Crypto Portfolio Strategies 2025

Master cryptocurrency portfolio construction in 2025. Discover proven diversification strategies, risk management techniques, and allocation models to construct profitable cryptocurrency portfolios.

Introduction

Cryptocurrency portfolio construction has evolved from simple Bitcoin accumulation to sophisticated multi-asset strategies. These incorporate risk management, diversification principles, and institutional-grade allocation models. As the cryptocurrency market matures, successful portfolio management requires a systematic approach. This balances the tremendous growth potential of digital assets with inherent volatility and risks.

The cryptocurrency ecosystem now encompasses thousands of digital assets across multiple categories. These include store-of-value cryptocurrencies, smart contract platforms, decentralised finance protocols, non-fungible tokens, and emerging sectors. This diversity creates opportunities for enhanced returns through strategic diversification. It also creates challenges in selecting appropriate assets and allocation weights.

Modern cryptocurrency portfolio strategies draw from traditional finance principles. They adapt to the unique characteristics of digital assets. These include 24/7 trading, extreme volatility, technological risks, and regulatory uncertainty. Successful portfolio construction requires understanding the fundamental value propositions of different cryptocurrency categories. It also requires understanding correlation patterns, liquidity considerations, and market dynamics.

Professional cryptocurrency portfolio management has become increasingly sophisticated. It incorporates quantitative analysis, risk-adjusted performance metrics, and systematic rebalancing strategies. The most successful cryptocurrency portfolios combine strategic long-term positioning with tactical adjustments. These are based on market conditions, technological developments, and regulatory changes.

Systematic portfolio management in cryptocurrency investing is crucial. The difference between random asset accumulation and strategic portfolio construction often determines long-term investment success. Disciplined portfolio management approaches can significantly improve risk-adjusted returns. They reduce the emotional decision-making that often leads to poor investment outcomes in volatile markets.

This comprehensive guide examines proven cryptocurrency portfolio strategies for 2025. It covers everything from basic allocation models suitable for beginners to sophisticated institutional approaches. These incorporate derivatives, yield generation, and dynamic rebalancing. The strategies presented are based on empirical research, institutional best practices, and real-world performance data.

Understanding the principles of effective portfolio construction, risk management, and performance optimisation will help you navigate cryptocurrency investing. It positions your portfolio for sustainable long-term growth in this rapidly evolving market.

Market conditions in 2025 have created unique opportunities for portfolio diversification. Institutional adoption is driving the development of new asset categories and investment vehicles. The emergence of cryptocurrency ETFs, regulated staking services, and institutional-grade custody solutions has expanded the toolkit available to portfolio managers.

The integration of traditional finance principles with cryptocurrency-specific strategies has proven most effective for long-term wealth building. This hybrid approach combines the time-tested wisdom of diversification and risk management with the innovative opportunities presented by blockchain technology and decentralised finance protocols, creating portfolios that can capture the growth potential of digital assets while maintaining appropriate risk controls.

Technological advancements in portfolio management tools have democratised access to sophisticated investment strategies. Modern portfolio tracking platforms provide real-time performance analytics, automated rebalancing capabilities, and comprehensive tax reporting. These tools enable individual investors to implement institutional-grade portfolio management strategies that were previously accessible only to professional fund managers.

The psychological aspects of cryptocurrency portfolio management deserve careful consideration. The extreme volatility characteristic of digital asset markets tests investor discipline and emotional resilience. Successful portfolio strategies incorporate mechanisms to reduce emotional decision-making, including predetermined rebalancing schedules, clear entry and exit criteria, and systematic position sizing rules that prevent overexposure to individual assets.

Portfolio Fundamentals

Building a successful cryptocurrency portfolio requires understanding fundamental principles that apply to all investment strategies, adapted for the unique characteristics of digital assets.

Core Portfolio Principles

- Diversification: Spread risk across different assets and sectors

- Risk Management: Never invest more than you can afford to lose

- Time Horizon: Align strategy with investment timeline

- Regular Review: Monitor and adjust based on performance

- Emotional Discipline: Stick to strategy during volatility

Crypto-Specific Considerations

Cryptocurrency portfolios have unique characteristics:

- High Volatility: Expect significant price swings

- 24/7 Markets: Continuous trading requires discipline

- Technological Risk: Protocol upgrades and technical issues

- Regulatory Uncertainty: Changing legal landscape

- Correlation Patterns: Assets often move together during crashes

Investment Goals Framework

Define clear objectives before building your portfolio:

- Wealth Preservation: Focus on established assets (BTC, ETH)

- Moderate Growth: Balanced approach with some altcoins

- Aggressive Growth: Higher allocation to emerging projects

- Income Generation: Emphasis on staking and yield opportunities

Risk Tolerance Assessment

Honestly evaluate your risk capacity:

- Conservative: 5-10% total portfolio in crypto

- Moderate: 10-20% total portfolio in crypto

- Aggressive: 20-30% total portfolio in crypto

- Crypto-Native: 50%+ portfolio in crypto (high risk)

Portfolio Size Considerations

Your portfolio size significantly influences strategy selection and implementation. Different capital levels require distinct approaches to diversification, fee management, and risk allocation.

