Crypto vs Stocks 2025: Which is Better?

Compare cryptocurrency and stock market investments in 2025. Analyse historical returns, risk profiles, volatility, and optimal portfolio allocation strategies for both asset classes.

Introduction

The investment landscape has fundamentally transformed over the past decade, with cryptocurrency emerging as a legitimate asset class alongside traditional stocks. In 2025, investors face an increasingly complex decision: how to allocate capital between these two distinct yet potentially complementary investment vehicles. This comprehensive analysis examines the key differences, advantages, and risks associated with both cryptocurrency and stock market investments in the current economic environment.

Cryptocurrency has evolved from a speculative experiment to a mature financial ecosystem, with institutional adoption reaching unprecedented levels. Major corporations like Tesla, MicroStrategy, and Square now hold Bitcoin on their balance sheets, while traditional financial institutions including JPMorgan, Goldman Sachs, and Fidelity offer comprehensive crypto services to their clients. This institutional validation has brought greater legitimacy and stability to cryptocurrency markets, though volatility remains significantly higher than traditional assets.

Simultaneously, the stock market continues to provide access to established companies with proven business models, dividend income, and regulatory protections that have attracted investors for over a century. The S & P 500 has delivered consistent long-term returns, while individual stocks offer opportunities to participate in the growth of innovative companies across various sectors. The regulatory framework surrounding stocks is well-established, providing investor protections and market transparency that cryptocurrency markets are still developing.

The choice between crypto and stocks is no longer binary in 2025's sophisticated investment landscape. Modern portfolio theory suggests that diversification across asset classes can optimise risk-adjusted returns, and many successful investors now include both traditional and digital assets in their portfolios. However, understanding the unique characteristics, risk profiles, and market dynamics of each asset class is crucial for making informed investment decisions that align with your financial objectives.

Market conditions in 2025 have created unique opportunities and challenges for both asset classes. Cryptocurrency markets have matured significantly with the introduction of Bitcoin ETFs, clearer regulatory frameworks, and improved infrastructure, while stock markets face headwinds from inflation concerns, geopolitical tensions, and changing monetary policy. These evolving conditions require investors to carefully consider how each asset class fits into their overall investment strategy and risk management approach.

This comprehensive guide provides data-driven insights to help you navigate this complex landscape and develop an investment strategy aligned with your financial goals, risk tolerance, and time horizon. We'll examine historical performance, volatility patterns, correlation dynamics, and practical considerations for implementing either or both strategies in your portfolio. Whether you're a seasoned investor looking to diversify your holdings or a newcomer trying to understand these markets, this comparison will equip you with the knowledge needed to make confident investment decisions in 2025's dynamic financial environment.

