Wirex payment card Withdrawal Guide 2025

Convert your cryptocurrency into cash with Wirex. This comprehensive 2025 guide covers ATM cash access, bank transfers, costs, limits, plus optimisation strategies to minimise expenses.

Introduction

How does Wirex help you access crypto? The Wirex card has revolutionised how cryptocurrency holders access their digital assets. It provides a seamless bridge. You connect the cryptocurrency ecosystem with traditional financial infrastructure. As one of the pioneering cryptocurrency debit cards, Wirex enables you to spend Bitcoin, Ethereum, and other digital assets. You can use millions of merchants worldwide. You earn cashback rewards in cryptocurrency. This comprehensive guide explores the available withdrawal methods. You'll learn to efficiently convert your cryptocurrency holdings into cash. Use ATM withdrawals and bank transfers.

Why understand Wirex withdrawals? Understanding the Wirex withdrawal system is crucial. You maximise the utility of your cryptocurrency investments. You minimise costs and complications. The platform offers multiple ways to access your funds. Each has distinct advantages, limitations, and fee structures. These can significantly impact your overall returns. Are you making occasional cash withdrawals? Planning larger transfers? Mastering Wirex fund extraction saves you substantial amounts in fees. You have the flexibility to access your cryptocurrency wealth whenever you need to.

How has the crypto card landscape evolved? The cryptocurrency card landscape has evolved dramatically. Wirex first launched years ago. Regulatory changes happened. Technological improvements came. Increased adoption created new opportunities and challenges. In 2025, Wirex continues to adapt. It offers enhanced security features. Geographic coverage expanded. Client experience improved. Competitive fee structures remain. This evolution has made Wirex cards increasingly attractive. Both casual cryptocurrency users and serious investors benefit. You get practical ways to utilise your digital assets in everyday transactions.

How secure is Wirex? Security considerations play a paramount role. This applies to cryptocurrency card usage. Particularly when dealing with withdrawals and cash access. The Wirex platform implements multiple layers of protection. Your funds are safeguarded. Advanced encryption works. Multi-factor authentication helps. Real-time transaction monitoring protects you. Understanding these security features helps. Implementing best practices for card usage protects your cryptocurrency holdings. You ensure smooth, reliable access to your funds when you need them.

What will this guide cover? This guide provides detailed insights. You'll optimise your Wirex card usage. Get maximum efficiency and cost-effectiveness. We'll explore advanced strategies. Minimise withdrawal fees. Maximise cashback rewards. Navigate regional restrictions. These may affect your ability to access funds. Additionally, we'll cover troubleshooting common issues. Understanding compliance requirements helps. Leveraging the full potential of the Wirex ecosystem enhances your cryptocurrency experience. You get financial flexibility in an increasingly digital world.

Why is crypto-fiat integration important? The integration of cryptocurrency with traditional payment systems represents a fundamental shift. How do we think about money? Financial transactions are changing. Wirex has positioned itself at the forefront. You get the ability to seamlessly transition. Move between digital and fiat currencies. No complexity is typically associated with cryptocurrency exchanges. This accessibility has opened new possibilities. Cryptocurrency adoption grows. Digital assets become more practical for everyday use. You maintain security and decentralisation benefits. These make cryptocurrencies attractive to investors and technology enthusiasts alike.

What will you learn? This comprehensive guide will equip you with knowledge and strategies. You'll maximise the benefits of your Wirex card. Minimise costs. Avoid common pitfalls. These can impact your cryptocurrency spending experience. From understanding fee structures to optimising withdrawal timing, we cover everything. Leverage advanced features. Troubleshoot potential issues. Use your Wirex card effectively and efficiently in 2025's evolving cryptocurrency landscape. For broader crypto education, explore our complete cryptocurrency guide.

What extra features does Wirex offer? Beyond basic withdrawal functionality, the Wirex card ecosystem offers sophisticated features. These enhance the client experience. They add value for cryptocurrency holders. The platform's cashback rewards program is denominated in cryptocurrency. You earn passive income from everyday spending. You simultaneously build your digital asset portfolio. This innovative approach represents a significant departure. Traditional credit card cashback systems differ. You get exposure to the potential for cryptocurrency appreciation. Immediate spending benefits come alongside. For detailed analysis, see our Wirex review and our crypto cards comparison.

What are X-Accounts? The Wirex X-Accounts feature provides you with multi-currency wallets. These support both fiat and cryptocurrency holdings. You get seamless conversion between different assets. No need for external exchanges. This integrated approach simplifies the management of diverse cryptocurrency portfolios. You maintain flexibility. Access funds in various currencies. This depends on spending needs and market conditions. The ability to hold multiple currencies simultaneously provides natural hedging opportunities. You reduce exposure to single-currency volatility.

Wirex's partnership with major payment networks ensures broad acceptance of the card across millions of merchants worldwide, effectively transforming cryptocurrency holdings into universally accepted payment instruments. This extensive merchant network includes online retailers, physical stores, restaurants, hotels, and service providers, enabling users to spend their cryptocurrency holdings in virtually any situation where traditional payment cards are accepted. The seamless integration with existing payment infrastructure eliminates the friction typically associated with cryptocurrency spending.

