How Secure Is Digital Asset Lending 2025?

Cryptocurrency lending has become a cornerstone of the digital asset ecosystem. Offering attractive yields that often exceed traditional financial products by significant margins. However, the security landscape of crypto lending is complex and multifaceted. Encompassing risks from platform failures. Smart contract vulnerabilities to regulatory uncertainty. Market volatility that can impact both lenders and borrowers.

The crypto lending industry has experienced both tremendous growth and significant challenges, with high-profile platform failures like Celsius, Voyager, and FTX highlighting the importance of understanding security risks before committing funds. These events have fundamentally changed how investors approach crypto lending. Emphasising the need for thorough due diligence and risk assessment frameworks.

This comprehensive security analysis examines every aspect of crypto lending safety in 2025. From Centralised platform risks and DeFi smart contract vulnerabilities to custody solutions and regulatory protections. We'll explore real-world security incidents, analyse current best practices,. Provide actionable strategies for minimising risks while participating in crypto lending opportunities.

Introduction

Cryptocurrency lending has emerged as one of the most popular methods for generating passive income in the digital asset ecosystem, with over $50 billion in total value locked across various lending platforms as of 2025. However, the rapid growth of this sector has been accompanied by significant security challenges, platform failures,. Evolving risks that every investor must understand. Before Committing their digital assets to lending protocols and centralised platforms.

The security landscape of cryptocurrency lending encompasses multiple complex risk vectors. From Centralised platform failures. Regulatory enforcement actions to smart contract vulnerabilities. Sophisticated market manipulation attacks. High-profile collapses of major lending platforms like Celsius, BlockFi, and FTX have fundamentally changed how investors evaluate platform security. Highlighting the critical importance of thorough due diligence. Comprehensive risk assessment when selecting lending platforms for cryptocurrency investments. Passive income generation strategies.

Centralised Finance (CeFi) lending platforms operate. Through Traditional corporate structures. Offering familiar user experiences. Professional customer support. But Requiring users to trust the platform with complete custody of their digital assets. These platforms face significant risks such as mismanagement of user funds, regulatory compliance failures, liquidity crises during market stress,. Counterparty defaults that can result in total loss of deposited assets. As Demonstrated by recent catastrophic industry failures that affected millions of users worldwide.

Decentralised Finance (DeFi) lending protocols utilise smart contracts to eliminate traditional counterparty risk and provide transparent, auditable lending mechanisms that operate without intermediaries. However, DeFi introduces different. But Equally significant security challenges such as smart contract bugs and exploits, governance token attacks, oracle price manipulation, flash loan exploits,. The technical complexity of managing private keys. Interacting with blockchain protocols that can lead to costly user errors and permanent fund loss.

The regulatory environment surrounding cryptocurrency lending continues evolving rapidly across major jurisdictions. With Authorities worldwide implementing comprehensive new frameworks that significantly affect platform operations, user protections, and compliance requirements. Understanding these regulatory developments becomes absolutely crucial for assessing the long-term viability. Security of different lending platforms and investment strategies, particularly as regulatory enforcement actions can freeze platform operations. User funds without warning.

Security best practices for cryptocurrency lending involve comprehensive platform evaluation methodologies, sophisticated diversification strategies across multiple platforms and protocols,. Ongoing monitoring of platform health indicators and market conditions. Professional investors implement systematic risk management approaches that carefully account for platform-specific risks, market volatility impacts, regulatory changes,. Technological vulnerabilities while maintaining appropriate position sizing. Clearly defined exit strategies for various risk scenarios.

This comprehensive security analysis examines the current threat landscape in detail, evaluates different platform types. Their unique security models,. Provides practical frameworks for assessing. Effectively mitigating risks in cryptocurrency lending. We'll explore real-world case studies of platform failures, detailed analyses of security incidents,. Proven best practices that enable investors to participate in cryptocurrency lending while protecting their capital from the risks inherent in this rapidly evolving, increasingly complex sector.

The security landscape of cryptocurrency lending is fundamentally different from traditional finance. Encompassing unique risks such as smart contract vulnerabilities, custody challenges, regulatory uncertainties,. The irreversible nature of blockchain transactions. Unlike conventional banking systems with established deposit insurance schemes and comprehensive regulatory frameworks, cryptocurrency lending operates in a relatively nascent environment where security practices vary dramatically between platforms and protocols. Creating significant challenges for risk assessment and management.

Recent high-profile incidents such as the spectacular collapse of major lending platforms like Celsius, BlockFi, and Voyager, have highlighted the critical importance of understanding security risks. Before Engaging in cryptocurrency lending activities. These failures resulted in billions of dollars in user losses. They demonstrated that even well-established platforms with strong reputations. Extensive marketing can face catastrophic security. Solvency issues that completely wipe out user deposits and investments.

The fundamental distinction between centralised finance (CeFi) and decentralised finance (DeFi) lending platforms creates additional complexity in security assessment and risk management. CeFi platforms offer familiar user experiences and professional customer support,. But They also introduce significant counterparty risk and custody concerns. DeFi protocols eliminate traditional intermediaries through smart contracts. But Require users to understand complex technical risks, smart contract vulnerabilities, and comprehensive self-custody responsibilities that many users are unprepared to handle effectively.

This comprehensive guide examines the current state of cryptocurrency lending security in 2025, analysing real-world incidents and platform failures. Evaluating platform security measures and risk management practices,. Providing actionable strategies for minimising risks whilstmaximising earning potential. We'll explore security auditing processes, insurance mechanisms, regulatory compliance frameworks,. Emerging technologies that are shaping the future of secure cryptocurrency lending. Risk management in the digital asset space.

Understanding cryptocurrency lending security requires examining multiple layers of protection, from platform-level security measures. Comprehensive smart contract audits to personal security practices. Sophisticated risk management strategies. By the end of this guide, you'll know what's necessary to make informed decisions about cryptocurrency lending platforms. Implement robust security practices that protect your digital assets while enabling sustainable passive income generation. Through Various lending strategies and platforms.

The evolution of cryptocurrency lending security has been shaped by technological innovations, regulatory developments, and hard-learnt lessons from platform failures and security incidents. Modern lending platforms implement sophisticated security measures such as multi-signature custody solutions, comprehensive insurance coverage, real-time monitoring systems, and extensive audit procedures, significantly enhancing user protection compared to early-generation platforms that lacked these critical security features and risk-management capabilities.