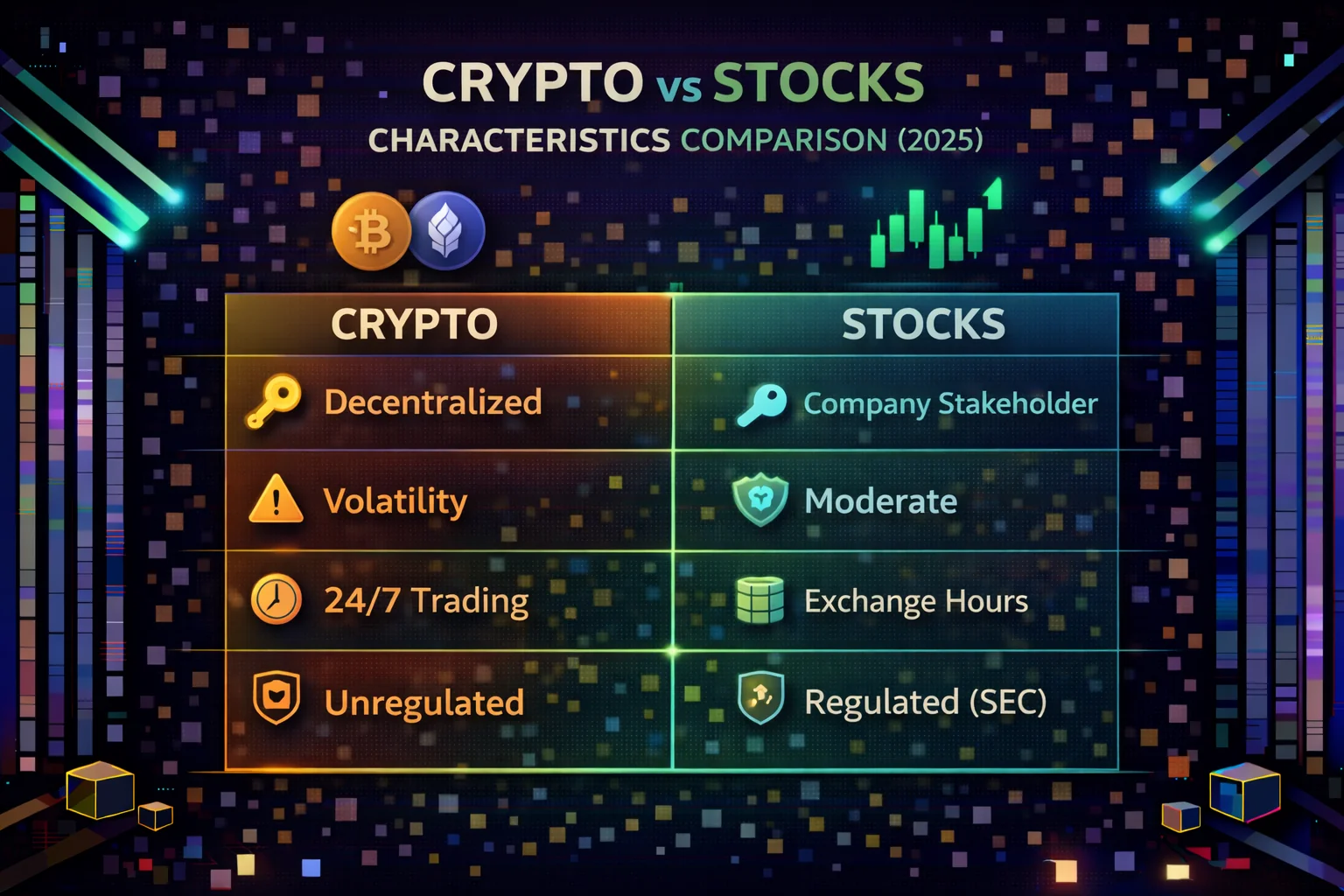

Crypto vs Stocks: Quick Overview

| Factor | Cryptocurrency | Stocks |

|---|---|---|

| Market Hours | 24/7/365 | Business hours only |

| Historical Returns (10yr) | Very High (but volatile) | Moderate (~10% annually) |

