How to Stake Ethereum (ETH) in 2025

Earn 3-5% APR on your Ethereum while helping secure the network. This comprehensive guide covers solo validator setup, LST protocols, CEX options, risks, and optimisation strategies for 2025.

Introduction

Ethereum staking has transformed from a complex technical process into one of the most accessible and rewarding opportunities in the cryptocurrency ecosystem, offering ETH holders the ability to earn passive income while contributing to the security and decentralisation of the world's leading smart contract platform. Following the successful completion of The Merge in 2022 and the Shanghai upgrade in 2023, Ethereum's proof-of-stake consensus mechanism has matured into a robust and user-friendly system that accommodates both individual stakers and institutional participants.

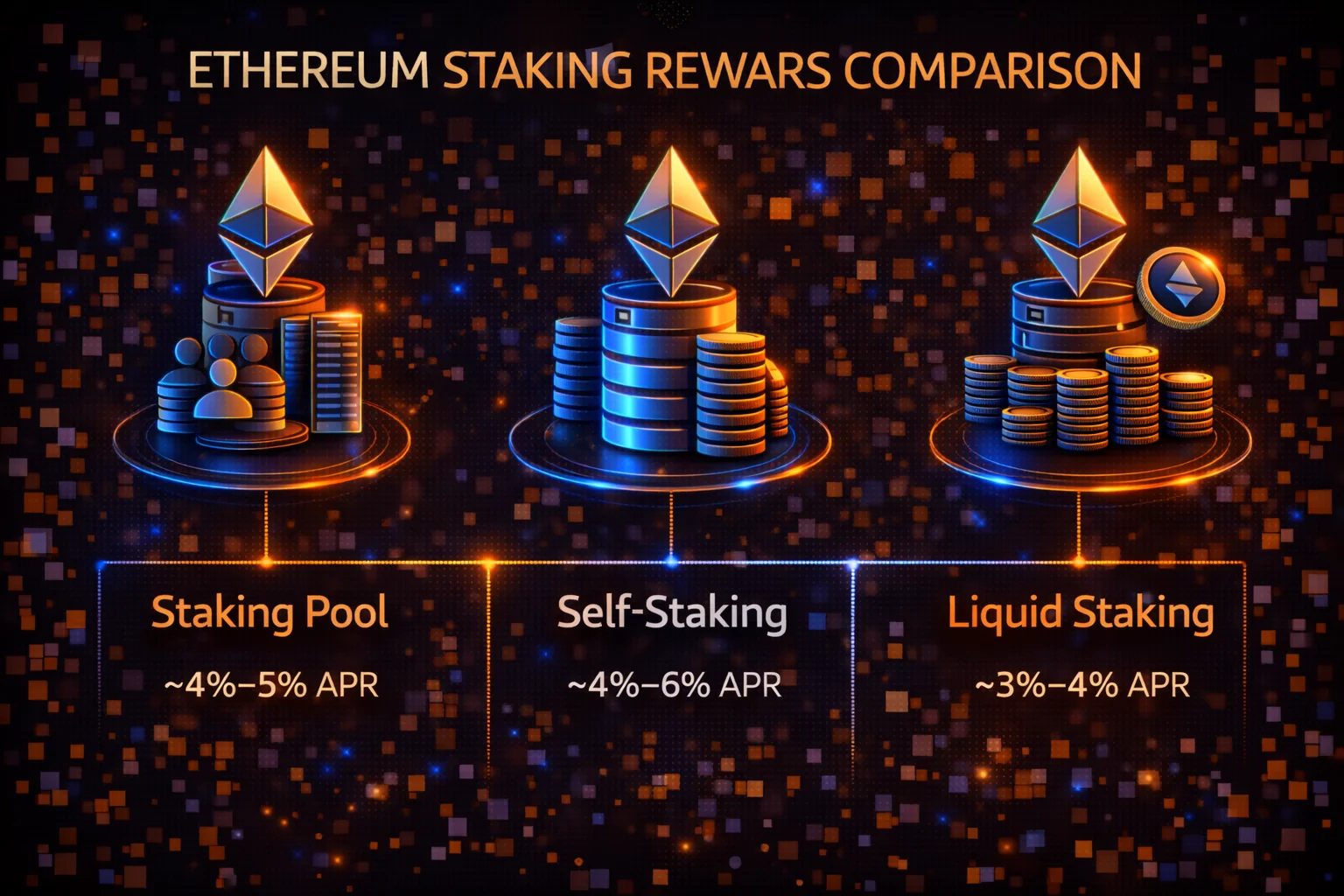

The evolution of Ethereum staking infrastructure has created multiple pathways for participation, each designed to serve different user needs and technical capabilities. Solo staking allows technically proficient users to run their own validators with 32 ETH, maintaining maximum decentralisation and earning full staking rewards. Liquid staking protocols like Lido and Rocket Pool have democratized access by eliminating minimum requirements and providing liquidity through derivative tokens, while centralised exchanges offer the simplest entry point for beginners seeking hassle-free staking experiences.

The current staking landscape in 2025 offers unprecedented flexibility and opportunity, with over 30 million ETH staked across various platforms and methods. Annual percentage yields typically range from 3-5% for basic staking, with opportunities for enhanced returns through DeFi integration and advanced strategies. Understanding the trade-offs between different staking approaches—including custody considerations, liquidity options, technical requirements, and reward structures—is essential for optimising your Ethereum investment strategy.

Security and risk management have become paramount considerations in Ethereum staking, with users needing to evaluate smart contract risks, validator performance, slashing penalties, and platform reliability. The maturation of the staking ecosystem has introduced sophisticated risk mitigation tools, including distributed validator technology, insurance options, and improved withdrawal mechanisms that provide greater flexibility and security for stakers at all levels.

This comprehensive guide provides everything you need to successfully stake Ethereum in 2025, from understanding the fundamental mechanics of proof-of-stake to implementing advanced strategies for maximising returns. We'll explore the various staking methods available, provide detailed step-by-step tutorials for popular platforms, analyse risk factors and mitigation strategies, and share expert insights on optimising your staking approach for long-term success.