The platform's mobile application provides comprehensive account management capabilities, including real-time transaction monitoring, instant notifications, spending analytics, and security controls that allow users to freeze or unfreeze their cards. These features provide users with unprecedented control over their cryptocurrency spending while maintaining the convenience and accessibility expected from modern banking services. The application's intuitive interface makes complex cryptocurrency operations accessible to users regardless of their technical expertise.

Wirex's commitment to legal adherence and security standards has positioned the platform as a trusted intermediary between the cryptocurrency ecosystem and traditional financial infrastructure. The company maintains licenses and registrations across multiple jurisdictions, ensuring users benefit from regulatory protections when accessing innovative cryptocurrency services. This adherence to legal requirements provides users with confidence that their funds are managed in accordance with established financial standards and best practices.

Understanding the Wirex System

Wirex operates as a bridge between digital assets and traditional finance, offering a Visa debit card that lets you spend virtual currencies anywhere Visa is accepted. The service functions by converting your cryptocurrency holdings into fiat currency, which gets loaded onto your debit solution for spending or cash retrieval.

Unlike traditional cryptocurrency exchanges that require you to sell digital currencies plus transfer funds to a bank account, Wirex provides immediate access to your converted funds through their payment system. This makes it particularly beneficial for travellers, frequent spenders, or anyone who requires quick access to cash from their cryptocurrency holdings.

Supported Digital Assets and Fiat Money

Supported Digital Assets

Wirex supports a wide range of virtual currencies for conversion plus spending:

- Major Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC)

- Stablecoins: USDT, USDC, DAI, TUSD

- Altcoins: XRP, Stellar (XLM), Chainlink (LINK)

- Native Token (WXT): Wirex token with additional benefits

Supported Fiat Currencies

Available traditional currencies vary by region but commonly include:

- EUR: Available across European Union countries

- GBP: United Kingdom plus select territories

- USD: United States plus USD-accepting regions

- Regional Currencies: SGD, AUD, CAD, JPY (availability varies)

The Wirex card supports multiple fiat currencies for withdrawals, providing flexibility for international users and travellers.

Cash Access Methods: ATM vs Bank Transfer

ATM Cash Withdrawals

ATM access is the most common way to obtain physical currency from your Wirex debit card. The process is straightforward plus works at any ATM that accepts Visa cards worldwide.

