Ethereum Explained Simply: Guide 2025

Discover Ethereum - the world's programmable blockchain. Learn how smart contracts work, what DApps are, and why Ethereum is powering the future of decentralised finance and Web3.

Introduction

Ethereum has fundamentally transformed the cryptocurrency landscape by introducing programmable blockchain technology that extends far beyond simple digital currency transactions. As the world's second-largest cryptocurrency by market capitalisation and the foundation for the majority of decentralised finance (DeFi) applications, Ethereum represents one of the most significant technological innovations in the blockchain space. Understanding Ethereum is crucial for anyone seeking to participate in the modern cryptocurrency ecosystem, whether as an investor, developer, or user of decentralised applications.

The platform's revolutionary smart contract functionality has enabled the creation of an entirely new financial system that operates without traditional intermediaries like banks or brokers. From automated lending protocols and decentralised exchanges to non-fungible tokens (NFTs) and complex financial derivatives, Ethereum has become the backbone of a thriving ecosystem worth hundreds of billions of dollars. This programmable infrastructure has democratized access to financial services and created opportunities for innovation that were previously impossible in traditional finance.

Ethereum's transition from Proof of Work to Proof of Stake consensus mechanism in 2022 marked a pivotal moment in blockchain technology, reducing energy consumption by over 99% whilst preserving security and decentralisation. This upgrade, known as "The Merge," demonstrated Ethereum's ability to evolve and adapt to changing technological and environmental requirements, positioning it as a sustainable foundation for the future of decentralised applications and digital finance.

The network's extensive developer ecosystem and continuous innovation have established Ethereum as the de facto standard for blockchain-based applications. With thousands of developers building on the platform and billions of dollars in total value locked across various protocols, Ethereum has proven its utility and resilience through multiple market cycles and technological challenges. The platform's influence extends beyond cryptocurrency into areas such as supply chain management, digital identity, and decentralised governance systems.

For newcomers to cryptocurrency, Ethereum represents both an investment opportunity and a gateway to understanding the broader potential of blockchain technology. The platform's native currency, Ether (ETH), serves multiple functions, including transaction fees, staking rewards, and collateral for various DeFi protocols. This comprehensive guide explores Ethereum's technology, ecosystem, investment potential, and practical applications, equipping readers to navigate and participate effectively in the Ethereum ecosystem.

As blockchain technology continues to mature and gain mainstream adoption, Ethereum's role as a foundational infrastructure layer becomes increasingly important. The platform's ability to support complex applications whilst preserving decentralisation and security makes it an essential component of the emerging Web3 ecosystem, where users have greater control over their data, assets, and digital interactions.

The scalability improvements introduced through Layer 2 solutions and the ongoing development of Ethereum 2.0 have addressed many of the network's historical limitations, including high transaction fees and limited throughput. These enhancements have made Ethereum more accessible to everyday users without compromising the security and decentralisation that make the platform valuable for mission-critical applications.

Institutional adoption of Ethereum has accelerated significantly, with major corporations, financial institutions, and governments exploring blockchain applications built on the platform. This mainstream recognition validates Ethereum's technological approach and suggests continued growth and development as traditional industries integrate blockchain technology into their operations.

The network effects surrounding Ethereum create a powerful moat that reinforces its position as the leading smart contract platform. As more developers build applications, more users join the ecosystem, and more capital flows into Ethereum-based protocols, the platform becomes increasingly valuable and difficult to displace, creating a virtuous cycle of growth and innovation that benefits all participants.

What is Ethereum?

Ethereum is a programmable blockchain platform that goes far beyond simple money transfers. Whilst Bitcoin is like digital gold, Ethereum is like a global computer that can run applications, execute contracts, and power entire financial systems.

Created by Vitalik Buterin in 2015, Ethereum introduced the concept of "smart contracts" - self-executing programs that automatically enforce agreements without intermediaries. This innovation opened the door to decentralised finance (DeFi), NFTs, and Web3 applications.

Ethereum Key Features:

- Smart Contracts: Self-executing code that runs automatically

- DApps: decentralised applications built on Ethereum

- EVM: Ethereum Virtual Machine processes all transactions

- Gas Fees: Transaction costs paid in ETH

- Proof of Stake: Energy-efficient consensus mechanism

- Programmable Money: ETH can be programmed with conditions

The Ethereum Ecosystem in Numbers (2025)

Ethereum has evolved into the largest innovative contract platform, with over $50 billion in total value locked (TVL) across decentralised finance (DeFi) protocols. The network processes over 1 million transactions daily and hosts thousands of decentralised applications serving millions of users worldwide.

- Market Cap: Second largest cryptocurrency by market capitalization

- DeFi Dominance: Over 60% of all DeFi activity happens on Ethereum

- NFT Market: 90%+ of NFT trading volume occurs on Ethereum

- Developer Activity: Largest developer community in blockchain

- Institutional Adoption: Major corporations building on Ethereum

The History and Evolution of Ethereum

The Genesis (2013-2015)

Vitalik Buterin, a 19-year-old programmer and co-founder of Bitcoin Magazine, proposed Ethereum in late 2013. Frustrated by Bitcoin's limited scripting capabilities, he envisioned a blockchain that could run any program, not just simple transactions.

