Yield Farming vs Staking 2025: Guide

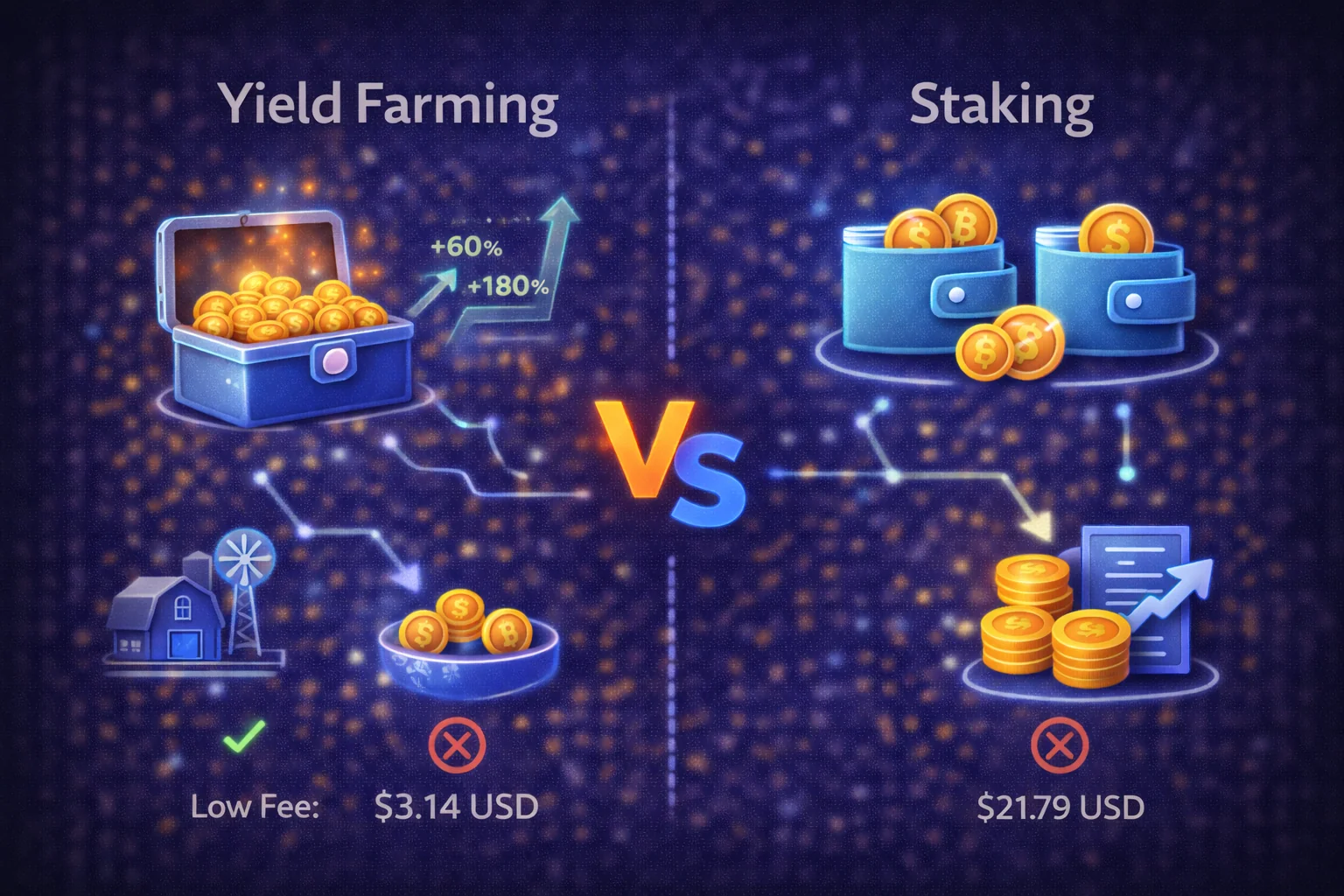

Understand the key differences between farming and staking in 2025. Learn about risks, rewards, and strategies, and discover which approach aligns with your investment goals and risk tolerance.

Introduction

How has crypto investing evolved? The cryptocurrency landscape has evolved dramatically. It moved beyond simple buy-and-hold strategies. Yield farming and staking emerged as two prominent methods. You can generate passive income from digital assets. These sophisticated earning mechanisms have transformed how investors approach cryptocurrency investment. You get opportunities to earn substantial returns. You contribute to the security and functionality of blockchain networks. Understanding the differences between these approaches is crucial. This applies to any serious cryptocurrency investor seeking to maximise returns while managing risk appropriately.

What is yield farming? Yield farming represents the more aggressive and complex approach. It involves strategic deployment of cryptocurrency assets. You work across various decentralised finance protocols. This maximises returns. This method typically requires active management. You need a deep understanding of DeFi mechanics. You must tolerate higher risk. In exchange, you get potentially superior yields. Farmers provide liquidity to automated market makers. They participate in lending protocols. They engage with governance tokens. This optimises earning potential across multiple platforms simultaneously.

What is staking? Staking offers a more conservative and straightforward path. You get passive income through direct participation. You help with blockchain network validation. This approach involves delegating or directly validating transactions. You work on proof-of-stake networks. You earn rewards for helping secure the blockchain infrastructure. Staking typically provides more predictable returns. It has lower complexity. This makes it accessible to investors who prefer stability to maximum yield optimisation.

What factors should you consider? The choice between yield farming and staking extends beyond simple risk-reward calculations. Consider technical expertise requirements. Think about time commitment. Assess liquidity needs. Evaluate long-term investment objectives. Yield farming demands continuous monitoring. You track market conditions, protocol changes, and optimisation opportunities. Staking often offers a more passive approach. It's set-and-forget. Both strategies have evolved significantly in 2025. Innovations improve user experience, security, and earning potential.

