Crypto Loan Tax Guide 2025: Complete Guide

Understand the tax implications of digital asset financing. Complete guide covering IRS regulations, reporting requirements, taxable events, optimisation strategies, and international tax differences for 2025.

Disclaimer: This guide provides general information only. Consult a qualified tax professional for advice specific to your situation.

Introduction

The taxation of cryptocurrency loans represents one of the most complex and evolving areas of digital asset tax compliance, with significant implications for investors, traders, and DeFi participants who utilise borrowing strategies as part of their cryptocurrency investment approach. Whilst the fundamental principle that obtaining a loan is generally not a taxable event applies to cryptocurrency borrowing, the unique characteristics of digital assets and the innovative lending mechanisms available in the cryptocurrency ecosystem create numerous scenarios where tax obligations may arise unexpectedly.

Understanding the tax implications of cryptocurrency loans is crucial for anyone participating in DeFi lending protocols, using centralised lending platforms, or employing borrowing strategies for tax optimisation, liquidity management, or investment leverage. The complexity arises from the intersection of traditional tax principles with innovative blockchain-based financial products that often don't fit neatly into existing regulatory frameworks, creating uncertainty and potential compliance risks for users.

The regulatory landscape surrounding cryptocurrency loan taxation continues to evolve rapidly, with tax authorities worldwide developing new guidance and enforcement strategies that directly impact how digital asset borrowing activities are treated for tax purposes. Recent developments include clarifications on DeFi protocol interactions, treatment of liquidation events, and the tax implications of cross-chain borrowing activities that create additional compliance considerations for cryptocurrency users.

Professional tax planning for cryptocurrency loans requires comprehensive understanding of multiple jurisdictions, as digital asset activities often span international boundaries and involve protocols operating under different regulatory frameworks. The global nature of cryptocurrency markets means that borrowers may face tax obligations in multiple countries, particularly when using decentralised protocols that don't have clear jurisdictional boundaries or when borrowing activities trigger tax events in different locations.

This comprehensive guide examines the tax implications of cryptocurrency loans across major jurisdictions, providing detailed analysis of current regulations, emerging compliance requirements, and strategic considerations for optimising tax outcomes while maintaining regulatory compliance. Whether you're a casual DeFi user or a professional cryptocurrency trader, understanding these tax implications is essential for avoiding costly compliance mistakes and optimising your overall tax strategy in the evolving digital asset landscape.

Cryptocurrency loans can take various forms, from traditional overcollateralised loans where borrowers pledge digital assets as security, to innovative flash loans that exist only within single blockchain transactions, to yield farming strategies that blur the lines between lending, borrowing, and trading activities. Each type of loan structure presents unique tax considerations that must be carefully evaluated to ensure compliance with applicable tax regulations.

The regulatory landscape surrounding cryptocurrency taxation continues to evolve rapidly, with tax authorities worldwide developing new guidance and enforcement strategies specifically targeting digital asset transactions. Recent developments include increased reporting requirements, clarification of specific scenarios, and enhanced enforcement mechanisms that make proper tax planning and compliance more critical than ever for cryptocurrency users.

This comprehensive guide examines the tax implications of cryptocurrency loans across multiple jurisdictions, providing practical guidance for compliance, record-keeping, and strategic planning. Whether you're a casual DeFi user or a sophisticated institutional investor, understanding these tax implications is essential for protecting your financial interests and maintaining compliance with applicable regulations.

The emergence of decentralised finance has created entirely new categories of lending and borrowing transactions that challenge traditional tax frameworks. Automated liquidations, yield farming rewards, governance token distributions, and cross-chain borrowing protocols introduce novel tax considerations that require careful analysis and often professional guidance to navigate properly.

International tax considerations add significant complexity for cryptocurrency borrowers, particularly those using global platforms or DeFi protocols that operate across multiple jurisdictions. Transfer pricing rules, controlled foreign corporation regulations, and tax treaty provisions may all apply depending on the specific circumstances, requiring sophisticated tax planning and compliance strategies.

Record-keeping requirements for cryptocurrency loans are particularly demanding, as taxpayers must maintain detailed documentation of all transactions, collateral movements, interest accruals, and related activities. The decentralised nature of many DeFi protocols can make obtaining necessary documentation challenging, requiring proactive strategies and specialised tools for comprehensive tax compliance.

The distinction between different types of cryptocurrency loans is crucial for tax purposes, with traditional collateralized loans, DeFi protocol interactions, yield farming activities, and flash loan strategies each presenting unique tax considerations. Understanding these distinctions and their implications enables proper tax planning and compliance while avoiding unexpected tax liabilities that can significantly impact investment returns.

International tax considerations add another layer of complexity for cryptocurrency loan participants, with different jurisdictions applying varying approaches to digital asset taxation, cross-border transactions, and DeFi protocol interactions. Users must navigate these international tax implications while ensuring compliance with both domestic and foreign tax obligations that may arise from their cryptocurrency lending activities.

The emergence of sophisticated DeFi lending protocols has created new tax scenarios that traditional tax frameworks struggle to address, including liquidity mining rewards, governance token distributions, automated market maker interactions, and complex multi-step transactions that may trigger multiple taxable events within single protocol interactions. Understanding these scenarios is crucial for accurate tax reporting and compliance.

Record-keeping requirements for cryptocurrency loans are particularly demanding, requiring detailed documentation of loan terms, collateral values, interest payments, liquidation events, and protocol interactions that may span multiple blockchain networks and involve numerous token types. Proper documentation is essential for accurate tax reporting and defending positions during potential audits or investigations.

Tax optimisation strategies for cryptocurrency loans can provide significant benefits when properly implemented, including tax-loss harvesting opportunities, strategic timing of loan origination and repayment, and structuring transactions to minimise taxable events while achieving investment objectives. However, these strategies must be carefully planned and executed to ensure compliance with applicable tax regulations and avoid potential penalties.

The institutional adoption of cryptocurrency lending has brought increased scrutiny from tax authorities and enhanced reporting requirements that affect both platforms and users. Understanding these institutional developments and their implications is crucial for individual users who may be subject to enhanced reporting requirements or audit scrutiny due to their participation in institutional-grade lending platforms.

Emerging technologies including artificial intelligence and automated tax reporting tools are transforming how cryptocurrency loan taxes are calculated, reported, and optimised. These technological developments offer opportunities for improved compliance and optimisation while also creating new challenges for users who must understand and properly utilise these tools to maintain accurate tax records.

The future of cryptocurrency loan taxation will be shaped by continued regulatory development, technological innovation, and the integration of traditional tax principles with blockchain-native financial products. Understanding these trends and their implications enables proactive tax planning and compliance strategies that protect against future regulatory changes while optimising current tax positions.

The regulatory landscape surrounding cryptocurrency taxation continues to evolve rapidly, with tax authorities worldwide developing new guidance and enforcement strategies specifically targeting digital asset transactions. Recent developments in tax policy, court decisions, and regulatory guidance have clarified some aspects of cryptocurrency loan taxation while creating new uncertainties in other areas, making it essential for cryptocurrency users to stay informed about current requirements and best practices.