The Ethereum whitepaper, published in November 2013, outlined a "next-generation smart contract and decentralised application platform." After raising $18 million in a crowdfunding campaign, Ethereum launched on July 30, 2015, with the Ethereum team mining the first block.

Major Milestones and Upgrades

- 2015 - Frontier: Initial Ethereum launch with basic functionality

- 2016 - Homestead: First stable release with improved security

- 2016 - The DAO Hack: $60M exploit led to Ethereum/Ethereum Classic split

- 2017 - Byzantium: Enhanced privacy and scalability features

- 2019 - Constantinople: Reduced block rewards and gas costs

- 2020 - DeFi Summer: Explosive growth in decentralised finance

- 2021 - London (EIP-1559): Fee burning mechanism introduced

- 2022 - The Merge: Transition to Proof of Stake consensus

- 2023 - Shanghai: Enabled ETH staking withdrawals

Ethereum's Impact on the Crypto Industry

Ethereum's introduction of smart contracts revolutionised blockchain technology, enabling entirely new categories of applications. It sparked the ICO boom of 2017, the DeFi explosion of 2020, and the NFT craze of 2021, establishing itself as the foundation for most blockchain innovation.

Ethereum vs Bitcoin: Detailed Comparison

| Feature | Ethereum | Bitcoin |

|---|---|---|

| Primary Purpose | Programmable blockchain platform | Digital money & store of value |

| Smart Contracts | Yes - core feature | Limited scripting capability |

| Consensus Mechanism | Proof of Stake | Proof of Work |

| Transaction Speed | ~15 seconds | ~10 minutes |

| Supply Limit | No fixed limit (~120M ETH) | 21 million BTC maximum |

| Energy Consumption | 99.9% less than Bitcoin | High (mining intensive) |

| Use Cases | DeFi, NFTs, DApps, Web3 | Payments, store of value |

| Programming Language | Solidity, Vyper | Script (limited) |

| Staking Rewards | 4-6% APY for validators | No native staking |

| Institutional Adoption | Growing (JPMorgan, Microsoft) | High (Tesla, MicroStrategy) |

Which Should You Choose?

Bitcoin and Ethereum serve different purposes and can complement each other in a diversified crypto portfolio. Bitcoin excels as "digital gold" - a store of value and hedge against inflation. Ethereum offers exposure to the growing Web3 economy through its platform utility and staking rewards.

Many investors hold both Bitcoin for long-term value storage and Ethereum for participation in DeFi, NFTs, and emerging blockchain applications. Consider your investment goals, risk tolerance, and interest in actively using blockchain technology.

