income when received

- Wrong Tax Year: Reporting transactions in incorrect tax periods

- Missing Estimated Payments: Underpaying quarterly taxes

- Last-Minute Planning: Waiting until year-end for tax planning

Classification Mistakes

- Income vs Capital: Misclassifying the nature of crypto gains

- Business vs Investment: Wrong classification affecting tax rates

- Like-Kind Exchanges: Incorrectly applying old exchange rules

- Gift vs Income: Misunderstanding airdrop taxation

Compliance Mistakes

- Unreported Income: Failing to report all crypto income

- Missing Forms: Not filing required additional forms

- Inconsistent Reporting: Different treatment across tax years

- Ignoring Foreign Accounts: Not reporting overseas crypto accounts

Future Tax Developments to Watch

Emerging Regulatory Trends

Increased Reporting Requirements

- Broker reporting rules expanding to DeFi protocols

- Automatic exchange of information between countries

- Enhanced KYC requirements for crypto platforms

- Real-time transaction reporting systems

Standardization Efforts

- OECD crypto tax framework development

- Harmonized treatment across EU member states

- International cooperation on tax enforcement

- standardised definitions for crypto activities

Technology Integration

- Blockchain analysis tools for tax authorities

- Automated compliance systems

- AI-powered audit selection

- Real-time tax calculation systems

Preparing for Future Changes

- Stay Informed: Follow regulatory developments in your jurisdiction

- Maintain Flexibility: Use systems that can adapt to new requirements

- Conservative Positions: Take defensible tax positions that can withstand scrutiny

- Professional Networks: Build relationships with crypto-savvy tax professionals

- Technology Adoption: Use tools that provide audit trails and compliance features

Real-World Tax Scenarios

Scenario 1: Simple Delegation - US Taxpayer

Situation: Sarah delegated 10 ETH through Coinbase in 2025

Activity:

- Delegated 10 ETH on January 1, 2025 (value: $20,000)

- Earned 0.4 ETH in validation rewards throughout the year

- ETH price when rewards received: average $2,200

- Did not sell any ETH during the year

Tax Treatment:

- Ordinary Income: 0.4 ETH × $2,200 = $880

- Cost Basis: $880 for the 0.4 ETH rewards

- Capital Gains: None (didn't sell)

- Forms Required: Schedule 1 (Additional Income), Form 8949 basis tracking

- Tax Owed: $880 × 24% (her bracket) = $211.20

Key Lesson: Simple delegation creates straightforward income reporting. Track reward receipt dates and values carefully.

Scenario 2: Active Yield Farming - US Taxpayer

Situation: Mike provided liquidity to Curve and Uniswap pools

Activity:

- Provided $10,000 liquidity to Curve USDC/DAI pool

- Earned $300 in trading fees (paid in LP tokens)

- Earned $200 in CRV rewards

- Provided $5,000 to Uniswap ETH/USDC pool

- Earned $150 in trading fees

- Suffered $100 IL when withdrawing

- Sold all reward tokens for $600 total

Tax Treatment:

- Ordinary Income: $650 (fees + rewards at receipt)

- Capital Loss: $100 (IL on withdrawal)

- Capital Gains: $50 (sold rewards for $600, basis was $550)

- Net Taxable: $650 income + $50 gains - $100 loss = $600

- Forms Required: Schedule 1, Schedule D, Form 8949 (multiple entries)

- Tax Owed: ~$144 (24% bracket)

Key Lesson: Yield farming creates multiple taxable events. IL can offset some gains. Detailed record-keeping essential.

Scenario 3: UK Taxpayer - Delegation

Situation: James delegated through Lido in the UK

Activity:

- Staked 5 ETH (£8,000 value)

- Earned 0.2 ETH rewards (£360 value at receipt)

- Sold 0.1 ETH rewards for £200

Tax Treatment:

- Income Tax: £360 (rewards as miscellaneous income)

- Capital Gains: £200 proceeds - £180 cost basis = £20 gain

- Personal Allowance: £12,570 (no income tax if below)

- CGT Allowance: £3,000 (no CGT if below)

- Tax Owed: Likely £0 (within allowances)

Key Lesson: UK personal allowances can shelter small delegation operations. Track both income and capital gains separately.

