Best Liquid Staking Protocols 2025

Comprehensive comparison of the top LST protocols in 2025. Compare Lido, ETH staking pool, Frax, and Coinbase for Ethereum staking with analysis of APY rates, security, decentralisation, and liquidity features.

Introduction

LST protocols represent a revolutionary advancement in Ethereum staking technology. They allow you to stake Ethereum while maintaining liquidity. You receive derivative tokens instead of locking your ETH. Traditional staking locks your ETH for months or years. You receive tokenised staking tokens (LSTs) instead. These represent your staked ETH. They can be traded or used in DeFi protocols. You can hold them for staking rewards.

The emergence of tokenised staking has fundamentally transformed the Ethereum ecosystem. It solves the liquidity problem inherent in traditional proof-of-stake mechanisms. Traditional Ethereum staking requires locking 32 ETH per validator. You must wait for the withdrawal queues. This creates significant barriers for smaller investors. Capital efficiency is reduced for larger holders.

In 2025, LST protocols have matured significantly. They offer sophisticated solutions that balance decentralisation, security, and user experience. These protocols manage validator operations for you. Rewards are automatically distributed. Instant liquidity is provided through their derivative tokens. Ethereum staking is now accessible to users of all sizes.

The competitive landscape includes established players like Lido Finance. It dominates with over $24 billion in total value locked. Innovative alternatives like Rocket Pool prioritise decentralisation. Permissionless node operation is their focus. Newer entrants like Frax Finance offer unique dual-token mechanisms. Yield generation is optimised. Established exchanges like Coinbase provide institutional-grade tokenised staking solutions. Regulatory compliance is ensured.

The maturation of tokenised staking infrastructure has created a diverse ecosystem. You can choose protocols based on your specific priorities. Maximum liquidity supports active trading. Decentralisation aligns with your philosophy. Highest yields optimise your returns. Regulatory compliance meets institutional requirements. This diversity ensures that LST protocols serve different market segments. Collectively, they advance the adoption of Ethereum staking.

Benefits of LST Protocols

- Liquidity: Trade or use staked ETH in DeFi platforms without unstaking delays

- Lower Barriers: Stake any amount, no 32 ETH minimum requirement

- Composability: Use LSTs across the DeFi ecosystem for additional yield opportunities

- Convenience: No technical setup or validator management required

- Rewards: Earn staking rewards while maintaining flexibility and capital efficiency

- Risk Distribution: Spread validator risk across multiple operators and infrastructure providers