Small Portfolios (£500-£5,000): Focus on 3-5 core assets to minimise transaction fees. Prioritise Bitcoin and Ethereum (70-80% combined), with remaining allocation to 1-2 high-conviction altcoins. Avoid excessive diversification that creates negligible positions and high relative fees.

Medium Portfolios (£5,000-£50,000): Expand to 8-12 positions across multiple sectors. Maintain 50-60% in Bitcoin and Ethereum, allocate 25-30% to established altcoins (top 20 by market cap), and reserve 10-15% for higher-risk opportunities. This size enables meaningful diversification whilst maintaining manageable tracking overhead.

Large Portfolios (£50,000+): Implement sophisticated strategies with 15-25 positions. Consider institutional-grade approaches including derivatives, yield farming, and cross-chain opportunities. Allocate 40-50% to Bitcoin and Ethereum, 30-35% to diversified altcoins, 10-15% to DeFi protocols, and 5-10% to emerging opportunities.

Time Horizon Planning

Your investment timeline fundamentally shapes portfolio construction and risk management. Short-term traders require different strategies than long-term holders, with distinct approaches to volatility, rebalancing frequency, and tax efficiency.

Short-Term (3-12 months): Focus on liquid, established assets with clear catalysts. Maintain higher stablecoin allocation (20-30%) for tactical opportunities. Monitor technical indicators and market sentiment closely. Accept higher trading frequency and associated tax implications.

Medium-Term (1-3 years): Balance growth potential with stability. Allocate 60-70% to established assets, 20-30% to growth opportunities, and 10% to speculative positions. Rebalance quarterly or semi-annually. This horizon captures full market cycles whilst avoiding excessive short-term noise.

Long-Term (3+ years): Emphasise protocol fundamentals over price action. Allocate 70-80% to Bitcoin and Ethereum, 15-20% to high-conviction altcoins with strong fundamentals, and 5-10% to emerging technologies. Rebalance annually or when allocations drift significantly. Optimise for tax efficiency through long-term capital gains treatment.

Allocation Strategies

The 70-20-10 Strategy (Conservative)

A balanced approach for most investors:

- 70% Blue Chips: Bitcoin (40%) + Ethereum (30%)

- 20% Established Altcoins: Top 10-50 cryptocurrencies

- 10% Speculative: Newer projects and opportunities

The 50-30-20 Strategy (Moderate)

More aggressive growth potential:

- 50% Blue Chips: Bitcoin (30%) + Ethereum (20%)

- 30% Established Altcoins: Diversified across sectors

- 20% Speculative: High-growth potential projects

Sector-Based Allocation

Diversify across cryptocurrency sectors:

- Store of Value (30%): Bitcoin, digital gold alternatives

- Smart Contract Platforms (25%): Ethereum, Solana, Cardano

- DeFi Protocols (20%): Uniswap, Aave, Compound

- Layer 2 Solutions (10%): Polygon, Arbitrum, Optimism

- Infrastructure (10%): Chainlink, The Graph

- Emerging Sectors (5%): Gaming, NFTs, Web3

Diversification Models

Market Cap Diversification

| Category | Market Cap | Risk Level | Allocation |

|---|---|---|---|

| Large Cap | $10B+ | Lower | 60-80% |

| Mid Cap | $1B-$10B | Medium | 15-25% |

| Small Cap | $100M-$1B | Higher | 5-15% |

| Micro Cap | $100M | Highest | 0-5% |

Use Case Diversification

Include different cryptocurrency use cases:

- Digital Currency: Bitcoin, Litecoin, Bitcoin Cash

- Smart Contracts: Ethereum, Solana, Avalanche

- Privacy Coins: Monero, Zcash (where legal)

- Stablecoins: USDC, DAI for stability

- Utility Tokens: BNB, UNI, LINK

Technology Diversification

Spread across different blockchain technologies:

- Proof of Work: Bitcoin, Litecoin, Monero

- Proof of Stake: Ethereum 2.0, Cardano, Polkadot

- Delegated Proof of Stake: EOS, Tron

- Novel Consensus: Avalanche, Algorand, Hedera

Risk Management

Position Sizing Rules

Systematic approach to position sizes:

- Maximum Single Position: Never more than 25% in one asset

- High-Risk Limit: Maximum 10% in any speculative asset

- New Project Limit: Maximum 2-3% in unproven projects

- Stablecoin Buffer: Keep 5-10% in stablecoins for opportunities

Stop-Loss Strategies

Protecting against major losses:

- Percentage Stop-Loss: Sell if asset drops 30-50%

- Time-Based Stops: Exit if thesis doesn't play out in timeframe

- Technical Stops: Based on support/resistance levels

- Portfolio Stop: Reduce crypto allocation if total portfolio drops X%

Emotional Risk Management

- Written Plan: Document strategy and stick to it

- Regular Reviews: Monthly portfolio assessments

- Avoid FOMO: Don't chase pumping assets

- Take Profits: Systematically realise gains

- Support Network: Discuss with knowledgeable peers

Rebalancing Strategies

Time-Based Rebalancing

Regular schedule approach:

- Monthly: Good for active traders, higher costs

- Quarterly: Balanced approach for most investors

- Semi-Annual: Lower maintenance, may miss opportunities

- Annual: Minimal effort, higher drift risk

Threshold-Based Rebalancing

Rebalance when allocations drift:

- 5% Threshold: Rebalance when any asset deviates 5%

- 10% Threshold: More common, reduces trading frequency

- 15% Threshold: For less active management

- Asset-Specific: Different thresholds for different assets

Rebalancing Considerations

- Transaction Costs: Factor in exchange fees

- Tax Implications: Rebalancing creates taxable events

- Market Conditions: Avoid rebalancing during extreme volatility

- Slippage: Large orders may impact prices

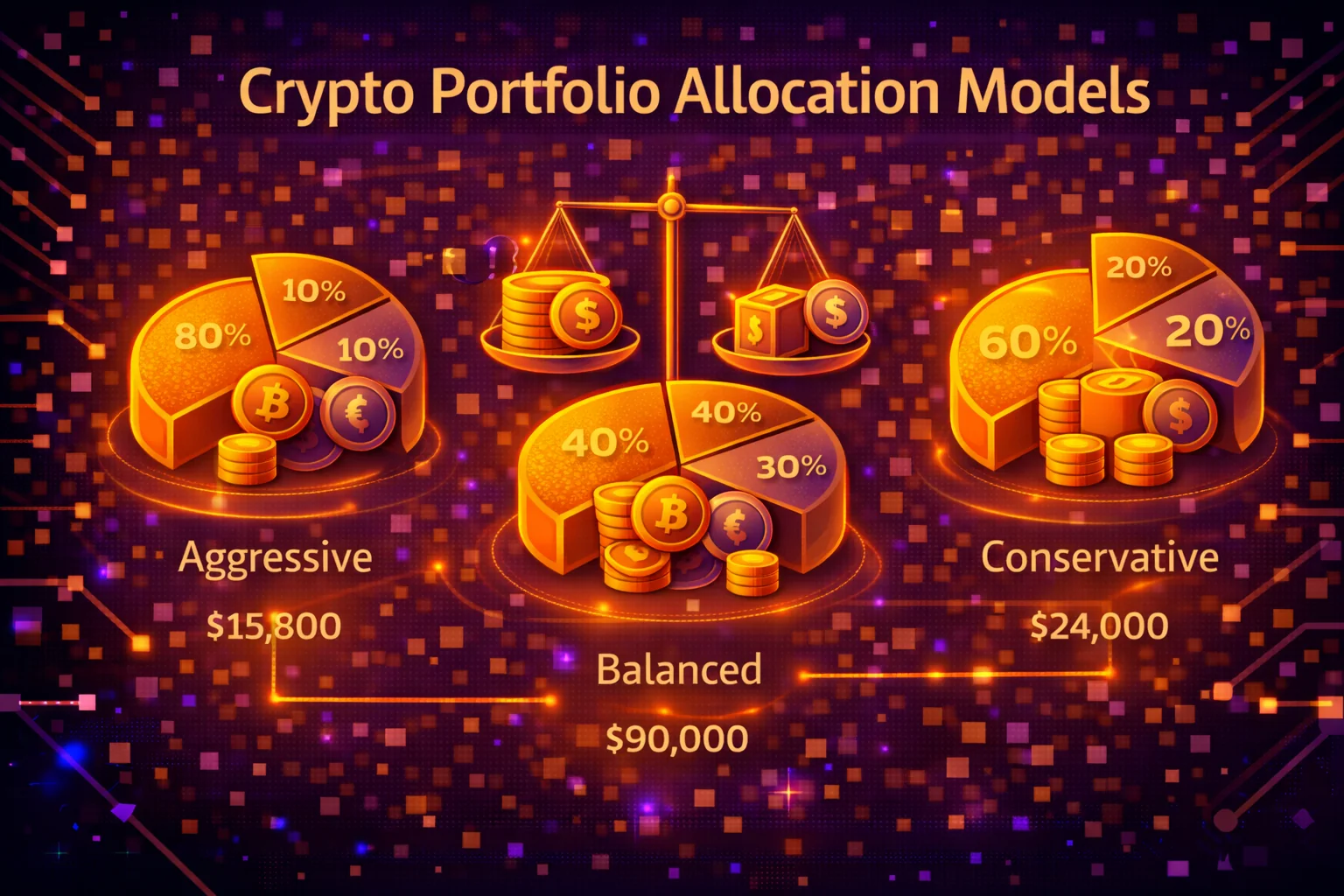

Portfolio Types by Risk Level

Conservative Portfolio (Low Risk)

