Crypto Loan-to-Value (LTV) Ratio Guide

Complete guide to understanding, calculating, and optimising LTV ratios for safe cryptocurrency borrowing in 2025.

Introduction

The loan-to-value (LTV) ratio represents one of the most critical concepts in cryptocurrency lending and borrowing, serving as the primary risk management tool that determines how much you can borrow against your digital asset collateral while maintaining a safe margin against liquidation. Understanding and properly managing LTV ratios is essential for anyone participating in DeFi lending protocols or centralised cryptocurrency lending platforms, as improper LTV management is one of the leading causes of liquidation and capital loss in the cryptocurrency lending ecosystem.

The concept of LTV in cryptocurrency lending builds upon traditional finance principles. Still, it introduces unique complexities due to the extreme volatility of digital assets and the automated liquidation mechanisms employed by most lending platforms. Unlike traditional secured loans, where human intervention and negotiation may provide flexibility during market stress, cryptocurrency lending platforms typically employ algorithmic liquidation systems that execute automatically when LTV thresholds are breached, making precise LTV management crucial for capital preservation.

Professional cryptocurrency borrowers understand that LTV management extends far beyond simply staying below liquidation thresholds. Effective LTV strategies involve dynamic risk assessment, market timing considerations, and sophisticated hedging techniques that enable borrowers to maximise capital efficiency while maintaining appropriate safety margins. The most successful cryptocurrency borrowers develop systematic approaches to LTV management that account for market volatility patterns, correlation risks between different digital assets, and the specific liquidation mechanisms employed by different lending platforms.

The cryptocurrency lending landscape offers diverse LTV requirements and liquidation mechanisms across different platforms and protocols, ranging from conservative 50% maximum LTV ratios on centralised platforms to aggressive 90%+ ratios available on certain DeFi protocols. Each platform's approach to LTV calculation, liquidation triggers, and collateral valuation creates unique risk profiles that borrowers must understand and navigate effectively to optimise their borrowing strategies while avoiding liquidation events.

This comprehensive guide examines every aspect of LTV management in cryptocurrency lending, from basic calculation methods to advanced risk management strategies that professional traders use to optimise their borrowing activities. Whether you're new to cryptocurrency lending or seeking to refine your existing LTV management approach, this guide provides the knowledge and tools necessary to borrow safely and effectively in the dynamic cryptocurrency lending ecosystem.

The cryptocurrency lending landscape offers a wide range of LTV options across different platforms and protocols, with maximum LTV ratios varying significantly based on the collateral asset, platform risk parameters, and market conditions. Whilst higher LTV ratios allow for greater capital efficiency and larger borrowing capacity, they also dramatically increase liquidation risk, particularly during periods of high market volatility that are common in cryptocurrency markets.

Effective LTV management requires understanding not only the mathematical calculations involved but also the psychological and strategic aspects of maintaining appropriate safety margins, monitoring market conditions, and implementing risk management strategies that protect against both gradual price declines and sudden market crashes. The difference between successful and unsuccessful cryptocurrency borrowers often comes down to their approach to LTV management and their ability to maintain discipline during periods of market stress.

The evolution of DeFi lending protocols has introduced additional complexity to LTV management, with features like dynamic interest rates, governance token rewards, and multi-asset collateral pools creating new opportunities and risks that require a sophisticated understanding of protocol mechanics and market dynamics. Modern LTV management strategies must account for these innovations while maintaining focus on the fundamental goal of capital preservation and risk mitigation.

This comprehensive guide examines all aspects of LTV ratio management in cryptocurrency lending, from basic calculations and platform comparisons to advanced strategies for optimising risk-adjusted returns while maintaining appropriate safety margins in volatile market conditions.

Market conditions in 2025 have created both opportunities and challenges for cryptocurrency borrowers, with institutional adoption driving platform improvements while regulatory developments provide clearer frameworks for lending activities. Understanding how these macro trends affect LTV management strategies is essential for making informed decisions about collateral deployment and risk management in the evolving cryptocurrency lending landscape.

Platform diversity has expanded significantly, offering borrowers multiple options with varying LTV limits, liquidation mechanisms, and risk management features. Each platform implements unique approaches to collateral valuation, liquidation procedures, and user protection measures, making platform selection a critical component of overall LTV strategy development and implementation.

The integration of advanced risk management tools, real-time monitoring systems, and automated position management features has transformed how sophisticated borrowers approach LTV optimisation. These technological improvements enable more precise risk control while providing opportunities for enhanced capital efficiency through dynamic position management and automated rebalancing strategies.

What is the LTV Ratio in cryptocurrency loans?

The Loan-to-Value (LTV) ratio measures how much you can borrow relative to your collateral value. It's the fundamental metric determining loan size and liquidation risk.