Different types of cryptocurrency loans present varying tax implications, from simple collateralised borrowing arrangements that mirror traditional secured loans to complex DeFi protocols involving liquidity provision, yield farming, and governance token rewards that may create multiple taxable events throughout the loan lifecycle. The distinction between different loan structures and their respective tax treatments is crucial for proper compliance and tax planning strategies.

Geographic considerations add another layer of complexity to cryptocurrency loan taxation, as different jurisdictions apply varying approaches to digital asset taxation, loan recognition, and cross-border transactions. Users operating across multiple jurisdictions or using international platforms must navigate potentially conflicting tax requirements and reporting obligations that can significantly impact their overall tax liability and compliance burden.

This comprehensive guide examines the current state of cryptocurrency loan taxation across major jurisdictions, providing practical guidance for common scenarios while highlighting areas of uncertainty and potential risk that require professional tax advice and careful documentation to ensure compliance with evolving regulatory requirements.

Fundamental Framework

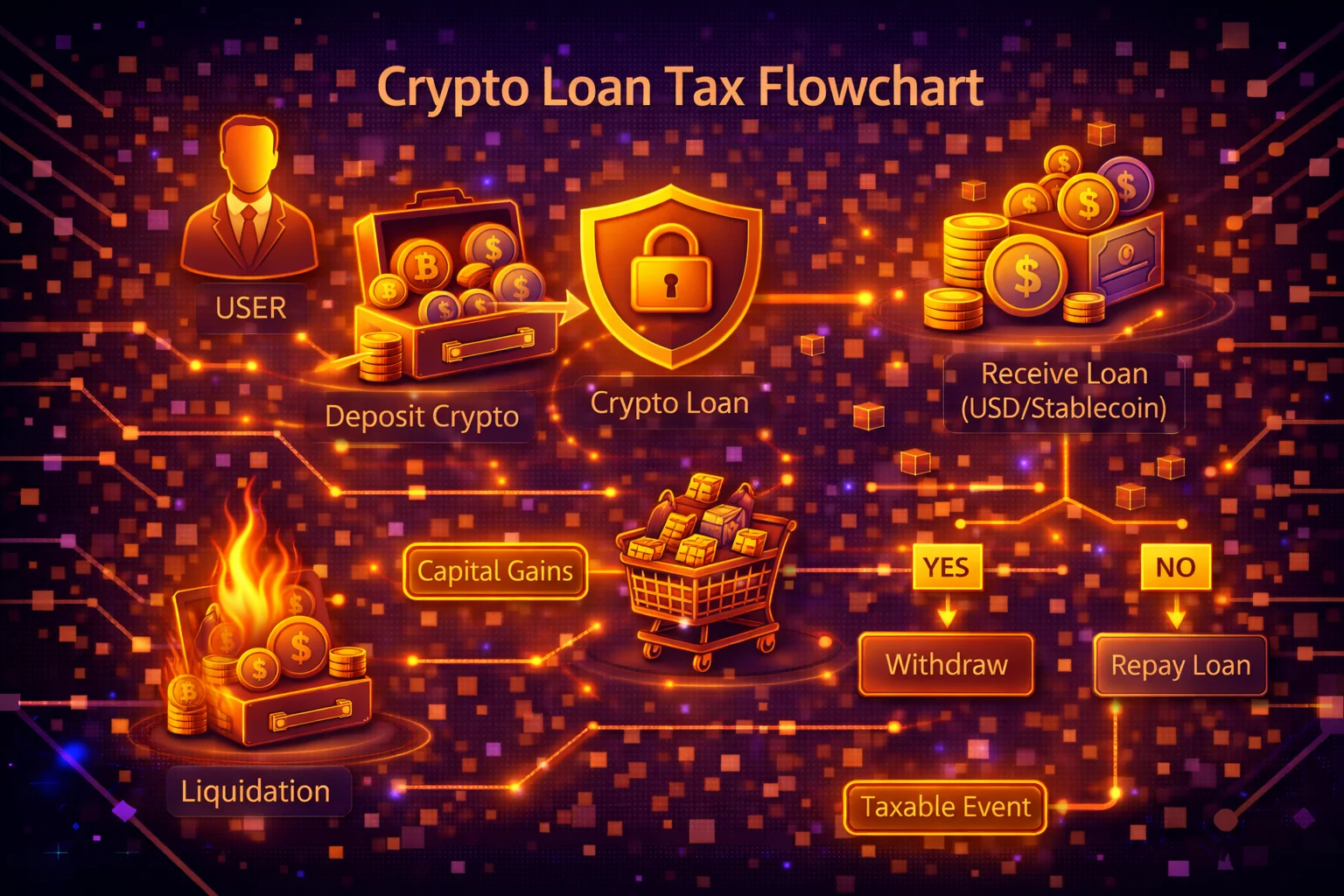

Revenue authorities globally approach virtual currency lending similarly to conventional borrowing arrangements:

- Obtaining funds: Exempt from income recognition (receiving capital, not earnings)

- Pledging collateral: Exempt from income recognition (no asset disposal occurs)

- Settling obligations: Exempt from income recognition (returning borrowed capital)

- Reclaiming collateral: Exempt from income recognition (retrieving your original assets)

Taxable Scenarios

Conversely, these circumstances DO create fiscal liabilities:

- Collateral liquidation: Asset disposal tax on disposed assets

- Debt forgiveness: Classified as taxable income

- Interest from pledged assets: Income tax on generated returns

- Disposing borrowed digital currencies: Asset gains upon eventual disposal

Significance for Investors

Understanding blockchain lending regulations enables you to:

- Prevent unexpected fiscal liabilities: Plan for taxable events

- Enhance financial planning: utilise borrowing to defer asset taxes

- Maintain compliance: Accurate reporting prevents penalties

- optimise returns: Revenue-efficient lending approaches

Common Misconception

Myth: "Virtual currency borrowing serves as tax avoidance to circumvent asset taxes."

Reality: Borrowing defers fiscal obligations, not eliminates them. You remain liable for taxes upon eventual asset disposal or liquidation event.

Key Takeaway

Blockchain lending itself remains revenue-neutral, yet you must monitor all associated transactions and understand when taxable events occur. This comprehensive guide covers everything necessary regarding virtual currency loan regulations for 2025.

Critical Disclaimer: This guide furnishes general information exclusively and should not constitute fiscal advice. Revenue regulations differ by jurisdiction and evolve frequently. Always consult qualified tax professionals for guidance specific to your circumstances.

Market Evolution and Regulatory Landscape

The blockchain asset borrowing ecosystem has experienced tremendous growth, with institutional platforms offering sophisticated lending products. Traditional financial institutions increasingly recognise virtual currencies as legitimate collateral, creating new opportunities and compliance challenges.

