Crypto Borrowing Risks 2025: Guide

Complete guide to understanding and mitigating all major risks when borrowing cryptocurrency, from liquidation to smart contract vulnerabilities.

Introduction

Cryptocurrency borrowing has emerged as one of the most powerful yet potentially dangerous financial strategies in the digital asset ecosystem, offering unprecedented leverage and liquidity while introducing complex risks that can result in significant financial losses if not properly understood and managed. The decentralised and volatile nature of cryptocurrency markets creates unique risk profiles that differ fundamentally from traditional lending , requiring specialised knowledge and risk management strategies that go far beyond conventional financial planning approaches.

The rapid growth of both centralised and decentralised lending platforms has democratized access to cryptocurrency borrowing, enabling users to leverage their digital assets for additional capital, trading opportunities, or liquidity needs. However, this accessibility has also exposed many users to sophisticated financial risks that they may not fully comprehend, leading to substantial losses during market downturns and highlighting the critical importance of comprehensive risk education. Recent market events, including the collapse of major lending platforms like Celsius and BlockFi, have demonstrated that even experienced investors can suffer total losses when borrowing risks are not properly managed .

Understanding crypto borrowing risks requires analysing multiple interconnected factors, including market volatility, liquidation mechanisms, smart contract vulnerabilities, platform security, regulatory uncertainty, and counterparty risks. Each of these risk categories can independently or collectively impact borrowing positions , making risk assessment and mitigation strategies essential components of any successful crypto borrowing strategy. The interconnected nature of these risks means that a single market event can trigger cascading failures across multiple risk categories simultaneously.

The consequences of inadequate risk management in crypto borrowing can be catastrophic , ranging from partial liquidations that reduce portfolio value to complete loss of collateral during extreme market events. The automated and often irreversible nature of liquidation mechanisms in both DeFi protocols and centralised platforms means that borrowers have limited recourse once risk thresholds are breached, emphasising the importance of proactive risk management and conservative position sizing strategies.

Market volatility represents the most immediate and visible risk in crypto borrowing, with cryptocurrency prices capable of experiencing dramatic fluctuations within hours or even minutes. Bitcoin can drop 20-30% in a single day, while altcoins can lose 50% or more of their value during market stress periods . These price movements can rapidly alter loan-to-value ratios, trigger liquidation events, and transform profitable positions into significant losses, making volatility management a critical skill for anyone engaging in cryptocurrency borrowing strategies.

The cryptocurrency lending industry has experienced over $15 billion in liquidations during major market downturns , with individual borrowers losing millions of dollars in collateral within hours of market crashes. These events highlight the importance of understanding not just individual risk factors, but how they interact during periods of market stress when correlations increase and traditional diversification strategies may fail to provide adequate protection.

Smart contract risks add another layer of complexity unique to decentralised finance protocols, where code vulnerabilities, oracle manipulation, and governance attacks can result in total loss of funds regardless of market conditions. Over $3 billion has been lost to DeFi exploits and hacks since 2020 , demonstrating that technical risks can be just as dangerous as market risks for cryptocurrency borrowers who rely on these protocols for leverage and liquidity.

Platform risks in centralised lending services have proven equally dangerous, with multiple major platforms filing for bankruptcy and freezing user funds during the 2022 market downturn. Borrowers on these platforms not only lost their collateral but remained legally obligated to repay their loans , creating situations where users faced total financial ruin despite following platform guidelines and maintaining adequate collateral ratios.

Regulatory uncertainty continues to evolve rapidly, with government agencies worldwide implementing new rules that can affect platform operations, user access, and the legal status of cryptocurrency lending activities. Recent regulatory actions have forced major platforms to cease operations in certain jurisdictions , leaving borrowers scrambling to manage their positions and potentially facing forced liquidations due to platform closures rather than market movements.

This comprehensive guide examines all major risk categories associated with cryptocurrency borrowing, providing a detailed analysis of risk factors, real-world examples of risk events, and practical strategies for identifying, assessing, and mitigating these risks. Whether you're considering your first crypto loan or looking to optimise an existing borrowing strategy, understanding these risks and how to manage them effectively is essential for protecting your capital and achieving your financial objectives in the volatile cryptocurrency market. The strategies and insights presented here are based on analysis of historical market events, platform failures, and successful risk management approaches used by professional cryptocurrency investors and institutions.

Crypto Borrowing Risk Overview

Borrowing cryptocurrency involves unique risks not present in traditional lending. Understanding these risks is essential before taking any crypto loan, whether through DeFi protocols or centralised platforms.

Primary Risk Categories

- Liquidation Risk: Automatic collateral sale if value drops

- Volatility Risk: Rapid price fluctuations affecting collateral

- Smart Contract Risk: Code bugs or exploits in DeFi

- Platform Risk: Exchange insolvency or operational failures

- Regulatory Risk: Legal changes affecting crypto lending

Each risk requires specific mitigation strategies. Learn the basics in our crypto borrowing guide.