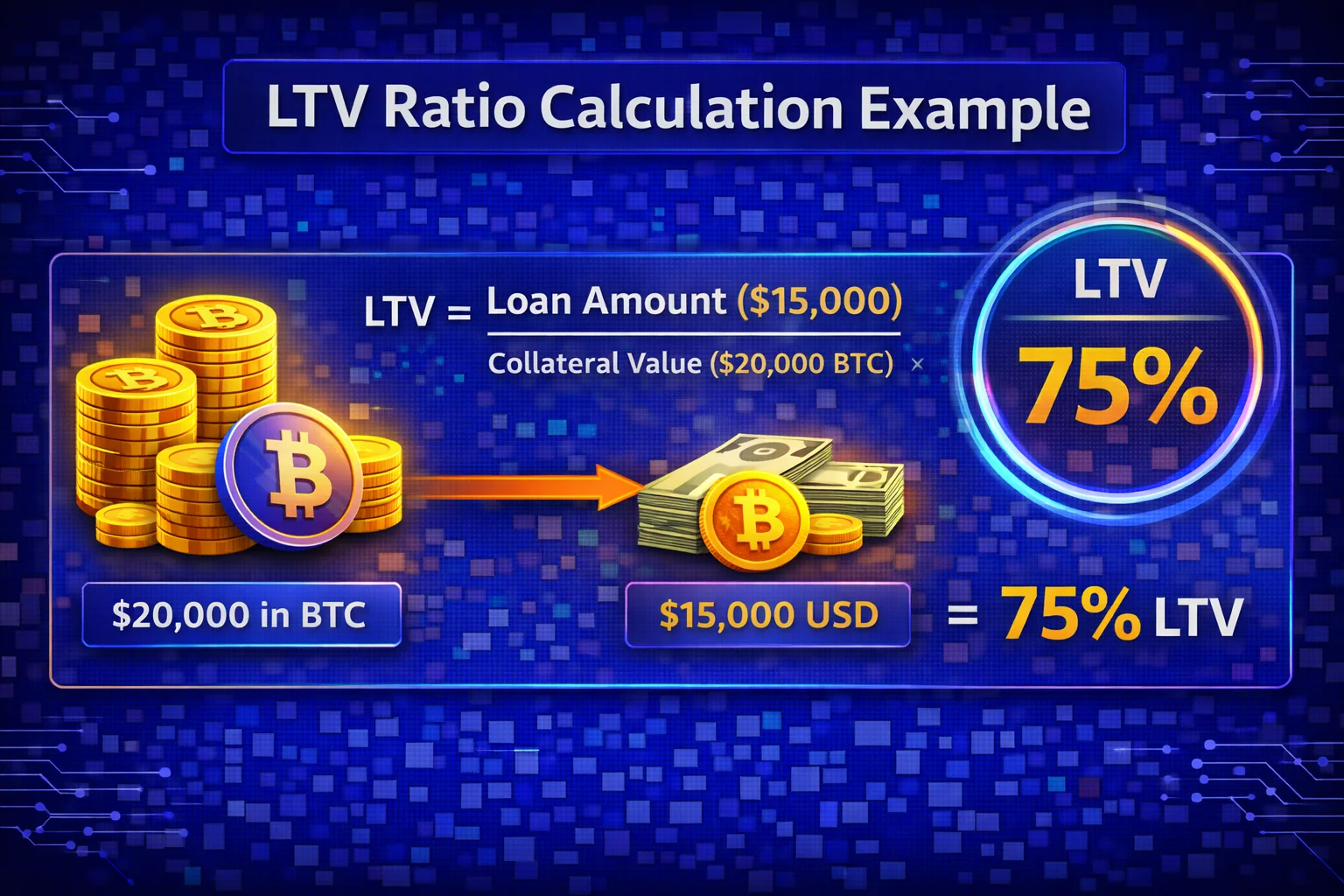

LTV Formula

LTV = (Loan Amount / Collateral Value) × 100%

Simple Example

- Collateral: $10,000 worth of Bitcoin

- Loan: $5,000 USDT

- LTV: ($5,000 / $10,000) × 100% = 50%

Why LTV Matters

- Determines Loan Size: Higher LTV = more borrowing capacity

- Affects Liquidation Risk: Higher LTV = closer to liquidation

- Impacts Interest Rates: Some platforms charge more for higher LTV

- Reflects Risk Level: Lower LTV = safer position

Understand collateral basics in our collateral guide.

How to Calculate LTV Ratio

Step-by-Step Calculation

Step 1: Determine Collateral Value

Example: 2 ETH at $2,500 each

- Collateral Value = 2 × $2,500 = $5,000

- Always use current market prices for accurate calculations

- Consider using multiple price sources for verification

Step 2: Determine Loan Amount

You want to borrow $2,000 USDT

Step 3: Calculate LTV

LTV = ($2,000 / $5,000) × 100% = 40%

Reverse Calculation: Maximum Loan

If the platform offers 50% max LTV:

- Collateral: $10,000

- Max Loan: $10,000 × 50% = $5,000

- Safe Loan: $10,000 × 35% = $3,500 (recommended conservative approach)

Dynamic LTV Changes

Price Increase Scenario

- Initial: $10,000 collateral, $5,000 loan = 50% LTV

- ETH +20%: $12,000 collateral, $5,000 loan = 41.7% LTV

- Result: LTV improves, safer position

Price Decrease Scenario

- Initial: $10,000 collateral, $5,000 loan = 50% LTV

- ETH -20%: $8,000 collateral, $5,000 loan = 62.5% LTV

- Result: LTV worsens, approaching liquidation

Interest Impact on LTV

Loan value increases over time due to interest:

- Month 1: $5,000 loan at 8% APR

- Month 6: $5,200 loan (with interest)

- LTV Change: 50% → 52% (if collateral stable)

Platform LTV Limits

CeFi Platform LTV Ratios

Nexo

- Bitcoin: Up to 50% LTV

- Ethereum: Up to 50% LTV

- Stablecoins: Up to 90% LTV

- Altcoins: 20-33% LTV

- Liquidation: Varies by tier and asset

Crypto.com

- Bitcoin/Ethereum: Up to 50% LTV

- Stablecoins: Up to 50% LTV

- Other Assets: 25-40% LTV

YouHodler

- Bitcoin: Up to 70% LTV

- Ethereum: Up to 70% LTV

- Stablecoins: Up to 90% LTV

- Note: Higher LTV = higher risk

DeFi Protocol LTV Ratios

Aave

- Bitcoin (WBTC): 70% max LTV, 75% liquidation

- Ethereum: 80% max LTV, 82.5% liquidation

- Stablecoins: 75-80% max LTV

- E-Mode: Up to 97% LTV for correlated assets

Compound

- Bitcoin (WBTC): 70% collateral factor

- Ethereum: 82.5% collateral factor

- Stablecoins: 75-85% collateral factor

MakerDAO

- ETH-A: 170% min collateral (58.8% max LTV)

- WBTC-A: 175% min collateral (57.1% max LTV)

- USDC-A: 101% min collateral (99% max LTV)

Understanding Liquidation Thresholds

Liquidation threshold is always higher than max LTV:

- Max LTV: Maximum you can borrow initially

- Liquidation Threshold: LTV at which liquidation triggers

- Buffer: Difference between max and liquidation

Example (Aave ETH):

- Max LTV: 80%

- Liquidation: 82.5%

- Buffer: 2.5% (very small!)

