Bitcoin vs Ethereum 2025: Comparison

The cryptocurrency landscape in 2025 remains dominated by two revolutionary digital assets: BTC and ETH. Each represents fundamentally different approaches to blockchain technology and digital value creation.

Bitcoin, launched in 2009 as the world's first cryptocurrency, has evolved into the undisputed "digital gold". It boasts a market capitalization exceeding $1 trillion and institutional adoption from companies like Tesla, MicroStrategy, and El Salvador.

Its primary value proposition centres on being a decentralised store of value and a peer-to-peer electronic cash system. Bitcoin offers an alternative to traditional monetary systems and protection against inflation and currency debasement.

Ethereum, introduced in 2015 by Vitalik Buterin, revolutionised the blockchain space by introducing smart contracts and programmable money. This created the foundation for an entire ecosystem of decentralised applications (DApps), decentralised finance (DeFi) protocols, and non-fungible tokens (NFTs).

With its transition to Proof of Stake consensus in 2022, Ethereum became 99.9% more energy efficient. It maintains its position as the world's largest smart contract platform, hosting over $100 billion in total value locked throughout several DeFi protocols.

This complete comparison examines every aspect of both cryptocurrencies. We analyse their underlying technology, consensus mechanisms, investment potential, use cases, and market performance in 2025.

We examine transaction costs, scalability solutions, environmental impact, and regulatory considerations. Our analysis helps investors, developers, and cryptocurrency enthusiasts make informed decisions about which digital asset best aligns with their goals and investment strategy.

Introduction

The cryptocurrency revolution has been defined by two groundbreaking digital assets that represent fundamentally different visions for the future of money and decentralised technology. Bitcoin, the original cryptocurrency launched in 2009, established the foundation for peer-to-peer digital cash and has evolved into the world's premier store-of-value asset, often referred to as "digital gold" due to its scarcity, security, and growing institutional adoption throughout traditional finance sectors. Bitcoin came first. It changed money forever.

Ethereum emerged in 2015 as a revolutionary platform that extended blockchain technology beyond simple value transfer to enable programmable smart contracts and decentralised applications. This innovation created an entirely new category of blockchain use cases, spawning the decentralised finance (DeFi) ecosystem, non-fungible tokens (NFTs), and Web3 applications that collectively represent hundreds of billions of dollars in economic activity and technological innovation. Ethereum does more than Bitcoin. It runs apps and programs.

Understanding the differences between BTC and ETH is crucial for anyone seeking to participate in the cryptocurrency ecosystem, whether as an investor, developer, or technology enthusiast. Whilst both assets have delivered exceptional returns to early adopters, their distinct technological architectures, use cases, and market positioning create different risk-reward profiles that appeal to other investment strategies and philosophical approaches to digital asset ownership. Each coin serves different needs. Both have strong communities.

The choice between BTC and ETH often reflects broader investment philosophies: Bitcoin appeals to those seeking a digital alternative to gold and other traditional store-of-value assets, whilst Ethereum attracts investors and developers interested in participating in the growth of decentralised applications and programmable money systems. However, many advanced investors choose to hold both assets as complementary components of a diversified cryptocurrency portfolio. You can own both. Many people do this.

This comprehensive analysis examines the critical aspects of both cryptocurrencies in 2025, including their technological foundations, market performance, use cases, investment potential, regulatory considerations, and long-term growth prospects. We provide practical guidance for choosing between these digital assets based on your specific investment goals, risk tolerance, and beliefs about the future direction of cryptocurrency adoption and blockchain technology development. This guide helps you decide. Read on to learn more.