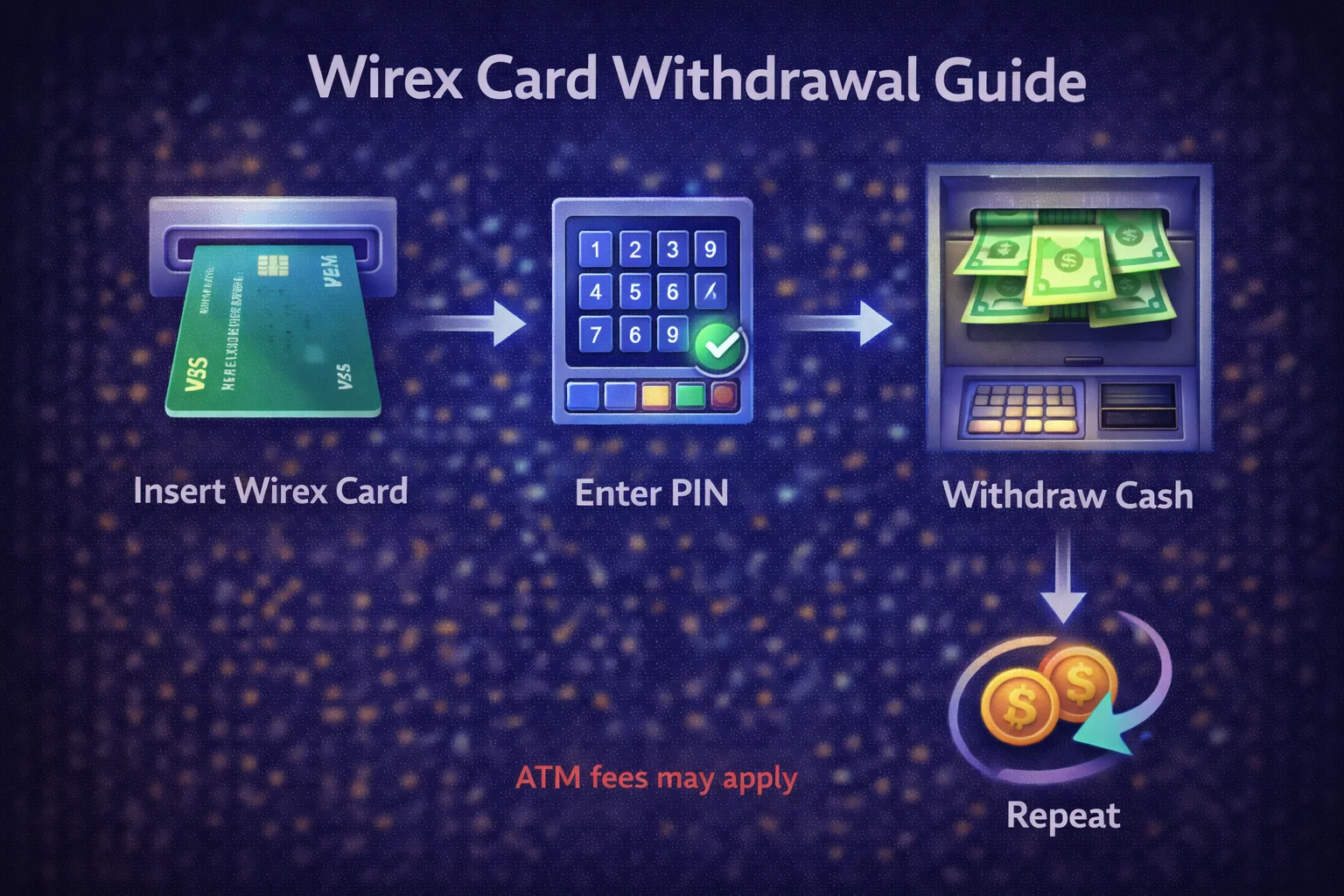

ATM Withdrawal Process

- Locate a compatible ATM: Look for Visa or Mastercard logos

- Insert or tap your card: Follow the ATM prompts

- Enter your PIN: Use the 4-digit PIN set in your Wirex app

- Select withdrawal amount: Choose from preset amounts or enter custom amount

- Choose local currency: Always select local currency to avoid DCC fees

- Collect cash plus receipt: Keep receipt for record-keeping

Bank Transfer Withdrawals

In supported regions, Wirex allows direct bank transfers from your account balance to your traditional bank account. This method is beneficial for larger amounts or when you prefer not to use ATMs.

Bank Transfer Process

- Open Wirex app: Navigate to the Transfer section

- Add bank account: Enter your bank details (one-time setup)

- Verify account: Complete any required verification steps

- Initiate transfer: Enter amount plus confirm transaction

- Wait for processing: Transfers typically take 1-3 business days

Step-by-Step Cash Access Guide

Pre-Withdrawal Setup

- Complete KYC verification: Upload ID documents plus complete identity verification

- Order your physical card: Request card delivery through the app

- Activate your card: Follow activation instructions when the card arrives

- Set your PIN: Choose a secure 4-digit PIN in the app

- Load funds: Deposit cryptocurrencies or fiat into your Wirex account

Converting Crypto to Fiat

Before withdrawing cash, you need to convert your cryptocurrencies to traditional currency:

- Open the Wirex app: Navigate to the Exchange section

- Select currencies: Choose crypto source plus fiat destination

- Check exchange rate: Review the current rate plus any fees

- Enter amount: Specify how much cryptocurrency to convert

- Confirm exchange: Complete the conversion transaction

- Verify balance: Check that fiat funds appear in your card wallet

Making Your First ATM Withdrawal

- Find a suitable ATM: Prefer bank-owned ATMs to minimise surcharges

- Check your balance: Verify available funds in the Wirex app

- Insert card plus enter PIN: Follow standard ATM procedures

- Select withdrawal amount: Stay within daily limits

- Choose local currency: Decline any currency conversion offers

- Complete transaction: Take cash, card, plus receipt

- Verify transaction: Check the app for transaction confirmation

Comprehensive Fee Structure plus Limits

ATM Withdrawal Fees

Wirex ATM withdrawal fees vary by account tier plus region:

- Standard Account: 2.5% fee with €2.50 minimum

- Premium Account: 1.5% fee with €1.50 minimum

- Metal Account: 1% fee with €1 minimum

- ATM Operator Fees: Additional fees may apply from ATM owners

Daily plus Monthly Limits

| Account Tier | Daily ATM Limit | Monthly Limit | Annual Limit |

|---|---|---|---|

| Standard | €500 | €2,500 | €15,000 |

| Premium | €1,000 | €5,000 | €50,000 |

| Metal | €2,000 | €10,000 | €100,000 |

Exchange plus Conversion Fees

- Crypto to Fiat: 1-2% spread depending on currency pair

- Foreign Exchange: 1.5-3% markup on interbank rates

- Weekend Trading: Additional 1% fee for weekend conversions

- WXT Token Benefits: Reduced fees when holding WXT tokens

Regional Availability and Compliance

Supported Regions

Wirex operates in 130+ countries with varying levels of service:

Full Service Countries

- European Union: Complete card and crypto services

- United Kingdom: Full functionality with FCA regulation

- Singapore: Licensed operations with MAS oversight

- Australia: AUSTRAC registered services

Limited Service Regions

- United States: Crypto services only, no card issuance

- Canada: Restricted card functionality

- Japan: Crypto exchange services with limited card features

Restricted Regions

- China: No services available

- North Korea: Prohibited jurisdiction

- Iran: Sanctions restrictions apply

Professional Wirex Card Management and Advanced Withdrawal Techniques

Strategic Cash Management and Liquidity optimisation

Professional Wirex card users implement sophisticated cash management strategies that optimise liquidity access while minimising fees and maximising rewards through strategic timing and withdrawal planning. Advanced users leverage multiple funding sources, strategic balance management, and optimal withdrawal timing to enhance their overall financial efficiency and reduce operational costs associated with cryptocurrency-to-fiat conversion processes.

