Nexo vs Aave Borrowing Complete 2025

Choosing between Nexo and Aave for crypto loans? This comprehensive comparison covers rates, features, security, and user experience to help you decide which platform fits your borrowing needs.

Introduction

The cryptocurrency borrowing landscape in 2025 presents users with two fundamentally different approaches: centralised finance (CeFi) platforms like Nexo and decentralised finance (DeFi) protocols like Aave. Understanding these philosophical and operational differences is crucial for making an informed borrowing decision that aligns with your risk tolerance, technical expertise, and financial objectives.

Both platforms have evolved significantly since their inception, with Nexo establishing itself as a leading regulated cryptocurrency lending institution and Aave pioneering innovative DeFi lending mechanisms. The choice between these platforms represents more than just comparing interest rates—it's a decision between traditional financial structures adapted for cryptocurrency and entirely new decentralised financial systems.

Nexo: CeFi Lending Platform

Nexo is a centralised cryptocurrency lending platform founded in 2018 that operates like a traditional financial institution but for crypto assets. When you borrow on Nexo, you deposit collateral with the company, and they manage the lending process through their internal systems and risk management protocols. The platform has processed over $80 billion in transactions and serves more than 4 million users worldwide.

Nexo's approach mirrors traditional banking, where the institution assumes custody of your assets and provides lending services in exchange for interest payments. This model offers familiar user experiences and regulatory compliance but requires trust in the centralised entity. The platform operates under multiple financial licenses and maintains insurance coverage for custodied assets, providing institutional-grade security measures.

Key characteristics:

- Regulated entity with licenses in multiple jurisdictions, including the EU and the US

- Custodial service - Nexo holds your collateral in secure, insured storage

- User-friendly interface similar to traditional banking applications

- 24/7 customer support via live chat with human representatives

- Insurance coverage for custodied assets up to $375 million

- Fiat currency borrowing options with bank account withdrawals

Aave: DeFi Lending Protocol

Aave represents the cutting edge of decentralised finance, operating as a non-custodial protocol where users maintain control of their assets throughout the borrowing process. Launched in 2020, Aave has become the largest DeFi lending protocol with over $10 billion in total value locked (TVL) across multiple blockchain networks including Ethereum, Polygon, and Avalanche.

Unlike traditional lending platforms, Aave operates through smart contracts that automatically execute lending and borrowing transactions without human intervention. Users interact directly with the protocol through their own cryptocurrency wallets, maintaining full custody of their assets while accessing lending services. This approach eliminates counterparty risk associated with centralised platforms but requires users to understand blockchain technology and manage their own security.

Key characteristics:

- Non-custodial protocol - users maintain control of their private keys and assets

- Smart contract automation with transparent, auditable code on blockchain

- Multi-chain deployment across Ethereum, Polygon, Avalanche, and other networks

- Innovative features like flash loans, rate switching, and collateral swapping

- Governance token (AAVE) allowing community participation in protocol decisions

- Open-source development with continuous community contributions and improvements

The fundamental difference between these platforms extends beyond technical implementation to philosophical approaches to finance. Nexo represents the evolution of traditional banking for the cryptocurrency era, whilstAave embodies the revolutionary potential of decentralised finance to eliminate intermediaries entirely.