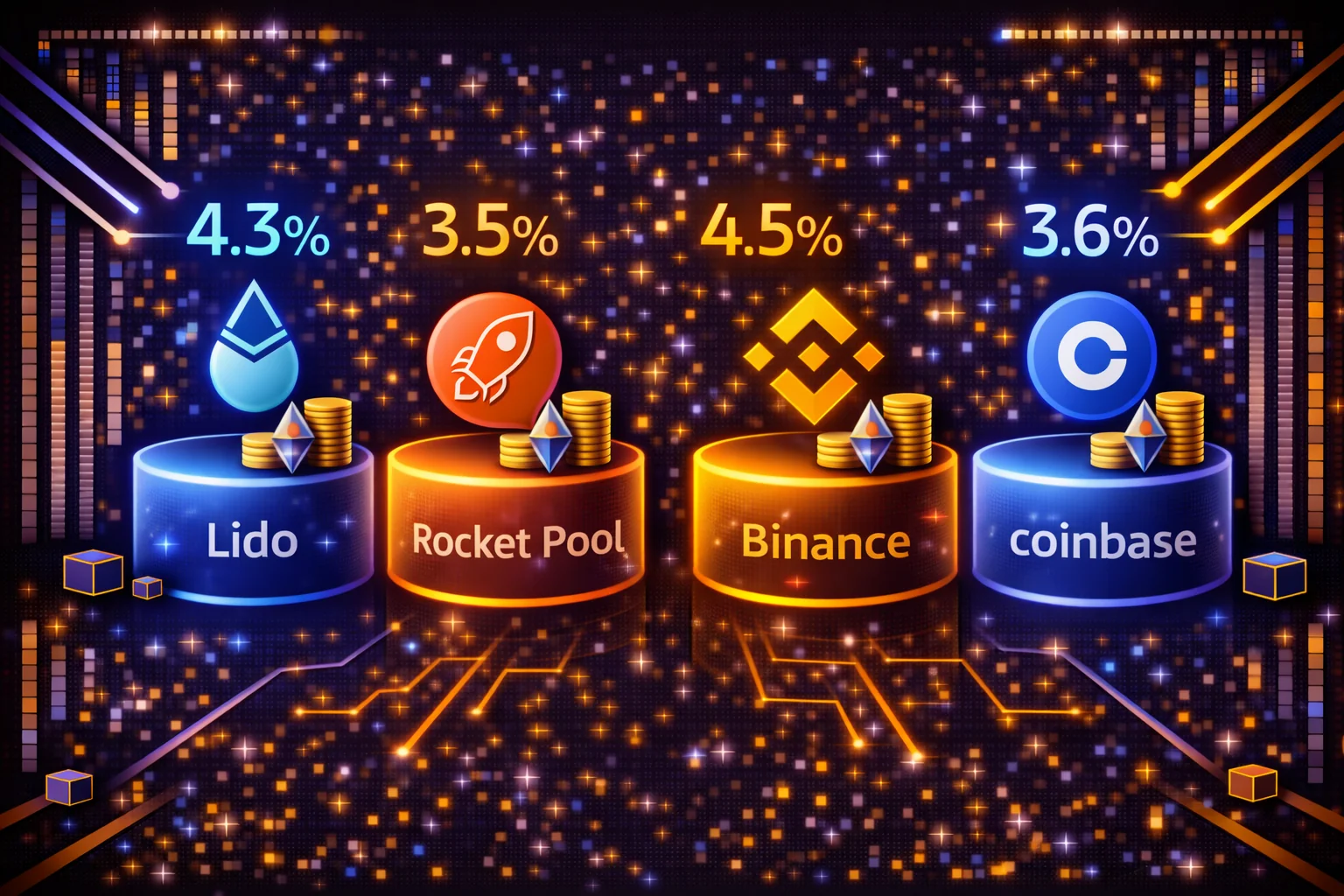

Quick Comparison Table

| Protocol | APY | TVL | Token | decentralisation | Liquidity | Rating |

|---|---|---|---|---|---|---|

| Lido | 3.2-3.8% | $24B+ | stETH | Medium | Excellent | 9.0/10 |

| RocketPool | 3.0-3.5% | $3B+ | rETH | High | Good | 8.8/10 |

| Frax | 3.5-4.0% | $1B+ | sfrxETH | Medium | Good | 8.5/10 |

| Coinbase | 2.8-3.2% | $2B+ | cbETH | Low | Good | 8.0/10 |

| Swell | 3.0-3.5% | $500M+ | swETH | Medium | Growing | 7.5/10 |

| Ankr | 2.9-3.4% | $300M+ | ankrETH | Medium | Moderate | 7.2/10 |

| StakeWise | 3.1-3.6% | $200M+ | sETH2 | High | Moderate | 7.8/10 |

| Binance | 2.5-3.0% | $1.5B+ | BETH | Low | Good | 7.0/10 |

Detailed Protocol Analysis

Which protocol should you choose? Let's examine each option in detail. Your priorities determine the best fit for you.

1. Lido - Market Leader

Overview

Lido is the largest protocol, controlling over 30% of all staked ETH. It offers the most LST token (stETH) with the deepest liquidity across blockchain protocols. Does market dominance matter to you?

Key Features

- Token: stETH (rebasing) and wstETH (wrapped, non-rebasing)

- APY: 3.2-3.8% (varies with network conditions)

- Minimum Stake: No minimum, stake any amount

- Validator Set: 30+ professional node operators

- Governance: LDO token holders control protocol

- Multi-Chain: Supports Ethereum, Solana, Polygon, Terra

Advantages

- Best Liquidity: Deepest markets and DeFi integration for you

- Proven Track Record: Operating since 2020 without major issues

- Wide Adoption: Accepted across most smart contract platforms you use

- Professional Operators: Experienced validator network protects you

- Insurance: Slashing insurance coverage available for you

Disadvantages

- Centralisation Concerns: Large market share raises centralisation risks - does this worry you?