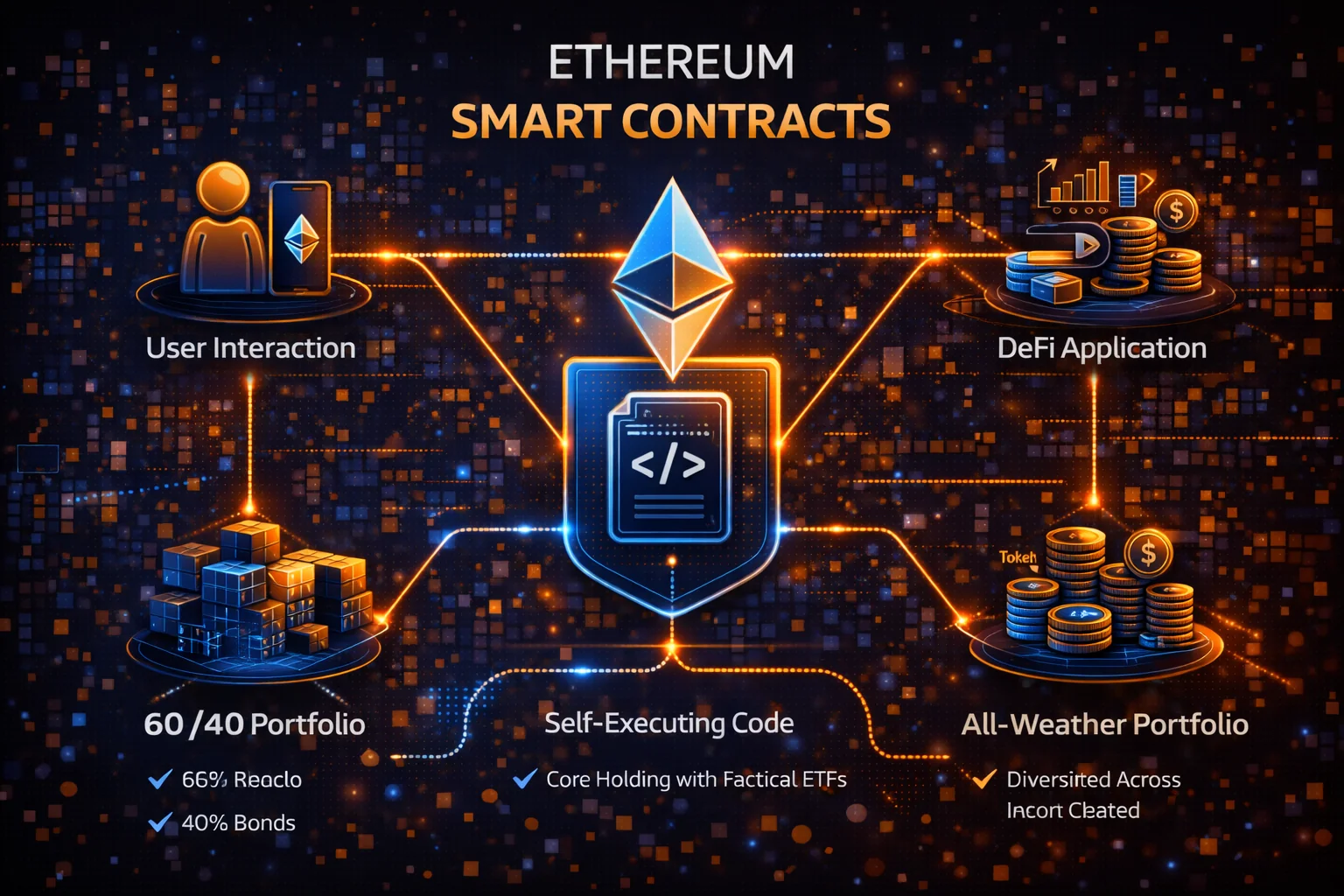

Smart Contracts: The Heart of Ethereum

Smart contracts are self-executing programs that automatically enforce agreements when predetermined conditions are met. According to Ethereum.org, smart contracts are "programs stored on a blockchain that run when predetermined conditions are met," enabling trustless execution without intermediaries. [1] Think of them as digital vending machines - you put in the correct input, and you automatically get the expected output.

How Smart Contracts Work:

- Code is Written: Developers write contract logic in Solidity programming language

- Deployed to Blockchain: Contract is uploaded to Ethereum network with unique address

- Conditions are Met: External events or user actions trigger contract execution

- Automatic Execution: Contract runs without human intervention or third parties

- Immutable Results: Outcomes are recorded permanently on blockchain

Smart Contract Programming Languages

Solidity is the primary programming language for Ethereum smart contracts, designed specifically for the Ethereum Virtual Machine (EVM). It's similar to JavaScript and C++, making it accessible to many developers. Vyper is an alternative language focused on security and simplicity.

Real-World Smart Contract Examples:

decentralised Finance (DeFi)

- Automated Market Makers: Uniswap enables token swaps without order books

- Lending Protocols: Aave allows borrowing against crypto collateral

- Yield Farming: Compound automatically distributes interest to lenders

- Stablecoins: MakerDAO maintains DAI's $1 peg through algorithmic mechanisms

Insurance and Risk Management

- Parametric Insurance: Automatic payouts based on weather data or flight delays

- Crop Insurance: Farmers receive compensation based on satellite weather data

- Travel Insurance: Flight delay compensation without claims processing

Supply Chain and Logistics

- Product Tracking: Walmart tracks food products from farm to store

- Authenticity Verification: Luxury goods provenance and anti-counterfeiting

- Automated Payments: Suppliers paid automatically upon delivery confirmation

Smart Contract Security Considerations

Whilst smart contracts offer transparency and automation, they're only as secure as their code. Bugs or vulnerabilities can lead to significant losses, as seen in various DeFi hacks. Always use audited contracts from reputable projects and understand the risks before interacting with smart contracts.

- Code Audits: Professional security reviews before deployment

- Bug Bounties: Rewards for finding vulnerabilities

- Formal Verification: Mathematical proofs of contract correctness

- Gradual Rollouts: Testing with small amounts before full deployment

decentralised Applications (DApps): The Web3 Revolution

DApps are applications that run on the Ethereum blockchain, rather than centralised servers. They combine smart contracts (backend logic) with user interfaces (frontend) to create fully decentralised services that no single entity can control or shut down.

Key Characteristics of DApps

- decentralised: No single point of failure or control

- Open Source: Code is publicly verifiable and auditable

- Autonomous: Operate without human intervention once deployed

- Incentivized: Token economics align user and developer interests

- Permissionless: Anyone can use without approval or registration

Popular DApp Categories and Examples:

DeFi (decentralised Finance) - $50B+ TVL

- Uniswap: Largest decentralised exchange with $4B+ daily volume

- Aave: Leading lending protocol with $10B+ in deposits

- Compound: Algorithmic money market for earning interest

- MakerDAO: decentralised stablecoin (DAI) with $5B+ supply

- Curve: specialised DEX for stablecoin and similar asset trading

- Synthetix: Synthetic asset platform for trading derivatives

NFTs and Digital Collectibles - $20B+ Market

- OpenSea: Largest NFT marketplace with millions of items

- SuperRare: Curated digital art platform

- Foundation: Invite-only creative platform

- Async Art: Programmable and dynamic NFT art

Gaming and Metaverse

- Axie Infinity: Play-to-earn game with $4B+ revenue

- Decentraland: Virtual world with user-owned land

- The Sandbox: Gaming metaverse with NFT assets

- Gods Unchained: Trading card game with true ownership

Web3 Infrastructure and Social

- ENS (Ethereum Name Service): Human-readable blockchain addresses

- IPFS: decentralised file storage and sharing

- Mirror: decentralised publishing platform

- Lens Protocol: Social media infrastructure owned by users

How to Use DApps Safely

Using DApps requires connecting a Web3 wallet, such as MetaMask. Always verify you're on the correct website, understand what transactions you're signing, and start with small amounts to test functionality.