Scenario 4: German Taxpayer - Holding Period Strategy

Situation: Anna used Germany's 1-year holding period exemption

Activity:

- Bought 2 ETH in January 2024 (€3,000)

- Staked through Kraken (no rewards, just holding)

- Sold in February 2025 for €5,000

- Held for 13 months

Tax Treatment:

- Capital Gains: €2,000 gain

- Holding Period: >1 year = tax-free

- Tax Owed: €0

Alternative (if delegation rewards received):

- Delegation rewards would be taxable income

- Holding period for tax-free gains extends to 10 years

- Strategy: Hold delegated assets for 10 years to avoid CGT

Key Lesson: Germany's holding period rules create strategic opportunities. Delegation rewards significantly change tax treatment.

Scenario 5: Audit Situation - Poor Record Keeping

Situation: Tom was audited with incomplete records

What Happened:

- Farmed across 5 protocols in 2024

- Didn't track reward receipt dates or values

- Reported only final sale proceeds ($15,000)

- IRS audit in 2025 requested detailed records

Audit Outcome:

- IRS reconstructed transactions from blockchain

- Assessed $8,000 additional income (rewards)

- Applied penalties: 20% accuracy penalty = $1,600

- Interest charges: $400

- Total Additional Tax: $3,920 + $1,600 + $400 = $5,920

What Should Have Been Done:

- Use Koinly or CoinTracker from day one

- Export transaction history monthly

- Track all reward receipts with USD values

- Maintain separate records for each protocol

- Estimated proper tax: $3,200 (vs $5,920 with penalties)

Key Lesson: Poor record-keeping costs more than proper tax software. Penalties and interest add 50%+ to tax bills.

Common Patterns from Real Cases

- Simple delegation: Easiest to report, lowest audit risk, clear tax treatment

- Yield farming: Complex reporting, higher audit risk, requires professional help

- Record-keeping: Single biggest factor in audit outcomes

- Tax software: $100-300/year investment prevents $1000s in penalties

- Professional advice: Worth it for portfolios >$50,000 or complex strategies

- Jurisdiction matters: Tax treatment varies dramatically by country

Institutional Tax Strategies and Professional Compliance Frameworks

Corporate Entity Tax optimisation

Institutional cryptocurrency operations require sophisticated entity structuring to optimise tax outcomes across staking and yield farming activities:

Limited Liability Company (LLC) Structures

- Pass-Through Taxation: Profits and losses flow directly to members' personal returns

- Business Expense Deductions: Hardware, software, professional services fully deductible

- Loss utilisation: Cryptocurrency losses can offset other business income

- Multi-Member Benefits: Profit sharing and tax allocation flexibility

- State Tax Considerations: Choosing favorable state jurisdictions for formation

Corporate Tax Strategies

- C-Corporation Benefits: Lower corporate tax rates on retained earnings

- S-Corporation Election: Pass-through taxation with payroll tax savings

- Qualified Small Business Stock: Potential Section 1202 exclusion benefits

- International Structures: Offshore entities for global operations

- Tax-Deferred Exchanges: Like-kind exchange strategies where applicable

Advanced Compliance and Reporting Systems

Automated Tax Reporting Infrastructure

Professional operations require sophisticated systems for accurate tax reporting:

- Real-Time Transaction Monitoring: Automated capture of all staking and farming activities

- Multi-Jurisdiction Compliance: Simultaneous reporting across different tax authorities

- Audit Trail Generation: Comprehensive documentation for regulatory examinations

- Fair Value Determination: Systematic pricing methodologies for illiquid tokens

- Reconciliation Procedures: Cross-verification between different data sources

Professional Service Integration

Institutional operations benefit from specialised professional services:

- Big Four Accounting Firms: Comprehensive audit and tax services

- Cryptocurrency Tax Specialists: Boutique firms with DeFi expertise

- Legal Counsel: Regulatory compliance and structure optimisation

- Technology Vendors: specialised software for cryptocurrency tax management

- Custodial Services: Institutional-grade asset custody with tax reporting

Tax Risk Management and Mitigation Strategies

Regulatory Risk Evaluation

Professional operations must assess and mitigate various tax-related risks:

- Regulatory Change Risk: Adapting to evolving cryptocurrency tax regulations

- Audit Risk Assessment: Probability and impact analysis of tax examinations

- Penalty Exposure: Quantifying potential penalties for non-compliance

- Reputational Risk: Impact of tax controversies on business operations

- Operational Risk: System failures affecting tax compliance

Mitigation Strategies

Comprehensive risk mitigation approaches for institutional operations:

- Conservative Tax Positions: Taking defensible positions to minimise audit risk

- Professional Representation: Engaging qualified tax professionals for examinations

- Insurance Coverage: Tax liability insurance for significant exposures

- Contingency Planning: Procedures for handling adverse tax developments

- Continuous Monitoring: Ongoing assessment of tax compliance status

Cross-Border Tax Planning and Compliance

Multi-Jurisdictional Operations

Global cryptocurrency operations face complex international tax challenges:

- Transfer Pricing: Arm's length pricing for intercompany transactions

- Permanent Establishment: Avoiding unintended tax presence in foreign jurisdictions

- Treaty Benefits: utilising tax treaties to minimise withholding taxes

- Controlled Foreign Corporation Rules: Managing CFC income inclusions

- Base Erosion Prevention: Compliance with BEPS initiatives

Reporting Obligations

International operations trigger various reporting requirements:

- FBAR Reporting: Foreign bank account reporting for US persons

- Form 8938 (FATCA): Foreign asset reporting requirements

- CRS Compliance: Common Reporting Standard obligations

- Local Disclosure Rules: Country-specific reporting requirements

- Economic Substance Requirements: Demonstrating genuine business activities

Advanced Tax Strategies and Professional Compliance Management

Complex Staking Tax Scenarios and Solutions

Ethereum 2.0 Validator Tax Implications

Operating an Ethereum validator creates unique tax considerations beyond simple delegation:

- MEV Revenue: Maximum Extractable Value earnings are additional taxable income

- Slashing Events: Validator penalties may qualify as deductible losses

- Hardware Depreciation: Validator equipment costs can be depreciated over useful life

- Electricity Deductions: Power costs for validator operations are business expenses

- Professional vs Hobby: IRS classification affects deduction availability

Liquid Staking Token Complexities

Liquid staking derivatives create additional tax layers:

- Initial Exchange: ETH to stETH conversion may be taxable event

- Rebasing Mechanics: Automatic balance increases trigger income recognition

- Secondary Trading: stETH/ETH price differences create arbitrage opportunities

- Unstaking Queues: Withdrawal delays affect timing of tax events

- Slashing Risk: Potential validator penalties affect token values

Yield Farming Tax Complexities and Professional Solutions

Automated Market Maker (AMM) Tax Issues

Providing liquidity to AMMs creates multiple simultaneous tax events:

- Token Swapping: Creating LP positions often requires token swaps (taxable)

- Proportional Ownership: LP tokens represent proportional pool ownership

- Fee Accumulation: Trading fees automatically compound into positions

- Impermanent Loss realisation: IL becomes permanent upon withdrawal

- Rebalancing Events: Pool rebalancing affects underlying asset ratios

Multi-Token Reward Systems

Modern yield farming often involves multiple reward tokens:

- Native Protocol Tokens: Platform-specific governance tokens

- Partner Token Incentives: Additional rewards from protocol partnerships

- Boosted Rewards: Enhanced yields for token holders or long-term participants

- Vesting Schedules: Time-locked rewards with complex tax timing

- Claimable vs Auto-Compound: Different tax implications for reward distribution methods

Professional Tax Software and Calculation Methods

Fair Market Value Determination

Accurate valuation is crucial for proper tax reporting:

- Exchange Rate Sources: Using reputable exchanges for price determination

- Volume-Weighted Pricing: Considering trading volume for accurate valuations

- Illiquid Token Valuation: Methods for valuing new or low-volume tokens

- Timestamp Precision: Exact timing for reward receipt and valuation

- Multi-Exchange Averaging: Using multiple sources for price validation

Cost Basis Tracking Methodologies

Professional cost basis tracking requires sophisticated methods:

- FIFO (First In, First Out): Default method for most jurisdictions

- LIFO (Last In, First Out): Alternative method where permitted

- Specific Identification: Tracking individual token lots for optimisation

- Average Cost Method: Simplified approach for fungible tokens

- Highest Cost First: Tax optimisation strategy for capital gains

DeFi Tax Implications and Advanced Reporting Strategies

decentralised finance taxation presents unique challenges including complex transaction tracking, sophisticated yield calculation, and advanced reporting requirements that impact DeFi participation and tax compliance for professional investors and institutional participants. DeFi tax management includes comprehensive transaction analysis, sophisticated yield tracking, and advanced reporting procedures that ensure legal adherence while maintaining process optimisation and tax optimisation through professional DeFi tax management and comprehensive compliance frameworks designed for institutional DeFi operations.

Sophisticated DeFi tax reporting requires comprehensive transaction tracking, detailed yield calculations, and advanced compliance procedures that enable optimal decentralised finance participation while maintaining regulatory adherence and tax efficiency. Professional DeFi tax management employs advanced analytics, systematic tracking systems, and comprehensive reporting frameworks that ensure optimal tax compliance while maintaining operational excellence and regulatory adherence through professional DeFi taxation and institutional compliance management designed for sophisticated decentralised finance operations and professional cryptocurrency management excellence.

Tax-Efficient Portfolio Management and Strategic Asset Allocation

Tax-efficient cryptocurrency portfolio management requires sophisticated allocation strategies, comprehensive tax-loss harvesting, and advanced rebalancing procedures that optimise after-tax returns while preserving investment objectives and risk management standards. Tax-efficient allocation includes systematic tax planning, comprehensive portfolio optimisation, and advanced tax strategies that maximise after-tax performance while maintaining appropriate risk distribution and process optimisation through professional tax-efficient portfolio management and institutional cryptocurrency operations designed for sophisticated tax optimisation and investment excellence.

Strategic asset allocation for tax efficiency includes comprehensive tax analysis, sophisticated rebalancing procedures, and advanced optimisation strategies that enhance after-tax returns while supporting investment objectives and legal adherence. Professional tax-efficient management utilises advanced analytics, systematic tax planning, and comprehensive optimisation frameworks that enable optimal after-tax performance while preserving operational excellence and regulatory adherence through professional tax-efficient portfolio management and institutional asset allocation designed for sophisticated cryptocurrency operations and professional investment management excellence.

Advanced Tax Mitigation Strategies for Cryptocurrency Operations

Sophisticated tax mitigation requires specialised cryptocurrency tax planning, comprehensive loss harvesting strategies, and advanced timing optimisation that minimises tax liability while supporting investment objectives and regulatory compliance. Advanced tax mitigation includes systematic tax-loss harvesting, comprehensive wash sale avoidance, and sophisticated timing strategies that optimise tax outcomes while maintaining portfolio performance and legal adherence through professional cryptocurrency tax mitigation and institutional tax planning designed for sophisticated digital asset operations.

Professional tax mitigation employs advanced analytics, systematic loss recognition, and comprehensive timing optimisation that reduces tax liability while preserving investment performance and regulatory compliance. Sophisticated tax planning utilises comprehensive analysis, advanced optimisation strategies, and systematic implementation procedures that enhance after-tax returns while ensuring operational excellence and legal adherence through professional cryptocurrency tax mitigation and institutional tax optimisation designed for sophisticated digital asset management and professional tax planning excellence.