Target: Capital preservation with modest growth

- Bitcoin (50%): Digital store of value

- Ethereum (30%): Established smart contract platform

- Stablecoins (15%): USDC for stability and opportunities

- Blue Chip Altcoin (5%): One established project

Expected Return: 15-25% annually

Max Drawdown: 40-60%

Moderate Portfolio (Medium Risk)

Target: Balanced growth with managed risk

- Bitcoin (35%): Core holding

- Ethereum (25%): Smart contract exposure

- Top 10 Altcoins (25%): Diversified across 3-4 projects

- Mid-Cap Projects (10%): Growth opportunities

- Stablecoins (5%): Dry powder for opportunities

Expected Return: 25-40% annually

Max Drawdown: 60-80%

Aggressive Portfolio (High Risk)

Target: Maximum growth potential

- Bitcoin (25%): Reduced but present

- Ethereum (20%): Smart contract foundation

- Established Altcoins (30%): 5-6 diversified projects

- Emerging Projects (20%): High-growth potential

- Speculative (5%): Very early stage projects

Expected Return: 40-100%+ annually

Max Drawdown: 80-95%

Advanced Strategies

Dollar-Cost Averaging (DCA)

Systematic investment approach:

- Regular Purchases: Buy fixed dollar amount regularly

- Frequency Options: Daily, weekly, bi-weekly, monthly

- Automation: Set up automatic purchases

- Benefits: Reduces timing risk, emotional decisions

- Platforms: Coinbase, exchange comparison offer DCA features

Yield optimisation

maximising passive income:

- Staking Rewards: Stake ETH, ADA, DOT for yields

- Liquidity Mining: Provide liquidity for trading fees

- Lending Protocols: Lend assets on Aave, Compound

- Yield Aggregators: Use Yearn, Convex for optimisation

Momentum vs Mean Reversion

Two contrasting approaches:

- Momentum: Increase allocation to outperforming assets

- Mean Reversion: Buy dips, sell rallies

- Hybrid Approach: Combine both strategies

- Market Conditions: Adapt strategy to market cycles

Tools and Tracking

Portfolio Tracking Apps

- CoinTracker: Comprehensive tracking and tax reporting

- Blockfolio/FTX: Popular mobile portfolio tracker

- Delta: Clean interface, good for beginners

- CoinGecko: Free tracking with market data

- Zapper: DeFi-focused portfolio tracking

Rebalancing Tools

- Shrimpy: Automated portfolio rebalancing

- 3Commas: Trading bots and portfolio management

- Hodlbot: Index fund-style crypto investing

- Balancer: DeFi protocol for automated rebalancing

Key Metrics to Track

- Total Portfolio Value: Overall performance

- Asset Allocation: Current vs. target weights

- Performance Attribution: Which assets drive returns

- Risk Metrics: Volatility, drawdowns, Sharpe ratio

- Rebalancing Triggers: When to adjust positions

Adapting to Market Cycles

Bull Market Strategy

During bull markets, focus on profit-taking and risk management:

- Take Profits: Systematically sell portions at predetermined levels

- Reduce Risk: Shift from speculative to established assets

- Avoid FOMO: Stick to your allocation strategy

- Prepare for Correction: Keep dry powder for opportunities

Bear Market Strategy

Bear markets offer accumulation opportunities:

- Dollar-Cost Average: Increase buying frequency during dips

- Quality Focus: Concentrate on proven projects

- Patience Required: Avoid panic selling

- Opportunity Assessment: Research new projects at lower valuations

Institutional-Grade Strategies

Endowment Model

Long-term focused approach similar to university endowments:

- Core Holdings (60%): Bitcoin and Ethereum for stability

- Growth Assets (25%): Established altcoins with strong fundamentals

- Opportunistic (10%): Emerging sectors and technologies

- Liquid Reserves (5%): Stablecoins for rebalancing

Risk Parity Approach

Equal risk contribution from each asset:

- Volatility Weighting: Lower allocation to higher volatility assets

- Correlation Analysis: Reduce allocation to highly correlated assets

- Dynamic Adjustment: Regular rebalancing based on risk metrics

- Diversification Focus: Maximum diversification across risk factors

Tax optimisation Strategies

Understanding Crypto Tax Implications

Cryptocurrency taxation varies significantly by jurisdiction, but most countries treat crypto as property subject to capital gains tax. Understanding these implications is crucial for portfolio optimisation, as tax efficiency can significantly impact your net returns over time.