Whether you're a first-time staker looking to earn passive income on your ETH holdings or an experienced investor seeking to optimise your staking strategy, this guide will help you navigate the complexities of Ethereum staking and make informed decisions that align with your investment goals, risk tolerance, and technical capabilities in the dynamic cryptocurrency landscape of 2025.

The regulatory environment for Ethereum staking has also evolved significantly, with clearer guidelines emerging in major jurisdictions regarding tax treatment, compliance requirements, and legal frameworks. This regulatory clarity has encouraged institutional participation and provided retail investors with greater confidence in the legitimacy and long-term viability of staking as an investment strategy. Understanding these regulatory considerations is crucial for ensuring compliance and optimising tax efficiency in your staking operations. For specific staking platforms, explore our Lido liquid staking review and ETH staking platforms comparison.

Ethereum Staking After The Merge and Shanghai Upgrade

Ethereum completed its transition to Proof-of-Stake with The Merge in September 2022, fundamentally changing how the network operates [1]. Instead of energy-intensive mining, Ethereum now relies on validators who stake ETH to secure the network and validate transactions.

The Shanghai upgrade in April 2023 was equally transformative, enabling withdrawals of staked ETH for the first time [1]. This eliminated the indefinite lock-up period that previously deterred many potential stakers, making Ethereum staking significantly more attractive and accessible.

Today, Ethereum staking offers a compelling way to earn passive income while contributing to the network's security [2]. With over 30 million ETH staked (approximately 25% of the total supply), the ecosystem has matured, offering multiple staking options suitable for different risk tolerances and levels of technical expertise.

Three Main Ways to Stake ETH in 2025

Ethereum staking has evolved to accommodate different user needs, from technical experts to complete beginners. Each method offers distinct advantages and trade-offs in terms of control, complexity, and returns.

| Method | Min ETH | Est. APR | Custody | Complexity |

|---|---|---|---|---|

| Solo Validator | 32 ETH | 4-5% | Self-Custody | High |

| LST Protocols | 0.01 ETH | 3.5-4% | Protocol | Medium |

| CEX Staking | 0.001 ETH | 3-4% | Custodial | Low |

Solo Validator: Maximum Control and Rewards

Solo staking represents the purest form of Ethereum staking, where you run your own validator node with 32 ETH. This method offers the highest rewards and maximum decentralisation but requires significant technical knowledge and ongoing maintenance.

Advanced Solo Staking Considerations

Running a solo validator involves numerous technical and operational considerations that extend beyond basic setup requirements:

- Hardware Redundancy: Implement backup systems including secondary internet connections, uninterruptible power supplies, and redundant hardware components to minimise downtime

- Client Diversity: Choose minority execution and consensus clients to support network decentralisation and reduce correlation risks during client-specific bugs

- Monitoring and Alerting: Set up comprehensive monitoring systems with real-time alerts for validator performance, attestation effectiveness, and potential slashing conditions

- Security Hardening: Implement advanced security measures including firewall configuration, SSH key management, and regular security updates

- Performance optimisation: Fine-tune validator settings for optimal performance, including proper time synchronization and network configuration

Validator Economics and Profitability

Understanding the economic aspects of solo validation helps optimise returns and manage operational costs:

- Reward Components: Base rewards, attestation rewards, sync committee rewards, and MEV (Maximal Extractable Value) opportunities

- Operational Costs: Electricity consumption (typically $50-100 monthly), internet costs, hardware depreciation, and maintenance time

- Slashing Risks: Potential penalties for validator misbehavior, including offline penalties and more severe slashing for malicious actions

- Opportunity Costs: Compare staking returns with alternative investment opportunities and consider the 32 ETH lock-up period

- Tax Implications: Understand tax treatment of staking rewards in your jurisdiction, including timing of income recognition

Advanced Validator Strategies

Experienced validators can implement sophisticated strategies to maximise returns and minimise risks:

- MEV-Boost Integration: Connect to MEV-Boost relays to capture additional value from block building and transaction ordering

- Smooth Operator: Join smoothing pools to reduce variance in MEV rewards and create more predictable income streams

- Multi-Validator Management: Scale operations across multiple validators while maintaining proper key management and security practices

- Geographic Distribution: Distribute validators across different geographic locations to reduce correlation risks and improve network resilience

- Professional Services: Consider using professional staking services for key management while maintaining control over validator operations

Liquid Staking Protocols: Advanced Analysis

Liquid staking has revolutionized Ethereum staking by solving the liquidity problem while maintaining decentralisation. Understanding the nuances of different protocols helps optimise your staking strategy:

Protocol Comparison and Selection Criteria

Choosing the right liquid staking protocol requires careful analysis of multiple factors beyond simple APR comparisons:

- decentralisation Metrics: Evaluate validator distribution, governance structure, and protocol ownership to assess decentralisation levels

- Smart Contract Risk: Review audit history, bug bounty programs, and protocol maturity to understand technical risks

- Liquidity and Peg Stability: analyse secondary market liquidity and historical peg stability for liquid staking tokens

- Fee Structures: Compare protocol fees, performance fees, and any additional costs that impact net returns

- Governance Participation: Understand how protocols handle Ethereum governance voting and whether token holders can participate

Advanced Liquid Staking Strategies

Sophisticated users can implement complex strategies using liquid staking tokens to maximise returns and manage risk:

- Yield Farming: Use liquid staking tokens as collateral in DeFi protocols to earn additional yields on top of staking rewards

- Arbitrage Opportunities: Monitor price discrepancies between liquid staking tokens and underlying ETH to capture arbitrage profits

- Leveraged Staking: Borrow against liquid staking tokens to increase exposure to Ethereum staking rewards

- Cross-Protocol Strategies: Diversify across multiple liquid staking protocols to reduce concentration risk and optimise returns

- Options Strategies: Use derivatives markets to hedge liquid staking token price risk or generate additional income

Institutional Staking Solutions

Large institutions and high-net-worth individuals require specialised staking solutions that address unique regulatory, operational, and risk management requirements:

Institutional Staking Providers

- Coinbase Institutional: Regulated staking services with institutional-grade custody and compliance features

- Kraken Institutional: Professional staking services with dedicated support and custom reporting

- Figment: specialised institutional staking provider with comprehensive validator infrastructure

- Blockdaemon: Enterprise blockchain infrastructure with managed staking solutions

- Staked: Institutional staking platform with advanced risk management and reporting capabilities

Regulatory and Compliance Considerations

- Securities Regulations: Understand how staking rewards are classified and regulated in different jurisdictions

- Custody Requirements: Ensure staking solutions meet institutional custody standards and regulatory requirements

- Reporting Standards: Implement proper accounting and reporting procedures for staking activities and rewards

- Tax optimisation: Structure staking activities to optimise tax efficiency while maintaining compliance

- Risk Management: Implement comprehensive risk management frameworks for staking operations

Requirements for Solo Staking

- 32 ETH minimum: Required to activate a validator

- Dedicated hardware: Recommended specs include 16GB RAM, 1TB NVMe SSD, and stable internet

- Technical expertise: Command line familiarity and Linux knowledge helpful

- Reliable uptime: 99%+ uptime required to avoid penalties

- Security practices: Proper key management and backup procedures

Solo Staking Process

- Set up execution and consensus clients (e.g., Geth + Prysm)

- Generate validator keys using the official Ethereum deposit CLI

- Make the 32 ETH deposit through the official launchpad

- Wait for validator activation (typically 1-7 days)

- Monitor validator performance and maintain uptime

Solo validators earn the full staking reward (~4-5% APR) plus MEV (Maximal Extractable Value) rewards and priority fees. However, they also bear full responsibility for validator performance and face slashing risks for malicious behaviour or extended downtime.

flexible staking: Flexibility and DeFi Integration

LST protocols have revolutionised Ethereum staking by allowing users to stake any amount of ETH while receiving tradeable tokens representing their staked position. This innovation solves the capital efficiency problem of traditional staking.

Leading tokenised staking Protocols

- Lido (stETH): Largest tokenised staking protocol with ~30% market share

- RocketPool (rETH): decentralised protocol with permissionless node operators

- Frax Ether (sfrxETH): Dual-token model with higher yields for active stakers

- Coinbase cbETH: Institutional-grade tokenised staking from Coinbase

- Binance WBETH: Wrapped beacon ETH from Binance

How LST Protocols Work

When you deposit ETH into a tokenised staking protocol, your funds are combined with those of other users and used to run validators. In return, you receive staking tokens tokens (LSTs) that represent your share of the staked ETH plus accumulated rewards.

These tokens can be used throughout DeFi while still earning staking income, enabling strategies like:

- Lending stETH on Aave for additional yield

- Providing liquidity in Curve pools for trading fees

- Using LSTs as collateral for borrowing

- Participating in yield farming opportunities

LST Protocol Risks

- Smart contract risk: Protocol bugs could affect funds

- Slashing risk: Validator misbehavior affects all token holders

- Depeg risk: LSTs may trade below their ETH value during stress

- centralisation concerns: Large protocols may concentrate validator control

CEX Staking: Simplicity and Convenience

Centralised exchange staking offers the easiest entry point for beginners, requiring just a few clicks to start earning rewards. Major exchanges have built user-friendly interfaces that abstract away the technical complexity of staking.

Popular CEX Staking Options

- Kraken: ETH 2.0 staking with flexible and locked options

- OKX Review: Platform analysis with competitive rates

- Coinbase: Automatic staking for eligible users

- Kraken: On-chain and off-chain staking options

CEX Staking Advantages

- No minimum requirements (often as low as 0.001 ETH)

- One-click staking and unstaking

- No technical knowledge required

- Customer support available

- Often includes additional services like tax reporting

CEX Staking Risks

- Custodial risk: Exchange controls your private keys

- Regulatory risk: Potential restrictions or shutdowns

- Counterparty risk: Exchange insolvency affects your funds

- Lower yields: Exchanges typically take a fee from rewards

Step-by-Step Tutorial: Tokenized Staking with Lido

This tutorial demonstrates how to stake ETH using Lido, the most popular tokenised staking protocol. The process is similar to that of other LST platforms.

Prerequisites

- MetaMask or compatible Web3 wallet installed

- ETH in your wallet (minimum 0.01 ETH recommended)

- Additional ETH for gas fees (~0.001-0.005 ETH)

Staking Process

- Visit Lido: Access the Lido platform

- Connect wallet: Click "Connect wallet" and select MetaMask

- Enter amount: Input the amount of ETH you want to stake

- Review transaction: Check the gas fee and confirm details

- Submit transaction: Click "Submit" and confirm in MetaMask

- Receive stETH: You'll receive stETH tokens that automatically accrue rewards

After Staking

Your stETH balance will gradually increase as delegation rewards are distributed. You can track your rewards on the Lido dashboard or add stETH to your wallet to monitor the balance directly.

Gas Fee optimisation Strategies

Ethereum gas fees can significantly impact your staking returns, especially for smaller amounts. Here are strategies to minimise costs:

Timing Your Transactions

- Best times: Tuesday-Thursday, 2:00-8:00 AM UTC

- Avoid: Weekends and major DeFi events

- Monitor gas prices: Use tools like GasNow or ETH Gas Station

Layer 2 Solutions

Several Layer 2 networks now support staking derivatives with significantly lower fees:

- Arbitrum: Lido stETH available with ~90% lower fees

- Optimism: Multiple LST options

- Polygon: Wrapped staking tokens available

- zkSync Era: Native and bridged staking tokens

Gas Settings optimisation

- Set max priority fee to 1-2 Gwei for non-urgent transactions

- Use "Standard" gas settings unless time-sensitive

- Consider batching multiple DeFi operations together

Withdrawal Strategies and Timeline

The Shanghai upgrade enabled ETH withdrawals, but the process varies depending on your staking method:

Solo Validator Withdrawals

- Partial withdrawals: Rewards above 32 ETH automatically withdrawn

- Full exit: Requires voluntary exit, takes 1-3 days depending on queue

- Exit queue: Limited to ~1,800 validators per day

LST Withdrawals

- Instant swaps: Trade LSTs for ETH on DEXs like Curve or Uniswap

- Protocol withdrawals: Request withdrawal through protocol (1-3 days)

- Arbitrage opportunities: LSTs sometimes trade at discount during high demand

CEX Withdrawals

- Flexible staking: Usually instant or within 24 hours

- Locked staking: Must wait for term completion

- Queue systems: Some exchanges implement withdrawal queues during high demand

Comprehensive Risk Management

Technical Risks

- Slashing: Validators can lose up to 100% of stake for malicious behaviour

- Inactivity penalties: Offline validators lose small amounts over time

- Smart contract bugs: Staking derivatives protocols may have vulnerabilities

- Key management: Lost keys mean lost access to validator rewards

Market Risks

- ETH price volatility: Rewards are in ETH, subject to price fluctuations

- Interest rate risk: Staking yields may decrease as more ETH is staked

- Opportunity cost: Missing out on potentially higher DeFi yields

Regulatory Risks

- Staking regulations: Potential classification as securities

- Tax implications: Changing tax treatment of staking yields

- Exchange restrictions: Potential limitations on staking services

Risk Mitigation Strategies

- Diversify across multiple staking methods

- Use reputable, audited protocols

- Maintain proper backup procedures

- Stay informed about regulatory developments

- Consider insurance options where available

Tax Implications and Record Keeping

Validation rewards have complex tax implications that vary by jurisdiction. Understanding these requirements is crucial for compliance:

General Tax Treatment

- Income tax: Rewards typically taxed as income when received

- Fair market value: Rewards valued at time of receipt

- Capital gains: Additional tax when selling staked ETH or rewards

- Cost basis: Important for calculating future gains/losses

Record Keeping Requirements

- Date and amount of each reward payment

- Fair market value of ETH at time of receipt

- Transaction hashes for verification

- Staking method and platform used

- Any fees paid for staking services

Tax optimisation Strategies

- Use tax-advantaged accounts where possible

- Consider timing of reward claims

- Track cost basis carefully for future sales

- Consult with crypto-experienced tax professionals

Advanced Staking Strategies

Yield optimisation

- LST farming: Use staking derivatives tokens in yield farming

- Leverage strategies: Borrow against staked ETH for additional exposure

- Cross-chain opportunities: Bridge LSTs to other networks for higher yields

- MEV strategies: Solo validators can optimise MEV extraction

Portfolio Allocation

- Core position: 50-70% in stable LST protocols

- Diversification: Split across multiple protocols

- Risk management: Keep some ETH unstaked for flexibility

- Rebalancing: Adjust allocation based on market conditions

Market Analysis and Future Outlook for ETH Staking

Current Market Dynamics

The Ethereum staking landscape in 2025 has matured significantly since the Shanghai upgrade enabled withdrawals in April 2023. Currently, over 30 million ETH is staked, representing approximately 25% of the total ETH supply. This substantial participation demonstrates the network's security and the attractiveness of validation rewards.

Staking yields have stabilized around 3-4% APR for most staking derivatives protocols, with solo validators earning slightly higher returns due to MEV (Maximum Extractable Value) opportunities. The yield environment reflects a healthy balance between network security incentives and sustainable tokenomics.

Institutional Adoption Trends

Institutional adoption of Ethereum staking has accelerated dramatically in 2025. Major financial institutions, pension funds, and corporate treasuries are allocating portions of their portfolios to ETH staking as a yield-generating digital asset. This institutional interest has led to the development of more sophisticated staking infrastructure and compliance-focused solutions.

Regulatory clarity in major jurisdictions has further boosted institutional confidence. The classification of staking income as income rather than new asset creation has provided the certainty institutions needed to participate at scale.

Technological Developments

Several technological improvements are enhancing the staking experience in 2025. Distributed Validator Technology (DVT) is reducing single points of failure for solo stakers, while improvements to client software have made running validators more reliable and efficient.

Layer 2 scaling solutions are also impacting staking dynamics. As more activity moves to L2s, base layer transaction fees have become more predictable, affecting the MEV opportunities available to validators. However, this has also made staking more accessible by reducing the gas costs associated with staking operations.

Competitive Landscape

The flexible staking market has become increasingly competitive, with protocols differentiating through features like governance participation, MEV sharing, and integration with DeFi protocols. Lido maintains its market leadership but faces growing competition from Rocket Pool, Frax Ether, and newer entrants offering innovative features.

centralised exchanges have also improved their staking offerings, with many now providing instant liquidity options and competitive rates. However, the trend towards decentralisation continues, with many users preferring non-custodial solutions despite the additional complexity.

Advanced Portfolio Strategies for ETH Staking

Diversification Approaches

Sophisticated stakers in 2025 often employ diversification strategies across multiple staking methods and protocols. A common approach is the "barbell strategy" - combining the security of established protocols like Lido with smaller allocations to newer, potentially higher-yielding options.

Geographic diversification is also vital for solo stakers. Running validators across different jurisdictions and using diverse infrastructure providers helps mitigate regulatory and operational risks. Cloud provider diversification (AWS, Google Cloud, Azure, and specialised blockchain infrastructure providers) further reduces single points of failure.

Yield optimisation Techniques

Advanced stakers employ various techniques to optimise their yields beyond basic staking rewards. MEV-Boost integration for solo validators can significantly increase returns, though it requires careful consideration of MEV relay selection and potential centralisation concerns.

tokenised staking token strategies involve using stETH, rETH, or other staking tokens derivatives in DeFi protocols to earn additional yield. Popular strategies include providing liquidity to Curve pools, using staking derivatives tokens as collateral for borrowing, or participating in yield farming opportunities.

Risk-Adjusted Return Analysis

Professional stakers conduct thorough risk-adjusted return analysis when selecting staking strategies. This involves evaluating not just the headline APR, but also the volatility of returns, correlation with ETH price movements, and tail risk scenarios.