| Volatility | Very High (60-80%) | Moderate (15-20%) |

| Regulation | Evolving/Uncertain | Well-established |

| Dividends/Yield | Staking rewards (some) | Dividend payments |

| Market Maturity | Emerging (15 years) | Mature (100+ years) |

| Correlation | Low (but increasing) | High with economy |

| Accessibility | Global, permissionless | Geographic restrictions |

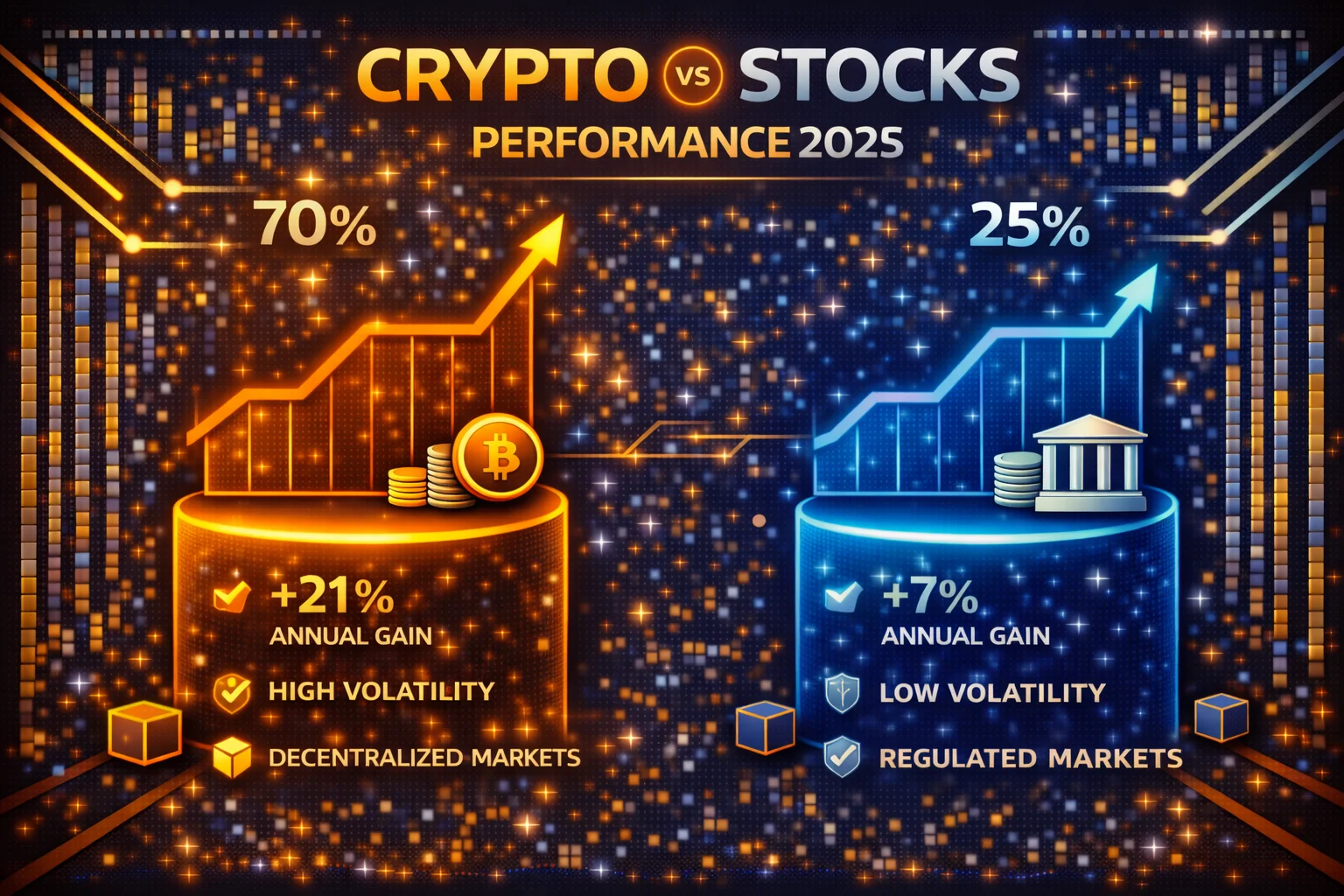

Historical Performance Analysis

Cryptocurrency Returns

Cryptocurrency has delivered exceptional returns for early adopters, but with extreme volatility that makes it unsuitable for risk-averse investors.

Bitcoin Performance (2013-2025)

- 10-Year CAGR: ~60% annually (highly volatile)

- Best Year: +300% (2017)

- Worst Year: -73% (2018)

- Maximum Drawdown: -84% (2017-2018)

- Volatility: 60-80% annually

Ethereum Performance (2015-2025)

- 10-Year CAGR: ~80% annually (extremely volatile)

- Best Year: +9,000% (2017)

- Worst Year: -82% (2018)

- Maximum Drawdown: -94% (2018)

- Volatility: 80-100% annually

Stock Market Returns

Stock markets have provided consistent long-term returns with moderate volatility, making them suitable for a broader range of investors.

S & P 500 Performance (2013-2025)

- 10-Year CAGR: ~12% annually

- Best Year: +31% (2019)

- Worst Year: -18% (2022)

- Maximum Drawdown: -34% (2020 COVID crash)

- Volatility: 15-20% annually

Growth Stocks Performance

- NASDAQ 100: ~15% annual returns (2013-2025)

