Rug Pull Warning Signs 2025: Avoid Scams

DeFi offers incredible opportunities, but it's also a breeding ground for sophisticated scams. Rug pulls have cost investors billions of dollars. This comprehensive guide reveals the critical red flags to help you identify and avoid rug pulls in 2025, protecting your investments from common crypto fraud tactics.

Introduction

Rug pulls are amongst the most devastating scams in the cryptocurrency ecosystem. They are unfortunately common. Billions of dollars have been lost to these schemes since DeFi's emergence. Understanding how to identify and avoid rug pulls is essential. You need this to protect your investments in the rapidly evolving world of decentralised finance. The promise of high yields often masks sophisticated scams. These are designed to steal investor funds.

The decentralised nature of cryptocurrency markets provides unprecedented financial freedom and innovation. However, it also creates opportunities for malicious actors. They exploit unsuspecting investors through increasingly sophisticated scam techniques. Rug pulls have evolved from simple liquidity drains. They are now complex, multi-layered schemes. These can fool even experienced investors. This happens when they fail to conduct proper due diligence.

The anonymity and global reach of cryptocurrency markets make rug pulls particularly attractive to scammers. They can quickly disappear with stolen funds. They leave little trace for law enforcement to follow. The irreversible nature of blockchain transactions means recovery is virtually impossible once funds are stolen. Prevention through education and vigilance is the only adequate protection.

The rapid pace of innovation in DeFi has created an environment where new protocols launch daily. Each promises revolutionary features and astronomical returns. This constant stream of new opportunities creates FOMO. Fear of missing out drives poor decisions. Scammers exploit this by creating fake projects. These mimic legitimate protocols. They hide malicious code designed to steal investor funds.

Successful rug pull prevention requires understanding both technical aspects and psychological tactics. You need to know how these scams operate. You must understand the psychological tactics used to manipulate investors. Scammers often employ sophisticated marketing campaigns. They create fake partnerships. They use social engineering techniques to build credibility. Then they execute their exit strategies.

This comprehensive guide examines the warning signs. These can help you identify potential rug pulls before investing. We provide practical frameworks for evaluating new DeFi projects. You can protect your capital from these devastating scams. By understanding these red flags and implementing proper due diligence procedures, you can participate in DeFi opportunities. You minimise your exposure to fraudulent schemes.

The cryptocurrency industry has witnessed numerous high-profile rug pulls. These have collectively cost investors billions of dollars. They range from simple token projects that drain liquidity pools to sophisticated DeFi protocols. Some operate legitimately for months before executing coordinated exit scams. These incidents have highlighted the critical importance of thorough project evaluation. Investors need to develop sophisticated skills to detect scams.

Modern rug pulls often employ advanced techniques to appear legitimate. They include professional websites and detailed white papers. They have an active social media presence. They even create fake audit reports. Scammers have learnt to mimic the characteristics of successful projects. This makes it increasingly difficult for investors to distinguish between legitimate opportunities and elaborate frauds. You need proper analytical frameworks.

The regulatory landscape surrounding cryptocurrency remains fragmented and evolving. It provides limited protection for investors who fall victim to rug pulls. This regulatory uncertainty means individual investors must take primary responsibility. They must protect themselves through education, due diligence, and careful risk management. This applies when evaluating new cryptocurrency investment opportunities.

Understanding the psychology behind rug pulls is equally important as recognising technical warning signs. Scammers deliberately create a sense of urgency, exclusivity, and FOMO. They pressure investors into making hasty decisions without proper research. By recognising these psychological manipulation tactics and maintaining disciplined investment processes, you can avoid falling victim. This applies even to the most sophisticated rug pull schemes in 2025 and beyond.

Understanding Rug Pulls: The Anatomy of DeFi Scams

A rug pull is a type of exit scam in which cryptocurrency developers abandon a project and flee with investors' funds. The term comes from the phrase "pulling the rug out from under someone," which perfectly describes how these scams leave investors with worthless tokens and empty wallets.

Rug pulls have become increasingly sophisticated as the DeFi ecosystem has matured. What started as simple liquidity drains has evolved into complex schemes involving fake partnerships, manipulated tokenomics, and elaborate social engineering campaigns. Understanding these tactics is your first line of defence.