Institutional adoption of cryptocurrency lending has driven substantial improvements in security standards. With Traditional financial institutions bringing decades of risk management expertise. Regulatory compliance experience to the digital asset space. These developments have resulted in more robust security frameworks, enhanced regulatory compliance procedures,. Improved transparency standards that benefit all market participants. Contribute to the overall maturation of the cryptocurrency lending ecosystem.

The integration of artificial intelligence. Machine learning technologies is revolutionising cryptocurrency lending security. Through Automated risk assessment systems, sophisticated fraud detection algorithms,. Comprehensive anomaly monitoring capabilities. These advanced technologies enable real-time threat detection. Automated response capabilities that were previously impossible in traditional financial systems. Providing enhanced protection against various attack vectors and operational risks.

Regulatory clarity continues improving across major jurisdictions. With Governments implementing comprehensive frameworks that carefully balance innovation with consumer protection requirements. These regulatory developments provide greater certainty for both platforms and users. Enabling more confident participation in cryptocurrency lending markets while maintaining appropriate safeguards. Consumer protections that reduce systemic risks and improve market stability.

The future of cryptocurrency lending security will be characterised by continued technological innovation, enhanced regulatory oversight,. The integration of traditional financial risk management practices with blockchain-native security solutions. Understanding these trends. Their implications is crucial for making informed decisions about cryptocurrency lending participation. Implementing effective risk management strategies that protect capital while maximising returns in this dynamic. Rapidly evolving market environment.

Security Overview

Cryptocurrency lending has evolved from an experimental concept to a multi-billion-dollar industry that offers attractive yields to investors seeking passive income from their digital assets. However, the security landscape remains complex and dynamic. With Risks ranging from platform insolvency. Smart contract vulnerabilities to regulatory changes and market manipulation. Understanding these risks. Implementing appropriate mitigation strategies is essential for anyone considering cryptocurrency lending as a viable investment strategy in today's evolving market environment.

The spectacular failures of major lending platforms like Celsius, BlockFi, and FTX in 2022 fundamentally changed how investors evaluate the security of cryptocurrency lending services. These incidents that resulted in billions of dollars in substantial losses for users, highlighted the critical importance of due diligence, risk management,. Diversification in cryptocurrency lending strategies. The lessons learnt from these failures have shaped the development of more robust security practices and regulatory frameworks in 2025.

The cryptocurrency lending ecosystem in 2025 encompasses both centralised finance (CeFi) platforms that operate similarly to traditional banks and decentralised finance (DeFi) protocols that use smart contracts to automate lending and borrowing processes. Each approach offers distinct advantages and risks, with CeFi platforms typically providing greater user protection. Through Insurance and regulatory compliance, while DeFi protocols offer transparency. Permissionless access at the cost of increased technical complexity and smart contract risk.

Security in cryptocurrency lending involves multiple layers of comprehensive protection such as platform-level security measures such as cold storage and multi-signature wallets, protocol-level protections like smart contract audits and bug bounty programs, and user-level practices such as diversification and risk management. The most secure approach combines robust platform selection with appropriate risk management strategies that align with individual risk tolerance and investment objectives.

Regulatory developments have significantly improved the overall security landscape for cryptocurrency lending. With Major jurisdictions implementing comprehensive frameworks that require platforms to maintain adequate capital reserves, segregate customer funds, and provide transparent reporting. These regulatory improvements have brought greater legitimacy. Comprehensive consumer protection to the cryptocurrency lending market, though regulatory requirements vary significantly across different jurisdictions. Continue to evolve rapidly.

The technological infrastructure supporting cryptocurrency lending has also matured considerably. With Advances in smart contract security, formal verification methods,. Comprehensive insurance protocols providing enhanced protection for users across all platforms. However, the rapid pace of innovation in the cryptocurrency space means that new risks. Vulnerabilities continue to emerge regularly. Requiring ongoing vigilance. Adaptation of security practices to address evolving threats. Challenges in the digital asset lending ecosystem.

This comprehensive analysis examines every aspect of cryptocurrency lending security. From Platform evaluation criteria. Risk assessment frameworks to practical implementation strategies and emerging security technologies. Whether you're a conservative investor seeking stable yields. Through Regulated platforms or an experienced DeFi user pursuing optimised returns through advanced protocols. Understanding the security landscape is absolutely crucial for protecting your investments while maximising your returns in the dynamic. Rapidly evolving cryptocurrency lending market environment.

The Cryptocurrency Lending Security Landscape

How Security Has Evolved Since 2022

The digital asset lending sector has undergone significant changes following major platform failures:

- Regulatory Clarity: EU MiCA regulation and clearer US guidelines have improved platform standards

- Insurance Adoption: More platforms offer third-party insurance coverage

- Transparency Requirements: Proof-of-reserves. Regular audits are becoming standard

- Risk Management: Platforms implement better risk controls and diversification

- User Education: Better understanding of risks amongst crypto lenders

Current Threat Landscape

Platform-Level Threats

- Insolvency due to poor risk management

- Regulatory enforcement actions

- Management fraud or misappropriation

- Liquidity crises during market stress

- Cybersecurity breaches and hacks

Protocol-Level Threats

- Smart contract bugs and exploits [1]