Cryptocurrency Succession Planning and Inheritance Tax Strategies

Cryptocurrency succession planning requires specialised inheritance strategies, comprehensive valuation procedures, and advanced tax planning that ensures optimal asset transfer while maintaining regulatory compliance and family objectives. Wealth transfer for digital assets includes systematic inheritance planning, comprehensive tax optimisation, and advanced inheritance strategies that minimise estate tax liability while maintaining family wealth preservation and legal adherence through professional cryptocurrency succession planning and institutional inheritance management designed for sophisticated wealth transfer and family office operations.

Advanced inheritance planning utilises comprehensive valuation methodologies, sophisticated tax strategies, and systematic asset transfer procedures that optimise inheritance tax outcomes while maintaining family objectives and regulatory compliance. Professional inheritance planning employs advanced analytics, comprehensive tax planning, and systematic implementation frameworks that ensure optimal inheritance outcomes while maintaining operational excellence and legal adherence through professional cryptocurrency succession planning and institutional wealth management designed for sophisticated family office operations and professional inheritance planning excellence.

International Tax Compliance and Cross-Border Cryptocurrency Taxation

International cryptocurrency taxation requires comprehensive cross-border compliance, sophisticated reporting procedures, and advanced tax planning that ensures global regulatory adherence while optimising international tax outcomes. Cross-border tax management includes systematic international reporting, comprehensive treaty optimisation, and advanced compliance procedures that minimise global tax liability while maintaining regulatory adherence and operational excellence through professional international cryptocurrency taxation and institutional cross-border tax management designed for sophisticated global operations.

Global tax compliance utilises comprehensive international analysis, sophisticated treaty planning, and systematic reporting procedures that ensure worldwide regulatory adherence while optimising international tax outcomes. Professional cross-border management employs advanced analytics, comprehensive compliance frameworks, and systematic implementation procedures that enhance global tax efficiency while maintaining operational excellence and regulatory adherence through professional international cryptocurrency taxation and institutional global tax management designed for sophisticated multinational operations and professional international tax planning excellence.

Specific Tax Code Sections and Legal Precedents

Understanding specific tax code provisions is crucial for proper cryptocurrency taxation compliance:

Internal Revenue Code Section 61 - Gross Income Definition

IRC Section 61 defines gross income as "all income from whatever source derived" which explicitly includes cryptocurrency staking rewards and yield farming proceeds. The broad language ensures that all cryptocurrency earnings, regardless of their novel nature, fall within taxable income definitions. This foundational provision establishes the baseline requirement that all cryptocurrency gains must be reported unless specifically excluded by other code sections.

Internal Revenue Code Section 1001 - Determination of Gain or Loss

IRC Section 1001 governs the calculation of gains and losses from property dispositions, directly applicable to cryptocurrency sales and exchanges. The section requires taxpayers to determine their adjusted basis in cryptocurrency holdings and calculate the difference between sale proceeds and basis to determine taxable gain or deductible loss. This provision is particularly relevant for yield farming activities where multiple token swaps occur.

Treasury Regulation 1.451-1 - Taxable Year of Inclusion

Treasury Regulation 1.451-1 establishes the timing rules for income recognition, critical for determining when staking rewards become taxable. Under the cash method of accounting, income is generally recognised when received, meaning staking rewards are taxable upon receipt rather than when sold. This regulation clarifies that constructive receipt principles apply to cryptocurrency rewards.

Revenue Ruling 2019-24 - Cryptocurrency Hard Forks

Revenue Ruling 2019-24 provides guidance on the tax treatment of cryptocurrency received through hard forks and airdrops. Whilst not directly addressing staking, the ruling establishes principles for determining when new cryptocurrency constitutes taxable income. The ruling requires taxpayers to recognise income equal to the fair market value of new cryptocurrency when they have dominion and control over it.

Notice 2014-21 - Virtual Currency Guidance

Notice 2014-21 remains the foundational IRS guidance on cryptocurrency taxation, establishing that virtual currency is treated as property for federal tax purposes. This classification means that general tax principles applicable to property transactions apply to cryptocurrency, including staking and yield farming activities. The notice specifically addresses the tax treatment of cryptocurrency received as payment for goods or services.