- Verify URLs: Bookmark official DApp websites to avoid phishing

- Check Permissions: Understand what access you're granting

- Start Small: Test with minimal amounts before larger transactions

- Read Documentation: Understand risks and how the protocol works

- Monitor Gas Fees: Avoid high-fee periods when possible

Ethereum 2.0: The Merge and Proof of Stake

Note: This upgrade was previously called eth2 (also "Ethereum 2.0" or "ETH2"). Since the Merge in September 2022, the Ethereum Foundation no longer uses this term and simply refers to the network as "Ethereum."

In September 2022, Ethereum completed "The Merge" - the most significant upgrade in blockchain history. This transition from energy-intensive Proof of Work to eco-friendly Proof of Stake reduced Ethereum's energy consumption by over 99.9% whilst preserving security and decentralisation.

What Changed with The Merge

- Consensus Mechanism: Switched from mining to validator staking

- Energy Consumption: Reduced from 78 TWh/year to 0.01 TWh/year

- Block Production: Validators propose blocks instead of miners

- Issuance Rate: Reduced ETH inflation from ~4% to ~0.5% annually

- Security Model: Economic security through staked ETH instead of computational power

How Ethereum Staking Works

Ethereum's Proof of Stake requires validators to stake 32 ETH to participate in block production and validation. Validators are randomly selected to propose blocks and earn rewards, while malicious behaviour results in slashing (penalty).

Staking Options for Regular Users

- Solo Staking: Run your own validator with 32 ETH (highest rewards, technical complexity)

- Staking Pools: Combine funds with others (Rocket Pool, Lido)

- Exchange Staking: Stake through Coinbase, Binance, Kraken (easiest, centralised)

- Liquid Staking: Receive tradeable tokens representing staked ETH

Staking Rewards and Risks

Ethereum staking currently offers a 4-6% annual percentage yield (APY), which varies based on the total staked amount and network activity. Rewards come from block proposals, attestations, and MEV (Maximal Extractable Value).

- Rewards: 4-6% APY in ETH, paid continuously

- Slashing Risk: Penalties for validator misbehavior (rare with proper setup)

- Liquidity: Staked ETH was locked until the Shanghai upgrade (March 2023)

- Technical Risk: Validator downtime reduces rewards

Future Ethereum Upgrades and Roadmap

Ethereum's development continues with several significant upgrades planned to improve scalability, security, and user experience. The roadmap focuses on making Ethereum more accessible without sacrificing decentralisation.

Upcoming Improvements

- Proto-Danksharding (EIP-4844): Reduces Layer 2 transaction costs by 10-100x

- Full Danksharding: Massive scalability improvement through data availability sampling

- Account Abstraction: Improved user experience with programmable wallets

- Verkle Trees: Reduced node storage requirements and faster sync

- Single Slot Finality: Faster transaction confirmation times

- Quantum Resistance: Future-proof cryptography against quantum computers

Layer 2 Scaling Solutions

Whilst Ethereum's base layer prioritises security and decentralisation, Layer 2 solutions provide immediate scalability. These networks process transactions off-chain while inheriting Ethereum's security guarantees.

- Optimistic Rollups: Arbitrum, Optimism - assume validity, challenge if needed

- ZK Rollups: Polygon zkEVM, zkSync - cryptographic proofs of validity

- State Channels: Lightning-style payment channels for specific use cases

- Sidechains: Polygon PoS - separate chains with bridges to Ethereum

Understanding Ethereum Gas Fees

Gas is the fee required to execute transactions and smart contracts on the Ethereum blockchain. Think of gas as the fuel needed to power the Ethereum network - more complex operations require more gas. Understanding gas mechanics helps you optimise transaction costs and timing.

Gas Fee Components (Post-EIP-1559)

- Base Fee: Minimum cost that gets burnt (removed from circulation)

- Priority Fee (Tip): Optional payment to incentivize faster processing

- Gas Limit: Maximum gas units you're willing to spend

- Gas Used: Actual computational work performed

Factors Affecting Gas Fees

- Network Congestion: High demand during DeFi/NFT activity increases fees

- Transaction Complexity: Simple transfers cost ~21,000 gas, complex DeFi interactions can cost 200,000+ gas

- Time of Day: Peak hours (US/Europe active) typically have higher fees

- Market Volatility: Price movements trigger trading activity and higher fees

- Gas Price: Measured in Gwei (1 ETH = 1 billion Gwei)

Gas optimisation Strategies

- Timing: Use ETH Gas Station or similar tools to find low-fee periods

- Layer 2: Use Polygon, Arbitrum, or Optimism for cheaper transactions

- Batch Transactions: Combine multiple operations when possible

- Gas Tokens: Pre-purchase gas during low-fee periods (advanced)

- Alternative Networks: Consider Binance Smart Chain or other EVM chains

Typical Gas Costs (2025 Estimates)

- Simple ETH Transfer: $2-10 depending on network congestion

- ERC-20 Token Transfer: $5-20 for standard tokens

- Uniswap Trade: $15-50 for token swaps

- NFT Minting: $20-100+ depending on contract complexity

- DeFi Interactions: $10-200+ for lending, borrowing, yield farming

Ethereum as an Investment: Opportunities and Risks

Investment Thesis for Ethereum

Ethereum's investment case centres on its role as the foundation for Web3 infrastructure. As the dominant smart contract platform, ETH benefits from network effects, developer adoption, and the growth of DeFi, NFTs, and decentralised applications.