In the United States, cryptocurrency transactions are taxable events, including trading one crypto for another, selling crypto for fiat, and using crypto to purchase goods or services. Each transaction creates a taxable gain or loss based on the difference between the purchase price (cost basis) and the sale price.

Tax-Loss Harvesting

Tax-loss harvesting involves strategically realising losses to offset gains, reducing your overall tax liability. Unlike traditional securities, cryptocurrency is not subject to wash sale rules in most jurisdictions, allowing for more aggressive tax-loss harvesting strategies.

- Systematic Harvesting: Regularly review portfolio for unrealized losses that can offset gains

- Rebalancing Opportunities: Combine tax-loss harvesting with portfolio rebalancing

- Year-End Planning: Strategic realisation of gains and losses before tax year end

- Carry-forwards Benefits: Unused losses can offset future gains in most jurisdictions

Long-Term vs Short-Term Capital Gains

Most tax jurisdictions provide preferential treatment for long-term capital gains (assets held over one year). This creates a strong incentive for buy-and-hold strategies, particularly for core portfolio positions in established cryptocurrencies like Bitcoin and Ethereum.

Strategic timing of sales can optimise tax outcomes. For example, if you need to rebalance a position that has appreciated significantly, waiting until it qualifies for long-term capital gains treatment can substantially reduce your tax liability.

Staking and DeFi Tax Considerations

Staking rewards and DeFi yields are generally treated as ordinary income at the time of receipt, with the fair market value becoming your cost basis for future capital gains calculations. This creates ongoing tax obligations that must be factored into yield calculations.

Consider the after-tax yield when comparing staking opportunities. A 10% staking reward taxed at 35% ordinary income rates provides a 6.5% after-tax return, which may be less attractive than a 7% return from price appreciation taxed at 20% long-term capital gains rates.

Geographic Arbitrage and Tax Planning

Some investors consider geographic arbitrage, relocating to jurisdictions with more favorable cryptocurrency tax treatment. Countries like Portugal, Singapore, and the UAE offer attractive tax environments for crypto investors, though this strategy requires careful planning and professional advice.

Even without relocating, understanding international tax treaties and structures can provide optimisation opportunities for larger portfolios. However, always ensure compliance with all applicable tax laws and reporting requirements.

Record Keeping and Compliance

Maintaining detailed records is essential for tax compliance and optimisation. Track all transactions, including dates, amounts, prices, and the purpose of each transaction. Use specialised cryptocurrency tax software to automate calculations and ensure accuracy.

- Transaction Records: Complete history of all buys, sells, trades, and transfers

- Cost Basis Tracking: Accurate cost basis for each position using appropriate accounting methods

- Income Documentation: Records of staking rewards, airdrops, and other taxable events

- Professional Support: Work with tax professionals experienced in cryptocurrency taxation

Portfolio Performance Analysis

Key Performance Metrics

Effective portfolio management requires systematic performance measurement using appropriate metrics that account for the unique characteristics of cryptocurrency markets. Traditional metrics must be adapted for the higher volatility and 24/7 nature of crypto markets.

Risk-Adjusted Returns

The Sharpe ratio measures excess return per unit of risk, calculated as (portfolio return - risk-free rate) / portfolio standard deviation. For cryptocurrency portfolios, use a risk-free rate appropriate for your jurisdiction and time horizon, typically government bond yields.

The Sortino ratio improves on the Sharpe ratio by only considering downside volatility, which is more relevant for investors primarily concerned with losses. This metric is particularly useful for cryptocurrency portfolios given the asymmetric nature of crypto returns.

Maximum Drawdown Analysis

Maximum drawdown measures the largest peak-to-trough decline in portfolio value, providing insight into the worst-case scenario an investor experienced. For crypto portfolios, analyse both absolute drawdown and the time required to recover to previous highs.

Track rolling maximum drawdowns over different time periods (30-day, 90-day, 1-year) to understand how portfolio risk characteristics change over time. This analysis helps identify whether your risk management strategies are effective across different market conditions.

Benchmark Comparison

Compare your portfolio performance against relevant benchmarks to assess the value of active management. Common cryptocurrency benchmarks include market-cap weighted indices, equal-weighted baskets of major cryptocurrencies, and Bitcoin-only portfolios.

Consider creating custom benchmarks that reflect your investment strategy. For example, if you focus on DeFi tokens, compare against a DeFi-specific index rather than the broader cryptocurrency market. This provides more meaningful performance attribution.

Attribution Analysis

Performance attribution breaks down portfolio returns into components: asset allocation, security selection, and timing effects. This analysis helps identify which aspects of your strategy are adding value and which may need improvement.