What will this guide cover? This comprehensive analysis examines both strategies across multiple dimensions. We look at potential returns, risk profiles, and technical requirements. Practical implementation considerations are included. We'll explore real-world examples. We analyse current market conditions. You'll get actionable guidance. Learn how to incorporate these earning strategies into a diversified cryptocurrency portfolio. Whether you're a DeFi veteran or a newcomer, this guide helps you. You'll make informed decisions about which approach best aligns with your investment goals and risk tolerance.

How have these ecosystems matured? The maturation of both yield farming and staking ecosystems in 2025 has brought increased institutional participation. Regulatory clarity improved. Infrastructure benefits retail investors. Major cryptocurrency exchanges now offer simplified staking services. DeFi protocols have developed more user-friendly interfaces. Automated strategies reduce technical barriers to yield farming. This evolution has democratized access. You get sophisticated earning strategies. The potential for significant returns remains. Investors across all experience levels can participate. You can join the growing cryptocurrency economy through strategic asset deployment and network participation.

Which strategy is right for you? The choice ultimately depends on your risk tolerance, technical expertise, and investment timeline. Both strategies offer compelling advantages in the right circumstances. Many successful cryptocurrency investors utilise a combination of both approaches. This diversifies earning potential. It manages overall portfolio risk. Understanding these fundamental differences helps you. You'll make informed decisions. These align with your financial objectives and risk management preferences in the dynamic cryptocurrency landscape of 2025.

Executive Overview

The cryptocurrency landscape in 2025 offers investors two primary strategies for generating passive income: yield farming and staking. Both approaches have evolved significantly since their inception, with institutional adoption and regulatory clarity transforming these once-experimental concepts into legitimate investment strategies. Understanding the fundamental differences between these approaches is crucial for making informed decisions about your cryptocurrency portfolio allocation.

Staking involves locking digital assets to secure blockchain networks through proof-of-stake consensus mechanisms, earning steady returns typically ranging from 4-12% annually. This approach has gained widespread acceptance due to its simplicity and lower risk profile. Major cryptocurrencies like Ethereum, Cardano, and Solana offer staking opportunities directly through their networks, while centralised exchanges provide beginner-friendly staking services.

Yield farming, also known as liquidity mining, involves providing liquidity to decentralised finance (DeFi) protocols in exchange for rewards. This strategy can generate significantly higher returns, often exceeding 20-100% annually, but comes with increased complexity and risk. Yield farmers must navigate impermanent loss, smart contract risks, and constantly changing reward structures across multiple protocols.

The choice between these strategies depends on several factors: your risk tolerance, technical expertise, time commitment, and investment goals. Conservative investors often prefer staking for its predictable returns and lower maintenance requirements, while more aggressive investors may pursue yield farming for its potential for higher profits. Many sophisticated investors employ a hybrid approach, allocating portions of their portfolio to both strategies to optimise risk-adjusted returns.

Market conditions in 2025 have created unique opportunities in both sectors. The maturation of DeFi protocols has reduced some risks associated with yield farming, while the growth of liquid staking derivatives has made staking more flexible and accessible. Regulatory developments have also provided more straightforward guidelines for both activities, reducing uncertainty for institutional and retail investors alike.

This comprehensive guide examines both strategies in detail, providing practical insights for investors at all experience levels. We'll explore the mechanics of each approach, analyse risk-reward profiles, and offer actionable frameworks to choosing the strategy that aligns with your investment objectives. Whether you're a beginner looking to earn your first cryptocurrency rewards or an experienced investor optimising your DeFi strategy, this analysis will equip you with the knowledge needed to make confident decisions in 2025's evolving cryptocurrency landscape.

Key differences at a glance

- Complexity: Staking = straightforward, Yield farming = intricate

- Risk: Staking = minimal, Yield farming = elevated

- Returns: Staking = consistent, Yield farming = fluctuating

- Time commitment: Staking = hands-off, Yield farming = hands-on

- Technical knowledge: Staking = basic, Yield farming = advanced

Understanding Token Delegation

What Is Proof-of-Stake Participation?

Token delegation involves locking cryptocurrency assets to help secure and validate transactions on proof-of-stake blockchain protocols. In return, participants earn incentives in the form of additional digital currencies through network consensus mechanisms.

How Consensus Participation Works

- Asset commitment: Deposit digital currencies with validators or delegation pools

- Network participation: Validators utilise committed assets to propose and validate blockchain transactions

- Incentive distribution: Earn proportional benefits based on your committed position

- Compounding growth: Reinvest earnings to amplify future income generation

Delegation Benefits

- Simplicity: Set-and-forget approach with minimal portfolio management

- Predictable returns: More stable incentive rates compared to market making

- Lower risk: Fewer smart contract interactions and protocol dependencies

- Network support: Directly contributes to blockchain security infrastructure

- Regulatory clarity: Generally better understood by financial regulators

Delegation Disadvantages

- Lockup periods: Many protocols require assets to be committed for specific timeframes

- Slashing risk: Potential penalties for validator misconduct or technical failures

- Lower yields: Generally offers modest earnings compared to successful liquidity provision

- Inflation exposure: Incentives often derive from token supply expansion

- Validator dependency: Performance relies on chosen validation service provider

Popular Consensus Participation Options 2025

| Asset | Typical APR | Lockup Period | Best For |

|---|---|---|---|

| Ethereum (ETH) | 3-5% | Queue-based exit | Long-term holders |

| Solana (SOL) | 6-7% | 2-3 days | Flexible staking |

| Cardano (ADA) | 3-4% | None | Beginners |

| Cosmos (ATOM) | 15-18% | 21 days | High yield seekers |

Detailed Network Analysis by Protocol

Ethereum Consensus Participation Deep Dive

Ethereum's transition to Proof of Stake has created the largest delegation opportunity in cryptocurrency markets:

- Minimum requirement: 32 ETH for solo validation, any amount for pooled participation

- Current APR: 3.2-4.8% depending on protocol participation levels

- Validator queue: Entry and exit queues can cause processing delays

- Slashing conditions: Penalties for double signing or extended downtime incidents

- MEV incentives: Additional income from maximum extractable value opportunities

Ethereum Delegation Calculation Example:

- Commitment: 10 ETH at 4% annual percentage rate

- Annual earnings: 10 × 0.04 = 0.4 ETH

- Monthly earnings: 0.4 ÷ 12 = 0.033 ETH

- If ETH = $2,500: Monthly income = $83

Solana Protocol Participation Analysis

Solana offers attractive delegation incentives with relatively short unbonding periods:

- Protocol inflation: ~8% annually, decreasing over time

- Validator commission: Typically 5-10% of earnings

- Epoch system: Incentives distributed every 2-3 days

- Delegation flexibility: Can change validators without unstaking

- Liquid delegation options: mSOL, stSOL for maintaining liquidity

Cosmos Ecosystem Token Delegation

The Cosmos ecosystem offers some of the highest delegation incentives:

- ATOM delegation: 15-18% APR with 21-day unbonding

- Osmosis (OSMO): 20-25% APR with additional LP earnings

- Juno (JUNO): 25-30% APR for early ecosystem participation

- Governance participation: Additional incentives for voting on proposals

- Airdrops: Delegators often eligible for new token distributions

Delegation Incentive Calculations

Simple vs Compound Interest

Understanding how delegation incentives compound is crucial for maximising earnings:

Simple Interest Formula:

- Final Amount = Principal × (1 + (Rate × Time))

- Example: 100 SOL at 7% for 1 year = 100 × (1 + 0.07) = 107 SOL

- No compounding effect: earnings remain constant each period

Compound Interest Formula:

- Final Amount = Principal × (1 + Rate/n)^(n×Time)

- Where n = compounding frequency

- Daily compounding: 100 SOL at 7% = 100 × (1 + 0.07/365)^365 = 107.25 SOL

Real-World Delegation Returns Analysis

| Investment | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| $10,000 ETH (4% APR) | $10,408 | $11,249 | $12,214 |

| $10,000 SOL (7% APR) | $10,725 | $12,250 | $14,026 |

| $10,000 ATOM (16% APR) | $11,735 | $16,105 | $22,080 |

Understanding Liquidity Provision

What Is decentralised Finance Cultivation?

Liquidity cultivation involves providing digital assets to decentralised finance (DeFi) protocols to earn rewards in the form of exchange fees, interest, and token incentives. Cultivators move their assets between different protocols to maximise returns through strategic positioning.

How DeFi Cultivation Works

- Asset provision: Deposit digital currencies into blockchain protocols (AMMs, lending platforms)

- Revenue mechanisms: Collect trading costs, lending interest, and governance token rewards

- Strategy optimisation: Monitor and adjust positions for maximum profitability

- Compounding growth: Reinvest earnings into new opportunities for exponential returns

Common Liquidity Cultivation Strategies

Automated Market Maker Participation

- Provide liquidity to decentralised exchanges (DEXs)

- Earn transaction fees plus governance token incentives

- Examples: Uniswap, SushiSwap, PancakeSwap protocols

Lending Protocol Participation

- Supply assets on platforms like Aave or Compound

- Generate interest plus protocol token incentives

- Can combine with borrowing for leveraged strategies

Automated Vault Strategies

- Use automated optimisation platforms for maximum efficiency

- Examples: Yearn Finance, Beefy Finance, Harvest protocols

- Automated compounding and strategy switching mechanisms

Advanced Liquidity Cultivation Techniques

Leveraged Position Management

Advanced cultivators use borrowed funds to amplify their positions:

- Mechanism: Borrow assets to increase cultivation position size

- Leverage ratios: Typically 2x-5x, depending on platform and collateral requirements

- Risk amplification: Both gains and losses are magnified proportionally

- Liquidation risk: Positions can be liquidated if collateral value drops significantly

- Platforms: Alpha Homora, Gearbox, Instadapp protocols

Cross-Chain Opportunities

Multi-chain cultivation strategies offer diversification benefits:

- Bridge protocols: Move assets between different blockchain ecosystems

- Arbitrage opportunities: Exploit price differences across chains

- Ecosystem rewards: Participate in multiple network incentive programs

- Risk distribution: Spread exposure across various blockchain networks

Cultivation Disadvantages

- Complexity: Requires constant monitoring and strategy adjustments

- IL risk: Risk of losing value when providing liquidity to AMMs

- Smart contract risk: Vulnerability to bugs and exploits in protocol code

- Gas fees: High transaction costs can erode profits, especially on Ethereum

- Regulatory uncertainty: Unclear legal status in many jurisdictions

Leveraged Farming Example:

- Deposit: $10,000 USDC

- Borrow: $20,000 USDC at 5% interest

- Total farming position: $30,000

- Farm APR: 20%

- Gross return: $30,000 × 0.20 = $6,000

- Borrowing cost: $20,000 × 0.05 = $1,000

- Net return: $5,000 on $10,000 = 50% APR

Cross-Chain farming protocols

Opportunities exist across multiple blockchain networks:

Ethereum Ecosystem

- Curve Finance: Stablecoin pools with 5-15% APR + CRV rewards

- Convex Finance: Boosted Curve rewards, 10-25% APR

- Balancer: Multi-asset pools with BAL incentives

- Frax Finance: Algorithmic stablecoin ecosystem rewards

Binance Smart Chain

- PancakeSwap: CAKE farming with 20-100% APR

- Venus Protocol: Lending and borrowing with XVS rewards

- Alpaca Finance: Leveraged farming platform

- Beefy Finance: Auto-compounding vault strategies

Polygon Network

- QuickSwap: Low-fee DEX with QUICK rewards

- Aave Polygon: Lending with MATIC incentives

- Sushi Polygon: Cross-chain farming opportunities

- Gains Network: Leveraged trading and farming

liquidity mining Profitability Analysis

liquidity risk Calculations

Understanding price divergence loss is crucial for AMM strategies:

Advanced Institutional Strategies and Professional Portfolio Integration

Professional asset managers and institutional investors implement sophisticated hybrid strategies that combine staking and yield farming within comprehensive risk management frameworks. These advanced approaches utilise quantitative models to optimise allocation between low-risk staking positions and higher-yield farming opportunities based on volatility analysis, correlation modelling, and risk-adjusted return calculations. Institutional strategies incorporate dynamic rebalancing algorithms that automatically adjust exposure between staking and farming based on predetermined risk parameters, market conditions, and regulatory compliance requirements.