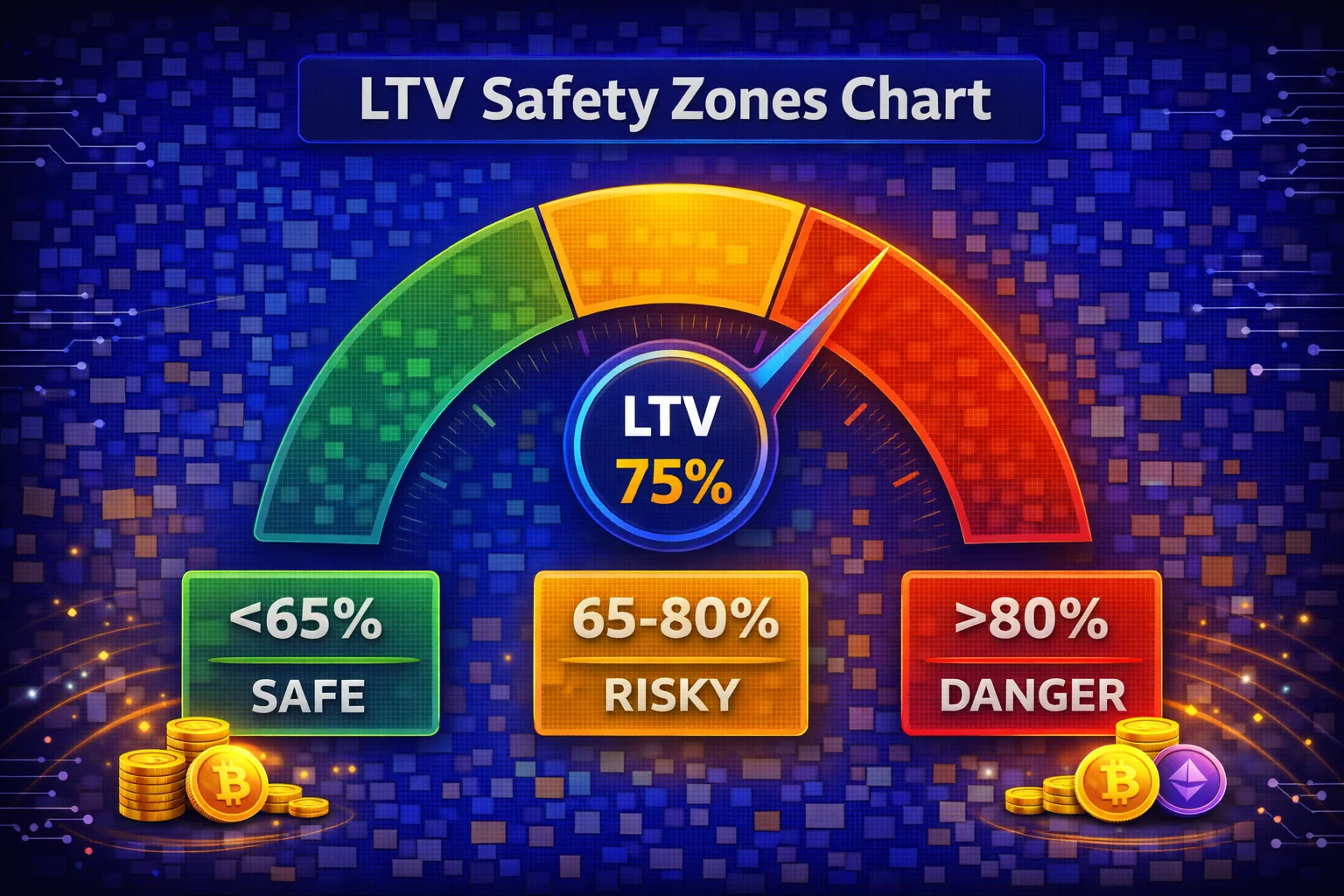

Optimal LTV Ratios for Safety

Conservative LTV Recommendations

By Asset Volatility

- Bitcoin (Low Volatility): 30-40% LTV

- Ethereum (Moderate): 25-35% LTV

- Major Altcoins (High): 20-30% LTV

- Stablecoins (None): 70-80% LTV

By Risk Tolerance

- Conservative: 20-30% LTV (large buffer)

- Moderate: 30-40% LTV (balanced)

- Aggressive: 40-50% LTV (higher risk)

- Dangerous: 50%+ LTV (not recommended)

LTV Strategy by Market Conditions

Bull Market

- Strategy: Can use slightly higher LTV (40-50%)

- Reason: Collateral likely to appreciate

- Caution: Bull markets end suddenly

Bear Market

- Strategy: Use very low LTV (20-30%)

- Reason: Collateral likely to depreciate

- Safety: Large buffer protects from crashes

High Volatility

- Strategy: minimise LTV (20-25%)

- Reason: Rapid price swings increase risk

- Alternative: Use stablecoin collateral

LTV optimisation Examples

Example 1: Conservative Bitcoin Loan

- Collateral: 1 BTC at $50,000

- Target LTV: 30%

- Loan Amount: $15,000

- Liquidation Buffer: 40-50% price drop before liquidation

Example 2: Moderate Ethereum Loan

- Collateral: 10 ETH at $2,500 = $25,000

- Target LTV: 35%

- Loan Amount: $8,750

- Liquidation Buffer: 35-45% price drop

Example 3: Stablecoin Efficiency

- Collateral: $50,000 USDC

- Target LTV: 75%

- Loan Amount: $37,500

- Risk: Minimal (stablecoin depeg only)