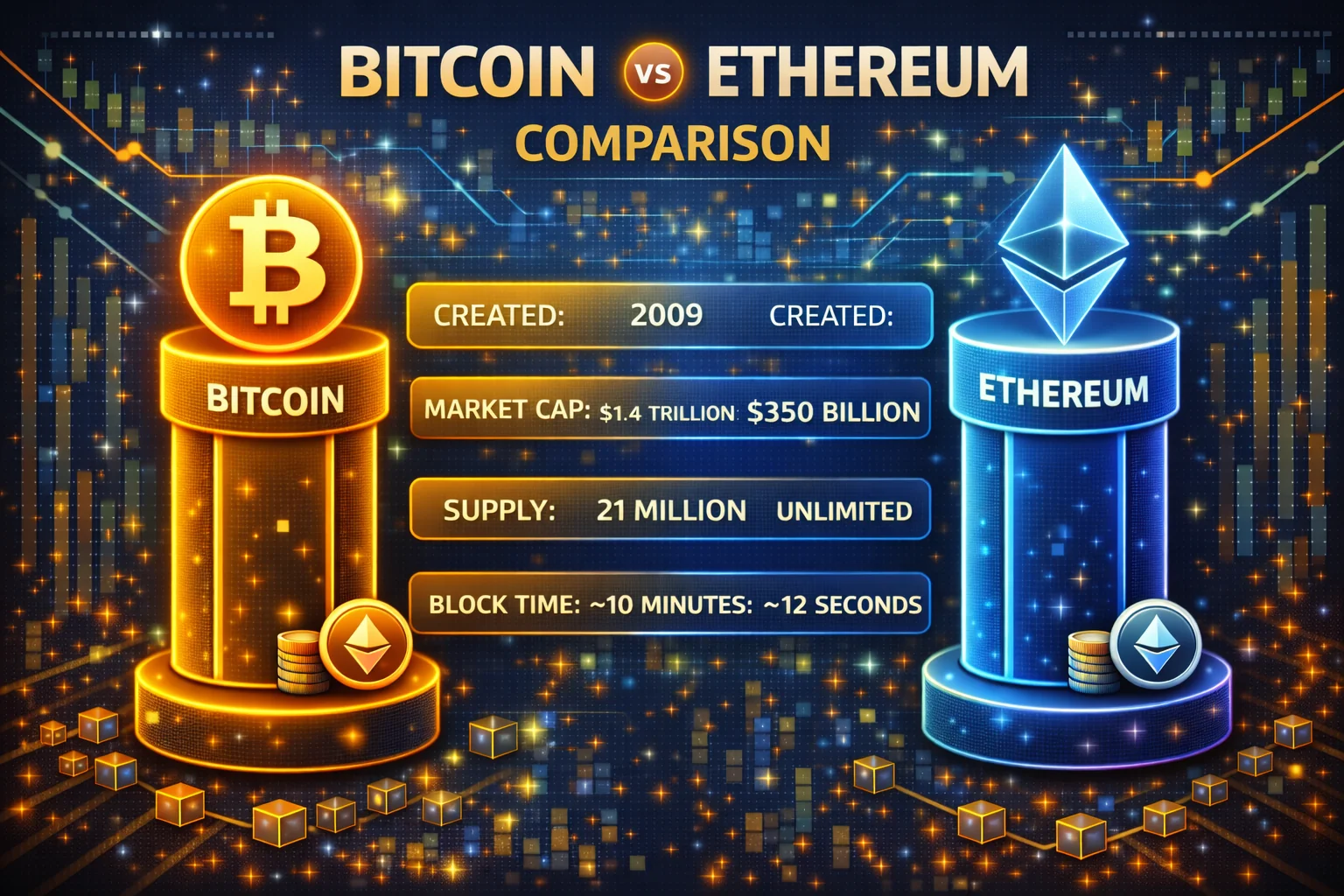

Bitcoin vs Ethereum: Quick Overview

Here is a quick look at both coins. Bitcoin came first in 2009. Ethereum launched in 2015. They work differently but both are popular.

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Market Cap Rank | #1 | #2 |

| Primary Purpose | Digital money & store of value | Smart contracts & DApps platform |

| Consensus Mechanism | Proof of Work | Proof of Stake |

| Maximum Supply | 21 million BTC | No fixed limit |

| Transaction Speed | ~7 TPS | ~15 TPS |

| Energy Efficiency | High energy use | 99% less energy (post-Merge) |

| Smart Contracts | Limited scripting | Full smart contract support |

These technical differences create distinct use cases for each blockchain.