Quick Comparison Table

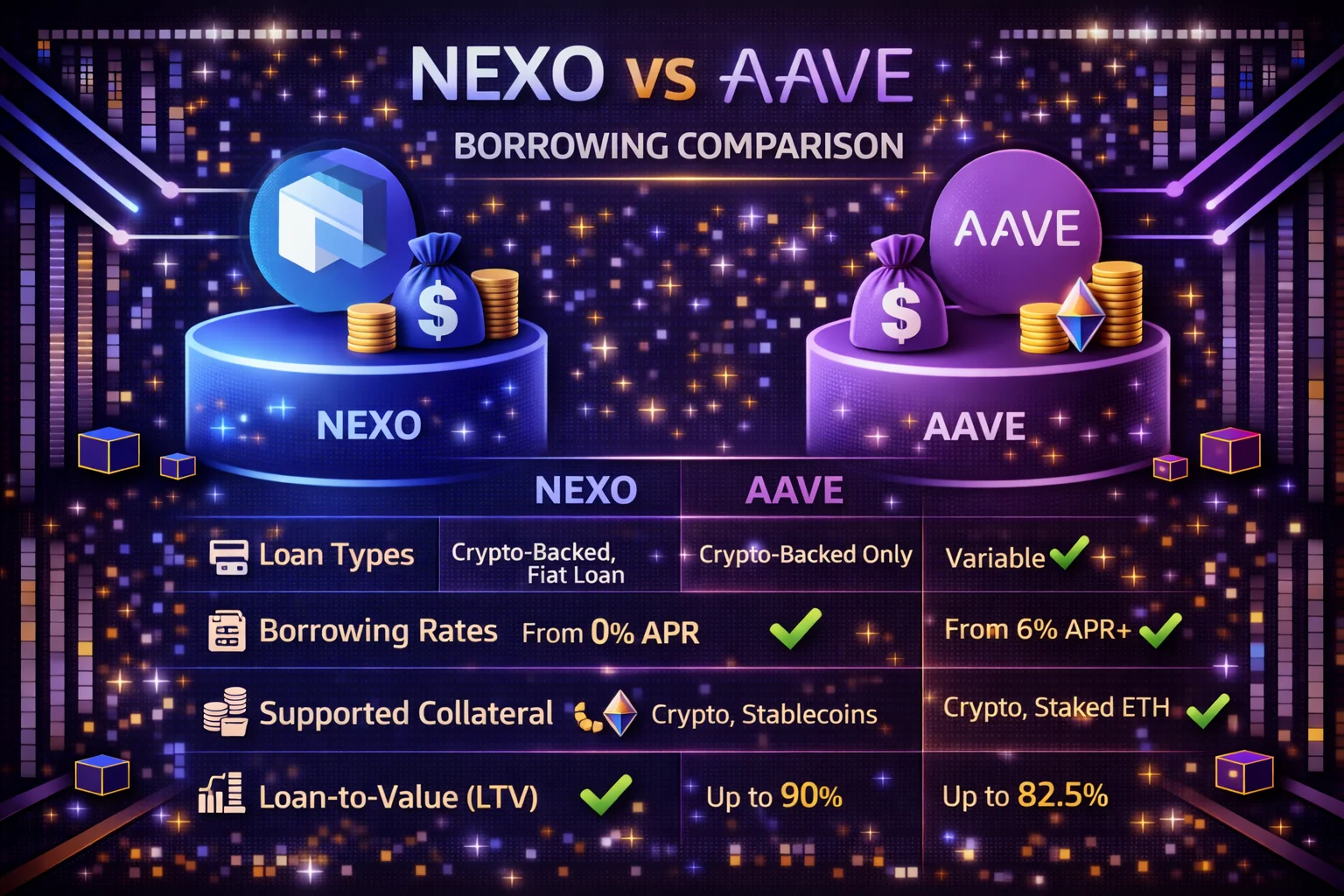

| Feature | Nexo (CeFi) | Aave (DeFi) |

|---|---|---|

| Platform Type | centralised (CeFi) | decentralised (DeFi) |

| Interest Rates | 0-6.9% APR | 2-9% APR (variable) |

| KYC Required | Yes | No |

| Custody | Nexo holds funds | Non-custodial (you control) |

| Max LTV | 50-90% | 50-90% |

| Supported Chains | Single platform | Ethereum, Polygon, Avalanche, Arbitrum, Optimism, Base |

| Customer Support | 24/7 live support | Community forums only |

| Best For | Beginners, convenience | Advanced users, privacy |

Interest Rates and Borrowing Costs

Interest rates represent the most immediate cost consideration when choosing between Nexo and Aave for cryptocurrency borrowing. However, the rate structures, calculation methods, and additional fees differ significantly between these platforms, making direct comparison more complex than simply comparing advertised rates.

Nexo Interest Rate Structure

Nexo employs a tiered interest rate system based on your loyalty level within their ecosystem. The platform offers both fixed and variable rate options, with rates determined by several factors including loan-to-value (LTV) ratio, collateral type, and your NEXO token holdings. As of 2025, Nexo's borrowing rates typically range from 6.9% to 13.9% APR for cryptocurrency-backed loans.

Nexo rate factors:

- Loyalty tier (Basic, Silver, Gold, Platinum) based on NEXO token holdings

- Loan-to-value ratio - lower LTV ratios receive better rates

- Collateral type - Bitcoin and Ethereum typically offer the best rates

- Loan amount and duration - larger, longer-term loans may receive preferential rates

- Geographic location - rates may vary based on regulatory requirements

Nexo's Platinum tier members (holding 10% of their portfolio in NEXO tokens) can access rates as low as 6.9% APR, whilstBasic tier users might pay up to 13.9% APR for similar loans. The platform also offers fiat currency loans at competitive rates, typically ranging from 8% to 16% APR depending on the currency and market conditions.

Aave Interest Rate Mechanism

Aave utilises a dynamic interest rate model that adjusts automatically based on supply and demand within each asset pool. The protocol offers both stable and variable rate options, with rates fluctuating in real-time according to market conditions and utilisation ratios. This algorithmic approach ensures optimal capital efficiency but creates rate volatility that borrowers must manage.

Aave rate determinants:

- Utilisation rate - percentage of available liquidity currently borrowed

- Asset-specific risk parameters set by Aave governance

- Market conditions and overall DeFi lending demand

- Blockchain network congestion affecting transaction costs

- Protocol reserve factors and safety mechanisms

Aave's rates can be significantly lower than traditional platforms during periods of high liquidity, with some assets offering rates below 3% APR. However, during market stress or high demand periods, rates can spike dramatically, sometimes exceeding 20% APR for popular borrowing assets like stablecoins.

Hidden Costs and Fee Comparison

Beyond headline interest rates, both platforms impose additional costs that significantly impact the total borrowing expense. Understanding these fees is crucial for accurate cost comparison and budgeting.

Nexo additional costs:

- No origination fees for cryptocurrency loans

- Early repayment penalties may apply to fixed-rate loans

- Currency conversion fees for fiat withdrawals (typically 0.5-1.5%)

- Withdrawal fees for cryptocurrency transfers (network dependent)

- Potential margin call fees during volatile market conditions

Aave transaction costs:

- Ethereum gas fees for all protocol interactions (can be $10-100+ per transaction)

- No platform fees - all costs are transparent blockchain transaction fees

- Potential liquidation penalties (typically 5-10% of collateral value)

- Bridge fees when using multi-chain deployments

- MEV (Maximum Extractable Value) costs during high-volatility periods

Collateral Requirements and LTV Ratios

Collateral requirements determine how much you can borrow against your cryptocurrency holdings and represent a critical factor in platform selection. Both Nexo and Aave employ different approaches to collateral management, risk assessment, and loan-to-value calculations that significantly impact borrowing capacity and liquidation risk.