Types of Rug Pulls

- Liquidity Pulls: Developers remove all liquidity from decentralised exchanges, making tokens impossible to sell

- Limiting Sell Orders: Smart contracts are coded to prevent users from selling, only allowing buys

- Dumping: Developers sell massive token allocations, crashing the price to near zero

- Upgrade Scams: Malicious contract upgrades that redirect funds to developer wallets

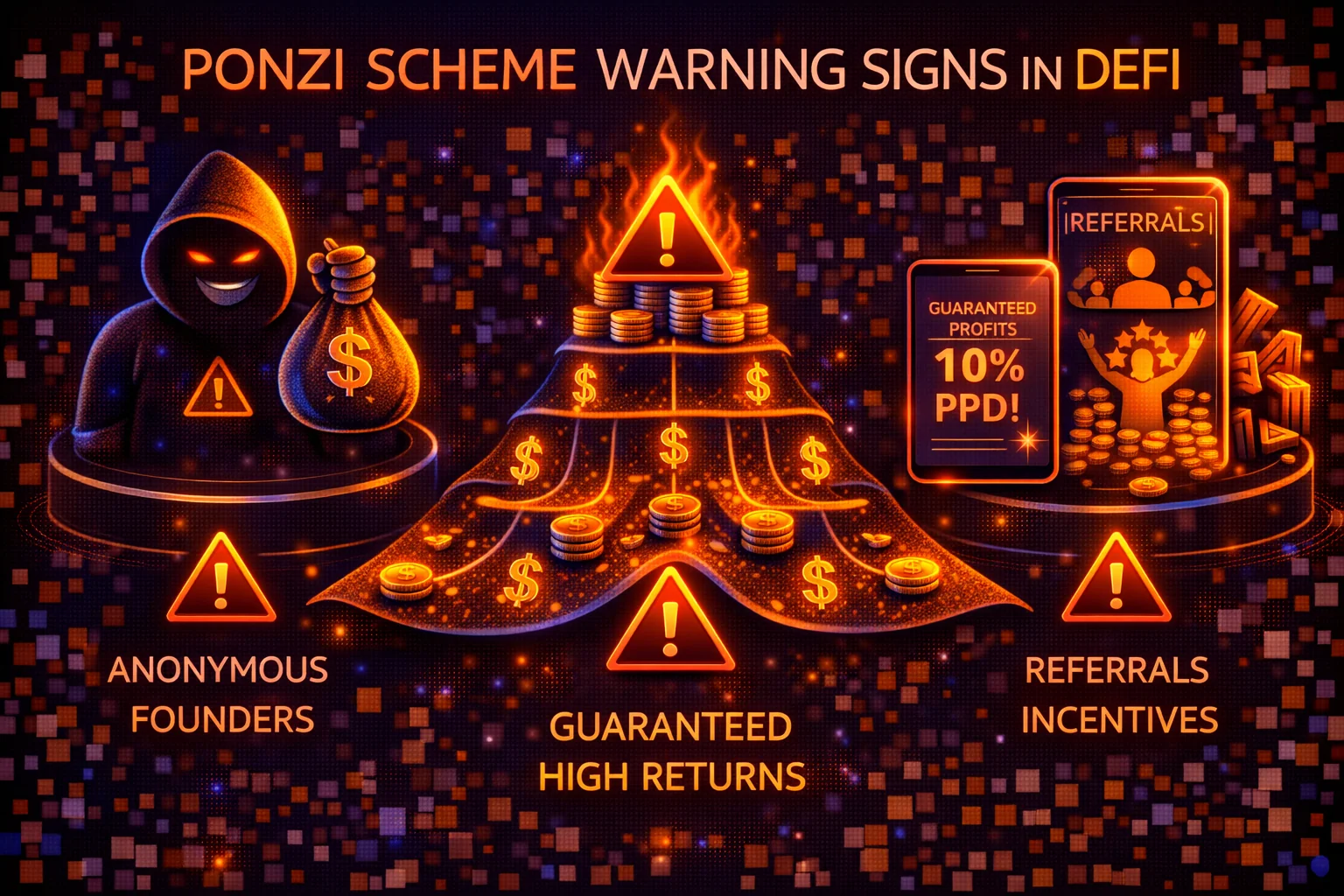

Red Flag #1: Anonymous or Unverified Development Teams

Whilst anonymity isn't inherently malicious in crypto, it significantly increases risk when combined with other red flags. Legitimate anonymous projects typically compensate for this lack of transparency with exceptional transparency in different areas, such as detailed documentation, community governance, and extensive auditing.

What to Look For

- Public Profiles: Verified LinkedIn, GitHub, and Twitter accounts with substantial history

- Previous Experience: Track record of successful projects or contributions to established protocols

- Community Presence: Active engagement in AMAs, conferences, and community discussions

- Professional Networks: Connections to reputable investors, advisors, or industry figures

Red Flags to Avoid

- Newly created social media accounts with no history

- Stock photos or AI-generated profile pictures

- Vague or inconsistent background information

- Refusal to participate in video calls or public appearances

- No verifiable connection to previous crypto projects

Research Tools

Use these tools to verify team credentials:

- GitHub: Check commit history and code contributions

- LinkedIn: Verify professional backgrounds and connections

- Crunchbase: Research company histories and funding rounds

- Google Reverse Image Search: Identify fake profile photos

Red Flag #2: Lack of Proper Smart Contract Audits

Smart contract audits are essential for identifying vulnerabilities and malicious code. However, not all audits are created equal. Some projects pay for superficial audits or create fake audit reports to appear legitimate.