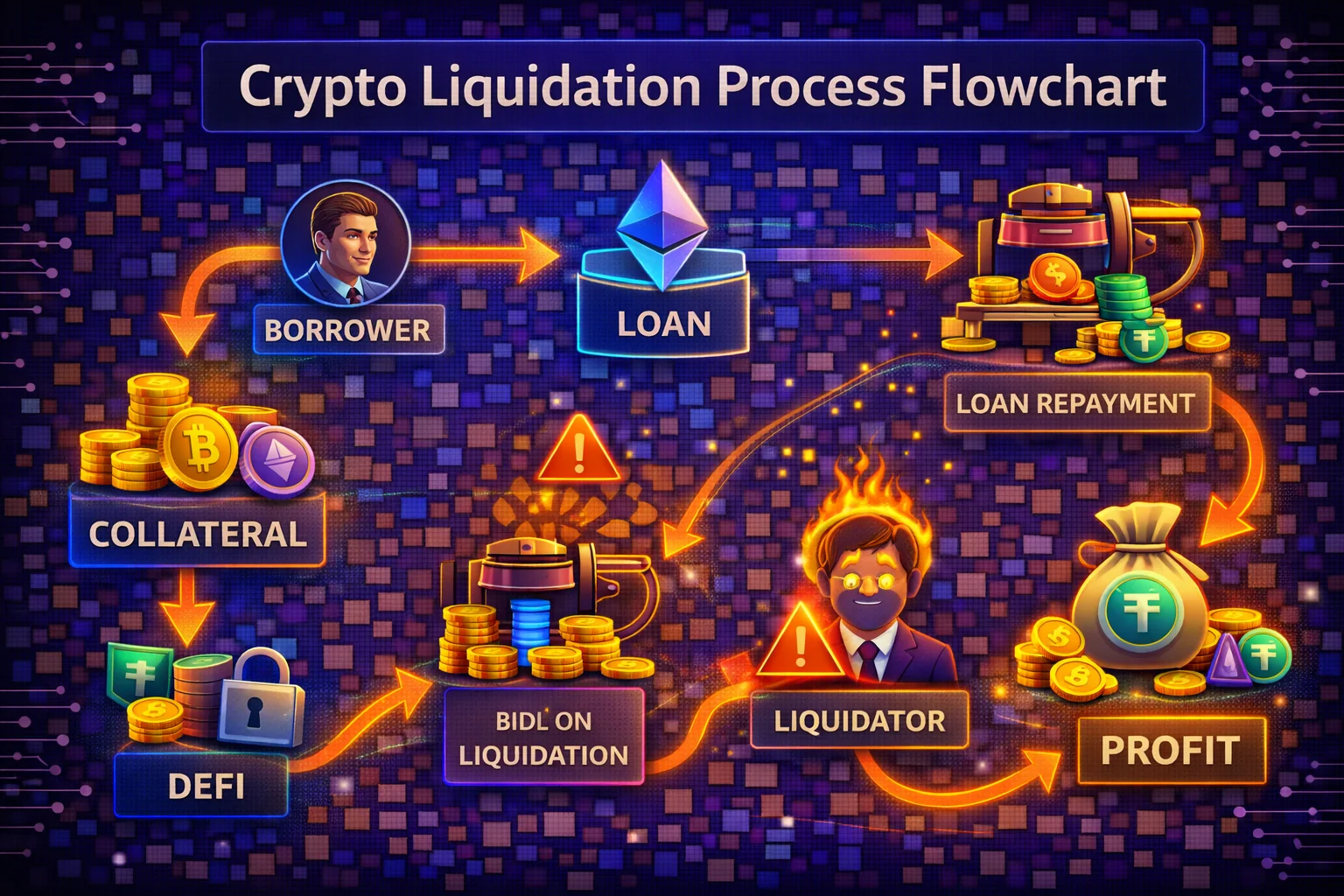

Liquidation Risk: The Primary Danger

Liquidation is the automatic sale of your collateral when its value drops below the required threshold. This is the most common and costly risk in crypto borrowing , affecting thousands of borrowers during every major market downturn and resulting in billions of dollars in losses annually.

How Liquidation Works

Critical Example Scenario:

- Initial Position : You deposit $15,000 ETH as collateral (150% ratio)

- Loan Amount : You borrow $10,000 USDT

- Danger Zone : Liquidation threshold: 120% (platform-specific)

- Market Crash : ETH price drops 25%: your collateral now worth $11,250

- Liquidation Trigger : New ratio: 112.5% (below 120% threshold)

- Automatic Loss : Platform liquidates your ETH to repay the loan

Liquidation Consequences

Immediate Financial Losses

- Total Collateral Loss : Your crypto is sold at market price (often below fair value)

- Liquidation Penalty : 5-15% fee on top of losses (varies by platform)

- Remaining Debt : You may still owe money if collateral insufficient

- Transaction Costs : Additional gas fees for liquidation execution

- Opportunity Cost : Loss of future price appreciation on liquidated assets

Real Example: May 2021 Crypto Market Crash

During the May 2021 market crash, over $10 billion in crypto loans were liquidated within 24 hours . Many borrowers lost 100% of their collateral due to:

- Extreme Price Drops : 50%+ price declines in major cryptocurrencies within hours

- Network Congestion : Ethereum gas fees exceeded $500, preventing collateral additions

- Cascading Liquidations : Forced selling created additional downwards pressure

- Platform Overload : Some platforms experienced technical difficulties during peak stress

Liquidation Protection Strategies

Conservative LTV Ratios (Most Important)

Never borrow at maximum LTV ratios offered by platforms . Safe ratios by collateral type:

- Bitcoin : 30-40% LTV (liquidation typically at 50-60%)

- Ethereum : 25-35% LTV (liquidation typically at 45-55%)

- Major Altcoins : 20-30% LTV (liquidation typically at 40-50%)

- Small Cap Altcoins : Avoid as collateral (too volatile)

Multi-Level Price Alert System

Set multiple alert levels to provide adequate warning time :

- Green Zone (150%+ ratio) : Monitor weekly, normal operations

- Yellow Zone (130-150% ratio) : Monitor daily, prepare for action

- Orange Zone (120-130% ratio) : Immediate attention required

- Red Zone (Below 120% ratio) : Emergency action - liquidation imminent

Emergency Fund Management

Maintain 20-30% of loan value in stablecoins for emergency collateral additions during market drops. This emergency fund should be:

- Easily Accessible : On the same platform or blockchain as your loan

- Immediately Available : Not locked in staking or other protocols

- Sufficient Size : Large enough to handle 30-40% collateral price drops

- Regularly Reviewed : Adjusted based on loan size and market conditions

Detailed protection strategies in our liquidation protection guide.

Volatility Risk: Price Fluctuation Impact

Cryptocurrency volatility affects both your collateral value and loan stability , with price swings that can trigger liquidations within minutes. Understanding volatility patterns enables effective risk management and position sizing strategies.

Volatility Patterns and Risk Levels

Daily Volatility Ranges (2025 Data)

- Bitcoin : 5-10% daily swings common, 20-30% during stress periods

- Ethereum : 8-15% daily movements, 30-40% during major events

- Major Altcoins : 15-30% daily fluctuations, 50-70% during crashes

- Small Cap Altcoins : 30-80% daily swings (extremely dangerous as collateral)

Market Crash Scenarios

- Flash Crashes : 20-40% drops in minutes (often triggered by large liquidations)

- Bear Market Declines : 50-80% declines over months (systematic risk)

- Black Swan Events : Unpredictable extreme moves (regulatory bans, exchange hacks)

- Weekend Volatility : Higher volatility during low liquidity periods

Advanced Volatility Mitigation Strategies

Stablecoin Collateral Strategy

Some platforms accept stablecoins as collateral with higher LTV ratios (80-90%) . Benefits include:

- Zero Liquidation Risk from price volatility

- Predictable Collateral Value for position planning

- Higher Capital Efficiency due to stable value

- Reduced Monitoring Requirements (no price alerts needed)

⚠️ Critical Warning : Stablecoins have their own risks including depeg events (USDC, USDT), regulatory issues, and backing concerns. Never assume stablecoins are completely risk-free .