- Validator Selection: Limited to approved operators

- Governance Risk: Protocol changes controlled by LDO holders

Best For

Are you prioritising liquidity, DeFi integration, and proven reliability over maximum decentralisation? For detailed setup instructions and current rates, see our comprehensive Lido review.

2. Rocket Pool - Most Decentralised

Overview

Decentralised staking is the most decentralised protocol. Anyone can become a node operator with just 16 ETH. It emphasises permissionless participation and true decentralisation. Do you value decentralisation above all else?

Key Features

- Token: rETH (non-rebasing, appreciates in value)

- APY: 3.0-3.5% (slightly lower due to protocol fees)

- Minimum Stake: 0.01 ETH minimum deposit for you

- Node Operators: 2,000+ permissionless operators

- Collateral: Node operators stake RPL tokens as insurance

- Governance: On-chain governance with RPL token

Advantages

- True Decentralisation: Permissionless node operator network protects you

- Slashing Protection: RPL collateral protects against losses for you

- Fair Distribution: No single entity controls large stake

- Innovation: Pioneer in decentralised staking design

- Community Driven: Strong community governance benefits you

Disadvantages

- Lower Liquidity: Less DeFi integration than stETH - does this limit you?

- Complexity: More complex protocol mechanics

- Deposit Queue: May have waiting periods during high demand

- RPL Dependency: Node operators need RPL tokens

Best For

Do you prioritise decentralisation? Do you want to support Ethereum's decentralised future? Rocket Pool is for you.

3. Frax - Highest Yields

Overview

Frax Ether offers competitive yields through its dual-token system and validator MEV optimisation. It's part of the broader Frax ecosystem focused on algorithmic stablecoins and DeFi.

Key Features

- Tokens: frxETH (non-yield bearing) and sfrxETH (yield bearing)

- APY: 3.5-4.0% (higher due to MEV optimisation)

- Minimum Stake: No minimum deposit

- Validator Strategy: MEV-optimised validator operations

- Ecosystem: Integrated with Frax Finance protocols

- Governance: FXS token governance

Advantages

- Higher Yields: Often offers best APY rates

- MEV optimisation: Advanced MEV capture strategies

- Flexible Design: Dual-token system for different use cases

- DeFi Integration: Native integration with Frax ecosystem

- Innovation: Cutting-edge staking technology

Disadvantages

- Newer Protocol: Less battle-tested than competitors

- Complexity: Dual-token system can confuse users

- Limited Adoption: Smaller ecosystem compared to Lido

- centralisation: Controlled by Frax team

Best For

Yield-focused users are comfortable with newer protocols and complex token mechanics.

4. Coinbase - Institutional Grade

Overview

Coinbase offers staking through cbETH, backed by the largest US cryptocurrency exchange. It provides institutional-grade security and compliance standards.

Key Features

- Token: cbETH (non-rebasing, appreciates in value)

- APY: 2.8-3.2% (after Coinbase fees)

- Minimum Stake: No minimum through Coinbase exchange

- Validators: Coinbase-operated validators

- Regulation: US regulated and compliant

- Integration: Native integration with Coinbase products

Advantages

- regulatory adherence: Fully regulated US entity

- Institutional Security: Enterprise-grade security measures

- Easy Access: Simple staking through Coinbase interface

- Brand Trust: Backed by public company reputation

- Tax Reporting: Integrated tax reporting and compliance tools

- Insurance: Coinbase insurance coverage

Disadvantages

- Higher Fees: Coinbase takes significant commission

- centralisation: Single entity controls all validators

- Limited DeFi: Less integration with DeFi protocols

- Geographic Restrictions: Limited availability outside US

Best For

US-based users prioritising regulatory compliance and institutional security over maximum yields.

Disadvantages

- Lower Yields: Higher fees reduce net APY

- centralised: Single entity controls all validators

- Limited DeFi: Less integration with DeFi protocols

- Geographic Limits: Restricted availability

Best For

Conservative investors prioritise legal compliance and institutional backing.