Bullish Factors

- Network Effects: Largest developer ecosystem and user base

- Institutional Adoption: Major corporations building on Ethereum

- Deflationary Mechanics: EIP-1559 burns ETH, reducing supply

- Staking Yield: 4-6% APY provides income stream

- DeFi Growth: Total Value Locked continues expanding

- Layer 2 Scaling: Improved user experience driving adoption

- ESG Compliance: 99.9% energy reduction attracts institutional investors

Risk Factors

- Competition: Solana, Cardano, and other "Ethereum killers"

- Regulatory Uncertainty: Potential government restrictions on DeFi

- Technical Risks: Smart contract bugs and protocol vulnerabilities

- Scalability Challenges: High fees may limit mainstream adoption

- Market Volatility: Crypto markets remain highly speculative

- Execution Risk: Ethereum roadmap delays or technical issues

Ethereum Investment Strategies

Buy and Hold (HODLing)

Long-term investors buy ETH and hold through market cycles, believing in Ethereum's fundamental value proposition. This strategy requires firm conviction and the ability to withstand significant volatility.

Staking for Yield

Staking ETH provides 4-6% annual returns while supporting network security. Consider liquid staking tokens (stETH, rETH) for flexibility or direct staking for maximum rewards.

DeFi Participation

Advanced users can earn higher yields through DeFi protocols, but this involves smart contract risks, impermanent loss, and complex tax implications. Start small and thoroughly understand the protocols.

Dollar-Cost Averaging (DCA)

Regular purchases, regardless of price, help smooth volatility and reduce timing risk. Many investors DCA into ETH weekly or monthly to build positions over time.

Tax Considerations

Ethereum transactions may trigger taxable events in most jurisdictions. Consult tax professionals familiar with cryptocurrency regulations in your country. Key considerations include:

- Capital Gains: Selling ETH for profit is typically taxable

- Staking Rewards: May be taxed as income when received

- DeFi Activities: Complex tax implications for yield farming, liquidity provision

- Record Keeping: Track all transactions for accurate reporting

How to Get Started with Ethereum

Step 1: Buy ETH on Exchanges

Purchase Ethereum on reputable exchanges using fiat currency or other cryptocurrencies. Choose exchanges based on your location, fees, and security features.

Recommended Exchanges

- Coinbase: User-friendly, regulated in US, higher fees

- Binance: Lowest fees, largest selection, advanced features

- Kraken: Strong security, good for institutions, US-regulated

- Gemini: Regulated, insurance coverage, good for beginners

Step 2: Set Up an Ethereum Wallet

Use wallets to store your ETH and interact with DApps. Choose between hot wallets (convenient) and cold wallets (secure).

Wallet Options

- MetaMask: Most popular browser extension wallet

- Trust Wallet: Mobile-first with built-in DApp browser

- Ledger: Hardware wallet for maximum security

- Trezor: Alternative hardware wallet option

- Coinbase Wallet: Self-custody wallet from Coinbase

Step 3: Explore DApps Safely

Start with simple DApps to understand how Ethereum applications work. Begin with small amounts and gradually increase as you gain experience.

Beginner-Friendly DApps

- Uniswap: decentralised token trading

- OpenSea: NFT marketplace browsing

- ENS: Register human-readable addresses

- Compound: Earn interest on ETH deposits

Step 4: Learn About Gas and Fees

Understanding gas fees helps you optimise transaction costs and timing. Use tools like ETH Gas Station to monitor current fees and plan transactions accordingly.

Step 5: Stay Informed and Secure

- Follow Official Channels: Ethereum Foundation, Vitalik Buterin

- Join Communities: Reddit r/ethereum, Discord servers

- Security Best Practices: Never share private keys, verify URLs

- Continuous Learning: Ethereum evolves rapidly, stay updated

Advanced Ethereum Concepts and Technical Deep Dive

Ethereum Virtual Machine Architecture

The Ethereum Virtual Machine operates as a stack-based computing environment with 256-bit word size, supporting 140+ opcodes for arithmetic, logical, and cryptographic operations. The EVM maintains three distinct data areas: the stack (a maximum of 1024 items), memory (an expandable byte array), and storage (a persistent key-value mapping). Gas metering prevents infinite loops by computational cost accounting, where each opcode consumes a predetermined number of gas units based on its computational complexity.

Smart contract bytecode compilation transforms Solidity source code into EVM-compatible instructions through the Solidity compiler (solc). Contract deployment involves two transaction types: contract creation transactions that generate new contract addresses through deterministic calculation (sender address + nonce), and message calls that execute existing contract functions. State transitions occur through transaction execution, modifying account balances, contract storage, and generating transaction receipts with event logs.

Consensus Mechanisms and Validator Economics

Ethereum's Proof-of-Stake consensus utilises the Casper FFG finality gadget combined with the LMD-GHOST fork choice rule. Validators participate through 32 ETH in staked ETH, earning rewards from block proposals (base reward + priority fees + MEV), attestations (voting on the chain head), and sync committee participation. Slashing penalties apply for provable misbehaviour: 1/32 of the stake for offline violations, up to the entire stake for double-signing or surround voting attacks.