Diversified Collateral Portfolio

Spread collateral across multiple assets to reduce single-asset volatility impact:

- 50% Bitcoin (lowest volatility amongst cryptocurrencies)

- 30% Ethereum (moderate volatility, strong fundamentals)

- 20% Stablecoins (stability buffer for emergencies)

- 0% Small Cap Altcoins (too risky for collateral use)

Market Timing and Risk Assessment

Avoid borrowing during high-risk periods :

- All-Time Highs : Increased crash risk due to profit-taking

- High VIX Periods : When traditional markets show stress

- Major News Events : Fed meetings, regulatory announcements

- Low Liquidity Periods : Weekends, holidays, Asian trading hours

- Technical Breakdown Levels : When key support levels are broken

Volatility Hedging Techniques

Advanced borrowers can use derivatives to hedge volatility risk :

- Put Options : Insurance against collateral price drops

- Futures Contracts : Hedge with short positions

- Volatility Swaps : Direct volatility hedging instruments

- Collar Strategies : Combine puts and calls for cost-effective protection

Note : Derivatives hedging requires advanced knowledge and can introduce additional risks if not properly implemented.

Smart Contract Risk: DeFi-Specific Dangers

DeFi protocols rely on smart contracts that can contain bugs, vulnerabilities, or be exploited by attackers . This risk doesn't exist in centralised platforms but represents a unique and potentially catastrophic danger for DeFi borrowers.

Types of Smart Contract Risks

Code Vulnerabilities and Programming Errors

Programming errors that cause unexpected behaviour and potential fund loss :

- Logic Errors : Incorrect calculations or conditions in smart contract code

- Reentrancy Attacks : Recursive function calls that can drain protocol funds

- Integer Overflow/Underflow : Mathematical errors in token calculations

- Access Control Issues : Unauthorized access to admin functions

- Front-Running Vulnerabilities : MEV attacks exploiting transaction ordering

Economic Exploits and Protocol Manipulation

Attacks exploiting protocol mechanics without traditional code bugs :

- Flash Loan Attacks : Manipulating prices with borrowed funds within single transaction

- Oracle Manipulation : Feeding false price data to trigger liquidations

- Governance Attacks : Malicious protocol changes through voting manipulation

- Sandwich Attacks : Exploiting large transactions for profit

- Liquidity Pool Manipulation : Draining automated market makers

Historical Smart Contract Failures (Major Losses)

Cream Finance (2021): $130 Million Loss

Flash loan attack exploited price oracle vulnerability , allowing attacker to manipulate asset prices and drain user collateral. Borrowers lost their collateral despite maintaining proper ratios .

bZx Protocol (2020): $8 Million Loss

Multiple sophisticated attacks exploiting oracle manipulation and flash loans . Demonstrated how complex DeFi interactions can create unexpected vulnerabilities.

Harvest Finance (2020): $24 Million Loss

Flash loan attack manipulating asset prices within the protocol , showing how yield farming protocols can be vulnerable to economic exploits.

Poly Network (2021): $600 Million Loss

Largest DeFi hack in history due to cross-chain bridge vulnerability, demonstrating risks of complex multi-chain protocols.

Smart Contract Risk Mitigation Strategies

Choose Battle-Tested, Audited Protocols

Only use protocols with multiple security audits from reputable firms :

- Tier 1 (Safest) : Aave, Compound, MakerDAO

- Multiple audits from top security firms

- Years of operation without major exploits

- Billions in TVL indicating market confidence

- Active bug bounty programs with substantial rewards

- Tier 2 (Moderate Risk) : Newer protocols with 2+ audits from top firms

- Avoid Completely : Unaudited, newly launched, or fork protocols

Protocol Due Diligence Checklist

- Age and Track Record : 2+ years operation preferred

- Total Value Locked : Higher TVL indicates market confidence

- Audit History : Multiple audits from Consensys, Trail of Bits, OpenZeppelin

- Incident History : Zero major exploits or hacks

- Bug Bounty Programs : Active security researcher incentives

- Code Transparency : Open source and regularly updated

- Team Reputation : Known developers with strong track records

Insurance and Protection Options

Smart contract insurance can provide financial protection against code failures :

- Nexus Mutual : decentralised coverage for DeFi protocols

- Coverage : Smart contract failures, oracle failures

- Cost : 2-5% of covered amount annually

- Claims Process : Community-based assessment

- InsurAce : Multi-chain DeFi insurance platform

- Unslashed Finance : Parametric insurance for DeFi risks

Risk Diversification Strategy

Never put all collateral in one protocol . Optimal diversification approach:

- Maximum 40% in any single protocol (even Tier 1)

- Split across 2-3 established platforms to limit single-protocol risk

- Combine DeFi and CeFi for different risk profiles

- Regular rebalancing based on protocol developments

Ongoing Monitoring and Risk Assessment

Smart contract risks evolve constantly . Essential monitoring practices:

- Follow protocol announcements and governance proposals

- Monitor security researcher reports and vulnerability disclosures

- Track TVL changes as indicators of market confidence

- Stay informed about new attack vectors and exploit techniques

- Have exit strategy if red flags appear

Platform Risk: centralised Exchange Dangers

Centralised platforms (CeFi) face different risks than DeFi: insolvency, operational failures, and custody issues.

Platform Failure Scenarios

Insolvency and Bankruptcy

Recent examples show platform failure consequences:

- Celsius (2022): Bankruptcy, user funds frozen

- BlockFi (2022): Bankruptcy following FTX collapse

- Voyager (2022): Bankruptcy, partial fund recovery

Impact: Users lost access to collateral and borrowed funds, with recovery taking years through bankruptcy proceedings.

Operational Failures

- Withdrawal Freezes: Platform halts withdrawals during stress

- System Outages: Can't manage positions during volatility

- Liquidation Errors: Incorrect liquidations due to bugs

Custody Risk

When you deposit collateral on CeFi platforms:

- Platform controls your private keys

- Your crypto is in their custody

- You're an unsecured creditor if they fail

- No blockchain-level protection

Platform Risk Mitigation

Choose Regulated Platforms

prioritise platforms with proper licensing:

- Nexo: EU regulated, licensed in multiple jurisdictions

- Kraken: US state licenses, strong compliance

- Coinbase: Publicly traded, regulatory oversight

Check Financial Health

- Proof of Reserves: Regular third-party audits

- Insurance: FDIC-style coverage for fiat, crypto insurance

- Transparency: Public financial statements

- Backing: Strong institutional investors

Limit Exposure

- Never keep more than you can afford to lose on any platform

- Withdraw excess funds to self-custody wallets

- Use multiple platforms to diversify risk

Monitor Warning Signs

Red flags indicating platform problems:

- Withdrawal delays or restrictions

- Sudden interest rate changes

- Executive departures

- Regulatory investigations

- Unusual social media activity

Compare safe platforms in our platform comparison guide.