Court Cases and Legal Precedents Affecting Cryptocurrency Taxation

Jarrett v. United States (2020) - Staking Reward Timing

The Jarrett case involved taxpayers who argued that Tezos staking rewards should not be taxable until sold, similar to crop production. The court rejected this argument, holding that staking rewards constitute immediate taxable income upon receipt. This precedent establishes that the "creation" theory does not apply to cryptocurrency staking, and rewards are taxable when received regardless of subsequent sale timing.

United States v. Coinbase (2017) - Record Keeping Requirements

The Coinbase summons case established the IRS's authority to obtain cryptocurrency transaction records from exchanges. Whilst not directly addressing staking taxation, the case demonstrates the IRS's commitment to cryptocurrency tax enforcement and the importance of maintaining detailed records. The court's approval of the summons signals that cryptocurrency transactions are subject to the same scrutiny as traditional financial activities.

Cryptocurrency Tax Cases in Development

Several pending cases may establish important precedents for staking and yield farming taxation:

- DeFi Protocol Classification: Cases examining whether DeFi protocols constitute securities or commodities for tax purposes

- Impermanent Loss Deductions: Litigation regarding the deductibility of impermanent losses in liquidity provision

- Cross-Chain Transaction Treatment: Cases addressing the tax implications of cross-chain bridges and wrapped tokens

- DAO Token Taxation: Disputes over the proper tax treatment of governance tokens and DAO participation

State-Specific Tax Considerations and Variations

California Franchise Tax Board Guidance

California generally conforms to federal tax treatment of cryptocurrency but has specific provisions affecting high-income taxpayers. The state's 13.3% top marginal rate significantly impacts cryptocurrency taxation, making tax planning crucial for California residents. The Franchise Tax Board has indicated it will follow federal guidance on cryptocurrency taxation while maintaining its own enforcement priorities.

New York State Department of Taxation Positions

New York State has taken an aggressive stance on cryptocurrency taxation, requiring detailed reporting of cryptocurrency transactions. The state's high tax rates (up to 10.9%) make tax planning essential for New York residents engaged in staking and yield farming. The Department of Taxation has issued guidance requiring taxpayers to report all cryptocurrency transactions, including staking rewards.

Texas - No State Income Tax Benefits

Texas residents benefit from the absence of state income tax on cryptocurrency activities, making it an attractive jurisdiction for cryptocurrency operations. However, federal tax obligations remain unchanged, and Texas residents must still comply with all federal reporting requirements. The state's business-friendly environment has attracted numerous cryptocurrency companies and mining operations.

Florida - Favorable Tax Environment

Florida's lack of state income tax provides significant advantages for cryptocurrency investors and businesses. The state has actively courted cryptocurrency companies through favorable regulatory approaches and tax policies. Florida residents can focus solely on federal tax compliance without additional state-level complications for cryptocurrency activities.

Cryptocurrency Tax Software and Professional Tools Analysis

Leading Cryptocurrency Tax Platforms

CoinTracker Professional Features

CoinTracker offers specialised features for staking and yield farming taxation:

- Automatic Staking Detection: Identifies staking rewards across 300+ platforms

- DeFi Protocol Integration: Direct API connections to major yield farming protocols

- Impermanent Loss Calculations: Automated IL tracking and tax impact analysis

- Multi-Chain Support: Comprehensive coverage across Ethereum, Polygon, BSC

- Professional Reporting: Tax forms generation and audit support documentation

Koinly Advanced Capabilities

Koinly provides comprehensive DeFi tax management tools:

- Smart Contract Recognition: Automatic categorization of DeFi transactions

- Yield Farming Tracking: Detailed analysis of LP positions and rewards

- Tax optimisation Features: Loss harvesting and timing optimisation tools

- International Compliance: Support for 20+ country tax regulations

- Professional Services: Access to cryptocurrency tax specialists

TokenTax Enterprise Solutions

TokenTax focuses on institutional and high-volume users:

- Institutional Reporting: Enterprise-grade compliance and audit features

- Custom Integration: API access for institutional portfolio management

- Multi-Entity Support: Complex corporate structure tax management

- Professional Review: CPA review services for complex situations

- Audit defence: Professional representation during tax examinations

Manual Calculation Methods and Spreadsheet Solutions

Staking Reward Calculation Templates

Professional spreadsheet templates for accurate staking tax calculations:

- Daily Reward Tracking: Timestamp, amount, fair market value, cost basis

- Validator Performance: Tracking individual validator rewards and penalties

- Multi-Asset Portfolios: Consolidated tracking across different staked assets

- Compound Interest Calculations: Accurate modelling of reinvested rewards

- Tax Year Summaries: Annual aggregation for tax return preparation

Yield Farming Calculation Frameworks

Comprehensive frameworks for complex yield farming tax calculations:

- LP Position Tracking: Entry/exit prices, fee accumulation, IL calculations

- Multi-Token Rewards: Separate tracking for each reward token type

- Protocol-Specific Templates: customised calculations for Uniswap, Curve, Balancer

- Cross-Chain Reconciliation: Coordinating positions across multiple networks

- Professional Validation: CPA review processes for complex calculations

2025 Regulatory Developments and Future Tax Implications

United States Tax Developments

IRS Guidance Updates

Recent IRS developments affecting cryptocurrency taxation:

- Revenue Ruling 2023-14: Clarification on staking reward timing

- Form 1099-DA Implementation: New reporting requirements for digital assets

- Broker Reporting Rules: Enhanced third-party reporting starting 2025

- Wash Sale Rule Extension: Potential application to cryptocurrency transactions

- Like-Kind Exchange Prohibition: Confirmed elimination for crypto-to-crypto trades

Congressional Legislation Proposals

Pending legislation that could affect cryptocurrency taxation:

- Digital Asset Market Structure Bill: Comprehensive regulatory framework

- Stablecoin Regulation: Potential impact on stablecoin yield farming

- DeFi Regulation Proposals: Oversight requirements for decentralised protocols

- Tax Simplification Acts: Proposed de minimis exemptions for small transactions

- Innovation Sandbox Programs: Regulatory relief for emerging technologies

Global Regulatory Trends and Harmonization Efforts

European Union Initiatives

EU-wide coordination on cryptocurrency taxation:

- DAC8 Implementation: Enhanced reporting requirements for crypto service providers

- MiCA Regulation: Comprehensive framework affecting taxation approaches

- Transfer Pricing Guidelines: OECD guidance on crypto transfer pricing

- VAT Harmonization: Consistent VAT treatment across member states

- Cross-Border Coordination: Improved information sharing between tax authorities

Asia-Pacific Regulatory Evolution

Rapid regulatory development across Asia-Pacific markets:

- Singapore Framework: Comprehensive guidelines for DeFi taxation

- Japan Regulatory Updates: Enhanced clarity on yield farming treatment

- Australia ATO Guidance: Detailed rules for staking and DeFi activities

- Hong Kong Consultation: Proposed framework for crypto taxation

- Regional Coordination: ASEAN initiatives for regulatory harmonization

Conclusion

Navigating the tax implications of cryptocurrency staking and yield farming in 2025 requires careful planning, meticulous record-keeping, and a thorough understanding of your local jurisdiction's regulations. Whilst both activities offer attractive opportunities for generating passive income from digital assets, they come with distinct tax obligations that can significantly impact your overall returns if not properly managed.

Staking generally offers a more straightforward tax profile, with most jurisdictions treating staking rewards as ordinary income taxable at the time of receipt. The predictable nature of staking rewards, combined with simpler transaction structures, makes compliance more manageable for most investors. However, questions around timing, valuation, and the treatment of different staking mechanisms continue to evolve as regulators gain more experience with these technologies.

Yield farming presents significantly more complexity from a tax perspective, with multiple layers of transactions, frequent token swaps, and complex reward structures creating numerous taxable events. The automated nature of many DeFi protocols can generate hundreds of micro-transactions, each requiring proper documentation and reporting. Whilst the potential returns may be higher, the compliance burden and associated costs can be substantial.