- Tech Giants: Apple, Microsoft, Google delivered 15-20% CAGR

- Growth ETFs: QQQ, VGT outperformed broad market

Risk Profile Comparison

Cryptocurrency Risks

High-Risk Factors

- Extreme Volatility: 50-80% price swings common

- Regulatory Risk: Government bans or restrictions

- Technology Risk: Bugs, hacks, or obsolescence

- Market Manipulation: Smaller market cap enables manipulation

- Custody Risk: Lost keys = lost funds permanently

- Liquidity Risk: Some altcoins have poor liquidity

Unique Crypto Risks

- Exchange Hacks: centralised exchanges can be compromised

- Fork Risk: Network splits can create uncertainty

- Quantum Computing: Future threat to cryptographic security

- Environmental Concerns: Energy usage criticism

Stock Market Risks

Traditional Risk Factors

- Market Risk: Broad market declines affect all stocks

- Company Risk: Individual company failures

- Sector Risk: Industry-specific downturns

- Economic Risk: Recessions impact corporate earnings

- Inflation Risk: Rising prices erode real returns

- Interest Rate Risk: Rate changes affect valuations

Mitigating Factors

- Diversification: Thousands of stocks available

- Regulation: Strong investor protections

- Transparency: Required financial reporting

- Professional Management: Mutual funds and ETFs

Investment Characteristics

Cryptocurrency Advantages

- 24/7 Trading: No market hours restrictions

- Global Access: Anyone with internet can participate

- High Growth Potential: Early-stage technology adoption

- Inflation Hedge: Fixed supply assets like Bitcoin

- Uncorrelated Returns: Different from traditional assets

- Innovation Exposure: Cutting-edge financial technology

- Self-Custody: Direct ownership without intermediaries

Stock Market Advantages

- Proven Track Record: 100+ years of wealth creation

- Income Generation: Dividend payments

- Professional Analysis: Extensive research coverage

- Regulatory Protection: Investor safeguards

- Diversification: Thousands of companies and sectors

- Liquidity: Easy to buy and sell large amounts

- Tax Advantages: Long-term profit taxation treatment

Cryptocurrency Disadvantages

- Extreme Volatility: Unsuitable for risk-averse investors

- No Intrinsic Value: Value based purely on speculation

- Regulatory Uncertainty: Unclear legal framework

- Technical Complexity: Requires understanding of technology

- No Income: Most cryptos don't pay dividends

- Environmental Concerns: Energy consumption issues

Stock Market Disadvantages

- Market Hours: Limited trading times

- Geographic Restrictions: Access limitations

- Intermediaries Required: Need brokers and custodians

- Inflation Risk: Real returns can be eroded

- Corporate Risk: Management decisions affect returns

- Market Manipulation: Institutional advantages

Portfolio Allocation Strategies

Traditional Portfolio (No Crypto)

- 60% Stocks: Diversified equity exposure

- 40% Bonds: Stability and income

- Expected Return: 7-9% annually

- Volatility: 10-15% annually

Conservative Crypto Allocation (1-5%)

- 55% Stocks: Reduced equity allocation

- 40% Bonds: Stability component

- 5% Crypto: Bitcoin and Ethereum

- Expected Return: 8-10% annually

- Volatility: 12-18% annually

Moderate Crypto Allocation (5-10%)

- 50% Stocks: Core equity exposure

- 35% Bonds: Reduced bond allocation

- 10% Crypto: Diversified crypto portfolio

- 5% Alternatives: REITs, commodities

- Expected Return: 9-12% annually

- Volatility: 15-22% annually

Aggressive Crypto Allocation (10-20%)

- 45% Stocks: Growth-focused equities

- 25% Bonds: Minimal fixed income

- 20% Crypto: Major cryptocurrencies + altcoins

- 10% Alternatives: Growth investments

- Expected Return: 10-15% annually

- Volatility: 20-30% annually

Investment Timeline Considerations

Short-Term (1-3 years)

Recommendation: Favor Stocks

- Crypto too volatile for short-term goals

- Stocks provide more predictable returns

- Consider high-quality dividend stocks

- Avoid speculative investments

Medium-Term (3-10 years)

Recommendation: Balanced Approach

- 5-10% allocation is reasonable

- Focus on established cryptocurrencies

- Maintain diversified stock portfolio

- Regular rebalancing important

Long-Term (10+ years)

Recommendation: Higher Crypto Allocation Possible

- 10-20% allocation for risk-tolerant investors

- Time to ride out crypto volatility cycles

- Benefit from potential technology adoption

- Maintain core stock/bond foundation

How to Invest in Both Asset Classes

Cryptocurrency Investment

Start with reputable exchanges and focus on major cryptocurrencies:

- Coinbase - Best for crypto beginners

- Binance - Advanced features and low fees

- Kraken - Strong security and compliance

Stock Market Investment

Use established brokers with low fees and good research:

- Interactive Brokers - Low-cost global stock trading

- Vanguard: Low-cost index funds and ETFs

- Fidelity: Zero-fee stock trades and research

- Schwab: Comprehensive investment platform

Hybrid Approach

- Core Holdings: 80-90% in diversified stock/bond portfolio

- Satellite Holdings: 10-20% in crypto and alternatives

- Rebalancing: Quarterly or semi-annual rebalancing

- Dollar-Cost Averaging: Regular investments in both asset classes

Tax Implications Comparison

Cryptocurrency Taxation

Crypto taxation is complex and varies by jurisdiction, but generally follows these principles:

United States Tax Treatment

- asset appreciation: Crypto-to-crypto trades are taxable events

- Short-term: Ordinary income tax rates (up to 37%)

- Long-term: trading profits rates (0%, 15%, or 20%)

- Staking Rewards: Taxed as ordinary income when received

- Mining: Business income subject to self-employment tax

- Record Keeping: Must track every transaction

International Crypto Taxation

- Germany: Tax-free after 1 year holding period

- Portugal: No investment gains tax for individuals

- Singapore: No investment gains tax for long-term investors

- UK: profit taxation tax with annual exemption

- Canada: 50% of gains taxable as income

Stock Market Taxation

Stock taxation is more straightforward and established:

United States Stock Taxation

- Dividends: Qualified dividends taxed at capital gains rates

- Capital Gains: Same rates as crypto (0%, 15%, 20%)

- Tax-Advantaged Accounts: 401(k), IRA, Roth IRA available

- Wash Sale Rule: Prevents tax loss harvesting abuse

- Foreign Tax Credits: Available for international stocks

Tax optimisation Strategies

For Cryptocurrency

- HODL Strategy: Hold for 1+ years for long-term rates

- Tax Loss Harvesting: realise losses to offset gains

- Like-Kind Exchanges: No longer available post-2017

- Retirement Accounts: Some allow crypto investments

For Stocks

- Tax-Deferred Accounts: maximise 401(k) and IRA contributions

- Asset Location: Hold tax-inefficient assets in tax-advantaged accounts

- Dividend Timing: Consider qualified dividend requirements

- Municipal Bonds: Tax-free income for high earners

Market Cycles and Timing

Cryptocurrency Market Cycles

Crypto markets exhibit distinct 4-year cycles correlated with Bitcoin halving events:

Typical Crypto Cycle Pattern

- Year 1 (Post-Halving): Accumulation phase, gradual price increase

- Year 2: Bull market acceleration, mainstream attention

- Year 3: Peak euphoria, market top, crash begins

- Year 4 (Pre-Halving): Bear market bottom, preparation for next cycle

Historical Crypto Cycles

- 2012-2016: Bitcoin $200 to $20,000

- 2016-2020: Bitcoin $3,200 to $69,000

- 2020-2024: Bitcoin $15,500 to $73,000

- 2024-2028: Current cycle in progress

Stock Market Cycles

Stock markets follow longer, less predictable cycles influenced by economic factors:

Economic Cycle Correlation

- Expansion: Rising corporate earnings, bull market

- Peak: Overvaluation, market euphoria

- Contraction: Recession, bear market

- Trough: Market bottom, value opportunities

Historical Stock Cycles

- 2009-2020: Longest bull market in history (11 years)

- 2020: COVID crash and recovery

- 2022: Inflation-driven bear market

- 2023-2025: Recovery and new highs

Institutional Adoption Trends

Cryptocurrency Institutional Adoption

Institutional adoption of cryptocurrency has accelerated significantly since 2020:

Corporate Treasury Adoption

- MicroStrategy: $5+ billion in Bitcoin holdings

- Tesla: $1.5 billion Bitcoin purchase (partially sold)

- Block (Square): Significant Bitcoin treasury allocation

- Coinbase: Public company with crypto-native business model

Investment Product Growth

- Bitcoin ETFs: Multiple spot Bitcoin ETFs approved in 2024

- Ethereum ETFs: Spot Ethereum ETFs launched in 2024

- Grayscale Trusts: Converted to ETF structure

- Futures Products: CME Bitcoin and Ethereum futures

Traditional Stock Market Infrastructure

Stock markets benefit from mature institutional infrastructure:

Established Systems

- Clearing Houses: DTCC processes trillions in transactions

- Custody Services: Bank of New York Mellon, State Street

- Market Makers: Citadel Securities, Virtu Financial

- Prime Brokerage: Goldman Sachs, Morgan Stanley

Regulatory Framework

- SEC Oversight: Comprehensive market regulation

- FINRA: Broker-dealer regulation and oversight

- SIPC Insurance: Investor protection up to $500,000

- Transparency Rules: Required financial disclosures

Final Recommendation

The Verdict: Both Have a Place

Rather than choosing between crypto and stocks, most investors benefit from a diversified approach that includes both asset classes in appropriate proportions based on risk tolerance, investment timeline, and financial objectives. The evidence from 2025 market conditions demonstrates that both asset classes offer unique advantages and serve different roles in a well-constructed portfolio.

The maturation of cryptocurrency markets, combined with the continued strength of traditional equity markets, has created an environment where both assets can coexist and complement each other effectively. Cryptocurrency provides portfolio diversification benefits, inflation hedging potential, and exposure to technological innovation, while stocks offer stability, dividend income, and participation in established business growth.

Recommended Approach by Investor Type

Conservative Investors

- Allocation: 70% stocks, 25% bonds, 5% crypto

- Crypto Focus: Bitcoin and Ethereum only

- Strategy: Buy and hold, minimal trading

- Risk Management: Dollar-cost averaging, long-term perspective

Moderate Investors

- Allocation: 60% stocks, 25% bonds, 10% crypto, 5% alternatives

- Crypto Focus: Top 5-10 cryptocurrencies

- Strategy: Regular rebalancing, DCA approach

- Risk Management: Quarterly portfolio reviews, systematic rebalancing

Aggressive Investors

- Allocation: 50% stocks, 20% bonds, 20% crypto, 10% alternatives

- Crypto Focus: Diversified crypto portfolio including DeFi

- Strategy: Active management, higher risk tolerance

- Risk Management: Advanced strategies, options hedging

Key Success Factors for 2025

Successful investing in both asset classes requires understanding their unique characteristics and implementing appropriate strategies. For cryptocurrency investments, this means focusing on established projects with strong fundamentals, understanding the technology and use cases, and maintaining appropriate position sizing. For stock investments, this involves fundamental analysis, diversification across sectors and geographies, and maintaining a long-term perspective despite short-term volatility.

The most important factor for success in either asset class is education and continuous learning. Both markets evolve rapidly, with new opportunities and risks emerging regularly. Staying informed about technological developments, regulatory changes, and market trends is essential for making informed investment decisions and adapting strategies as conditions change.

2025 Market Outlook

Looking ahead to 2025, several factors will influence both markets and create new opportunities for informed investors:

Cryptocurrency Catalysts

- Bitcoin Halving: 2024 halving effects continuing into 2025

- ETF Adoption: Increased institutional access and adoption

- Regulatory Clarity: Clearer frameworks emerging globally

- Technology Advances: Layer 2 scaling, improved UX

Stock Market Factors

- AI Revolution: Continued growth in AI-related stocks

- Interest Rates: Federal Reserve policy normalization

- Economic Growth: Post-pandemic recovery continuation

- Geopolitical Risks: Ongoing global tensions and trade issues

Key Takeaway

Diversification is key. Both crypto and stocks offer unique benefits and risks. A well-balanced portfolio that includes both asset classes, sized appropriately for your risk tolerance, provides the best risk-adjusted returns over the long term. Start with a small crypto allocation (1-5%) and increase gradually as you become more comfortable with the volatility.

Investment Implementation and Strategic Execution

Professional Portfolio Construction

Professional investment implementation requires a sophisticated understanding of asset allocation principles, risk management frameworks, and market dynamics that enable optimal portfolio construction across both cryptocurrency and traditional stock investments. Advanced portfolio management includes systematic rebalancing procedures, comprehensive performance monitoring, and sophisticated risk assessment frameworks that optimise returns while maintaining appropriate risk levels across different investor profiles and market conditions, leveraging professional investment management techniques.