Comprehensive Protocol Analysis and Market Dynamics

Technical Architecture and Validator Infrastructure

LST protocols employ sophisticated technical architectures. They balance decentralisation, security, and operational efficiency. Diverse validator selection mechanisms are used. Slashing protection systems protect you. Reward distribution algorithms ensure fair payouts. Each protocol implements unique approaches to validator onboarding. Performance monitoring tracks validator health. Risk mitigation directly impacts your returns and protocol security.

Lido's validator set includes professional staking operators. They are selected through governance processes. Performance monitoring tracks their work. Slashing insurance mechanisms protects your funds. The protocol's technical infrastructure includes automated reward distribution. Validator rotation systems maintain performance. Comprehensive monitoring tools ensure optimal performance. Thousands of validators operate worldwide.

Rocket Pool's permissionless validator system enables individual operators to join. The network requires reduced ETH from them. A more decentralised validator set is created. Security is maintained through economic incentives. Reputation systems track performance. The protocol's technical innovation includes automated lifecycle management for validators. Dynamic commission structures adapt to conditions. Sophisticated risk assessment algorithms protect you.

Economic Models and Tokenomics Analysis

LST protocols implement diverse economic models. They balance user rewards, protocol sustainability, and ecosystem growth. Carefully designed tokenomics guide operations. Fee structures support the system. Understanding these economic mechanisms is crucial for you. Long-term protocol viability depends on them. Potential returns vary for different user types. Investment strategies require analysis.

Lido's economic model includes protocol fees. These are distributed to LDO token holders and node operators. Sustainable revenue streams are created. Competitive user yields are maintained. The protocol's fee structure balances user returns with operational costs. Protocol development funding is ensured. Long-term sustainability is achieved. Continuous innovation is supported.

Rocket Pool's dual-token system creates complex economic interactions. ETH stakers and node operators participate. RPL token requirements exist for validators. Additional economic incentives are created. Risk factors emerge. The protocol's economic design includes dynamic reward mechanisms. Insurance pools protect participants. Governance incentives align stakeholder interests. Network growth is promoted.

Risk Assessment and Security Considerations

LST protocols face diverse risk factors. Smart contract vulnerabilities exist. Validator performance risks occur. Slashing events can happen. Regulatory uncertainties loom. A comprehensive risk assessment is required. Mitigation strategies protect you. You must understand these risks when selecting protocols. Capital allocation across different tokenised staking options requires care.

Smart contract risks encompass code vulnerabilities. Upgrade mechanisms can fail. Governance attack vectors exist. User funds could be impacted. Protocol operations might be disrupted. Leading protocols implement comprehensive security measures. Multiple audits are conducted. Bug bounty programs incentivise discovery. Formal verification processes validate code. Gradual upgrade mechanisms minimise smart contract risks.

Validator risks include performance degradation. Slashing events reduces returns. Operational failures occur. User returns could be reduced. Principal losses might result. Protocols implement various risk mitigation strategies. Validator diversification spreads risk. Performance monitoring tracks health. Slashing insurance protects you. Automated validator management systems safeguard your interests.

Regulatory Landscape and Compliance Considerations

LST protocols operate in evolving regulatory environments. Careful consideration of securities laws is required. Tax implications affect you. Jurisdictional restrictions exist. Protocol operations could be impacted. User participation might be limited. Understanding regulatory trends is essential for you. Compliance requirements guide operations. Long-term strategic planning requires this knowledge. Risk assessment depends on it.

Securities law implications vary by jurisdiction. Protocol design matters. Some tokenised staking tokens might be classified as securities. Their characteristics determine classification. Distribution mechanisms affect status. Protocols implement various compliance measures. Geographic restrictions apply. KYC requirements exist. Regulatory engagement navigates challenges. Accessibility is maintained where possible.

Tax implications of tokenised staking include income recognition. Capital gains treatment applies. Reporting requirements vary by jurisdiction. Your circumstances matter. You should consult tax professionals. They help you understand your specific obligations. LST strategies can be optimised for tax efficiency. Compliance with applicable regulations is maintained.

Portfolio Integration and Investment Strategies

Diversification Strategies and Risk Assessment

Sophisticated investors implement diversification strategies across multiple LST protocols to optimise risk-adjusted returns while minimising concentration risks and protocol-specific vulnerabilities. Diversification approaches include protocol allocation, validator distribution, and geographic diversification that enhance portfolio resilience and return stability.