Regulatory Risk: Legal Uncertainty

Cryptocurrency lending operates in evolving regulatory environments. Legal changes can impact platform operations and user access.

Regulatory Challenges

Securities Classification

Regulators may classify crypto lending as securities offerings:

- SEC Actions: US enforcement against lending platforms

- Registration Requirements: Platforms may need licenses

- Geographic Restrictions: Services blocked in certain regions

Recent Regulatory Actions

- BlockFi (2022): $100M SEC settlement, operations ceased

- Celsius (2021): State cease-and-desist orders

- Nexo (2023): Exited US market due to regulatory pressure

Regulatory Risk Mitigation

Use Compliant Platforms

- Choose platforms with proper licenses in your jurisdiction

- Verify platform's legal status before depositing

- Understand your local crypto lending regulations

DeFi as Alternative

Decentralised protocols face less regulatory risk:

- No central entity to regulate

- Permissionless access globally

- Smart contracts can't be shut down

Trade-off: DeFi has higher smart contract risk but lower regulatory risk.

Stay Informed

- Monitor regulatory news in your jurisdiction

- Follow platform announcements

- Have exit strategy if regulations change

Comprehensive Risk Mitigation Strategy

Combine multiple protection layers for maximum safety when borrowing crypto . Successful risk management requires systematic implementation of proven strategies across all risk categories.

Pre-Borrowing Checklist

- Calculate safe LTV ratio (30-40% for volatile assets, never exceed 50%)

- Verify platform security and track record (2+ years, multiple audits)

- Understand liquidation mechanics and thresholds for your specific platform

- Set up comprehensive price alerts and monitoring systems

- Prepare emergency collateral funds (20-30% of loan value in stablecoins)

- Review smart contract audits (DeFi protocols only)

- Check platform financial health (CeFi platforms only)

- Understand regulatory status in your jurisdiction

Active Management Requirements

- Daily Monitoring : Check collateral ratio and health factor every day

- Multi-Level Price Alerts : Set warnings at 150%, 130%, and 120% ratios

- Dynamic Rebalancing : Add collateral or repay during high volatility periods

- News Monitoring : Stay informed about platform and regulatory developments

- Performance Tracking : Monitor costs, yields, and risk-adjusted returns

Emergency Procedures

If Approaching Liquidation (Critical Action Required)

- Option 1 : Add more collateral immediately (fastest solution)

- Option 2 : Repay portion of loan to improve health ratio

- Option 3 : Close position entirely if market conditions deteriorating

- Never Wait : Act immediately when alerts trigger, don't hope for recovery

If Platform Shows Warning Signs

- Immediate Action : Repay loan and withdraw collateral without delay

- Don't Wait : Don't wait for official announcements or confirmations

- Accept Small Losses : Better to lose fees than lose everything

- Monitor Continuously : Watch for withdrawal delays, rate changes, executive departures

Portfolio-Level Risk Management

- Platform Diversification : Use 2-3 platforms maximum, never concentrate everything

- Position Sizing : Never borrow more than 20% of total portfolio value

- Emergency Reserves : Keep 30% of portfolio in liquid stablecoins

- Insurance Consideration : Evaluate DeFi insurance for positions over $50,000

- Regular Review : Reassess strategy monthly based on market conditions

When NOT to Borrow (Critical Warning Signs)

Avoid crypto borrowing completely if :

- You can't monitor positions daily (borrowing requires active management)

- You don't have emergency funds for collateral additions

- You're borrowing to invest in risky assets (leverage on leverage is dangerous)

- Market volatility is extremely high (VIX above 30, crypto fear index below 20)

- You don't fully understand liquidation mechanics (education is mandatory)

- You're emotionally attached to collateral assets (must be willing to lose them)

- Platform shows any red flags (withdrawal delays, executive changes, regulatory issues)

Advanced Risk Management Techniques

Hedging Strategies for Crypto Borrowers

Advanced borrowers use hedging techniques to protect against adverse price movements while maintaining their borrowing positions. These strategies can significantly reduce liquidation risk but require sophisticated understanding of derivatives markets and careful position management.

Delta-neutral hedging involves taking offsetting positions in derivatives markets to neutralise price exposure. For example, if you've borrowed against ETH collateral, you might short ETH futures to hedge against price declines. This strategy protects against liquidation while allowing you to maintain your underlying position.

Professional hedging implementation requires precise position sizing calculations to ensure the hedge ratio remains effective across different market scenarios. The optimal hedge ratio depends on the correlation between the collateral asset and the hedging instrument, which can vary significantly during periods of market stress. Advanced practitioners utilise dynamic hedging models that adjust hedge ratios based on realised volatility, implied volatility surfaces, and correlation breakdowns during extreme market events.

Basis risk represents a critical consideration in cryptocurrency hedging strategies, as the relationship between spot prices and derivatives prices can diverge significantly during volatile periods. Futures contango and backwardation patterns affect hedging costs and effectiveness, requiring sophisticated understanding of term structure dynamics and roll costs. Professional borrowers implement comprehensive basis risk monitoring systems that track these relationships and adjust hedging strategies accordingly to maintain effective risk protection.

Options-Based Protection

Put options provide insurance-like protection against declines in collateral prices. By purchasing put options on your collateral assets, you can establish a floor price that limits your downside risk. Whilst options premiums reduce overall returns, they provide valuable protection during volatile market conditions.

Collar strategies combine selling call options and buying put options to create a protected price range for your collateral. This strategy generates premium income from the call options while providing downside protection through the put options, creating a cost-effective hedging solution for large positions.

Advanced options strategies include protective put spreads, which reduce premium costs by purchasing put options at higher strikes while selling puts at lower strikes, creating a protected range rather than absolute floor protection. This strategy provides cost-effective downside protection while maintaining some upside participation, making it particularly suitable for borrowers with moderate risk tolerance and limited hedging budgets.

Volatility trading strategies can enhance options-based protection by taking advantage of implied volatility premiums during periods of market stress. Professional practitioners implement systematic volatility harvesting strategies that sell options during high implied volatility periods and purchase protection during low volatility environments, creating self-funding hedging programs that reduce net hedging costs over time.