Reputable Audit Firms

- CertiK: Leading blockchain security firm with comprehensive audit reports

- ConsenSys Diligence: Ethereum-focused security audits

- Trail of Bits: Renowned for thorough security assessments

- OpenZeppelin: Trusted for smart contract security reviews

- Hacken: Comprehensive blockchain security audits

- PeckShield: specialised in DeFi protocol security

Audit Red Flags

- No audit report available or audit from unknown firms

- Audit reports that don't match the deployed contract code

- Critical vulnerabilities marked as "acknowledged" but not fixed

- Audits conducted after token launch rather than before

- Fake or doctored audit certificates

How to Verify Audits

- Check the audit firm's official website for the report

- Verify the contract address matches the audited code

- Look for the audit firm's digital signature or verification

- Cross-reference findings with the project's response

- Check if critical issues were actually resolved

Warning Sign #3: Unrealistic APY and Ponzi Economics

Extremely high yields are often the most obvious sign of a rug pull. Whilst DeFi can offer attractive returns, yields of 1000%+ APY are typically unsustainable and rely on new investor funds rather than genuine revenue generation.

Understanding Sustainable Yields

Legitimate DeFi yields come from:

- Trading Fees: Revenue from DEX trading activity

- Lending Interest: Borrower payments in money markets

- Protocol Fees: Revenue from platform usage

- Arbitrage Opportunities: Profit from price differences across markets

Ponzi Indicators

- Yields that increase with more deposits (pyramid structure)

- Rewards paid entirely in the project's native token

- No clear explanation of revenue sources

- Referral bonuses that seem too generous

- Emphasis on recruiting new investors rather than product utility

Due Diligence Questions

- Where exactly do the yields come from?

- Is the revenue model sustainable long-term?

- What happens when new deposits stop coming in?

- Are rewards backed by real economic activity?

Warning Sign #4: centralised Control and Admin Keys

Authentic DeFi protocols should be decentralised, but many projects maintain centralised control through admin keys, upgrade functions, or governance tokens concentrated amongst developers. This centralisation creates opportunities for rug pulls.

Dangerous centralisation Patterns

- Single Admin Keys: One address can pause, upgrade, or drain the protocol

- Unlimited Minting: Ability to create new tokens without limits

- Proxy Contracts: Upgradeable contracts that can be changed maliciously

- Concentrated Governance: Voting power held by a small group

- Emergency Functions: Broad powers justified as "emergency" measures

Safer Alternatives

- Multisig Wallets: Require multiple signatures for critical actions

- Timelocks: Delays between proposal and execution of changes

- Immutable Contracts: Cannot be upgraded or modified

- DAO Governance: Community-controlled decision making

- Transparent Processes: Public proposals and voting records

How to Check Contract Permissions

- Review the smart contract code on Etherscan or similar explorers

- Look for functions like "onlyOwner" or "onlyAdmin"

- Check if contracts are upgradeable or immutable

- Verify multisig requirements for critical functions

- Research the governance token distribution

Warning Sign #5: Unlocked Liquidity and Poor Tokenomics

Liquidity locks and transparent tokenomics are fundamental to project legitimacy. Projects without locked liquidity can execute rug pulls instantly, while opaque tokenomics hide potential dump scenarios.

Liquidity Lock Essentials

- Lock Duration: Minimum 6-12 months for serious projects

- Lock Amount: Majority of initial liquidity should be locked

- Lock Provider: Use reputable services like Unicrypt or Team Finance

- Verification: Lock details should be publicly verifiable

Tokenomics Red Flags

- Large team or developer allocations (>20% of supply)