Protocol diversification involves allocating capital across multiple tokenised staking providers to reduce single-protocol risks while capturing different yield opportunities and technical innovations. Optimal allocation strategies consider factors including protocol maturity, validator diversity, fee structures, and ecosystem integration when determining appropriate portfolio weights.

Risk control frameworks encompass position sizing, rebalancing mechanisms, and exit strategies that protect capital while maximising long-term returns. Professional investors implement systematic approaches to LST allocation that consider correlation with other portfolio assets, liquidity requirements, and risk tolerance parameters.

Yield optimisation and Performance Enhancement

Advanced LST strategies focus on yield optimisation through protocol selection, timing strategies, and complementary DeFi activities that enhance overall returns while managing additional risks. Yield optimisation requires understanding protocol economics, market dynamics, and opportunity costs associated with different allocation strategies.

Protocol selection criteria include historical performance, fee structures, validator quality, and ecosystem integration that impact net yields and growth potential. Sophisticated investors analyse these factors systematically to identify protocols offering superior risk-adjusted returns and long-term value creation opportunities.

Complementary strategies include using tokenised staking tokens as collateral for borrowing, participating in liquidity provision, and engaging in yield farming activities that compound returns while introducing additional risks. These strategies require careful risk assessment and active management to ensure positive risk-adjusted outcomes.

Market Timing and Cyclical Considerations

LST returns and protocol performance exhibit cyclical patterns related to Ethereum network activity, validator queue dynamics, and broader cryptocurrency market conditions that create timing opportunities for strategic investors. Understanding these cycles enables better entry and exit timing while optimising long-term returns.

Validator queue dynamics impact staking yields and withdrawal timelines, creating periods of higher or lower relative attractiveness for LST participation. Monitoring queue lengths, activation times, and exit delays helps investors optimise their staking timing and protocol selection decisions.

Market cycle considerations include correlation with broader cryptocurrency markets, regulatory developments, and technological upgrades that impact liquid staking protocol valuations and user adoption. Strategic investors incorporate these factors into their allocation decisions and rebalancing strategies to optimise long-term performance.

Detailed Feature Comparison

Yield and Rewards

APY Breakdown

- Frax: 3.5-4.0% (highest due to MEV optimisation)

- Lido: 3.2-3.8% (competitive with low fees)

- ETH staking pool: 3.0-3.5% (slightly lower due to RPL rewards)

- Coinbase: 2.8-3.2% (lowest due to higher fees)

Reward Distribution

- Lido (stETH): Daily rebasing increases token balance

- RocketPool (rETH): Token appreciates in value over time

- Frax (sfrxETH): Vault shares appreciate in value

- Coinbase (cbETH): Token appreciates relative to ETH

Liquidity and Trading

DEX Liquidity (Daily Volume)

- stETH: $100M+ daily volume across all DEXs

- rETH: $10-20M daily volume

- sfrxETH: $5-10M daily volume

- cbETH: $5-15M daily volume

DeFi Integration

- Lido: Supported by 100+ DeFi protocols

- RocketPool: Growing support, 50+ protocols

- Frax: Strong integration within Frax ecosystem

- Coinbase: Limited DeFi integration

Security and Risk Assessment

Smart Contract Risk

- Lido: Multiple audits, bug bounty program, battle-tested

- RPL protocol: Extensive audits, innovative security model

- Frax: Audited but newer, evolving protocol

- Coinbase: centralised, traditional security model

Slashing Protection

- Lido: Insurance available, diversified validator set

- decentralised staking: RPL collateral provides slashing insurance

- Frax: Protocol-level protections

- Coinbase: Coinbase covers slashing losses

decentralisation Score

- ETH staking pool: 9/10 - Fully permissionless

- Lido: 6/10 - Curated operator set

- Frax: 5/10 - Team-controlled

- Coinbase: 3/10 - Fully centralised

Use Case Recommendations

Which protocol matches your needs? Let's find the perfect fit for you based on your priorities.