Regulatory clarity continues evolving across jurisdictions, with some countries providing comprehensive frameworks while others maintain ambiguous positions. This regulatory uncertainty requires careful navigation and proactive compliance strategies.

Platform Diversity and Risk Considerations

Modern digital asset lending encompasses various models, including centralised exchanges, decentralised protocols, peer-to-peer networks, and institutional custody solutions. Each platform type presents unique risk profiles, regulatory implications, and fiscal considerations that borrowers must evaluate.

Smart contract protocols introduce additional complexity through automated liquidation mechanisms, yield farming opportunities, and governance token distributions that may trigger unexpected taxable events.

Advanced Lending Strategies and Portfolio Management

Sophisticated investors employ multi-platform diversification techniques to optimise borrowing costs while minimising counterparty exposure. This approach involves distributing collateral across multiple reputable platforms to reduce concentration risk and maintain access to competitive interest rates.

Professional portfolio managers integrate crypto borrowing with traditional asset allocation strategies, using blockchain asset loans to maintain exposure while accessing liquidity for other investment opportunities or revenue optimisation purposes.

Institutional borrowers frequently implement hedging mechanisms through derivatives markets, utilising futures contracts and options to mitigate volatility exposure during loan periods. These sophisticated risk management techniques enable larger borrowing positions while maintaining prudent exposure levels across diverse market conditions.

Regulatory arbitrage opportunities emerge when borrowers strategically select jurisdictions with favourable treatment frameworks. Cross-border lending structures require careful navigation of international compliance requirements, including beneficial ownership disclosure obligations and withholding provisions that vary significantly between territories.

Quantitative models increasingly incorporate machine learning algorithms to predict optimal collateralization ratios based on historical volatility patterns, correlation matrices, and macroeconomic indicators. These algorithmic approaches enable dynamic adjustment of borrowing parameters to maximise capital efficiency while minimising liquidation probability under various stress scenarios.

Emerging decentralised autonomous organisation (DAO) governance structures introduce novel complexities for borrowers participating in protocol governance decisions. Token-weighted voting mechanisms and proposal submission requirements create additional considerations for users maintaining significant collateral positions within these experimental frameworks.

Interoperability bridges and cross-chain protocols expand borrowing opportunities across multiple blockchain ecosystems. However, they introduce additional smart contract risks and potential attack vectors that sophisticated users must carefully evaluate before deployment.

Zero-knowledge proof implementations and privacy-preserving technologies enable confidential transaction processing while maintaining regulatory transparency requirements. These cryptographic innovations allow borrowers to protect sensitive financial information without compromising compliance obligations or audit trail integrity.

Flash loan arbitrage strategies and MEV (maximal extractable value) opportunities create sophisticated revenue streams for experienced traders. However, these techniques require a deep understanding of mempool dynamics and sandwich attack prevention mechanisms.

Synthetic asset protocols and perpetual swap mechanisms enable leveraged exposure without traditional margin requirements, utilising oracle price feeds and funding rate adjustments to maintain peg stability across volatile market conditions and liquidity fluctuations.

Automated market maker (AMM) algorithms and concentrated liquidity positions optimise capital efficiency through mathematical formulas that dynamically adjust pricing curves based on trading volume, slippage tolerance, and impermanent loss mitigation strategies.

Technological Infrastructure and Security Protocols

Modern lending platforms implement enterprise-grade security measures, including multi-signature wallets, hardware security modules, insurance coverage, and real-time monitoring systems. These technological safeguards protect borrower assets while ensuring platform stability and regulatory compliance.

Blockchain technology enables transparent, immutable transaction records that facilitate accurate tax reporting and audit compliance. Smart contract automation reduces human error while providing deterministic execution of lending terms and liquidation procedures.

Economic Impact and Market Dynamics

cryptocurrency loans markets demonstrate significant correlation with broader virtual currency volatility, interest rate environments, and regulatory developments. Understanding these macroeconomic factors helps borrowers time their lending activities and anticipate potential liquidation risks.

Market makers and institutional arbitrageurs utilise DeFi lending to maintain inventory, hedge positions, and capture yield opportunities across different platforms and blockchain networks. This professional activity contributes to market efficiency and the provision of liquidity.

US Taxation Regulations (IRS)

The IRS has provided limited but important guidance on blockchain taxation. Here's how virtual currency lending is treated under US tax law in 2025.

IRS Position on Blockchain Lending

Official Guidelines

The IRS has not issued specific guidance on virtual currency lending, but applies general tax principles:

- Loans are not income: Borrowed capital is not taxable

- Collateral deposit: Not a taxable disposition

- Repayment: Not deductible (personal borrowing)

IRS Notice 2014-21

The foundational IRS guidance treats cryptocurrencies as property, not currency:

- Virtual currency constitutes property for revenue purposes

- General fiscal principles apply to property transactions

- Asset disposal rules apply to blockchain sales

Revenue-Generating Events Under US Law

1. Security Liquidation

Revenue Treatment: Asset gains or loss

Illustration:

Original Purchase:

- Bought 10 ETH at $1,500 = $15,000 cost basis

Financing Position:

- Deposited 10 ETH as collateral

- Obtained $10,000 USDC

- Health factor drops, liquidation occurs

Liquidation:

- 10 ETH disposed at $2,000 = $20,000

- Asset gains: $20,000 - $15,000 = $5,000

- Tax liability: $5,000 × 15-20% = $750-1,000

You must report these asset gains on Schedule D

2. Obligation Forgiveness

Revenue Treatment: Ordinary earnings

- If the lender forgives debt, it constitutes taxable income

- Rare in blockchain financing, but possible in bankruptcy

- Report on Form 1040 as "Other Earnings"

3. Yield Earned on Security

Tax Treatment: Taxable income

- Some platforms pay yield on deposited security

- This yield constitutes taxable income

- Report on Schedule 1 (Form 1040)

4. Disposing Borrowed Virtual Currency

Revenue Treatment: Asset gains when disposed

Illustration:

1. Obtain 1 BTC (not assessable)

2. Dispose 1 BTC for $50,000 (establishes cost basis)

3. Subsequently, acquire 1 BTC for $45,000 to settle

4. Asset gains: $50,000 - $45,000 = $5,000

5. Levy owed: $5,000 × 15-20% = $750-1,000

Non-Revenue Events

Obtaining Virtual Currency

- Receiving lending proceeds: Not assessable

- No earnings recognition

- No capital appreciation/loss

Pledging Security

- Not a disposal or exchange

- No fiscal event

- tax basis preserved

Settling Obligations

- Paying back principal: Not deductible

- Interest payments: Generally not deductible (personal financing)

- Exception: Business financing may have deductible interest

Reclaiming Security

- Receiving your own assets back

- No fiscal event

- Original acquisition cost maintained

Investment Tax Rates (2025)

Short-Term: Held less than one year

| Earnings Level | Levy Rate |

|---|---|

| $0 - $11,600 | 10% |

| $11,600 - $47,150 | 12% |

| $47,150 - $100,525 | 22% |

| $100,525 - $191,950 | 24% |

| $191,950 - $243,725 | 32% |

| $243,725 - $609,350 | 35% |

| $609,350+ | 37% |

Long-Term (Held > 1 Year)

| Earnings Level | Levy Rate |

|---|---|

| $0 - $47,025 | 0% |

| $47,025 - $518,900 | 15% |

| $518,900+ | 20% |

Reporting Requirements

Form 1040

Main fiscal return - check "Yes" to crypto question:

- "At any time during 2025, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?"