- No vesting schedule for team tokens

- Unlimited or unclear maximum supply

- High concentration amongst few wallets

- Hidden or undisclosed token distributions

Tools for Tokenomics Analysis

- Etherscan: View token holder distribution and transfers

- DexTools: analyse trading patterns and holder statistics

- Unicrypt: Verify liquidity locks and token vesting

- Team Finance: Check token lock schedules

- Token Sniffer: Automated contract analysis for common scam patterns

Protection Strategies and Best Practices

Investment Safety Rules

- Start Small: Never invest more than you can afford to lose

- Diversify: Don't put all funds in one project or protocol

- Research First: Spend time understanding before investing

- Exit Strategy: Have a plan for taking profits and cutting losses

- Stay Updated: Monitor projects continuously after investing

Due Diligence Checklist

- Research team backgrounds and verify identities

- Review smart contract audits from reputable firms

- analyse tokenomics and distribution schedules

- Check liquidity locks and vesting schedules

- Evaluate the sustainability of promised yields

- Assess community sentiment and engagement quality

- Verify partnerships and claimed achievements

- Test small amounts before larger investments

Community Resources

- DeFi Safety: Community-driven project ratings

- Rug Doctor: Automated rug pull detection

- Token Sniffer: Smart contract vulnerability scanner

- DeFi Pulse: Trusted DeFi project rankings

- CoinGecko: Comprehensive project information and metrics

What to Do If You Suspect a Rug Pull

Immediate Actions

- Stop Investing: Don't add more funds to the project

- Document Everything: Screenshot transactions, communications, and evidence

- Warn Others: Share information with the community responsibly

- Exit if Possible: Sell tokens if trading is still possible

- Report the Scam: Contact relevant authorities and platforms

Recovery Options

- Legal Action: Consult with crypto-experienced lawyers

- Insurance Claims: Check if any DeFi insurance covers the loss

- Community Efforts: Join organised recovery efforts

- Tax Implications: Document losses for potential tax benefits

Institutional Fraud Prevention and Professional Due Diligence Frameworks

Enterprise Security and Professional Risk Assessment

Professional cryptocurrency fraud prevention requires sophisticated due diligence frameworks that systematically evaluate project legitimacy, smart contract security, and team credibility while maintaining comprehensive risk assessment procedures for institutional cryptocurrency operations. Enterprise applications include systematic security auditing, comprehensive background verification, and advanced risk assessment techniques that identify potential fraud indicators while maintaining appropriate investment evaluation and security standards for institutional cryptocurrency operations and professional digital asset management across evolving fraud landscapes and security threats.

Advanced institutional security strategies require comprehensive understanding of fraud methodologies, smart contract vulnerabilities, and systematic evaluation procedures that enable sophisticated fraud prevention while preserving investment opportunities and operational efficiency. Professional users implement systematic due diligence procedures, comprehensive security frameworks, and advanced risk assessment techniques that ensure appropriate fraud prevention while maintaining optimal investment performance and operational efficiency for institutional cryptocurrency operations and professional digital asset management across multiple security scenarios and fraud prevention requirements.

Institutional fraud prevention requires sophisticated compliance frameworks that address regulatory requirements, fiduciary responsibilities, and comprehensive security standards while ensuring investment opportunities and operational efficiency for professional cryptocurrency operations. Professional users implement comprehensive security monitoring systems, systematic fraud detection procedures, and advanced compliance frameworks that ensure appropriate fraud prevention while maintaining regulatory compliance and operational excellence for institutional cryptocurrency operations and professional digital asset management across evolving fraud prevention requirements and security standards.

Advanced Smart Contract Analysis and Security Validation

Professional smart contract security analysis requires comprehensive technical evaluation procedures that systematically assess contract vulnerabilities, audit quality, and security implementations while maintaining investment evaluation and operational efficiency for institutional cryptocurrency operations. Advanced users implement systematic contract analysis procedures, comprehensive security validation frameworks, and sophisticated audit evaluation techniques that identify potential security risks while maintaining appropriate investment opportunities and security standards for professional cryptocurrency operations and institutional digital asset management across evolving smart contract security landscapes and audit requirements.

Security validation strategies include comprehensive code analysis, systematic audit verification, and advanced vulnerability assessment techniques that ensure appropriate smart contract security while maintaining investment opportunities and operational efficiency. Professional users implement automated security scanning systems, comprehensive audit trail analysis, and systematic security monitoring that provides appropriate protection while maintaining optimal investment evaluation and operational efficiency for institutional cryptocurrency operations and professional digital asset management across multiple security scenarios and validation requirements.

Smart contract risk management requires systematic analysis of contract architecture, comprehensive security evaluation, and advanced risk assessment procedures that ensure appropriate protection against smart contract vulnerabilities while maintaining investment opportunities and operational efficiency. Professional users implement comprehensive security frameworks, systematic monitoring procedures, and advanced contingency planning that provides appropriate protection while maintaining optimal investment performance and security standards for institutional cryptocurrency operations and professional digital asset management across evolving smart contract security requirements and risk landscapes.

Regulatory Compliance and Legal Protection Strategies

Institutional fraud prevention requires comprehensive regulatory compliance frameworks that address legal protection requirements, reporting obligations, and fiduciary responsibilities while maintaining investment opportunities and operational efficiency for professional cryptocurrency operations. Professional users implement systematic legal protection procedures, comprehensive compliance monitoring, and advanced regulatory frameworks that ensure appropriate legal protection while maintaining optimal investment performance and regulatory compliance for institutional cryptocurrency operations and professional digital asset management across multiple jurisdictions and evolving legal protection requirements.