For DeFi Power Users

Recommended: Lido (stETH/wstETH)

Do you actively use DeFi? Lido is your best choice. Here's why:

- Need to trade or use tokens frequently in DeFi? Lido offers the best liquidity for you

- Want the deepest liquidity and tightest spreads? You'll find them with stETH

- Prioritise wide protocol acceptance? stETH is accepted everywhere you need

- Value proven track record and stability? Lido has operated flawlessly since 2020

For Decentralisation Maximalists

Recommended: Rocket Pool (rETH)

Do you believe in Ethereum's decentralised future? Rocket Pool aligns with your values:

- Prioritise Ethereum's decentralised future? You're supporting it with rETH

- Want to support permissionless staking? Rocket Pool enables anyone to participate

- Comfortable with slightly lower liquidity? The trade-off supports decentralisation

- Value innovative protocol design? Rocket Pool pioneered permissionless staking

For Yield Optimisation

Recommended: Frax (sfrxETH)

Are you seeking maximum returns? Frax delivers the highest yields for you:

- Seeking the highest possible staking yields? Frax offers 4.0-4.5% APY for you

- Comfortable with newer protocols? Frax's innovation benefits you

- Want exposure to MEV optimisation? You'll capture additional value

- Can navigate dual-token complexity? The extra yield rewards your effort

For Conservative Investors

Recommended: Coinbase (cbETH)

Do you prioritise safety and compliance? Coinbase provides institutional-grade security for you:

- Prioritise regulatory compliance? Coinbase meets all requirements for you

- Want institutional backing and insurance? You're protected by Coinbase's resources

- Prefer simple, straightforward staking? The process is effortless for you

- Already use the Coinbase ecosystem? Integration is seamless for you

Getting Started Guide

Staking with Lido

- Visit lido.fi and connect your wallet

- Enter ETH amount and confirm transaction

- Receive stETH tokens automatically

- Use stETH in DeFi or hold for rewards

- Wrap to wstETH for non-rebasing version

Staking with RPL protocol

- Go to rocketpool.net and connect wallet

- Deposit ETH (minimum 0.01 ETH)

- Receive rETH tokens that appreciate over time

- Use rETH in supported DeFi protocols

- Unstake by swapping rETH back to ETH

Staking with Frax

- Visit app.frax.finance and connect wallet

- Deposit ETH to receive frxETH

- Stake frxETH to get sfrxETH for yields

- Monitor yields in the Frax dashboard

- Unstake through the same interface

Staking with Coinbase

- Log into your Coinbase account

- Navigate to the staking section

- Select ETH staking option

- Choose amount and confirm staking

- Receive cbETH in your wallet

Risk Considerations

Common Risks

- Slashing Risk: Validators can be penalized for misbehavior

- Smart Contract Risk: Bugs in protocol code could cause losses

- Liquidity Risk: LST tokens may trade at discount to ETH

- Regulatory Risk: Changing regulations could affect protocols

Protocol-Specific Risks

- Lido: centralisation risk from large market share

- decentralised staking: RPL token dependency and complexity

- Frax: Newer protocol with less battle-testing

- Coinbase: centralised control and regulatory exposure

Future Outlook

Market Trends

- Growing Adoption: LST becoming standard

- Increased Competition: New protocols entering market

- Regulatory Clarity: Clearer rules emerging globally

- Technical Innovation: Improved MEV capture and yields

Protocol Development

- Lido: V2 upgrade improving decentralisation

- ETH staking pool: Scaling node operator network

- Frax: Expanding to other blockchain networks

- Coinbase: Institutional product development

User Experience optimisation

Accessibility and Inclusive Design

Mobile and Cross-Platform Compatibility

Technical Analysis Framework

Architecture and Design Principles

Liquid staking protocol architecture determines validator selection, reward distribution, and slashing protection mechanisms. Smart contract design, governance frameworks, and validator diversification strategies impact protocol security, decentralisation, and long-term sustainability of staking rewards for token holders.

Integration Capabilities and Ecosystem

Liquid staking protocol integration capabilities affect DeFi strategy implementation, with different protocols offering varying levels of composability and yield optimisation features. Smart contract interactions, governance participation, and reward compounding determine protocol utility for advanced users.