Nexo Collateral Framework

Nexo operates a comprehensive collateral system supporting over 40 different cryptocurrencies as acceptable collateral. The platform employs conservative LTV ratios designed to protect both lenders and borrowers from market volatility, with maximum ratios varying based on asset volatility and liquidity characteristics.

Nexo LTV ratios by asset class:

- Bitcoin (BTC): Up to 50% LTV for cryptocurrency loans, 20% for fiat loans

- Ethereum (ETH): Up to 50% LTV for crypto loans, 20% for fiat loans

- Stablecoins (USDC, USDT): Up to 90% LTV for cryptocurrency loans, 83.3% for fiat

- Major altcoins (BNB, ADA, DOT): Up to 40% LTV depending on market conditions

- NEXO tokens: Up to 50% LTV with additional loyalty benefits

- Smaller altcoins: Typically 15-30% LTV with regular reassessment

Nexo's collateral management includes automatic rebalancing features and margin call systems designed to protect borrowers from liquidation. The platform provides 24-hour notice before liquidation events and offers multiple options for addressing margin calls, including partial repayment, additional collateral deposit, or automatic top-up services.

Aave Collateral Mechanics

Aave's collateral system operates through isolated risk pools for each supported asset, with LTV ratios determined by community governance based on asset risk assessments. The protocol supports over 30 different assets as collateral across its various deployments, with parameters that can be adjusted in real-time based on market conditions.

Aave LTV parameters (Ethereum mainnet):

- Wrapped Bitcoin (WBTC): 70% LTV with 75% liquidation threshold

- Ethereum (ETH): 80% LTV with 82.5% liquidation threshold

- Stablecoins (USDC, DAI): 80-85% LTV with 87-90% liquidation thresholds

- Major DeFi tokens (LINK, UNI): 65-70% LTV with varying thresholds

- Volatile altcoins: 40-60% LTV with conservative liquidation parameters

Aave's liquidation mechanism operates automatically through smart contracts, with no grace period or manual intervention. When a position's health factor drops below 1.0, liquidators can purchase collateral at a discount (typically 5-10%), providing immediate settlement but potentially resulting in larger losses for borrowers during volatile market conditions.

Risk Management Comparison

The approaches to risk management reflect the fundamental philosophical differences between centralised and decentralised finance. Nexo's human-managed system provides flexibility and borrower protection, whilstAave's algorithmic approach ensures consistent, predictable execution without human bias or intervention.

Nexo risk management features:

- 24-hour liquidation notice with multiple resolution options

- Automatic top-up services for qualifying accounts

- Manual review process for large positions or unusual market conditions

- Insurance coverage for platform-related losses

- Customer support assistance during margin call situations

Aave risk management mechanisms:

- Real-time health factor monitoring with transparent calculations

- Automatic liquidation execution without human intervention

- Safety module providing protocol-level insurance through staked AAVE tokens

- Governance-controlled risk parameter adjustments

- Multi-signature emergency pause functionality for extreme market conditions

User Experience and Platform Accessibility

The user experience represents a critical differentiator between Nexo and Aave, particularly for newcomers to cryptocurrency borrowing. The complexity, learning curve, and support systems vary dramatically between these platforms, influencing both accessibility and long-term user satisfaction.

Nexo User Interface and Experience

Nexo provides a traditional banking-style interface designed for users familiar with conventional financial services. The platform prioritises simplicity and guided workflows, making it accessible to users regardless of their technical cryptocurrency knowledge. The web application and mobile apps offer intuitive navigation with clear explanations of borrowing terms and conditions.

Nexo interface highlights:

- Dashboard showing portfolio overview, active loans, and available credit

- One-click borrowing with automatic collateral calculation

- Integrated wallet management with deposit and withdrawal functionality

- Real-time notifications for margin calls and account updates

- Educational resources and tutorials integrated into the platform

- Multi-language support covering 15+ languages

The platform's customer support infrastructure includes 24/7 live chat, email support, and phone assistance for premium tier customers. Response times typically range from minutes for urgent issues to 24 hours for complex inquiries, with support staff trained specifically in cryptocurrency lending concepts.

Aave Protocol Interaction

Aave requires users to interact directly with smart contracts through Web3 wallets, creating a more complex but ultimately more powerful user experience. The protocol interface assumes familiarity with decentralised finance concepts and blockchain technology, making it less suitable for beginners but offering advanced users complete control and transparency.

Aave interaction requirements:

- Compatible Web3 wallet (MetaMask, WalletConnect, Coinbase Wallet)

- Understanding of gas fees and transaction confirmation processes

- Knowledge of smart contract interactions and approval mechanisms

- Ability to monitor and manage positions independently

- Familiarity with DeFi concepts like health factors and liquidation risks

The Aave interface provides comprehensive data and analytics, including real-time interest rates, utilisation statistics, and detailed position management tools. However, users must understand these metrics independently, as the protocol provides no customer support or guided assistance.

Mobile Accessibility and Cross-Platform Support

Mobile accessibility varies significantly between platforms, reflecting their different target audiences and technical architectures. Nexo offers native mobile applications, whilstAave relies on mobile Web3 browser integration.