Validator activation requires deposit contract interaction, followed by inclusion in the activation queue. Epoch-based consensus (32 slots per epoch, 12-second slot times) enables finality after two epochs under normal conditions. The inactivity leak mechanism gradually reduces the offline validator stakes during extended non-finality periods, ensuring network recovery from catastrophic events that affect validator participation rates.

Layer 2 Scaling Architecture

Optimistic Rollups achieve scalability through fraud-proof mechanisms, assuming transaction validity unless challenged within dispute windows (typically 7 days). Arbitrum uses interactive fraud proofs with binary search dispute resolution, while Optimism employs single-round fraud proofs with a cannon fault-proof system. Both solutions compress transaction data using call data optimisation and batch submission to minimise Layer 1 costs.

Zero-Knowledge Rollups provide immediate finality through validity proofs generated using zk-SNARKs or zk-STARKs. Polygon zkEVM maintains EVM compatibility through zkEVM circuits, enabling seamless smart contract migration. StarkNet utilises the Cairo programming language for provable computation, offering native account abstraction and enhanced privacy features through STARK proof systems.

DeFi Protocol Mechanics

Automated Market Makers implement constant product formulas (x * y = k) for decentralised token exchange without order books. Uniswap V3 introduces concentrated liquidity through custom price ranges, enabling capital efficiency improvements up to 4000x compared to V2. Liquidity providers earn trading fees proportional to their pool share, while impermanent loss occurs when token price ratios diverge from deposit ratios.

Lending protocols utilise over-collateralization to mitigate default risk, with liquidation mechanisms triggered when collateral ratios fall below maintenance thresholds. Compound's algorithmic interest rate models adjust borrowing costs based on utilisation rates, while Aave introduces flash loans, enabling uncollateralized borrowing within single transactions. Risk parameters including loan-to-value ratios and liquidation bonuses are governed through decentralised governance processes.

Development Frameworks and Tooling

Hardhat development environment provides comprehensive testing capabilities through Ethereum network forking, enabling mainnet state simulation for complex DeFi integration testing. Foundry offers a Rust-based toolchain with property-based testing via invariant fuzzing and differential testing. OpenZeppelin contracts library provides audited implementations of common patterns, including access control, token standards, and proxy upgrades.

Formal verification tools like Certora and K Framework enable mathematical proofs of smart contract correctness through specification languages and automated theorem proving. Static analysis tools, including Slither and MythX, identify common vulnerabilities such as reentrancy, integer overflow, and access control issues before deployment. Gas optimisation techniques include storage packing, function selector optimisation, and assembly-level optimisations for performance-critical operations.

Ethereum Improvement Proposals and Governance

Ethereum Improvement Proposals (EIPs) provide structured mechanisms for protocol evolution through community consensus. Core EIPs modify protocol rules requiring hard forks, while ERC standards define application-level conventions for tokens, NFTs, and interfaces. The EIP process includes draft submission, community review, implementation testing, and final deployment through coordinated network upgrades.

Governance mechanisms include rough consensus amongst core developers, client implementation teams, and community stakeholders. Major upgrades undergo extensive testing on testnets, including Goerli, Sepolia, and Holesky, before mainnet deployment. The Ethereum Foundation coordinates research and development whilst preserving protocol neutrality through decentralised decision-making processes.

Security Architecture and Cryptographic Primitives

Ethereum employs elliptic curve cryptography using secp256k1 curves for digital signatures, enabling secure transaction authorisation through private key control. Merkle Patricia Trees organise state data with cryptographic integrity guarantees, while Keccak-256 hashing provides collision resistance for address generation and data verification. Account abstraction proposals enable programmable authentication beyond traditional ECDSA signatures.

Smart contract security relies on deterministic execution, immutable deployment, and transparent verification. Common attack vectors include reentrancy exploits, front-running via MEV extraction, and oracle manipulation, all of which require comprehensive security auditing. Multi-signature wallets, timelock contracts, and emergency pause mechanisms provide additional security layers for high-value applications and protocol governance.

Tokenomics and Economic Mechanisms

Ethereum's monetary policy includes base fee burning through EIP-1559, reducing ETH supply during high network usage periods. Validator rewards consist of consensus rewards (block proposals and attestations) plus execution rewards (priority fees and MEV). The issuance rate adjusts based on total staked ETH, targeting optimal security through economic incentives whilst keeping sustainable inflation rates.

Token standards enable diverse economic models including ERC-20 fungible tokens, ERC-721 NFTs, and ERC-1155 multi-token contracts. DeFi protocols implement sophisticated tokenomics through governance tokens, liquidity mining incentives, and protocol-owned liquidity mechanisms. Automated market makers utilise bonding curves and concentrated liquidity to optimise capital efficiency and reduce slippage for traders.

Interoperability and Cross-Chain Infrastructure

Cross-chain bridges enable asset transfers between Ethereum and other blockchains through lock-and-mint mechanisms or liquidity pools. Canonical bridges maintain direct connections to specific chains, while generalised bridges support multiple networks through standardised protocols. Bridge security relies on validator sets, multi-signature schemes, or optimistic verification with fraud-proof challenges.