Bitcoin excels as digital gold and a store of value.

Ethereum dominates programmable blockchain applications.

Deep Technology & Architecture Analysis

The technology behind each coin is different. Bitcoin uses simple code for payments. Ethereum uses smart contracts for apps. Both systems are secure and tested.

Bitcoin: The Digital Gold Standard

Bitcoin was designed as peer-to-peer electronic cash with an unwavering focus on security, decentralisation, and immutability. Every design decision prioritises these core principles over speed or functionality.

Bitcoin's Technical Foundation

- SHA-256 Proof of Work: The most battle-tested consensus mechanism, securing over $800 billion in value for 15+ years without a successful attack

- UTXO Model: Each transaction creates new "coins" rather than updating balances, providing superior privacy and parallel processing capabilities

- Script Language: Intentionally limited scripting prevents complex bugs while enabling basic smart contract functionality

- 10-Minute Block Time: optimised for global consensus and network stability rather than speed

- 1MB Block Size: Ensures anyone can run a full node, maintaining decentralisation

- Difficulty Adjustment: Self-regulating system maintains consistent block times regardless of mining power

Bitcoin Layer 2 Solutions

Bitcoin's base layer limitations have spawned innovative scaling solutions:

- Lightning Network: Instant, low-cost payments via payment channels

- Liquid Network: Federated sidechain for faster settlements between exchanges

- Taproot: 2021 upgrade enabling more complex smart contracts and privacy

- Ordinals & BRC-20: NFTs and tokens built on Bitcoin's base layer

Ethereum: The World Computer Revolution

Ethereum represents a paradigm shift from simple value transfer to programmable money and decentralised computation. It's designed as a global, decentralised computer capable of running any program.

Ethereum's Technical Architecture

- Proof of Stake (Post-Merge): 99.9% energy reduction while maintaining security via economic incentives

- Account-Based Model: Simpler balance tracking allows complex smart contract interactions

- Ethereum Virtual Machine (EVM): Turing-complete runtime environment for smart contracts

- Gas System: Prevents infinite loops whilstpricing computational resources fairly

- 12-Second Block Time: Faster finality for better user experience

- Dynamic Block Size: Adjusts based on network demand up to gas limits

Ethereum's Scaling Roadmap

Ethereum's multi-phase upgrade plan addresses scalability while maintaining decentralisation:

- Layer 2 Rollups: Arbitrum, Optimism, and Polygon process transactions off-chain

- Sharding (Future): Will split the network into 64 parallel chains

- EIP-4844 (Proto-Danksharding): Reduces Layer 2 costs by 10-100x

- Statelessness: Reduces node storage requirements for better decentralisation

Security Model Comparison

| Security Aspect | Bitcoin | Ethereum |

|---|---|---|

| Consensus Mechanism | Proof of Work (SHA-256) | Proof of Stake (Casper FFG) |

| Attack Cost | $20B+ (51% hash power) | $15B+ (33% of staked ETH) |

| Finality | Probabilistic (6+ confirmations) | Economic finality (2 epochs) |

| Validator Count | ~15,000 mining pools | ~900,000 validators |

| Slashing Risk | None (miners lose electricity) | Yes (validators lose staked ETH) |

| centralisation Risk | Mining pool concentration | Staking service concentration |

Use Cases & Applications

Bitcoin and Ethereum serve different purposes. Bitcoin is mainly for storing value. Ethereum runs programs and apps. Both are useful in different ways.