LTV Management Strategies

Monitoring Your LTV

Daily Checks

- Check current LTV on platform dashboard

- Compare to your target safe LTV

- Note distance to liquidation threshold

- Track collateral price trends

Alert Setup

- Warning Level: LTV reaches 45% (if target is 35%)

- Action Level: LTV reaches 50%

- Critical Level: LTV reaches 55%

Improving Your LTV

Method 1: Add Collateral

Current: $10,000 collateral, $5,000 loan = 50% LTV

Add $2,000 collateral:

- New collateral: $12,000

- New LTV: $5,000 / $12,000 = 41.7%

- Improvement: 8.3 percentage points

Method 2: Repay Loan

Current: $10,000 collateral, $5,000 loan = 50% LTV

Repay $1,000:

- New loan: $4,000

- New LTV: $4,000 / $10,000 = 40%

- Improvement: 10 percentage points

Method 3: Combination

- Add $1,000 collateral

- Repay $500 loan

- New LTV: $4,500 / $11,000 = 40.9%

LTV Rebalancing Schedule

Monthly Rebalancing

- Review LTV on 1st of each month

- If above target, add collateral or repay

- If well below target, consider borrowing more

Event-Based Rebalancing

- After 10% Price Drop: Check and adjust

- After 20% Price Drop: Immediate action

- After Profit Taking: Repay portion of loan

Advanced LTV Strategies

Laddered LTV Approach

Implement multiple loans with different LTV ratios to optimise risk and capital efficiency. This strategy involves creating several smaller positions rather than one large loan, allowing for more granular risk management and flexible adjustment options.

- Conservative Tier (25% LTV): Core position with maximum safety margin

- Moderate Tier (35% LTV): Balanced risk-reward positioning

- Aggressive Tier (45% LTV): Higher yield with increased monitoring requirements

Dynamic LTV Management

Adjust your target LTV based on market conditions, volatility levels, and personal risk tolerance. During bull markets, you might accept higher LTV ratios, while bear markets require more conservative positioning.

- Bull Market Strategy: Target 40-50% LTV for maximum capital efficiency

- Bear Market Strategy: Target 20-30% LTV for enhanced safety margins

- Sideways Market: Target 30-40% LTV for balanced approach

- High Volatility: Reduce target LTV by 10-15 percentage points

Cross-Platform LTV optimisation

Different lending platforms offer varying LTV limits and liquidation thresholds. Advanced users can optimise their overall position by utilising multiple platforms strategically, taking advantage of each platform's unique features and risk parameters.

- Platform A: Conservative LTV for stable income generation

- Platform B: Moderate LTV for balanced growth

- Platform C: Higher LTV for short-term opportunities

Split collateral across multiple loans with different LTV ratios:

- Loan 1: 30% LTV (ultra-safe)

- Loan 2: 40% LTV (moderate)

- Loan 3: 50% LTV (aggressive)

- Benefit: Diversified risk, partial liquidation only

Dynamic LTV Adjustment

- Bull Market: Gradually increase LTV to 45-50%

- Bear Market: Reduce LTV to 25-30%

- Sideways: Maintain moderate 35-40%

Learn protection strategies in our liquidation protection guide.

Psychology of LTV Management

Emotional Decision-Making Traps

Understanding psychological factors helps maintain disciplined LTV management during market volatility.

Common Psychological Mistakes

- Greed During Bull Markets: Borrowing at maximum LTV when prices rise, assuming they'll continue. This leaves no buffer for inevitable corrections.

- Fear During Bear Markets: Panic-closing positions at losses instead of adding collateral. Often results in realising losses unnecessarily.

- Overconfidence Bias: Believing "this time is different" and ignoring historical volatility patterns. Markets always revert to volatility eventually.

- Anchoring to Entry Price: Refusing to adjust strategy when market conditions change fundamentally.

Disciplined LTV Framework

Rule-Based Approach

Remove emotions by following predetermined rules:

- Maximum LTV Rule: Never exceed 50% LTV regardless of market sentiment

- Rebalancing Rule: Add collateral when LTV exceeds 45%, no exceptions

- Profit-Taking Rule: Repay 20% of loan when collateral appreciates 30%+

- Emergency Rule: Close position if unable to maintain safe LTV for 30+ days

Stress Testing Your LTV

Before borrowing, test your strategy against historical scenarios:

- 50% Crash Scenario: Can you survive if collateral drops 50% in one month?

- Extended Bear Market: Can you maintain a position for 12-18 months of decline?

- Black Swan Event: Do you have emergency funds for 70%+ crash?

If you can't confidently answer "yes" to all three, reduce your LTV or loan size. Conservative positioning prevents forced liquidations during the worst market conditions.

Advanced LTV Management Strategies

Dynamic LTV Rebalancing

Professional borrowers implement systematic rebalancing strategies to maintain optimal LTV ratios. This involves setting specific thresholds for adding collateral or reducing debt based on market conditions and volatility patterns.

Automated Rebalancing Systems

Advanced platforms offer automated tools that monitor your LTV ratio continuously and execute predefined actions when thresholds are reached. These systems can automatically add collateral from connected wallets or partially repay loans to maintain safe LTV levels.

Multi-Asset Collateral optimisation

Sophisticated borrowers diversify collateral across multiple assets to reduce correlation risk. By using a basket of uncorrelated assets (Bitcoin, Ethereum, stablecoins, and tokenised real-world assets), you can achieve more stable LTV ratios even during market volatility.

Cross-Platform LTV Arbitrage

Different platforms offer varying LTV ratios for the same assets. Advanced users can exploit these differences by borrowing on platforms with higher LTV limits while maintaining conservative ratios, then using borrowed funds on platforms with better rates or features.