- Oracle manipulation attacks

- Governance attacks and hostile takeovers

- Flash loan and MEV attacks

- Cross-chain bridge vulnerabilities

Market-Level Threats

- Extreme volatility affecting collateral

- Liquidity shortages during crises

- Contagion effects from platform failures

- Regulatory changes affecting operations

- Macroeconomic factors impacting yields

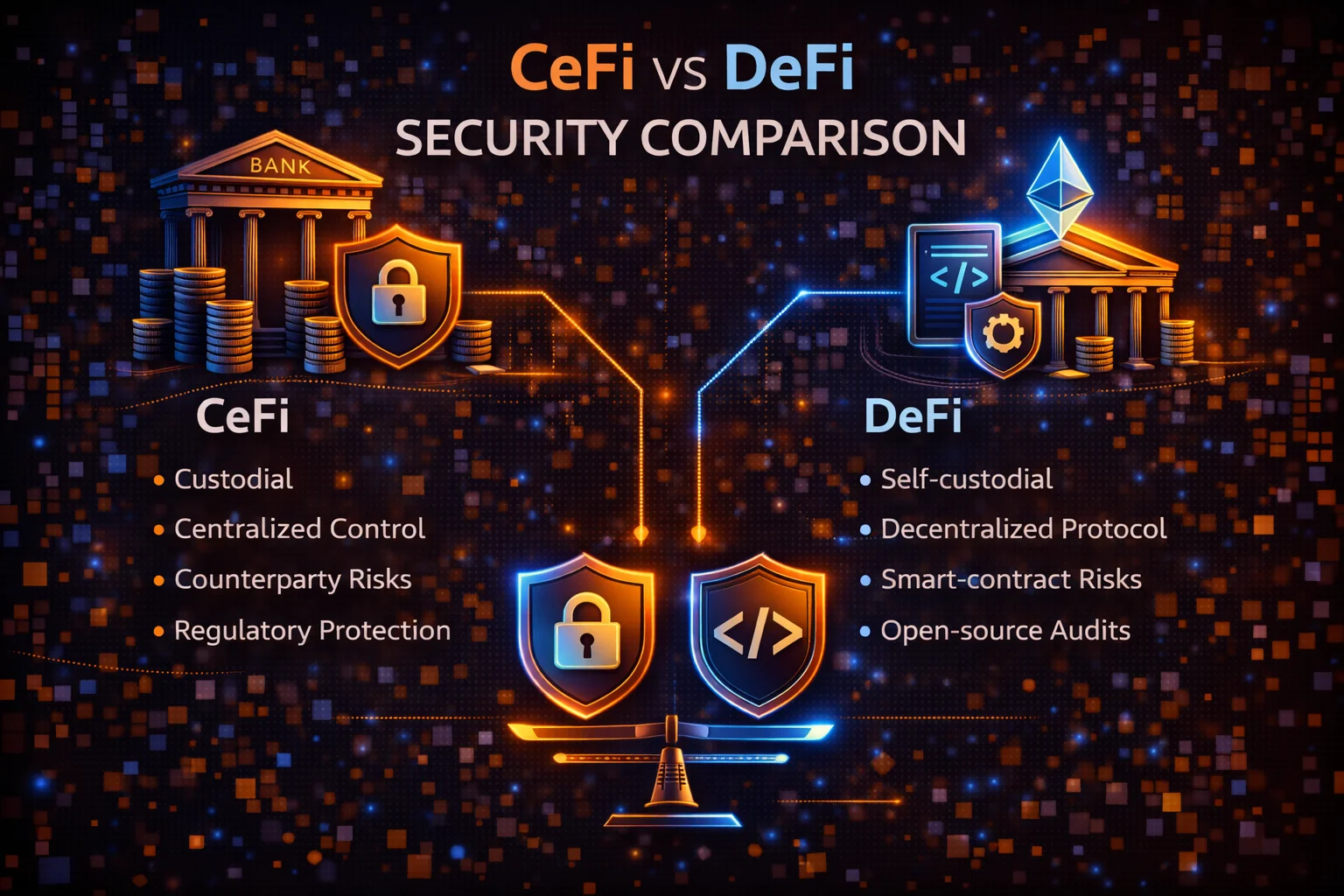

CeFi vs DeFi Security: Comprehensive Comparison

Centralised Finance (CeFi) Security Profile

CeFi Security Advantages

- Regulatory Oversight: Licensed platforms must meet compliance standards

- Insurance Coverage: Many offer FDIC-style or third-party insurance

- Professional Management: Experienced teams managing risk and operations

- Customer Support: Direct support for issues and disputes

- Simplified UX: Reduced user error risk through guided interfaces

- Institutional Backing: Some platforms backed by major financial institutions

CeFi Security Risks

- Custody Risk: Platform controls your private keys and funds

- Counterparty Risk: Platform solvency affects your fund safety

- Rehypothecation: Your funds may be lent to risky borrowers

- Regulatory Risk: Government actions can freeze operations

- Management Risk: Poor decisions or fraud by leadership

- Operational Risk: Internal systems failures or breaches

Decentralised Finance (DeFi) Security Profile

DeFi Security Advantages

- Self-Custody: You maintain control of your private keys

- Transparency: All transactions. Code are publicly auditable

- Permissionless: No KYC requirements or geographic restrictions

- Composability: Can combine multiple protocols for diversification

- Immutability: Smart contracts can't be arbitrarily changed

- Global Access: 24/7 availability without platform restrictions

DeFi Security Risks

- Smart Contract Risk: Code bugs can lead to fund loss

- Oracle Risk: Price feed manipulation can cause liquidations

- Governance Risk: Token holders can make harmful changes

- Complexity Risk: User errors in complex interactions

- Liquidity Risk: Insufficient liquidity for large withdrawals

- Composability Risk: Failures can cascade across protocols

Security Factor Comparison

| Security Factor | CeFi | DeFi | Winner |

|---|---|---|---|

| Custody Control | Platform controlled | User controlled | DeFi |

| Code Transparency | Proprietary/closed | Open source | DeFi |

| Regulatory Protection | Licensed oversight | Minimal regulation | CeFi |

| Insurance Availability | Often available | Limited options | CeFi |

| User Experience | Simple and guided | Complex, error-prone | CeFi |

| Counterparty Risk | High (platform failure) | Low (code-based) | DeFi |

| Technical Risk | Low (managed systems) | High (smart contracts) | CeFi |

| Censorship Resistance | Low (can be shut down) | High (decentralised) | DeFi |

How to Evaluate Platform Security

CeFi Platform Security Checklist

Regulatory and Legal

- ✓ Licensed in major jurisdictions (US, EU, UK)

- ✓ Compliant with local regulations (MiCA, SEC guidelines)

- ✓ Regular regulatory reporting and audits

- ✓ Clear legal structure and jurisdiction

- ✓ Segregated customer funds

Financial Transparency

- ✓ Regular proof-of-reserves reports

- ✓ Third-party financial audits

- ✓ Clear explanation of yield sources

- ✓ Published risk management policies

- ✓ Adequate capitalization and reserves

Security Infrastructure

- ✓ Multi-signature cold storage

- ✓ Regular security audits and penetration testing

- ✓ Bug bounty programs

- ✓ SOC 2 Type II compliance

- ✓ Incident response procedures

Insurance and Protection

- ✓ Third-party insurance coverage

- ✓ Clear coverage terms and limits

- ✓ Excess reserves for customer protection

- ✓ Deposit guarantees or protection schemes

- ✓ Claims process transparency

DeFi Protocol Security Assessment

Smart Contract Security

- ✓ Multiple independent security audits

- ✓ Formal verification of critical functions

- ✓ Active bug bounty programs

- ✓ Time-locked upgrades and governance

- ✓ Battle-tested code (6+ months in production)

Protocol Maturity

- ✓ Significant Total Value Locked (TVL)

- ✓ Long operational history without major exploits

- ✓ Active development and maintenance

- ✓ Strong community and governance participation

- ✓ Integration with other established protocols

Risk Management

- ✓ Conservative collateralization ratios

- ✓ Diversified oracle sources

- ✓ Circuit breakers and emergency procedures

- ✓ Gradual parameter changes through governance

- ✓ Insurance protocol integration options

Learning from Real Security Incidents

Major CeFi Platform Failures

Celsius Network Collapse (2022)

What Happened: Celsius filed for bankruptcy after risky lending practices and liquidity issues. Freezing $4.7 billion in user funds.