Liquidity optimisation techniques include maintaining strategic balances across different cryptocurrencies, timing withdrawals to coincide with favorable exchange rates, and utilising Wirex's various funding options to minimise conversion costs. Professional users monitor market conditions, fee structures, and reward opportunities to optimise their cash management strategies and maximise the value derived from their Wirex card usage.

International Travel and Multi-Currency Management

Wirex card users travelling internationally benefit from sophisticated multi-currency management strategies that minimise foreign exchange costs while maximising convenience and security. Advanced travel strategies include pre-loading appropriate currencies, understanding regional fee structures, and optimising withdrawal timing to take advantage of favorable exchange rates and minimise transaction costs.

International usage optimisation encompasses understanding regional ATM networks, identifying fee-free withdrawal opportunities, and managing currency exposure through strategic balance allocation. Professional travellers implement comprehensive planning strategies that include backup funding sources, emergency access procedures, and optimal currency allocation based on travel destinations and expected expenses.

Security Protocols and Risk Management for High-Value Users

High-value Wirex card users implement comprehensive security protocols that protect against fraud, unauthorised access, and operational risks through systematic security measures and risk management procedures. Advanced security strategies include multi-factor authentication optimisation, transaction monitoring systems, and emergency response procedures that protect user funds while maintaining operational flexibility.

Risk management frameworks encompass daily withdrawal limits optimisation, geographic usage restrictions, and comprehensive monitoring systems that detect unusual activity patterns. Professional users implement layered security approaches that balance convenience with protection, ensuring that their Wirex card usage remains secure while providing necessary access to funds across diverse usage scenarios.

Business and Professional Applications

Business users leverage Wirex cards for professional applications including expense management, international payments, and corporate treasury operations that require efficient cryptocurrency-to-fiat conversion capabilities. Professional applications include systematic expense tracking, automated accounting integration, and comprehensive reporting systems that meet business requirements while optimising process optimisation.

Corporate usage strategies encompass employee expense management, international business travel support, and treasury operations that benefit from Wirex's cryptocurrency integration capabilities. Businesses implement comprehensive policies and procedures that govern Wirex card usage while ensuring compliance with corporate financial controls and regulatory requirements.

Comprehensive Wirex Platform Integration and Ecosystem utilisation

DeFi Integration and Yield optimisation Strategies

Advanced Wirex users integrate their card usage with broader DeFi strategies that optimise yield generation while maintaining liquidity access through strategic balance management and yield farming activities. Integration strategies include using Wirex as a fiat off-ramp for DeFi profits, maintaining strategic balances for immediate liquidity needs, and optimising the relationship between yield generation and spending requirements.

Yield optimisation approaches encompass timing DeFi position exits to coincide with spending needs, using Wirex card balances as emergency liquidity reserves, and implementing systematic approaches to converting DeFi yields into spendable fiat currency. Professional users develop comprehensive strategies that balance yield generation with practical spending requirements while maintaining appropriate risk management protocols.

Portfolio Management and Asset Allocation Strategies

Sophisticated Wirex users implement comprehensive portfolio management strategies that integrate card usage with broader cryptocurrency investment approaches through strategic asset allocation and rebalancing procedures. Portfolio integration includes using Wirex balances as tactical allocation tools, implementing systematic rebalancing through card funding, and optimising overall portfolio liquidity through strategic Wirex card management.

Asset allocation strategies encompass maintaining appropriate cryptocurrency exposure through Wirex balances, using card spending as a systematic profit-taking mechanism, and implementing dollar-cost averaging strategies through regular card funding activities. Professional users develop comprehensive approaches that integrate Wirex card usage with their broader investment strategies and financial planning objectives.

Tax optimisation and Compliance Strategies

Professional Wirex card users implement sophisticated tax optimisation strategies that minimise tax liabilities while maintaining compliance with applicable regulations through systematic record-keeping and strategic transaction timing. Tax optimisation includes understanding the tax implications of cryptocurrency-to-fiat conversions, implementing tax-loss harvesting strategies, and maintaining comprehensive records for tax reporting purposes.

Compliance strategies encompass systematic transaction documentation, understanding jurisdictional requirements, and implementing procedures that ensure accurate tax reporting while optimising overall tax efficiency. Professional users work with tax advisors to develop comprehensive strategies that integrate Wirex card usage with broader tax planning objectives while maintaining full compliance with applicable regulations.