Bitcoin Use Cases

- Store of Value: Digital gold for wealth preservation

- Inflation Hedge: Protection against currency debasement

- Cross-border Payments: Censorship-resistant money transfers

- Institutional Treasury: Corporate balance sheet diversification

- Remittances: Low-cost international money transfers

- Financial Sovereignty: Self-custody without banks

Ethereum Use Cases

- DeFi platforms: decentralised lending, borrowing, trading

- Smart Contracts: Automated agreements and escrow

- NFTs: Non-fungible tokens for digital ownership

- DAOs: decentralised autonomous organisations

- Web3 Applications: decentralised social media, gaming

- Staking: Earn rewards by securing the network

Comprehensive Investment Analysis 2025

Bitcoin: The Digital Store of Value

Bitcoin's Investment Strengths

- Unmatched Brand Recognition: Bitcoin is synonymous with cryptocurrency, commanding 50%+ market dominance

- Fixed Supply Scarcity: 21 million BTC cap creates deflationary pressure as adoption grows

- Institutional Adoption: MicroStrategy, Tesla, El Salvador, and Bitcoin ETFs legitimise BTC as a treasury asset

- Proven Resilience: Survived multiple bear markets, regulatory attacks, and technical challenges

- Simple Value Proposition: "Digital gold" narrative is easy for institutions and retail to understand

- Network Effects: Largest and most secure blockchain network with highest hash rate

- Regulatory Clarity: Increasingly recognised as commodity rather than security

Bitcoin's Investment Risks

- Limited Utility: Primarily store of value with limited smart contract functionality

- Environmental Concerns: Proof of Work energy consumption faces regulatory scrutiny

- Scalability Constraints: 7 TPS limit requires Layer 2 solutions for mass adoption

- Mining centralisation: Large mining pools could theoretically coordinate attacks

- Quantum Computing Threat: Future quantum computers could break Bitcoin's cryptography

- Regulatory Risk: Government bans or restrictions could impact price

Ethereum: The Programmable Money Platform

Ethereum's Investment Strengths

- Developer Ecosystem: 4,000+ active developers building on Ethereum monthly

- DeFi Dominance: $50B+ Total Value Locked throughout Ethereum DeFi protocols

- Multiple Revenue Streams: Transaction fees, staking rewards, and MEV create diverse income

- Continuous Innovation: Regular upgrades improve scalability, security, and efficiency

- Network Effects: Most DApps, tokens, and protocols built on Ethereum

- Institutional Interest: Major banks and corporations exploring Ethereum for business applications

- Deflationary Mechanics: EIP-1559 burns ETH, potentially making it deflationary

- Staking Yield: 4-6% annual returns for ETH stakers provide passive income

Ethereum's Investment Risks

- Technical Complexity: Smart contract bugs and protocol risks increase failure probability

- Scalability Competition: Solana, Avalanche, and other chains offer faster, cheaper transactions

- Regulatory Uncertainty: DeFi applications face potential regulatory crackdowns

- No Supply Cap: Unlimited ETH issuance could dilute value long-term

- Execution Risk: Complex roadmap upgrades could face delays or technical issues

- Gas Fee Volatility: High fees during congestion periods hurt user experience

Market Dynamics and Correlations

Bitcoin Market Behavior

- Macro Correlation: Increasingly correlated with traditional markets during risk-off periods

- Halving Cycles: 4-year supply reduction events historically drive bull markets

- Institutional Flows: Large purchases/sales by institutions create significant price movements

- Safe Haven Status: Often outperforms during currency crises and inflation spikes

Ethereum Market Behavior

- Usage-Driven Value: Price correlates with network activity and DeFi adoption

- Higher Beta: More volatile than Bitcoin, amplifying both gains and losses

- Upgrade Catalysts: Major protocol upgrades often drive price appreciation

- DeFi Cycles: Performance tied to DeFi summer periods and NFT booms

Valuation Models and Price Targets

Bitcoin Valuation Approaches

- Stock-to-Flow Model: Scarcity-based model suggesting $100K+ long-term targets

- Network Value to Transactions: Compares market cap to transaction volume

- Digital Gold Thesis: If Bitcoin captures 10% of gold's market cap = $1.3M per BTC

- Institutional Adoption: 1% allocation by institutions could drive massive demand

Ethereum Valuation Approaches

- Discounted Cash Flow: Values ETH based on future fee generation and staking yields