Advanced practitioners employ cross-protocol arbitrage opportunities, leveraged staking mechanisms, and complex derivatives positions to enhance returns while managing downside risk through sophisticated hedging strategies. These approaches require deep understanding of DeFi protocol mechanics, smart contract interactions, and advanced financial modelling techniques including value-at-risk calculations, stress testing scenarios, and correlation analysis across different cryptocurrency assets and yield generation mechanisms. Professional users implement comprehensive due diligence frameworks that evaluate protocol security, tokenomics sustainability, and regulatory compliance standards.

Quantitative Analysis and Mathematical optimisation Frameworks

Professional yield optimisation requires sophisticated mathematical frameworks including stochastic calculus, Monte Carlo simulations, and machine learning algorithms to predict optimal allocation strategies across staking and farming opportunities. Advanced practitioners utilise statistical arbitrage techniques, mean reversion models, and volatility forecasting algorithms to identify high-probability yield generation opportunities while maintaining appropriate risk-adjusted returns through systematic portfolio optimisation and dynamic hedging strategies.

Institutional quantitative approaches incorporate advanced derivatives modelling, cross-asset correlation analysis, and sophisticated risk management techniques that enable large-scale yield generation while maintaining regulatory compliance and operational security standards. These mathematical frameworks include complex optimisation algorithms, real-time risk monitoring systems, and automated execution mechanisms that systematically identify and capture yield opportunities across multiple protocols, networks, and market conditions while preserving capital and managing downside risk exposure.

Regulatory Compliance and Enterprise Risk Management Systems

Professional staking and farming strategies require comprehensive regulatory compliance frameworks that address tax reporting obligations, anti-money laundering (AML) requirements, and know-your-customer (KYC) verification standards across multiple jurisdictions and protocol interactions. Institutional infrastructure includes sophisticated custody solutions, comprehensive audit trails, and advanced reporting capabilities that meet regulatory requirements for transparency, security, and operational control while maintaining the efficiency advantages of decentralised finance protocols.

Advanced compliance systems incorporate automated monitoring tools, comprehensive transaction reporting, and sophisticated risk assessment frameworks that ensure institutional participants can maintain regulatory compliance while accessing high-yield staking and farming opportunities. These systems include real-time compliance monitoring, automated tax reporting integration, and comprehensive audit capabilities that meet international regulatory standards while preserving operational efficiency and yield optimisation advantages of professional cryptocurrency earning strategies across diverse blockchain networks and DeFi protocols.

IL risk Formula:

- IL = (2 × √(price_ratio)) / (1 + price_ratio) - 1

- Where price_ratio = current_price / initial_price

- IL increases exponentially with price divergence between paired assets

IL risk Examples:

| Price Change | liquidity risk | Break-even APR Needed |

|---|---|---|

| +25% / -20% | -0.6% | 7.2% annually |

| +50% / -33% | -2.0% | 24% annually |

| +100% / -50% | -5.7% | 68% annually |

| +200% / -67% | -13.4% | 160% annually |

Gas Fee Impact Analysis

Transaction costs significantly impact farming profitability:

Ethereum Gas Cost Examples (50 gwei):

- Simple swap: ~$15-25

- Add liquidity: ~$25-40

- Stake LP tokens: ~$20-30

- Harvest rewards: ~$15-25

- Compound rewards: ~$30-50

Break-even Analysis:

- Total setup cost: $100 (add liquidity + stake)

- Monthly harvest cost: $40

- Annual gas costs: $100 + ($40 × 12) = $580

- Minimum position size for 5% gas impact: $580 ÷ 0.05 = $11,600

Token Reward Valuation

Many farming rewards come in governance tokens with volatile prices:

- Emission schedules: Token distribution rates often decrease over time

- Price volatility: Reward tokens can lose 50-90% of value quickly

- Vesting periods: Some rewards are locked or vested over time

- Selling pressure: High APR often leads to immediate selling

Conservative Reward Valuation:

- Discount token rewards by 50-70% for volatility

- Focus on protocols with sustainable tokenomics

- Consider immediate vs delayed reward claiming

- Factor in potential token price appreciation

DeFi farming Advantages

- Higher potential returns: Can significantly outperform staking during bull markets

- Flexibility: Ability to quickly move between opportunities

- Innovation access: Early access to new protocols and tokens

- Composability: Combine multiple strategies for enhanced returns

- Active management: optimise returns through strategic positioning

yield generation Disadvantages

- High complexity: Requires deep understanding of DeFi protocols

- price divergence loss: Risk of losing value when providing liquidity to AMMs

- Smart contract risk: Exposure to bugs and exploits

- Gas fees: High transaction costs can eat into profits

- Time intensive: Requires constant monitoring and adjustment

- Regulatory uncertainty: Less clear regulatory framework

Comprehensive Comparison

Risk Profile Analysis

| Risk Factor | Staking | farming protocols |

|---|---|---|

| Smart Contract Risk | Low-Medium | High |

| price divergence | None | High (AMM strategies) |

| Slashing Risk | Low-Medium | None |

| Liquidity Risk | Medium (lockups) | Low-Medium |

| Complexity Risk | Low | High |

Return Potential Comparison

| Aspect | Staking | liquidity mining |

|---|---|---|

| Typical APR Range | 3-18% | 5-100%+ (highly variable) |

| Return Stability | High | Low |

| Compounding | Automatic/Manual | Manual optimisation required |

| Fee Impact | Low | High (gas fees) |

| Sustainability | High | Variable (incentive-dependent) |

Time and Effort Requirements

| Activity | Staking | DeFi farming |

|---|---|---|

| Initial Setup | 1-2 hours | 4-8 hours |

| Daily Monitoring | 5-10 minutes | 30-60 minutes |

| Strategy Adjustments | Monthly | Weekly/Daily |

| Learning Curve | Beginner-friendly | Advanced knowledge required |

| Stress Level | Low | Medium-High |

Risk Management Strategies

Staking Risk Mitigation

- Validator selection: Choose validators with high uptime and reasonable fees

- Platform diversification: Spread stakes across multiple validators or platforms