The regulatory landscape continues to evolve rapidly, with 2025 bringing increased clarity in some areas while introducing new complexities in others. Major jurisdictions are developing more sophisticated frameworks for cryptocurrency taxation, but significant variations remain in interpretation and enforcement. Staying informed about regulatory developments in your jurisdiction is crucial for maintaining compliance and optimising your tax strategy.

Proper planning and professional guidance are essential for anyone engaging in significant cryptocurrency yield generation activities. The complexity of modern DeFi protocols, combined with evolving regulatory requirements, makes it increasingly difficult for individual investors to navigate these waters alone. Investing in proper tax software, maintaining detailed records, and consulting with qualified professionals can save significant time, money, and stress in the long run.

Key success factors include: implementing robust record-keeping systems from day one, understanding the tax implications before engaging in any activity, maintaining detailed transaction logs with accurate valuations, setting aside appropriate reserves for tax obligations, and staying informed about regulatory developments that may affect your obligations.

As the cryptocurrency ecosystem continues to mature, tax compliance will become an increasingly important factor in investment decision-making. The strategies and approaches that work today may not work tomorrow, so maintaining flexibility and adapting to changing regulations will be crucial for long-term success. By understanding these complexities upfront and implementing proper systems and processes, you can participate in the exciting world of cryptocurrency yield generation while maintaining full compliance with your tax obligations.

Remember that this guide provides general information only and should not be considered professional tax advice. Tax laws vary significantly by jurisdiction and are subject to frequent changes. Always consult with qualified tax professionals who specialise in cryptocurrency taxation for advice specific to your situation and jurisdiction.

Sources & References

Frequently Asked Questions

- Is staking taxed differently from yield farming in 2025?

- Both are generally taxed as ordinary income when rewards are received, but yield farming may have additional complexity due to multiple token types, IL (impermanent loss), and frequent transactions. Staking is typically simpler for tax reporting purposes, while yield farming requires more detailed record-keeping and may involve more frequent taxable events.

- When do I pay taxes on staking rewards?

- In most jurisdictions, staking rewards are taxed as ordinary income at fair market value when received or when they become available to claim, not when you sell them. This means you owe taxes immediately upon receiving rewards, even if you don't convert them to fiat currency.

- How is impermanent loss treated for taxes?

- IL (impermanent loss) tax treatment varies by jurisdiction and is often unclear. Some treat it as a capital loss when liquidity is withdrawn, while others don't recognise it until disposal. The US and UK generally don't allow deduction until the LP position is closed, while some EU countries may allow mark-to-market accounting for professional traders.

- What records do I need for crypto tax reporting?

- Keep detailed records of all transactions, including dates, amounts, fair market values at the time of transaction, transaction hashes, gas fees, and the purpose of each transaction. Utilise crypto tax software for automated tracking and maintain records for at least seven years in most jurisdictions.

- Can I deduct gas fees and platform fees?

- Gas fees and platform fees may be deductible as business expenses if you're engaged in crypto activities as a business, or they may be added to the cost basis of acquired assets. The treatment depends on your jurisdiction and whether your crypto activities are classified as business or investment activities.

- How do I handle airdrops and governance tokens?

- Airdrops and governance tokens are generally taxable income at fair market value when received. This can be particularly challenging for new tokens that lack an established market price. Document the receipt and use reasonable valuation methods, potentially seeking professional guidance for significant amounts.

- What happens if I can't determine the fair market value of a token?

- Use reasonable valuation methods such as the first available exchange price, comparable token prices, or professional appraisals for significant amounts. Document your methodology and be prepared to defend your valuation approach. When in doubt, consult a tax professional.

- Should I report crypto activities if I made a loss?

- Yes, you should report crypto activities even if you made a loss. Capital losses can often be used to offset other gains and may be carried forwards to future tax years. Proper reporting also demonstrates compliance and helps establish your cost basis for future transactions.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.