Platform Comparison Strategy

Regularly compare LTV offerings across platforms. For example, if Platform A offers 70% LTV on ETH while Platform B offers 60%, you might use Platform A for borrowing while keeping your actual LTV at 40% for safety, giving you more borrowing capacity.

Hedging Strategies for LTV Protection

Professional borrowers use derivatives to hedge against adverse price movements that could increase their LTV ratios. This includes using perpetual swaps, options, or futures to create delta-neutral positions.

Perpetual Funding Arbitrage

By shorting perpetual contracts equal to your collateral value, you can create a market-neutral position that generates funding rate income while protecting against LTV increases due to price drops.

Institutional LTV Management

Large borrowers and institutions employ sophisticated risk management frameworks that include stress testing, value-at-risk calculations, and correlation analysis across their entire portfolio of crypto loans.

Portfolio-Level LTV optimisation

Instead of managing individual loan LTVs, institutions optimise at the portfolio level, considering correlations between different collateral assets and borrowing positions across multiple platforms and strategies.

LTV Management Across Market Cycles

Bull Market LTV Strategies

During bull markets, collateral values increase, naturally reducing LTV ratios. This creates opportunities to either borrow more or maintain ultra-conservative ratios for maximum safety. However, bull markets can also create overconfidence, leading to dangerous LTV increases.

Bull Market Best Practices

- Resist overleverage: Don't increase borrowing just because LTV ratios improve

- Take profits: Use improved ratios to partially repay loans and lock in gains

- Prepare for reversals: Bull markets don't last forever; maintain conservative ratios

- Diversify timing: Don't add all collateral at market peaks

Bear Market LTV Management

Bear markets are the ultimate test of LTV management. Collateral values decline rapidly, causing LTV ratios to spike towards dangerous levels. Successful borrowers prepare for these conditions in advance.

Bear Market Survival Tactics

- Emergency reserves: Maintain cash or stablecoin reserves for adding collateral

- Gradual deleveraging: Reduce loan amounts as markets decline

- Asset rotation: Switch to more stable collateral during downturns

- Platform diversification: Spread risk across multiple platforms

Sideways Market optimisation

Range-bound markets offer unique opportunities for LTV optimisation. With reduced volatility, borrowers can operate at slightly higher LTV ratios while implementing systematic rebalancing strategies.

Range Trading with Loans

In sideways markets, some borrowers use their loans for range trading strategies, buying at support levels and selling at resistance while maintaining strict LTV discipline throughout the process.

Regulatory and Tax Implications of LTV Management

Tax-Efficient LTV Strategies

LTV management decisions can have significant tax implications. In many jurisdictions, borrowing against crypto assets is not a taxable event, making it an attractive alternative to selling assets for liquidity.

Tax optimisation Techniques

- Avoid taxable sales: Use loans instead of selling appreciated assets

- Harvest losses: If forced to liquidate, consider tax loss harvesting

- Timing strategies: Plan LTV adjustments around tax year boundaries

- Record keeping: Maintain detailed records of all LTV-related transactions

Regulatory Compliance

As digital asset lending regulations evolve, LTV management must consider compliance requirements. Some jurisdictions are implementing maximum LTV limits or requiring additional disclosures for high-LTV loans.

Compliance Best Practices

- Know your jurisdiction: Understand local regulations on cryptocurrency loans

- Platform compliance: Use regulated platforms where possible

- Documentation: Maintain comprehensive records for regulatory reporting

- Professional advice: Consult with crypto-savvy tax and legal professionals

Practical Implementation Guidelines

Cryptocurrency loan-to-value ratio optimisation requires comprehensive analysis of collateral assets, market conditions, and borrowing objectives that influence lending capacity. Effective LTV management combines conservative positioning with strategic leverage to maximise borrowing potential while maintaining adequate safety margins against liquidation risks.

Step-by-Step Execution Framework

Strategic LTV implementation begins with comprehensive planning that includes ratio calculation, collateral evaluation, and risk management procedures. Professional borrowers establish clear protocols for collateral allocation, ratio monitoring, and adjustment schedules that maintain consistency while allowing flexibility for market opportunities and changing collateral values.

Security and Operational Procedures

Robust LTV security frameworks encompass collateral protection, ratio monitoring, and secure backup procedures that protect against both technical failures and liquidation security breaches. Professional borrowers implement comprehensive operational security protocols including ratio verification procedures, liquidation alert systems, and emergency collateral management plans.

Performance Tracking and optimisation

Loan-to-value ratio optimisation requires systematic assessment of collateral values, liquidation thresholds, and market volatility that determine borrowing capacity. Regular LTV monitoring enables risk management and position adjustment while maintaining alignment with safety margins and borrowing objectives.

Advanced LTV Strategies and Professional Risk Management

Institutional LTV Management and Professional Implementation

Professional cryptocurrency lending requires sophisticated loan-to-value management frameworks, comprehensive risk assessment procedures, and advanced operational protocols that enable institutional participation while maintaining fiduciary responsibilities and regulatory compliance. Institutional LTV management includes systematic collateral evaluation, comprehensive risk monitoring, and advanced optimisation strategies that maximise borrowing capacity whilstprotecting capital through professional lending management and institutional cryptocurrency operations designed for sophisticated borrowing requirements and professional asset management excellence.

Professional implementation strategies include comprehensive portfolio analysis, sophisticated risk modelling, and advanced operational procedures that optimise LTV ratios while maintaining appropriate risk distribution and regulatory compliance. Institutional LTV management utilises advanced analytics, systematic monitoring procedures, and comprehensive risk management frameworks that enable optimal borrowing efficiency while maintaining security standards and operational excellence through professional lending operations and institutional cryptocurrency management designed for sophisticated borrowing strategies and professional financial operations excellence.