Interoperability protocols include Cosmos IBC for sovereign blockchain communication, Polkadot parachains for shared security models, and LayerZero for omnichain applications. Ethereum serves as a settlement layer for many Layer 2 networks, providing security guarantees while enabling specialised execution environments for gaming, social media, and enterprise applications requiring specific performance characteristics.

Ethereum Ecosystem Development and Professional Implementation

Enterprise Ethereum Integration and Institutional Adoption

Enterprise Ethereum implementations require sophisticated infrastructure, including private networks, consortium blockchains, and hybrid architectures that enable institutional participation whilst ensuring regulatory compliance and operational security. Enterprise integration includes comprehensive identity management, advanced access control systems, and sophisticated monitoring frameworks that enable professional blockchain utilisation whilst preserving security standards and operational excellence through institutional Ethereum deployment and professional blockchain management.

Institutional adoption includes development of custody solutions, comprehensive compliance frameworks, and advanced reporting systems that enable enterprise Ethereum participation whilst upholding fiduciary responsibilities and regulatory adherence. Professional enterprise implementation utilises advanced security protocols, systematic risk management, and comprehensive operational procedures that enable institutional blockchain adoption whilst ensuring performance standards and operational reliability through enterprise Ethereum excellence and professional blockchain integration.

Advanced Smart Contract Architecture and Design Patterns

Professional smart contract development requires sophisticated architectural patterns, including proxy contracts for upgradability, factory patterns for standardised deployment, and diamond patterns for modular functionality that enable complex application development whilst preserving security standards and operational efficiency. Advanced architecture includes comprehensive access control systems, sophisticated state management, and strategic optimisation, enabling professional smart contract development whilst ensuring security and performance standards through architectural excellence.

Design pattern implementation includes utilisation of established security patterns, comprehensive testing frameworks, and systematic code review processes that ensure smart contract reliability whilst ensuring development efficiency and operational security. Professional smart contract architecture utilises advanced development tools, systematic security assessment, and comprehensive optimisation techniques that enable sophisticated blockchain application development whilst preserving security standards and operational excellence through professional smart contract design and architectural optimisation.

Ethereum Virtual Machine optimisation and Performance Engineering

EVM optimisation requires a comprehensive understanding of gas mechanics, storage optimisation, and computational efficiency that enables cost-effective smart contract execution without compromising functionality and security requirements. Performance engineering includes systematic gas analysis, comprehensive optimisation strategies, and advanced profiling techniques that minimise transaction costs whilstmaximising application performance through EVM optimisation excellence and professional performance management.

Advanced optimisation techniques include assembly-level programming, storage slot optimisation, and computational complexity reduction that enhance smart contract efficiency whilst preserving security standards and operational reliability. Professional EVM optimisation utilises advanced development tools, systematic performance analysis, and comprehensive optimisation frameworks that enable optimal smart contract performance without compromising functionality and security through performance engineering excellence and professional EVM optimisation designed for cost-effective blockchain application development and operational efficiency.

decentralised Governance and Community Management

Ethereum governance includes sophisticated voting mechanisms, comprehensive proposal systems, and strategic community engagement that enables decentralised decision-making whilst preserving protocol security and development progress. Governance implementation includes token-based voting, delegation mechanisms, and comprehensive proposal evaluation, enabling community participation whilst ensuring operational efficiency and strategic direction through decentralised governance excellence and professional community management.

Community management includes systematic stakeholder engagement, comprehensive communication strategies, and strategic consensus building that enables effective governance whilst ensuring community cohesion and development momentum. Professional governance utilises advanced voting systems, systematic proposal evaluation, and comprehensive community engagement frameworks that enable effective decentralised governance whilst preserving protocol security and development excellence through community management and professional governance designed for sustainable blockchain ecosystem development and community-driven innovation.

The future of Ethereum continues to evolve through systematic research, comprehensive development, and strategic innovation that enhances protocol capabilities whilst preserving security standards and decentralisation principles. Successful Ethereum utilisation requires continuous education, strategic planning, and professional implementation to achieve optimal results in the evolving blockchain ecosystem through excellence in Ethereum and professional blockchain mastery.

Ethereum's technological advancement includes ongoing research into sharding, statelessness, and quantum resistance that will enhance scalability, efficiency, and long-term security. Professional Ethereum development requires understanding of these emerging technologies, systematic skill development, and strategic positioning to leverage future protocol enhancements whilst preserving current operational excellence and development proficiency through continuous learning and professional blockchain expertise designed for long-term success in the Ethereum ecosystem.

Understanding Ethereum's comprehensive architecture enables developers and users to participate effectively in the decentralised economy whilst building innovative applications and financial solutions that leverage blockchain technology for maximum impact and professional success.

Advanced Ethereum Development and Professional Implementation

Professional Ethereum development requires a comprehensive understanding of advanced protocol features, sophisticated development methodologies, and strategic implementation approaches that maximise application performance whilst preserving security standards and operational excellence. Advanced development includes implementation of complex smart contract architectures, optimisation of gas efficiency, and creation of sophisticated user interfaces that provide exceptional user experience while leveraging Ethereum's full capabilities through professional development excellence and systematic implementation designed for enterprise-grade Ethereum applications.