Full Service Regions

- European Union: Complete card and banking services

- United Kingdom: Full functionality with GBP support

- United States: Limited availability in select states

- Asia-Pacific: Singapore, Australia, Japan (varying features)

Limited Service Regions

- Restricted Countries: Some features may be unavailable

- Compliance Requirements: Enhanced KYC may be required

- Currency Limitations: Limited fiat currency options

Regulatory Considerations

Wirex maintains compliance with local regulations in each operating jurisdiction:

- EU Regulations: MiCA compliance and PSD2 requirements

- UK Compliance: FCA registration and e-money license

- US Regulations: State-by-state money transmitter licenses

- AML/KYC: Enhanced due diligence for high-value transactions

Cost optimisation Strategies

minimising Withdrawal Costs

- Upgrade Account Tier: Higher tiers offer reduced costs plus higher limits

- Hold WXT Tokens: Native token provides fee discounts

- Batch Withdrawals: Make fewer, larger withdrawals to reduce fixed costs

- Choose Bank ATMs: Avoid independent ATMs with high surcharges

- Time Conversions: Convert crypto during favorable market conditions

Foreign Exchange optimisation

- Local Currency Selection: Always choose local currency at ATMs

- Decline DCC: Refuse dynamic currency conversion offers

- Monitor conversion rates: Convert during favorable FX conditions

- Use Base Currency: Withdraw in your card's base currency when possible

Strategic Planning

- Travel Planning: Convert funds before travelling to avoid weekend costs

- Limit Management: Plan withdrawals to maximise daily/monthly limits

- Fee Tracking: Monitor total costs to optimise withdrawal patterns

- Alternative Methods: Consider bank transfers for larger amounts

Security Best Practices

App Security

- Biometric Authentication: Enable fingerprint or face recognition

- Strong PIN: Use a unique 4-digit PIN not used elsewhere

- Two-Factor Authentication: Enable 2FA for account access

- Regular Updates: Keep the Wirex app updated to latest version

Card Security

- Card Controls: Use app controls to freeze/unfreeze your Wirex payment card

- Transaction Limits: Set appropriate spending plus ATM limits

- Real-time Notifications: Enable instant transaction alerts

- Secure Storage: Keep Wirex crypto card in RFID-blocking wallet

ATM Safety

- Choose Safe Locations: Use ATMs in well-lit, busy areas

- Cover PIN Entry: Shield keypad when entering PIN

- Check for Skimmers: Inspect card reader for unusual devices

- Monitor Surroundings: Be aware of people watching transactions

Troubleshooting Common Issues

Transaction Declined Issues

- Insufficient Balance: Check available fiat balance in app

- Daily Limit Exceeded: Verify you haven't reached daily limits

- Regional Restrictions: Confirm Wirex Visa card works in your location

- ATM Compatibility: Try different ATM or bank location

- Card Status: Ensure Wirex debit card is active plus not frozen

Fee plus Rate Issues

- Unexpected Costs: Check for ATM operator surcharges

- Poor currency rates: Verify you declined DCC at ATM

- Weekend Premiums: Avoid conversions during weekends

- Multiple Conversions: Check for unnecessary currency conversions

Technical Problems

- App Connectivity: Ensure stable internet connection

- Card Activation: Complete activation process if new Wirex payment card

- PIN Issues: Reset PIN through app if forgotten

- Account Verification: Complete any pending KYC requirements

Professional Wirex Strategies and Corporate Implementation

Enterprise Cryptocurrency Card Management and Treasury Integration

Professional Wirex implementations enable sophisticated corporate cryptocurrency spending strategies that leverage crypto-to-fiat conversion capabilities for business expense management, systematic treasury optimisation, and comprehensive financial operations while maintaining legal adherence and process optimisation. Enterprise applications include systematic corporate spending strategies, comprehensive expense management frameworks, and advanced treasury integration techniques that optimise cryptocurrency utilisation while maintaining appropriate oversight and compliance requirements for professional cryptocurrency operations and corporate financial management across multiple jurisdictions and evolving regulatory frameworks.

Advanced corporate strategies require comprehensive understanding of Wirex fee structures, conversion mechanisms, and compliance requirements that enable sophisticated cryptocurrency spending operations while maintaining fiduciary responsibilities and institutional financial management standards. Professional users implement systematic spending optimisation procedures, comprehensive expense tracking systems, and advanced compliance frameworks that ensure optimal cryptocurrency utilisation while maintaining appropriate oversight and legal adherence for corporate cryptocurrency operations and professional digital asset management across complex business requirements and financial regulations.

Advanced Withdrawal optimisation and Cost Management

Professional Wirex withdrawal strategies require systematic optimisation of conversion timing, fee management, and currency selection that minimises costs while maintaining operational flexibility for corporate cryptocurrency operations. Advanced users implement comprehensive cost analysis procedures, systematic timing optimisation, and sophisticated currency management techniques that maximise after-fee value while managing foreign exchange risks and operational complexity for professional cryptocurrency spending and corporate treasury management across multiple currencies and market conditions.