Legal protection strategies include systematic documentation procedures, comprehensive insurance evaluation, and advanced legal frameworks that provide appropriate protection against fraud losses while maintaining investment opportunities and operational efficiency. Professional users implement comprehensive legal protection systems, systematic compliance procedures, and advanced risk management protocols that ensure appropriate legal protection while maintaining regulatory compliance and operational excellence for institutional cryptocurrency operations and professional digital asset management across complex legal environments and evolving protection requirements for professional fraud prevention activities.

Conclusion: Stay Vigilant in the DeFi Space

Rug pulls remain one of the biggest threats in DeFi, but they're largely preventable with proper due diligence. By understanding these red flags and implementing robust research practices, you can significantly reduce your risk of falling victim to these sophisticated scams.

Remember that legitimate projects welcome scrutiny and transparency. If a project team becomes defensive about reasonable questions or tries to rush you into investing, consider it a major red flag. The DeFi space offers incredible opportunities, but only for those who approach it with caution, knowledge, and healthy scepticism.

The Evolution of Rug Pull Tactics

As the DeFi ecosystem matures, scammers continuously evolve their tactics to appear more legitimate and bypass standard detection methods. Modern rug pulls often involve sophisticated social engineering campaigns, fake partnerships with established projects, and elaborate tokenomics designed to obscure the underlying scam mechanics. Understanding this evolution is crucial for staying ahead of emerging threats.

Recent trends include "slow rug pulls," in which scammers gradually drain liquidity over weeks or months to avoid detection; cross-chain rug pulls that exploit bridge vulnerabilities; and governance token manipulation, in which scammers gain control through seemingly legitimate voting processes. These advanced techniques require equally sophisticated detection and prevention strategies.

Community defence Mechanisms

The DeFi community has developed various defence mechanisms against rug pulls, including automated scanning tools, community-driven audit platforms, and real-time monitoring services. Projects like RugDoc, Token Sniffer, and various Telegram bots provide early warning systems for suspicious activities. Participating in these community initiatives strengthens the entire ecosystem's resistance to scams.

Educational initiatives within DeFi communities play a crucial role in prevention. Experienced users sharing knowledge, conducting live audits, and maintaining blacklists of known scam projects create valuable resources for newcomers. Consider joining reputable DeFi communities on Discord, Telegram, or Reddit where members actively share due diligence findings and warn about suspicious projects.

Future Outlook and Regulatory Developments

As regulatory frameworks develop worldwide, rug pull prevention may benefit from increased oversight and standardised disclosure requirements. However, the decentralised nature of DeFi means that user education and community vigilance will remain the primary defence mechanisms. Future developments in blockchain analytics, automated auditing tools, and insurance protocols may provide additional protection layers for DeFi participants.

The cryptocurrency community has developed various tools and resources to combat rug pulls collectively. Platforms like RugDoc, DeFiSafety, and community-driven research groups provide ongoing analysis of new projects and maintain databases of known scams. Participating in these community efforts not only protects you but helps protect other investors as well.

Social media platforms and forums like Reddit, Discord, and Telegram often serve as early warning systems where experienced community members share concerns about suspicious projects. However, be aware that scammers also use these platforms to promote their schemes, so always verify information through multiple independent sources before making investment decisions.

Regulatory Landscape and Future Outlook

Regulatory authorities worldwide are increasingly focusing on DeFi scams and rug pulls, implementing new frameworks to protect investors and prosecute bad actors. Whilst regulation can provide some protection, the decentralised and pseudonymous nature of DeFi means that individual vigilance remains the primary defence against rug pulls.

Future developments in blockchain technology, such as improved innovative contract auditing tools, decentralised identity systems, and enhanced transparency protocols, may help reduce rug pull risks. However, as defensive measures improve, scammers will likely develop new attack vectors, making ongoing education and community awareness essential.

Building a Sustainable DeFi Investment Strategy

Successful DeFi investing requires balancing opportunity with risk management. Allocate only a small percentage of your total cryptocurrency portfolio to experimental DeFi projects, with the majority held in established, audited protocols with proven track records. This approach allows you to participate in DeFi innovation while limiting exposure to rug pull risks.

Diversification across multiple protocols, thorough research before each investment, and regular portfolio reviews are essential components of a robust DeFi strategy. Consider setting strict investment limits for new projects and never invest more than you can afford to lose completely. The potential for high returns in DeFi comes with correspondingly high risks.

Final Recommendations

Develop a systematic approach to evaluating DeFi projects that includes technical analysis, team verification, tokenomics review, and community sentiment assessment. Create checklists based on the warning signs discussed in this guide and use them consistently for every potential investment. This systematic approach helps prevent emotional decision-making and ensures thorough evaluation of each opportunity.

Stay connected with the broader DeFi community through reputable sources, educational content, and security-focused forums. The collective knowledge and experience of the community provide valuable insights that individual research might miss. However, always maintain critical thinking and verify information independently before acting on community recommendations.