Dynamic Collateral Management

Sophisticated borrowers implement dynamic collateral management systems that automatically adjust positions based on market conditions and volatility metrics. These systems can automatically add collateral during high volatility periods or reduce exposure when risk metrics exceed predetermined thresholds.

Automated rebalancing tools can monitor multiple positions across different platforms and execute protective actions without manual intervention. However, these systems require careful configuration and regular monitoring to ensure they function correctly during market stress periods.

Machine learning algorithms enhance dynamic collateral management by analysing historical patterns, market microstructure data, and cross-asset correlations to predict liquidation risks before they become critical. These systems incorporate natural language processing of news sentiment, social media analysis, and technical indicators to provide comprehensive risk assessment capabilities that exceed traditional threshold-based monitoring systems.

Real-time risk monitoring systems integrate multiple data sources including on-chain analytics, derivatives market data, and macroeconomic indicators to provide comprehensive risk assessment and automated response capabilities. Advanced systems utilise artificial intelligence to identify emerging risk patterns and execute protective actions before human operators can respond, providing critical protection during fast-moving market events that characterize cryptocurrency volatility.

Cross-Platform Risk Distribution

Advanced risk management involves distributing borrowing activities across multiple platforms and blockchain networks to reduce concentration risk. This strategy requires understanding the correlation between different platforms and the additional complexity of managing multiple positions simultaneously.

Cross-chain borrowing strategies can provide additional diversification benefits but introduce bridge risks and technical complexities that must be carefully evaluated. The optimal distribution depends on individual risk tolerance, technical expertise, and available capital for position management.

Multi-chain risk management requires sophisticated understanding of different blockchain architectures, consensus mechanisms, and security models that affect borrowing safety across various networks. Ethereum-based protocols offer the most mature ecosystem but face scalability constraints and high transaction costs during network congestion. Layer 2 solutions provide cost advantages but introduce additional technical risks related to bridge security and withdrawal delays that must be carefully evaluated.

Alternative blockchain networks including Binance Smart Chain, Polygon, and Avalanche offer different risk-reward profiles with varying degrees of decentralisation, security, and ecosystem maturity. Professional risk management requires comprehensive evaluation of validator sets, governance structures, and historical security incidents across different networks to optimise risk-adjusted returns while maintaining appropriate diversification and operational complexity management.

Quantitative Risk modelling and Stress Testing

Professional cryptocurrency borrowing risk management utilises advanced quantitative models including Monte Carlo simulations, value-at-risk calculations, and comprehensive stress testing frameworks that provide precise risk measurements and scenario analysis capabilities. These models incorporate historical volatility patterns, correlation structures, and tail risk characteristics specific to cryptocurrency markets to generate accurate risk assessments and optimal position sizing recommendations.

Stress testing methodologies include historical scenario analysis based on previous market crashes, hypothetical stress scenarios designed to test extreme but plausible market conditions, and reverse stress testing that identifies conditions under which borrowing positions would fail. Professional practitioners implement comprehensive stress testing programs that evaluate portfolio performance under various market scenarios including liquidity crises, regulatory changes, and technical failures.

Advanced risk metrics include expected shortfall calculations, maximum drawdown analysis, and time-to-liquidation modelling that provide comprehensive risk assessment beyond traditional value-at-risk measures. These metrics enable sophisticated risk budgeting and position sizing decisions that optimise risk-adjusted returns while maintaining appropriate safety margins and operational flexibility for dynamic market conditions.

Institutional Risk Management Infrastructure

Enterprise-grade cryptocurrency borrowing operations require comprehensive risk management infrastructure including real-time monitoring systems, automated alert mechanisms, and sophisticated reporting capabilities that enable systematic risk oversight and operational excellence. Professional risk management systems integrate multiple data sources, provide comprehensive analytics, and enable rapid response to emerging risks through automated and manual intervention capabilities.

Risk governance frameworks include comprehensive policies and procedures, regular risk committee oversight, and systematic risk reporting that ensure borrowing operations remain within established risk parameters while enabling strategic development and operational optimisation. Professional risk governance requires clear accountability structures, comprehensive documentation, and regular review processes that maintain risk management effectiveness and regulatory compliance.

Operational risk management includes comprehensive business continuity planning, disaster recovery procedures, and systematic operational controls that ensure borrowing operations can continue during adverse conditions while maintaining security and operational integrity. Professional operational risk management requires comprehensive threat assessment, advanced security measures, and systematic operational monitoring that protect against both internal and external operational risks.

Real-World Risk Case Studies

Case Study 1: The March 2020 Liquidation Cascade

Background: During the COVID-19 market crash, Bitcoin dropped from $8,000 to $3,800 in 24 hours, triggering massive liquidations across DeFi protocols.

What Happened: MakerDAO experienced over $8 million in bad debt as collateral auctions failed due to network congestion and high gas fees. Many borrowers couldn't add collateral or repay loans due to transaction failures, leading to liquidations at unfavorable prices.

Lessons learnt: Always maintain larger safety margins during uncertain market conditions. Have emergency funds on the same blockchain as your loan to avoid cross-chain delays. Consider the impact of network congestion on your ability to manage positions during crisis periods.

Case Study 2: Celsius Network Collapse

Background: Celsius Network, a central centralised lending platform, filed for bankruptcy in July 2022, freezing billions in user funds including collateral from borrowers.

What Happened: Borrowers who had taken loans from Celsius found their collateral frozen while still owing debt to the platform. Many users lost access to their collateral permanently, while still being legally obligated to repay their loans.

Lessons learnt: Centralised platform risk can result in total loss regardless of loan performance. Diversify across multiple platforms and never concentrate large amounts with a single provider. Monitor platform financial health indicators and withdraw at the first signs of trouble.

Case Study 3: Terra Luna Ecosystem Collapse

Background: The Terra Luna ecosystem collapse in May 2022 affected multiple lending protocols and caused widespread liquidations across the crypto market.

What Happened: Borrowers using LUNA as collateral experienced a complete loss as the token's value went to near zero. Even borrowers using other assets faced liquidations due to the broader market panic and correlation effects.

Lessons learnt: Avoid using experimental or algorithmic tokens as collateral. Understand the interconnectedness of different protocols and tokens. Market-wide events can affect all positions regardless of individual asset fundamentals.

Case Study 4: Successful Risk Management During Volatility

Background: An experienced DeFi user maintained multiple borrowing positions during the 2022 bear market without experiencing liquidations.

Strategy: Used conservative 30% LTV ratios, maintained 50% of portfolio in stablecoins for emergency collateral, set up automated alerts at multiple threshold levels, and diversified across Aave, Compound, and MakerDAO.