Nexo mobile features:

- Native iOS and Android applications with full functionality

- Biometric authentication and advanced security features

- Push notifications for account updates and market alerts

- Offline portfolio viewing and transaction history

- Integrated customer support chat within mobile apps

Aave mobile access:

- Web-based interface optimised for mobile browsers

- Integration with mobile Web3 wallets like MetaMask Mobile

- Full protocol functionality available through mobile browsers

- Community-developed mobile applications with varying feature sets

- Responsive design adapting to different screen sizes

Learning Curve and Educational Resources

The educational requirements and learning curves differ substantially between platforms, influencing user onboarding success and long-term platform satisfaction.

Nexo educational approach:

- Comprehensive help centre with step-by-step guides

- Video tutorials covering all platform features

- Webinars and educational content for different experience levels

- Personal account managers for high-value customers

- Integration with traditional financial concepts and terminology

Aave learning requirements:

- Understanding of blockchain technology and smart contracts

- Familiarity with DeFi concepts and terminology

- Knowledge of gas optimisation and transaction timing

- Community-driven education through forums and documentation

- Self-directed learning and problem-solving capabilities

Security and Regulatory Compliance

Security and regulatory compliance represent fundamental considerations when choosing between centralised and decentralised borrowing platforms. The approaches, risks, and protections differ significantly between Nexo's regulated, custodial model and Aave's decentralised, non-custodial protocol.

Nexo Security Infrastructure

Nexo operates under a traditional financial security model with institutional-grade custody solutions, insurance coverage, and regulatory oversight. The platform maintains SOC 2 Type 2 compliance and undergoes regular third-party security audits, providing users with familiar protections similar to traditional banking services.

Nexo security measures:

- Multi-signature cold storage for 95% of customer funds

- Real-time transaction monitoring and fraud detection systems

- Two-factor authentication and biometric security options

- Insurance coverage up to $375 million through Lloyd's of London

- Regular penetration testing and security audits by leading firms

- Compliance with GDPR, PCI DSS, and other international standards

The platform's regulatory status provides additional security through government oversight and consumer protection mechanisms. Nexo holds licenses in multiple jurisdictions and maintains segregated customer funds, offering legal recourse in case of platform issues or disputes.

Aave Protocol Security Model

Aave's security relies on smart contract audits, decentralised governance, and the inherent transparency of blockchain technology. The protocol has undergone extensive security reviews by leading audit firms and maintains a bug bounty programme to incentivise ongoing security research.

Aave security features:

- Open-source smart contracts audited by multiple security firms

- Decentralised governance preventing single points of failure

- Safety module providing protocol insurance through staked AAVE tokens

- Time-locked upgrades allowing community review of protocol changes

- Bug bounty programme with rewards up to $250,000 for critical vulnerabilities

- Formal verification of critical smart contract components

The non-custodial nature of Aave means users maintain control of their private keys and assets, eliminating counterparty risk associated with centralised platforms. However, this approach also places full responsibility for security on individual users, including wallet management and transaction verification.

Regulatory Compliance and Legal Protections

Regulatory compliance varies dramatically between these platforms, reflecting the current uncertain legal landscape surrounding decentralised finance and cryptocurrency services.

Nexo regulatory status:

- Licensed money services business in multiple US states

- European Union regulatory compliance under MiCA framework

- UK Financial Conduct Authority registration for cryptocurrency activities

- Anti-money laundering (AML) and know-your-customer (KYC) compliance

- Regular regulatory reporting and government oversight

- Consumer protection mechanisms and dispute resolution processes

Aave regulatory considerations:

- Decentralised protocol with no central controlling entity

- Governance token holders collectively manage protocol decisions

- No KYC requirements or geographic restrictions at protocol level

- Regulatory uncertainty regarding DeFi classification and oversight

- Individual users responsible for tax reporting and compliance

- Limited legal recourse in case of smart contract vulnerabilities or exploits

Risk Assessment and Mitigation

Understanding the different risk profiles helps users make informed decisions based on their risk tolerance and security priorities.

Nexo risk factors:

- Counterparty risk - reliance on Nexo's financial stability and operations

- Regulatory risk - potential changes in cryptocurrency regulations

- Custody risk - centralised storage of customer assets

- Operational risk - platform downtime or technical issues

- Insurance limitations - coverage may not extend to all loss scenarios

Aave risk factors:

- Smart contract risk - potential vulnerabilities in protocol code

- Governance risk - malicious or poorly designed protocol upgrades

- Liquidity risk - potential inability to withdraw funds during market stress

- User error risk - mistakes in wallet management or transaction execution

- Regulatory risk - potential government restrictions on DeFi protocols

Aave is a decentralised lending protocol launched in 2020 (evolved from ETHLend) that operates through smart contracts on multiple blockchains, with no central authority controlling the platform. The protocol has become the largest DeFi lending platform with over $10 billion in total value locked across multiple blockchain networks, demonstrating the maturity and adoption of decentralised lending solutions.

Aave's decentralised approach eliminates intermediaries, allowing users to interact directly with smart contracts that automatically execute lending and borrowing functions. This model provides transparency, censorship resistance, and global accessibility but requires users to understand blockchain technology and manage their own security. The protocol's governance is controlled by AAVE token holders who vote on protocol upgrades and parameter changes.