Advanced institutional frameworks incorporate quantitative risk models that analyse correlation structures between different collateral assets, enabling sophisticated portfolio-level LTV optimisation that accounts for diversification benefits and concentration risks. Professional institutions implement systematic stress testing procedures that evaluate LTV performance under various market scenarios, including extreme volatility events, liquidity crises, and correlation breakdowns that can occur during market stress periods.

Institutional risk management systems integrate real-time monitoring capabilities with automated alert mechanisms that notify risk managers when LTV ratios approach predetermined thresholds. These systems incorporate machine learning algorithms that analyse historical patterns and market microstructure data to predict potential liquidation risks before they become critical, enabling proactive risk management and position adjustment strategies.

Quantitative Risk Models and Statistical Analysis

Advanced quantitative frameworks for LTV management incorporate sophisticated statistical models including Value-at-Risk calculations, Monte Carlo simulations, and stress testing methodologies that evaluate potential losses under extreme market conditions. These models utilise historical volatility data, correlation matrices, and tail risk measurements to establish optimal LTV thresholds that balance capital efficiency with risk management objectives across different market environments and asset classes.

Statistical analysis of liquidation events reveals critical patterns in LTV performance during market stress periods, enabling development of predictive models that identify high-risk scenarios before they materialize. Professional risk managers implement Bayesian updating mechanisms that continuously refine risk parameters based on new market data, ensuring LTV strategies remain optimised for current market conditions while maintaining appropriate safety margins for unexpected volatility spikes.

Copula models and extreme value theory applications enable sophisticated analysis of tail dependencies between different cryptocurrency assets, providing insights into correlation breakdown scenarios that can dramatically increase portfolio-level liquidation risks. These advanced statistical techniques inform optimal diversification strategies and position sizing decisions that maintain stable LTV ratios even during periods of extreme market stress and correlation regime changes.

Machine learning algorithms including neural networks, random forests, and support vector machines analyse vast datasets of market microstructure information, order book dynamics, and sentiment indicators to predict short-term volatility spikes that could threaten LTV stability. These predictive models enable proactive position adjustments and risk management actions that prevent liquidation events through early warning systems and automated response protocols.

Dynamic LTV optimisation and Market Volatility Management

Dynamic loan-to-value optimisation requires sophisticated market analysis, comprehensive volatility modelling, and advanced adjustment strategies that maintain optimal borrowing positions while managing market risks and operational complexities. Dynamic LTV management includes real-time monitoring systems, comprehensive risk assessment algorithms, and advanced rebalancing procedures that optimise borrowing capacity whilstprotecting against liquidation risks through professional volatility management and institutional lending operations designed for sophisticated market conditions and professional risk management excellence.

Market volatility management includes comprehensive hedging strategies, sophisticated risk mitigation techniques, and advanced operational procedures that protect borrowing positions while maintaining optimal LTV ratios and operational efficiency. Professional volatility management utilises advanced analytics, systematic risk assessment procedures, and comprehensive monitoring systems that enable optimal borrowing performance while maintaining appropriate risk management and operational excellence through professional market management and institutional lending operations designed for sophisticated cryptocurrency borrowing and professional asset management excellence.

Volatility forecasting models incorporate multiple data sources including implied volatility from options markets, realised volatility calculations, and sentiment indicators from social media and news analysis. These models enable dynamic adjustment of target LTV ratios based on expected volatility levels, allowing borrowers to maintain appropriate safety margins while optimising capital efficiency during different market regimes.

Professional volatility management includes implementation of volatility-adjusted position sizing models that automatically reduce LTV targets during high volatility periods and increase them during stable market conditions. These systems incorporate regime-switching models that identify changes in market volatility patterns and adjust risk parameters accordingly, providing systematic protection against sudden volatility spikes that characterize cryptocurrency markets.

Advanced Hedging Strategies and Derivative Applications

Sophisticated hedging strategies utilise cryptocurrency derivatives including perpetual swaps, options contracts, and futures instruments to create delta-neutral positions that protect against adverse price movements while maintaining borrowing capacity. Professional hedging implementations incorporate dynamic hedge ratios that adjust automatically based on changing market conditions, volatility levels, and correlation structures between different cryptocurrency assets and derivative instruments.

Options-based hedging strategies include protective put purchases, collar strategies, and volatility trading techniques that provide downside protection while preserving upside participation in collateral appreciation. These strategies enable maintenance of higher LTV ratios by providing insurance against liquidation events through systematic options positioning that activates during market stress periods and provides capital for collateral enhancement or loan repayment.

Perpetual swap hedging involves establishing short positions equivalent to collateral value, creating market-neutral exposure that generates funding rate income whilstprotecting against LTV deterioration. Professional implementations incorporate funding rate arbitrage strategies that optimise hedge positioning based on funding rate cycles, enabling generation of additional income while maintaining comprehensive downside protection through systematic derivative positioning.

Cross-asset hedging strategies utilise correlations between different cryptocurrency assets to create synthetic hedges using liquid instruments to protect illiquid collateral positions. These techniques enable sophisticated risk management for exotic or low-liquidity collateral assets through proxy hedging using highly liquid Bitcoin or Ethereum derivatives that provide effective protection while maintaining operational efficiency and cost effectiveness.

Multi-Asset Collateral Strategies and Portfolio optimisation

Multi-asset collateral strategies enable comprehensive diversification across different cryptocurrency assets, reducing concentration risk whilstmaximising borrowing capacity through strategic allocation across various digital assets and lending protocols. Multi-asset implementation includes systematic asset evaluation, comprehensive correlation analysis, and advanced allocation strategies that optimise LTV ratios while managing asset-specific risks and operational complexities through professional multi-asset management and institutional lending operations designed for sophisticated collateral strategies and professional portfolio optimisation excellence.