- Asset Allocation Effect: Returns from choosing sector/category weights

- Security Selection Effect: Returns from choosing specific cryptocurrencies within categories

- Interaction Effect: Combined impact of allocation and selection decisions

- Timing Effect: Impact of entry and exit timing on returns

Correlation and Diversification Analysis

Regularly analyse correlations between portfolio holdings to ensure diversification benefits are maintained. Cryptocurrency correlations can change rapidly during market stress, potentially reducing diversification when it's needed most.

Use rolling correlation analysis to identify trends in asset relationships. If correlations are increasing across your portfolio, consider adding assets with different risk factors or reducing position sizes to maintain diversification benefits.

Stress Testing and Scenario Analysis

Conduct regular stress tests to understand how your portfolio might perform under adverse conditions. Model scenarios such as major regulatory changes, exchange hacks, or broader market crashes to ensure your portfolio can withstand various shocks.

Historical scenario analysis examines how your current portfolio would have performed during past market events, such as the 2018 crypto winter or the March 2020 COVID crash. This provides insight into portfolio resilience and helps identify potential vulnerabilities.

Performance Reporting and Review

Establish a regular performance review schedule with standardised reporting formats. Monthly performance summaries should include returns, risk metrics, benchmark comparisons, and commentary on market conditions and portfolio changes.

Quarterly reviews should include deeper analysis of strategy effectiveness, rebalancing decisions, and any necessary adjustments to investment approach. Annual reviews provide opportunity for comprehensive strategy evaluation and goal reassessment.

Key Performance Report Components

- Return Summary: Absolute and relative returns across multiple time periods

- Risk Metrics: Volatility, maximum drawdown, and risk-adjusted returns

- Attribution Analysis: Sources of outperformance or underperformance

- Portfolio Composition: Current allocations and changes from previous period

- Market Commentary: Analysis of market conditions and their impact on performance

- Forwards Outlook: Expected market conditions and potential strategy adjustments

Market Evolution

Portfolio strategies adapt to changing market conditions through continuous optimisation and strategic adjustments that reflect evolving market dynamics and emerging opportunities in the cryptocurrency ecosystem.

Advanced Portfolio Strategies and Professional Implementation

Institutional Portfolio Management

Professional cryptocurrency portfolio management requires sophisticated allocation frameworks and comprehensive risk assessment procedures. Institutional strategies include systematic asset allocation, diversification techniques, and advanced rebalancing procedures. These optimise returns whilst protecting capital through professional portfolio management.

Algorithmic Portfolio Rebalancing

Algorithmic rebalancing systems utilise mathematical models, real-time market data analysis, and automated execution protocols. These maintain optimal asset allocation whilst minimising transaction costs and market impact. Systems incorporate algorithms that analyse market conditions, volatility patterns, and correlation structures to determine optimal rebalancing timing.

Quantitative Portfolio Optimisation

Quantitative cryptocurrency portfolio optimisation utilises mathematical models, statistical analysis, and optimisation algorithms. These maximise risk-adjusted returns whilst maintaining appropriate diversification. Monte Carlo simulation techniques enable comprehensive scenario analysis and stress testing. Black-Litterman optimisation models combine market equilibrium assumptions with investor views to generate optimal portfolio allocations.

Multi-Strategy Portfolio Construction

Multi-strategy cryptocurrency portfolio construction enables comprehensive diversification across different investment approaches. This reduces strategy-specific risks whilst maximising return opportunities. Alternative investment integration includes DeFi strategies, yield generation techniques, and structured product integration.

Dynamic Asset Allocation

Dynamic asset allocation requires sophisticated market analysis, timing models, and rebalancing strategies. These optimise portfolio performance whilst managing market volatility. Tactical allocation strategies incorporate short-term market views and opportunistic positioning. Momentum and mean reversion strategies provide systematic approaches to market timing.

Risk Parity and Factor-Based Construction

Risk parity cryptocurrency portfolio construction utilises risk budgeting, factor analysis, and allocation techniques. These optimise risk distribution whilst maintaining return objectives. Factor-based portfolio construction includes factor research, exposure management, and operational procedures. Smart beta strategies combine passive indexing benefits with active management techniques.

ESG Integration and Sustainable Cryptocurrency Investment

Environmental, social, and governance integration in cryptocurrency portfolios requires comprehensive sustainability assessment, sophisticated screening procedures, and advanced operational frameworks that align investment objectives with sustainability goals while maintaining return targets and operational efficiency. ESG integration includes systematic sustainability evaluation, comprehensive impact assessment, and advanced screening techniques that enhance portfolio sustainability while maintaining investment performance through professional ESG management and institutional sustainable operations designed for sophisticated sustainable investment and professional asset management excellence.

Sustainable cryptocurrency investment includes comprehensive protocol evaluation, sophisticated governance assessment, and advanced operational procedures that optimise sustainable investment allocation while maintaining appropriate risk management and regulatory compliance. Professional sustainable investment management utilises advanced analytics, systematic sustainability monitoring, and comprehensive impact measurement that enable optimal sustainable investment performance while maintaining operational excellence and regulatory adherence through professional sustainable operations and institutional ESG management designed for sophisticated cryptocurrency investment and professional sustainable asset management excellence.