- staking derivatives: Use protocols like Lido for flexibility

- Regular monitoring: Check validator performance and network updates

- Emergency planning: Understand unstaking procedures and timeframes

yield generation Risk Mitigation

- Protocol research: Only use audited, established protocols

- Position sizing: Never risk more than you can afford to lose

- Diversification: Spread across multiple strategies and protocols

- IL risk hedging: Use single-asset strategies or IL protection

- Exit strategies: Set clear profit-taking and stop-loss levels

- Gas fee management: Time transactions during low-congestion periods

Market Conditions Impact on Strategy Choice

Bull Market Strategies

During bull markets, both strategies can be profitable, but with different risk-reward profiles:

Staking in Bull Markets

- Price appreciation: Staked tokens benefit from underlying asset price gains

- Network growth: Increased adoption often leads to higher staking yields

- Opportunity cost: May miss out on higher DeFi yields

- Liquidity constraints: Lockup periods prevent taking profits at peaks

farming protocols in Bull Markets

- High APRs: New protocols offer attractive incentives to bootstrap liquidity

- Token appreciation: Reward tokens often appreciate significantly

- temporary loss risk: Volatile assets can cause significant IL

- FOMO risks: Easy to chase unsustainable yields

Bear Market Strategies

Bear markets require more defensive approaches:

Staking in Bear Markets

- Steady income: Rewards continue regardless of price action

- Dollar-cost averaging: Reinvesting rewards at lower prices

- Network security: Continued participation supports network health

- Lower competition: Fewer stakers can mean higher individual rewards

liquidity mining in Bear Markets

- Reduced incentives: Many protocols cut reward emissions

- Stablecoin focus: Shift to stablecoin pairs to avoid IL

- Protocol risk: Increased risk of protocol failures and exploits

- Liquidity crunch: Reduced TVL can make positions harder to exit

Sideways Market Strategies

Range-bound markets offer unique opportunities:

- Stablecoin farming: Focus on USD-pegged assets to minimise IL

- Range trading: Provide liquidity in concentrated ranges

- Consistent staking: Steady rewards without price volatility stress

- Strategy testing: Good time to experiment with new approaches

Seasonal Patterns and Timing

DeFi Summer Patterns

Historical analysis shows recurring patterns in DeFi yields:

- Q2-Q3 peaks: "DeFi summers" often occur in mid-year

- New protocol launches: Highest yields typically in first 1-3 months

- Governance token cycles: Rewards often follow token unlock schedules

- Network upgrade cycles: Major updates can impact validation rewards

Optimal Entry and Exit Timing

- Farming entry: Early in bull markets or new protocol launches

- Farming exit: When APRs normalise or market sentiment shifts

- Staking entry: During bear markets or before major network upgrades

- Staking exit: Consider flexible staking to maintain flexibility

How to Choose: Decision Framework

Choose Staking If You:

- Prefer income generation with minimal management

- Want predictable, steady returns

- Are new to crypto or DeFi

- Have a long-term investment horizon

- Want to support network security

- Prefer lower-risk strategies

- Don't want to monitor positions actively

Choose yield generation If You:

- Have experience with DeFi protocols

- Want to maximise potential returns

- Enjoy active portfolio management

- Can dedicate time to research and monitoring

- Are comfortable with higher risks

- Want access to new opportunities and tokens

- Have sufficient capital to absorb gas fees

Hybrid Approach

Many successful crypto investors use a combination strategy:

- Core position (60-80%): Stake major assets for steady returns

- Opportunistic allocation (15-30%): Yield farm with established protocols

- Experimental portion (5-10%): Try new strategies and protocols

Portfolio Allocation by Experience Level

| Experience Level | Staking % | farming protocols % | Focus Areas |

|---|---|---|---|

| Beginner | 90-100% | 0-10% | Learn basics, major assets only |

| Intermediate | 70-80% | 20-30% | Established protocols, risk management |

| Advanced | 50-70% | 30-50% | Complex strategies, new opportunities |

Recommended Platforms 2025

Best Staking Platforms

centralised Exchanges

- Binance Earn - Largest selection, flexible terms

- Coinbase - US-regulated, beginner-friendly

- Kraken - Strong security record

tokenised staking Protocols

- Lido - Largest liquid staking protocol

- Rocket Pool - decentralised Ethereum staking

- Marinade - Solana liquid staking

Best liquidity mining Platforms

Automated Vaults

- Yearn Finance - Pioneer in yield optimisation

- Beefy Finance - Multi-chain farming

- Harvest Finance - Automated strategies

AMM Platforms

- Uniswap - Leading Ethereum DEX

- PancakeSwap - BSC ecosystem leader

- Curve - Stablecoin-focused AMM

Lending Protocols

- Aave - Multi-chain lending leader

- Compound - Established Ethereum lending

- Venus - BSC lending protocol

Tax and Regulatory Considerations

Staking Tax Implications

Income Recognition

- Timing: Most jurisdictions treat staking rewards as income when received

- Valuation: Fair market value at time of receipt determines taxable amount

- Frequency: Daily, weekly, or epoch-based reward distribution affects reporting

- Compounding: Auto-restaked rewards create additional taxable events

Cost Basis Tracking

- Original stake: Purchase price and date of initially staked tokens

- Reward basis: Each reward creates new cost basis at FMV

- FIFO/LIFO: Accounting method affects capital gains calculations

- Record keeping: Detailed logs essential for accurate reporting

DeFi farming Tax Complexity

Multiple Taxable Events

- LP token creation: May be taxable swap depending on jurisdiction

- Reward harvesting: Each claim creates taxable income

- Compounding: Reinvesting rewards triggers additional events

- IL risk: Complex calculations for realised vs unrealized losses

Token Reward Valuation Challenges

- Illiquid tokens: Difficulty determining fair market value

- Vested rewards: Timing of income recognition for locked tokens

- Governance tokens: Utility vs investment classification

- Cross-chain rewards: Tracking rewards across multiple networks

Regulatory Landscape 2025

United States

- IRS guidance: Staking rewards treated as ordinary income

- DeFi regulations: Increasing scrutiny of farming protocols

- Broker reporting: Form 1099 requirements for centralised platforms

- State variations: Different state tax treatments and regulations

European Union

- MiCA framework: Comprehensive crypto asset regulation

- Tax harmonization: Efforts to standardise crypto taxation

- DeFi classification: Ongoing regulatory clarity development

- Cross-border reporting: Enhanced information sharing requirements

Other Major Jurisdictions

- United Kingdom: Clear staking guidance, DeFi under review

- Canada: Business vs investment income distinction

- Australia: CGT vs income tax treatment based on circumstances

- Singapore: Generally tax-free for individuals, business tax for companies

Tax optimisation Strategies

Timing Strategies

- Harvest timing: Claim rewards in low-income years

- Loss harvesting: realise losses to offset staking income

- Jurisdiction shopping: Consider tax-friendly locations

- Retirement accounts: Use tax-advantaged accounts where possible

Record Keeping Best Practices

- Automated tracking: Use tools like Koinly, CoinTracker, or Rotki

- Transaction logs: Export all platform transaction histories

- Price documentation: Maintain records of token values at reward time

- Professional help: Consult crypto-specialised tax professionals

Best Practices for Success

General Principles

- Start small: Begin with amounts you can afford to lose

- Educate yourself: Understand the protocols and risks involved

- Diversify: Don't put all funds in one strategy or platform

- Keep records: Track all transactions for tax purposes

- Stay informed: Follow protocol updates and market news

Staking Best Practices

- Research validator track records and commission rates

- Understand unbonding periods before committing funds

- Consider liquid staking for flexibility

- Monitor validator performance regularly

- Keep some funds unstaked for opportunities

yield generation Best Practices

- Only use audited protocols with proven track records

- Calculate liquidity risk before providing liquidity

- Factor gas fees into return calculations

- Set up monitoring alerts for position changes

- Have clear exit strategies for each position

- Regularly rebalance and optimise strategies

Real-World Strategy Comparisons

Example 1: Conservative Investor - Staking Winner

Profile: Risk-averse, long-term holder, minimal time commitment

Staking Strategy:

- Asset: 10 ETH staked via Lido (liquid staking)

- Initial Value: $20,000 (at $2,000/ETH)

- APY: 4.5% in ETH rewards

- Time Commitment: 10 minutes setup, monthly check-ins

12-Month Results:

- ETH rewards earned: 0.45 ETH ($900 at entry price)

- ETH price appreciation: $2,000 → $2,400 (+20%)

- Total position value: $25,080 (10.45 ETH × $2,400)

- Total return: $5,080 (25.4%)

- price divergence loss: $0

Why Staking Won: Simple setup, no temporary loss, benefited fully from ETH price appreciation, minimal management required.

Example 2: Active Trader - farming protocols Winner

Profile: Advanced DeFi trader, comfortable with high-risk strategies, actively monitors positions

liquidity mining Strategy:

- Platform: Curve Finance stETH/ETH pool

- Initial Investment: $20,000 (5 ETH + 5 stETH)

- Base APY: 3% trading fees + 5% CRV rewards = 8%

- Time Commitment: 2 hours setup, weekly monitoring

12-Month Results:

- Trading fees: $600

- CRV rewards: $1,000

- Position value: $24,200 (accounting for small IL)

- Total return: $5,800 (29%)

- temporary loss: ~$200 (offset by rewards)

Why DeFi farming Won: Higher APY from multiple reward sources, correlated assets minimised IL, active management optimised returns.

Example 3: Hybrid Approach - Best of Both

Profile: Moderate risk tolerance, diversification focus

Combined Strategy:

- 60% Staking: 6 ETH staked via Rocket Pool (4.2% APY)

- 40% Yield Farming: $8,000 in Curve USDC/DAI pool (6% APY)

- Total Capital: $20,000

12-Month Results:

- Staking rewards: $504 (6 ETH × 4.2%)

- Farming: $480 ($8,000 × 6%)

- ETH appreciation: +20% on staked portion = $2,400

- Total return: $3,384 (16.9%)

Why Hybrid Won: Balanced risk-reward, diversified income streams, reduced overall portfolio volatility, maintained exposure to ETH upside.

Example 4: Cautionary Tale - Yield Farming Gone Wrong

Profile: Aggressive yield chaser, insufficient research

Failed Strategy:

- Platform: New protocol offering 200% APY

- Pool: ETH/NewToken volatile pair

- Initial Investment: $10,000

- Expected APY: 200%

3-Month Results:

- Week 1-2: Position grew to $11,500 (+15%)

- Week 3: NewToken crashed 70%

- Week 4: IL risk realised: -45%

- Month 3: Protocol exploit, lost remaining funds

- Final Result: Total loss of $10,000

Lessons learnt:

- Unsustainable APYs are red flags

- New protocols need time to prove security

- Volatile pairs amplify liquidity risk

- Diversification limits single-protocol risk

- If staking offered 4%, chasing 200% wasn't worth the risk

Key Takeaways from Real Examples

- Risk-adjusted returns matter: Staking's 25% return with low risk often beats farming's 29% with high risk

- Time commitment counts: Farming requires active management; factor in your time value

- Hybrid strategies work: Combining both approaches balances risk and reward effectively

- Sustainable yields win: 4-8% sustainable beats 200% unsustainable every time

- Know your risk tolerance: Choose a strategy based on your comfort level, not maximum APY

Advanced Considerations for Portfolio optimisation

Risk-Adjusted Performance Metrics

When evaluating returns cultivation versus delegation approaches, sophisticated investors analyse risk-adjusted performance using metrics like Sharpe ratio, maximum drawdown, and volatility-adjusted earnings. These calculations help determine whether higher potential profits justify increased exposure to smart contract vulnerabilities, impermanent loss scenarios, and market manipulation risks inherent in decentralised finance ecosystems.