Portfolio optimisation includes strategic asset allocation, comprehensive risk distribution, and advanced rebalancing procedures that maximise borrowing efficiency while maintaining appropriate risk management and operational flexibility. Professional portfolio management utilises sophisticated analytics, systematic optimisation procedures, and comprehensive monitoring systems that enable optimal multi-asset utilisation while maintaining security standards and regulatory compliance through professional portfolio operations and institutional lending management designed for sophisticated cryptocurrency borrowing and professional asset management excellence.

Advanced portfolio construction techniques incorporate modern portfolio theory principles adapted for cryptocurrency markets, including optimisation algorithms that account for the unique characteristics of digital assets such as higher volatility, lower liquidity, and different correlation structures compared to traditional assets. These models enable construction of efficient collateral portfolios that maximise borrowing capacity while minimising overall portfolio risk.

Multi-asset collateral management systems implement dynamic rebalancing algorithms that maintain optimal asset allocation weights while accounting for changing market conditions and relative asset performance. These systems incorporate transaction cost analysis to optimise rebalancing frequency and minimise operational costs while maintaining desired risk characteristics and LTV optimisation objectives.

Algorithmic Trading Integration and Automated Management

Algorithmic trading systems integrated with LTV management enable automated position adjustments, systematic rebalancing, and dynamic risk management that maintains optimal borrowing ratios without manual intervention. These systems incorporate sophisticated algorithms that monitor market conditions continuously, executing trades and adjustments based on predetermined parameters while maintaining strict risk management protocols and operational security standards.

Automated LTV management systems utilise artificial intelligence and machine learning algorithms to optimise borrowing strategies based on historical performance data, market conditions, and risk parameters. These systems can automatically add collateral, repay loans, or adjust positions based on changing market dynamics while maintaining user-defined risk tolerances and investment objectives through systematic automation and professional algorithmic management.

High-frequency monitoring systems track LTV ratios in real-time across multiple platforms and positions, providing instant alerts and automated responses when ratios approach dangerous levels. These systems incorporate latency optimisation techniques that ensure rapid response times during volatile market conditions, enabling protection against flash crashes and sudden liquidation events through systematic monitoring and automated intervention protocols.

Smart contract integration enables automated LTV management through decentralised protocols that execute predetermined strategies without human intervention. These systems incorporate oracle price feeds, automated liquidation protection mechanisms, and systematic rebalancing protocols that maintain optimal LTV ratios while minimising operational overhead and human error risks through comprehensive automation and professional smart contract implementation.

Cross-Platform LTV Arbitrage and Yield optimisation

Cross-platform loan-to-value arbitrage enables sophisticated yield optimisation through strategic utilisation of different lending platforms, comprehensive rate comparison, and advanced operational strategies that maximise borrowing efficiency while managing platform-specific risks and operational complexities. Cross-platform implementation includes systematic platform evaluation, comprehensive risk assessment, and advanced operational procedures that optimise borrowing costs while maintaining appropriate risk distribution through professional arbitrage management and institutional lending operations designed for sophisticated yield optimisation and professional borrowing excellence.

Yield optimisation strategies include comprehensive rate analysis, sophisticated timing mechanisms, and advanced operational procedures that enhance borrowing returns while managing platform risks and operational requirements. Professional yield optimisation utilises advanced analytics, systematic monitoring procedures, and comprehensive risk management frameworks that enable optimal cross-platform utilisation while maintaining security standards and operational efficiency through professional yield management and institutional lending operations designed for sophisticated borrowing strategies and professional financial optimisation excellence.

Cross-platform arbitrage strategies require sophisticated operational infrastructure that can monitor rates and LTV parameters across multiple platforms simultaneously, identifying opportunities for rate arbitrage while maintaining appropriate risk management standards. These systems incorporate automated execution capabilities that can rapidly deploy capital to take advantage of temporary rate discrepancies while maintaining overall portfolio risk parameters.

Platform risk assessment frameworks evaluate counterparty risk, smart contract security, and operational reliability across different lending platforms, enabling informed decisions about capital allocation and risk distribution. These assessments incorporate quantitative metrics such as total value locked, historical security incidents, and governance token distribution alongside qualitative factors including team experience and regulatory compliance status.

Regulatory Compliance and Professional Tax Management

Cryptocurrency lending regulatory landscape includes complex tax implications, reporting requirements, and jurisdictional considerations that impact LTV strategy implementation and operational procedures. Regulatory compliance includes comprehensive legal framework adherence, sophisticated tax optimisation strategies, and advanced reporting procedures that ensure regulatory compliance whilstmaximising borrowing efficiency through professional tax management and comprehensive regulatory compliance designed for institutional lending operations and professional cryptocurrency management excellence.

Professional tax management includes systematic record keeping, comprehensive transaction analysis, and sophisticated tax planning that optimises borrowing strategies while maintaining regulatory compliance and operational transparency. Tax optimisation strategies utilise advanced analytics, systematic reporting procedures, and comprehensive compliance frameworks that ensure optimal tax efficiency while maintaining regulatory adherence and operational excellence through professional tax management and institutional compliance designed for sophisticated lending operations and professional cryptocurrency asset management excellence.

Tax-efficient LTV management strategies incorporate jurisdiction-specific regulations regarding cryptocurrency lending, including treatment of borrowing events, collateral appreciation, and liquidation scenarios. Professional tax planning includes timing strategies that optimise the tax impact of LTV adjustments and position management activities while maintaining compliance with evolving regulatory requirements.

Regulatory compliance frameworks incorporate ongoing monitoring of regulatory developments across multiple jurisdictions, enabling proactive adjustment of LTV strategies to maintain compliance with changing legal requirements. These frameworks include comprehensive documentation procedures that support regulatory reporting requirements and audit preparation while maintaining operational efficiency and strategic flexibility.