Sharpe ratio calculations help compare different staking strategies on a risk-adjusted basis. Solo staking typically offers the highest returns but with higher operational risk, while staking derivatives provides more consistent returns with smart contract risk. CEX staking offers the lowest operational complexity but introduces counterparty risk.

Regulatory and Compliance Considerations

Global Regulatory Landscape

The regulatory environment for Ethereum staking has evolved significantly in 2025. Most major jurisdictions now have clear frameworks for staking activities, treating staking rewards as taxable income at the time of receipt. This clarity has enabled institutional participation and professional staking services.

In the United States, the IRS has provided guidance treating stakeholder rewards as ordinary income, with the fair market value at the time of receipt determining the tax basis. The European Union has implemented similar frameworks under MiCA (Markets in Crypto-Assets) regulation, providing harmonized treatment across member states.

Compliance Best Practices

Professional stakers maintain detailed records of all staking activities, including validator performance, reward receipts, and any slashing events. Automated tools and APIs from staking providers help streamline this record-keeping process.

For institutional stakers, compliance extends to custody requirements, reporting obligations, and fiduciary duties. Many institutions work with specialised service providers that offer compliant staking solutions with appropriate controls and reporting capabilities.

Future Regulatory Developments

Regulatory developments continue to evolve, with potential impacts on staking strategies. Proposed regulations around validator concentration, environmental reporting, and consumer protection could affect how staking services operate and market themselves.

Stakers should stay informed about regulatory developments in their jurisdictions and consider how changes might affect their chosen staking strategies. Professional advice from tax and legal experts familiar with digital assets is increasingly important for significant staking operations.

Advanced Ethereum Staking Strategies and Professional optimisation

Liquid Staking Derivatives and Capital Efficiency Optimisation

Liquid staking represents the most sophisticated approach to Ethereum staking. It enables users to maintain capital liquidity. Users earn staking rewards through innovative derivative tokens. Professional liquid staking includes utilisation of platforms like Lido, Rocket Pool, and Frax. These provide stETH, rETH, and frxETH tokens. These tokens can be used across DeFi protocols for additional yield generation. They maintain exposure to Ethereum staking rewards and network security participation.

Capital efficiency optimisation through liquid staking includes implementation of sophisticated yield farming strategies, utilisation of lending protocols for additional income generation, and strategic deployment of staking derivatives across multiple DeFi platforms. Advanced practitioners implement automated rebalancing strategies, systematic monitoring of yield opportunities, and comprehensive risk management procedures that maximise returns while managing smart contract risks and market volatility exposure.

Validator Operation and Technical Infrastructure Management

Professional validator operation requires sophisticated technical infrastructure, comprehensive monitoring systems, and advanced security procedures that ensure optimal performance while maintaining network security and maximising staking rewards. Technical infrastructure includes implementation of redundant hardware systems, sophisticated monitoring capabilities, and comprehensive backup procedures that ensure validator uptime and performance optimisation under various operational conditions.

Advanced validator management includes implementation of automated monitoring systems, sophisticated alerting mechanisms, and comprehensive performance optimisation procedures that maximise validator effectiveness whilstminimising operational risks. Professional validator operation includes understanding of slashing conditions, implementation of comprehensive security procedures, and development of sophisticated operational procedures that ensure consistent performance and reward maximisation.

Risk Management and Slashing Protection Strategies

Ethereum staking involves various risks, including slashing penalties, validator downtime, and smart contract vulnerabilities that require comprehensive risk management strategies to protect staked assets and optimise returns. Professional risk management includes implementation of diversification strategies across multiple validators and platforms, comprehensive monitoring of validator performance, and systematic assessment of platform security and operational procedures.

Slashing protection includes understanding of consensus mechanism requirements, implementation of sophisticated monitoring systems, and development of comprehensive operational procedures that minimise slashing risks while maintaining validator performance. Advanced risk management includes utilisation of insurance products where available, implementation of diversification strategies, and systematic monitoring of network conditions and validator performance metrics.

Tax Optimisation and Regulatory Compliance for Staking

Ethereum staking creates complex tax implications that vary across jurisdictions and require a sophisticated understanding of cryptocurrency taxation, staking reward treatment, and compliance requirements. Professional tax optimisation includes systematic record-keeping of staking rewards, understanding of tax treatment for different staking methods, and strategic timing of staking activities to optimise tax implications while maintaining investment objectives.

Regulatory compliance includes understanding of local cryptocurrency regulations, implementation of appropriate reporting procedures, and systematic documentation of staking activities for tax and regulatory purposes. Advanced tax planning includes consultation with qualified tax professionals, implementation of tax-efficient staking strategies, and comprehensive understanding of evolving regulatory frameworks that impact staking activities and reward taxation.

Portfolio Integration and Strategic Asset Allocation

Ethereum staking integration within broader cryptocurrency and traditional investment portfolios requires sophisticated analysis of risk-return characteristics, correlation patterns, and strategic allocation optimisation. Professional portfolio integration includes systematic analysis of staking returns relative to other investment opportunities, implementation of dynamic allocation strategies, and comprehensive risk assessment that accounts for staking-specific risks and opportunities.

Strategic asset allocation includes understanding of staking's role within diversified portfolios, implementation of systematic rebalancing procedures, and development of comprehensive investment frameworks that optimise risk-adjusted returns while maintaining appropriate diversification. Advanced portfolio management includes consideration of staking lockup periods, liquidity requirements, and strategic timing of staking activities within broader investment strategies and market conditions.

Institutional Staking and Enterprise Solutions

Institutional Ethereum staking requires sophisticated custody solutions, comprehensive compliance frameworks, and advanced operational procedures that meet fiduciary standards while providing competitive staking returns. Professional institutional staking includes evaluation of enterprise staking platforms, implementation of appropriate governance frameworks, and development of comprehensive risk management procedures that ensure regulatory compliance and operational excellence.

Enterprise staking solutions include access to institutional-grade custody platforms, comprehensive reporting and analytics capabilities, and sophisticated operational support that enables efficient staking management for large-scale operations. Institutional approaches include implementation of systematic staking procedures, development of comprehensive governance frameworks, and creation of sophisticated performance measurement systems that meet institutional reporting and oversight requirements.