Carbon footprint analysis and environmental impact assessment enable evaluation of cryptocurrency investments based on energy consumption, consensus mechanisms, and environmental sustainability factors. These assessments incorporate comprehensive energy usage analysis, renewable energy utilisation evaluation, and carbon offset mechanisms that enable environmentally conscious investment decisions while maintaining portfolio performance objectives and operational efficiency through professional environmental analysis and institutional sustainable investment management.

Governance token analysis and decentralised autonomous organisation evaluation provide insights into project governance structures, decision-making processes, and community participation mechanisms that influence long-term sustainability and investment attractiveness. These analyses incorporate comprehensive governance framework assessment, voting mechanism evaluation, and community engagement analysis that enable informed investment decisions based on governance quality and sustainability factors through professional governance analysis and institutional ESG investment strategies.

Technology Integration and Automated Portfolio Management

Technology integration for cryptocurrency portfolio management includes advanced automation systems, sophisticated monitoring platforms, and comprehensive operational tools that enhance investment efficiency while maintaining risk management standards and operational excellence. Technology implementation includes real-time portfolio monitoring, comprehensive alert systems, and advanced automation procedures that optimise portfolio management whilstreducing operational overhead through professional technology integration and institutional portfolio operations designed for sophisticated investment automation and professional operational excellence.

Automated portfolio management includes sophisticated algorithms, comprehensive risk assessment systems, and advanced rebalancing procedures that maintain optimal portfolio allocation while managing market volatility and operational requirements. Professional automation utilises advanced technology platforms, systematic monitoring procedures, and comprehensive risk management frameworks that enable optimal portfolio performance while maintaining security standards and operational efficiency through professional automation systems and institutional portfolio operations designed for sophisticated cryptocurrency investment and professional asset management excellence.

Artificial intelligence and machine learning applications enable sophisticated pattern recognition, predictive analytics, and automated decision-making that enhance portfolio management effectiveness whilstreducing human error and operational costs. These systems incorporate natural language processing for news analysis, computer vision for chart pattern recognition, and deep learning algorithms for market prediction that enable advanced portfolio optimisation and risk management through professional AI implementation and institutional machine learning strategies.

Blockchain integration and decentralised finance protocols provide access to automated portfolio management tools, yield optimisation strategies, and sophisticated financial instruments that enhance portfolio performance while maintaining operational transparency and security. These integrations include automated market makers, yield aggregators, and portfolio management protocols that enable sophisticated DeFi strategies while maintaining appropriate risk management and operational security through professional blockchain integration and institutional DeFi portfolio management.

Final Thoughts

Successful cryptocurrency portfolio management requires a comprehensive understanding of market dynamics, risk management principles, and strategic allocation techniques. The strategies outlined in this guide provide frameworks for building resilient portfolios that can navigate market volatility while capturing long-term growth opportunities in the evolving digital asset ecosystem.

Whether implementing traditional portfolio theory or exploring advanced DeFi strategies, the key to success lies in maintaining disciplined execution, continuous learning, and adaptive risk management. As the cryptocurrency market continues to mature, investors who combine fundamental analysis with sophisticated portfolio construction techniques will be best positioned to achieve their financial objectives while managing downside risks effectively.

Portfolio Recovery Control Loop (90-Day Cadence)

To avoid drift, review your allocation every 90 days with the same sequence each time: rebalance target weights, re-score each holding by conviction and liquidity, then remove assets that no longer meet your thesis. Run your execution venue check with the crypto exchanges 2025 comparison and reassess income allocation via the staking platforms 2025 comparison. This keeps strategy updates evidence-driven instead of reactive.

Conclusion

Building a successful cryptocurrency portfolio requires careful planning, disciplined execution, and continuous learning that extends far beyond simple asset selection. The strategies outlined in this guide provide a comprehensive framework for constructing portfolios that balance the tremendous growth potential of digital assets with sophisticated risk management techniques that protect capital during volatile market conditions and unexpected downturns.

Remember that no single strategy works for everyone, and the optimal portfolio construction approach depends heavily on your individual risk tolerance, investment timeline, financial goals, and level of cryptocurrency market experience. Starting with a conservative approach allows you to gain valuable experience with cryptocurrency market dynamics while minimising the risk of significant losses. Consider reading our crypto vs stocks comparison to understand how digital assets fit into traditional portfolios.

The cryptocurrency market will continue to evolve at a rapid pace, bringing new opportunities through technological innovation and institutional adoption, as well as new challenges through regulatory developments and market maturation. Successful portfolio management requires staying informed about these developments, remaining flexible in your approach, and always prioritising risk management and capital preservation over the pursuit of maximum potential returns.