Professional Risk Assessment and Due Diligence

Comprehensive due diligence procedures for cryptocurrency lending platforms include evaluation of smart contract security audits, insurance coverage, regulatory compliance status, and operational track records that inform platform selection decisions for professional LTV management strategies. These assessments incorporate quantitative risk metrics including historical liquidation rates, platform downtime statistics, and security incident analysis alongside qualitative factors such as team experience and governance structures.

Professional risk assessment frameworks utilise sophisticated scoring methodologies that evaluate platform reliability, counterparty risk, and operational security across multiple dimensions. These frameworks incorporate stress testing scenarios that evaluate platform performance during extreme market conditions, enabling informed decisions about capital allocation and risk distribution across different lending platforms and protocols.

Ongoing monitoring procedures track platform performance metrics, security developments, and regulatory changes that could impact LTV strategy effectiveness and risk profiles. These monitoring systems provide early warning indicators of potential platform issues or regulatory changes that require strategic adjustments or position reallocation to maintain optimal risk management and operational security standards.

Insurance and protection mechanisms including platform insurance coverage, smart contract insurance, and self-insurance strategies provide additional layers of protection for professional LTV management operations. These protection mechanisms enable maintenance of higher LTV ratios by providing coverage against platform failures, smart contract vulnerabilities, and operational risks that could otherwise require more conservative positioning and reduced capital efficiency.

Conclusion: Mastering LTV for DeFi lending Success

Understanding and managing loan-to-value ratios is fundamental to successful crypto lending, representing the cornerstone of effective risk management in the volatile cryptocurrency market. The difference between profitable borrowing and devastating liquidation often comes down to disciplined LTV management, conservative risk-taking, and the ability to maintain emotional control during periods of market stress when the temptation to increase leverage is highest.

Key Principles for Success

- Conservative approach: Always maintain LTV ratios well below platform maximums to provide adequate safety margins

- Continuous monitoring: Check your positions regularly, especially during volatile periods when prices can change rapidly

- Emergency planning: Have clear procedures for adding collateral or repaying loans quickly when market conditions deteriorate

- Platform diversification: Don't put all your borrowing on a single platform to reduce counterparty risk

- Market awareness: Adjust strategies based on market conditions, volatility levels, and macroeconomic factors

- Psychological discipline: Resist the urge to increase leverage during bull markets or panic during corrections

- Continuous education: Stay informed about platform updates, new features, and evolving best practices

Remember that crypto lending is a powerful tool for accessing liquidity without selling your assets, but it requires respect for the risks involved and a thorough understanding of the mechanics that govern liquidation events. By maintaining conservative LTV ratios, implementing proper risk management protocols, and staying informed about market conditions and platform developments, you can use crypto loans effectively while protecting your capital from the extreme volatility that characterizes cryptocurrency markets.

The crypto lending landscape continues to evolve with new platforms, innovative features, and developing regulatory frameworks that create both opportunities and challenges for borrowers. Success in this environment requires staying educated about these developments, starting conservatively with small positions, and gradually building your expertise as you gain experience with different platforms and market conditions. The most successful crypto borrowers treat LTV management as an active discipline rather than a set-and-forget strategy, adapting their approach based on changing market dynamics while maintaining unwavering focus on capital preservation.

Sources & References

- Compound. (2025). Compound Collateral Factors. LTV calculations and borrowing limits.

- Aave. (2025). Aave Risk Parameters. Official documentation on LTV ratios and liquidation thresholds.

- MakerDAO. (2025). MakerDAO Whitepaper. Collateralization ratios and stability mechanisms.

- Aave. (2025). Aave LTV Parameters. Loan-to-value ratios and risk management.

- Nexo. (2025). Nexo LTV Guide. CeFi platform LTV requirements and tiers.

Frequently Asked Questions

- What is the LTV ratio in crypto lending?

- LTV (Loan-to-Value) ratio is the percentage of your collateral value that you can borrow. Formula: (Loan Amount / Collateral Value) × 100%. For example, borrowing $5,000 against $10,000 collateral = 50% LTV. Lower LTV means a safer position.

- What is a safe LTV ratio for crypto loans?

- Conservative safe ratios: Bitcoin 30-40%, Ethereum 25-35%, Altcoins 20-30%. This provides a 30-50% buffer before liquidation. Never exceed 50% LTV on volatile assets. Stablecoins can safely use 70-80% LTV

- What's the difference between max LTV and liquidation threshold?

- Max LTV is the maximum you can borrow initially. The liquidation threshold is the LTV at which your position is liquidated. Example: Aave ETH has 80% max LTV but liquidates at 82.5%. The 2.5% difference is your safety buffer.

- How do I calculate my current LTV?

- Current LTV = (Current Loan Value / Current Collateral Value) × 100%. Check your platform dashboard for real-time values. Remember that both the loan (due to interest) and the collateral (due to price changes) have constantly changing values.

- What happens if my LTV gets too high?

- If your LTV reaches the liquidation threshold, your collateral gets automatically sold to repay the loan. You lose your collateral, plus a liquidation penalty of 5-15%. To prevent this, add collateral or repay the loan when the LTV approaches the danger zone.

- Can I borrow more if my LTV is low?

- Yes, if your LTV is below the maximum allowed, you can borrow more. Example: 30% current LTV with 50% permitted max means you can borrow an additional 20% of collateral value. However, consider keeping a buffer for safety.

- How does price volatility affect LTV?

- Collateral price drops increase your LTV (more dangerous). Price increases decrease your LTV (a safer approach). Example: A 20% drop in collateral price can change a 40% LTV to a 50% LTV. This is why conservative LTV ratios are crucial for volatile assets.

- Should I use the maximum LTV offered by platforms?

- No, never use maximum LTV. Platforms offer high LTV to attract users, but it's a hazardous approach. If the platform offers a maximum LTV of 70%, use only 35-40% for safety. The extra borrowing capacity isn't worth the risk of liquidation.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.