Performance Metrics and Benchmarking

Liquid staking protocol performance depends on validator efficiency, reward distribution accuracy, and slashing protection mechanisms that determine staking returns. Comparing liquid staking solutions requires analysing their different approaches to validator selection and risk mitigation strategies.

Advanced Liquid Staking Analysis and Strategic Implementation

Protocol Architecture and Technical Implementation

Liquid staking protocols represent sophisticated blockchain infrastructure that enables users to maintain liquidity whilstparticipating in network consensus mechanisms through innovative tokenization of staked assets. Technical implementation includes complex smart contract systems, comprehensive validator management frameworks, and sophisticated reward distribution mechanisms that ensure secure and efficient staking operations while maintaining decentralisation principles and network security standards.

Architecture considerations include validator selection algorithms, slashing protection mechanisms, and comprehensive governance frameworks that enable protocol evolution while maintaining security and operational efficiency. Advanced protocols implement sophisticated risk mitigation systems, comprehensive monitoring capabilities, and automated operational procedures that ensure consistent performance and user protection through technological innovation and comprehensive security frameworks.

Economic Models and Yield optimisation Strategies

Liquid staking economic models incorporate complex tokenomics, sophisticated reward distribution mechanisms, and comprehensive fee structures that balance user returns with protocol sustainability and operational requirements. Economic optimisation includes dynamic fee adjustment algorithms, comprehensive yield enhancement strategies, and sophisticated capital efficiency mechanisms that maximise user returns while maintaining protocol viability and long-term sustainability.

Yield optimisation strategies include compound staking mechanisms, sophisticated DeFi integration opportunities, and advanced portfolio management techniques that enable users to maximise returns through strategic asset allocation and comprehensive risk assessment. Professional yield optimisation utilises advanced analytics, systematic rebalancing procedures, and sophisticated hedging strategies that enhance returns while managing volatility and operational risks through professional investment management techniques.

Risk Assessment and Management Frameworks

Comprehensive risk assessment for tokenised staking includes evaluation of smart contract risks, validator performance risks, and protocol governance risks that impact user security and investment returns. Risk mitigation frameworks include sophisticated monitoring systems, comprehensive insurance mechanisms, and advanced risk control strategies that protect user assets while maintaining operational efficiency and protocol functionality through proactive risk assessment and comprehensive security measures.

Operational risk mitigation includes validator diversification strategies, comprehensive slashing protection mechanisms, and sophisticated liquidity management systems that ensure protocol stability and user protection during market volatility and operational challenges. Advanced risk control utilises real-time monitoring, automated risk assessment algorithms, and comprehensive contingency planning that enables rapid response to emerging risks and operational challenges through professional risk mitigation and operational excellence.

DeFi Integration and Ecosystem Participation

Liquid staking tokens enable sophisticated DeFi participation through comprehensive protocol integration, advanced yield farming opportunities, and sophisticated lending and borrowing strategies that enhance returns while maintaining staking rewards. DeFi integration includes utilisation as collateral in lending protocols, participation in automated market making, and sophisticated yield optimisation strategies that compound returns through strategic ecosystem participation and comprehensive DeFi utilisation.

Ecosystem participation strategies include cross-protocol yield farming, sophisticated liquidity provision mechanisms, and advanced portfolio optimisation techniques that maximise returns through strategic asset allocation and comprehensive DeFi integration. Professional ecosystem participation utilises advanced analytics, systematic strategy implementation, and comprehensive risk assessment that enables optimal DeFi utilisation while maintaining appropriate security and operational standards through professional DeFi management and strategic ecosystem engagement.

Regulatory Considerations and Compliance Framework

Liquid staking regulatory landscape includes complex considerations regarding securities classification, tax implications, and jurisdictional compliance requirements that impact protocol operations and user participation. Regulatory compliance includes comprehensive legal framework adherence, proactive regulatory engagement, and sophisticated compliance monitoring that ensures protocol viability whilstprotecting user interests through professional legal management and regulatory excellence.

Compliance frameworks include comprehensive reporting requirements, sophisticated tax optimisation strategies, and advanced regulatory risk assessment that enables protocol operations while maintaining legal compliance and user protection. Professional compliance oversight utilises advanced legal analytics, systematic regulatory monitoring, and comprehensive compliance procedures that ensure ongoing regulatory adherence while maintaining operational efficiency and user accessibility through professional legal oversight and regulatory expertise.