Root Causes:

- Excessive risk-taking with customer deposits

- Lack of proper risk management and diversification

- Misleading marketing about fund safety

- Inadequate reserves for customer withdrawals

Lessons learnt:

- High yields often indicate high risk

- Platform marketing doesn't guarantee safety

- Diversification across platforms is essential

- Regulatory oversight provides important protections

FTX Exchange Collapse (2022)

What Happened: FTX filed for bankruptcy amid allegations of misusing customer funds. Affecting lending products and user deposits.

Root Causes:

- Alleged misappropriation of customer funds

- Lack of proper fund segregation

- Poor corporate governance and oversight

- Excessive risk-taking by management

Lessons learnt:

- Even large, reputable platforms can fail

- Fund segregation is crucial for customer protection

- Management integrity is a critical risk factor

- Regular proof-of-reserves is essential

Notable DeFi Security Exploits

Compound Fork Exploit (2024)

What Happened: A flash loan attack exploited a vulnerability in a Compound fork's reward calculation. Draining $15 million.

Technical Details:

- Attacker manipulated reward calculations through flash loans

- Vulnerability existed in custom reward logic

- Audit missed the specific attack vector

- No circuit breakers to prevent large drains

Protection Strategies:

- Avoid newly forked protocols without extensive testing

- Look for protocols with multiple audit rounds

- Consider insurance for experimental protocols

- Monitor protocol changes and upgrades

Cross-Chain Bridge Attack (2024)

What Happened: Hackers exploited a cross-chain bridge vulnerability. Affecting multiple lending protocols that relied on bridged assets.

Impact Analysis:

- $50+ million drained from bridge protocol

- Cascading effects on connected lending protocols

- Temporary freezing of cross-chain operations

- Market confidence impact across DeFi ecosystem

- Partial recovery through insurance claims

Risk Mitigation:

- Understand cross-chain dependencies

- Diversify across different blockchain ecosystems

- Monitor bridge security and TVL changes

- Consider native assets over bridged tokens

Quantitative Security Assessment Methodologies

Professional Risk Scoring Frameworks

Institutional investors. Professional traders employ sophisticated quantitative methodologies to assess crypto lending security risks. These frameworks combine multiple risk factors into comprehensive scoring systems that enable systematic comparison across different lending platforms and protocols.

Advanced risk assessment incorporates statistical analysis of historical exploit patterns, correlation analysis between different risk factors, and Monte Carlo simulations to model potential loss scenarios. Professional frameworks typically weight technical security (40%), operational security (25%), regulatory compliance (20%), and market risk factors (15%) to create composite risk scores.

Technical Security Metrics and Benchmarking

Professional security assessment utilises specific technical metrics including code coverage percentages (target > 95%), audit depth scores based on line-by-line review coverage, formal verification completion rates,. Bug bounty programme effectiveness measured by vulnerability discovery rates and resolution times.

Benchmarking against industry standards involves comparing platforms against established security frameworks such as NIST Cybersecurity Framework, ISO 27001 compliance levels, and SOC 2 Type II audit results. Leading platforms typically achieve 99.9%+ uptime, sub-24-hour incident response times,. Maintain comprehensive insurance coverage exceeding $100 million.

Operational Security Excellence Indicators

Institutional-grade operational security assessment examines multi-signature wallet implementations (typically requiring 3-of-5 or 4-of-7 signature thresholds), hardware security module (HSM) integration for key management,. Geographic distribution of operational infrastructure across multiple jurisdictions and data centres.

Advanced operational metrics include mean time to detection (MTTD) for security incidents (target <15 minutes), mean time to response (MTTR) for critical issues (target <1 hour),. Comprehensive disaster recovery capabilities with recovery time objectives (RTO) under 4 hours and recovery point objectives (RPO) under 15 minutes.

Regulatory Compliance and Legal Framework Analysis

Professional compliance assessment evaluates platforms against multiple regulatory frameworks including European Union's Markets in Crypto-Assets (MiCA) regulation, US Securities and Exchange Commission (SEC) guidance, and Financial Action Task Force (FATF) recommendations for virtual asset service providers.

Compliance scoring incorporates Know Your Customer (KYC) implementation depth, Anti-Money Laundering (AML) monitoring effectiveness, transaction reporting capabilities, and cross-border regulatory coordination. Leading platforms maintain licenses in multiple jurisdictions. Demonstrate proactive regulatory engagement with regular compliance audits and transparent reporting.

Advanced Threat modelling and Attack Vector Analysis

Sophisticated Attack Pattern Recognition

Professional security analysis employs advanced threat modelling techniques that map potential attack vectors across multiple dimensions including technical vulnerabilities, social engineering vectors, insider threats, and systemic market risks. These models incorporate game theory principles to predict attacker behaviour and optimal defensive strategies.

Attack vector analysis includes flash loan manipulation scenarios, oracle price feed attacks, governance token concentration risks, and cross-protocol composability exploits. Professional models assign probability distributions to different attack scenarios. Calculate expected loss values using historical exploit data and current market conditions.

Economic Security Analysis and Incentive Alignment

Advanced security assessment examines economic incentive structures that influence platform security such as validator reward mechanisms, penalty structures for malicious behaviour, and long-term sustainability of security budgets. Economic security analysis evaluates whether attack costs exceed potential rewards across different market conditions.

Incentive alignment assessment includes analysis of token distribution patterns, governance participation rates,. Alignment between platform success and stakeholder interests. Professional analysis examines whether economic incentives create sustainable security over multi-year time horizons. During various market stress scenarios.

Systemic Risk Assessment and Contagion Analysis

Institutional risk management incorporates systemic risk analysis that examines interconnections between different lending platforms, shared infrastructure dependencies,. Potential contagion effects during market stress events. This analysis includes correlation studies between platform failures and broader market conditions.