- Network Effects: Metcalfe's Law suggests value grows with user base squared

- Total Addressable Market: DeFi and Web3 markets could reach trillions in value

- Burn Rate Analysis: EIP-1559 fee burning could make ETH deflationary

Market Performance & Metrics

Historical Performance

Both BTC and ETH have delivered exceptional returns for early investors, but with different risk-return profiles:

Bitcoin Performance Characteristics

- Lower volatility compared to most altcoins

- Strong correlation with institutional adoption cycles

- 4-year halving cycles create predictable supply shocks

- Often leads market cycles as "digital gold" narrative strengthens

Ethereum Performance Characteristics

- Higher volatility but potentially higher returns

- Performance tied to DeFi and NFT adoption cycles

- Benefits from network usage and fee burning (EIP-1559)

- More sensitive to technological developments and upgrades

Network Fundamentals

| Metric | Bitcoin | Ethereum |

|---|---|---|

| Daily Active Addresses | ~800K - 1M | ~400K - 600K |

| Daily Transaction Volume | $10B - 30B | $5B - 15B |

| Developer Activity | Moderate | Very High |

| Institutional Holdings | High | Growing |

2025 Market Trends and Catalysts

Bitcoin Catalysts for 2025

- Bitcoin ETF Expansion: More countries approving Bitcoin ETFs increases institutional access

- Corporate Treasury Adoption: More companies following MicroStrategy's Bitcoin strategy

- Lightning Network Growth: Improved payment infrastructure drives adoption

- Regulatory Clarity: Clearer regulations reduce uncertainty and institutional barriers

- Halving Aftermath: 2024 halving effects typically manifest 12-18 months later

- Sovereign Adoption: More countries considering Bitcoin as legal tender or reserves

Ethereum Catalysts for 2025

- Proto-Danksharding (EIP-4844): Dramatically reduces Layer 2 costs

- Institutional DeFi: Traditional finance integrating with Ethereum protocols

- Real World Assets (RWAs): Tokenization of traditional assets on Ethereum

- Enterprise Adoption: Major corporations building on Ethereum infrastructure

- Staking Derivatives: Liquid staking tokens unlock capital efficiency

- Layer 2 Maturation: Arbitrum, Optimism, and Polygon reaching mainstream adoption

Competitive Landscape Analysis

Bitcoin's Competitive Position

Bitcoin faces limited direct competition as a store of value, but several factors could impact its dominance:

- Digital Currencies: Central Bank Digital Currencies (CBDCs) could compete for payments

- Gold Tokenization: Tokenized gold products offer similar store of value properties

- Other Cryptocurrencies: Some investors view Ethereum or other cryptos as better stores of value

Ethereum's Competitive Challenges

Ethereum faces intense competition from newer, faster blockchains:

- Solana: Higher throughput and lower costs attract DeFi and NFT projects

- Avalanche: Subnet architecture allows custom blockchain solutions

- Polygon: Ethereum-compatible scaling solutions

- Binance Smart Chain: Lower costs attract price-sensitive users and developers

- Cardano & Polkadot: Alternative approaches to smart contract platforms

Investment Decision Framework

Choose Bitcoin If You:

- prioritise Simplicity: Want straightforward "digital gold" exposure without complexity

- Seek Lower Volatility: Prefer Bitcoin's relatively lower volatility in crypto markets

- Value Proven Track Record: Trust 15+ years of battle-tested security and adoption

- Want Institutional Exposure: Benefit from growing corporate and institutional adoption

- Prefer Store of Value: Believe in Bitcoin as inflation hedge and wealth preservation

- Are Risk-Averse: Want the "safest" cryptocurrency investment option

- Think Long-Term: Plan to hold for 5+ years via multiple comprehensive market cycles

Choose Ethereum If You:

- Embrace Innovation: Want exposure to cutting-edge blockchain technology

- Seek Higher Returns: Accept higher volatility for potentially greater gains

- Believe in DeFi: Think decentralised finance will disrupt traditional banking

- Want Passive Income: Interested in earning 4-6% via ETH staking

- Value Utility: Prefer assets with multiple use cases beyond store of value

- Are Tech-Savvy: Comfortable with smart contracts and advanced DeFi protocols and ecosystem innovations