Cost optimisation strategies include systematic fee analysis, comprehensive conversion timing, and advanced currency selection techniques that minimise total costs while maintaining process optimisation. Professional users implement automated monitoring systems, comprehensive cost tracking, and systematic optimisation procedures that ensure consistent cost management while maintaining appropriate operational flexibility and legal adherence for corporate cryptocurrency operations and professional digital asset utilisation across evolving fee structures and market conditions.

Real-World Usage Examples

Case 1: Digital Nomad in Southeast Asia

User: Sarah, freelance developer travelling through Thailand, Vietnam, plus Indonesia

Challenge: Needed reliable access to crypto funds without high exchange costs

Solution: Used Wirex payment solution for daily ATM cash access (€200-300 per transaction) to minimise per-transaction costs. Converted BTC to EUR during favorable FX rates plus kept balance on the solution.

Result: Saved approximately 15% compared to traditional currency exchange services. Total costs: 2.5% ATM + 1% FX vs 8-10% at local exchange bureaus.

Case 2: Emergency Cash Access in Europe

User: Marco, Italian investor with crypto portfolio

Challenge: Needed €5,000 cash urgently for property deposit, but bank transfer would take 3-5 days

Solution: Converted ETH to EUR on Wirex, made five daily ATM cash access operations of €1,000 over 5 days (within daily limits). Used Premium tier to reduce costs.

Result: Accessed funds within hours instead of days. Total cost: €125 in ATM charges (2.5%) vs €50 bank transfer charge but gained 4 days of time value.

Case 3: Business Expense Management

User: Tech startup paying contractors in crypto

Challenge: Contractors needed local currency for living expenses

Solution: Issued platform payment solutions to contractors, loaded with USDC monthly. Contractors either accessed currency locally or used the solution to make purchases.

Result: Eliminated international wire transfer charges (€25-50 per transfer). Contractors saved 3-5% on currency conversion vs traditional banks. Company maintained crypto-native payment flow.

Case 4: Travel Spending optimisation

User: James, UK resident travelling to US for 2 weeks

Challenge: Wanted to avoid UK banks' 3% foreign transaction charges

Solution: Loaded platform payment solution with £2,000 equivalent in USDC. Used the solution for all purchases and 2 terminal accesses ($500 each) for currency needs.

Result: Paid only 1% FX charge on platform vs 3% on UK debit solution. Saved £40 on £2,000 spending. Terminal charges: $25 total (2.5% on $1,000) vs potential $60 with UK bank.

Case 5: Crypto Profit realisation

User: Anna, German crypto trader

Challenge: Wanted to spend trading profits without selling the entire position or waiting for bank transfers

Solution: Converted 20% of BTC gains to EUR on the platform payment solution monthly. Used the solution for daily expenses and occasional terminal accesses.

Result: Maintained 80% crypto exposure while accessing profits instantly. Avoided exchange access charges (0.5-1%) and bank transfer delays. Spent directly from crypto gains with 1-2.5% total cost.

Advanced Access Strategies

Multi-Currency optimisation

For users dealing with multiple currencies, Wirex offers sophisticated balance management options. You can hold balances in EUR, USD, GBP, plus various cryptocurrencies simultaneously. This allows you to:

- Currency Arbitrage: Convert between fiat currencies when exchange rates are favorable

- Regional optimisation: Use local currency balances to avoid FX costs entirely

- Hedging Strategies: Maintain stable coin balances to protect against crypto volatility

- Tax optimisation: Time conversions to align with tax planning strategies

- Travel Efficiency: Pre-load destination currencies before international trips

- Business Operations: Manage multi-currency business expenses efficiently

Timing Your Conversions

The timing of crypto-to-fiat conversions can significantly impact your effective access costs:

- Market Hours: Convert during active trading hours for better spreads

- Weekend Premiums: Avoid conversions during weekends when spreads widen

- Volatility Windows: Use high volatility periods to your advantage

- Batch Conversions: Convert larger amounts less frequently to reduce spread impact

- News Events: Monitor major announcements that might affect exchange rates

- Seasonal Patterns: Understand historical patterns in cryptocurrency markets

Fee minimisation Techniques

Advanced users can employ several techniques to minimise total access costs:

- Tier optimisation: Calculate break-even points for premium account upgrades

- ATM Selection: Research fee-free ATM networks in your region

- Access Scheduling: Plan currency access to maximise daily limits efficiently

- Alternative Methods: Compare ATM vs bank transfer costs for larger amounts

- Loyalty Programs: Take advantage of WXT token benefits plus rewards

- Partnership Benefits: Use partner merchant discounts when available

Business Use Cases

Businesses can leverage Wirex solutions for various operational needs:

- Employee Payments: Issue cards to remote workers for expense management

- Contractor Payments: Pay freelancers in crypto, let them access currency locally

- Travel Expenses: Provide employees with crypto-funded travel cards

- International Operations: Manage multi-currency business expenses efficiently

- Payroll Solutions: Offer cryptocurrency salary options to employees

- Vendor Payments: Streamline international supplier payments

Regional Access Considerations

European Union

EU users benefit from SEPA integration plus regulatory protections:

- SEPA Transfers: Low-cost bank transfers within EU (typically €1-3)

- Regulatory Protection: E-money license provides consumer protections

- ATM Network: Extensive Visa/Mastercard acceptance across EU

- Tax Reporting: Automatic reporting in some jurisdictions

United Kingdom

UK users have specific considerations post-Brexit:

- FCA Regulation: Wirex holds UK e-money license

- Faster Payments: Quick GBP transfers to UK bank accounts

- ATM Charges: Some UK ATMs charge additional costs

- Tax Implications: CGT considerations for crypto conversions

United States

US users face additional regulatory complexity:

- State Regulations: Availability varies by state

- Banking Integration: ACH transfers for bank access

- Tax Reporting: 1099 forms for significant transactions

- Compliance Requirements: Enhanced KYC/AML procedures

Asia-Pacific

APAC users should consider local banking relationships:

- Banking Hours: Limited weekend processing in some countries

- ATM Networks: Varying acceptance rates by country

- Currency Controls: Some countries have access limits

- Local Partnerships: Wirex partnerships with local banks

Advanced Cost optimisation Strategies

Understanding Total Cost of Ownership

When evaluating Wirex costs, consider all components of your total expense:

- Conversion Spreads: Difference between market rate plus Wirex rate (typically 0.5-2%)

- ATM Charges: Wirex charges for currency access (1-2.5% depending on tier)

- Operator Surcharges: Additional charges from ATM owners (€1-5 per transaction)

- Foreign Exchange Costs: Currency conversion charges when travelling abroad

- Monthly Maintenance: Account maintenance charges for premium tiers

- Inactivity Penalties: Charges for dormant accounts after extended periods

Strategic Timing for Conversions

Optimise your crypto-to-fiat conversions by understanding market dynamics:

- Market Volatility: Convert during stable periods to avoid slippage

- Trading Volume: Higher volume periods typically offer better spreads

- Weekend Premiums: Avoid conversions Friday evening to Sunday evening

- Holiday Periods: Reduced liquidity can increase conversion costs

- News Events: Major announcements can cause temporary spread widening

Account Tier optimisation

Calculate the break-even point for premium account upgrades:

- Standard to Premium: Break-even at approximately €500 monthly ATM usage

- Premium to Metal: Break-even at approximately €2,000 monthly ATM usage

- Additional Benefits: Consider non-monetary benefits like priority support

- Annual vs Monthly: Annual subscriptions often provide 10-15% savings

Geographic Arbitrage Opportunities

Leverage regional differences in costs plus availability:

- ATM Density: Urban areas typically have more charge-free options

- Banking Partnerships: Some regions have preferential ATM networks

- Regulatory Advantages: EU users benefit from SEPA integration

- Currency Stability: Use stable local currencies to minimise FX exposure

Advanced Considerations and Professional Implementation

Efficient Wirex card withdrawals depend on understanding ATM networks, daily limits, and fee optimisation strategies. Users should plan withdrawals during off-peak hours, utilise partner ATM networks when available, and maintain adequate card balances to avoid declined transactions and associated penalty fees.

Advanced Wirex Card Strategies and Professional Usage

Corporate and Business Applications

Professional users and businesses can leverage Wirex cards for sophisticated financial management strategies that optimise cryptocurrency utilisation while maintaining operational efficiency and compliance requirements. Corporate applications include implementing expense management systems, establishing employee payment programs, and developing comprehensive cryptocurrency treasury management strategies that integrate traditional business operations with digital asset capabilities.

Business implementations require understanding regulatory compliance obligations, establishing appropriate internal controls, and developing comprehensive policies that address cryptocurrency usage while maintaining operational security and financial oversight. Professional Wirex card usage includes establishing spending limits, implementing approval workflows, and maintaining detailed transaction records that support business accounting and regulatory reporting requirements.

International Travel and Multi-Currency optimisation

Advanced Wirex card strategies include optimising international usage through strategic currency selection, understanding foreign exchange implications, and implementing comprehensive travel financial management that minimises costs whilstmaximising convenience during international transactions. Professional travel strategies require understanding ATM networks, foreign transaction fees, and optimal withdrawal timing that reduces overall costs during extended international travel periods.

Multi-currency optimisation includes maintaining appropriate balances across different cryptocurrencies, understanding exchange rate timing, and implementing strategic conversion approaches that maximise purchasing power whilstminimising transaction costs. Professional users develop systematic approaches to currency management that account for market volatility, transaction timing, and optimal balance allocation across different digital assets supported by the Wirex platform.

Security Enhancement and Risk Management

Professional Wirex card security requires implementing comprehensive protection strategies that address both digital asset security and traditional payment card risks through multi-layered security approaches and systematic risk management protocols. Advanced security measures include establishing transaction monitoring systems, implementing spending alerts, and developing comprehensive incident response procedures that protect against unauthorised usage while maintaining operational convenience.