Results: Successfully navigated multiple market crashes by adding collateral during volatility spikes and reducing exposure during uncertain periods. Total portfolio drawdown was limited to 15% despite 80% market decline in some assets.

Key Success Factors: Conservative position sizing, adequate emergency reserves, diversification across platforms, and disciplined risk management execution during stressful market conditions.

Advanced Risk Management and Professional Mitigation Strategies

Institutional Risk Assessment and Quantitative Analysis

Professional cryptocurrency borrowing risk management utilises sophisticated quantitative models including comprehensive value-at-risk calculations, advanced stress testing, and systematic correlation analysis that identify and quantify borrowing risks while enabling strategic risk mitigation and operational optimisation. Institutional risk assessment incorporates advanced mathematical techniques, sophisticated monitoring systems, and comprehensive reporting capabilities that enable systematic risk evaluation while maintaining appropriate risk tolerance and operational oversight through professional risk management excellence and institutional-grade cryptocurrency borrowing strategies.

Quantitative risk analysis includes implementation of advanced statistical models, sophisticated scenario modelling, and comprehensive backtesting frameworks that provide precise risk measurements while enabling strategic decision-making and risk optimisation. Professional practitioners utilise advanced econometric techniques, comprehensive performance attribution, and sophisticated risk decomposition that enable continuous improvement in borrowing risk management while maintaining competitive returns through quantitative excellence and professional risk analysis designed for institutional cryptocurrency borrowing operations and risk optimisation.

Advanced Statistical modelling and Predictive Analytics

Sophisticated risk modelling incorporates Monte Carlo simulations, Bayesian inference techniques, and machine learning algorithms that analyse historical market data, volatility patterns, and correlation structures to predict potential liquidation scenarios and optimise position sizing strategies. These models utilise thousands of market scenarios to generate probability distributions of potential outcomes, enabling borrowers to make informed decisions about risk tolerance and position management based on quantitative analysis rather than intuition or emotion.

Predictive analytics frameworks integrate multiple data sources including on-chain metrics, market microstructure data, and macroeconomic indicators to generate early warning signals for potential market stress events that could impact borrowing positions. Advanced practitioners implement machine learning models that continuously learn from new market data and adapt their risk assessments based on evolving market conditions, providing dynamic risk management capabilities that respond to changing market environments.

Time series analysis and volatility forecasting models enable sophisticated prediction of market volatility patterns, enabling borrowers to adjust their risk management strategies proactively based on expected market conditions. These models incorporate regime-switching frameworks that identify different market states and adjust risk parameters accordingly, providing more accurate risk assessment during periods of market transition and stress.

Copula models and extreme value theory applications enable analysis of tail dependencies and correlation breakdown scenarios that can occur during market stress periods. These advanced statistical techniques provide insights into the probability of simultaneous adverse movements across different assets and protocols, enabling more robust diversification strategies and risk management approaches that account for correlation instability during crisis periods.

Advanced Hedging Strategies and Risk Mitigation Techniques

Sophisticated cryptocurrency borrowing risk mitigation utilises advanced hedging strategies including derivatives utilisation, comprehensive portfolio diversification, and systematic risk offsetting that protect against adverse market movements while maintaining borrowing capacity and operational efficiency. Advanced hedging techniques incorporate options strategies, futures contracts, and sophisticated synthetic instruments that provide comprehensive risk protection while preserving upside potential through professional derivatives utilisation and institutional-grade risk management excellence.

Risk mitigation implementation includes development of comprehensive hedging frameworks, sophisticated position management systems, and advanced monitoring capabilities that provide real-time risk protection while maintaining operational efficiency and strategic positioning. Professional hedging strategies require advanced derivatives knowledge, comprehensive risk assessment capabilities, and sophisticated operational controls that ensure effective risk mitigation while maintaining competitive borrowing capacity through professional risk management excellence and institutional hedging strategies designed for advanced cryptocurrency borrowing operations and risk optimisation.

Dynamic Risk Adjustment and Automated Protection Systems

Automated risk management systems utilise artificial intelligence and machine learning algorithms to continuously monitor borrowing positions and execute protective actions based on predetermined risk parameters and market conditions. These systems can automatically adjust collateral ratios, execute hedging transactions, and implement position reductions when risk metrics exceed acceptable thresholds, providing 24/7 protection that responds faster than human operators during volatile market conditions.

Smart contract-based protection mechanisms enable automated liquidation protection through decentralised protocols that can execute protective actions without relying on centralised systems or human intervention. These systems include automated collateral addition, position rebalancing, and emergency liquidation procedures that activate based on on-chain price feeds and risk calculations, providing transparent and reliable protection mechanisms.

Dynamic position sizing algorithms adjust borrowing amounts based on real-time volatility measurements, correlation analysis, and market stress indicators to maintain optimal risk-adjusted exposure across different market conditions. These systems incorporate volatility targeting frameworks that automatically reduce leverage during high volatility periods and increase exposure during stable market conditions, providing systematic risk management that adapts to changing market dynamics.

Multi-asset portfolio optimisation algorithms continuously rebalance collateral composition and borrowing strategies to maintain optimal risk-return profiles based on changing market conditions, correlation structures, and individual asset performance. These systems utilise modern portfolio theory principles adapted for cryptocurrency markets to generate optimal allocation recommendations that maximise risk-adjusted returns while maintaining appropriate safety margins.

Technology Integration and Automated Risk Management

Modern cryptocurrency borrowing risk management utilises advanced technology including artificial intelligence, machine learning algorithms, and comprehensive automation systems that optimise risk monitoring whilstimproving operational efficiency and risk response capabilities through technological excellence and innovation. Technology-enhanced risk management includes automated monitoring systems, sophisticated alert mechanisms, and comprehensive analytics platforms that enable real-time risk assessment while maintaining strategic positioning and operational control through technological innovation and professional automation designed for advanced borrowing risk management.

Automated risk management includes implementation of advanced algorithms for dynamic risk adjustment, sophisticated early warning systems, and comprehensive performance optimisation that minimise borrowing risks whilstmaximising capital efficiency through technological excellence. Professional technology integration requires advanced system architecture, comprehensive data management capabilities, and sophisticated analytical frameworks that enable continuous risk optimisation while maintaining security and operational excellence through technological innovation and professional automation designed for institutional cryptocurrency borrowing risk management and operational excellence.

Blockchain Analytics and On-Chain Risk Monitoring

Advanced on-chain analytics provide comprehensive insights into protocol health, liquidity conditions, and systemic risks that affect borrowing safety across different platforms and blockchain networks. These analytics include monitoring of total value locked trends, liquidation cascades, governance proposal activities, and smart contract upgrade patterns that can impact borrowing positions and platform stability over time.