Future Developments and Protocol Evolution

Ethereum's ongoing development includes implementation of advanced features, protocol improvements, and ecosystem enhancements that will impact staking opportunities and requirements. Professional staking requires understanding of planned protocol upgrades, assessment of their impact on staking operations, and strategic planning for adaptation to evolving network requirements and opportunities.

Protocol evolution includes implementation of advanced consensus mechanisms, development of improved validator economics, and creation of enhanced staking infrastructure that will provide new opportunities and requirements for staking participants. Advanced practitioners maintain awareness of development roadmaps, participate in community discussions, and implement strategic planning procedures that position them for success as the Ethereum ecosystem continues evolving and expanding its capabilities and opportunities.

Ethereum Staking Innovation and Technological Advancement

Distributed Validator Technology (DVT) Implementation

Distributed Validator Technology represents a paradigm shift in Ethereum staking security by distributing validator operations across multiple parties, reducing single points of failure and improving overall network resilience. DVT implementations like SSV Network and Obol Labs enable validators to operate with enhanced security guarantees while maintaining decentralisation principles that are fundamental to Ethereum's long-term success.

Professional DVT deployment involves selecting reliable operator networks, understanding threshold cryptography mechanisms, and implementing monitoring systems that track distributed validator performance across multiple operators. This technology enables institutional validators to achieve higher uptime guarantees while reducing operational risks associated with single-operator validator management.

MEV-Boost Integration and Revenue optimisation

Maximal Extractable Value (MEV) represents a significant additional revenue stream for Ethereum validators through sophisticated block construction and transaction ordering strategies. MEV-Boost integration allows validators to access competitive block building markets while maintaining decentralisation through relay diversity and transparent auction mechanisms.

Professional MEV strategies involve connecting to multiple relay networks, understanding MEV auction dynamics, and implementing monitoring systems that optimise MEV capture while maintaining validator performance and network health. Advanced validators can earn 20-50% additional revenue through sophisticated MEV extraction strategies during high-activity periods.

Liquid Staking Protocol Evolution

Liquid staking protocols continue evolving with innovations including improved validator selection algorithms, enhanced slashing protection mechanisms, and sophisticated reward distribution systems that optimise returns for token holders. Leading protocols like Lido and Rocket Pool implement governance-driven improvements that enhance security and efficiency while maintaining competitive yields.

Advanced liquid staking features include automated validator rotation, performance-based allocation systems, and integration with DeFi protocols that enable compound yield strategies. These innovations make liquid staking increasingly attractive for both retail and institutional participants seeking Ethereum exposure with enhanced liquidity and yield optimisation.

Cross-Chain Ethereum Staking Solutions

Cross-chain liquid staking enables Ethereum staking participation from alternative blockchain networks through bridge technologies and wrapped token mechanisms. These solutions expand access to Ethereum staking while enabling users to participate in high-yield opportunities on Layer 2 networks and alternative chains.

Professional cross-chain strategies involve evaluating bridge security, understanding wrapped token mechanics, and implementing risk management procedures that account for cross-chain risks while accessing enhanced yield opportunities. Layer 2 integration enables liquid staking tokens to be used in sophisticated DeFi strategies with significantly reduced transaction costs.

Ethereum Staking Market Analysis and Economic Dynamics

Post-Merge Economic Impact Assessment

Ethereum's transition to proof-of-stake fundamentally altered the network's economic model, introducing deflationary mechanisms through EIP-1559 fee burning while providing staking rewards to validators. This dual mechanism creates complex dynamics where network usage directly impacts the real yield of staking through fee burning that reduces ETH supply over time.

The relationship between network activity, fee burning, and staking yields creates scenarios where high network usage can make Ethereum deflationary despite ongoing staking rewards. Understanding these dynamics helps stakers evaluate the long-term value proposition of Ethereum staking beyond nominal APY calculations, considering the potential for supply reduction to enhance token value.

Validator Economics and Competition Analysis

Ethereum's validator economics create interesting competitive dynamics where increased participation reduces individual yields but enhances network security. The optimal balance between validator rewards and network security requires careful economic design that incentivizes sufficient participation while maintaining attractive returns for validators.

Professional analysis of validator economics includes understanding the relationship between total staked ETH, reward rates, and network security guarantees. As more ETH becomes staked, individual yields decrease but the network becomes more secure, creating long-term value for all ETH holders through enhanced security and reduced supply through staking lockup.

Institutional Adoption Impact

Institutional adoption of Ethereum staking has accelerated significantly, with major financial institutions, pension funds, and corporate treasuries allocating portions of their portfolios to ETH staking. This institutional interest has led to the development of sophisticated staking infrastructure and compliance-focused solutions that meet institutional requirements.

The impact of institutional adoption extends beyond increased staking participation to include enhanced legitimacy, improved infrastructure, and regulatory clarity that benefits all staking participants. Professional staking services have evolved to meet institutional needs while maintaining the decentralised principles that make Ethereum valuable for long-term wealth preservation.

Future of Ethereum Staking and Strategic Positioning

Protocol Roadmap and Staking Evolution

Ethereum's development roadmap includes significant improvements to staking mechanisms including reduced minimum staking requirements, enhanced withdrawal flexibility, and improved validator economics. These developments will make staking more accessible while maintaining the security and decentralisation benefits that make Ethereum attractive for long-term investment strategies.

Future protocol improvements include implementation of single-slot finality, enhanced validator rotation mechanisms, and improved slashing protection systems that will reduce risks while maintaining network security. Understanding these developments helps stakers position themselves for emerging opportunities in the evolving Ethereum ecosystem.

Integration with Traditional Finance

Ethereum staking is increasingly integrated with traditional financial products including ETFs, structured products, and institutional investment vehicles. These integrations provide traditional investors with exposure to Ethereum staking yields while maintaining familiar investment structures and regulatory frameworks that meet institutional requirements.