- Answer "Yes" if you had digital asset financing with fiscal events

- Include all cryptocurrency-related activities in your annual tax filing

Schedule D

Report asset gains and losses:

- Liquidated security

- Sold borrowed digital assets

- Include date acquired, date sold, proceeds, original cost

Form 8949

Detailed asset gains transactions:

- List each transaction separately

- Include all digital asset disposals

- Attach to Schedule D

Schedule 1

Additional earnings:

- Yield earned on security

- Obligation forgiveness earnings

- Other digital asset-related earnings

Yield Deductibility

Personal Financing

Not deductible: Yield on personal crypto financing cannot be deducted

Business Financing

May be deductible: If financing is for business purposes:

- Must be ordinary and necessary business expense

- Proper documentation required

- Report on Schedule C

Investment Yield

Limited deduction: If financing to invest:

- Deductible up to net investment earnings

- Report on Form 4952

- Complex rules apply

Wash Sale Rules

Current Status (2025)

Wash sale rules do NOT currently apply to virtual currencies:

- Can dispose at a loss and rebuy immediately

- Loss remains deductible

- This may change in future legislation

Fiscal Loss Harvesting

Strategy to offset appreciation:

- Dispose crypto assets at loss before year-end

- Offset asset gains from liquidations

- Can deduct up to $3,000 against ordinary earnings

- Carry forwards excess losses

State Levies

State fiscal treatment varies:

- No state earnings levy: FL, TX, WA, NV, WY, SD, TN, NH, AK

- Follow federal rules: Most states

- Special rules: Some states have unique cryptocurrency fiscal laws

Penalties for Non-Compliance

- Failure to file: 5% per month (max 25%)

- Failure to pay: 0.5% per month

- Accuracy penalty: 20% of underpayment

- Fraud penalty: 75% of underpayment

- Criminal prosecution: Possible for willful evasion

The IRS increasingly focuses on crypto compliance. Proper reporting remains essential to avoid penalties and audits.

International Tax Regulations

Digital asset financing regulations vary significantly across jurisdictions. Here's how major countries approach virtual asset financing in 2025.

European Union

General EU Approach

Most EU countries follow similar principles:

- Financing: Not subject to assessment

- Security deposit: Not subject to assessment

- Liquidation: Investment tax

- Yield earnings: Subject to earnings assessment

Germany

Unique 1-year rule:

- Virtual assets held more than 1 year: Tax-free gains

- Virtual assets held less than 1 year: Taxed as income (up to 45%)

- Important: Using crypto as collateral may reset holding period

- Borrowing itself not taxable

Illustration:

Scenario: Bought BTC in Jan 2024, used as collateral in June 2024

Question: Does the security deposit reset the 1-year timer?

Answer: Unclear - consult German fiscal advisor

Conservative approach: Assume timer resets

France

- Flat levy: 30% on crypto gains (12.8% income + 17.2% social)

- Alternative: Progressive income tax rates

- Borrowing: Not taxable unless liquidation occurs

- Reporting: Annual declaration required

Netherlands

- Box 3 wealth tax: Virtual assets taxed as wealth, not gains

- Rate: ~1.2-1.8% of total crypto value annually

- Borrowing: Debt may reduce taxable wealth

- No investment tax: On crypto disposals

Portugal

- Assessment-free: Personal crypto appreciation not taxed (as of 2025)

- Exception: Professional trading is assessed

- Financing: Not assessable

- Note: Regulations may change - monitor legislation

United Kingdom

HMRC Guidelines

The UK has detailed crypto fiscal guidelines:

- Financing: Not a disposal, not assessable

- Security: Not a disposal if you retain beneficial ownership

- Liquidation: Investment assessment (10% or 20%)

- Annual exemption: £3,000 (2025/26 fiscal year)

Investment Assessment Rates

- Basic rate taxpayers: 10%

- Higher/additional rate: 20%

- Annual exemption: First £3,000 assessment-free

Reporting

- Self Assessment: Report on SA100 fiscal return

- Real-time reporting: Required for appreciation >£50,000

- Record keeping: Detailed transaction records required

Canada

CRA Treatment

- Virtual assets as commodity: Subject to investment taxes or business earnings

- Financing: Not assessable

- Liquidation: 50% of gains assessable

- Business earnings: 100% assessable if trading professionally

Asset Disposal

- Inclusion rate: 50% of gains assessable

- Assessment rate: Your marginal assessment rate (up to 53.5%)

- Lifetime exemption: Not available for crypto

Illustration:

Asset gains from liquidation: $10,000

Assessable amount: $10,000 × 50% = $5,000

Tax liability (at 40% marginal rate): $5,000 × 40% = $2,000

Australia

ATO Position

- Crypto as asset: Subject to CGT

- Loans: Not a CGT event

- Liquidation: CGT applies

- 50% discount: If held >12 months

Investment Tax

- Short-term: Full gain taxed at marginal rate

- Long-term (>12 months): 50% discount

- Tax-free threshold: First $18,200 income

Reporting

- Tax return: Report on individual fiscal return

- Record keeping: 5 years minimum

- ATO data matching: Exchanges report to ATO

Singapore

Tax-Friendly Jurisdiction

- No asset disposal assessment: Personal crypto gains assessment-free

- Exception: Trading as business is assessed

- Borrowing: Not assessable

- Interest income: May be assessable

Business vs Personal

- Personal: Long-term holding, infrequent trades

- Business: Frequent trading, profit motive

- Business tax: Up to 22% corporate rate

Switzerland

Crypto-Friendly Approach

- Wealth tax: Crypto included in wealth (cantonal rates vary)

- No asset disposal assessment: For private investors

- Professional trading: Assessed as income

- Borrowing: Not assessable

Cantonal Differences

- Zug: 0.1-0.3% wealth tax

- Geneva: 0.5-1% wealth tax

- Zurich: 0.3-0.5% wealth tax

United Arab Emirates

Zero Tax Jurisdiction

- No income tax: Personal income tax-free

- No asset disposal assessment: Crypto gains assessment-free

- Corporate tax: 9% (introduced 2023, exemptions apply)

- Borrowing: Not taxable

Comparison Table

| Country | Advance Assessable? | Liquidation Assessment | Max Rate | Holding Period Benefit |

|---|---|---|---|---|

| USA | No | investment gains | 37% | Yes (>1 year: 0-20%) |

| UK | No | profit taxation | 20% | No |

| Germany | No | Earnings/CGT | 45% | Yes (>1 year: 0%) |

| Canada | No | 50% inclusion | 53.5% | No |

| Australia | No | asset appreciation | 45% | Yes (>12 months: 50% discount) |

| Singapore | No | None (personal) | 0% | N/A |

| Portugal | No | None (personal) | 0% | N/A |

| UAE | No | None | 0% | N/A |

Fiscal Residency Considerations

Where Are You Assessed?