Key characteristics:

- Non-custodial - you maintain control of your assets through self-custody wallets

- Open-source smart contracts audited by leading security firms

- No KYC or registration required - pseudonymous access

- Multi-chain deployment across 6+ networks including Ethereum, Polygon, Avalanche

- Governed by AAVE token holders through decentralised governance

- Innovative features like flash loans and efficiency mode

The fundamental difference: Nexo is a company you trust with your funds, while Aave is code you interact with directly. This distinction affects everything from user experience and security models to regulatory compliance and available features.

Interest Rates Comparison

Nexo Interest Rates

Nexo offers tiered interest rates based on your Nexo token holdings and loan-to-value ratio:

- 0% APR: Available at 20% LTV with 10%+ portfolio in NEXO tokens

- 6.9% APR: Standard rate for most users without NEXO holdings

- 13.9% APR: Higher LTV ratios (50%+) without NEXO tokens

Rate advantages:

- Fixed rates - predictable costs

- 0% APR option unique in the market

- No origination or early repayment fees

Aave Interest Rates

Aave uses algorithmic variable rates based on supply and demand:

- Stable rate: 2-5% APR (less volatile, slightly higher)

- Variable rate: 1.5-9% APR (fluctuates with market conditions)

- E-Mode: Reduced rates for correlated assets (e.g., ETH/stETH)

Rate advantages:

- Often lower than CeFi during low demand periods

- E-Mode offers competitive rates for stablecoin borrowing

- Transparent rate calculation visible on-chain

Which Has Better Rates?

Nexo wins if: You hold NEXO tokens and qualify for 0% APR, or prefer rate predictability.

Aave wins if: Market rates are low, you're borrowing stablecoins in E-Mode, or you want to optimise across multiple chains.

In 2025, typical rates: Nexo 6.9% fixed vs Aave 3-5% variable for similar collateral.

Supported Assets

Nexo Supported Assets

Collateral options (40+ assets):

- Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC)

- Stablecoins: USDT, USDC, DAI, TUSD

- Altcoins: XRP, ADA, DOT, LINK, MATIC, SOL

- Nexo token (NEXO) for rate discounts

Borrowing options: USDT, USDC, USD, EUR, GBP (fiat currencies)

Aave Supported Assets

Varies by chain, but typically includes:

- Ethereum: 30+ assets including ETH, WBTC, stablecoins, DeFi tokens

- Polygon: 15+ assets with lower gas fees

- Avalanche: 10+ assets including AVAX

- Arbitrum/Optimism: Major assets with L2 efficiency

Unique options: Liquid staking derivatives (stETH, rETH), governance tokens (AAVE, CRV), real-world assets (experimental)

Asset Availability Winner

Nexo: Better for fiat borrowing and simple asset selection.

Aave: Better for DeFi tokens, liquid staking derivatives, and multi-chain flexibility.