Tax Implications and Regulatory Considerations

Different jurisdictions treat returns cultivation and delegation activities with varying tax frameworks. Some countries classify delegation earnings as passive income subject to capital gains treatment, while returns cultivation activities may trigger more frequent taxable events due to automated compounding, liquidity provision adjustments, and governance asset distributions. Consult qualified tax professionals familiar with digital currency regulations in your jurisdiction.

Institutional vs Retail Approaches

Institutional investors often employ sophisticated hedging mechanisms, automated rebalancing algorithms, and professional custody solutions when engaging with decentralised finance protocols. Retail participants should consider their technical expertise, time commitment for active management, and access to advanced tools when choosing between delegation simplicity and returns cultivation complexity.

Future Evolution and Technological Developments

The landscape continues evolving with innovations like liquid delegation derivatives, cross-chain interoperability solutions, and automated optimisation strategies. Emerging technologies such as zero-knowledge proofs, layer-2 scaling solutions, and improved oracle networks may significantly alter risk-reward profiles for both delegation and returns cultivation methodologies in coming years.

Advanced optimisation Strategies and Professional Portfolio Management

Dynamic Allocation and Risk-Adjusted Returns

Professional cryptocurrency yield generation requires sophisticated allocation strategies that optimise between yield farming and staking based on market conditions, risk tolerance, and return objectives. Dynamic allocation includes systematic evaluation of risk-adjusted returns, comprehensive correlation analysis, and strategic timing of allocation adjustments that maximise portfolio performance while maintaining appropriate risk controls and operational efficiency for long-term wealth building through diversified yield generation strategies.

Risk-adjusted optimisation includes implementation of systematic rebalancing procedures, comprehensive performance tracking, and sophisticated decision-making frameworks that enable optimal allocation between yield farming and staking opportunities. Professional optimisation includes development of quantitative models, implementation of automated monitoring systems, and creation of comprehensive analytics platforms that provide actionable insights for continuous strategy improvement and performance enhancement through systematic yield generation optimisation and professional portfolio management excellence.

Technology Integration and Automation Excellence

Modern yield generation leverages advanced technology platforms, automated management systems, and sophisticated analytics tools that enhance operational efficiency whilstreducing manual oversight requirements and optimisation complexity. Technology integration includes utilisation of automated yield optimisation systems, implementation of comprehensive monitoring platforms, and deployment of intelligent decision support systems that maximise returns while maintaining security and operational reliability for professional yield generation management and strategic portfolio optimisation through systematic technology integration and operational excellence.

Strategic Implementation and Long-term Success

Successful yield generation requires systematic implementation combining market analysis, risk assessment, and performance optimisation to achieve sustainable returns while maintaining security standards. Professional implementation encompasses continuous strategy evaluation, adaptive allocation adjustments, and comprehensive risk management that ensures long-term success through disciplined investment practices and institutional-grade portfolio management designed for optimal yield generation performance and strategic wealth building excellence in the evolving cryptocurrency ecosystem.

Emerging Trends and Future Opportunities

The cryptocurrency yield generation landscape continues evolving with innovative developments including liquid staking derivatives, cross-chain yield optimisation protocols, and automated strategy management platforms. These emerging technologies enable sophisticated investors to access previously unavailable opportunities while maintaining operational simplicity and enhanced security through institutional-grade infrastructure and professional management services designed for optimal performance in dynamic market conditions.

Future developments include integration of artificial intelligence for predictive yield optimisation, implementation of advanced risk management algorithms, and deployment of sophisticated analytics platforms that provide comprehensive insights for strategic decision-making. These technological advances enable professional investors to achieve superior risk-adjusted returns through systematic optimisation and intelligent automation designed for long-term wealth building success in the evolving decentralised finance ecosystem.

Quantitative Analysis and Performance Metrics

Professional cryptocurrency yield generation employs sophisticated quantitative methodologies including Sharpe ratio calculations, maximum drawdown analysis, and volatility-adjusted return assessments. These mathematical frameworks enable precise evaluation of risk-adjusted performance across different yield generation strategies, providing objective criteria for strategic allocation decisions and portfolio optimisation initiatives that maximise returns while maintaining appropriate risk controls.

Advanced performance measurement incorporates correlation analysis between different yield sources, systematic evaluation of temporal performance patterns, and comprehensive assessment of market cycle impacts on yield generation effectiveness. Quantitative frameworks include implementation of Monte Carlo simulations, stress testing scenarios, and sensitivity analysis that provide robust foundations for strategic decision-making and long-term portfolio optimisation success.

Regulatory Compliance and Institutional Standards

Modern yield generation strategies must navigate complex regulatory environments while maintaining compliance with evolving cryptocurrency regulations and institutional governance requirements. Professional implementation includes comprehensive legal framework analysis, systematic compliance monitoring, and proactive adaptation to regulatory developments that ensure sustainable operations within established legal boundaries and institutional standards.

Compliance frameworks encompass anti-money laundering procedures, know-your-customer requirements, and comprehensive reporting standards that meet institutional expectations while maintaining operational efficiency. Professional yield generation includes implementation of audit trails, systematic documentation procedures, and comprehensive governance frameworks that ensure regulatory compliance and institutional-grade operational standards for sustainable long-term success.

Technical Infrastructure and Security Protocols

Blockchain validator nodes require specialised hardware configurations, redundant network connections, and continuous uptime monitoring to maintain network participation eligibility. Validator infrastructure includes enterprise-grade servers, backup power systems, and geographic distribution strategies that minimise slashing risks whilstmaximising delegation rewards through reliable network contribution and consensus participation excellence.

Liquidity provision mechanisms utilise automated market maker algorithms, concentrated liquidity ranges, and dynamic fee tier adjustments that optimise capital efficiency while minimising impermanent loss exposure. Technical implementation includes smart contract auditing, oracle price feed verification, and multi-signature wallet configurations that ensure secure asset custody and operational reliability for decentralised finance participation.