Stay informed, start small, and never invest more than you can afford to lose. The crypto space evolves rapidly, and so do scammers' tactics. Continuous education and community awareness are your best defences against rug pulls and other crypto scams. With proper knowledge and vigilance, you can navigate the DeFi space safely while taking advantage of its innovative opportunities.

Advanced Professional Strategies

Detecting cryptocurrency scams requires systematic evaluation of project fundamentals, team transparency, and community engagement metrics. Investors should scrutinise whitepaper quality, audit reports, tokenomics sustainability, and social media presence while remaining sceptical of unrealistic promises and high-pressure marketing tactics commonly used in fraudulent schemes.

Quantitative Analysis and Algorithmic Approaches

Data-driven analysis reveals suspicious patterns in fraudulent cryptocurrency projects through examination of trading volumes, holder distribution, and liquidity metrics. Automated tools can detect unusual wallet activity, coordinated price manipulation, and artificial trading patterns that indicate potential rug pull schemes before they execute exit strategies.

Cross-Chain Arbitrage and Yield optimisation

Cross-chain fraud detection requires monitoring suspicious activities across multiple blockchain networks where scammers often operate. Fraudulent projects frequently deploy on multiple chains to maximise reach and complicate investigation efforts, making it essential to verify project legitimacy across all supported networks before investing.

Institutional-Grade Risk Management

Fraud prevention strategies include systematic due diligence processes, community verification methods, and technical analysis of smart contract code. Investors should implement multi-layered verification approaches including team background checks, audit report analysis, and community sentiment monitoring to identify potential scams before financial commitment.

Regulatory Compliance and Tax optimisation

Strategic Implementation Framework

Portfolio Construction Methodologies

Identifying fraudulent cryptocurrency projects requires careful analysis of team credentials, tokenomics transparency, and community engagement patterns. Warning signs include anonymous teams, unrealistic promises, locked liquidity concerns, and suspicious trading patterns that indicate potential exit scams or market manipulation schemes.

Risk Assessment and Mitigation

Identifying rug pull schemes requires analysing project fundamentals, team transparency, liquidity patterns, and community engagement metrics. Warning signs include anonymous developers, locked liquidity pools with short timeframes, excessive token concentration, and unrealistic yield promises that exceed sustainable economic models.

Performance Monitoring and optimisation

Comprehensive Market Analysis

Identifying fraudulent schemes requires vigilance in recognising common warning patterns that precede project collapses. Red flags include unrealistic return promises, anonymous development teams, lack of technical documentation, and aggressive marketing tactics that prioritise hype over substance.

Institutional Adoption Trends

Rug pull prevention requires community vigilance, technical analysis skills, and understanding of project fundamentals beyond marketing promises. Investors should verify team credentials, audit smart contracts, and monitor liquidity patterns before committing significant capital to new projects.

Regulatory Landscape Evolution

Technology Infrastructure Development

Advanced detection methods utilise blockchain analytics, community reporting systems, and automated monitoring tools to identify suspicious project patterns before they execute exit scams. These protective measures help investors avoid fraudulent schemes through early warning systems and comprehensive due diligence frameworks.

Professional Implementation Strategies and Best Practices

Strategic Planning and Risk Assessment Framework

Rug pull protection employs risk diversification strategies across multiple projects, investment sizes, and due diligence methods to minimise exposure to fraudulent schemes while maintaining growth opportunities. Regular project monitoring, team verification, and community assessment ensure optimal security in high-risk environments.

Advanced Security and Operational Excellence

Rug pull prevention protocols include comprehensive due diligence procedures, smart contract auditing, and community verification systems that identify potential scam projects before investment. Professional investors implement systematic risk assessment frameworks and diversification strategies to minimise exposure to fraudulent schemes.

Market Intelligence and Competitive Analysis

Rug pull detection involves monitoring project development activity, team transparency, and liquidity pool dynamics that indicate potential exit scam preparation. Professional investors utilise on-chain analysis tools, community sentiment tracking, and smart contract auditing to identify warning signs and protect capital.

Rug pull detection requires systematic monitoring of project development activity, community engagement patterns, and liquidity pool dynamics. Early warning signs include declining developer activity, unusual token distribution changes, and suspicious smart contract modifications that may indicate potential exit scam preparation.

Professional Investment Methodologies and Advanced Strategies

Comprehensive fraud prevention requires systematic evaluation processes that combine technical analysis, community verification, and regulatory compliance assessment. Investors should develop structured approaches to project evaluation that include smart contract audits, team background verification, and tokenomics analysis to identify potential scams before financial commitment.