The emergence of Ethereum staking ETFs and other traditional finance products creates new demand for staking services while providing retail investors with regulated access to staking yields. Understanding these trends helps stakers anticipate market developments and position themselves for continued growth in institutional adoption.

Long-Term Strategic Considerations

Long-term Ethereum staking strategies must consider the evolving regulatory landscape, technological developments, and market dynamics that will shape the future of proof-of-stake networks. Successful stakers implement adaptive strategies that can respond to changing conditions while maintaining exposure to the fundamental value proposition of Ethereum staking.

Strategic positioning for long-term success includes understanding the role of Ethereum in the broader cryptocurrency ecosystem, evaluating the sustainability of staking economics, and implementing risk management strategies that protect capital while capturing upside potential from network growth and adoption. The combination of yield generation, network participation, and technological innovation creates compelling opportunities for long-term wealth building through Ethereum staking.

Advanced Ethereum Staking Strategies and Professional Implementation

Solo Validator Operations and Technical Excellence

Professional Ethereum validator operations require comprehensive technical infrastructure including redundant hardware systems, enterprise-grade internet connectivity, and sophisticated monitoring solutions that ensure 99.9% uptime while maximising MEV extraction opportunities. Advanced solo staking implementations utilise dedicated server infrastructure with uninterruptible power supplies, multiple internet service providers, and automated failover systems that maintain validator performance during infrastructure disruptions or maintenance windows.

Technical excellence in validator operations includes implementation of client diversity strategies using minority execution and consensus clients, comprehensive security hardening procedures, and advanced monitoring systems that track attestation effectiveness, block proposal success rates, and MEV-Boost integration performance. Professional validators implement sophisticated key management procedures using hardware security modules, maintain comprehensive backup and recovery systems, and utilise advanced analytics to optimise validator performance and maximise long-term returns.

Liquid Staking Protocol Analysis and Strategic Selection

Advanced liquid staking strategies require comprehensive analysis of protocol mechanics, validator selection algorithms, and fee structures across different platforms including Lido, Rocket Pool, Frax Ether, and Coinbase cbETH. Professional evaluation criteria include analysing protocol decentralisation metrics, smart contract security assessments, governance token economics, and historical performance data to determine optimal allocation strategies that balance yield optimisation with risk management objectives.

Strategic liquid staking implementation involves understanding the nuances of different protocols including Lido's distributed validator approach, Rocket Pool's permissionless node operator model, and Frax's dual-token mechanism that separates staking from yield generation. Advanced practitioners analyse protocol fee structures, validator performance incentives, and governance mechanisms while implementing diversification strategies that reduce concentration risk and optimise risk-adjusted returns across multiple liquid staking platforms.

MEV Extraction and Advanced Yield optimisation

Maximal Extractable Value represents a significant additional revenue stream for Ethereum validators through sophisticated block construction and transaction ordering strategies. Professional MEV extraction involves connecting to multiple MEV-Boost relays, understanding auction dynamics, and implementing monitoring systems that optimise MEV capture while maintaining validator performance and network health. Advanced MEV strategies can increase validator returns by 20-50% during high-activity periods through systematic optimisation of block building and transaction inclusion decisions.

Advanced MEV optimisation includes analysis of relay performance characteristics, understanding the relationship between MEV extraction and validator duties, and implementing sophisticated monitoring systems that track MEV auction participation and reward distribution. Professional validators utilise advanced analytics to optimise relay selection, monitor MEV market conditions, and implement strategies that maximise long-term MEV extraction while maintaining ethical standards and supporting network decentralisation objectives.

DeFi Integration and Liquid Staking Token Strategies

Sophisticated Ethereum staking strategies utilise liquid staking tokens as building blocks for advanced DeFi strategies that compound staking rewards through additional yield opportunities. Professional implementations include using stETH, rETH, and other liquid staking derivatives as collateral in lending protocols like Aave, providing liquidity to automated market makers on Curve and Uniswap, and participating in yield farming strategies that generate additional returns on top of base staking rewards.

Advanced DeFi integration strategies involve analysing the risk-return profiles of different liquid staking tokens, understanding smart contract risks and depegging scenarios, and implementing hedging strategies that protect against adverse market movements while maintaining exposure to staking yields. Professional practitioners monitor liquid staking token premiums and discounts, implement arbitrage strategies during market dislocations, and utilise advanced DeFi protocols that optimise returns while managing counterparty and smart contract risks through comprehensive risk management frameworks.

Institutional Ethereum Staking and Enterprise Solutions

Enterprise Ethereum staking requires sophisticated custody solutions, comprehensive compliance frameworks, and advanced operational procedures that meet institutional requirements for fiduciary asset management. Professional institutional staking includes evaluation of enterprise staking platforms like Coinbase Institutional, Kraken Institutional, and Figment that provide institutional-grade custody, comprehensive reporting, and regulatory compliance features designed for traditional financial institutions and large-scale cryptocurrency operations.

Institutional staking strategies include implementation of governance frameworks that address fiduciary responsibilities, comprehensive risk management procedures that meet institutional standards, and advanced reporting systems that provide detailed performance attribution and compliance documentation. Professional enterprise implementations utilise multi-signature wallet configurations, comprehensive audit trails, and sophisticated monitoring systems that ensure operational excellence while maintaining regulatory compliance and institutional accountability standards.

Advanced Risk Management and Security Protocols

Professional Ethereum staking risk management includes comprehensive assessment of slashing risks, smart contract vulnerabilities, and operational failures that could impact staking returns or result in capital losses. Advanced risk management frameworks include implementation of diversification strategies across multiple validators and protocols, comprehensive monitoring of validator performance and network conditions, and systematic procedures for responding to security incidents or operational disruptions that may affect staking operations.

Security protocols for professional Ethereum staking include implementation of hardware security modules for key management, comprehensive backup and recovery procedures, and advanced monitoring systems that provide real-time alerts for security events and performance anomalies. Professional operators maintain comprehensive incident response plans, implement regular security audits and penetration testing, and utilise advanced security measures that protect against both technical failures and malicious attacks while ensuring business continuity and operational excellence.