Enterprise Ethereum implementation includes comprehensive security auditing, systematic performance optimisation, and strategic deployment procedures that ensure production-ready applications meet institutional requirements without sacrificing decentralisation principles and protocol compatibility. Professional Ethereum development utilises advanced development tools, comprehensive testing frameworks, and systematic quality assurance that enables reliable Ethereum applications whilst ensuring development efficiency and operational excellence through professional development practices and strategic Ethereum implementation designed for long-term success and sustainable blockchain innovation.

Conclusion

Ethereum has established itself as the foundational infrastructure for the decentralised web, enabling innovations that extend far beyond simple cryptocurrency transactions. From decentralised finance and non-fungible tokens to complex smart contract applications and Web3 services, Ethereum's programmable blockchain has created an entirely new digital economy that operates without traditional intermediaries.

The platform's successful transition to Proof of Stake consensus and ongoing scalability improvements demonstrate Ethereum's ability to evolve and adapt to changing technological requirements without compromising security and decentralisation. These upgrades have positioned Ethereum as a sustainable and scalable foundation for the future of blockchain applications, addressing many of the concerns that previously limited mainstream adoption.

For investors and users, Ethereum represents both a store of value and a utility token that provides access to the world's largest ecosystem of decentralised applications. The network effects surrounding Ethereum create powerful incentives for continued development and adoption, making it an essential component of any comprehensive cryptocurrency portfolio or blockchain strategy. Explore our Ethereum 2025 review or read Bitcoin vs Ethereum comparison.

Understanding Ethereum's technology, ecosystem, and potential applications is crucial for anyone seeking to participate in the evolving cryptocurrency landscape. Whether you're interested in DeFi protocols, NFT marketplaces, or simply holding ETH as an investment, the knowledge and strategies outlined in this guide provide the foundation for successful participation in the Ethereum ecosystem.

As blockchain technology continues to mature and gain mainstream acceptance, Ethereum's role as the leading smart contract platform becomes increasingly important. The platform's combination of technological innovation, developer adoption, and network effects suggests continued growth and development, making it an essential technology to understand and potentially invest in for the future of decentralised applications and digital finance.

Key Takeaways for 2025

Ethereum's evolution from experimental blockchain to critical financial infrastructure demonstrates the transformative potential of programmable money and decentralised applications. The successful implementation of Proof-of-Stake consensus, combined with Layer 2 scaling solutions, has created a robust platform capable of supporting global-scale applications whilst upholding the security and decentralisation principles that define blockchain technology's core value proposition.

The institutional adoption and regulatory clarity emerging in 2025 validate Ethereum's position as essential digital infrastructure. Major corporations integrate Ethereum-based solutions for supply chain management, digital identity, and financial services, while governments explore central bank digital currencies and regulatory frameworks that recognise blockchain technology's legitimate role in modern financial systems.

Start Using Ethereum

Ready to buy, store, or use Ethereum? Get started with these trusted platforms:

- Buy Ethereum on Binance - Low fees and high liquidity

- MetaMask Ethereum Wallet - Access DeFi and dApps

- Ledger Hardware Wallet Review - Secure ETH storage

Sources & References

This guide is based on authoritative Ethereum sources:

- Ethereum Smart Contracts Documentation - Ethereum Foundation

https://ethereum.org/en/smart-contracts/

Official documentation on smart contracts and their functionality - Ethereum Whitepaper - Vitalik Buterin

https://ethereum.org/en/whitepaper/

Original Ethereum whitepaper outlining the vision and technical design - Ethereum Developer Documentation - Ethereum Foundation

https://ethereum.org/en/developers/docs/

Comprehensive technical documentation for Ethereum development

Frequently Asked Questions

- What is Ethereum and how does it differ from Bitcoin?

- Ethereum is a programmable blockchain platform that enables smart contracts and decentralised applications (dApps), while Bitcoin is primarily digital money. Ethereum uses Proof of Stake consensus, processes transactions in ~15 seconds, and supports complex programmable functionality beyond simple payments.

- How do smart contracts work on Ethereum?

- Smart contracts are self-executing programs that automatically enforce agreements when predetermined conditions are met. They're written in Solidity, deployed to the Ethereum blockchain, and execute automatically without human intervention when triggered by external events.

- Is Ethereum a good investment in 2025?

- Ethereum boasts strong fundamentals, including its transition to Proof of Stake, a growing DeFi ecosystem, and increasing institutional adoption. However, like all cryptocurrencies, it's volatile and risky. Consider your risk tolerance, diversify investments, and never invest more than you can afford to lose.

- What are Ethereum gas fees and why are they high?

- Gas fees are transaction costs paid to validators for processing operations on the Ethereum network. Fees fluctuate based on network congestion, transaction complexity, and demand. Layer 2 solutions like Polygon and Arbitrum offer lower-cost alternatives for many applications.

- How can I earn money with Ethereum?

- You can earn with Ethereum through: staking ETH for 4-6% APY, providing liquidity to DeFi protocols, trading tokens, creating and selling NFTs, or building DApps. Each method has different risk levels and complexity requirements.

- What is Ethereum 2.0 and the Proof of Stake upgrade?

- Ethereum 2.0 (The Merge) transitioned Ethereum from energy-intensive Proof of Work to efficient Proof of Stake in September 2022. This upgrade reduced energy consumption by 99.95%, enabled staking rewards for ETH holders, and laid groundwork for future scalability improvements through sharding.

← Back to Cryptocurrency Guide 2025

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.