- See Web3 Potential: Believe in decentralised internet and digital ownership

Strategic Portfolio Allocation Models

Conservative Crypto Portfolio (Lower Risk)

- 75% Bitcoin, 25% Ethereum

- Focus on established, proven cryptocurrencies

- Suitable for risk-averse investors or crypto beginners

- Expected volatility: Moderate for crypto standards

Balanced Crypto Portfolio (Moderate Risk)

- 60% Bitcoin, 40% Ethereum

- Balances stability with growth potential

- Most popular allocation amongst crypto investors

- Captures both store of value and utility trends

Growth-Oriented Portfolio (Higher Risk)

- 40% Bitcoin, 60% Ethereum

- Emphasizes innovation and higher return potential

- Suitable for investors bullish on DeFi and Web3

- Higher volatility but greater upside potential

Advanced Multi-Asset Strategy

- 50% Bitcoin, 35% Ethereum, 15% Other Cryptos

- Includes exposure to Layer 1 competitors and DeFi tokens

- Requires more research and active management

- Highest risk but maximum diversification benefits

Dollar-Cost Averaging Strategy

Regardless of allocation choice, consider dollar-cost averaging (DCA) to reduce timing risk:

- Weekly DCA: Small, consistent purchases reduce volatility impact

- Monthly DCA: Larger purchases with lower transaction costs

- Dip Buying: Increase purchases during market downturns

- Profit Taking: Sell portions during significant price increases

How to Buy BTC and ETH in 2025

Best Exchanges for Beginners

- Coinbase - Most user-friendly interface, excellent for US beginners

- Kraken - Strong security record and advanced capabilities

- Gemini - Regulated exchange with insurance coverage

Best Exchanges for Advanced Traders

- Binance - Lowest fees, highest liquidity, global access

- OKX - Integrated Web3 wallet and DeFi access

- Bybit - Excellent derivatives trading platform

Essential Security: Hardware Wallets

Never store large amounts on exchanges. Use hardware wallets for long-term storage:

- Ledger Nano X - Industry standard with mobile app support

- Trezor Model T - Open-source security with touchscreen

- Tangem Wallet - Card-style wallet for easy backup

Software Wallets for Active Use

- MetaMask - Essential for Ethereum DeFi and NFTs

- Exodus - Beautiful interface supporting both BTC and ETH

- Electrum - Lightweight Bitcoin wallet for advanced clients

Step-by-Step Buying Guide

- Choose an Exchange: Select based on your location, experience level, and needs

- Complete KYC: Verify your identity with government-issued ID

- Fund Your Account: Bank transfer, credit card, or other payment methods

- Place Your Order: Market buy for immediate purchase or limit order for specific price

- Secure Your Crypto: Transfer to hardware wallet for long-term storage

- Set Up DCA: Consider recurring purchases to reduce timing risk

Institutional Adoption and Professional Investment Strategies

Corporate Treasury Management and Institutional Holdings

BTC and ETH serve different roles in institutional portfolio management, with Bitcoin primarily functioning as digital gold and a store of value, whilst Ethereum offers access to decentralised finance applications and smart contract functionality for advanced investment strategies.

Institutional adoption includes complete due diligence processes, advanced risk management frameworks, and advanced custody solutions that enable professional cryptocurrency investment while maintaining fiduciary obligations and regulatory compliance requirements via institutional-grade cryptocurrency investment and professional asset management strategies with enhanced security protocols.

Professional investment strategies include systematic allocation methodologies, complete risk assessment frameworks, and advanced portfolio optimisation techniques that balance Bitcoin's store of value characteristics with Ethereum's utility and growth potential while maintaining appropriate diversification and risk management for institutional requirements. Corporate treasury management includes complete regulatory compliance, advanced custody solutions, and advanced reporting capabilities that enable institutional cryptocurrency adoption while maintaining operational efficiency and stakeholder protection via professional cryptocurrency investment and institutional asset management excellence designed for corporate treasury operations and professional investment management with comprehensive risk controls.