- Fiscal residency: Usually where you spend >183 days/year

- Citizenship-based: USA assesses citizens worldwide

- Double assessment: Treaties may provide relief

- Reporting: May need to report in multiple countries

Nomad Considerations

- No fixed residence: Complex fiscal situation

- Establish residency: In assessment-friendly jurisdiction

- Professional advice: Essential for international situations

OECD Cryptocurrency Reporting Framework

CARF (Crypto-Asset Reporting Framework)

New international standard (effective 2026-2027):

- Automatic exchange: Cryptocurrency transaction data between countries

- Platform reporting: Exchanges must report user transactions

- Global reach: 47+ countries participating

- Impact: Harder to avoid assessments through foreign platforms

International crypto fiscal regulations are complex and evolving. Always consult a fiscal professional familiar with both crypto and international fiscal law for your specific situation.

Assessable Events

Understanding exactly when fiscal obligations are triggered is crucial for proper planning and compliance. Here's a comprehensive breakdown of assessable and non-assessable events.

Non-Assessable Events

1. Taking Out a Digital Asset Advance

Revenue Status: No assessable earnings

- Obtained funds are not earnings

- You have obligation to settle

- No capital appreciation or loss

- No reporting required (unless other assessable events occur)

2. Depositing Security

Assessment Implications: No assessment consequences

- Not considered a disposal or exchange

- You retain beneficial ownership

- purchase price preserved

- Holding period continues

3. Settling the Obligation

Fiscal Status: Not assessable or deductible

- Principal settlement: Not deductible

- Yield payments: Generally not deductible (personal advance)

- No capital appreciation/loss on settlement

4. Withdrawing Security

Assessment Treatment: Non-assessable event

- Receiving your own assets back

- No disposal occurred

- Original cost basis maintained

- Holding period unaffected

Assessable Events

1. Security Liquidation

Assessment Status: trading profits or loss

How It Works:

Purchase: 5 ETH at $1,500 = $7,500 purchase price

Security: Deposited 5 ETH

Advance: Obtained $5,000 USDC

Liquidation: 5 ETH disposed at $2,200 = $11,000

Investment gains Calculation:

Proceeds: $11,000

Cost Basis: $7,500

profit taxation: $3,500

Tax Due (20% rate): $700

Key Points:

- Liquidation is an assessable disposal

- Calculate appreciation/loss based on original cost

- Short-term vs long-term depends on holding period

- Report on Schedule D and Form 8949

2. Partial Liquidation

Assessment Status: asset appreciation/loss on liquidated portion only

Illustration:

Security: 10 ETH (tax basis $15,000)

Partial Liquidation: 3 ETH disposed at $2,000 = $6,000

Acquisition Cost Calculation:

Original: $15,000 / 10 ETH = $1,500 per ETH

Liquidated: 3 ETH × $1,500 = $4,500 purchase price

Investment gains:

Proceeds: $6,000

cost basis: $4,500

Appreciation: $1,500

3. Selling Borrowed Crypto

Tax Status: Capital gain/loss when you sell

Scenario:

1. Borrow 1 BTC (establishes $50,000 tax basis when borrowed)

2. Sell 1 BTC for $52,000

3. Capital gain: $52,000 - $50,000 = $2,000

4. Later buy 1 BTC for $48,000 to repay

5. Additional gain: $50,000 - $48,000 = $2,000

6. Total taxable gain: $4,000

Important:

- Cost basis = price when you borrowed

- Gain/loss = selling price - borrowing price

- Repurchase creates separate transaction

- Both transactions are taxable

4. Obligation Forgiveness

Tax Status: Taxable income

When It Happens:

- Lender forgives obligation

- Bankruptcy discharge

- Settlement for less than owed

Assessment Treatment:

- Forgiven amount = taxable income

- Taxed at income rates (up to 37%)

- Report on Form 1040, Schedule 1

- Lender may issue Form 1099-C

5. Yield Earned on Security

Tax Status: Taxable income

Platforms That Pay Yield:

- Nexo: Earn yield on security

- Some CeFi platforms offer this feature

- Yield is assessable when received

Reporting:

- Report as "Other Earnings"

- Platform may issue Form 1099-MISC

- Taxed at income rates

6. Swapping Collateral

Tax Status: Depends on method

With Flash Loan (Atomic):

- May be considered non-taxable swap

- No disposal if done atomically

- Unclear IRS guidance - consult tax pro

Traditional Method:

- Withdraw old collateral: Not taxable

- Sell old collateral: Taxable disposal

- Buy new collateral: Establishes new acquisition cost

- Deposit new collateral: Not taxable

Special Situations

Stablecoin Borrowing

Tax Implications:

- Borrowing USDC/USDT: Not taxable

- Using borrowed stablecoins: Depends on use

- Converting to fiat: Not taxable (1:1 value)

- Liquidation of stablecoin backing: Minimal gain/loss

Cross-Chain Borrowing

Tax Treatment:

- Bridging assets: May be taxable swap

- Wrapped tokens: Unclear guidance

- Each chain transaction: Separate tax event

- Complex tracking required

DeFi vs CeFi Differences

DeFi (Aave, Compound):

- Smart contract interactions

- Receipt tokens (aTokens, cTokens) may complicate basis

- Automatic interest accrual

- Less clear reporting

CeFi (Nexo, BlockFi alternatives):

- Platform handles transactions

- May provide tax documents

- Clearer transaction history

- Easier to track

cost basis Methods

FIFO (First In, First Out)

- Default IRS method

- Oldest coins disposed first

- May result in higher assessments (older = lower foundation)

LIFO (Last In, First Out)

- Newest coins disposed first

- May reduce assessments (newer = higher foundation)

- Must be consistent

Specific Identification

- Choose which coins to dispose

- Most assessment-efficient

- Requires detailed records

- Must identify at time of disposal

Timing Considerations

Year-End Planning

- Liquidation timing: Control which assessment year

- Loss harvesting: realise losses before Dec 31

- Appreciation deferral: Delay liquidation to next year

- Holding period: Wait for long-term rates

Estimated Assessment Payments

- Required if owing >$1,000

- Quarterly payments (April, June, Sept, Jan)

- Avoid underpayment penalties

- Calculate based on expected liquidations

Common Mistakes

1. Not Reporting Liquidations

Thinking liquidation isn't assessable because you didn't "dispose" - it IS assessable.

2. Wrong tax basis

Using the current price instead of the original purchase price for the foundation calculation.

3. Forgetting Partial Liquidations

Each partial liquidation is a separate assessable event that must be reported.

4. Not Tracking Holding Period

Missing long-term profit taxation benefits by not tracking when you bought.