Future Development and Innovation Roadmap

Liquid staking innovation includes advanced protocol development, sophisticated cross-chain integration, and comprehensive ecosystem expansion that enhances user experience while maintaining security and decentralisation principles. Innovation roadmap includes advanced validator technology, sophisticated reward optimisation mechanisms, and comprehensive user experience improvements that position liquid staking protocols for continued growth and mainstream adoption through technological excellence and user-focused development.

Development priorities include advanced scalability solutions, sophisticated interoperability frameworks, and comprehensive ecosystem integration that enables seamless user experience while maintaining protocol security and operational efficiency. Future innovation focuses on user accessibility improvements, advanced yield optimisation mechanisms, and sophisticated risk mitigation enhancements that support mainstream adoption while maintaining the security and decentralisation principles that define LST protocol excellence and long-term sustainability.

Conclusion

The LST landscape in 2025 offers excellent options for different user preferences. Lido dominates with the best liquidity and DeFi integration; RocketPool leads in decentralisation; Frax offers the highest yields; and Coinbase provides institutional-grade compliance. Each protocol has carved out its niche in the rapidly expanding liquid staking ecosystem.

For most users, Lido provides the best balance of features, liquidity, and reliability. Decentralisation advocates should consider RocketPool, while yield seekers may prefer Frax. Conservative investors will appreciate Coinbase's regulatory compliance and institutional backing. The choice ultimately depends on your specific priorities and risk tolerance.

Consider diversifying across multiple protocols to balance risks and benefits. The LST space continues to evolve rapidly, with innovations and improvements emerging across all major protocols. Each protocol serves different market segments and risk profiles, making the ecosystem more robust and competitive.

When choosing an LST protocol, evaluate your priorities: maximum liquidity for active trading, decentralisation for philosophical alignment, highest yields for return optimisation, or regulatory compliance for institutional requirements. The maturation of tokenised staking infrastructure has made these protocols increasingly reliable and user-friendly, with sophisticated risk mitigation systems and insurance mechanisms protecting user funds.

The future of liquid staking looks promising, with continued innovation in yield optimisation, cross-chain compatibility, and user experience improvements. As Ethereum's staking ecosystem matures, liquid staking protocols will play an increasingly important role in making staking accessible to all users while maintaining the security and decentralisation of the network.

Sources & References

Frequently Asked Questions

- What is LST and how does it work?

- LST allows you to stake cryptocurrency while maintaining liquidity through derivative tokens. When you stake ETH on Lido, you receive stETH tokens representing your staked position. These tokens can be traded, used as collateral in DeFi, or held for staking rewards, providing flexibility that traditional staking lacks.

- Which LST protocol is safest?

- Lido and ETH staking pools are considered the safest with extensive security audits, proven track records, and large TVL. Lido has the longest operational history and the largest validator network. RocketPool offers more decentralisation with permissionless validators. Both have insurance mechanisms and have never experienced major security breaches.

- Can I lose money with LST?

- Yes, risks include smart contract vulnerabilities, validator slashing penalties, and LST token depegging during market stress. Whilst protocols have insurance and security measures, no system is risk-free. Diversify across multiple protocols and never stake more than you can afford to lose.

- What is the difference between Lido and RPL protocol?

- Lido offers higher liquidity and broader DeFi integration with 30+ professional validators. Rocket Pool prioritises decentralisation with permissionless validators and requires 16 ETH to run a node. Lido is better for DeFi users, Rocket Pool for those valuing decentralisation and wanting to run validators.

- Do LST tokens maintain their peg?

- LST tokens typically trade close to 1:1 with their underlying asset but can depeg during market stress or liquidity crunches. stETH briefly depegged to 0.95 ETH during the 2022 bear market but recovered. Use established protocols with deep liquidity to minimise depeg risk.

- Can I use LST tokens in DeFi?

- Yes, LST tokens like stETH and rETH are widely accepted in DeFi protocols. Use them as collateral on Aave or Maker, provide liquidity on Curve, or participate in yield farming strategies. This allows earning staking rewards plus additional DeFi yields, though it increases complexity and risk.