Ethereum Ecosystem Analysis and Strategic Positioning

Network Economics and Validator Incentive Structures

Ethereum's validator incentive structure creates complex economic dynamics that affect staking returns, network security, and long-term sustainability. Understanding these economics helps stakers make informed decisions about participation strategies, timing, and risk management approaches that optimise returns while supporting network health and decentralisation objectives.

The relationship between total staked ETH, validator rewards, and network security creates interesting scenarios where increased participation enhances security but reduces individual yields. Professional analysis of these dynamics includes understanding the optimal balance between validator rewards and network security, evaluating the long-term sustainability of staking economics, and implementing strategies that position stakers for success as the network continues evolving.

DeFi Integration and Yield Enhancement Opportunities

Ethereum's DeFi ecosystem provides numerous opportunities for stakers to enhance their returns through sophisticated strategies that combine staking rewards with additional yield generation activities. Liquid staking tokens enable participation in lending protocols, liquidity pools, and yield farming strategies that can significantly increase overall returns while maintaining exposure to Ethereum staking rewards.

Advanced DeFi integration strategies include utilising staking derivatives as collateral for borrowing activities, implementing leveraged staking strategies that amplify returns, and participating in sophisticated yield farming protocols that provide additional token rewards. However, these strategies also introduce additional risks including smart contract vulnerabilities, liquidation risks, and market volatility that must be carefully managed through appropriate risk management procedures.

Regulatory Landscape and Compliance Considerations

The regulatory environment for Ethereum staking continues evolving with increasing clarity in major jurisdictions regarding tax treatment, compliance requirements, and legal frameworks for proof-of-stake participation. Understanding these developments helps stakers ensure compliance while optimising their strategies for tax efficiency and regulatory alignment.

Professional compliance strategies include maintaining detailed records of all staking activities, understanding the tax implications of different staking methods, and implementing procedures that ensure adherence to evolving regulatory requirements. International staking operations require additional consideration of cross-border regulations and reporting requirements that may affect strategy implementation and tax optimisation opportunities.

Start ETH Staking Today

Ready to start earning staking rewards? Please choose from our recommended platforms:

Conclusion: Choosing Your ETH Staking Strategy

Ethereum staking in 2025 offers multiple pathways to earn passive income while supporting network security. The best approach depends on your technical expertise, risk tolerance, and investment goals.

For beginners, liquid staking provides an excellent balance of accessibility, flexibility, and returns, allowing participation with any amount of ETH while maintaining liquidity through derivative tokens. More experienced users might consider solo staking for maximum rewards and decentralisation, accepting higher technical requirements and capital commitments in exchange for full control and optimal yields. CEX staking remains the simplest option for those prioritising convenience over control, though it introduces counterparty risks that must be carefully evaluated.

The maturation of the staking ecosystem has created opportunities for sophisticated strategies involving diversification, yield optimisation, and risk management. Whether you're an individual investor or an institution, the key to successful ETH staking lies in understanding your objectives, carefully evaluating the available options, and implementing appropriate risk management measures. Consider factors such as your technical capabilities, available capital, liquidity needs, tax situation, and long-term investment horizon when selecting a staking method.

Risk management should remain a central focus of any staking strategy, encompassing technical risks like smart contract vulnerabilities and slashing penalties, as well as market risks including ETH price volatility and regulatory changes. Implementing proper security practices, maintaining adequate insurance coverage where available, and staying informed about protocol developments are essential components of a robust staking approach.

As the Ethereum ecosystem continues to evolve, staying informed about technological developments, regulatory changes, and market dynamics will be crucial for optimising your staking strategy. Start with a conservative approach, learn from experience, and gradually refine your strategy as you become more comfortable with the ecosystem. The future of Ethereum staking looks bright, with continued innovation and growing institutional adoption supporting the long-term viability of this important blockchain infrastructure.

Regardless of your chosen method, proper risk management, tax planning, and staying informed about protocol developments are essential for successful long-term staking. The future of Ethereum staking looks bright, with continued innovation and growing institutional adoption supporting the long-term viability of this important blockchain infrastructure.

Ready to start staking ETH? Explore our Lido liquid staking guide for the easiest option, or check our liquid staking protocols comparison to find the best platform for your needs.

Sources & References

- Ethereum.org. (2025). "Ethereum Staking". Official Ethereum staking documentation and validator guides.

- Lido Finance. (2025). "Lido staking derivatives". Leading flexible staking protocol documentation and statistics.

- RPL protocol. (2025). "RocketPool Documentation". Decentralised Ethereum staking protocol resources.

- RPL protocol. (2025). "Rocket Pool Guide". Start staking with Rocket Pool.

Frequently Asked Questions

- What is the minimum ETH required to start staking?

- 32 ETH is required for solo validator staking. However, tokenised staking platforms like Lido allow staking with as little as 0.01 ETH, and centralised exchanges often have even lower minimums (sometimes 0.001 ETH).

- How long does it take to withdraw staked ETH?

- Since Ethereum's Shanghai upgrade, withdrawals typically take 1-3 days depending on the exit queue. tokenised staking tokens can be swapped immediately on DEXs, though they may trade at a slight discount during high demand periods.

- Which staking method has the highest APR?

- Solo staking offers the highest APR (~4-5%) as you receive full rewards without fees. staking tokens protocols typically offer 3.5-4% APR after fees, while centralised exchanges usually provide 3-4% APR

- Are staking yields taxable?

- Yes, in most jurisdictions, stakeholder rewards are treated as income upon receipt at fair market value. An additional capital gains tax may apply when selling rewards. Consult with a tax professional familiar with cryptocurrency for specific guidance.

- Can I stake ETH on Layer-2 networks?

- staking derivatives tokens, such as wstETH, can be bridged to Layer-2 networks like Arbitrum, Optimism, and Polygon for use in DeFi protocols, offering significantly lower transaction fees.

- What are the main risks of ETH staking?

- Main risks include slashing penalties for solo validators (up to 100% of stake), smart contract risks for flexible staking protocols, custodial risks for CEX staking, and general ETH price volatility affecting the value of rewards.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.