5. Assuming Advances Are Assessment-Free

Whilst financing isn't assessable, related events (liquidation) definitely are.

Proper understanding of fiscal events helps you plan strategically and avoid unexpected assessment bills. Track every transaction carefully.

Learn more about cryptocurrency financing risks including liquidation scenarios.

How to Report

Proper reporting of digital asset borrowing transactions is essential for fiscal compliance. Here's a step-by-step guide to reporting virtual asset lending on your return.

US Tax Forms Overview

Form 1040 - Main Tax Return

Crypto Question (Page 1):

- "At any time during 2025, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset?"

- Answer "Yes" if: You had liquidations, sold borrowed crypto, or other disposals

- Answer "No" if: Only borrowed/repaid with no taxable events

Schedule D - asset appreciation and Losses

Use for:

- Collateral liquidations

- Selling borrowed crypto

- Any crypto disposals

Parts:

- Part I: Short-term gains/losses (held ≤1 year)

- Part II: Long-term gains/losses (held >1 year)

- Part III: Summary and tax calculation

Form 8949 - Sales and Dispositions

Detailed transaction listing:

- List each digital asset disposal separately

- Include: description, date acquired, date sold, proceeds, acquisition cost, gain/loss

- Attach to Schedule D

Example Entry:

Description: 5 ETH

Date Acquired: 01/15/2024

Date Sold: 06/20/2025

Proceeds: $11,000

Cost Basis: $7,500

Gain/Loss: $3,500

Schedule 1 - Additional Income

Use for:

- Interest earned on collateral

- Loan forgiveness income

- Other crypto income

Line 8z - Other Income:

"Crypto yield income: $500"

"Loan forgiveness: $2,000"

Step-by-Step Reporting Process

Step 1: Gather All Transaction Data

- Platform statements (Nexo, Aave, etc.)

- Blockchain transaction records

- Original purchase records

- Liquidation notices

- Interest statements

Step 2: Calculate Cost Basis

- Identify original purchase date and price

- Calculate purchase price for liquidated assets

- Use a consistent method (FIFO, LIFO, or specific ID)

- Account for fees in basis

Step 3: Determine Holding Period

- Count days from purchase to liquidation

- ≤365 days = short-term

- >365 days = long-term

- Use date acquired, not date deposited as collateral

Step 4: Complete Form 8949

- List each transaction separately

- Use correct checkbox (A, B, C, D, E, or F)

- Include all required information

- Calculate gain/loss for each

Step 5: Transfer to Schedule D

- Sum short-term transactions (Part I)

- Sum long-term transactions (Part II)

- Calculate total capital gain/loss

- Apply $3,000 loss limitation if applicable

Step 6: Report Other Income

- Interest income on Schedule 1

- Loan forgiveness on Schedule 1

- Any other digital asset-related income

Crypto Tax Software

Recommended Tools:

1. CoinTracker

- Features: Automatic import, fiscal forms, portfolio tracking

- Pricing: Free for more than 25 transactions, $59-$999/year

- Best for: General crypto tax reporting

2. Koinly

- Features: Multi-country support, DeFi tracking

- Pricing: $49-$999/year

- Best for: International users, DeFi

3. CoinLedger (formerly CryptoTrader.Tax)

- Features: IRS-compliant reports, audit support

- Pricing: $49-$299/year

- Best for: US taxpayers

4. TokenTax

- Features: CPA support, complex scenarios

- Pricing: $65-$3,000/year

- Best for: High-volume traders

Software Benefits:

- Automatic transaction import

- Cost basis calculation

- Form generation (8949, Schedule D)

- Error checking

- Audit trail

Platform Tax Documents

What Platforms Provide:

CeFi Platforms (Nexo, etc.):

- Form 1099-MISC: Interest income >$600

- Transaction history: CSV exports

- Tax summaries: Annual reports

- Liquidation notices: Email notifications

DeFi Protocols (Aave, Compound):

- No fiscal forms: decentralised = no reporting

- Blockchain records: All transactions on-chain

- Self-tracking required: You must calculate everything

- Tools needed: Use Etherscan + tax software

Special Reporting Situations

Multiple Liquidations

If you had multiple partial liquidations:

- Report each separately on Form 8949

- Calculate basis for each portion

- Track holding period for each

- May have both short-term and long-term gains

Cross-Platform Loans

If you used multiple platforms:

- Combine all transactions

- Track each platform separately

- Reconcile total positions

- Use software to aggregate

DeFi Complexity

For DeFi advances (Aave, Compound):

- Track smart contract interactions

- Account for receipt tokens (aTokens, cTokens)

- Calculate accrued interest

- Use specialised DeFi tax tools

Amended Returns

When to Amend (Form 1040-X):

- Discovered unreported liquidation

- Incorrect cost basis used

- Missing yield income

- Math errors in original return

Time Limits:

- General rule: 3 years from original filing date

- Substantial understatement: 6 years

- Fraud: No time limit

Process:

- File Form 1040-X

- Explain changes

- Include corrected forms (8949, Schedule D)

- Pay additional tax + interest

State Tax Reporting

Most States:

- Follow federal treatment

- Report same gains/losses

- Use state-specific forms

- Apply state tax rates

No State Income Tax:

- Alaska, Florida, Nevada, South Dakota

- Tennessee, Texas, Washington, Wyoming

- New Hampshire (no tax on wages, but taxes interest/dividends)

Audit Risk and Documentation

What Triggers Audits:

- Large unreported gains

- Inconsistent reporting

- Missing 1099 forms

- Suspicious patterns

- High-value transactions

Audit Protection:

- Keep detailed records (7 years)

- Save all platform statements

- Document tax basis calculations

- Maintain transaction logs

- Use professional tax software

If Audited:

- Respond promptly to IRS notices

- Provide requested documentation

- Consider hiring tax attorney

- Don't ignore correspondence

International Reporting

FBAR (FinCEN Form 114):

- Required if: Foreign accounts >$10,000

- Crypto question: Unclear if crypto advances count

- Conservative approach: Report if unsure

- Deadline: April 15 (auto-extension to October 15)

FATCA (Form 8938):

- Required if: Foreign assets >$50,000 (varies by status)

- Crypto treatment: Unclear guidance

- Penalties: $10,000+ for non-filing

Proper reporting remains your best protection against penalties and audits. When in doubt, consult a digital asset fiscal professional.

Record Maintenance

Meticulous record maintenance is essential for accurate assessment reporting and audit protection. Here's what to track and how to organise it.