Strategic execution includes diversification for you. Different asset classes work. Investment strategies vary. Market sectors balance growth potential with risk management considerations. Professional investors implement dynamic allocation strategies for you. These adapt to changing market conditions. Long-term strategic objectives are maintained. Systematic investment approaches work. Comprehensive risk management frameworks support sustainable portfolio growth. Wealth preservation across diverse market environments happens. Economic cycles get navigated.

Technology Integration and Investment Tools

Modern investment success increasingly depends on leveraging advanced technology platforms for you. Automated portfolio management systems help. Sophisticated analytics tools enhance investment decision-making. Portfolio optimisation across both cryptocurrency and traditional stock markets works. Technology adoption includes the implementation of sophisticated monitoring systems for you. Automated rebalancing mechanisms work. Comprehensive performance tracking enables you to optimise investment strategies. Appropriate oversight is maintained. Control mechanisms through advanced investment technology work. Analytical capabilities help.

Investment tool integration includes the use of advanced research platforms, automated trading systems, and comprehensive risk management software that provide a competitive advantage while maintaining security and compliance standards. Professional investors leverage technology to enhance their analytical capabilities, improve operational efficiency, and optimise investment outcomes while maintaining appropriate risk management and regulatory compliance through comprehensive technology integration and innovation adoption strategies that support long-term investment success.

Portfolio Allocation Strategies and Risk Management

Strategic Asset Allocation Models

Professional investors implement sophisticated allocation models that balance cryptocurrency and stock exposure based on individual risk tolerance, investment timeline, and financial objectives. Conservative allocation models typically limit cryptocurrency exposure to 5-10% of total portfolio value, while aggressive growth strategies may allocate 15-25% to digital assets. The key principle is to maintain diversification across asset classes while optimising risk-adjusted returns through strategic rebalancing and systematic investment approaches.

Advanced allocation strategies include core-satellite approaches where stable stock index funds form the portfolio foundation whilst cryptocurrency investments provide growth potential and diversification benefits. Professional portfolio construction considers correlation patterns between different asset classes, volatility characteristics, and market cycle dynamics to optimise allocation decisions. Regular rebalancing ensures that portfolio allocation remains aligned with strategic objectives, captures gains from outperforming assets, and maintains appropriate risk levels.

Risk Management and Hedging Techniques

Effective risk management for mixed crypto-stock portfolios requires understanding the unique risk characteristics of each asset class and implementing appropriate hedging strategies. Cryptocurrency investments benefit from position sizing based on volatility metrics, stop-loss strategies, and diversification across different digital assets. Stock investments provide stability through dividend-paying companies, value stocks, and defensive sectors that perform well during market downturns and economic uncertainty.

Advanced risk management includes correlation analysis between cryptocurrency and stock markets, understanding how different market conditions affect each asset class, and implementing hedging strategies that protect against systematic risks. Professional investors utilise options strategies, inverse ETFs, and alternative investments to hedge portfolio risks while maintaining exposure to growth opportunities in both traditional and digital asset markets.

Tax optimisation and Regulatory Considerations

Tax-efficient portfolio management requires understanding the different tax implications of cryptocurrency and stock investments, implementing strategies that minimise tax burden whilst maximising after-tax returns. Cryptocurrency investments require detailed record-keeping for every transaction, whilst stock investments benefit from long-term capital gains treatment and tax-loss harvesting opportunities. Professional tax planning includes utilising tax-advantaged accounts where possible and timing investment decisions to optimise tax outcomes.

Regulatory considerations include understanding the evolving regulatory landscape for cryptocurrency investments, compliance requirements for different investment strategies, and the impact of regulatory changes on portfolio allocation decisions. Professional investors stay informed about regulatory developments, maintain compliance with reporting requirements, and adjust strategies based on changing regulatory environments while maintaining optimal portfolio performance and risk management.

Advanced Investment Strategies and Portfolio Integration

Sophisticated investors implement hybrid strategies that leverage the strengths of both crypto and stock investments through strategic asset allocation, correlation analysis, and dynamic rebalancing approaches. Advanced portfolio construction includes understanding correlation patterns between cryptocurrency and equity markets, implementing hedging strategies during market stress periods, and optimising allocation ratios based on risk tolerance and investment objectives.