Real-time blockchain monitoring systems track transaction patterns, whale movements, and protocol utilisation metrics to identify potential risks before they impact borrowing positions. These systems can detect unusual activity patterns, large liquidation events, and protocol stress conditions that may indicate emerging risks requiring immediate attention or position adjustment to protect borrowing capital.

Cross-chain risk analysis evaluates risks associated with bridge protocols, multi-chain strategies, and interoperability solutions that enable borrowing across different blockchain networks. These analyses include assessment of bridge security, validator set decentralisation, and historical incident patterns that affect the safety of cross-chain borrowing strategies and multi-network position management.

Protocol governance monitoring tracks voting patterns, proposal outcomes, and parameter changes that can affect borrowing conditions, liquidation thresholds, and platform stability. Advanced monitoring systems provide early warning of governance proposals that could impact borrowing positions, enabling proactive position management and risk mitigation before changes take effect.

Regulatory Risk Management and Compliance Excellence

Cryptocurrency borrowing regulatory risk management requires comprehensive compliance frameworks including advanced legal analysis, sophisticated regulatory monitoring, and systematic compliance procedures that ensure borrowing operations meet evolving regulatory standards while managing regulatory uncertainty and operational complexity. Regulatory risk management incorporates advanced compliance systems, sophisticated monitoring capabilities, and comprehensive reporting tools that enable systematic regulatory compliance while maintaining operational efficiency and strategic positioning through regulatory excellence and professional compliance management.

Professional regulatory compliance includes development of comprehensive policies, sophisticated training programs, and advanced monitoring systems that ensure borrowing operations remain compliant while enabling strategic development and risk optimisation. Regulatory excellence requires comprehensive legal frameworks, advanced compliance implementation, and sophisticated operational controls that enable cryptocurrency borrowing while maintaining regulatory standards and compliance leadership through professional regulatory management and institutional compliance excellence designed for enterprise cryptocurrency borrowing operations and regulatory risk mitigation.

Crisis Management and Emergency Response Strategies

Advanced cryptocurrency borrowing requires comprehensive crisis management including sophisticated emergency procedures, advanced contingency planning, and systematic response protocols that protect borrowing positions while maintaining operational continuity during market stress and operational emergencies. Crisis management excellence includes implementation of comprehensive response plans, sophisticated communication systems, and advanced coordination mechanisms that ensure effective crisis response while minimising operational disruption and financial losses through professional crisis management and emergency response excellence.

Emergency response strategies include development of comprehensive backup procedures, sophisticated recovery mechanisms, and advanced operational continuity plans that ensure borrowing operations can continue during adverse conditions while maintaining security and operational integrity. Professional crisis management requires comprehensive threat assessment, advanced response planning, and sophisticated operational controls that enable effective emergency response while maintaining borrowing capacity and operational excellence through professional emergency management and institutional crisis response designed for cryptocurrency borrowing operations and operational resilience optimisation.

Insurance and Protection Mechanisms

Comprehensive insurance strategies for cryptocurrency borrowing include evaluation of available coverage options, cost-benefit analysis of different protection mechanisms, and implementation of multi-layered insurance approaches that provide protection against various risk scenarios. Insurance options include smart contract coverage, custody insurance, and specialised cryptocurrency lending insurance products that provide financial protection against specific risks associated with borrowing activities.

Self-insurance strategies involve maintaining adequate reserves and implementing systematic risk management procedures that provide internal protection against potential losses without relying on external insurance providers. These strategies include maintaining emergency funds, implementing conservative position sizing, and utilising diversification techniques that reduce overall risk exposure while maintaining borrowing capacity and operational flexibility.

Parametric insurance products designed specifically for cryptocurrency markets provide automated payouts based on predetermined triggers such as price movements, volatility levels, or protocol events. These products offer transparent and efficient protection mechanisms that can provide rapid compensation for specific risk events without requiring complex claims processes or subjective damage assessments.

Insurance portfolio optimisation involves balancing insurance costs with risk reduction benefits to determine optimal coverage levels and protection strategies that maximise risk-adjusted returns while providing appropriate protection against catastrophic losses. Professional insurance strategies require comprehensive risk assessment, cost analysis, and ongoing monitoring to ensure insurance coverage remains appropriate and cost-effective as market conditions and risk profiles evolve over time.

Platform Risk Comparison and Selection

DeFi Protocol Risk Assessment

Different DeFi protocols have varying risk profiles based on their architecture, governance, and track record. Aave offers isolation mode for new assets and has a strong safety record, while Compound provides simplicity but with less sophisticated risk management features.

MakerDAO offers the most battle-tested system with extensive governance oversight, but its complexity can lead to user errors. Newer protocols may offer attractive rates but carry higher smart contract risks and less proven stability during market stress.

centralised Platform Evaluation

Centralised platforms vary significantly in their financial stability, regulatory compliance, and user protection measures. Established platforms like Nexo and BlockFi (before its issues) offered insurance and regulatory compliance but carried counterparty risk.

When evaluating centralised platforms, consider their financial backing, regulatory status, insurance coverage, and transparency in reporting. Platforms that provide regular attestations and maintain segregated customer funds generally offer better protection.

Geographic and Regulatory Considerations

Platform availability and regulatory protection vary by jurisdiction. Users in regulated markets may have access to platforms with stronger consumer protections but potentially lower yields due to compliance costs.

Consider the regulatory environment of both your location and the platform's jurisdiction when selecting borrowing venues. Platforms operating in multiple jurisdictions may offer better stability but could face restrictions in certain markets.

Risk-Adjusted Platform Selection

The optimal platform selection depends on individual risk tolerance, technical expertise, and capital size. Conservative users may prefer regulated centralised platforms despite lower yields, while experienced users might choose DeFi protocols for better rates and transparency.

Consider implementing a tiered approach where you use the most conservative platforms for the majority of your borrowing needs while experimenting with higher-risk, higher-reward platforms for smaller amounts. This strategy balances yield optimisation with risk management.

The cryptocurrency borrowing landscape continues to evolve rapidly, with new risk management tools, insurance products, and regulatory frameworks emerging to address the challenges identified in this comprehensive guide. Advanced monitoring systems powered by artificial intelligence and machine learning are enhancing risk detection capabilities, enabling more sophisticated early warning systems that can alert borrowers to potential liquidation risks before they become critical.