Future Market Positioning and Strategic Outlook

BTC and ETH maintain distinct market positions, with Bitcoin focusing on monetary policy innovation and store-of-value functionality, whilst Ethereum emphasises technological advancement and decentralised application development. Strategic positioning includes continued protocol development, regulatory compliance enhancements, and expanded institutional adoption, strengthening both networks' market leadership while addressing scalability, sustainability, and regulatory requirements through professional development excellence and institutional-grade cryptocurrency innovation designed for long-term market success and global financial system integration.

Investment Strategy Integration and Portfolio Allocation

Professional investment strategies integrate BTC and ETH allocations based on portfolio objectives, risk tolerance, and market conditions to optimise risk-adjusted returns while maintaining appropriate diversification and strategic positioning. Investment integration includes systematic evaluation of allocation ratios, implementation of dynamic rebalancing procedures, and development of comprehensive performance monitoring systems that enable optimal portfolio construction and management through institutional-grade investment strategies and professional asset allocation excellence designed for long-term wealth building and strategic investment success in the evolving cryptocurrency ecosystem.

Future Market Dynamics and Strategic Positioning

Cryptocurrency market evolution requires a comprehensive understanding of technological developments, regulatory changes, and institutional adoption trends that influence long-term investment strategies and portfolio positioning. Professional investors implement systematic market analysis, comprehensive trend monitoring, and advanced forecasting methodologies that optimise strategic positioning across different market cycles and economic conditions.

Strategic asset allocation includes consideration of macroeconomic factors, technological innovation cycles, and regulatory development timelines that affect cryptocurrency market dynamics and investment performance. Advanced portfolio management requires a systematic approach to risk assessment, opportunity evaluation, and strategic positioning that maximises long-term returns while maintaining appropriate risk controls and operational efficiency through professional cryptocurrency investment strategies and institutional-grade asset management excellence.

Market positioning optimisation includes a comprehensive analysis of correlation patterns, volatility characteristics, and liquidity dynamics that inform strategic allocation decisions and risk management protocols. Professional implementation requires systematic monitoring of market conditions, comprehensive performance attribution analysis, and strategic adjustment procedures that optimise portfolio performance through a systematic approach to cryptocurrency investment excellence and professional asset management optimisation for sustainable long-term growth and wealth preservation. These sophisticated analytical frameworks ensure optimal investment performance while maintaining institutional security standards and regulatory compliance across diverse market conditions with enhanced monitoring capabilities and comprehensive risk assessment procedures for professional cryptocurrency investment management and strategic excellence with comprehensive optimisation and success excellence optimisation.

Implementation Strategies

Gradual Adoption Approach

Security Best Practices

Implement complete security measures featuring two-factor authentication, hardware wallet integration, and regular security audits of your accounts. Maintain separate email addresses for cryptocurrency activities and use strong, unique passwords for each platform.

Consider using VPN services and keeping software updated to protect against emerging threats. Regular security reviews help identify potential vulnerabilities before they become problems.

Performance Monitoring

Establish systematic monitoring procedures to track performance metrics, fee structures, and service quality throughout different platforms. Regular evaluation helps identify optimisation opportunities and guarantees your strategy remains aligned with evolving market conditions.

Use portfolio tracking tools and analytics platforms to maintain complete oversight of your investments. Professional monitoring enables data-driven decision making and strategic optimisation.

Contingency Planning

Develop complete backup plans for several scenarios featuring platform downtime, regulatory changes, and market volatility. Maintain access to alternative platforms and keep emergency procedures documented and easily accessible.

Regular testing of backup procedures guarantees readiness when needed. Consider geographic diversification and multiple custody solutions to enhance resilience against systemic risks.

Conclusion

Both BTC and ETH represent compelling investment opportunities in 2025, but they serve fundamentally different purposes in the cryptocurrency ecosystem and appeal to different investment philosophies and risk tolerances. Bitcoin has established itself as the premier digital store-of-value asset, offering unmatched brand recognition, institutional adoption, and proven resilience throughout multiple market cycles, making it ideal for conservative cryptocurrency investors seeking exposure to digital gold properties and protection against monetary debasement. Bitcoin is like digital gold. It stores value well.