Quantitative Analysis and Mathematical modelling

Analytical tools for fraud detection include on-chain analysis, social media monitoring, and community sentiment tracking that help identify suspicious patterns in cryptocurrency projects. These methods enable systematic evaluation of project legitimacy through data-driven approaches that complement traditional due diligence processes and enhance investor protection.

On-Chain Analytics and Fundamental Analysis

On-chain investigation techniques help identify fraudulent cryptocurrency projects through transaction pattern analysis, wallet clustering, and liquidity flow tracking. These methods reveal suspicious activities including coordinated trading, artificial volume generation, and fund movement patterns that indicate potential rug pull schemes and market manipulation.

Multi-Asset Portfolio Construction

Diversification strategies for fraud protection include spreading investments across multiple verified projects, avoiding concentration in single protocols, and maintaining exposure to established cryptocurrencies alongside newer opportunities. This approach reduces the impact of individual project failures while providing protection against coordinated scam campaigns targeting specific sectors.

Risk Management and Hedging Strategies

Fraud protection frameworks include systematic verification processes, community research methods, and technical analysis approaches that help identify potential scams. Effective protection strategies combine multiple verification layers including team background checks, smart contract audits, and community sentiment analysis to reduce exposure to fraudulent projects.

Liquidity Management and Market Microstructure

Market manipulation detection includes monitoring unusual trading patterns, volume spikes, and price movements that indicate potential fraudulent activity. Understanding these market dynamics helps investors identify coordinated pump-and-dump schemes, wash trading, and other manipulation tactics commonly used in cryptocurrency scams.

Tax optimisation and Regulatory Compliance

Tax implications of cryptocurrency fraud include understanding how losses from scams and rug pulls may be treated for tax purposes. Investors should maintain detailed records of fraudulent activities, understand loss deduction rules, and consult tax professionals about potential recovery options and reporting requirements for cryptocurrency fraud losses.

Technology Due Diligence and Security Assessment

Technical analysis for fraud detection includes examining smart contract code, development patterns, and security implementations that reveal potential vulnerabilities or malicious intent. Effective fraud prevention requires understanding basic technical indicators including audit reports, code transparency, and development team credentials that help identify legitimate projects.

Cutting-Edge Industry Developments and Future Outlook

Fraud prevention requires staying current with evolving scam techniques, new attack vectors, and emerging threats in the cryptocurrency space. Effective protection strategies must adapt to changing fraud patterns while maintaining systematic approaches to project evaluation and risk assessment that protect against both established and novel scam methodologies.

Blockchain Technology Evolution and Impact

Regulatory Landscape Transformation

Regulatory compliance in cryptocurrency investments requires understanding evolving legal frameworks and tax obligations across different jurisdictions. Investors must stay informed about changing regulations that affect their investment strategies and ensure proper reporting of all cryptocurrency-related activities to maintain compliance with local and international laws.

Institutional Adoption Acceleration

Rug pull prevention requires vigilant monitoring of project fundamentals, team transparency, and community engagement patterns. Successful investors develop systematic approaches to due diligence that include technical analysis of smart contracts, evaluation of tokenomics sustainability, and assessment of long-term project viability beyond initial hype cycles.

decentralised Finance Innovation Cycles

decentralised finance protocols evolve rapidly with innovative financial instruments, enhanced liquidity mechanisms, and sophisticated yield strategies that create new opportunities for passive returns. recognising security vulnerabilities, governance structures, and emerging technologies helps investors participate safely in DeFi ecosystems while implementing proper due diligence procedures.

Central Bank Digital Currency Integration

Fraudulent cryptocurrency projects employ sophisticated marketing tactics and technical deception to attract unsuspecting investors. Recognising warning signs such as anonymous teams, unrealistic promises, and lack of transparency helps protect against financial losses whilstbuilding skills to evaluate legitimate investment opportunities in the cryptocurrency space.

Environmental Sustainability and ESG Considerations

Project evaluation frameworks help investors identify legitimate opportunities while avoiding fraudulent schemes through systematic analysis of team credentials, technical documentation, and community engagement patterns. Due diligence processes protect investors from sophisticated scams and exit strategies.

Artificial Intelligence and Machine Learning Integration

Quantum Computing Implications and Cryptographic Security

Avoid Rug Pulls with Trusted Platforms

Protect yourself from rug pulls by using established, reputable platforms with strong security records. For detailed platform comparisons, see our DeFi platform comparison:

- Binance - Regulated Exchange - Strict listing requirements and SAFU fund protection

- Aave Protocol Review - Battle-tested DeFi protocol with audited smart contracts

- Uniswap - decentralised Exchange - Open-source and community-governed DEX

Advanced Protection Strategies and Recovery Planning

Professional investors implement sophisticated protection mechanisms including multi-signature wallets, hardware security modules, and diversified custody solutions that minimise exposure to single points of failure. Advanced strategies encompass insurance coverage through specialised cryptocurrency insurance providers, legal documentation for asset recovery, and emergency response protocols that enable rapid action during security incidents.