Essential Records to Maintain

1. Original Purchase Records

- Date of purchase

- Amount purchased

- Purchase price per unit

- Total cost (including fees)

- Exchange/platform used

- Transaction ID

2. Advance Transaction Records

- Date advance initiated

- Amount obtained

- Security deposited (type and amount)

- Platform used

- Advance terms (LTV, yield rate)

- Transaction confirmations

3. Liquidation Records

- Date of liquidation

- Amount liquidated

- Price at liquidation

- Liquidation penalty

- Platform notification

- Blockchain transaction hash

4. Yield and Earnings Records

- Yield earned on security

- Dates received

- Amounts in USD

- Platform statements

- 1099 forms (if provided)

5. Settlement Records

- Date of settlement

- Amount settled

- Yield paid

- Security withdrawn

- Transaction confirmations

organisation Framework

Digital Filing Framework:

Cryptocurrency_Assessments_2025/

├── Purchases/

│ ├── 2024_Q1_purchases.csv

│ ├── 2024_Q2_purchases.csv

│ └── receipts/

├── Advances/

│ ├── Nexo_statements/

│ ├── Aave_transactions/

│ └── advance_summary.xlsx

├── Liquidations/

│ ├── liquidation_notices/

│ └── liquidation_calculations.xlsx

├── Assessment_Forms/

│ ├── 1099_forms/

│ └── generated_forms/

└── Supporting_Docs/

├── platform_statements/

└── blockchain_records/

Retention Period

- IRS requirement: 3 years minimum

- Recommended: 7 years

- Substantial understatement: 6 years

- Fraud/no return filed: Indefinitely

Tools for Record Maintenance

- Spreadsheets: Excel, Google Sheets

- Crypto assessment software: Automatic tracking

- Cloud storage: Google Drive, Dropbox

- Blockchain explorers: Etherscan, etc.

Tax optimisation

Legal strategies to minimise your digital asset advance tax burden.

Strategic Timing

1. Hold for Long-Term Rates

- Wait >1 year before liquidation

- Reduce levy rate from 37% to 20% (max)

- Plan collateral deposits accordingly

2. Year-End Loss Harvesting

- realise losses before December 31

- Offset gains from liquidations

- Deduct up to $3,000 against ordinary earnings

- Carry forwards excess losses

3. Defer Gains to Next Year

- Add collateral to avoid liquidation

- Push liquidation into next tax year

- Spread gains across multiple years

Borrowing Strategies

1. Borrow Instead of Selling

- Defer trading profits indefinitely

- Maintain crypto exposure

- Access liquidity without taxes

2. Conservative LTV Ratios

- Avoid liquidation = avoid taxes

- Use 30-40% LTV instead of 70%

- Maintain health factor >2.0

3. Stablecoin Collateral

- Minimal price movement

- Lower liquidation risk

- Minimal gain/loss if liquidated

Cost Basis optimisation

Specific Identification Method

- Choose the highest cost basis coins for liquidation

- minimise investment gains

- Requires detailed tracking

- Must identify at time of liquidation

Business Structure

For Professional Traders:

- LLC/Corporation: May offer benefits

- Business expenses: Deductible

- Interest deduction: Possible for business advances

- Consult CPA: Complex decision

Retirement Accounts

Self-Directed IRA:

- Hold crypto in IRA

- Tax-deferred or tax-free growth

- Loans within IRA may be prohibited

- Complex rules - professional guidance needed

When to Get Professional Assistance

Digital asset fiscal circumstances can be intricate. Here's when you should engage a professional.

Engage a Digital Asset Fiscal Advisor If:

Intricate Circumstances:

- Multiple liquidations across platforms

- DeFi advances with complex interactions

- Cross-border transactions

- Business crypto activities

- Large positions (>$100,000)

Audit or IRS Concerns:

- Received IRS notice

- Being audited

- Past non-compliance

- Unclear how to report

International Considerations:

- Foreign platforms

- Multiple assessment jurisdictions

- FBAR/FATCA requirements

- Assessment residency questions

Types of Professionals

1. Crypto-specialised CPA

- Best for: Assessment preparation and planning

- Cost: $200-500/hour

- Services: Returns, planning, representation

2. Assessment Attorney

- Best for: Audits, legal concerns

- Cost: $300-800/hour

- Services: Legal representation, disputes

3. Enrolled Agent

- Best for: IRS representation

- Cost: $150-300/hour

- Services: Assessment prep, IRS dealings

Finding the Right Professional

- Look for crypto experience

- Check credentials and reviews

- Ask about their crypto client base

- Verify they understand DeFi/CeFi differences

Cost vs Benefit

- DIY: $0-500 (software)

- Professional: $1,000-5,000+

- Savings: Often worth it for intricate circumstances

- Peace of mind: Priceless

Market Evolution and Regulatory Landscape

The crypto borrowing ecosystem has undergone a tremendous transformation since its inception. Understanding this evolution helps contextualize current regulatory frameworks and anticipate future developments.

Historical Development

Crypto lending emerged from the broader decentralised finance (DeFi) movement, initially operating in regulatory grey areas. Early platforms focused primarily on peer-to-peer transactions without traditional banking oversight.

Key Milestones

- 2017-2018: First centralised lending platforms launch

- 2019-2020: DeFi protocols introduce automated market makers

- 2021-2022: Institutional adoption accelerates

- 2023-2024: Regulatory clarity emerges globally

- 2025: Mainstream integration with traditional finance

Platform Diversity and Innovation

Modern crypto lending encompasses various models, each with distinct characteristics and regulatory implications:

centralised Finance (CeFi) Platforms

- Traditional custodial model with institutional backing

- Regulatory compliance through licensing frameworks

- Insurance coverage and consumer protection measures

- standardised reporting and transparency requirements

decentralised Finance (DeFi) Protocols

- Smart contract automation eliminates intermediaries

- Permissionless access and global availability

- Algorithmic interest rate determination

- Composability with other DeFi applications

Advanced Strategies and Considerations

Sophisticated users employ various techniques to optimise their crypto lending activities while managing regulatory compliance:

Portfolio optimisation

- Diversification: Spreading risk across multiple platforms and assets

- Yield farming: maximising returns through strategic protocol selection

- Liquidity management: Balancing accessibility with earning potential

- Risk mitigation: Implementing hedging strategies and position sizing

Technological Infrastructure

The underlying technology continues evolving, introducing new possibilities and challenges:

- Layer 2 solutions: Reducing transaction costs and improving scalability

- Cross-chain protocols: Enabling interoperability between different blockchains

- Automated strategies: Smart contracts executing complex lending strategies

- Privacy enhancements: Zero-knowledge proofs protecting user confidentiality

Economic Impact and Future Outlook

Crypto lending represents a significant component of the broader virtual currency economy, with implications extending beyond individual users:

Market Dynamics

- Capital efficiency: Unlocking value from dormant cryptocurrency holdings

- Price discovery: Contributing to more efficient crypto markets

- Institutional adoption: Bridging traditional finance with virtual currencies

- Innovation catalyst: Driving development of new financial products

Regulatory Convergence

Global regulatory frameworks are gradually converging around common principles while maintaining jurisdictional differences:

- Consumer protection: Ensuring adequate safeguards for retail participants

- Market integrity: Preventing manipulation and ensuring fair access

- Systemic stability: Managing risks to broader financial system

- Innovation balance: Fostering development while maintaining oversight

Conclusion

Navigating the tax implications of cryptocurrency loans requires a thorough understanding of both traditional tax principles and the unique characteristics of digital asset lending. Whilst the fundamental rule that obtaining a loan is generally not a taxable event applies to cryptocurrency borrowing, the complexity of modern DeFi protocols and lending platforms creates numerous scenarios where tax obligations may arise unexpectedly, making careful planning and documentation essential for compliance.