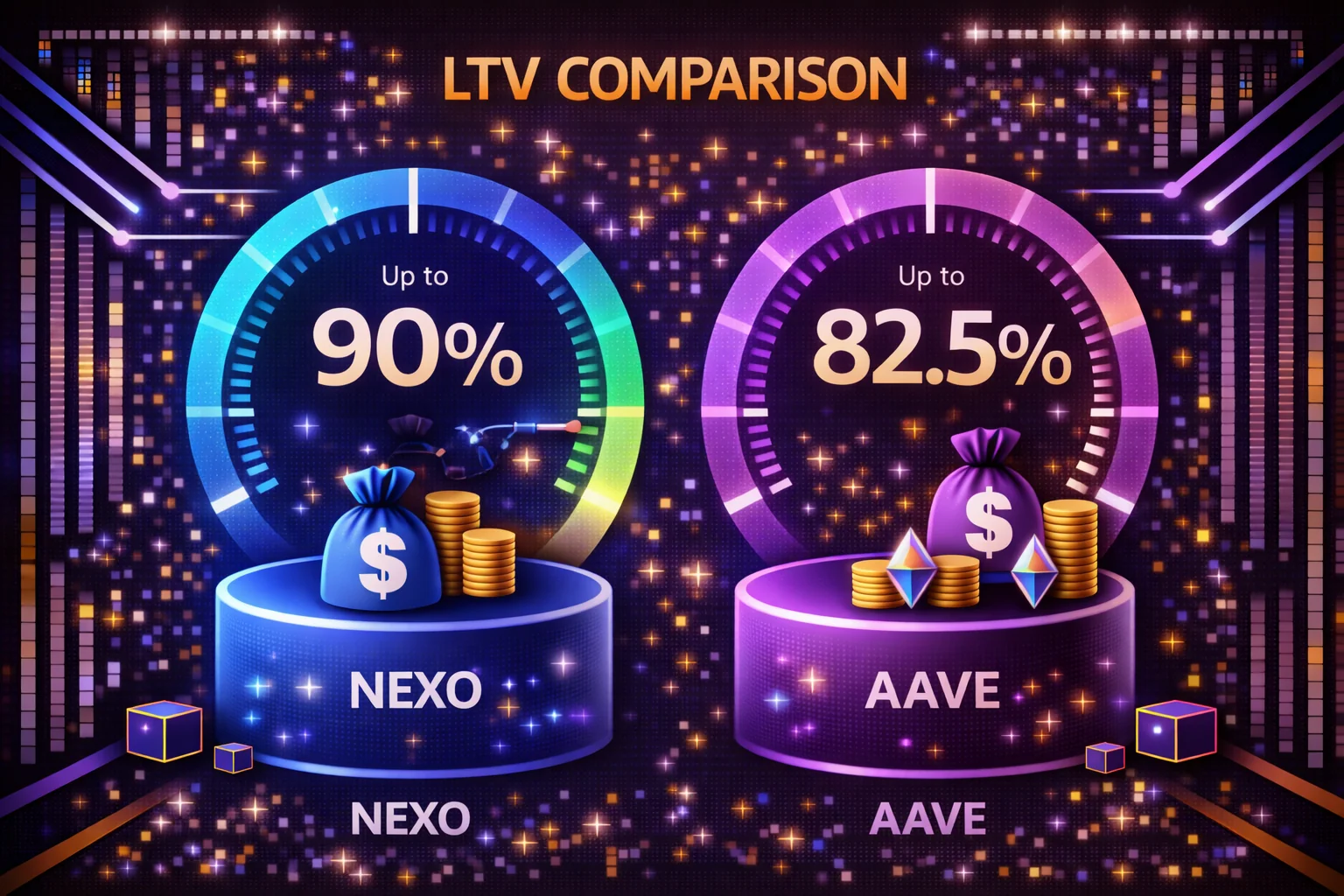

LTV Ratios Comparison

Nexo LTV Limits

| Asset Type | Max LTV | Liquidation LTV |

|---|---|---|

| Bitcoin (BTC) | 50% | 83.3% |

| Ethereum (ETH) | 50% | 83.3% |

| Stablecoins | 90% | 92% |

| Altcoins | 15-50% | Varies |

Aave LTV Limits

| Asset Type | Max LTV | Liquidation LTV |

|---|---|---|

| ETH | 80% | 82.5% |

| WBTC | 70% | 75% |

| Stablecoins | 75-80% | 85% |

| E-Mode (correlated) | 90% | 93% |

Key differences:

- Aave generally offers higher LTV for major assets

- Nexo provides larger liquidation buffer (50% → 83.3%)

- Aave's E-Mode enables 90% LTV for correlated assets

- Both platforms adjust LTV based on market volatility

Security & Risks

Nexo Security

Strengths:

- Custodial insurance up to $775 million through Lloyds of London

- Military-grade encryption for user data

- Real-time attestations of reserves

- Regulated entity with compliance oversight

- 24/7 security monitoring

Risks:

- Counterparty risk - you trust Nexo with your funds

- Regulatory risk - subject to government actions

- Company risk - business failure could affect users

- Centralised control - Nexo can freeze accounts

Aave Security

Strengths:

- Non-custodial - you control private keys

- Open-source code audited by Trail of Bits, OpenZeppelin, ABDK

- Safety Module with $400M+ in staked AAVE as insurance

- Battle-tested protocol with $10B+ TVL history

- No single point of failure

Risks:

- Smart contract risk - code vulnerabilities possible

- No customer support - you're responsible for mistakes

- Liquidation risk - automated and irreversible

- Oracle risk - price feed manipulation potential

- Governance risk - token holders control protocol changes

Security Verdict

Nexo: Better for users who want insurance, support, and don't mind trusting a company.

Aave: Better for users who prioritise self-custody and trust code over institutions.

User Experience

Nexo User Experience

Ease of use: 9/10

- Simple web and mobile apps

- One-click borrowing process

- Automatic collateral management

- 24/7 live chat support

- Email notifications for account activity

Onboarding: KYC required (15-30 minutes), then instant deposits and borrowing.

Aave User Experience

Ease of use: 6/10

- Requires crypto wallet (MetaMask, Ledger, etc.)

- Understanding of gas fees and blockchain transactions

- Manual health factor monitoring

- No customer support - community forums only

- Multiple interfaces (Aave.com, DeFi Saver, Instadapp)

Onboarding: No KYC, but requires wallet setup and understanding of DeFi concepts.

User Experience Winner

Nexo wins for: Beginners, users wanting support, those comfortable with KYC.

Aave wins for: Experienced DeFi users, privacy advocates, and those wanting full control.

Which Platform Should You Choose?

Choose Nexo If You:

- Are new to crypto borrowing and want a simple interface

- Value customer support and insurance coverage

- Want to borrow fiat currencies (USD, EUR, GBP)

- Can qualify for 0% APR with NEXO token holdings

- Prefer fixed interest rates for budgeting

- Don't mind KYC and centralised custody

Choose Aave If You:

- Are experienced with DeFi and comfortable managing wallets

- Prioritise privacy and don't want to complete KYC

- Want non-custodial control of your assets

- Need multi-chain flexibility (Ethereum, Polygon, Arbitrum, etc.)

- Want to borrow DeFi tokens or liquid staking derivatives

- Prefer variable rates that can be lower during low demand

Can You Use Both?

Yes! Many advanced users diversify across both platforms:

- Nexo for: Fiat borrowing, 0% APR loans, insured custody

- Aave for: DeFi token borrowing, multi-chain access, privacy

- Both for: Portfolio diversification and risk management across CeFi and DeFi

This strategy reduces platform risk and lets you optimise rates across different use cases.