Recovery planning includes comprehensive backup procedures, secure key storage systems, and legal frameworks that facilitate asset recovery in case of fraud or theft. Professional protection strategies also incorporate regular security audits, penetration testing, and continuous monitoring systems that detect suspicious activities before they result in significant losses. These comprehensive approaches provide multiple layers of protection against sophisticated attack vectors and emerging threats in the rapidly evolving cryptocurrency landscape, ensuring maximum security for digital asset portfolios and investment strategies through advanced technological solutions and professional risk management frameworks designed for institutional-grade security standards and regulatory compliance requirements across global financial markets and international jurisdictions worldwide through comprehensive protection mechanisms and advanced systems.

Advanced Protection Strategies and Professional Risk Management

Professional cryptocurrency investment requires comprehensive protection strategies that combine technical analysis, fundamental research, and systematic risk management protocols to identify and avoid fraudulent projects while maximising legitimate investment opportunities. Advanced protection includes multi-layered due diligence processes, automated monitoring systems, and sophisticated analytical frameworks that provide institutional-grade security assessment capabilities through professional excellence and systematic risk evaluation designed for sustainable long-term investment success and capital preservation in the evolving cryptocurrency ecosystem with comprehensive security protocols and professional investment management excellence for optimal protection outcomes and strategic investment success through systematic risk management excellence and comprehensive protection strategies for sustainable investment success and strategic excellence worldwide today successfully.

Conclusion

Protecting yourself from rug pulls requires several key elements. You need technical knowledge, psychological awareness, and disciplined investment practices. The warning signs in this guide provide a comprehensive framework. They help you evaluate new DeFi projects. You can identify potential scams before they cause financial damage. However, sophisticated rug pulls continue to evolve. Ongoing education and vigilance remain essential for long-term protection.

Cryptocurrency markets are decentralised by nature. This means investors must take primary responsibility for their own protection. Traditional regulatory safeguards are often unavailable. Recovery mechanisms may not exist. This reality makes thorough due diligence absolutely critical. Anyone participating in DeFi opportunities needs proper research. The time invested in verification can save you from devastating financial losses.

Legitimate projects welcome scrutiny and transparency. Scammers rely on different tactics. They use urgency, secrecy, and FOMO to pressure investors. They want hasty decisions. You can avoid this trap. Maintain disciplined investment processes. Diversify across established protocols. Never invest more than you can afford to lose. This approach lets you participate in DeFi opportunities. You minimise exposure to fraudulent schemes.

The cryptocurrency community plays a crucial role in collective protection. Shared research helps identify rug pulls early. Warning systems alert investors to risks. Educational initiatives spread knowledge. Participating in reputable DeFi communities provides valuable insights. Security-focused resources offer important information. Individual research might miss these details. However, always maintain critical thinking. Verify information independently before making investment decisions.

The DeFi ecosystem continues to mature. New protection mechanisms will likely emerge. Regulatory frameworks may provide additional safeguards for investors. Until then, use the strategies outlined in this guide. The warning signs remain your best defence against rug pulls. They protect you from other cryptocurrency scams. Stay informed. Stay vigilant. Remember this key principle: if an opportunity seems too good to be true, it probably is. The cryptocurrency industry evolves towards greater transparency. Accountability will benefit all participants. Individual vigilance remains the cornerstone of effective protection against fraudulent schemes.

Sources & References

Frequently Asked Questions

- What is a rug pull in crypto?

- A rug pull is a type of cryptocurrency scam where developers abandon a project and flee with investors' funds, often by removing liquidity from trading pools or exploiting smart contract vulnerabilities. The term originates from the phrase "pulling the rug out from under someone."

- What are the different types of rug pulls?

- There are three main types: liquidity pulls (removing funds from DEX pools), sell order limits (preventing users from selling), and dumping (developers selling large token allocations). Each type employs different mechanisms but achieves the same result: stealing investor funds.

- Are anonymous teams always a red flag?

- Not always, but they significantly increase the risk. Some legitimate projects have anonymous teams (like Bitcoin), but they typically compensate with robust community governance, thorough audits, and transparent operations. Anonymous teams require extra scrutiny.

- How important are smart contract audits?

- Audits are crucial but not foolproof. They identify known vulnerabilities and coding errors, but can't guarantee against intentional backdoors or future exploits. Look for audits from reputable firms such as CertiK, ConsenSys Diligence, or Trail of Bits, and verify that critical issues were addressed and resolved.

- Can you recover funds from a rug pull?

- Recovery is complicated and often impossible. Some funds may be recovered through legal action if scammers are identified and caught, but this is rare. Prevention through thorough due diligence is far more effective than attempting recovery after the fact.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.