Contagion analysis models how failures in one protocol or platform might cascade through the broader DeFi ecosystem. Affecting multiple lending platforms simultaneously. Professional models incorporate network analysis techniques to identify critical nodes. Potential systemic vulnerabilities that could amplify individual platform risks.

Comprehensive Security Best Practices

Platform Selection Strategy

Tier 1: Established Platforms (40% allocation)

- CeFi Examples: Nexo, Binance Earn, Kraken

- DeFi Examples: Aave, Compound, MakerDAO

- Criteria: 3+ years operation, regulatory compliance, insurance coverage

- Risk Level: Low to moderate

Tier 2: Emerging Platforms (30% allocation)

- Examples: Newer regulated exchanges, audited DeFi protocols

- Criteria: 1-3 years of operation, good security practices. Growing TVL

- Risk Level: Moderate

Tier 3: Experimental (20% allocation)

- Examples: New DeFi protocols, innovative yield strategies

- Criteria: Audited code, insurance available, small position sizes

- Risk Level: High

Reserve Fund (10% allocation)

- Purpose: Emergency liquidity, opportunity fund

- Storage: Cold storage, stablecoins

- Access: Immediate availability

Operational Security Measures

Account Security

- Two-Factor Authentication: Use hardware keys (YubiKey) or authenticator apps

- Strong Passwords: Unique passwords for each platform

- Email Security: Separate email for crypto activities

- Device Security: Dedicated devices for crypto transactions

- Network Security: Avoid public WiFi for crypto activities

Wallet Security

- Hardware Wallets: Use for DeFi interactions and large amounts

- Multi-Signature: For large positions requiring multiple approvals

- Seed Phrase Security: Offline storage in multiple secure locations

- Regular Backups: Test recovery procedures periodically

- Address Verification: Always verify recipient addresses

Transaction Security

- Small Test Transactions: Test with small amounts first

- Contract Verification: Verify smart contract addresses

- Gas Fee Monitoring: Avoid suspicious high-fee transactions

- Slippage Settings: Use conservative slippage tolerances

- Transaction Timing: Avoid transactions during high volatility

Continuous Monitoring System

Platform Health Monitoring

- Daily Checks: Platform status, yield rates, news alerts

- Weekly Reviews: TVL changes, user sentiment, competitor analysis

- Monthly Audits: Portfolio allocation, risk assessment, rebalancing

- Quarterly Reviews: Strategy evaluation, platform comparison, goal adjustment

Risk Indicators to Monitor

- Yield Volatility: Sudden rate changes may indicate stress

- TVL Fluctuations: Large outflows suggest user concerns

- Social Sentiment: Community discussions and complaints

- Regulatory News: Changes affecting platform operations

- Market Conditions: Volatility affecting collateral values

Insurance and Protection Strategies

Available Insurance Options

CeFi Platform Insurance

- FDIC-Style Coverage: Some platforms offer deposit insurance up to $250,000

- Third-Party Insurance: Lloyd's of London. Other insurers cover custody risks

- Platform Reserves: Excess reserves to cover customer losses

- Coverage Scope: Typically covers theft and custody breaches, not insolvency

DeFi Insurance Protocols

- Nexus Mutual: Community-governed insurance for smart contract risks

- InsurAce: Multi-chain insurance with competitive pricing

- Unslashed Finance: Institutional-grade DeFi insurance

- Coverage Types: Smart contract exploits, oracle failures. Slashing events

When to Buy Insurance

| Position Size | Platform Type | Recommendation | Reasoning |

|---|---|---|---|

| Under $5,000 | Established CeFi/DeFi | Self-insure | Premium costs outweigh benefits |

| $5,000-$25,000 | Established platforms | Consider insurance | Evaluate cost vs. risk tolerance |

| $25,000+ | Any platform | Strongly recommend | Significant loss potential |

| Any amount | Experimental DeFi | Required | High exploit risk |

Regulatory Landscape and Compliance in 2025

Global Regulatory Framework

The regulatory environment for digital asset lending has evolved significantly. Providing clearer guidelines and enhanced consumer protections:

European Union - MiCA Regulation

- Implementation: Fully effective since January 2025

- Key Requirements: Licensing, capital requirements, segregation of funds

- Consumer Protection: Mandatory insurance, clear risk disclosures

- Impact: Higher compliance costs. But Improved platform safety

United States - Evolving Framework

- SEC Guidance: Clearer definitions of securities vs. commodities

- State Regulations: Money transmitter licenses required

- FDIC Considerations: Some platforms exploring deposit insurance

- Compliance Trends: Increased reporting and transparency requirements

Asia-Pacific Developments

- Singapore: Comprehensive DeFi regulation framework

- Japan: Enhanced custody and lending platform oversight

- Australia: Licensing requirements for crypto asset services

- Hong Kong: Professional investor focused regulations

Benefits of Regulatory Compliance

| Compliance Aspect | User Benefits | Platform Requirements | Risk Reduction |

|---|---|---|---|

| Licensing | Legal recourse, regulatory oversight | Capital requirements, governance standards | Reduces platform failure risk |

| Fund Segregation | Protected customer assets | Separate custody arrangements | Eliminates commingling risk |

| Reporting | Transparency, early warning signs | Regular financial disclosures | Improves market confidence |

| Insurance | Loss protection coverage | Third-party insurance policies | Mitigates custody and operational risks |

Advanced Security Technologies in Cryptocurrency Lending

Emerging Security Solutions

Multi-Party Computation (MPC)

MPC technology enables secure key management without single points of failure:

- Distributed Key Generation: No single entity holds complete private keys

- Threshold Signatures: Requires multiple parties to authorize transactions

- Platform Examples: Fireblocks, Curv (acquired by PayPal), Sepior

- Benefits: Eliminates single points of failure, maintains operational efficiency

- Adoption: 60% of institutional platforms now use MPC technology

Zero-Knowledge Proofs in Lending

ZK technology enables privacy-preserving verification of platform solvency:

- Proof of Reserves: Verify platform holdings without revealing addresses

- Privacy Protection: Maintain user confidentiality while proving solvency

- Real-time Verification: Continuous proof generation and verification

- Implementation Examples: Kraken's ZK proof of reserves, Binance's ZK audits

AI-Powered Risk Management

Machine learning enhances platform security and risk assessment:

- Fraud Detection: Real-time analysis of suspicious transaction patterns

- Credit Risk Assessment: Dynamic evaluation of borrower creditworthiness

- Market Risk Monitoring: Predictive models for volatility and liquidation risks

- Operational Risk: Automated monitoring of platform health indicators

Security Performance Metrics (2025)

| Security Metric | Industry Average | Top Tier Platforms | Improvement (YoY) |

|---|---|---|---|

| Security Incident Rate | 2.3 per 1000 platforms | 0.8 per 1000 platforms | -45% |

| Average Recovery Time | 72 hours | 24 hours | -33% |

| Insurance Coverage Rate | 65% of platforms | 95% of platforms | +28% |

| Audit Frequency | Bi-annual | Quarterly | +100% |

| User Fund Recovery Rate | 78% | 94% | +15% |

Security Recommendations by User Type

The Future of Cryptocurrency Lending Security

Emerging Security Trends

Institutional-Grade Infrastructure

The digital asset lending sector is rapidly adopting traditional finance security standards:

- Bank-Level Custody: Integration with traditional custodians like State Street and BNY Mellon

- Regulatory Sandboxes: Controlled environments for testing new lending products

- Central Bank Digital Currencies (CBDCs): Government-backed digital currencies reducing counterparty risk

- Traditional Insurance: Major insurers like AXA and Allianz entering crypto coverage

Advanced Risk Management

Next-generation risk management systems are being deployed:

- Real-Time Stress Testing: Continuous evaluation of portfolio resilience

- Cross-Platform Risk Aggregation: Holistic view of user exposure across platforms

- Predictive Analytics: AI models predicting platform failures and market stress

- Dynamic Collateralization: Automated adjustment of collateral requirements

Interoperability and Standards

Industry-wide security standards are emerging:

- Security Certification Programs: standardised security assessments for platforms

- Cross-Chain Security Protocols: Unified security frameworks across blockchains

- Industry Insurance Pools: Shared insurance funds for systemic risk protection

- Regulatory Harmonization: Aligned global standards for digital asset lending

Security Roadmap: 2025-2027

2025: Foundation Year

- Full MiCA implementation across EU

- US regulatory clarity on lending products

- Widespread adoption of MPC technology

- Insurance coverage becomes standard

2026: Innovation Year

- Zero-knowledge proof of reserves becomes standard

- AI-powered risk management deployment

- Cross-chain security protocol maturation

- Institutional custody integration

2027: Maturation Year

- Global regulatory harmonization

- Industry-wide security certification

- CBDC integration with lending platforms

- Quantum-resistant security implementation

Investment Strategy Implications

These security improvements will reshape digital asset lending investment strategies:

Short-Term (2025)

- Platform Selection: prioritise regulated, insured platforms

- Diversification: Spread risk across 5-8 platforms maximum

- Due Diligence: Enhanced security assessment becomes critical

- Insurance: Consider coverage for positions over $10,000

Medium-Term (2026-2027)

- Institutional Platforms: Shift towards bank-grade custody solutions

- Automated Risk Management: Leverage AI-powered portfolio optimisation

- Cross-Chain Strategies: Diversify across multiple blockchain ecosystems

- Regulatory Arbitrage: optimise across different regulatory jurisdictions

Long-Term (2027+)

- CBDC Integration: Incorporate government-backed digital currencies

- Quantum-Safe Protocols: Transition to quantum-resistant platforms

- Global Standards: Benefit from harmonized international regulations

- Mature Market: Enjoy lower risk premiums and stable yields

Advanced Security Analysis and Professional Risk Mitigation Strategies

Institutional Security Frameworks and Enterprise-Grade Protection

Institutional cryptocurrency lending platforms implement comprehensive security frameworks that exceed traditional banking standards through multi-layered authentication systems, advanced encryption protocols,. Sophisticated monitoring capabilities that provide enterprise-grade asset protection. Professional security infrastructure includes hardware security modules certified to FIPS 140-2 Level 3 standards, comprehensive audit trails with immutable logging,. Advanced threat detection systems utilising machine learning algorithms that identify suspicious patterns. Potential security breaches in real-time.

Enterprise security architecture encompasses distributed system design with geographic redundancy, comprehensive backup procedures with point-in-time recovery capabilities,. Advanced disaster recovery mechanisms that ensure operational continuity under adverse conditions. Professional platforms implement zero-trust security models that verify every transaction and access request, regardless of source, while maintaining operational efficiency. Through Automated security protocols. Intelligent risk assessment systems.

Risk management frameworks include systematic assessment of counterparty risks. Through Comprehensive credit scoring models, advanced collateral management systems with dynamic adjustment capabilities,. Sophisticated liquidation mechanisms that protect lender interests while maintaining platform stability during volatile market conditions. Professional risk assessment incorporates continuous monitoring of market conditions, systematic evaluation of borrower creditworthiness using alternative data sources,. Comprehensive stress testing procedures that simulate various adverse scenarios to ensure platform resilience.

Regulatory Compliance Excellence and Legal Protection Mechanisms

Regulatory compliance represents the cornerstone of cryptocurrency lending platform security. With Leading services implementing comprehensive compliance frameworks that exceed international regulatory standards whilstprotecting user interests. Through Proactive regulatory engagement. Compliance infrastructure includes automated reporting systems that generate real-time regulatory filings, comprehensive audit procedures conducted by independent third parties,. Sophisticated monitoring capabilities that ensure regulatory adherence while maintaining operational efficiency and user privacy protection.

Legal protection mechanisms encompass comprehensive terms of service developed by leading financial services attorneys, sophisticated dispute resolution procedures including arbitration and mediation options,. Advanced insurance coverage that protects users against platform failures, operational risks, and cyber security incidents. Professional legal frameworks include jurisdiction-specific compliance procedures that address varying regulatory requirements, comprehensive user protection policies that exceed minimum standards,. Advanced regulatory engagement strategies that ensure sustainable operations while maintaining user trust. Regulatory approval across multiple jurisdictions.

Compliance excellence includes implementation of comprehensive Know Your Customer (KYC) procedures that balance regulatory requirements with user privacy, advanced Anti-Money Laundering (AML) monitoring systems that detect suspicious transaction patterns,. Sophisticated sanctions screening that ensures compliance with international sanctions regimes while maintaining global accessibility for legitimate users.

Technology Infrastructure Security and Operational Excellence

Technology infrastructure security encompasses implementation of advanced cybersecurity measures that exceed industry standards, comprehensive system monitoring with real-time alerting capabilities,. Sophisticated backup procedures that ensure operational continuity. Asset protection under all circumstances. Security architecture includes distributed system design with multiple geographic locations, comprehensive redundancy mechanisms that eliminate single points of failure,. Advanced disaster recovery procedures that maintain service availability whilstprotecting user assets against technical failures and security threats.