Cross-chain bridge protocols enable asset transfers between different blockchain networks through cryptographic proof systems, validator consensus mechanisms, and time-locked escrow contracts. Bridge security includes multi-party computation schemes, threshold signature protocols, and comprehensive monitoring systems that detect anomalous transaction patterns and prevent unauthorised asset movements across network boundaries.

Market Microstructure and Liquidity Dynamics

Automated market makers utilise constant product formulas (x*y=k), concentrated liquidity mathematics, and dynamic fee adjustments to optimise trading efficiency. Uniswap V3 positions require active management within specific price ranges, whilstCurve Finance employs StableSwap invariants for minimal slippage between correlated assets. Balancer pools support weighted distributions (80/20, 60/40) enabling customised exposure ratios.

Impermanent loss calculations demonstrate mathematical relationships between asset price divergence and liquidity provider returns. For 50/50 pools, 2x price movement results in 5.7% impermanent loss, whilst5x movement causes 25.5% loss. Concentrated positions amplify both fees and impermanent loss proportionally to range tightness and volatility exposure.

Validator economics involve slashing penalties (5% for downtime, 50% for equivocation), commission rates (0-100%), and delegation thresholds. Ethereum validators require 32 ETH minimum stake, whilstCosmos validators accept delegations from 1 ATOM. Solana validators need 1.1 SOL plus vote account rent exemption (0.02685 SOL).

Yield optimisation Algorithms and Automation

Yearn Finance vaults employ automated compounding strategies, rebalancing triggers, and gas optimisation techniques to maximise net returns. Harvest intervals depend on TVL thresholds, gas price conditions, and reward accumulation rates. Convex Finance boosts Curve rewards through vote-locked CRV (vlCRV) mechanisms, achieving 2.5x base rewards for maximum lockers.

Algorithmic stablecoins like Frax utilise fractional reserves, algorithmic monetary policy, and collateral ratios that adjust based on peg stability. Terra's UST employed mint/burn mechanisms with LUNA backing, whilstMakerDAO's DAI maintains overcollateralization through liquidation auctions and stability fees ranging from 0.5-8% annually depending on collateral type.

Conclusion

The choice between yield farming and staking in 2025 ultimately depends on your individual circumstances, risk tolerance, and investment objectives. Both strategies offer legitimate paths to generating passive income from cryptocurrency holdings, but they serve different investor profiles and market conditions.

Staking emerges as the clear winner for conservative investors seeking predictable returns with minimal complexity. With annual yields typically ranging from 4-12% and straightforward implementation through major exchanges or native wallets, staking provides an accessible entry point into cryptocurrency earning strategies. The lower risk profile, combined with the ability to contribute to network security, makes staking an attractive option for long-term holders and institutional investors.

Yield farming appeals to sophisticated investors willing to accept higher risks in exchange for potentially superior returns. The ability to earn 20-100%+ annually through liquidity provision and reward farming can significantly accelerate portfolio growth, but requires active management, technical knowledge, and constant monitoring of market conditions and protocol changes.

The hybrid approach represents the optimal strategy for many investors in 2025's mature cryptocurrency landscape. Allocating 60-80% of earning-focused assets to stable staking strategies while dedicating 20-40% to carefully selected yield farming opportunities can optimise risk-adjusted returns while maintaining portfolio stability.

Market evolution in 2025 has reduced many historical barriers to both strategies. Liquid staking derivatives have made staking more flexible, while improved DeFi protocols have reduced smart contract risks in yield farming. Regulatory clarity has also provided institutional investors with the confidence to participate in both markets, increasing liquidity and stability across the ecosystem.

Key success factors regardless of chosen strategy include: thorough due diligence on platforms and protocols, understanding of tax implications, appropriate position sizing, and regular portfolio rebalancing. Never invest more than you can afford to lose, and always prioritise security through proper wallet management and platform selection.

As the cryptocurrency ecosystem continues to mature, both staking and yield farming will likely become even more accessible and sophisticated. The investors who succeed will be those who understand the fundamental differences between these strategies and align their choices with their personal financial goals and risk management frameworks.

Sources & References

- Ethereum.org - Staking Documentation - Official Ethereum staking guide and technical specifications

- DeFiLlama - DeFi TVL and Yield Data - Real-time DeFi protocol analytics and farming metrics

- CoinDesk - Yield Farming Explained - Comprehensive educational resource on farming strategies

Frequently Asked Questions

- What is the main difference between staking and farming?

- Staking involves locking tokens to secure a proof-of-stake network and earn protocol rewards, while farming provides liquidity to DeFi protocols, earning trading fees and token incentives. Staking is generally simpler and carries lower risk, while farming offers higher potential returns but comes with increased complexity.

- Which approach is better for beginners?

- Staking is generally better for beginners due to its simplicity and lower risk profile. Start with significant assets through reputable platforms before exploring farming strategies.

- Can I combine staking and farming?

- Yes, many investors use a hybrid approach: staking a core position for stable returns while allocating a smaller portion to farming for higher potential returns.

- Which strategy offers higher returns?

- Farming can offer higher returns during favourable market conditions, but staking provides more predictable and sustainable returns over time. The best choice depends on your risk tolerance and the time commitment you are willing to make.

- How are staking and farming rewards taxed?

- Both are generally considered taxable income when received. Farming may be more complex due to multiple token rewards and the calculation of impermanent loss. Consult a tax professional for specific guidance.

- How much capital do I need to start?

- Staking can start with any amount on most platforms. Farming typically requires more capital due to gas fees - consider starting with at least $1,000 to make fees economically viable.

- How much time do I need to dedicate?

- Staking requires minimal time after initial setup - just periodic monitoring. Farming requires daily monitoring and regular strategy adjustments, making it much more time-intensive.

- Which is more secure?

- Staking is generally more secure due to fewer smart contract interactions and simpler mechanics. Farming involves multiple protocols and complex interactions, increasing potential attack vectors.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.