Risk management strategies include diversifying cryptocurrency holdings across multiple platforms, maintaining appropriate insurance coverage, and implementing comprehensive backup procedures that ensure continued access to funds during various emergency scenarios. Professional users establish systematic security reviews, maintain updated contact information, and develop comprehensive contingency plans that address various potential security incidents or platform disruptions that could affect card functionality and fund access.

Conclusion: Making the Most of Your Wirex Card

The Wirex payment card serves as a convenient bridge between cryptocurrency and traditional finance, enabling you to access your digital assets as cash anywhere in the world. By understanding the fee structure, optimising your withdrawal strategy, and following security best practices, you can minimise costs while maximising the utility of your crypto holdings. For more crypto card options, see our Wirex review or compare alternatives in our crypto cards comparison.

Strategic withdrawal planning becomes essential for cost optimisation, particularly when considering daily limits, fee structures, and timing considerations. Professional users develop systematic approaches to cash access that account for transaction costs, exchange rates, and security protocols while maintaining appropriate liquidity management across different geographic locations and use cases.

The evolving landscape of cryptocurrency payment solutions continues expanding access to digital assets through traditional financial infrastructure. Wirex card users benefit from staying informed about fee changes, new features, and security updates while maintaining disciplined withdrawal practices that optimise cost efficiency and security protocols.

Success with cryptocurrency payment cards requires balancing convenience with cost management, security with accessibility, and innovation with proven financial practices. By implementing the strategies outlined in this guide, users can maximise the value of their Wirex card while minimising unnecessary fees and maintaining appropriate security standards for their digital asset management needs.

Remember always to check the current fees and limits in your Wirex app, as they can change based on regulatory requirements and business updates. Start with small transactions to familiarise yourself with the process before making larger withdrawals.

Conclusion

Wirex card withdrawals offer convenient access to your cryptocurrency funds through traditional ATM networks worldwide. By understanding the fee structure, daily limits, and security protocols, you can optimise your withdrawal strategy and minimise costs while maintaining the security of your digital assets.

The key to successful Wirex card usage lies in strategic planning and understanding the various factors that influence withdrawal costs and limits. By timing your withdrawals appropriately, choosing optimal ATM locations, and maintaining proper security practices, you can significantly reduce fees while maximising the convenience of accessing your cryptocurrency funds in traditional financial environments.

Regular monitoring of your account activity, staying informed about fee structure changes, and implementing robust security measures will help ensure that your Wirex card remains a valuable tool for bridging the gap between cryptocurrency holdings and everyday spending needs. The platform's continued evolution and feature enhancements make it an increasingly attractive option for cryptocurrency users seeking practical access to their digital assets.

As the cryptocurrency ecosystem continues to mature and integrate with traditional financial services, tools like the Wirex card become increasingly important for mainstream adoption. By following the guidelines and best practices outlined in this guide, you can effectively leverage your Wirex card to access cryptocurrency funds while maintaining security and minimising costs in your daily financial activities.

The future of cryptocurrency cards like Wirex looks promising as regulatory frameworks become clearer and traditional financial institutions increasingly embrace digital assets. Enhanced features such as improved exchange rates, expanded merchant acceptance, and additional security measures will continue to make these cards more attractive for everyday use. Staying informed about platform updates and new features will help you maximise the benefits of your Wirex card while adapting to the evolving cryptocurrency landscape.

Remember that successful cryptocurrency card usage requires balancing convenience with security, cost optimisation with accessibility, and staying informed about regulatory changes that may affect your ability to use these services. By implementing the strategies and best practices outlined in this comprehensive guide, you can confidently use your Wirex card as an effective bridge between your cryptocurrency investments and traditional financial needs.

Sources & References

Frequently Asked Questions

- What are the ATM withdrawal limits and fees on Wirex?

- Limits and fees depend on region and account tier. Standard accounts typically have daily ATM limits of €500-1000 with 2-3% withdrawal fees. Premium tiers offer higher limits and reduced fees. Check the latest limits in your Wirex app under Card settings.

- How can I minimise FX costs when using the Wirex crypto card?

- Withdraw in the local currency, decline dynamic currency conversion (DCC), convert crypto to fiat during favourable rates, and make fewer, larger withdrawals to reduce fixed fees. Consider upgrading to premium tiers for better rates.

- Is the Wirex payment card available in my country?

- Wirex is available in 130+ countries, including the EU, UK, US, and Asia-Pacific regions. Check the current list in the Wirex app, as availability is subject to change due to regulatory requirements. Some features may be limited in certain regions.

- Can I transfer funds from Wirex to my bank account?

- Yes, Wirex supports bank transfers in supported regions. Transfer fees and processing times vary by country, typically 1-3 business days, with fees ranging from €1 to €5. This option is useful for larger amounts to avoid ATM fees.

- How secure are Wirex payment card withdrawals?

- Wirex uses standard Visa/Mastercard security protocols, including 3D Secure, real-time notifications, and payment card controls. Enable biometric authentication, transaction alerts, and use card freeze/unfreeze features for maximum security.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.