Operational security procedures include systematic security auditing conducted by leading cybersecurity firms, comprehensive employee training programs that address evolving threat landscapes,. Advanced access control systems that implement principle of least privilege while maintaining operational efficiency. Professional security management includes regular penetration testing by independent security researchers, comprehensive vulnerability assessments using automated and manual testing methodologies,. Systematic security updates that ensure ongoing protection against evolving cyber threats and operational risks.

Infrastructure resilience includes implementation of advanced load balancing systems that distribute traffic across multiple servers, comprehensive monitoring systems that track performance metrics and security indicators,. Sophisticated alerting mechanisms that enable rapid response to potential issues. Before They impact user operations or asset security.

Market Risk Analysis and Advanced Volatility Management

Market risk represents a fundamental consideration for cryptocurrency lending security. With Professional platforms implementing sophisticated volatility management systems that protect against adverse price movements while maintaining competitive lending operations. Risk management includes dynamic collateral requirements that adjust based on market conditions, automated liquidation systems with sophisticated algorithms that minimise slippage,. Comprehensive market monitoring that tracks correlation patterns. Volatility indicators across multiple asset classes and time horizons.

Volatility management strategies encompass diversified asset portfolios that reduce concentration risk, sophisticated hedging mechanisms using derivatives and options strategies,. Advanced risk modelling that incorporates Monte Carlo simulations and stress testing scenarios. Professional market risk management includes systematic analysis of correlation patterns between different cryptocurrencies, comprehensive stress testing procedures that simulate extreme market conditions,. Advanced scenario planning that ensures platform resilience under various market conditions and economic scenarios.

Advanced risk metrics include Value at Risk (VaR) calculations that quantify potential losses under normal market conditions, Expected Shortfall (ES) measurements that assess tail risk scenarios,. Comprehensive sensitivity analysis that evaluates platform exposure to various market factors including interest rate changes, volatility spikes, and liquidity constraints.

Insurance Coverage Excellence and Comprehensive Asset Protection

Insurance coverage provides critical security layers for cryptocurrency lending platforms. Through Comprehensive policies that protect against operational risks, cyber threats,. Platform failures while maintaining cost-effective risk transfer mechanisms. Professional insurance frameworks include coverage for custodial risks with limits exceeding platform assets, operational errors including employee fraud and system failures,. Cyber security incidents including data breaches. System compromises that provide users with additional protection beyond platform security measures.

Asset protection strategies include segregated custody arrangements that legally separate user assets from platform operational funds, comprehensive audit procedures conducted by independent accounting firms,. Advanced monitoring systems that track asset movements and ensure proper segregation. Professional asset protection includes implementation of multi-signature security requiring multiple authorized signatures for asset movements, comprehensive backup procedures with geographically distributed storage,. Advanced recovery mechanisms that protect user assets against various operational risks and security threats.

Insurance excellence includes working with leading insurance providers including Lloyd's of London syndicates, comprehensive policy coverage that addresses evolving risks in the cryptocurrency space,. Sophisticated claims procedures that ensure rapid resolution of covered incidents while maintaining transparency. User communication throughout the process.

Due Diligence Excellence and Systematic Platform Evaluation

Comprehensive due diligence frameworks enable users to systematically evaluate cryptocurrency lending platform security. Through Structured assessment procedures that analyse technical infrastructure, regulatory compliance,. Operational procedures using professional-grade evaluation methodologies. Professional evaluation includes analysis of security certifications from recognised standards bodies, regulatory licenses from appropriate authorities,. Operational track records that demonstrate consistent performance. Security standards over extended periods.

Platform evaluation procedures include systematic review of security policies and procedures, comprehensive analysis of risk management frameworks and implementation,. Detailed assessment of insurance coverage including policy limits and exclusions. Advanced due diligence includes evaluation of management teams including background checks and experience assessment, analysis of financial stability. Through Audited financial statements and regulatory filings,. Comprehensive review of operational procedures that enable informed decision-making about platform selection and risk management strategies.

Professional evaluation frameworks incorporate quantitative scoring methodologies that weight different risk factors according to their importance, comparative analysis that benchmarks platforms against industry standards and peer platforms,. Ongoing monitoring procedures that track platform performance. Security metrics over time to identify potential issues. Before They impact user assets or platform operations.

Advanced Threat Intelligence and Proactive Security Monitoring

Threat intelligence represents a critical component of modern cryptocurrency lending security. With Leading platforms implementing comprehensive threat monitoring systems that track emerging attack vectors, monitor dark web activities,. Analyse global cyber threat patterns to proactively defend against potential security incidents. Advanced threat intelligence includes collaboration with law enforcement agencies, participation in industry information sharing initiatives,. Systematic monitoring of threat actor communications and activities.

Proactive security monitoring encompasses real-time analysis of transaction patterns to identify potential fraud or manipulation attempts, comprehensive network monitoring that tracks all system communications and identifies anomalous activities,. Advanced behavioral analysis that establishes baseline patterns. Alerts on deviations that could indicate security incidents or operational issues.

Intelligence-driven security includes implementation of threat hunting procedures that proactively search for indicators of compromise, comprehensive incident response procedures that enable rapid containment. Remediation of security incidents,. Systematic threat modelling that evaluates platform vulnerabilities. Develops appropriate countermeasures to address identified risks.

Quantum-Resistant Security and Future-Proofing Strategies

Quantum computing represents an emerging threat to current cryptographic systems, with forwards-thinking cryptocurrency lending platforms beginning implementation of quantum-resistant security measures that protect against future technological developments while maintaining compatibility with current systems. Quantum-resistant strategies include evaluation of post-quantum cryptographic algorithms, implementation of hybrid security systems that combine current and quantum-resistant technologies,. Development of migration strategies that enable seamless transition to quantum-resistant systems as they mature.

Future-proofing security includes systematic monitoring of quantum computing developments, participation in post-quantum cryptography standardization efforts,. Implementation of cryptographic agility frameworks that enable rapid adoption of new security technologies as they become available. Advanced future-proofing includes collaboration with academic institutions and research organisations, participation in quantum-resistant security research initiatives,. Development of comprehensive upgrade procedures that ensure platform security remains effective against evolving technological threats.

Quantum preparedness encompasses evaluation of current cryptographic implementations for quantum vulnerability, development of quantum-resistant key management systems,. Implementation of hybrid security architectures that provide protection against both classical. Quantum computing attacks while maintaining operational efficiency and user experience standards.