Professional investment approaches include systematic rebalancing protocols, tax-loss harvesting strategies, and sector rotation techniques that maximise risk-adjusted returns across both asset classes. These strategies require a comprehensive understanding of market cycles, regulatory developments, and macroeconomic factors that influence both cryptocurrency and equity valuations through different market environments and economic conditions.

Institutional implementation includes multi-manager approaches, alternative beta strategies, and factor-based investing that incorporate cryptocurrency exposure alongside traditional equity allocations. These sophisticated approaches enable professional investors to capture the diversification benefits of cryptocurrency while maintaining exposure to established equity market returns and dividend income streams through systematic and disciplined investment processes.

Conclusion: Building a Balanced Investment Strategy

The debate between cryptocurrency and stocks doesn't require choosing sides. Both asset classes offer unique advantages and serve different purposes in a well-constructed investment portfolio. Stocks provide stability, dividend income, and exposure to established businesses with proven track records. Cryptocurrency offers growth potential, portfolio diversification, and exposure to emerging financial technologies that could reshape the global economy.

The key to successful investing in 2025 lies in understanding your personal financial situation, risk tolerance, and investment timeline. Conservative investors may prefer a stock-heavy portfolio with minimal crypto exposure, while younger investors with longer time horizons might allocate more significantly to cryptocurrency. The most important factor is maintaining a disciplined approach that aligns with your financial goals and risk capacity.

As both markets continue to evolve, staying informed about regulatory developments, technological advances, and market trends will be crucial for investment success. Regular portfolio rebalancing, continuous education, and a long-term perspective will serve investors well regardless of their chosen allocation between these two dynamic asset classes.

The investment landscape of 2025 offers unprecedented opportunities for those who approach it with knowledge, discipline, and appropriate risk management strategies and techniques. Whether you choose to focus on traditional stocks, embrace cryptocurrency innovation, or blend both approaches, success will ultimately depend on your ability to remain consistent with your strategy, adapt to changing market conditions, and maintain a clear focus on your long-term financial objectives.

Sources & References

Frequently Asked Questions

- Is cryptocurrency better than stocks?

- Neither is inherently better - it depends on your goals and risk tolerance. Cryptocurrency offers higher potential returns but with significantly more volatility and risk. Stocks provide more stability, regulatory protection, and proven long-term growth. Most investors benefit from holding both as part of a diversified portfolio, allocating based on their risk appetite and investment timeline.

- Should I invest in crypto or stocks first?

- Start with stocks if you're a beginner investor. Stock markets are more stable, better regulated, and easier to understand. Build a solid foundation with index funds and blue-chip stocks first. Once you understand the fundamentals of investing and have an emergency fund, you can allocate 5-10% of your portfolio to cryptocurrency for diversification and growth potential.

- Can I lose all my money in cryptocurrency?

- Yes, cryptocurrency investments can go to zero, especially with smaller altcoins. Unlike stocks, where companies have underlying assets and earnings, many cryptocurrencies have no intrinsic value beyond market speculation. Bitcoin and Ethereum are more established but still highly volatile. Never invest more than you can afford to lose, and diversify across multiple assets to manage risk.

- What percentage of my portfolio should be in crypto?

- Financial advisors typically recommend a 5-10% maximum allocation to cryptocurrency for most investors. Conservative investors might limit it to 1-5%, while aggressive investors, comfortable with high risk, might go up to 20%. The key is ensuring crypto losses won't significantly impact your financial goals. Start small and increase allocation only as you gain experience and understanding.

- Are stocks safer than cryptocurrency?

- Yes, stocks are generally safer due to regulatory oversight, established companies with real earnings, investor protections, and historical stability. Stock markets have existed for centuries and have proven to deliver long-term growth. Cryptocurrency markets are young, largely unregulated, and extremely volatile. However, both carry risks - diversification across both asset classes can provide balance between safety and growth potential.

- How do taxes differ between crypto and stocks?

- Both are subject to capital gains tax, but crypto taxation is more complex. Every crypto transaction (including trading between cryptocurrencies) is a taxable event, whereas stocks are taxed only when sold. Crypto requires detailed record-keeping of every transaction. Stock dividends and crypto staking rewards are taxed as income. Consult a tax professional familiar with cryptocurrency to ensure compliance and optimise your tax strategy.