The key to successful tax management in cryptocurrency lending lies in understanding the distinction between different types of transactions and their respective tax treatments. Simple collateralised borrowing typically follows traditional loan taxation principles, while complex DeFi interactions involving liquidity provision, yield farming, and governance tokens may create multiple taxable events that require careful tracking and reporting throughout the loan lifecycle.

Record-keeping emerges as perhaps the most critical aspect of cryptocurrency loan tax compliance, as the decentralised and often anonymous nature of blockchain transactions makes it challenging to reconstruct transaction histories after the fact. Maintaining detailed records of all loan-related activities, including collateral deposits, interest payments, liquidation events, and any associated token rewards, is essential for accurate tax reporting and audit defence.

The evolving regulatory landscape adds another layer of complexity to cryptocurrency loan taxation, with tax authorities worldwide continuing to develop new guidance and enforcement strategies. Staying informed about current requirements, proposed changes, and court decisions is crucial for maintaining compliance and avoiding unexpected tax liabilities that could significantly impact your overall investment returns.

Professional assistance becomes increasingly valuable as the complexity of cryptocurrency lending strategies grows, particularly for users engaging in sophisticated DeFi protocols, cross-border transactions, or high-value positions. The cost of professional tax advice is often justified by the potential savings from proper tax planning and the peace of mind that comes from knowing your compliance obligations are properly managed.

Ultimately, successful cryptocurrency loan tax management requires a proactive approach that combines a thorough understanding of tax principles, meticulous record-keeping, ongoing education about regulatory developments, and professional guidance when needed. By treating tax compliance as an integral part of your cryptocurrency investment strategy rather than an afterthought, you can maximise the benefits of cryptocurrency lending while minimising the risk of costly compliance failures.

Sources & References

- IRS. (2025). "IRS Cryptocurrency Fiscal Guidelines". Official US fiscal treatment of cryptocurrency.

- CoinTracker. (2025). "Cryptocurrency Assessment Guide". Comprehensive cryptocurrency assessment resource.

- CoinDesk. (2025). "Cryptocurrency Assessment Education". Assessment implications and strategies.

- Nexo Lending Guide

- Aave Protocol Guide

Frequently Asked Questions

- Are digital asset advances assessable?

- Generally, obtaining virtual currency financing is not an assessable event in most jurisdictions, including the US. However, liquidation of collateral, yield payments, and obligation forgiveness may trigger fiscal responsibilities. The financing itself is not earnings because you have an obligation to repay it.

- Do I need to report digital asset financing to the IRS?

- Whilst the financing itself may not be assessable, you should maintain records of all crypto financing transactions. Report any assessable events like security liquidation or obligation forgiveness on your fiscal return. Answer "Yes" to the crypto question on Form 1040 if you had any disposals.

- Is backing liquidation assessable?

- Yes, backing liquidation is an assessable disposal. You must calculate investment gains or losses based on your original tax basis and the liquidation price. Report this on Schedule D and Form 8949. The gains are assessed at either short-term (ordinary earnings rates) or long-term (0-20%) rates, depending on holding period.

- Can I deduct yield paid on digital asset advances?

- Generally, no for personal financing. Yield on personal digital asset advances is not deductible. However, if the advance is for business purposes, yield may be deductible as a business expense. Investment yield may be deductible up to the amount of net investment earnings. Consult a fiscal professional for your specific situation.

- What happens if I don't report crypto financing assessments?

- Failure to report assessable crypto transactions can result in penalties: 5% per month for failure to file (max 25%), 0.5% per month for failure to pay, 20% accuracy penalty for understatement, and potential criminal prosecution for willful evasion. The IRS increasingly focuses on crypto compliance.

- How do I calculate acquisition cost for liquidated backing?

- Use your original purchase price as purchase price, not the price when you deposited it as collateral. Include fees in your foundation. If you bought at different times, use FIFO (first-in, first-out) unless you specifically identify which coins were liquidated. Subtract foundation from liquidation proceeds to calculate appreciation/loss.

- Do I pay assessments when I deposit collateral?

- No, depositing crypto as backing is not an assessable event. You retain beneficial ownership and haven't disposed of the asset. Your cost foundation and holding period are preserved. Assessments apply only when backing is liquidated or when you dispose of the crypto.

- Are stablecoin advances assessed differently?

- The advance itself is treated the same (not assessable). However, if stablecoin backing is liquidated, you'll have minimal or no profit or loss tax, since stablecoins maintain a $1 value. This makes stablecoin backing more assessment-efficient during liquidation.

- What fiscal forms do I need for digital asset financing?

- You'll need Form 1040 (main return), Schedule D (asset appreciation), Form 8949 (transaction details), and Schedule 1 (if you have yield earnings or advance forgiveness). CeFi platforms may provide Form 1099-MISC for yield earnings over $600. DeFi protocols don't provide fiscal forms.

- How long should I keep crypto financing records?

- Keep records for at least 7 years. IRS requires 3 years minimum, but 6 years for substantial understatement. Seven years provides extra protection. Keep purchase records, advance documents, liquidation notices, platform statements, and all transaction confirmations.

- Can I use fiscal loss harvesting with digital asset financing?

- Yes, you can dispose of crypto at a loss to offset gains from liquidations. Unlike stocks, crypto is not subject to wash sale rules (as of 2025), so you can dispose of and immediately rebuy. Losses offset trading profits, and up to $3,000 can offset ordinary earnings annually.

- Are DeFi advances assessed differently than CeFi advances?

- The fiscal treatment is the same - financing isn't assessable, liquidation is. However, DeFi is more complex to track (no fiscal forms provided, you must track blockchain transactions yourself). CeFi platforms may provide 1099 forms and transaction summaries, making reporting easier.

- What if I obtained crypto and then disposed of it?

- You'll have two assessable events: (1) When you dispose of the obtained crypto, you establish a cost foundation at the financing price and recognise appreciation/loss at disposal. (2) When you buy crypto to repay the advance, that's another transaction with its own appreciation/loss. Both must be reported.

- Do other countries assess crypto financing?

- Most countries follow similar principles - financing isn't taxable, but liquidation triggers capital gains taxation. Rates vary: UK: 10-20%; Germany: 0% if held >1 year; Canada: 50% inclusion rate; Australia: 50% discount if held >12 months. Some countries, such as Portugal and Singapore, do not impose capital gains taxation on personal crypto.

- Should I hire a crypto fiscal professional?

- Consider hiring a professional if you have: multiple liquidations, large positions (>$100,000), DeFi complexity, cross-border transactions, IRS notices, or uncertainty about reporting. Cost is $1,000-5,000+ but often worth it for complex situations and peace of mind.

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.