Diversification across cryptocurrency categories, geographic regions, and investment strategies remains one of the most effective tools for managing portfolio risk while capturing upside potential from different market segments. However, diversification must be balanced with concentration in your highest-conviction opportunities, as over-diversification can dilute returns and make portfolio management unnecessarily complex.

The importance of systematic rebalancing, performance monitoring, and strategy refinement cannot be overstated in the dynamic cryptocurrency market. Regular portfolio reviews and adjustments based on changing market conditions, performance attribution analysis, and evolving investment objectives are essential for maintaining optimal portfolio construction and achieving long-term investment success.

With patience, discipline, and a commitment to continuous learning and improvement, a well-constructed cryptocurrency portfolio can serve as a valuable component of your overall investment strategy, providing exposure to one of the most innovative and potentially transformative asset classes of our time while managing the inherent risks through proven portfolio management principles.

The integration of cryptocurrency portfolios with traditional investment strategies represents an evolving frontier in modern portfolio theory. As institutional adoption increases and regulatory frameworks mature, the correlation patterns between digital assets and traditional markets continue to shift, creating new opportunities for portfolio optimisation and risk management that were not previously available to investors.

Tax efficiency considerations play an increasingly important role in cryptocurrency portfolio management, with different jurisdictions implementing varying approaches to digital asset taxation. Understanding the tax implications of different portfolio strategies, including the timing of rebalancing activities and the selection of specific tax lots for sales, can significantly impact after-tax returns and should be integrated into your overall portfolio management approach.

The emergence of new investment vehicles, including cryptocurrency exchange-traded funds, regulated custody solutions, and institutional-grade trading platforms, has expanded the toolkit available to portfolio managers whilst introducing new considerations for asset allocation and risk management. These developments make sophisticated portfolio strategies more accessible to a broader range of investors whilst maintaining appropriate security and regulatory compliance.

Environmental, social, and governance (ESG) considerations are becoming increasingly relevant in cryptocurrency portfolio construction, with growing attention to the energy consumption of different blockchain networks and the social impact of various cryptocurrency projects. Incorporating ESG factors into portfolio decisions can align investment strategies with personal values whilst potentially identifying projects with more sustainable long-term prospects.

The psychological aspects of cryptocurrency portfolio management deserve careful consideration, as the extreme volatility and 24/7 nature of cryptocurrency markets can lead to emotional decision-making that undermines long-term investment success. Developing a systematic approach to portfolio management, including predetermined rules for rebalancing and risk management, can help maintain discipline during periods of market stress and prevent costly emotional reactions to short-term price movements.

Looking forwards, the continued evolution of cryptocurrency markets will likely bring new challenges and opportunities that require ongoing adaptation of portfolio management strategies. Maintaining flexibility in your approach whilst adhering to core principles of diversification, risk management, and disciplined execution will be essential for navigating the dynamic landscape of digital asset investing and achieving sustainable long-term investment success.

Sources & References

Frequently Asked Questions

- What percentage of my portfolio should be in crypto?

- Most financial advisors recommend a 5-10% crypto allocation for conservative investors, 10-20% for moderate risk tolerance, and up to 30% for aggressive investors. Never invest more than you can afford to lose completely.

- Should I focus on Bitcoin and Ethereum or diversify into altcoins?

- A balanced approach works best: 60-70% in Bitcoin and Ethereum for stability, 20-30% in established altcoins, and 5-10% in higher-risk opportunities. This provides growth potential while managing risk.

- How often should I rebalance my crypto portfolio?

- Rebalance quarterly or when any asset deviates more than 10% from target allocation. In volatile markets, monthly rebalancing may be beneficial, but avoid over-trading, which increases costs and taxes.

- What's the best strategy for beginners?

- Start with dollar-cost averaging into Bitcoin and Ethereum (70-80% allocation), add 1-2 established altcoins (15-25%), and keep 5% for learning with smaller projects. Focus on education and gradually build your portfolio.

- How do I handle crypto portfolio taxes?

- Keep detailed records of all transactions, use tax software like Koinly or CoinTracker, consider tax-loss harvesting, and consult with a crypto-experienced CPA for complex situations.

- Should I use stop losses in crypto?

- Stop losses can be useful, but consider crypto's volatility. Set them at 30-50% below purchase price to avoid being stopped out by normal volatility. Time-based stops may be more effective than price-based ones.

- What's the difference between active and passive crypto strategies?

- Passive strategies involve buying and holding with periodic rebalancing, while active strategies involve frequent trading and market timing. Passive strategies typically perform better for most investors due to lower costs and reduced emotional decisions.

- How do I evaluate new cryptocurrencies for my portfolio?

- Research the team, technology, use case, competition, tokenomics, and community. Look for audited code, real-world adoption, and sustainable business models. Start with small allocations (1-2%) for new projects.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.