Advanced Borrowing Strategies and Professional Implementation

Portfolio optimisation and Multi-Platform Strategies

Professional cryptocurrency borrowing requires sophisticated portfolio optimisation strategies that leverage both centralised and decentralised platforms to maximise capital efficiency while managing risk exposure across different lending protocols. Advanced users implement systematic allocation strategies that utilise Nexo's 0% APR options for major capital requirements whilstleveraging Aave's competitive variable rates for shorter-term borrowing needs and DeFi yield farming opportunities, creating comprehensive borrowing portfolios that optimise costs while maintaining appropriate risk diversification.

Multi-platform strategies include systematic rate monitoring across both platforms, comprehensive risk assessment for different borrowing scenarios, and advanced timing strategies that capitalise on rate fluctuations and platform-specific advantages. Professional borrowers implement automated monitoring systems, comprehensive performance tracking, and sophisticated decision-making frameworks that enable optimal platform selection and allocation strategies while maintaining appropriate risk management and operational efficiency for complex borrowing requirements and professional cryptocurrency management.

Risk Management and Liquidation Protection Strategies

Professional borrowing risk management requires comprehensive frameworks that address platform-specific risks while maintaining optimal capital efficiency and borrowing capacity. Advanced risk management includes systematic collateral diversification across multiple assets, comprehensive monitoring of liquidation thresholds, and sophisticated hedging strategies that protect against adverse price movements while maintaining borrowing positions for long-term investment strategies and professional cryptocurrency operations.

Liquidation protection strategies include systematic collateral management, automated monitoring systems for health factor maintenance, and advanced contingency planning that ensures appropriate protection against liquidation events while maintaining optimal borrowing capacity. Professional users implement comprehensive backup procedures, systematic risk assessment protocols, and sophisticated emergency response systems that ensure appropriate protection while enabling efficient borrowing operations for complex cryptocurrency management requirements and institutional borrowing strategies.

Institutional Borrowing and Enterprise Implementation

Enterprise cryptocurrency borrowing requires comprehensive frameworks that address regulatory compliance, operational security, and professional asset management whilstleveraging borrowing capabilities for corporate treasury optimisation and business operations. Institutional implementations include systematic due diligence procedures for platform selection, comprehensive compliance frameworks, and advanced operational controls that enable businesses to utilise cryptocurrency borrowing while maintaining appropriate risk management and regulatory adherence for corporate financial operations.

Professional enterprise strategies include comprehensive legal consultation frameworks, systematic regulatory compliance procedures, and advanced reporting systems that ensure appropriate institutional adoption whilstmaximising operational efficiency and capital optimisation benefits. Enterprise users implement comprehensive governance procedures, systematic risk management protocols, and sophisticated monitoring systems that ensure professional borrowing operations while maintaining corporate standards and regulatory compliance requirements for institutional cryptocurrency management and corporate treasury optimisation.

Yield Generation and Capital Efficiency optimisation

Advanced borrowing strategies increasingly focus on yield generation and capital efficiency optimisation that leverage borrowed capital for systematic profit generation while managing borrowing costs and operational complexity. Professional yield strategies include systematic analysis of yield farming opportunities, comprehensive risk-return assessment for borrowed capital deployment, and advanced portfolio construction techniques that maximise returns while managing borrowing costs and protocol risks for sustainable long-term yield generation.

Capital efficiency optimisation includes systematic analysis of borrowing costs versus yield opportunities, comprehensive timing strategies for optimal capital deployment, and advanced monitoring systems that ensure optimal capital utilisation while maintaining appropriate risk management and operational efficiency. Professional users implement automated rebalancing systems, comprehensive performance tracking, and sophisticated decision-making frameworks that enable optimal capital efficiency while adapting to changing market conditions and yield opportunities for sustainable borrowing-based yield generation strategies.

User Experience optimisation

Accessibility and Inclusive Design

Mobile and Cross-Platform Compatibility

Technical Analysis Framework

Architecture and Design Principles

Borrowing platform architecture influences risk assessment, collateral management, and liquidation protection mechanisms. Smart contract design, oracle integration, and automated risk management systems determine borrowing safety and capital efficiency while maintaining platform solvency during market volatility.

Integration Capabilities and Ecosystem

DeFi borrowing platform integration capabilities determine strategy implementation effectiveness, with Nexo providing centralised financial services while Aave offers decentralised protocol composability. Smart contract interactions, governance participation, and yield optimisation features affect borrowing strategy sophistication.

Performance Metrics and Benchmarking

DeFi borrowing platform performance analysis examines liquidation protection efficiency, interest rate stability, and protocol governance effectiveness that impact borrowing costs. Nexo and Aave comparison requires evaluating their different approaches to collateral management and decentralised versus centralised lending models.

Conclusion

The choice between Nexo and Aave for cryptocurrency borrowing ultimately depends on your experience level, risk tolerance, and specific borrowing needs. Both platforms offer compelling advantages that serve different segments of the crypto borrowing market.

Nexo excels as a user-friendly, regulated platform that bridges traditional finance with cryptocurrency lending. Its 0% APR option, comprehensive insurance coverage, and professional customer support make it ideal for beginners and users who prioritise security and ease of use. The platform's fiat borrowing capabilities and established regulatory compliance provide additional peace of mind for conservative borrowers.

Aave represents the cutting edge of decentralised finance, offering non-custodial borrowing with complete user control over funds. Its multi-chain support, innovative features like flash loans, and typically lower interest rates appeal to experienced DeFi users who value privacy and technical flexibility. The protocol's transparent governance and extensive security audits demonstrate the maturity of decentralised lending.