The integration of cross-chain protocols and interoperability solutions is creating new opportunities for diversified borrowing strategies while introducing additional complexity that requires careful evaluation and understanding. Institutional-grade risk management tools are becoming more accessible to retail borrowers, democratizing access to sophisticated hedging strategies and automated position management systems that were previously available only to professional traders.

The development of parametric insurance products specifically designed for cryptocurrency borrowing is providing new forms of protection against smart contract failures, oracle manipulation, and other protocol-specific risks. Educational resources and professional advisory services focused on cryptocurrency borrowing risk management are becoming more widely available, helping borrowers make informed decisions based on comprehensive risk assessment and market analysis.

As the ecosystem matures, the most successful borrowers will be those who combine fundamental risk management principles with an understanding of the unique characteristics and evolving nature of cryptocurrency markets, maintaining discipline and adaptability while pursuing attractive risk-adjusted returns in this dynamic and rapidly changing financial landscape. The lessons learnt from past failures and successes provide valuable guidance for navigating future challenges and opportunities in the cryptocurrency borrowing space, emphasizing the importance of continuous education, careful risk assessment, and disciplined execution of protective strategies that prioritise capital preservation alongside yield generation objectives.

Conclusion

Cryptocurrency borrowing represents both tremendous opportunity and significant risk , requiring a sophisticated understanding of multiple interconnected risk factors and disciplined implementation of comprehensive risk management strategies. The analysis presented in this guide demonstrates that successful crypto borrowing depends not on avoiding all risks, but on understanding, quantifying, and systematically managing them through proven strategies and conservative positioning approaches.

The most critical lesson from examining crypto borrowing failures is that conservative position sizing and adequate safety margins are non-negotiable requirements for long-term success . Borrowers who maintain loan-to-value ratios below 40% for volatile assets, keep substantial emergency reserves, and implement multiple layers of protection consistently outperform those who maximise leverage and operate with minimal safety buffers. The additional yield from aggressive positioning rarely compensates for the catastrophic losses that can occur during market stress periods.

Platform diversification emerges as another essential strategy, with successful borrowers spreading their activities across multiple protocols and platforms to avoid concentration risk. The collapse of major centralised platforms like Celsius and BlockFi, combined with numerous DeFi protocol exploits, demonstrates that no single platform or protocol can be considered completely safe regardless of its reputation or track record . Diversification across both centralised and decentralised platforms, combined with geographic and regulatory diversification, provides the most robust protection against platform-specific risks.

Active monitoring and dynamic risk management separate successful borrowers from those who experience significant losses . The cryptocurrency market's 24/7 nature and extreme volatility require continuous position monitoring, automated alert systems, and predetermined response procedures that can be executed rapidly during market stress. Borrowers who implement comprehensive monitoring systems and maintain the discipline to execute protective actions during volatile periods consistently achieve better risk-adjusted returns than those who rely on passive management approaches.

The evolution of risk management tools and insurance products continues to improve the safety profile of cryptocurrency borrowing, with new solutions emerging to address the specific challenges identified in this analysis. Advanced monitoring systems, automated hedging strategies, and parametric insurance products are making sophisticated risk management techniques accessible to retail borrowers , democratizing access to institutional-grade protection mechanisms that were previously available only to professional traders and large institutions.

Education and continuous learning remain the foundation of effective risk management in the rapidly evolving cryptocurrency lending landscape . The risks, tools, and best practices continue to evolve as the market matures, requiring borrowers to stay informed about new developments, emerging risks, and improved protection strategies. Regular review and updating of risk management approaches based on new information and market developments is essential for maintaining effective protection over time.

The future of cryptocurrency borrowing will likely see continued innovation in risk management tools, regulatory clarity, and platform safety measures , making the activity safer and more accessible to mainstream investors. However, the fundamental principles of conservative positioning, comprehensive risk assessment, active monitoring, and disciplined execution will remain essential for success regardless of technological and regulatory developments.

For borrowers ready to implement these strategies, the cryptocurrency lending market offers compelling opportunities for generating yield and accessing liquidity while maintaining acceptable risk levels. Success requires treating crypto borrowing as a sophisticated financial strategy that demands respect, preparation, and ongoing attention rather than a simple way to access quick capital . Those who approach cryptocurrency borrowing with appropriate caution, comprehensive preparation, and disciplined risk management can participate in this growing market while protecting their capital and achieving their financial objectives in the dynamic world of digital asset finance.

Sources & References

Recommended Safe Borrowing Platforms

After understanding the risks, choose reputable platforms with strong security records:

- Nexo - Regulated CeFi Platform - EU licensed with insurance coverage

- Aave - Leading DeFi Protocol - Battle-tested smart contracts

- Compound Review - Established DeFi lending protocol

Frequently Asked Questions

- What is the biggest risk when borrowing crypto?

- Liquidation risk is the biggest danger. If your collateral value drops below the required ratio, your position will be automatically liquidated, and you will lose your collateral while still owing the loan. This can happen within hours during market crashes.

- Can I lose more than my collateral in crypto lending?

- Yes, in extreme market conditions. If liquidation happens too slowly during a crash, you may owe more than your collateral was worth, creating bad debt. Additionally, liquidation penalties (ranging from 5% to 15%) increase total losses.

- Is DeFi or CeFi safer for crypto borrowing?

- Each has different risks. DeFi has smart contract risk but no risk of platform insolvency. CeFi has custody risk and platform failure risk but no smart contract vulnerabilities. Diversify across both for balanced risk.

- How can I protect against liquidation?

- Use conservative LTV ratios (30-40%), set multiple price alerts, maintain emergency collateral funds, and monitor your position daily. Never borrow at maximum LTV ratios offered by platforms.

- What happens if a lending platform goes bankrupt?

- On CeFi platforms, you become an unsecured creditor and may lose both collateral and borrowed funds. Recovery from bankruptcy can take years, resulting in partial losses. DeFi protocols don't have bankruptcy risk as they're decentralised smart contracts.

- Are crypto loans insured?

- Some CeFi platforms offer limited insurance, but it rarely covers all scenarios. DeFi insurance protocols, such as Nexus Mutual, offer smart contract coverage at an annual premium of 2-5%. Most crypto loans are not fully insured.

- How do I know if a platform is safe?

- Check: multiple security audits, 2+ years of operation history, high TVL, proper licensing, proof of reserves, no major exploit history, active bug bounty program, and transparent team. Avoid new or unaudited platforms.

- What's a safe LTV ratio for crypto loans?

- Conservative ratios: Bitcoin 30-40%, Ethereum 25-35%, Altcoins 20-30%. Never exceed 50% LTV on volatile assets. Lower ratios provide larger safety buffers against liquidation during market drops.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.