Ethereum continues to power the future of decentralised finance, non-fungible tokens, and Web3 applications via its programmable smart contract platform and continuous technological innovation. The network's transition to Proof of Stake, ongoing scalability improvements via Layer 2 solutions, and expanding ecosystem of decentralised applications provide higher growth potential but with increased complexity and technical risks that require a more advanced understanding and active portfolio management. Ethereum powers apps and DeFi. It has more features.

Rather than viewing BTC and ETH as competing investments, most successful cryptocurrency investors recognise their complementary nature and hold both assets as core components of a diversified digital asset portfolio. This approach captures the stability and store-of-value properties of digital gold whilstparticipating in the growth potential of decentralised applications and programmable money systems that are reshaping traditional finance and internet infrastructure. Most investors own both coins. This spreads risk better.

The optimal allocation strategy depends on your individual risk tolerance, investment timeline, and beliefs about cryptocurrency adoption trends. Conservative investors might favour a Bitcoin-heavy allocation (60-70%) with limited Ethereum exposure, whilstthose seeking higher growth potential might prefer equal weighting or even an Ethereum-heavy portfolio. Regardless of allocation, implementing dollar-cost-averaging strategies and maintaining strict risk-management principles remains essential for long-term success in cryptocurrency investing throughout all market conditions and economic cycles. Choose based on your goals. Start small and learn first.

As the cryptocurrency market continues to mature in 2025 and beyond, both BTC and ETH are poised to benefit from increased institutional adoption, regulatory clarity, and technological advancements that enhance their utility and accessibility. The key to successful cryptocurrency investing lies in understanding each asset's unique value proposition, maintaining appropriate position sizing, and staying informed about technological developments and market trends that could impact long-term performance and adoption trajectories.

Sources & References

Frequently Asked Questions

- Which is a better investment: Bitcoin or Ethereum?

- There's no universal answer as both serve different purposes. Bitcoin is better for conservative investors seeking digital gold exposure, whilstEthereum suits those wanting exposure to DeFi and Web3 innovation. Most experts recommend holding both for diversified crypto exposure.

- Can BTC and ETH coexist long-term?

- Yes, they serve different market needs. Bitcoin focuses on being the ultimate store of value and digital gold, whilstEthereum aims to be the foundation for decentralised applications and programmable money. This complementary relationship allows both to thrive.

- Which has better long-term growth potential?

- Ethereum potentially has higher growth upside due to its expanding use cases in DeFi, NFTs, and Web3. However, Bitcoin's scarcity and institutional adoption provide for more predictable long-term appreciation. Risk tolerance should guide your choice.

- Is Ethereum more risky than Bitcoin?

- Yes, Ethereum carries higher technical and execution risks due to its complexity. Smart contract bugs, protocol upgrades, and competition from other blockchains pose additional risks. However, this complexity also allows higher potential returns.

- Should I stake my Ethereum?

- Staking ETH offers 4-6% annual returns but requires locking up your tokens. Consider your liquidity needs and risk tolerance. Liquid staking derivatives, such as Lido's stETH, offer flexibility while earning rewards.

- How do transaction fees compare?

- Bitcoin fees range from $1 to $50, depending on network congestion. Ethereum fees vary widely, from $ 5 to $200+ during peak usage. Layer 2 solutions like Arbitrum and Optimism reduce Ethereum costs to under $1 for most transactions.

- Which is more environmentally friendly?

- Ethereum became 99.9% more energy efficient after transitioning to Proof of Stake in 2022. Bitcoin still uses energy-intensive Proof of Work, though increasingly powered by renewable energy sources.

- Can I use Bitcoin for DeFi?

- Bitcoin has limited native DeFi capabilities, but wrapped Bitcoin (WBTC) allows BTC to be used in Ethereum DeFi protocols. Lightning Network also allows some DeFi-like functionality on Bitcoin's Layer 2.