For most users, the decision comes down to whether they prefer the safety and simplicity of a centralised platform (Nexo) or the innovation and control of decentralised finance (Aave). Advanced users often benefit from using both platforms strategically, leveraging Nexo's 0% APR for major purchases and Aave's competitive rates for DeFi activities.

Regardless of your choice, both platforms represent significant improvements over traditional lending options, offering cryptocurrency holders unprecedented access to liquidity without selling their digital assets. The continued evolution of both CeFi and DeFi lending ensures that borrowers will have increasingly sophisticated options for accessing capital in the growing cryptocurrency economy.

Sources & References

- Nexo. (2025). "Nexo Platform". CeFi borrowing rates and terms.

- Aave. (2025). "Aave Protocol". DeFi borrowing mechanics and rates.

- DeFi Llama. (2025). "DeFi Comparison Data". Independent platform comparison metrics.

Frequently Asked Questions

- Which is better for borrowing: Nexo or Aave?

- Nexo is better for beginners who want an easy interface, customer support, and a 0% APR option. The platform offers traditional banking-style customer service with phone support and live chat assistance. Aave is better suited for advanced users seeking non-custodial control, no KYC requirements, and multi-chain access across Ethereum, Polygon, Arbitrum, and other networks. Choose based on your experience level, privacy preferences, and technical comfort with DeFi protocols.

- Is Nexo or Aave safer?

- Different risk profiles exist for each platform: Nexo has custodial insurance coverage up to $375 million through Lloyd's of London and company backing with regulatory compliance, but introduces counterparty risk since they control your assets. Aave has non-custodial security with extensively audited smart contracts and no single point of failure, but carries smart contract risk and potential protocol governance changes. Both are relatively safe with proper risk management, but represent different security models - centralised vs decentralised.

- Can I get lower rates on Aave than Nexo?

- Yes, Aave's variable rates are often 2-5% APR compared to Nexo's 6.9% standard rate, especially during periods of low borrowing demand. However, Nexo's 0% APR option (requiring NEXO token holdings) can beat Aave's rates. Aave rates fluctuate based on supply and demand dynamics, while Nexo maintains more stable pricing. During high DeFi activity, Aave rates can spike above Nexo's fixed rates, making rate comparison time-sensitive.

- Do I need KYC for Nexo and Aave?

- Nexo requires comprehensive KYC (identity verification) including government ID, proof of address, and sometimes additional documentation for all users due to regulatory compliance requirements. The process typically takes 24-48 hours for approval. Aave requires no KYC whatsoever; you simply connect a compatible Web3 wallet and start borrowing immediately. This represents a fundamental difference between centralised finance (CeFi) and decentralised finance (DeFi) approaches to user onboarding.

- Which platform has higher LTV ratios?

- Aave generally offers higher loan-to-value ratios: up to 80% for ETH and 75% for most major cryptocurrencies, compared to Nexo's more conservative 50-60% LTV ratios. However, Nexo provides larger liquidation buffers and more gradual liquidation processes. Aave's Efficiency Mode (E-Mode) enables up to 90% LTV for correlated assets like stablecoins and liquid staking tokens, making it attractive for capital-efficient strategies but requiring careful risk management.

- Can I borrow fiat currency on Aave?

- No, Aave only supports cryptocurrency-to-cryptocurrency borrowing within the DeFi ecosystem. All borrowed assets remain as digital tokens on the blockchain. Nexo allows borrowing traditional fiat currencies including USD, EUR, and GBP, with funds directly withdrawable to linked bank accounts via wire transfer or card funding. This fiat borrowing capability makes Nexo unique for users needing traditional currency access while maintaining crypto collateral exposure.

- What happens if I get liquidated on each platform?

- Nexo employs gradual liquidation with multiple email warnings, customer support assistance, and insurance coverage protecting against technical failures. Their team may contact users before liquidation and offer solutions. Aave uses automatic smart contract liquidation with a 5-10% penalty that executes immediately when health factors drop below 1.0. The process is irreversible with no human intervention or appeals process. Nexo's approach is more forgiving for beginners, while Aave's is more predictable and transparent.

- Which platform has better rates for stablecoin borrowing?

- Aave typically offers superior rates for stablecoin borrowing, especially in Efficiency Mode where correlated assets can achieve 2-4% APR. Nexo charges their standard 6.9% APR for stablecoin borrowing unless you hold sufficient NEXO tokens for rate reductions. For pure stablecoin arbitrage strategies or yield farming, Aave provides more cost-effective borrowing options, though rates can fluctuate significantly based on protocol utilisation.

- How do collateral requirements differ between platforms?

- Nexo accepts a broader range of collateral including Bitcoin, Ethereum, and their native NEXO token, with simplified collateral management through their custodial system. Users can mix different collateral types within a single account. Aave requires users to deposit collateral into specific markets on each blockchain, with collateral isolated per network. Aave supports more exotic collateral including liquid staking derivatives and governance tokens, but requires more active management across different protocols and chains.

- What are the withdrawal and repayment processes like?

- Nexo offers traditional banking-style processes with scheduled repayments, partial payments, and customer service assistance for payment issues. Users can set up automatic payments and receive payment reminders. Borrowed fiat can be withdrawn directly to bank accounts. Aave requires manual repayment through blockchain transactions, with users responsible for monitoring health factors and managing repayments independently. All transactions are immediate and irreversible, requiring careful planning and sufficient gas fees for transaction execution.