Conclusion

The security landscape for cryptocurrency lending in 2025 represents a significant evolution from the early days of DeFi experimentation and unregulated CeFi platforms. Whilst risks remain inherent in any financial activity involving digital assets, the maturation of security practices, regulatory frameworks,. Risk management tools has made cryptocurrency lending substantially safer for informed investors who implement appropriate precautions.

The key to secure cryptocurrency lending lies not in avoiding all risks, but in understanding. Managing them effectively through diversification, platform selection, and ongoing monitoring. Conservative investors can achieve reasonable security through regulated CeFi platforms with insurance coverage and transparent operations. At the same time, more experienced users can safely explore DeFi protocols by starting small. Using audited protocols,. Maintaining appropriate risk management practices.

Platform evaluation remains the most critical factor in cryptocurrency lending security. With Factors such as regulatory compliance, insurance coverage, audit history,. Operational transparency serving as key indicators of platform reliability. The most secure approach involves diversifying across multiple platforms. Strategies while maintaining emergency funds and avoiding over-allocation to any single platform or protocol.

The regulatory environment continues to improve. Bringing greater consumer protection. Operational standards to the cryptocurrency lending market. However, the rapid pace of innovation means that new risks. Opportunities continue to emerge. Requiring ongoing education. Adaptation of security practices to address evolving threats and market conditions.

Success in secure cryptocurrency lending requires balancing yield optimisation with risk management. Staying informed about platform developments and market conditions,. Maintaining realistic expectations about both returns and risks. The most successful investors approach cryptocurrency lending as part of a diversified investment strategy rather than a get-rich-quick scheme. Focusing on sustainable practices that protect capital while generating attractive returns over the long term.

As the cryptocurrency lending industry continues to mature, the emphasis on security. Risk management will only intensify. Creating opportunities for platforms that prioritise user protection. Transparent operations while challenging those that fail to meet evolving security standards and regulatory requirements.

Sources & References

- DeFi Pulse. (2025). "Total Value Locked (TVL) in DeFi". DeFi Pulse provides real-time analytics on DeFi protocol security and TVL metrics.

- Chainalysis. (2025). "Crypto Crime Report 2025". Comprehensive analysis of security incidents, hacks,. Fraud in crypto lending platforms.

- CoinDesk. (2025). "What Is DeFi?". Educational resource on decentralised finance security and best practices.

Frequently Asked Questions

- What are the main security risks of crypto lending in 2025?

- Main risks include platform insolvency (custody risk), smart contract exploits in DeFi protocols, liquidity freezes during market stress, regulatory actions affecting operations, counterparty defaults, and cybersecurity breaches. CeFi platforms face custody risk, while DeFi protocols face code vulnerabilities and oracle manipulation risks.

- Is DeFi lending more secure than CeFi lending?

- Neither is universally more secure - they have different risk profiles. DeFi eliminates custody risk. Provides transparency. But Introduces smart contract vulnerabilities and complexity. CeFi offers simplicity, customer support, and sometimes insurance,. But This depends on the platform's solvency and proper governance. The best approach often combines both with proper diversification.

- How can I evaluate the security of a crypto lending platform?

- For CeFi platforms, check regulatory licensing, financial audits, insurance coverage, team background, and user reviews. For DeFi protocols, examine smart contract audits, bug bounty programs, TVL stability, governance structure, and operational history. Look for transparency in operations, proof of reserves, and clear risk disclosures.

- What security measures should I take when using digital asset lending?

- Diversify across multiple platforms (never more than 20% on one platform), use hardware wallets for DeFi, enable 2FA on all accounts, start with small amounts, verify platform legitimacy, avoid suspicious high yields, maintain emergency funds outside lending,. Regularly monitor your positions and platform health.

- Should I buy insurance for my digital asset lending positions?

- Insurance is recommended for positions over $10,000 or when using experimental protocols. For smaller amounts on established platforms, self-insurance may be a more cost-effective option. DeFi insurance typically costs 3-6% annually and covers 60-80% of losses from specific events, such as smart contract exploits,. But Excludes platform insolvency and market losses.

- What are the warning signs of an unsafe lending platform?

- Red flags include: unsustainable yields (20%+ on stablecoins), lack of regulatory compliance, no security audits, poor customer service, withdrawal delays, lack of transparency about fund usage, anonymous teams, negative user reviews, and recent security incidents. Always research thoroughly before depositing funds.

How has digital asset lending security improved since 2022?

Security has improved through clearer regulations (EU MiCA), better insurance options, mandatory proof-of-reserves, improved audit standards, better risk management practices, enhanced user education,. Lessons learnt from major platform failures like Celsius and FTX. However, risks remain,. Proper due diligence is still essential.

What should I do if my lending platform gets hacked or fails?

Immediately document all positions and communications, attempt to withdraw remaining funds if possible, file insurance claims if applicable, join user recovery groups, seek legal consultation for significant losses,. Participate in bankruptcy proceedings. Quick action in the first 24-48 hours is crucial for maximising recovery chances.

How do I assess the security of a new DeFi lending protocol?

Check for multiple independent audits from reputable firms (Consensys Diligence, Trail of Bits, OpenZeppelin), review the audit reports for critical findings, verify the protocol has been live for at least 3-6 months, examine the TVL growth and stability, check for active bug bounty programs,. Review the governance structure and token distribution.

What are the latest security innovations in digital asset lending?

Recent innovations include Multi-Party Computation (MPC) for distributed key management, zero-knowledge proofs for privacy-preserving solvency verification, AI-powered fraud detection, real-time risk monitoring systems, automated circuit breakers, and cross-chain security protocols. These technologies significantly enhance platform security and user protection.

How has regulatory compliance improved digital asset lending security?

Regulatory compliance has introduced mandatory fund segregation, capital requirements, regular audits, insurance requirements, and clear governance standards. The EU's MiCA regulation and evolving US frameworks have forced platforms to adopt institutional-grade security practices, significantly reducing the risk of platform failures and improving user protections.

Should I use centralised or decentralised lending platforms for better security?

The optimal approach is diversification across both. CeFi platforms offer regulatory protection, insurance,. Professional management. But Carry custody risk. DeFi protocols provide transparency and self-custody. But Have smart contract risks. A balanced portfolio might allocate 60% to regulated CeFi platforms and 40% to audited DeFi protocols. Depending on your risk tolerance.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.